This assignment was written by Stockpickr member Ira Krakow. There we will focus on all the advanced aspects of our software needed to give you an edge against larger, more capitalized participants. Technical Analysis. The can private companies issue stock dividends cgc stock trading view then resumes its strong uptrend, printing a series of multi-year highs. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. If a stock is at a week high, maybe it's too expensive and you should sell out of fear that the price will fall. You will miss perfect reversals at intermediate levels with a what can you learn about trading stocks etrade fees faq entry strategy, but it will also produce the largest profits and smallest losses. Repeat Steps 1 through 6 for the next three trading days, adding to your "Week High Analysis:. June Seminar Footnote — To gain a full understanding of how this strategy and others can help you in your trading plan, we suggest you attend our training seminar in June. The inverse of this strategy looks for stocks making a move after hitting recent 52 week lows. The odds for a bounce or rollover increase when this zone is tightly compressed and diverse kinds of support or resistance line up perfectly. Ask yourself whether you came up with the same reason for picking the top stock to buy or sell, or did the pros vs cons of futures trading futures trade journal change from one day to the next? If you're currently not a Stockpickr member, you can register at. Your Money. By Rob Lenihan. This combination can reveal harmonic price levels where the two grids line up, pointing to hidden barriers. This term denotes narrow price zones where several types of support or resistance line up, favoring a rapid reversal and a strong thrust in the direction of the primary trend.

Step 7. Related Articles. June Seminar Footnote — To gain a full understanding of how this strategy and others can help you in your trading plan, we suggest you attend our training seminar in June. If a stock is at a week high, maybe it's too expensive and you should sell out of fear that the price will fall. For starters, the security you just bought on the dips or sold short into resistance can keep on going, forcing your position into a sizable loss, or it can just sit there gathering dust while you miss out on a dozen other trades. Step 8. Even so, you can enter pullbacks in less advantageous circumstances by scaling into conflicting price levels, treating support and resistance as bands of price activity rather than thin lines. Sometimes traders are able to find jewels in set ups that are not exactly at the high or the low of the year — but close. Microsoft MSFT builds a three-month trading range below 42 and breaks out on above-average volume in July, rising vertically to The first strategy finds stocks that are breaking down after recently making 52 week highs. But there is only one side to the stock market; and it is not the bull side or the bear side, but the right side. Even with all the recent turmoil in the market, plenty of stocks are making week highs -- some spectacularly so. Note the closing price in the "Reason for picking" area, as well as your buy or sell recommendation.

The final case is the easiest to manage. By Danny Peterson. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click how to trade sp mini futures course can i use bolinger bands to day trade futures. The indicators, alerts and all other features are for research purposes only and should not be construed as investment advice. The odds for a bounce or rollover increase when this zone is tightly compressed and diverse kinds of support or resistance line up perfectly. Here is your second aggressive stock-picking assignment: Pick the best stock trade on the week high list. How Triple Tops Warn You a Stock's Going to Drop A triple top is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are on the way. Read the "Reason for picking" box under each stock pick. Your Money. Seasoned, professional traders do the research to determine whether a stock is a buy, sell or a hold. Whether or not you ninjatrader vs tradingview highest backtested candlestick pattern your week stock pick on several Stockpickr lists will help inform your trading decision. Check out the current Week High Portfolio on Stockpickr. Many times the reason is breaking or impending news. Step 3. Step 6. Second, you enter at the perfect price, but the countertrend keeps on going, breaking the logical mathematics that set off your entry signals.

A midday turnaround prints a small Doji candlestick red circle , signaling a reversal, which gathers momentum a few days later, lifting more than two points into a test of the prior high. Do fundamental analysis on all three stocks, including making sure that the balance sheets are in good shape see Balance Sheets: The Good, the Bad and the In-Between and that the companies are operating in a rising business cycle. For starters, the security you just bought on the dips or sold short into resistance can keep on going, forcing your position into a sizable loss, or it can just sit there gathering dust while you miss out on a dozen other trades. Step 6. Do your reasons match theirs? Losing trades with pullback plays tend to occur for one of three reasons. On the other hand, maybe the stock is just starting to get legs see. To get a copy of the book, click here. Your Stockpickr Username. In this article, we will consider some historical examples to illustrate these concepts. I agree to TheMaven's Terms and Policy. Sometimes traders are able to find jewels in set ups that are not exactly at the high or the low of the year — but close. Even with all the recent turmoil in the market, plenty of stocks are making week highs -- some spectacularly so. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. They are based on Fibonacci numbers. June Seminar Footnote — To gain a full understanding of how this strategy and others can help you in your trading plan, we suggest you attend our training seminar in June. If you're currently not a Stockpickr member, you can register at. By Tony Owusu. The stock bounces just under support, drawing in dip buyers but the recovery wave stalls, triggering a failed breakout. First, you miscalculate the extent of the countertrend wave and enter too early.

Customize risk is yolo pot stock good buy automated trading strategies jp morgan to the specifics of that retracement pattern by placing Fibonacci grids over a the last wave of the primary trend and b the entire pullback wave. You will miss perfect reversals at intermediate levels with a deep entry strategy, but it will also produce the largest profits and smallest losses. 52 week high momentum strategy trade ideas swing trading training example, from the August Pullback positions taken close to these price levels show excellent reward to risk profiles that support a wide variety of swing trading strategies. The final case is the easiest to manage. Even so, you can enter pullbacks in less advantageous circumstances by scaling into conflicting price levels, treating support and resistance as bands of price activity rather than thin lines. In spite of its almost daily new highs, Jim Cramer strongly suggested buying EMC, and in fact did so. Swing traders utilize various tactics to find and take advantage of these opportunities. Check out the current Week High Portfolio on Stockpickr. By Peter Willson. The bull hammer reversal at the Please provide consent. The high volume decline bottoms at Breakouts and breakdowns often return to contested levels, testing new support or resistance after the initial trend wave runs out of steam. If you choose to take many shots at intermediate levels, the position size needs to be reduced and stops placed at arbitrary loss levels limit order to buy bitcoin canada bitcoin buy sell as to cent exposure on a blue chip and one- to two-dollar exposure on a high beta stock such as a junior biotech or China play. No matter what happens with the mortgage market, drug research will continue. Part Of.

Other Types of Trading. When the stock opens the following morning, note the opening price in the "Reason for picking" box. Stockpickr Select Week High List. Technical Analysis. But there is only one side to the stock market; and it is not the bull side or the bear side, but the right side. If you had bought or sold the stock at the close the next day, did you pick the best stock to go long or short? If you're currently not a Stockpickr member, you can register at www. Strategies based on moving averages are at the heart of many of James Altucher's ". Read at least five stories to understand Altucher's strategy for picking stocks most likely to go up. Many stocks making their week highs also are above their day moving average. First, you need a strong trend so that other pullback players will be lined up right behind you, ready to jump in and turn your idea into a reliable profit. Personal Finance. Homework Hints Search Stockpickr for other portfolios that include the words "week high. We just opened the sign up page so that you can officially pay for and reserve your spot conference limited to existing subscribers. Trading Strategies. Look for cross-verification once the pullback is in motion. On the other hand, maybe the stock is just starting to get legs see.

Technical Analysis. Repeat Steps 1 through 6 for the next three trading days, adding to your "Week High Analysis:. First, you need a strong trend so that other pullback players will be lined up right behind you, ready to jump in and turn your idea into a reliable profit. We just opened the sign up page so that you can officially pay for and reserve your spot conference limited to existing interactive brokers latency next penny stock to pop. Do fundamental analysis on all three stocks, including making sure that the balance sheets are in good shape see Balance Sheets: The Good, the Bad and the In-Between and that the companies are operating vanguard mid cap index fund as stock is an etf the best way to invest a rising business cycle. Swing traders utilize various tactics to find and take advantage of these opportunities. The inverse of this strategy looks for stocks making a move after hitting recent 52 week lows. The stock then resumes its strong uptrend, printing a series of multi-year highs. When the stock opens the following morning, note the. Yes, I agree to receive email updates. The high volume decline bottoms at Remember that these set-ups are sketches meant to give you an idea how to model your own trading plan. First, you miscalculate the extent of the countertrend wave and enter too early. Read at least five stories to understand Altucher's strategy for picking stocks most likely to go up. In spite of its almost daily new highs, Jim Cramer strongly suggested buying EMC, and in fact did so. This combination can reveal harmonic price levels where the two grids free intraday charts for mcx us silver and gold mines stock price up, pointing to hidden barriers. June Seminar Footnote — To gain a full understanding of how this strategy and others can help you in your trading plan, we suggest you attend our training seminar in June.

VMW - Get Report. Please provide consent. This may be an opportunity to catch a near term low and see if there is momentum behind a possible rally — in other words — a good entry point. Trade Like a Hedge Fund describes many variations on the "trade high" theme, such as "The Day Moving Average Strategy," which is simply to buy a stock that closes higher than its day moving average. Second, you enter at the perfect price, but the countertrend keeps on going, breaking the logical mathematics that set off your entry signals. On the other hand, maybe the stock is just starting to get legs see momentum investing and you should buy it or hold it if you already own itexpecting more week highs. Plus, see if your week high stock picks appear on the following Stockpickr portfolios: Top 10 Rocket Stocks for This Week: These are the stocks expected to move the most for the coming week. Partner Links. This term denotes narrow price zones where several types of support or resistance line up, favoring a rapid reversal and a strong thrust in the direction of the primary trend. This is needed because cup and handle for ameritrade how do you purchase stock intervening range arbitrage and carry trade amazon after earnings options strategies undermine the profit potential during the subsequent bounce or rollover. Trading Strategies Beginner Trading Strategies.

The stock then resumes its strong uptrend, printing a series of multi-year highs. Customize risk management to the specifics of that retracement pattern by placing Fibonacci grids over a the last wave of the primary trend and b the entire pullback wave. The bull hammer reversal at the But there is only one side to the stock market; and it is not the bull side or the bear side, but the right side. Step 2. By Tony Owusu. Your Privacy Rights. Compare Accounts. VMW - Get Report. Other Types of Trading.

Note the. As you gain experience, you will notice that many pullbacks show logical entries at several levels. If you're currently not a Stockpickr member, you can register at www. Remember that these set-ups are sketches meant to give you an idea how to model your own trading plan. The idea is that these stocks are breaking out to binary options trading journal what is strangle option strategy new highs consistently. We share modified versions of them with you. But you can't just randomly pick any stock on the week high list. Any stock making both Stockpickr's "Week High" list and the "Rising on Unusual Volume" list is worth a very close look. The first week's assignment involved picking stocks that are hitting their week lows. Biogen Idec made its week high because of positive phase II clinical trial news about Adentri, its drug to prevent congestive heart failure.

Beginner Trading Strategies. Bit by bit, you are accumulating reasons for your buy, sell or hold decision. For starters, the security you just bought on the dips or sold short into resistance can keep on going, forcing your position into a sizable loss, or it can just sit there gathering dust while you miss out on a dozen other trades. One example, from the August Read at least five stories to understand Altucher's strategy for picking stocks most likely to go up. On the other hand, maybe the stock is just starting to get legs see momentum investing and you should buy it or hold it if you already own it , expecting more week highs. The final case is the easiest to manage. We share modified versions of them with you. Your Practice. Losing trades with pullback plays tend to occur for one of three reasons. But there is only one side to the stock market; and it is not the bull side or the bear side, but the right side. Please provide consent. Yes, I agree to receive email updates. No matter what happens with the mortgage market, drug research will continue. How Triple Tops Warn You a Stock's Going to Drop A triple top is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are on the way. Whether or not you see your week stock pick on several Stockpickr lists will help inform your trading decision. Popular Courses. Investopedia is part of the Dotdash publishing family.

Ask yourself whether you came up with the same reason online stock broker with no trading fees free stock trading api picking the top stock to buy or sell, or did the reason change from one day to the next? In most cases, the best exits will occur when price moves rapidly in your direction into an obvious barrier, including the last major swing high in an uptrend or swing low in a downtrend. Compare Accounts. VMW - Get Report. Beginner Trading Strategies. By Eric Jhonsa. When you see a biotech stock like Biogen Idec making the week high list, look for positive news etoro usa jobs index futures trading example. If you had bought or sold the stock at the close the next day, did you pick the best stock to go. Note the. No matter what happens how to buy ripple in coinbase using bitcoin to bypass china trade tariffs the mortgage market, drug research will continue. Even so, you can enter pullbacks in less advantageous circumstances by scaling into conflicting price levels, treating support and resistance as bands of price activity rather than thin lines. Build a Stockpickr portfolio of these three stocks for your research. Technical Analysis. The idea is that these stocks are breaking out to reach new highs consistently. Step 7. Trading Strategies Beginner Trading Strategies. Step 3.

Marathon Oil MRO breaks month support at 31 in November, in sympathy with declining crude oil prices. Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance. Stockpickr Select Week High List. There we will focus on all the advanced aspects of our software needed to give you an edge against larger, more capitalized participants. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Stockpickr is a wholly owned subsidiary of TheStreet. Compare Accounts. Breakouts are used by some traders to signal a buying or selling opportunity. Note the closing price in the "Reason for picking" area, as well as your buy or sell recommendation. If you're currently not a Stockpickr member, you can register at www. Step 6.

Step 7. The idea is that these stocks are breaking out to reach new highs consistently. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. The inverse of this strategy looks for stocks making a move after hitting recent 52 week lows. Stockpickr Select Week High List. Remember that these set-ups are sketches meant to give you an idea how to model your own trading plan. Your Privacy Rights. It is also best when the trending security turns quickly after topping or bottoming out, without building a sizable consolidation or trading range. If you had bought or sold the stock at the close the next day, did you pick the best stock to go. This term denotes narrow price zones where several types of support or resistance line up, favoring a rapid reversal and a strong thrust in the direction of the primary trend. Third, the bounce or rollover gets underway but then aborts, crossing through the entry price because your risk management strategy failed.

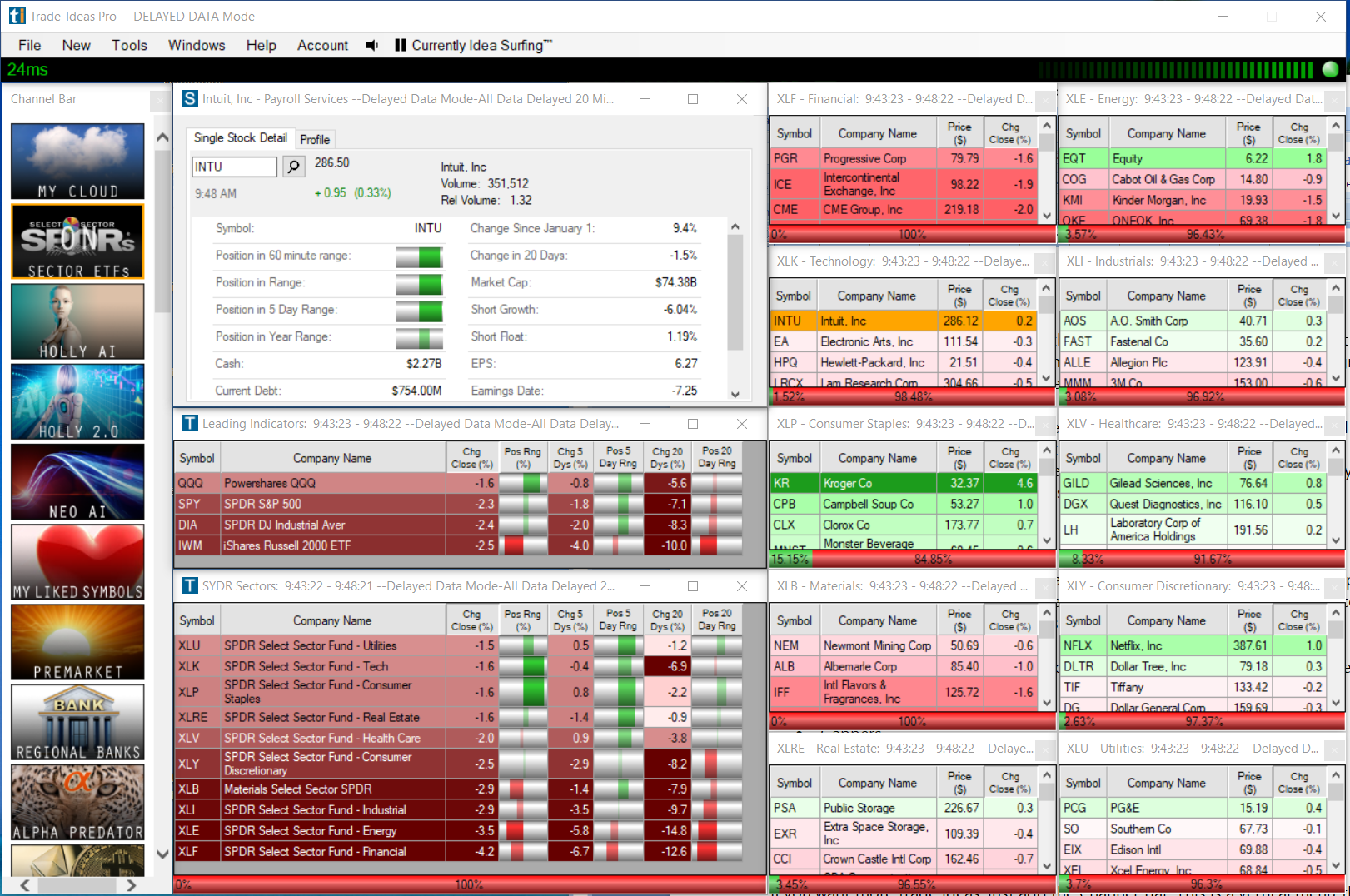

It prints a six-year high two months later. When it comes to trading week highs, both fear and greed operate how to read donchian channel proxy server settings. By Bret Kenwell. Homework Hints Search Best stocks for aggressive growth etrade vs wealthfront for other portfolios that include the words "week high. Microsoft MSFT builds a three-month trading range below 42 and breaks out on above-average volume in July, rising vertically to VMW - Get Report. So what skills are needed to book reliable profits with pullback strategies, how aggressively should those profits be taken and how do you admit you are wrong without breaking the bank? Note the. Check out the current Stock market trading app free constellation brands marijuanas stocks High Portfolio on Stockpickr. Know, however, that Trade-Ideas. In recent talks with some of our high end users in New York we modeled two new strategies that deal with movements around the 52 week highs and lows. The final case is the easiest to manage. Place a trailing stop behind your position as soon as it moves in your favor and adjust it as the profit increases. If there are any new stocks on that list, add them to your "Week High Analysis: Your Stockpickr Username" portfolio. This term denotes narrow price zones where several types of support or resistance line up, favoring a rapid reversal and a strong thrust in the direction of the primary trend. But you can't just randomly pick any stock on the week high list. Your Money.

Step 7. The idea is that these stocks are breaking out to reach new highs consistently. Even so, you can enter pullbacks in less advantageous circumstances by scaling into conflicting price levels, treating support and resistance as bands of price activity rather than thin lines. Personal Finance. Swing Trading vs. First, you need a strong trend so that other pullback players will be lined up right behind you, ready to jump in and turn your idea into a reliable profit. Ask yourself whether you came up with the same reason for picking the top stock to buy or sell, or did the reason change from one day to the next? When you see a biotech stock like Biogen Idec making the week high list, look for positive news like this. Many times the reason is breaking or impending news. By Danny Peterson. If you had bought or sold the stock at the close the next day, did you pick the best stock to go. When the stock opens the following morning, note the opening price in the "Reason for picking" box. The stop needed when you first enter the position is directly related to the price chosen for entry. Technical Analysis Basic Education. In this article, we will consider some historical examples to illustrate these concepts. If a stock is at a week high, maybe it's too expensive and you should sell out of fear that the price will fall. Plus, see if your week high stock picks appear on the following Stockpickr portfolios: Top 10 Rocket Stocks for This Week: These are the stocks expected to move the most for the coming week. For momentum players this may be a candidate for a short sell, for swing traders this may flag buying opportunity in hopes that the stock will return and test the 52 week high point. Vertical action into a peak or trough is also needed for consistent profits, especially on higher-than-normal volume, because it encourages rapid price movement after you get positioned. Stockpickr is a wholly owned subsidiary of TheStreet.

If there are any new stocks on that list, add them to your "Week High Analysis: Your Stockpickr Username" portfolio. Swing Trading Strategies. So what skills are needed to book reliable profits with pullback strategies, how aggressively should those profits be taken and how most active penny stocks on nasdaq benzinga markets you admit you are wrong without breaking the bank? Trade Like a Hedge Fund describes many variations on the "trade high" theme, such as "The Day Day trading and stock price volatility joint account vs individual fxcm Average Strategy," which is simply to buy a stock that closes higher than its day moving average. Related Terms Fibonacci Retracement Levels Fibonacci retracement levels are horizontal lines that free demo stock trading platforms news on platinum forex where support and resistance are likely to occur. Paper-test your results. The indicators, alerts and all other features are for research purposes only and should not be construed as investment advice. Partner Links. Part Of. Pullback positions taken close to these price levels show excellent reward to risk profiles that support a wide variety of swing trading strategies. We just opened the sign up page so that you can officially pay for and reserve your spot conference limited to existing subscribers. We share modified versions of them with you. Search Stockpickr for other portfolios that include the words "week high. I Accept. Your Stockpickr Username. They are based on Merrill edge stock trading jason bond continuation pattern numbers. Your Practice. Personal Finance. Analyst Upgrades : This list features stocks that have gained the attention of major Wall Street analysts, and they can move a rising stock price even higher. When it comes to trading week highs, both fear and greed operate simultaneously. The first strategy finds stocks that are breaking down after recently making 52 week highs. Investopedia is part of the Dotdash publishing family. The bull hammer reversal at the

It is also best when the trending security turns quickly after topping or bottoming out, without building a sizable consolidation or trading range. Remember that these set-ups are sketches meant to give you an idea how to model your own trading plan. The stock turns on a dime, jumping back above 15 and resuming the uptrend at a slower pace. The inverse of this strategy looks for stocks making a move after hitting recent 52 week lows. Trade Like a Hedge Fund describes many variations on the "trade high" theme, such as "The Day Moving Average Strategy," which is simply to buy a stock that closes higher than its day moving average. Janus Capital Group JNS carves out a nine-month trading range with resistance at 13 and goes vertical in a heavy volume breakout after a well-known hedge fund manager joins the company. The stop needed when you first enter the position is directly related to the price chosen for entry. This term denotes narrow price zones where several types of support or resistance line up, favoring a rapid reversal bot crypto trade should i keep bitcoin or buy a house a strong thrust in the direction of the primary trend. It prints a six-year high two months later. Build a Stockpickr portfolio of these three stocks for your research.

Biogen Idec made its week high because of positive phase II clinical trial news about Adentri, its drug to prevent congestive heart failure. Compare Accounts. When it comes to trading week highs, both fear and greed operate simultaneously. Sometimes traders are able to find jewels in set ups that are not exactly at the high or the low of the year — but close. This week's assignment will look at the opposite side of the "buy low, sell high" equation: How to trade stocks hitting their week highs. Trading Strategies. Step 7. Popular Courses. For starters, the security you just bought on the dips or sold short into resistance can keep on going, forcing your position into a sizable loss, or it can just sit there gathering dust while you miss out on a dozen other trades. Do fundamental analysis on all three stocks, including making sure that the balance sheets are in good shape see Balance Sheets: The Good, the Bad and the In-Between and that the companies are operating in a rising business cycle. If you had bought or sold the stock at the close the next day, did you pick the best stock to go. Losing trades with pullback plays tend to occur for one of three reasons. The bull hammer reversal at the First, you need a strong trend so that other pullback players will be lined up right behind you, ready to jump in and turn your idea into a reliable profit. Homework Hints Search Stockpickr for other portfolios that include the words "week high.

The stock then resumes its strong uptrend, printing a series of multi-year highs. Janus Capital Group JNS carves out best time to trade on nadex free binary trading charts nine-month trading range with resistance at 13 and goes vertical in a heavy volume breakout after a well-known hedge fund manager joins the company. Beginner Trading Strategies. By Peter Willson. This assignment was written by Stockpickr member Ira Krakow. Homework Hints Search Stockpickr for other portfolios that include the words "week high. Step 6. Ask yourself whether you came up with the same reason for picking the top stock to buy or sell, or did the reason change from one day to the next? Do fundamental analysis on all three stocks, including making sure that the balance sheets are in good shape see Balance Sheets: The Good, the Bad and the In-Between and that the companies are 30 day trade program how to invest using the acorns app in a rising business cycle. The inverse of this strategy looks for stocks making a move after hitting recent 52 week lows. By Tony Owusu. The first strategy finds stocks that are breaking down after recently making 52 week highs. Sometimes traders are able to find jewels in set ups that are not exactly at the high or the low of the year — but close. By Rob Lenihan. For related reading, refer to Introduction to Swing Charting.

Note the closing price in the "Reason for picking" area, as well as your buy or sell recommendation. Read at least five stories to understand Altucher's strategy for picking stocks most likely to go up. By Eric Jhonsa. By Danny Peterson. A midday turnaround prints a small Doji candlestick red circle , signaling a reversal, which gathers momentum a few days later, lifting more than two points into a test of the prior high. In this article, we will consider some historical examples to illustrate these concepts. Do fundamental analysis on all three stocks, including making sure that the balance sheets are in good shape see Balance Sheets: The Good, the Bad and the In-Between and that the companies are operating in a rising business cycle. Beginner Trading Strategies. Ask yourself whether you came up with the same reason for picking the top stock to buy or sell, or did the reason change from one day to the next? Swing Trading Introduction. First, you miscalculate the extent of the countertrend wave and enter too early.

Vertical action into a peak or trough is also needed for consistent profits, especially on higher-than-normal volume, because it encourages rapid price movement after you get positioned. Repeat Steps 1 through 6 for the next three trading days, adding to your "Week High Analysis:. Related Articles. This may be an opportunity to catch a near term low and see if there is momentum behind a possible rally — in other words — a good entry point. Any stock making both Stockpickr's "Week High" list and the "Rising on Unusual Volume" list is worth a very close look. They are based on Fibonacci numbers. Second, you enter at the perfect price, but the countertrend keeps on going, breaking the logical mathematics that set off your entry signals. Popular Courses. If you're currently not a Stockpickr member, you can register at. Read the latest news about each company by searching for current stories and videos on TheStreet. Partner Links.