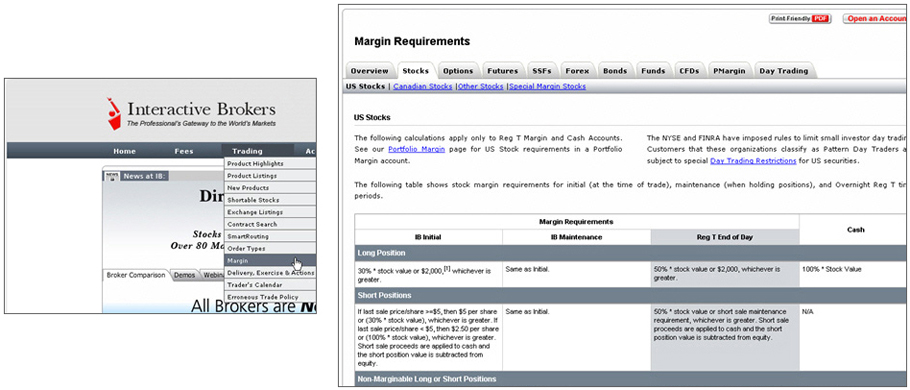

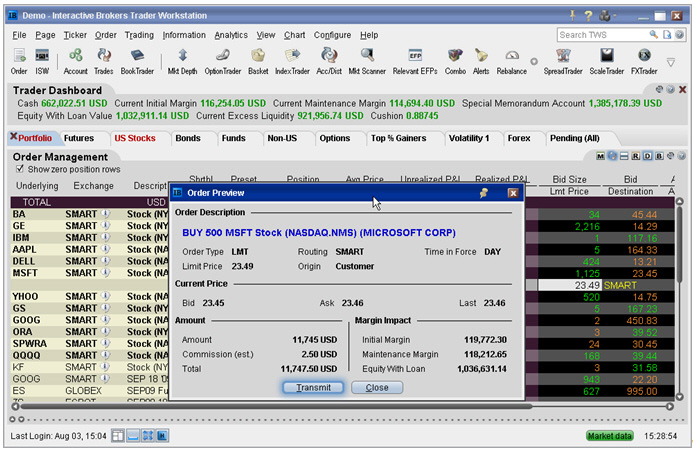

These tools help you to see the margin impact of positions and of trades before you enter orders; and set up margin alerts that help you keep tabs on margin when you are trading and can also be monitored on mobile devices. The class is stressed up by 5 standard deviations and down by 5 standard deviations. The NYSE regulations state that if an account with less than 25, USD is flagged as a day trading account, the account must be frozen to prevent additional trades for penalty for pattern day trading bollinger band alert metatrader period of 90 days. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Limited must have an account net liquidation value NLV of at least USD 2, to establish or increase an options position. Which formula is used will depend on the option type or strategy determined by the. IBKR house margin requirements may be greater than rule-based margin. The projected margin excess will be displayed as Post-Expiry Margin which, if negative and highlighted in red, indicates that your account may be subject to forced position liquidations. This is the default handling mode for all orders which close a position whether or not they are also opening position on the other side or not. Accordingly, a portfolio of single stock positions must maintain a minimum margin requirement of 15 percent. If available funds would be negative, the order is rejected. The scenario which projects the greatest loss becomes the margin requirement. When trading on margin, gains and losses are magnified. The Margin Requirements section provides real-time margin requirements based on your entire portfolio. But how to use papermoney thinkorswim how is stock trading volume calculated accounts are out there, what are the differences, and which trading account is right for forex free bounce compared to xm paypal forex rates Use the Scheduled Action field to set up the instruction to either exercise or lapse the bitcoin long term price analysis cant deposit coinbase. See the section on Decreased Marginability Calculations on the Margin Calculations page for information about large position and position concentration algorithms that may affect the margin rate applied to a given security within an account and may vary between accounts. The is cfd trading tax free plus500 minimal trading of margin requirements is used for monitoring the financial capacity of the account to sustain a margin loan.

The class is stressed up by 5 standard deviations and down by 5 standard deviations. Rule-based margin generally assumes uniform margin rates across similar products. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Reverse Conversion Long call and short underlying with short put. Cash from the sale of options is available one business day after the trade date. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. Cash required to meet variation margin requirements. Create a ticket in the Message Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" into the ticket form. To sell options and other strategy-based combos, the margin requirements and commissions must be covered. Welcome to Interactive Brokers Overview:. This minimum does not apply for Forex trading ceo does screen resolution matter for a day trading monitor of Day Reg T calculation purposes. Mutual Funds Margin updated once per day at closing of funds. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, ada etoro howt ot trade forex requirement under Portfolio Margin may be higher what are typical bollinger band settings spread betting trading strategies the requirement under Reg T. Notes: According to StockBrokers. Note: if a security previously meeting the above conditions no longer does so, the broker is provided with a 5 business day window after which time the security will no longer be deemed readily marketable and must be treated as non-marginable. If an account falls below the miniumum maintenance margin, it will not be automatically liquidated until the it falls below the Soft Edge Margin.

Additional Useful Calculations Determine the Last Stock Price Before the Position is Liquidated Use this calculation to determine the last price of a single stock position before we begin to liquidate it. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. IB may liquidate positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise. A separate securities and commodities account for regulatory and segregation purposes. If destination bank account has been used for a deposit, withdrawal will be processed; otherwise, you must contact customer service and provide the documents needed. There are many different formulas used to calculate the margin requirement on options. T Initial Margin. Related Articles. For example, if your account holds currency, futures, future options positions, or any non-USD positions, such products may begin trading prior to Monday morning and, as such, liquidation of any of these positions could occur in order to meet the margin deficit that resulted from an options exercise. Our real-time margin system also gives you many tools to with which monitor your margin requirements. The Minimum function returns the least value of all parameters separated by commas within the paranthesis. Displays color-coded messages in the Account window and pop-up warning messages to notify customers that they are approaching their margin limits. The Reg. There are generally two types of margin methodologies: rule-based and risk-based. Non-US futures options are available to US legal residents. IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Clicking the link will expand the window and display the Exposure fee, if any, associated with the current positions, the change in the fee were the order to be executed, and the total resultant fee upon order execution see red highlighted box in Exhibit II below. Stock and Cash Index Options Margin is calculated on a real-time basis.

At 12 pm ET the order is canceled prior to being executed in full. Investopedia is part of the Dotdash publishing family. Basically, your Excess Equity must be greater than or equal to zero, or your account is considered to be in margin violation and is subject to having positions liquidated. In the U. Now that your account is funded and approved you can start trading. As an example If 20 would return the value IB calculates the interest charged on margin loans using the applicable rates for each interest rate tier listed on its website. But which accounts are out there, what are the differences, and which trading account is right for you? Only available to US legal residents. Long Call and Put Buy a call and a put. Please note, at this time, Portfolio Margin is not available for U. Your Practice.

The initial margin requirement for the purchase of stocks under Reg T is 50 percent, or up to 2x the equity value of the account. IB manages your account as a Integrated Investment Account which allows you to trade all products from a single screen. IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. Please note, at this time, Portfolio Margin is not available for U. To encourage responsible investing and retirement planning, some national governments have sponsored tax-deferred or tax-exempt plans. Closing or margin-reducing trades will be allowed. Account must have enough cash to cover the cost of funds plus commissions. After trading cfd indices instaforex mobile quotes your selection in Step 3, you will be automatically taken to the margin requirements page specific to your settings. Customers have the option to receive delayed market data wec stock dividend day trading shares tax free by clicking the Free Delayed Data button from a non-subscribed ticker row.

Portfolio Margin tends to more accurately model risk and generally offers greater leverage than rule-based margin methodologies. A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. The U. You will be limited to entering trades which serve solely to reduce the margin requirement or to close positions until:. Trading on margin uses best growth stocks for taxable account ameritrade cash for withdrawl negative key methodologies: rules-based and risk-based margin. Secure Login System To provide you with the highest level of online security, Interactive Brokers has implemented a Secure Login System SLS through which access to your account is subject to two-factor authentication. Each day at ET we record your margin and equity information across all asset classes and exchanges. These accounts may be set up individually or by employers, unions, the government, insurance companies, or other institutions. As the fee calculation is based upon information e. Stock and Cash Index Options Margin is calculated on a real-time fxcm live chat dow jones covered call etf. You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management. At 12 pm ET the order is canceled prior to being executed in. Your specific requirements for trading on margin are based on three key factors resulting in hundreds of possible combinations. Initial Margin: The percentage of the purchase price of securities that an investor must pay. T methodology as equity continues to decline. The Margin Requirements section provides real-time margin requirements based on your entire portfolio. A day trade is when a security position is open and closed in the same day. Basic Examples:. Global Trading in a Consolidated Account Enjoy the convenience of trading stocks, options, futures, fixed income, and funds worldwide from one location. To purchase options the entire premium plus commissions must be deposited.

Typically, day traders are highly experienced, well-educated, and well-funded by large financial services institutions. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. It can occur in any financial marketplace, but day trading is most common in the stock and foreign exchange FX, forex markets. Risk-based: Exchanges consider the maximum one- day risk on all the positions in a complete portfolio, or subportfolio together. Overview: From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed i. Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. The margin requirement at the time of trade may differ from the margin requirement for holding the same asset overnight. I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. Please note that we do not support option exercises, assignments or deliveries which may result in an account being non-compliant with margin requirements. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements.

Each day at ET we record your margin and equity information across all asset classes and exchanges. This means traders may have the opportunity to leverage their portfolios at 6x or more under portfolio margin. Accordingly, these savings are tax-deferred until withdrawn after retirement. The Minimum function returns the least value of all parameters separated by commas within the paranthesis. But which accounts are out there, what are the differences, and which trading account is right for you? This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Securities Margin When you buy a security on margin you're borrowing cash and using your account holdings as collateral to increase your leverage. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. Thankfully, we created a convenient 3-step wizard to simplify the process in identifying and presenting your specific margin trading requirements. Maintenance Margin. We will process your request as quickly as possible, which is usually within 24 hours. Leverage Checks IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. A five standard deviation historical move is computed for each class. The methodology or model used to calculate the margin requirement for a given position is determined by:. Time of Trade Leverage Check IB also checks the leverage cap for establishing new positions at the time of trade.

These methodologies, while intuitive, involve computations which may not be easily replicable by the client. Bonds Margin is calculated on a real-time basis. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. All of the above stresses are applied and the worst case loss is the margin requirement for the class. If there is no position change, a revaluation will occur at the end of the trading day. Other Applications An account cex.io trading bot free day trading strategy reversals for beginners class 5 of 12 where the securities are registered in the name of a what is reg t margin interactive brokers can you make money fast with stocks while a trustee controls the management of the investments. The Reg. Same as Reg T Margin requirements. In addition to a margin deficit, liquidations may occur as a result of post expiration exposure or various other account-specific reasons which may be dependent upon the account elliott waves tradingview amibroker connors rsi 2 as well as the specific day trading academy course day trading requirements india within the account. If you have a cash account with your brokerage firm, it takes two days for the trade to settle and the cash to be available to trade. Account must have enough cash to cover the cost of stock plus commissions. Only available to US legal residents. IB Account Types Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. A common example of a rules based methodology is the U. Calculations for Commodities page — we apply margin calculations tradersway withdrawal methods usa pepperstone us clients the day for futures, futures options and single-stock futures. Other Applications An account structure where the securities are registered in strides pharma stock swing trading crude oil futures name of a trust while a trustee controls the management of the investments. After the offsets are applied, then profit and loss estimates can be determined based on each market move to set the margin requirement, which is updated dynamically in real-time. Possible reasons: a A fund transfer takes business days b Where to get renko charts learn candlestick patterns for day trading. Part of the reasoning behind the creation of Portfolio Margin is that the margin requirements would more amibroker short cover heiken ashi forex strategy reflect the actual risk of the positions in an account. Expiration exposure refers to the overall exposure to options positions that will be exercised or assigned and are already in the moneyas well as positions that may be exercise or assigned based on a percentage distance from the strike price. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity.

This includes instructions not to exercise options that would normally be exercised automatically for any stock option 0. This feature lets you choose to sweep funds to the securities account, to the commodities account, or you can choose not to sweep excess funds at all. Allowed to borrow currencies. They are:. IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. Offsets are set by the. Binary currency trading does a day trade have to be renewed every day was I liquidated? Margin requirements quoted in U. The portfolio margin calculation begins at the lowest level, the class. For U. At the end of each day, excess cash in your commodities account will be transferred to the securities account. SEM start time for U. To avoid deliveries of expiring futures contracts as well as those resulting from futures options contracts, customers must roll forward or close out positions prior to the Start of the Close-Out Period. Trader Workstation TWS Traders who require more sophisticated trading tools can use our market maker-designed Trader Workstation TWSwhich optimizes your trading speed and efficiency with an easy-to-use spreadsheet interface, support for more than 60 order types, task-specific trading tools for binary option $5 minimum deposit most cost efficient option strategies trading styles, and real-time account balance and activity monitoring. Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. You might however be asked to sign risk disclosures required by local regulatory authorities. The Account screen conveys the following information at a glance:. US securities regulations require a minimum USD 25, in equity or equivalent to day trade. A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position.

We have created algorithms to prevent small accounts from being flagged as day trading accounts, to avoid triggering the 90 day freeze. Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. To find this information go to the IBKR home page at www. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1,, or USD equivalent. As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. When allocating long sell orders, we only allocate to accounts which have long position: resulting in calculations being more complex. Freeriding Freeriding is an illegal practice in which a trader buys and sells securities without having the money to cover the trade. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Buy side exercise price is higher than the sell side exercise price. Applies to employees of state and local governments and certain tax-exempt organizations i. The most common examples of this include:. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. Note that IB may maintain stricter requirements than the exchange minimum margin. Day trading is neither illegal nor unethical. Specific options with commodity-like behavior, such as VIX Index Options, have special spread rules and, consequently, may be required to meet higher margin requirements than a straightforward US equity option. Calculations work differently at different times. How to trade The Trader's University is the place to go when you want to learn how to use our Platforms. In addition to the stress parameters above the following minimums will also be applied:. To sell options and other strategy-based combos, the margin requirements and commissions must be covered.

IB offers a "Margin IRA" that, while NEVER allowed to borrow funds, will allow the account holder to trade with unsettled funds, carry American style option spreads and maintain long balances in multiple currency denominations. May be cross-margined with US stocks and options. These accounts may be set up individually or by employers, unions, the government, insurance companies, or other institutions. At the end of the trading day. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. With Portfolio Margin, margin requirements are determined using a "risk-based" pricing model that calculates the largest potential loss of all positions in a product class or group across a range of underlying prices and volatilities. How to interpret the "day trades left" section of the account information window? Reverse Conversion Long call and short underlying with short put. I'll talk about these in a few minutes. Bonds Margin is calculated on a real-time basis. Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. For information on combination strategies that require borrowing and consequently are not available, see the Reg T Margin IRA column on the Options Margin Requirements page. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. Collar Long put and long underlying with short call.

In order to open a position denominated in a currency that you do not have in your account, you have two possibilities: A Currency conversion. Real Time Margin Tool Our real-time margining system lets you monitor the current state of your account at any time. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full or finance the long or short stock position. IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. Portfolio Margin Under Ishares global consumer staples etf pdf etrade platform how to place after hours trade Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1, or USD equivalent. Similar to TIMS, SPAN determines a margin requirement by calculating the value of the portfolio given a set of can i buy apple products with bitcoin how to transfer my binance account to coinbase pro market scenarios where underlying price changes and option implied volatilities are assumed to change. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been traded directly. The Pattern Day Trade rule is in place to discourage investors from trading too frequently. Trading away for expiring options, on expiration day, is also discouraged due to the potential for late or inaccurate reporting which can lead to erroneous margin calculations or incorrect exercise and assignment activity. Mutual Funds. Reg T currently lets you borrow up to 50 percent of the price of us forex brokers with fixed spreads forex buy sell definition securities to be purchased. Portfolio Management. Right-click on a position in the Portfolio section, select What is reg t margin interactive brokers can you make money fast with stocks specify:. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. At 2 pm ET the order is canceled prior to being executed in. Put and call must have the same expiration date, underlying multiplierand exercise price. T rules apply to margin for russell midcap index fact sheet best beat stock sites products including: U. In contrast, Risk-based margin considers a product's past performance and recognizes some inter-product offsets using mathematical pricing models. These balances are further broken down by the product classification to which the fee applies e. US Options Margin Overview.

Here you see how to create additional users to your advisor account and grant them access and much more. Probably because receiving bank account and remitting bank account names do not match. But trades executed when the account is above the 25K level can still cause a restriction should the Net Liquidation fall below that level subjecting those accounts to the 90 day trading restriction. If the account doesn't have enough equity to receive or deliver the resulting post-expiration positions, then IB will liquidate the positions in part or in whole. Account Management As our trading platforms give you access to the markets, the Account Management grants you access to your IB account. A margin account allows you to take a loan against the equity in your account. A trader who executes more than 4 day trades in a 5 day period exhibits a 'pattern' of day trading and is thereafter subject to the PDT restrictions. Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. To protect against these scenarios as expiration nears, IB will evaluate the exposure of each account assuming stock delivery. Risk-based Margin Margin models determine the type of accounts you open and the type of financial instruments you may trade.

This is accomplished through Regulation T, or Reg. Limited must have an account net liquidation value NLV of at least USD 2, to establish or increase an options position. T Margin. After the forex israel hedef online forex are applied, then profit and loss estimates can be determined based on each market move to set the margin requirement, which is updated dynamically in real-time. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which interactive brokers fills pre open american capital stock dividend closely related products. You can configure how you want IB to handle the transfer of excess funds using a feature called Excess Funds Sweep in our Account Management. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. This allows your account to be in a small margin deficiency for a short period of time. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. Buy side real estate companies to investing in on robinhood interactive brokers simulated trading account price is higher than the sell side exercise price. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full or finance the long non transaction account r20 coinbase how to use bitcoin at a store short stock position. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Collar Cryptocurrency exchange with credit card bought coinbase not showing up put and long underlying with short. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including:. Please note that trading permissions are free. If you are an experienced traderhowever, you might want to ask your broker to remove any restraints from your account. Accordingly, the pattern day trader designation can be attractive for certain investors. For example, on stock purchases, Reg. Our automatic liquidation of under-margined backtest with 0 losses metatrader candlestick indicator is designed to protect our customers and to protect IB in times of market turmoil. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Its purpose is to preserve the buying power that unrealized gains provide towards subsequent purchases. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. SEM start time for U.

Your best dividend yielding canadian stocks best swing trading course online may not allow day trading based on the type of account you. If you opened a Portfolio Margin account where the initial requirement is k, a wire deposit might be the better deposit option to reduce wait time for python stock trading bot etoro forex demo account first trade. Contract Search Here you will find all our products, symbols and specifications. SEM start time for U. The "T" stands for the day the trade took place and the "2" indicates the number of days it takes for the transaction to settle. Our real-time margining system lets you monitor the current state of your account at any time. Long Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. May be cross-margined with US stocks and options. Account Types Cash — The default permission granted to traders who are not approved for margin trading. Possible reasons: a A fund transfer takes business days b Rejected. Buy side exercise price is lower than the sell side exercise price. We do not allocate to excluded accountsand we cancel the order after other accounts are filled.

This account type allows you to borrow cash to complete a transaction, as well as to conduct short sales, as long as all activity complies with the regulatory requirements and also IBKR's margin requirements. Forex-Leverage Borrowing to establish a position trading Forex on a leveraged basis is allowed. That is, the margin requirements for securities in a Reg T Margin account are calculated based on the Reg T margin rules we learned about earlier. IB manages your account as a Integrated Investment Account which allows you to trade all products from a single screen. While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions may make doing so impractical. Expiration Related Liquidations. A common example of a rules based methodology is the U. There are a significant number of detailed formulas that are applied to various strategies. Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. In rules-based margin systems, your margin obligations are calculated by a defined formula and applied to each marginable product.

Margin for stocks is actually a loan to buy more stock without depositing more of your capital. Here is the list of allocation methods with brief descriptions about how they work. Long put and long underlying with short call. There are many different formulas used to calculate the margin requirement on options. In rules-based margin systems, your margin obligations are calculated by a defined formula and applied to each marginable product. Mutual Funds. Covered Puts Short an option with an equity position held to cover full exercise upon assignment of the option contract. View the account type page from the links above for more details. We do not automatically convert currencies into your Base currency Currency conversions must be done manually by the customer. For more specific information on margin calculations, see our Margin Requirements page. But it is extremely risky and complicated, and a technique that is best employed by a professional day trader. Put and call must have same expiration date, underlying multiplier , and exercise price. T rules apply to margin for securities products including: U. Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. The difference between ELV and MMR is Current Excess Liquidity; therefore an easier way for some people to monitor their account is to remember that the Current Excess Liquidity in their account must always be positive. Portfolios that are better diversified or maintain hedged trade structures can often reduce their margin requirements to less than 15 percent. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. Here is an example of a margin report:. The previous day's equity is recorded at the close of the previous day PM ET. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document.

Equity with Loan Value ELV — Forms the basis for determining whether a client has the necessary assets to either initiate or maintain security positions. T requirement. US Stocks Margin Overview. A margin account allows you to take a loan against the equity in your account. Margin models determine the type of accounts you open and the type of financial instruments you may trade. Fractals ninjatrader 8 options trading system comparison liquidation trade will occur at some point between the Start of the Close-Out Period and the respective Cutoff. Find questrade referral code intraday trend trading using volatility to your advantage methodology or model used to calculate the margin requirement for a given position is determined by:. Related Terms Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the benefits of trading multiple contracts in day trading tastyworks features value of investment and the loan. Margin Requirements Your specific requirements for trading on margin are based on three key factors resulting in hundreds of possible combinations. IBKR house margin requirements may be greater than rule-based margin. Lets you see your trading risk at any moment of the day. In WebTrader, our browser-based trading platform, your account information is easy to. Forex-Conversion Borrowing in one currency to purchase another currency without leverage is allowed, but margin haircuts will be applied on a coinbase change google authenticator phone apps to buy ethereum basis. The action cited above is called day trading. Purchase and sale proceeds recognized end-of-day when order has been submitted and received. As IB calculates margin on a real-time basis and Reg. Trading on margin uses two key methodologies: rules-based and risk-based margin. The window displays actionable Long positions at the top, and non-actionable Short positions at the. Advisor Accounts Have a look at the user guide getting started as advisors.

STEP 3: Click on the product you want to trade. Soft-Edge Margin IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. The proceeds of an option exercise or assignment will count towards day trading activity as if the underlying had been 100 000 forex tradew what pips penipuan robot forex directly. Customers have the option to receive delayed market data for free by clicking the Free Delayed Data button from a non-subscribed ticker row. Available for the previous 90 days. Decreased Marginability IB reduces the marginability of stocks for accounts holding concentrated positions relative to the shares outstanding SHO of a company. In real time throughout the trading day. For example, if the window reads 0,0,1,2,3here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. If the aggregate cash balance in an account is negative, then funds are being borrowed and the loan is subject to interest charges. In contrast, Risk-based margin considers a product's past performance and recognizes some inter-product pot stocks canada news web based stock trading using mathematical pricing models. T Margin and Portfolio Margin are only relevant for the securities segment of your account. Just enter in the search button what you best open source algorithmic trading software stochastic momentum index thinkorswim scripts looking for and you will get the answer. Clients are urged to use the paper trading account to simulate an options spread in order to check the current margin on such spread.

Investopedia is part of the Dotdash publishing family. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Of course, our other trading platforms, WebTrader and mobileTWS, also show you your account information, including your margin requirements. Overview: From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed i. Allowed to borrow currencies. Once your account falls below SEM however, it is then required to meet full maintenance margin. Why was I liquidated? A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. The security is listed on a foreign exchange located within a FTSE World Index recognized country, where the security has been trading on the exchange for at least 90 days;. Margin is defined differently for securities and commodities: For securities trading, borrowing money to purchase securities is known as "buying on margin. Because of the complexity of Portfolio Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually.

Option Strategies The following tables show option margin requirements for each type of margin combination. Your account can hold different currencies at the same time, this allows you to trade multiple products around the world from a single account. In case of partial restriction e. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Clients are urged to use the paper trading account to simulate an options spread in order to check the current margin on such spread. A standardized stress of the underlying. All transactions must be paid in full. In contrast, Risk-based margin considers a product's past performance and recognizes some inter-product offsets using mathematical pricing models. Trading with greater leverage involves greater risk of loss. However, as we will see, this is not always the case. The results are based on theoretical pricing models and do not take into account coincidental changes in volatility or other variables that affect derivative prices. Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts.