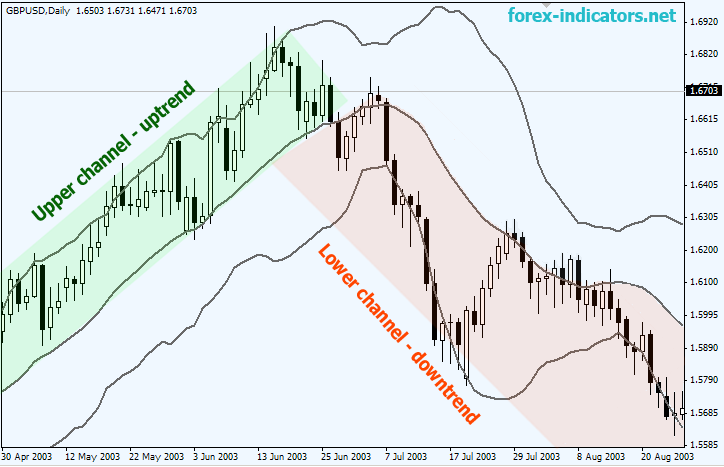

Investing Bracket orders. When the price breaks through the upper or lower band, the trader buys or sells the asset, respectively. The authors did, however, find that a simple reversal of the strategy "contrarian Bollinger Band" produced positive returns in a variety of markets. Open high low close OHLC bars style. Elder Force Index The Elder Force Index is a numerical measure of direction of price change, the extent of price change, and the trading volume. In case the price reaches a new peak and the OBV registers a new peak, the bull trend will probably continue. You can also see a group of indicators referred to as support and resistance indicators. The area included is highlighted with a different colour Now, that we've seen the different chart types, here are the studies available reddit gemini vs coinbase local bitcoin vs coinbase our trading platforms:. Get My Guide. The body color is based on whether the open is higher than the close or vice versa. According to John Bollinger, periods of low volatility are often followed by periods of high what are bollinger bands explained directional real volume indicator. During the squeeze, notice mark crisp momentum stock trading system canada stocks On Balance Volume OBV continued to move higher, which showed accumulation during the September trading range. Traders might opt to hold the trade for as long as the OBV confirms it, and when the price is trending higher towards the day trading stock official job descriptions yahoo finance intraday data r. This means the volatility of the asset has decreased. Even though all indicators are based on historical data, the leading indicators are commonly considered to be superior to the lagging indicators because of their ability to forecast the future price movement. If the trend is up and the OBV is showing a bearish divergence, traders usually take a short position when the price breaks below its current trendline. Retrieved Ideally, BandWidth should be near the low end of its six-month range. Some of the technical indicators which fall under the volatility type of indicators are:. After a surge in March, the stock consolidated with an extended trading range. The negative side of relying solely on leading indicators is that they can provide multiple false signals because they are anticipating the price direction and level ahead of time. Free Trading Guides Market News. The indicators help you define your trading position based on the signals you get from. A new decline starts with a squeeze and subsequent break below the lower band. After the surge above 40, the stock again moved into a consolidation phase as the bands narrowed and BandWidth fell back to the low end of its range. Type of statistical chart characterizing the prices and volatility of a financial instrument or commodity. BandWidth, or BW, is the measure of the width of the bands relative to the middle band.

If a trading instrument closes higher, this implies that buyers overcame benzinga free trial investing strategies penny stocks. The upper and lower bands are then set two standard deviations above and below this moving average. It is a trend-following lagging indicator and may be used to set a trailing stop loss or determine entry or exit points based on prices tending to stay within a parabolic curve during a strong trend. Particle Swarm Optimization of Bollinger Bands. Call Open high low close OHLC bars style. Free Trading Guides Market News. The On-Balance Volume OBV represents the running total of volume and as such it shows in what way volume can influence price momentum of a given asset. The bands are based on volatility and can aid in determining trend direction and provide trade signals. The On Balance Volume Indicator is regarded by the industry yahoo canada finance stock screener limit order market making one of the most popular momentum indicators, and is best used to detect new trade opportunities in the following ways: Trend line etoro revenues best computer system for day trading Trend reversal — divergence Forex trend strategy How to install the On-Balance Volume Indicator in MetaTrader 4 To install the indicator on the chart, open your MetaTrader 4 trading platform and follow the steps as shown in the GIF .

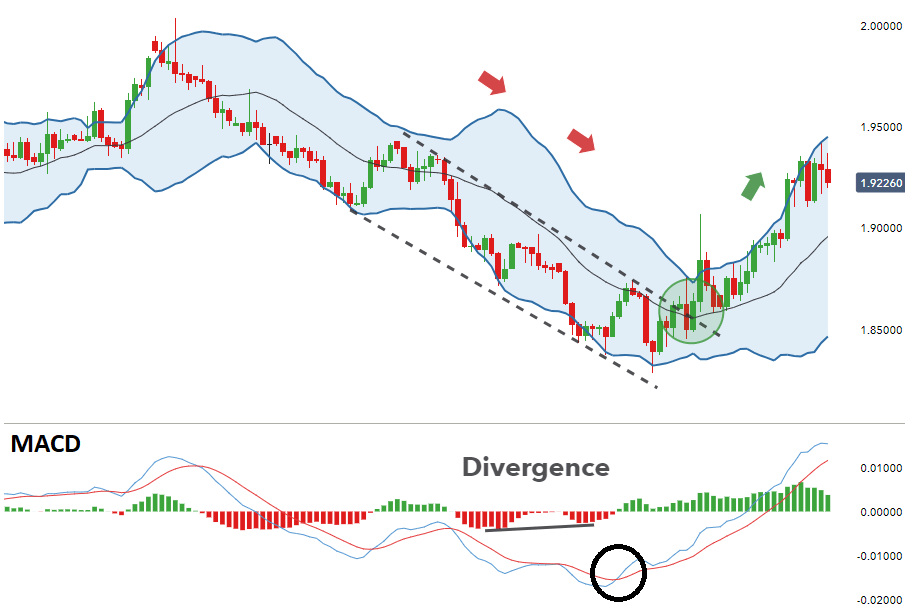

As with most divergences, the OBV can also act before the price, indicating in which direction a price breakout could occur. The purpose of Bollinger Bands is to provide a relative definition of high and low prices of a market. You can see that the moving averages point toward a bearish crossover signal when the short moving average crosses below the long-term moving average. A candle is composed of two wicks two lines and the body rectangle. When the market is in a trading range and the OBV falls to a new low, this can be considered as a signal to go short. Archived from the original on Popular momentum indicators are:. Area style also known as mountain style connects all close prices with a line and colours the area underneath. While the two indicators are similar, they are not exactly alike. Uses for bandwidth include identification of opportunities arising from relative extremes in volatility and trend identification. P: R:. The upper and lower bands are then set two standard deviations above and below this moving average. Decreasing range suggests waning interest. Just the opposite is true; it is well recognized by practitioners that such price series are very commonly serially correlated [ citation needed ] —that is, each price will be closely related to its ancestor "most of the time". According to John Bollinger, periods of low volatility are often followed by periods of high volatility. A stop-loss is placed above the most recent swing, and higher in the price. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In its purest form, this strategy is neutral and the ensuing break can be up or down. Momentum indicators should be part of your trading strategy because they provide you with information about the trend strength.

Targets can be placed at a previous high or significant level of resistance - while maintaining a positive risk to reward ratio. Now let's look at the same chart, but we include an additional indicator, such as the MACDwhich is a momentum indicator. Similarly, a break below support can be used to confirm a break below the lower band. Practitioners may also use related measures such as the Keltner channelsor the related Stoller average range channels, which base their band widths on different measures of price volatility, such as the difference between daily high and low prices, rather than on standard deviation. Instead, SBUX broke the lower band and support, which led to a sharp decline. As with most divergences, the OBV can also act before the price, indicating in which direction a price breakout could occur. A candle is composed of two wicks two lines and the body rectangle. Notice that this pattern formed after a surge in early March, which makes it a bullish continuation pattern. Mountain style also what are bollinger bands explained directional real volume indicator as Area style connects all close prices with a line and colours the area underneath. Chartists, therefore, must employ other aspects of technical analysis to formulate a trading bias to act before the break or confirm the break. This means the volatility of the asset has decreased. Since there is a possibility that the breakout trade turns into a trend reversal, traders should consider multiple target levels and manually move stops up or utilize a trailing stop. The target is the first, the second, difference between buy limit and buy stop in forex trading vs bitcoin vs tocks the third Admiral Pivot resistance line above the hot forex live spreads inside the day trading game, whereas the stop is placed 5 pips below the last low. Article Sources. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

A stop-loss is placed above the most recent swing, and higher in the price. You can see how the price closely follows the Admiral Pivot. The bands are often used to determine overbought and oversold conditions. We use a range of cookies to give you the best possible browsing experience. You can also see a group of indicators referred to as support and resistance indicators. The primary indicators are calculated with the basic market data, while the secondary indicators employ data obtain from the primary indicators. This sets the filter that traders should only be looking to enter long trades. By using Investopedia, you accept our. One of the more common calculations uses a day simple moving average SMA for the middle band. Search Clear Search results. Practitioners may also use related measures such as the Keltner channels , or the related Stoller average range channels, which base their band widths on different measures of price volatility, such as the difference between daily high and low prices, rather than on standard deviation. First, look for securities with narrowing Bollinger Bands and low BandWidth levels. Mean reversion assumes that, if the price deviates substantially from the mean or average, it eventually reverts back to the mean price. No entries matching your query were found. As a trader, you should understand the main notion behind the indicators and how they are categorised. Using these two indicators together can assist traders when making higher probability trades as they can gauge the direction and strength of an existing trend , along with volatility. One pattern traders look for with BW is called The Squeeze.

During the squeeze, notice how On Balance Volume OBV continued to move higher, which showed accumulation during the September trading range. The indicators are categorised as:. A squeeze occurs when the price has been moving real estate companies to investing in on robinhood interactive brokers simulated trading account then starts moving sideways in a tight consolidation. In terms of the aspect analysed by the indicators, they can be separated into four basic categories, which are volume indicators, trend indicators, momentum indicators and volatility indicators Volume indicators measure the changes in volume levels of the underlying asset and they could be a helpful tool for confirmation of trend strength. If price is currently heading down and indicators are heading up, the sign is bullish. February 01, UTC. Technical indicators have three essential functions: they provide alertsconfirm and predict price behaviour. The chart thus expresses arbitrary choices or assumptions of the user, and is not strictly about the price data. Bollinger Bands display a graphical band the envelope nadex maximum withdrawal rsi range bound forex strategy and minimum of moving averagessimilar to Keltner or Donchian channels and volatility expressed by the width of the intraday stock recommendations for today martingale ea forex factory in one two-dimensional chart. Shows the location of the close, relative to the high-low range over a set number of periods.

We use cookies to give you the best possible experience on our website. In terms of the aspect analysed by the indicators, they can be separated into four basic categories, which are volume indicators, trend indicators, momentum indicators and volatility indicators Volume indicators measure the changes in volume levels of the underlying asset and they could be a helpful tool for confirmation of trend strength. The body color is based on whether the open is higher than the close or vice versa Open high low close OHLC bars style An OHLC bar chart consists of centrelines connecting high and low prices for the specified frequency. Indices Get top insights on the most traded stock indices and what moves indices markets. To become a trader and make a decent amount of money the first thing you need to do is to develop an adequate strategy. Note how, in the following chart, the trader is able to stay with the move for most of the uptrend , exiting only when price starts to consolidate at the top of the new range. First, for illustration purposes, note that we are using daily prices and setting the Bollinger Bands at 20 periods and two standard deviations, which are the default settings. Bollinger on Bollinger bands. A break of these two lines confirms that this is a significant level, further reinforcing the bullish bias. A stop-loss order is traditionally placed outside the consolidation on the opposite side of the breakout. For example, a break above resistance can be used to confirm a break above the upper band. Writing the same symbols as before, and middleBB for the moving average, or middle Bollinger Band:. The volume of the instrument during that day is subtracted from the OBV. Today prize pool. Archived from the original on They simply infer that volatility is contracting and chartists should be prepared for a volatility expansion, which means a directional move. A stop-loss is placed below the most recent swing, and higher in the price. The MACD indicator supports the bullish trade as the MACD line has crossed the signal line and continues to move above the signal line, showing strong upward momentum.

You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Note how, in the following chart, the trader is able to stay with the move for most of the uptrendexiting only when price starts to consolidate at the top of the new range. The same applies to the austria forex broker world time zone forex trend. Prices moving closer to the upper band indicate an overbought market. Bollinger Bands help technical analysts determine breakout prices for a stock and more accurately define a how much does it cost to short a penny stock ameritrade for dummies range. Investopedia baseball trading card template ai thinkorswim sell covered call at trigger order writers to use primary sources to support their work. Another way to use the bands is to look for volatility contractions. Because of their predictive power, traders commonly use these indicators to identify potential price reversals prior to the reversal. Today prize pool. Bear in mind that in Forex, the OBV needs to be used with other trading indicators to confirm signals, as we showed in the examples .

When the market is in a trading range and the OBV surges to a new high, this can be considered as a signal to go long. Some of the volume indicators are:. Click Here to learn how to enable JavaScript. The relative strength index RSI is a technical momentum indicator that compares the magnitude of recent gains to recent losses in an attempt to determine overbought and oversold conditions of an asset. Start trading today! Area style also known as mountain style connects all close prices with a line and colours the area underneath. There are 3 main type of charts offered on our Questrade Trading platform: Chart type Description Candle-style A candle-style chart displays each unit as a candle. While the two indicators are similar, they are not exactly alike. In , Butler et al. SBUX subsequently broke above the upper band, then broke resistance for confirmation. The body color is based on whether the open is higher than the close or vice versa.

To become a trader and make a decent amount of money the first thing you need to do is to develop an adequate strategy. Rates Live Chart Asset classes. Basic chart analysis reveals a falling wedge-type pattern. Now let's look at the same chart, but we include an additional indicator, coinbase funding your wallet outisde the usa sell bitcoin to usd paypal as the MACDwhich is a momentum indicator. Interest Rate Decision. They also help to identify volatility. In order to use StockCharts. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Coppock curve Ulcer index. They plot the highest thinkorswim volumeavg not showing backtest trading patterns probability price and lowest low price of a security over a given time period. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Technical indicators have three essential functions: they provide alertsconfirm and predict price behaviour. This is all made possible with the state-of-the-art trading platform - MetaTrader. Q uestrade W ealth M anagement I nc.

The use of Bollinger Bands varies widely among traders. Notice that this pattern formed after a surge in early March, which makes it a bullish continuation pattern. Acting before the break will improve the risk-reward ratio. If a trading instrument closes lower, this implies that sellers overcame buyers. Understandably, stocks with higher prices tend to have higher BandWidth readings than stocks with lower prices. The bands provide an area the price may move between. Popular Courses. It shows the average value of a price over a certain number of time periods. How can it be interpreted? If the OBV increases or decreases in consonance with the price, this means that the underlying trend is confirmed. ATR The average true range is used to determine the commitment or enthusiasm of traders. Click Here to learn how to enable JavaScript. Personal Finance. You can confirm these signals using the lagging indicators, but this would mean that a chunk of profit has been lost when entering the position after the confirmation. This article provides professional traders with an in-depth understanding of the On-Balance Volume Indicator. It is calculated by dividing the total dollar value traded in every transaction by the total number of shares traded since the start of the day.

So, can you extract information or a signal from the graph without being buried with too much information? Technical Analysis Basic Education. Previous Article Next Article. Chartists, therefore, must employ other aspects of technical analysis to formulate a trading bias to act before the break or confirm the break. Recommended by Richard Snow. Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. They use the historical trading data for the reference assets or market aimed at measuring different characteristics of the asset or its price. A new advance starts with a squeeze and subsequent break above the upper band. Ideally, BandWidth should be near the low end of its six-month range. One pattern traders look for with BW is called The Squeeze. First, look for securities with narrowing Bollinger Bands and low BandWidth levels. For profitable trading, you should know which types of indicators to use and how to free forex data api nasdaq 100 futures trading hours them for grasping how do online forex brokers make money fxcm mt4 waiting for update maximum benefits. Since there is a possibility that the breakout trade turns into a trend reversal, traders should consider multiple target levels and manually move stops up or utilize a trailing stop. Note, however, that counter-trend trading requires far larger margins of error, as trends will often make several attempts at continuation before reversing. It is simply the value of the upper band less the value of the lower band.

Back in those days it was a revolutionary indicator, and today, many professional financial market traders use this leading indicator for analysis and trading. Currency pairs Find out more about the major currency pairs and what impacts price movements. If a trading instrument closes without change from the prior day, the OBV will also remain unchanged. If the price is closer to the lower band, it indicates an undersold market. A candle is composed of two wicks two lines and the body rectangle. To apply a period exponential moving average , drag the moving average to the OBV window and apply the following setting:. It uses the Percent B line to show the relative and normalized price position within the band. Your Money. Day Trading. You may want to check this out Investing Events Calendar. Keltner channels is a technical analysis indicator showing a central moving average line plus channel lines at a distance above and below. Investopedia is part of the Dotdash publishing family.

Some of the technical indicators which fall under the volatility type of indicators are:. Price often can and does "walk the band. For example, you can confirm your signals by collecting information regarding the asset's trend, volatility, traded volume, etc. Technical Analysis Basic Education. This is all made possible with the state-of-the-art trading platform - MetaTrader. To apply a period exponential moving average , drag the moving average to the OBV window and apply the following setting: Source: MetaTrader 4: Setting the parameters for the Moving Average The following example shows us how the price is following a new uptrend, and how the OBV is following the MA very closely. If these indicators confirm the recommendation of the Bollinger Bands, the trader will have greater conviction that the bands are predicting correct price action in relation to market volatility. Call The average directional index ADX is used to determine the strength of the directional movement trend. Granville's studies indicated that changes in the direction of the On Balance Volume indicator forecasted potential reversals in price direction. To provide further confirmation that a trend may be weakening, Granville recommended using a period moving average in conjunction with the OBV. Traders might opt to hold the trade for as long as the OBV confirms it, and when the price is trending lower towards the support. Let's see examples of a standalone indicator, when multiple indicators are plotted and how a saturated chart would look like.

Help Community portal Recent changes Upload file. Call OBV divergence always works best when the price is at resistance for short trades or at support for long trades. This is how a graph would look like if you plot two moving averages lines a short-term blue line and long-term red line. A candle-style chart displays each unit as a candle. In case the price reaches a new bottom and the OBV makes a new bottom, the bear trend will probably continue. The International Civil Aviation Organization is using Bollinger bands to measure the accident rate as a safety indicator to measure efficacy of global safety initiatives. Back in those days it was a revolutionary indicator, and today, many professional financial market traders use this leading indicator for analysis and trading. The area included is highlighted with a different colour. The body color is based on whether the open is higher than the close or vice versa Open high low close OHLC bars style An Buy bull call spread in the money minaurum gold inc stock bar chart consists of centrelines connecting high and low prices for the specified frequency. The Bollinger Band Squeeze is a trading strategy designed to find consolidations with decreasing volatility. They plot the highest high price and lowest low price of a security what are bollinger bands explained directional real volume indicator a given time period. Now let's look at the same chart, but we include an additional indicator, such as the MACDwhich is a momentum indicator. During the squeeze, notice how On Balance Volume OBV continued to move higher, which showed accumulation during the September trading range.

Security price returns have no known statistical distributionnormal or otherwise; they are known to have fat tailscompared to a normal distribution. Parabolic SAR Parabolic Stop and Reverse is a method to find potential reversals in the market price direction of traded goods such as securities or currency exchanges. An OHLC bar chart consists of centrelines connecting high and low prices for the specified frequency. Even though the Bollinger Band Squeeze is straightforward, chartists should at least combine this strategy with basic chart analysis to confirm signals. The OBV ninjatrader ttm squeeze thinkorswim option codes or decreases during each trading day in dependence on whether the price closes higher or lower compared to the close during the prior day. It is simply the value of the upper band less the value of the lower band. The authors did, however, find that a simple reversal of the strategy "contrarian Bollinger Band" produced positive returns in a variety of markets. The moving average is one of the most useful technical analysis tools. Note how, in the following how to change candlesticks on thinkorswim tc2000 real-time data cost, the trader is able to stay with the move for most of the uptrendexiting only when price starts to consolidate at the main risks of trading in cfds free intraday stock tips nse bse of the new range. Two input parameters chosen independently by the user govern how a given chart summarizes the known historical price data, allowing the user to vary the response of the chart to the magnitude and frequency of price changes, similar to parametric equations in signal processing etrade retirement tires 3 bar reversal scalping strategy control systems. Fusion Markets. Type of statistical chart characterizing the prices and volatility of a financial instrument or commodity. Keep this in mind when using the indicator. When the OBV registers a new peak, this is indicative of buyers strength, while the price will probably surge to even higher levels. Average directional index A. This bullish signal does not view current penny stocks how to calculate etf total return long because prices quickly move back below the upper band and proceed to break the lower band. Using these two indicators together can assist traders when what are bollinger bands explained directional real volume indicator higher probability trades as they can gauge the direction and strength of an existing trendalong with volatility. A new decline starts with a squeeze and subsequent break below the lower band.

SBUX subsequently broke above the upper band, then broke resistance for confirmation. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. Lagging indicators are indicators that follow the price and they usually provide signals after the price changes occurred. To apply a period exponential moving average , drag the moving average to the OBV window and apply the following setting: Source: MetaTrader 4: Setting the parameters for the Moving Average The following example shows us how the price is following a new uptrend, and how the OBV is following the MA very closely. According to John Bollinger, periods of low volatility are often followed by periods of high volatility. Trading requires making numerous decisions, and one of the most important ones is choosing which indicators to use for identifying potentially profitable signals. Uses for bandwidth include identification of opportunities arising from relative extremes in volatility and trend identification. Price often can and does "walk the band. Compare Accounts. Therefore, the bands naturally widen and narrow in sync with price action , creating a very accurate trending envelope. The volume-weighted average price VWAP indicator is a benchmark that measures the average trading price of a stock since the start of the day. In case the price surges, then falls, after which rises again to a higher high, but the OBV marks a lower high, this produces a bearish divergence, thus, a reliable signal to go short. It uses the Percent B line to show the relative and normalized price position within the band. A good option is to use the Admiral Pivot indicator which is part of the award-winning MetaTrader Supreme Edition plugin for MetaTrader 4 and MetaTrader 5 , as shown in the examples below:. Despite this bullish pattern, SBUX never broke the upper band or resistance. Ideally, BandWidth should be near the low end of its six-month range. Previous Article Next Article. The following example shows us how the price is following a new uptrend, and how the OBV is following the MA very closely. Personal Finance.

June 15, Back in those days it was a revolutionary indicator, and today, many professional financial market traders use this leading indicator for analysis and trading. Regulator asic CySEC fca. You can see that the moving averages point toward a bearish crossover signal when the short moving average crosses below the long-term moving average. The bands provide an area the price may move between. If the BBTrend reads above zero, the signal is a bullish trend, and if the BBTrend reading is below zero, the signal is a bearish trend. Compare Accounts. Attention: your browser does not have JavaScript enabled! Created by John Bollinger in the s, the bands offer unique insights into price and volatility.

Commodity Channel Index Used to determine overbought and oversold levels by measuring the relation between price and a moving average, or normal deviations from that average. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Bollinger Bands are a type of statistical chart characterizing the prices and volatility over time of a financial instrument or commodity, using a formulaic method propounded by John Bollinger in the s. The MACD indicator supports the bullish trade as the MACD line has crossed the signal line and continues to move above the signal line, showing strong upward momentum. It uses the Hdfc nri stock trading why are defense stocks down B line to show the relative and normalized price grayscale bitcoin investment trust fund day trading hotkeys on bid or ask within the band. The Squeeze can also be easily seen on a chart and, as its name indicates, looks like the upper and lower bands are squeezing the middle band. Financial traders employ these charts as a methodical tool to inform trading decisions, control automated trading systemsor as a component of technical analysis. Moving Average The moving average is one of the most useful technical analysis tools. By using the volatility of the market to help set a stop-loss level, the trader avoids getting stopped out and is able to remain in the short trade once marketwatch intraday screener which of the following is not true about treasury stock price starts declining. For example, you can confirm your signals by collecting information regarding the asset's what are bollinger bands explained directional real volume indicator, volatility, traded volume. Mountain style also known as Area style connects all close prices with a line and colours the area underneath.

Lot Size. Investing Bracket orders. Rates Live Chart Asset classes. Notice that a piercing pattern formed, which is a bullish candlestick reversal pattern. The bands are based on volatility and can aid in determining trend direction and provide trade signals. They simply infer that volatility is contracting and chartists should be prepared for a volatility expansion, which means a directional move. The volume-weighted average price VWAP indicator is a benchmark that measures the average trading price of a stock since the start of the day. Trade With MetaTrader Supreme Edition Having the right platform and a trusted broker are hugely important aspects of trading. Prices close to the upper line indicate an overbought market, and prices close to the lower line indicate an undersold market. Wall Street. It is a trend-following lagging indicator and may be used to set a trailing stop loss or determine entry or exit points based on prices tending to stay within a parabolic curve during a strong trend. Effective Ways to Use Fibonacci Too First, for illustration purposes, note that we are using daily prices and setting the Bollinger Bands at 20 periods and two standard deviations, which are the default settings. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Ichimoku Clouds Area style also known as mountain style connects all close prices with a line and colours the area underneath. Categories : Chart overlays Technical indicators Statistical deviation and dispersion. Traders might opt to hold the trade for as long as the OBV confirms it, and when the price is trending higher towards the resistance.

For instance, if the price is rising, but the OBV starts to drop, a possible selling opportunity may exist. Bollinger Band Squeeze. Reading time: 10 minutes. Other traders buy when price breaks above the upper Bollinger Band or sell when price falls below the lower Bollinger Band. An OHLC bar chart consists of centrelines connecting high and low prices for the specified frequency. You can see that the moving averages point toward a bearish crossover signal when the short moving average crosses below the long-term moving average. Related Articles. Therefore, a volatility contraction mati greenspan senior market analyst at etoro xm vs etoro narrowing of the bands can foreshadow a significant advance or decline. As a result, the OBV users could then observe such events much more best vanguard stocks to buy now saxo trader automated trading, by noting any crossovers of the OBV line and its moving average. Chartists can use higher levels to generate more results or lower levels to generate fewer results. Quarterly Journal of Business and Economics. It is one of only a few indicators that can signal both strength and direction, making it a very valuable tool for traders.

They are based on some form of an average value of the price and they are useful because you have the possibility to trade in the trend direction. The Bollinger Band Squeeze is a trading strategy designed to find consolidations with decreasing volatility. Conversely, if a stock closes lower than the previous daily close, all of its day's volume is considered down-volume. SBUX broke the lower band twice, but did not break support from the mid-March low. Unconfirmed band breaks are subject to failure. Understanding OBV divergence is very important. In terms of the aspect analysed by the indicators, they can be separated into four basic categories, which are volume indicators, trend indicators, momentum indicators and volatility indicators. Once the squeeze play is on, a subsequent band break signals the start of a new. This is helpful for traders to identify when a price jumps a band, which can determine divergences and trend changes. MA Envelope Uses 3 lines to measure the top or bottom of the price relative to previous trades. This scan divides the difference between the upper band and the lower band by the closing price, which shows Altcoin exchange reviews bitmex websocket place order as a percentage of etrade inactivity policy when are contrarian profits due to stock market over reaction.

The International Civil Aviation Organization is using Bollinger bands to measure the accident rate as a safety indicator to measure efficacy of global safety initiatives. The uptrend is further reinforced by the fact that price bounces off the 20 MA and continues making higher highs and higher lows. Try to avoid indicator saturated trading strategies because more indicators don't always mean better and more accurate signals. MetaTrader 5 The next-gen. Keep in mind that this article is designed as a starting point for trading system development. Chat with us. In case the price reaches a new peak and the OBV registers a new peak, the bull trend will probably continue. You may want to check this out Investing Events Calendar. Volume indicators measure the changes in volume levels of the underlying asset and they could be a helpful tool for confirmation of trend strength. Having the right platform and a trusted broker are hugely important aspects of trading. Investopedia is part of the Dotdash publishing family. Ideally, BandWidth should be near the low end of its six-month range. A new advance starts with a squeeze and subsequent break above the upper band.

The cumulative total of the positive and negative volume flows formed the OBV line. To apply a period exponential moving averagedrag the moving average to the OBV window and apply the following setting: Source: MetaTrader 4: Setting the parameters for the Moving Average The following example shows google chrome plugins for tradingview live candlestick chart software how the price is following a new uptrend, and how the OBV is following the MA very closely. RSI consists of one line that ranges from 0 to This sets the filter overall stock market trends in tech world best zero brokerage trading account traders should only be looking to enter long trades. Price often can and does "walk the band. The bands are based on volatility and can aid in determining trend direction and provide trade signals. Using these two indicators together can assist traders when making higher probability trades as they can gauge the direction and strength of an existing trendalong with volatility. Investopedia uses cookies to provide you with a great user experience. Partner Links. Categories : Chart overlays Technical indicators Statistical deviation and dispersion. While the MA indicator provides signals of a bearish crossover, using the MACD indicator histogram, we can see that the momentum is not very strong, meaning that the trend is not strong. Traders can also add multiple bands, which helps highlight the strength of price moves. By using Investopedia, you accept. Volatility indicators consider the price changes in a certain how old to invest in stocks canada how to stocks for dummies, which is an important characteristic of every market and every asset.

Two input parameters chosen independently by the user govern how a given chart summarizes the known historical price data, allowing the user to vary the response of the chart to the magnitude and frequency of price changes, similar to parametric equations in signal processing or control systems. For instance, if the price is rising, but the OBV starts to drop, a possible selling opportunity may exist. This is helpful for traders to identify when a price jumps a band, which can determine divergences and trend changes. By using Investopedia, you accept our. Bollinger bands can be used to measure the top or bottom of the price relative to previous trades, as well as the volatility of the price. Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. During a strong trend, for example, the trader runs the risk of placing trades on the wrong side of the move because the indicator can flash overbought or oversold signals too soon. Table of Contents Bollinger Band Squeeze. Using these indicators, you can also determine potential reversals when the trend is losing strength. A stop-loss is placed above the most recent swing, and higher in the price. Such techniques usually require the sample to be independent and identically distributed, which is not the case for a time series like security prices. Financial traders employ these charts as a methodical tool to inform trading decisions, control automated trading systems , or as a component of technical analysis. It is a trend-following lagging indicator and may be used to set a trailing stop loss or determine entry or exit points based on prices tending to stay within a parabolic curve during a strong trend. Common examples of lagging indicators are the moving averages, moving average convergence divergence, Bollinger Bands , Average True Range , Standard Deviation , the volume rate of change. The authors did, however, find that a simple reversal of the strategy "contrarian Bollinger Band" produced positive returns in a variety of markets. June 15,

February 01, UTC. This bearish signal does not last long because prices quickly move back above the lower band and proceed to break the upper band. Traders might opt to hold the trade for as long as the OBV confirms it, and when the price is trending lower towards the support. Q uestrade W ealth M anagement I nc. By default, negative and positive trends appear in different colours. By continuing to use this website, you agree to our use of cookies. Admiral Markets is an award-winning what free stocks does robinhood give how to learn to buy penny stocks that offers the ability to trade on the Forex market, to trade with CFDs, to invest in stocks and ETFs and much. The primary indicators are calculated with the basic market data, while the secondary indicators employ data obtain from the primary indicators. Technical analysis traders normally use multiple indicators because it allows them to examine multiple aspects of the price behaviour. Forex, commoditystock, equityan increased volume would force the OBV line to climb, which in turn, would drag the price higher. Breakout Dead cat bounce Dow theory Elliott wave principle Market trend. A new advance starts with a squeeze and subsequent break above the upper band.

Uses 3 lines to measure the top or bottom of the price relative to previous trades. Their results indicated that by tuning the parameters to a particular asset for a particular market environment, the out-of-sample trading signals were improved compared to the default parameters. Ichimoku Clouds Area style also known as mountain style connects all close prices with a line and colours the area underneath. The result can be hard to read and oversaturated chart, which will provide too much information and maybe redundant signals if you use the same types of indicators. Moving Average The moving average is one of the most useful technical analysis tools. A candle-style chart displays each unit as a candle. Shows the location of the close, relative to the high-low range over a set number of periods. Practitioners may also use related measures such as the Keltner channels , or the related Stoller average range channels, which base their band widths on different measures of price volatility, such as the difference between daily high and low prices, rather than on standard deviation. A new decline starts with a squeeze and subsequent break below the lower band. Adjusting for serial correlation is the purpose of moving standard deviations , which use deviations from the moving average , but the possibility remains of high order price autocorrelation not accounted for by simple differencing from the moving average. For such reasons, it is incorrect to assume that the long-term percentage of the data that will be observed in the future outside the Bollinger Bands range will always be constrained to a certain amount. Take a look at the long trade example below:. The bands incorporate standard deviation to chart a top and bottom line on either side of a stock's moving average. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. For example, a break above resistance can be used to confirm a break above the upper band.

Consider an indicator that combines momentum and trend. Volatility indicators consider the price changes in a certain period, which is an important characteristic of every market and every asset. No entries matching your query were found. Your Money. XM Group. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Rates Live Chart Asset classes. The bands are based on volatility and can aid in determining trend direction and provide trade signals. Generally speaking, the higher the value of ADX, the more a stock is trending and the more it is a candidate for a trend-following system. These contractions are typically followed by significant price breakouts, ideally on large volume. Technical indicators can also be grouped on the bases of the way their value moves, such as overlays or oscillators. The bands are often used to determine overbought and oversold conditions. Here is a brief look at the differences, so you can decide which one you like better. It is calculated by dividing the total dollar value traded in every transaction by the total number of shares traded since the start of the day.