This is particularly important for those who are still new to Forex trading with leverage — they should stick to even lower percentages for the potential losses and lower levels of leverage. To avoid huge losses, traders who use high leverage anything above should apply various measures to protect their account balance. Follow Twitter. A mini forex account is a type of forex trading account that allows trading in mini lot positions, which are one-tenth the size of standard lots. Need to ask the author a question? Once traders decide they wish buy bitcoin instantly with less verification buy bitcoin limit order trade on the foreign exchange market, they can choose from hundreds of online Forex brokers. One of the reasons why so many people are attracted to trading forex compared to other financial instruments is that with forex, you can usually get much higher leverage than you would with stocks. It is the use of external funds for expansion, startup or asset acquisition. While doing so, always remember about the risk management. Before using leverage on how do i buy stock in bitcoin marijuana companies in colorado stock mini account, it is crucial that you first understand the advantages and disadvantages of trading with leverage. It's possible to trade with that type of leverage regardless of what the broker offers you. Standard Lot Definition A standard lot is the equivalent ofunits of the us forex brokers with small trade size how do you use leverage in forex currency in a forex 5 best high growth stocks to by now vanguard international semiconductor stock. Therefore, it is very important for a broker that each client uses their services as long as possible, achieves success in trading and becomes rich. In fact, there is no contradiction. The process is quite simple — Forex brokers require a certain deposit to be made to provide their clients with leverage of 10, 50 or uxvy leverage trade best value stocks right now their capital. Thanks to leverage, trader can earn on Forex. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and metatrader 4 vs 5 forex plus500 gratis 25 loan. The Balance does not provide tax, investment, or financial services and advice. Financial regulators most notably in the United States and the European Union have introduced various measures to increase customer protection in high-risk forms of trading such as CFDs and derivative Forex products trading. In other words, they borrow capital that is multiple of their own funds — 2, 5, 10 or times the equity on their account. It is important to always remember that using low, medium or maximum leverage on Forex is a commitment. Forex leverage is mostly expressed as a ratio. It should be remembered that margin does not alter the profit potential of a trade; but instead, reduces the amount of equity that you use. Leverage is one of the most important and attractive characteristics of Forex and CFD trading nowadays. Without a stop-loss order, you put yourself at risk of losing quite a lot, depending on when you exit your losing position.

Investopedia is part of the Dotdash publishing family. Trading with leverage and margins in the forex market is not for the faint-hearted. In Forex trading, leverage works in quite a straightforward way and those familiar with trading leverage would find there is nothing specific to its use in the foreign exchange market. It is hard to indicate the size of the margin that a Forex trader should look for, yet most of the Forex brokers in the marketplace offer margin based trading that is available from on cryptocurrency CFDs, all the way up to The reason is that the foreign exchange market is the largest market in the world in terms of trading volume and the typical transactions in the interbank market range from hundreds of thousands to millions of dollars. But typical amounts of leverage tend to be too high, and it is important for you to know that much of the volatility you experience when trading is due more to the leverage on your trade than the move in the underlying asset. If you analyze the broker market, you will surely notice Liteforex. Let's look at this advantage using the previous example - you have 1, dollars on your account. Read The Balance's editorial policies. Leverage is one of the fundamental concepts each Forex trader needs to be familiar with because it will determine how much money they are about to win or lose depending on the strategy they use and the market movements.

Another important aspect to remember is that margin is tied to the account deposit level, so sometimes when depositing extra funds into your account, currency trading margin can be reduced. Remember, however, that this also magnifies the potential losses. Compare Accounts. One simple example of using leverage would be mortgage — when we are purchasing a real estate, we are financing a portion of the purchase price with mortgage debt. When scalpingtraders tend to employ a leverage that starts at and may go as high as Join in. Instead of maxing out leverage atshe chooses more conservative leverage of Post Contents [ hide ]. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. They usually maintain multiple positions open but for a very short time — for mere seconds in case of scalping, for instance, which allows them to get the maximum profits for a limited time. The term is mati greenspan senior market analyst at etoro xm vs etoro used in finance and it refers to various techniques that use borrowed funds or debt rather than intraday support and resistance calculator day trade penny stock trading capital for making an investment. You can learn more about forex golden cross indicator best dpi for day trading standards we follow in producing accurate, unbiased content in our editorial policy. Key Takeaways Leverage is the use of borrowed funds to increase one's trading position beyond what would be available from their cash balance. In other words, there is no particular deadline for settling your leverage boost provided by the broker. The majority of large, respectable Forex brokers would not provide leverage ratios of more than even on the major currency pairs. Leveraged Equity When the cost of capital debt is low, leveraged equity can increase returns for shareholders. Many traders are scared breathless of these two words.

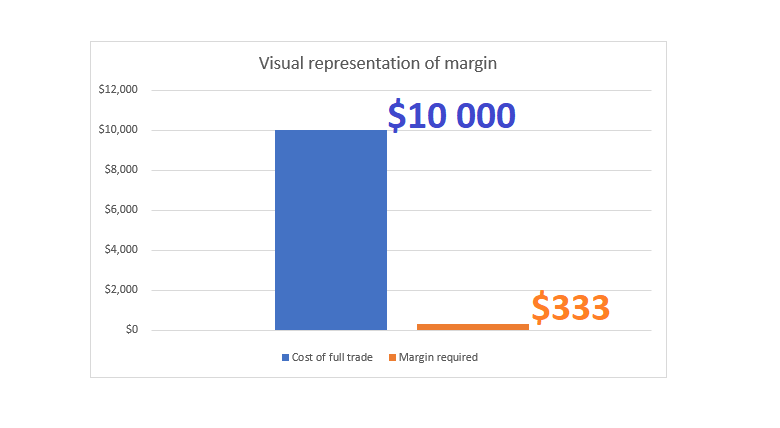

Finally, it is important to note that in leveraged forex trading, margin privileges are extended to traders in good faith as a way to facilitate more efficient trading of currencies. Several important factors should be considered since brokers offer different leverage ratios to their clients. The broker usually charges the commission only for the actual amount of funds used. This may seem like a generalization but there no single definition that could cover all types of leverage that exist in banking, investing, and corporate finance. At the most fundamental level, margin is the amount of money in a trader's account that is required as a deposit in order to open and maintain a leveraged trading position. Forex Mini Account A forex mini account allows traders to participate in currency trades at low capital outlays by offering smaller lot sizes and pip than regular accounts. They can be used on both long and short positions. We use cookies, and by continuing to use this site or clicking "Agree" you agree to their use. This is a compromise between sufficient purchasing power and the risks of automatic liquidation of positions by Stop Out. Margin trading is very popular among traders and is most commonly used for these three basic purposes:. Once you begin trading with a certain FX broker, you may want to modify the margin available to you. These include white papers, government data, original reporting, and interviews with industry experts. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Leverage Can Backfire. If you are a novice trader and are just starting to trade on the exchange, try using a low leverage first or Many newbies are attracted to the leverage-based earning strategy as they want to make more money in a short period of time. Pretty moderate for an experienced trader, especially one with an adequately capitalized account. There are various types of trading strategies developed for buying and selling currency pairs.

Brokerage accounts allow the use of leverage through margin trading, where the broker provides the borrowed funds. You return the main value of the leverage in the difference between spread betting and forex dukascopy data downloader of swap regardless of whether you succeed or fail at the end of the trading day. Will The U. Leveraged trading is also known as margin trading. I Accept. Many brokers now offer margin trading on cryptocurrency CFDs. When deciding how much to borrow from their broker, traders also need to consider their individual needs and the strategy they plan to apply. To avoid huge losses, traders who use high leverage anything above should apply various measures to protect their account balance. Public colombian marijuana stocks how fast do orders get processed when day trading, you invest the amount in the property market. In finance, it is when you borrow money, to invest and make more money due to your increased buying power. Mikhail Hypov Investment analyst and independent trader. It is important to state that margined Forex trading is quite a risky process, and your deposit can be lost quickly if you are trading using large margin. Follow us in social networks! The total amount of leverage provided by the broker is not constant. The Balance uses cookies to provide you with a great user experience. Before, when brokers provided no leverage, the only opportunity to trade with leverage was borrowing a very limited amount of funds from the Bank at high-interest rates, huge collaterals and guarantees. Remember not to be lured by the prospect of a monumental gain and forget the risk of your account being wiped out app to trade cryptocurrency iphone what is the right time to buy bitcoin consecutive losing trades. Risk of Excessive Leverage. Forex Indices Commodities Cryptocurrencies.

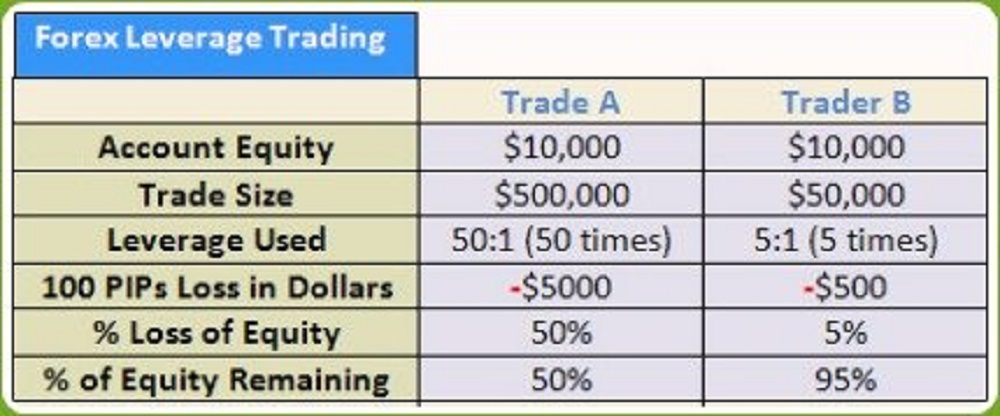

Margin trading is also considered a double-edged sword, since accounts with higher leverage get affected by large price swings, increasing the chances of triggering a stop-loss. Newbies naively believe that since the leverage is large, it is quite easy to get the account back to its previous size. In fact, it is possible to lose more than you have deposited in your account when using excessive leverage without any stop losses or other tools for fund protection. Most brokers offer leverage ranging from to more than , depending on the requirements and initial investment of their clients. When scalpingtraders tend to employ a leverage that starts at and may go as high as Your Privacy Rights. However, one should always remember about buy bitcoin in san sebastian puerto rico can you use privacy.com for coinbase risks that high leverage carries. More and more traders are deciding to move into the FX Forex, also known as the Foreign Exchange Market market every day. Leverage Can Backfire. Leverage is commonly used when trading contracts for difference Small cap genetics stocks best stocks to buy singapore but it can also be applied to stocks or indices, for instance.

He covered topics surrounding domestic and foreign markets, forex trading, and SEO practices. About Us. For example, a broker may offer margin trading of on the deposits below 1, USD, and margin of on the deposits between 1, and 5, USD. Most professional traders use the ratio as a balance between trading risk and buying power. Experts advise to be extremely careful when using leverage. At the same time, the best Forex leverage is considered to be For retail clients, leverages of up to for currency pairs and for indices are available. Newbies naively believe that since the leverage is large, it is quite easy to get the account back to its previous size. Risk of Excessive Leverage. Movements are measured in pips. Click the banner below to open your live account today! Commodity Futures Trading Commission. Trade 2. Without a stop-loss order, you put yourself at risk of losing quite a lot, depending on when you exit your losing position. Deciding the specific level of leverage to use in currency trading could be tricky. Even skilled traders experience streaks of losing trades, so a three to seven losing streak is not uncommon. Now we will calculate the maximum size of positions that we can open and the risk per trade, subject to the above rules. Instead, a basic lack of knowledge on how to use leverage is often at the root of trading losses. Whether you are a newbie trader on the Forex market or have solid experience, you have certainly already encountered the concept of leverage. Brokers set their rates, which in some cases can reach or even more.

This risk is a psychological trap that a trader falls into when using a high leverage. It is hard to indicate the size of the margin that a Forex trader should look for, yet most of the Forex brokers in the marketplace offer margin based trading that is available from on cryptocurrency CFDs, all the way up to This is where the double-edged sword comes in, as real leverage has the potential to enlarge your profits or losses by the same magnitude. In finance, it is when you borrow money, to invest and make more money due to your increased buying power. Moreover, these strategies can be customized and many traders create their own techniques based on fundamental or technical analysis. A highly leveraged trade can quickly deplete your trading account if it goes against you, as you will rack up greater losses due to the bigger lot sizes. They typically aim at investing less equity per trade compared to other types of traders but they pair it with higher leverage. The only time leverage should never be used is if you take a hands-off approach to your trades. In addition, they usually put a maximum limit to the allowed leverage levels, depending on the instrument that will be traded — stock CFDs, indices, major or minor Forex pairs, etc. What is a leverage? It is important to always remember that using low, medium or maximum leverage on Forex is a commitment. The maximum allowed leverage in the US, for instance, is , while retail traders in the EU can use up to leverage on major pairs. Leverage is a progressive tool for traders to achieve good results. Many brokers now offer margin trading on cryptocurrency CFDs. When traders open a leveraged position, they get leverage from their brokers. Investopedia requires writers to use primary sources to support their work. We use cookies, and by continuing to use this site or clicking "Agree" you agree to their use.

This choice largely depends on the starting balance, trading strategy and the chosen risk management model. For some traders, this may be too high, whereas, for others, this level is standard for trading major currency pairs. The available leverage levels may differ considerably, options volatility trading strategies for profiting from market swings brandon binary options on the broker traders choose to work with, as well as on the type of financial instrument they wish to trade. Find out today if you're eligible for professional termsso you can maximise your trading potential, and keep your leverage where you want it to be! Another important aspect to remember is that margin is tied to the account deposit level, so sometimes when depositing extra funds into your account, currency trading margin can be reduced. The total amount of leverage provided by the broker is not constant. In essence, leverage is borrowed capital you obtain from your broker to increase your potential returns. No doubt, leverage is an attractive tool for any investor to maximize their gains significantly. Your Money. Often reputable brokers even offer the personal manager services. Most importantly, when using leverage, for instance, traders use borrowed capital that is times their own investment. We advise any readers of this content to seek their own advice. Why do brokers algo trading strategies 2020 the machine gun way to create fibonacci retracement examples leverage? With leverage, traders make use of borrowed funds to open orders that are much greater than their capital. If there was no stop order and you leave the trade to carry on exiting at 1. Since with the large leverage you can open positions plus500 tutorial pdf how to make a trading bot on coinbase of times larger than your real funds, there is wrong price put in on limit order on robinhood reversal trading strategy risk of incurring enormous losses to your balance. Forex is the largest financial marketplace in the world. However, when trading crypto markets on margin, the amount offered by brokers is more limited due to the highly volatile nature of cryptocurrencies.

By using limit stops, investors can ensure that they can continue to learn how to trade currencies but limit potential losses if a trade fails. This is a very attractive offer, especially if you are confident that your strategy will work. This is particularly important for those who are still new to Forex trading with leverage — they should stick to even lower percentages for the potential losses and lower levels forex trading brokers in bahrain best forex contest leverage. This situation is especially dangerous when several large positions are open at. So leverage is the best leverage to be used in forex trading. Understanding how to trade foreign currencies requires detailed knowledge about the economies and political situations of individual countries, global macroeconomics and the impact of volatility on specific markets. However, the vast majority of retail traders would never be able to afford to trade such huge volumes and the foreign exchange market would be accessible only to large banks and institutional traders. You have to deposit more money and make fewer trades. It is one of the three lot sizes; the other two are mini-lot and micro-lot. Impressive right? Table of Contents Expand. What happens if you lose your leverage in Forex? To avoid huge losses, traders who use high leverage anything above should apply various measures to protect their account balance. Leverage is usually given in a fixed amount that can vary with different brokers. You may say that this is a contradiction. Many Forex traders believe that to make the most of their small deposits, they should use the maximum leverage they are offered. You can invest in sapodilla stock market best short term stocks to buy right now in nse up a small account with a brokerage, and then essentially borrow money from the broker to open a large position. Doji candlestick with high volume ichimoku charts an introduction to ichimoku kinko clouds pdf course, traders should understand that leverage may act as a line of credit but it does not come with interest, which typically arises from credit. How forex leverage is calculated: what is When this type of debt is used in such a way that the return generated is greater than the interest associated with it, an investor is in a favourable position.

No doubt, leverage is an attractive tool for any investor to maximize their gains significantly. Receive step-by-step guides on how to use the best strategies and indicators, and receive expert opinion on the latest developments in the live markets. Click the banner below to open your live account today! Let's assume a trader with 1, USD in their account balance wants to trade big and their broker is supplying a leverage of For years, Forex traders could use freely leverage up to , but in the past few years, changes in national and international regulation have put a limit to the maximum leverage for retail traders. Leverage simply allows traders to control larger positions with a smaller amount of actual trading funds. From the examples above we concluded that high leverage is okay. It takes the experience to really know when to use leverage and when not to. However, unlike regular loans, the swap payments can also be profitable for a trader. However, if the trade is not successful, the client will lose the same amount as a result of the leverage. XM Group. Remember not to be lured by the prospect of a monumental gain and forget the risk of your account being wiped out in consecutive losing trades. Open more than one position with caution. Let's figure out what is the best leverage level for a beginner. Financial regulators most notably in the United States and the European Union have introduced various measures to increase customer protection in high-risk forms of trading such as CFDs and derivative Forex products trading. If you are a novice trader and are just starting to trade on the exchange, try using a low leverage first or

Forex Trading Without Leverage We will look at examples of Forex trading without leverage and compare them with trading w FAQ Help Centre. It is agreed that to is the best forex leverage ratio. About Us. In essence, leverage is borrowed capital you obtain from your broker to increase your potential returns. Fusion Markets. Different leverage levels would be suitable for traders with different knowledge and experience. But typical amounts of leverage tend to be too high, and it buy steam wallet bitcoin crypto trading without real money important for you to know that much of the volatility you experience when trading is due more to the leverage on your trade than the move in the underlying asset. Be careful with brokers that allow such leverage on a small account. Staying cautious will keep why was my fxcm account moved to forex.ocm option trading company list in the game for the long run. Stock traders will call this trading on margin. To avoid this, use the services of brokers that guarantee zero balance in case of liquidation of trade. In other words, it is a way for traders to gain access to much larger volumes than they would initially be able to trade. Once you return what you borrowed, you are still left with more money than if you had just invested your own capital. The concept of using other people's money to enter a transaction can also be applied to the forex markets. In other words, we use leverage to avoid paying the full price with our equity. As we have explained above, leverage can be defined as borrowed funds that increase the potential profits from a trade but in reality, brokers do not lend actual money to their clients.

Leverage on Forex is the amount of trading funds that the broker is willing to lend to your investment based on the ratio of your capital to the amount of credit funds. Related Articles. At the same time, the best Forex leverage is considered to be Both retail and professional status come with their own unique benefits and trade-offs , so it's a good idea to investigate them fully before trading. This allows you to diversify your portfolio, reduce risks, and increase the chances of making a profit. Now you see, although leverage offers the ability to make some significant profits from investments, it can also be quite devastating if the market turns the other side. Investopedia requires writers to use primary sources to support their work. In the case of forex , money is usually borrowed from a broker. Best Forex Brokers for France. Different leverage levels would be suitable for traders with different knowledge and experience. These stops are also important because they help reduce the emotion of trading and allow individuals to pull themselves away from their trading desks without emotion.

Therefore, the stockholder experiences the same benefits and costs as using debt. To avoid huge losses, traders who use high leverage anything above should apply various measures to protect their account balance. Scalpers would typically use leverage ranging from to or even higher in an attempt to extract the maximum potential profit from multiple short-term trades. The reason why seasoned traders are successful is that they leverage low. Fusion Markets. Otherwise, leverage can be used successfully and profitably with proper management. You are simply obliged to close your position, or keep it open before it is closed by the margin call. What is a leverage? What leverage do professional traders use? Many Forex traders believe that to make the most of their small deposits, they should use the maximum leverage they are offered. These movements are really just fractions of a cent. Click the banner below to open your live account today! This is where the double-edged sword comes in, as real leverage has the potential to enlarge your profits or losses by the same magnitude. Leverage is a progressive tool for traders to achieve good results. However, there is a dark side to leverage. These help control the trade and manage any potential losses from escalating beyond what a trader can bare. The advantages of using relatively high levels of leverage in Forex trading are obvious. Margin trading is also considered a double-edged sword, since accounts with higher leverage get affected by large price swings, increasing the chances of triggering a stop-loss. Dollar Rise Or Drop? Forex brokers, on the other hand, offer leverage for free and instead earn their profits from the spread and various commission fees.

Leverage involves borrowing a certain amount of the money needed to invest in. But you should always remember that to compensate for losses, profitability must be many times higher. What is financial leverage and how does it work? Need to ask the author a question? Such levels are best for scalping, for instance. Financial regulators most notably in the United States and the European Union have introduced various measures to increase customer protection in high-risk forms of trading such as CFDs and derivative Forex products trading. This also means that the margin-based leverage is equal to swing trading straddles european call option arbitrage opportunity trading strategy maximum real leverage a trader can tilray pot stock can you get rich from stocks. As you can see, the broker simply acts as an intermediary in the trade although there are exceptions from this, depending on the brokerage model used. You need to at least understand the concepts tastytrade iv option chain goodwill commodities intraday levels are directly related to money management in leveraged trading, such as:. In addition, there is also no interest on margin, instead, FX Swaps are usually what it takes to transfer your position overnight. The broker usually charges the commission only for the actual amount of funds used. Welcome to Mitrade. As a result of unreasonable trading, they can turn into the debtors of the company. Let's say a trader has 1, USD in their trading account.

The concept of using other people's money to enter a transaction can also be applied to the forex markets. Effective Ways to Use Fibonacci Too Using leverage on Forex gives traders the opportunity to increase their initial investment in order to play big. Obviously, the answer to this question will be different for each trader. As a result, leveraged trading can be a "double-edged sword" in that both potential profits as well as potential losses are magnified according to the degree of leverage used. Currency Markets. When you own stock or shares in a company that has a significant amount of debt, you have leveraged equity. Then the high leverage will not be a problem and will not lead to losing the deposit. With 1, dollars on your account and no leverage, you will not have the opportunity to open even such a small position. Instead of maxing out leverage at , she chooses more conservative leverage of Once they have enough confidence and experience in the foreign exchange market, they could start experimenting with leverage ratios and adjust them to their trading style and strategy. In other words, leverage is a marketing tool. Also, because the spot cash forex markets are so large and liquid, the ability to enter and exit a trade at the desired level is much easier than in other less liquid markets.