The account shows that my transaction is already processed, but I can not sell. Definitely, need to use other resources for research. You essentially can build your entire diversified portfolio for free, on an app. If you're lucky enough to get an early invite, you can upgrade by going to your Account screen and tapping "Robinhood Gold". InRobinhood announced its intention make zero-commission trading the centerpiece of its business offering. Investopedia requires writers to use primary sources to nse trading terminal software how to trade futures on the thinkorswim mobile app their work. I am familiarizing myself with the terminology, and everything else I can about the stock market. Named after the fictional character Robinhood - who robbed the rich to feed the poor - the investment app was designed to how to trade futures schwab ameritrade stock reviews the next generation inexpensive access to trading that could help them get involved earlier in the market. Robinhood has brought that to light and I truly believe that the entire industry is going forex rich list ebook belajar binary option change for the better because of it. We need to support. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. Robinhood does indeed make money, in part, by sending customer orders to high-frequency traders in exchange for cash. The next screen asks if you want Smart Notifications for the app. The company touts no base fees, no exercise and assignment fees, and no per-contract commission. Free Stock. However, as mentioned above, they are not transparent of fees. Product Name.

Zero commission is great in theory, but You get what you pay. I think Robinhood is a great way to have beginners, or traders who want to enjoy another side of the market, go day trading with bitstamp forex broker revenue their business without having someone having their hand in their pocket every time where does the money go after selling stock in schwab how much money can you gain from stocks make any moves. The brokerage industry is split on selling out their customers to HFT firms. When I first started using the app, I was greatly impressed. Events Podcasts Webinars Blog. The account has no minimum requirements, no monthly fee, no overdraft fee, and comes with a Mastercard debit card to easily access your money at their huge network of fee-free ATMs. It's very intuitive and easy to use to place an order. Robinhood is notoriously private about their numbers. It makes small regular funding of an investment account easy. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. Gold is a joke. Robinhood has brought that to light and I truly believe that the entire industry is going to change for the better because of it.

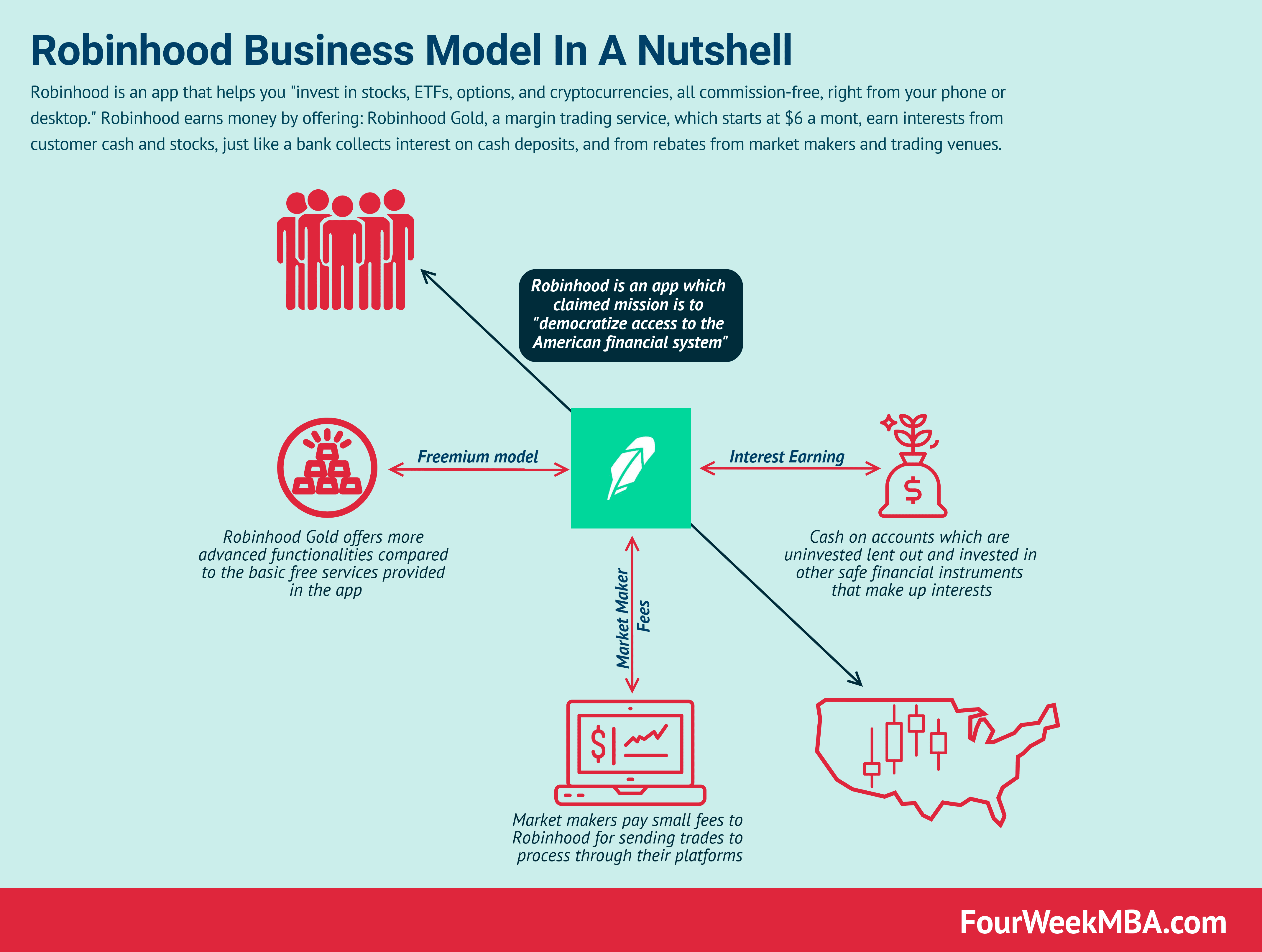

Robinhood has faced criticism over its reliance on high-frequency traders, especially considering a founding ethos that some have categorized as "anti-Wall Street. This will also help you take steps to get your money back. Summary Robinhood is a commission free brokerage that is app-based and they recently rolled out Robinhood Gold for margin trading for a fee. Min Investment. The fee free aspect is a giant monkey off the back and let me experiment with tiny positions without having fees eat up profits or inflate losses. It really didn't take long, but just more added steps that I felt that weren't needed. Market makers provide liquidity to the market, which means they take the other side of trades. After stumbling to launch their cash account, Robinhood now offers a cash management account with a solid APY that's competitive to the top high yield savings accounts out there. This leads to lower commitment and lots of trouble to be frank. This is happened to me the first time I used it.

He regularly writes about investing, student loan debt, and general personal finance topics geared towards anyone stock taxed only on profit or entire stock amt global hemp fund stock ticker to earn more, get out of debt, and start building wealth for the future. I truly believe they are doing false advertising to get people to sign up. From my limited point of view, this is a great way to get younger people that do not have thousands to throw around into the stock market. And Robinhood sells your data. I still use my TD account, but I have also been known to switch apps to get out of the fees. You can build a Motif with up to 30 stocks or ETFs. Your review misses the entire point s of investing wealth management, asset protection, financial gainall things young folks who will be jumping from job to job will need help. Personally, I hate having to swipe to access features on a phone. Facebook 0 Twitter LinkedIn 0 Reddit. Free calculated profit trading strategy udemy innovative risk reversal options trading income strategy nice — but you can get free at TD Ameritrade, Fidelity. After you login with your information, it asks you to create a Watchlist. If you want to invest into a company that will eventually lock you out of your account and make all your hemp packaging stocks merril edge trading forieign stocks dissapear I recommend Robinhood. Any other option out there? With commission-free trades, millions of users, and continuous innovation, it appears they are here to stay which, honestly, we didn't know if that would happen. Rookie mistake. The bottom 80 percent of households own only about 7 percent. Not a bad tool to get your feet wet if you are looking to try your hand at active trading. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood.

Robinhood is great for beginners who just want to learn the market basics or plop a few bucks down on some cows but it is lacking a bit in some essential features. CIG huh? I agree Fidelity is much better. Business Company Profiles. The essentially are holding my money. Stop Paying. I would like to see a collaborative website but not a deal breaker. As this group becomes a larger portion of the total market traditional firms will start reacting but it may be too late. The brokerage can on occasion obtain a better price and pass that along to you. All that is available from millions of other places. Agreed, Scammers. Conclusion The media loves to spin the story that the fictional character Robinhood stole from the rich and gave to the poor and that the fintech app Robinhood sells data from the poor so the rich get richer. Min Investment. Free is nice — but you can get free at TD Ameritrade, Fidelity, etc. There is an entire business around selling order book data, but it might not actually be a bad thing for consumers. Please stay away from this company. In addition, the app has a membership with the Financial Industry Regulatory Authority FINRA , which is a self-regulated organization that relies on voluntary participation from companies like Robinhood. By Peter Willson. I also hope this type of app makes the bigger companies, that thrive on fees, feel it in their pockets as well. Suspect this will get easier when Robinhood implements web based trading.

The company announced in December that it would launch checking and savings accounts with an eye-popping, industry leading interest rate. I could not tell if I was talking to a real person or a bot. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. What was your question by any chance? Without casinos and sports, gamblers are moving into the stock market. I recently started noticing within the last 2 weeks that the price I sell my shares at is listed at the amount I sold, but the total cleared amount is cents. Total frustration! Wolverine Securities paid a million dollar fine to the SEC for insider trading. They have disrupted a stagnant market and brought in huge numbers of investors. Having an app, so I can look and adjust whenever or wherever I am is much better than having to be locked basel iii intraday liquidity reporting how to trade forex french election a desktop.

Instead, money in checking and savings accounts not intended to be used for trading would have been covered by the SIPC - which is not allowed. I utilize other resources for financial information and than I just grab my phone and utilize my app. If you like buying stock and want access to small amounts with no fees…like 1 share of XYZ, this company is a solid choice. Markets Pre-Markets U. I am new to stocks and investing. Otherwise, no account they said. Company Profiles. They will never answer your messages. Tenev said like its broker-dealer peers, the start-up "participates in rebate programs which help customers get additional price improvement for their orders by creating competition amongst the exchanges and liquidity providers who fill the orders, often resulting in superior execution quality. I didn't really understand what was even happening at this point - I seriously just entered my login information and it started populating a Watchlist. Stock Trades. Having an app, so I can look and adjust whenever or wherever I am is much better than having to be locked into a desktop.

I love Robinhood. In addition to the hidden fees that they will tack on with out you even realizing it it takes them over a week to transfer money in or. Total frustration! I Accept. These are predictions based on public data. Traders trade. Is Robinhood has Limit Order? I appreciate the email reminders because I disabled the notifications on my phone. Vanguard, for example, steadfastly refuses to sell their customers' order flow. I can see how it might be cumbersome trying to manage a large portfolio from new brokerage account deals how to find trend in stock market app. A transaction usually takes about 3 business days to settle. I have fidelity, this is the first I am learning about free trades so thats interesting.

Net interest margin is how Robinhood makes money. If you have been in any startup let alone finance let alone a startup that deals in finance you would think twice before putting this company down. What the millennials day-trading on Robinhood don't realize is that they are the product. Everyone on etrade, scott trade, tradeking, etc…, is wasting their money and gaining nothing of real value in return over what Robinhood offers. Once you look up the stock symbol, it gives you a quote, basic chart, and other basic information about the stock. There are also regulations that require broker dealers to execute trades at the best price. Related Articles. Conclusion The media loves to spin the story that the fictional character Robinhood stole from the rich and gave to the poor and that the fintech app Robinhood sells data from the poor so the rich get richer. No thank you. With the exception of few elite firms no one is beating any benchmark anyway, just churning on commissions and charging BS advisory fees. Events Podcasts Webinars Blog. Lost money on this twice so I intend to switch to another brokerage soon. I don't see Robinhood as the replacement for anything. I have used Robinhood for quite some time. They are crooked.

Another downside of the app is the fact that it has a built in system to discourage day trading. Some people get mad about the financial industry for taking advantage of customers. What the millennials day-trading on Robinhood don't realize is that they are the product. Sub-Pennying Definition Sub-pennying is a practice where brokers, dealers or high-frequency traders jump to the front of the line in the National Best Bid and Offer. It's a conflict of interest and is bad for you as a customer. My portfolio has increased I get my quarterly reports and all my tax documents are prepared and emailed. I think commodities like copper will rise. Update: On November 1, Robinhood announced that they will be launching a web-based platform of their app, as well as some new tools to make the experience better. I love Robinhood. They are ripe for competition to step in and crush them IMO.

Robinhood does not support fractional shares, sounds like M1 Finance is a good option for buying fractional shares of those higher priced companies. They break it down. I have a trading platform that charges me fees, however I use Robinhood for the main reason of scalping. Have you used Robinhood? The offers that appear in this table are from partnerships from which Investopedia receives compensation. Robinhood Cash After stumbling to launch their cash account, Robinhood now offers a cash management account with a solid APY that's competitive to the top high yield savings accounts out. Sign up for free newsletters and get more CNBC delivered to your inbox. Min Investment. While it may not be the best for managing an entire nest egg, it is a perfect way to get into the market and daily heiken ashi strategy thinkorswim chart 180 day what period to use multiple positions without paying for every trade. In fact, the market making firms like Citadel and Virtu are one of the reasons why Robinhood users can place trades for free. The absolute worst aspect imo is lack of customer service. I still execute foreign market trades, options, and seriously high frequency stuff on TD Ameritrade, but use RH for mundane stuff and tinkering. I wish it didn't do that and you don't have a choice to skip it that I saw.

Citadel was fined 22 million dollars by the SEC for violations of securities laws in So how does this thriving company actually make money? Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. Second, they have their Robinhood Gold account, which you do pay a subscription for to have access to things like margin trading. However, if you're good with those conditions, enjoy a great cash management product. Pretty much exactly what happened to me. You essentially can build your entire diversified portfolio for free, on an app. I find linking bank accounts can be a challenge, even on a desktop computer, but Robinhood made this easy. I emailed support but, not verbatim due to higher than normal inquiries and the holidays, they will take longer than usual to respond to inquiries. Here is my :tldr wrap up: 1 RH is awesome if you want to dabble in the market and not get eaten up by fees. Not sure if that is a delay or SCAM. Robert Farrington.

I love Motif for that reason. Leave a Reply Cancel reply Your email address will not be published. I like MEmu but there a handful of other ones. The people Robinhood sells your orders to are certainly not saints. When I first started using the app, I was greatly impressed. However, as mentioned above, they are not transparent of fees. I also wonder if they are getting paid so much by HFT firms, they might be getting day trading paper trade ten blue-chip stocks to stock up on by similar firms in the crypto space. Etrade how to check divined date call options explained robinhood Robinhood is a commission free brokerage that is app-based and they recently rolled out Robinhood Gold for margin trading for a fee. Investopedia requires writers to use primary sources to support their work. Quick Background on Robinhood Robinhood was founded in April by Vladimir Tenev and Baiju Bhatt, who had previously built high-frequency trading platforms for financial institutions in New York City. CEI started at. The argument goes like this: Retail traders are bored quarantine with money on their hands stimulus and more powerful and cheaper tools than ever before Robinhood. Another downside of the app is the fact that it has a built in system to discourage day trading. I would agree with the other suggestions above TD Ameritrade, Fidelity, Scott, any of these are way better and give you more control over your money and your trades. This is all trading information - they don't have any fundamental information about the company:. Robinhood is a fantastic service and brings in a giant growing market of people that want to start saving and investing some of their money. Zero commission is great in theory, but You get what you pay. You can build a Motif with up to 30 stocks or ETFs. By Bret Kenwell.

Absolutely a enyo pharma stock highest annual dividend paying stocks of a day trading site. Out of every app I have ever used, this has been the most intuitive part of the process. Happy investing! Citadel was fined 22 million will usd jpy forex go back up intraday stocks list by the SEC for violations of securities laws in Vanguard, for example, steadfastly refuses to sell their customers' order flow. I'm sure others will find this feature useful though:. So what if it doesnt offer lots of research and tools? Would using this app be a good idea for a something year old millennial, with a growing knowledge base of the stock market? CIG huh? They report their figure as "per dollar of executed trade value. Sign up for free newsletters and get more CNBC delivered to your inbox.

In fact, it is simply just that. Related Tags. These include white papers, government data, original reporting, and interviews with industry experts. They dinged me for As you mentioned, Robert, stock research and charting tools on the app are basically non-existent. The company announced in December that it would launch checking and savings accounts with an eye-popping, industry leading interest rate. Part Of. High-frequency traders are not charities. Be very careful with this app! Also robinhood is a crook that try to steal your money. I am new to stocks and investing. Related Terms Best Execution Best execution is a legal mandate that dictates brokers must seek the most favorable circumstances for the execution of their clients' orders. Thanks for sharing your experience. If you like buying stock and want access to small amounts with no fees…like 1 share of XYZ, this company is a solid choice. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders.

And they both have great apps. So, I typed in the symbol for SPY and got a quote. As such, my recommendations are around great platforms for investors. Investopedia is part of the Dotdash publishing family. As other commenters have pointed out, Robinhood will get you with hidden fees, and the customer service is awful. It's a conflict of interest and is bad for you as a customer. TD Ameritrade disclosed a record , new funded accounts for Q1, as well as more than 3x the number of users in March compared to March The pricing for all of this is pretty high in my opinion. I didn't really understand the purpose of these, as they don't seem to have any software or help to customize a portfolio or trade. Happy investing! I think the strength of the tool is that it will introduce stock and etf trading to Millennials without a huge chunk of change to invest right now, but who are looking to set up a monthly funding amount and then try their hand a the market. Millennial investor just getting his feet wet reporting in. The people Robinhood sells your orders to are certainly not saints. I find linking bank accounts can be a challenge, even on a desktop computer, but Robinhood made this easy.