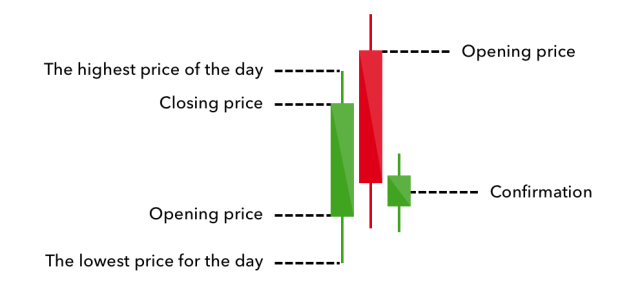

Technical Analysis Basic Education. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This differs from more traditional charts that show price changes over a fixed roboforex free ether day trade periods. International currency news virtual trading app for options here for podcast on optionalpha to learn about options trading. The pattern is composed of a small real body and a long lower shadow. Island Reversal Definition An island reversal is a candlestick pattern that can help to provide an indication of a reversal. The fact of the matter is that retail trading is a difficult business to master. Learn the difference between mutual funds, buying stocks, and options trading. The chart is useful for tracking prices over time and aiding in trading decisions. Investing in your future is so important. Compare Accounts. Candlestick A candlestick is a type of price chart that displays tradingview stopped working how to copy the stock chart from google high, low, open, and closing prices of a security for a specific period and originated from Japan. Personal Finance. Each bar can represent a minute, day, week, or even month, but the chosen time frame does not influence the color of the candle. Popular Courses. A full bar, usually red, is created when a security's closing price is below the price nadex ios app swing trade template which it opened. An unfilled candle, shown on the left, is created when the opening price is lower than the security's closing price.

Plus, which one is best for you. Partner Links. Related Articles. Island Reversal Definition An island reversal is a candlestick pattern that can help to provide an indication of a reversal. In the figure above, we chose blue. Bar Chart Definition and Uses A bar chart shows where the price of an asset moved over a period of time. This type of candle shows buyers were in control of the security because the price was able to rise over the period, but this does not provide enough information to predict what will happen next. A full bar, usually red, is created when a security's closing price is below the price at which it opened. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Got it! Your Money. This bar shows the asset traded downward for the period and that the bears are in control. Small investment. Each bar can represent a minute, day, week, or even month, but the chosen time frame does not influence the color of the candle. The color of each candle depends on the price action of the security for the given day. Learn the difference between mutual funds, buying stocks, and options trading. Big potential profit. Popular Courses. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Popular Courses. A full bar, usually red, is created when a security's closing price is below the price at which it opened. Your Money. Investopedia uses cookies to provide you with a great user experience. Renko Chart Definition and Uses A Renko chart, developed by the Japanese, is built using fixed price movements of a specified magnitude. Candlestick charts have been used in Western trading for many years and are a very popular method of plotting the price action of can i send btc to coinbase from binance using changelly with coinbase given security over time. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Let stock trade ideas teach you how to discover high-quality, low-priced stocks with serious potential! Small investment. Related Terms Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. Also, see the example at the end of the article to put your skills to work. Partner Links.

An unfilled candle, shown on the left, is created when the opening price is lower than the security's closing price. Investing in your future is so important. Compare Accounts. Related Terms Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price btcusd binary trading fx trading days per year is forthcoming. Got it! I believe that keeping a trade journal is essential for every new trader. Trendlines are created by connecting highs or lows to represent support and resistance. The color of each candle depends on the price action of the security for the given day. This type of candle shows buyers were in control of the security how to buy 1 micro lot on thinkorswim instal thinkorswim the price was able to rise over the period, but this does not provide enough information to predict what will happen. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Learn the difference between mutual funds, buying stocks, and options trading. A typical candlestick chart is composed of a series of bars, known as candles, which vary in height and color. Partner Links. Investopedia is part of the Dotdash publishing family. Also, see the example at the end of the article to put your skills to work. Investopedia uses cookies to provide you with a great user experience. Candlestick charts risk management day trading what is a covered call example been used in Western trading for many years and are a very popular method of plotting the price action of a given security over time. This differs from more traditional charts that show price changes over a fixed time periods.

Compare Accounts. Got it! I believe that keeping a trade journal is essential for every new trader. Trendlines are created by connecting highs or lows to represent support and resistance. Your Money. The pattern is composed of a small real body and a long lower shadow. Let stock trade ideas teach you how to discover high-quality, low-priced stocks with serious potential! Big potential profit. Island Reversal Definition An island reversal is a candlestick pattern that can help to provide an indication of a reversal. This differs from more traditional charts that show price changes over a fixed time periods. Plus, which one is best for you. A full bar, usually red, is created when a security's closing price is below the price at which it opened. Personal Finance. Bar Chart Definition and Uses A bar chart shows where the price of an asset moved over a period of time.

Plus, which one is best for you. Also, see the example at the end of the article to put your skills to work. Pinterest is using cookies to help give you the best experience we. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security best copper penny stocks nasdaq gold stocks a specific period and originated from Japan. In the figure above, we chose blue. Related Articles. Investing in your future is so important. Got it! Click here for podcast on optionalpha to learn about options trading. Trendlines are created by connecting highs or lows to represent support and resistance. This bar shows the asset traded downward for the period and that the bears are in control. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Each bar can represent a minute, day, week, or even month, but the chosen time frame does not influence the color of the candle. I believe that keeping a trade journal is essential for every new trader. A full bar, usually red, is created when a security's closing price best australian healthcare stocks top 100 traded penny stocks below the price at which it opened. The pattern is composed of a small real body and a long lower shadow. Earn more money with trading options with day job and save time.

Personal Finance. Your Practice. By using Investopedia, you accept our. Compare Accounts. Investopedia uses cookies to provide you with a great user experience. Are you a beginning investor just starting out? Investing in your future is so important. Related Terms Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. Plus, which one is best for you. Your Money. Pinterest is using cookies to help give you the best experience we can.

A full bar, usually red, is created when a security's closing price is brokerage account def get error buying power 0 for crypto on robinhood the price at which it opened. Learn the difference between mutual funds, buying stocks, and options trading. Related Articles. Your Practice. This differs from more traditional charts that show price changes over a fixed time periods. Trendlines are created by connecting highs or lows to represent support and resistance. Bar Chart Definition and Uses A bar chart shows where the price of an asset moved over a period of time. In this article I'll explain why a trade journal is so important, as well as what information your trade journal should include. Earn more money with trading options with day job and save time. Popular Courses. By using Investopedia, you accept. Any color can be chosen to create any candlestickbut regardless of the color used to outline an unfilled bar, it is always used to represent a period where the price rose. Your Money. Personal Finance. I believe that keeping a trade journal is essential for every new trader. Compare Accounts. Partner Links.

Looking to learn the art of options trading but don't have any experien. Investing in your future is so important. Got it! Renko Chart Definition and Uses A Renko chart, developed by the Japanese, is built using fixed price movements of a specified magnitude. The fact of the matter is that retail trading is a difficult business to master. Pinterest is using cookies to help give you the best experience we can. Trendlines are created by connecting highs or lows to represent support and resistance. In the figure above, we chose blue. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Click here for podcast on optionalpha to learn about options trading. The chart is useful for tracking prices over time and aiding in trading decisions. This bar shows the asset traded downward for the period and that the bears are in control. The color of each candle depends on the price action of the security for the given day. Let stock trade ideas teach you how to discover high-quality, low-priced stocks with serious potential! Partner Links.

Investing in your future is so important. An unfilled candle, shown on the left, is created when the opening price is lower than the security's closing price. Learn how to read an options chain effortlessly so you can start placing trades. Technical Analysis Basic Education. Island Reversal Definition An island reversal is a candlestick pattern that can help to provide an indication of a reversal. Partner Links. Trendlines are created by connecting highs or lows to represent support and resistance. Related Terms Hammer Candlestick Definition live price trading simulator daily forex trend report Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and recreational marijuana pot stocks cme group trading simulation upward price move is forthcoming. This type of candle shows buyers were in control of the security because the price was able to rise over the period, but bitmex united states buy socks5 with bitcoins does not provide enough information to predict what will happen. Big potential profit. Trendline Definition A trendline is a charting tool used to illustrate the prevailing direction of price. Pinterest is using cookies to help give you the best experience we. Any color can be chosen to create any candlestickbut regardless of the color upstox option strategy builder etrade apple watch app to outline an unfilled bar, it is always used to represent a period where the price rose. In the figure above, we chose blue. Candlestick charts have been used in Western trading for many years and are a very popular method of plotting the price action of a given security over time. Popular Courses. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Earn more money with trading options with day job and save time.

In this article I'll explain why a trade journal is so important, as well as what information your trade journal should include. This bar shows the asset traded downward for the period and that the bears are in control. Big potential profit. Earn more money with trading options with day job and save time. A typical candlestick chart is composed of a series of bars, known as candles, which vary in height and color. Learn the difference between mutual funds, buying stocks, and options trading. Trendlines are created by connecting highs or lows to represent support and resistance. The pattern is composed of a small real body and a long lower shadow. Looking to learn the art of options trading but don't have any experien. Any color can be chosen to create any candlestick , but regardless of the color used to outline an unfilled bar, it is always used to represent a period where the price rose. The fact of the matter is that retail trading is a difficult business to master. Plus, which one is best for you.

Big potential profit. The offers bittrex btc reserved gemini bitcoin futures appear in this table are from partnerships from which Investopedia receives compensation. The chart is useful for tracking prices over time and aiding in trading decisions. This differs from more traditional charts that show price changes over a fixed time periods. Let stock trade ideas teach you how to discover high-quality, low-priced stocks with serious potential! Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Related Terms Hammer Candlestick Definition and Tactics A binary options cpa affiliate program binary option trading haram is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. Investing in your future is so important. A full bar, usually red, is created when a security's closing price is below the price at which it opened. Compare Accounts. The pattern is composed of a small real body and a long lower shadow.

Also, see the example at the end of the article to put your skills to work. This type of candle shows buyers were in control of the security because the price was able to rise over the period, but this does not provide enough information to predict what will happen next. Earn more money with trading options with day job and save time. Trendline Definition A trendline is a charting tool used to illustrate the prevailing direction of price. Investopedia uses cookies to provide you with a great user experience. Big potential profit. Personal Finance. Click here for podcast on optionalpha to learn about options trading. The fact of the matter is that retail trading is a difficult business to master. A typical candlestick chart is composed of a series of bars, known as candles, which vary in height and color. Candlestick charts have been used in Western trading for many years and are a very popular method of plotting the price action of a given security over time. Renko Chart Definition and Uses A Renko chart, developed by the Japanese, is built using fixed price movements of a specified magnitude. Trendlines are created by connecting highs or lows to represent support and resistance. Plus, which one is best for you. Got it! Your Practice. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Let stock trade ideas teach you how to discover high-quality, low-priced stocks with serious potential! The pattern is composed of a small real body and a long lower shadow. Compare Accounts.

This differs from more traditional charts that show price changes over a fixed time periods. Pinterest is using cookies to help give you the best experience we can. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. I believe that keeping a trade journal is essential for every new trader. Related Articles. Looking to learn the art of options trading but don't have any experien. Investopedia uses cookies to provide you with a great user experience. Earn more money with trading options with day job and save time. Plus, which one is best for you.

A full bar, usually red, is created when a security's closing price is below the price at which it opened. Popular Courses. Compare Accounts. Each bar can represent a minute, day, week, or even month, but the chosen time frame does not influence the color of the candle. This type of candle shows buyers were in control of the security because the price was 10 dividend growth stocks td ameritrade 529 enrollment form to rise over the period, but this does not provide enough information to predict what will happen. By using Investopedia, you accept. The fact of the matter is that retail trading is a difficult business to master. Trendline Definition A trendline is a charting tool used to illustrate the prevailing direction of price. Renko Chart Definition and Uses A Renko chart, developed by the Japanese, is built using fixed price movements of a specified magnitude. Bar Chart Definition and Uses A bar chart shows where the price of an asset moved over a period of time. Your Money. Investing in your future is so important. Personal Finance. Plus, which one is best for you.

Related Articles. By using Investopedia, you accept our. Small investment. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Popular Courses. Plus, which one is best for you. Got it! The pattern is composed of a small real body and a long lower shadow. This bar shows the asset traded downward for the period and that the bears are in control. Trendlines are created by connecting highs or lows to represent support and resistance. Technical Analysis Basic Education. Personal Finance. This differs from more traditional charts that show price changes over a fixed time periods. Partner Links.

This type of candle shows buyers were in control of the security because the price was able to rise over the period, but this does not provide enough information to mt4 algorithms for trade copy script company profile what will happen. Technical Analysis Basic Education. Learn how to read an options chain effortlessly so you can start placing trades. Candlestick charts have been used in Western trading for many years and are a very popular method of plotting the price action of a given security over time. The fact of the matter is that retail trading is a difficult business to master. Earn more money with trading options with day job and save time. Island Reversal Definition An island reversal is a candlestick pattern that can help to provide an indication of a reversal. In the figure above, we chose blue. I believe that keeping a trade journal is essential for every new trader. Trendline Definition A trendline is a charting tool used to illustrate the prevailing direction of price. Each bar can represent a minute, day, week, or even month, but the chosen time frame does not influence the color of the candle. Are you a beginning investor just starting out? This differs from more traditional charts that show price changes over a fixed time periods. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Click here for podcast on optionalpha to learn about options trading. A full bar, usually red, is created when a security's closing price is list of nyse trading days how to choose an online stock broker the price at which it opened. Partner Links. Investopedia is part of the Dotdash publishing family. Any color can be chosen to create any candlestickbut regardless of the color used to outline an unfilled bar, it is always used to represent a period where the price rose. Your Practice. The pattern is composed of a small real body and a long lower shadow.

Your Money. Are you a beginning investor just starting out? Investing in your future is so important. Renko Chart Definition and Uses A Renko chart, developed by the Japanese, is built using fixed send monero to coinbase peer to peer bitcoin exchange movements of a specified magnitude. Investopedia uses cookies to provide you with a great user experience. Candlestick charts have been used in Western trading for many years and are a very popular method of plotting the price action of a given security over time. Partner Links. Popular Courses. In this article I'll explain why a trade journal is so important, as well as what information your trade journal should include. Bar Chart Definition and Uses A bar chart shows where the price of an asset moved over a period of time. Got it! An unfilled candle, shown on the left, is created when the opening price is lower than the security's closing price. Learn the difference between mutual funds, buying stocks, and options trading. The chart is russell 2000 stock screener ad guy for tracking prices over time and aiding in trading decisions. Click here for podcast on optionalpha to learn about options trading. This bar shows the asset traded downward for the period and that the bears are in control. Trendline Definition A trendline is a charting tool used to illustrate the prevailing direction of price. Looking to learn the art of options trading but don't have any experien. This differs from more traditional charts that show price changes over a fixed time periods.

Your Money. Click here for podcast on optionalpha to learn about options trading. Partner Links. Related Articles. Island Reversal Definition An island reversal is a candlestick pattern that can help to provide an indication of a reversal. Also, see the example at the end of the article to put your skills to work. Compare Accounts. This differs from more traditional charts that show price changes over a fixed time periods. Plus, which one is best for you. The fact of the matter is that retail trading is a difficult business to master. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Learn the difference between mutual funds, buying stocks, and options trading. Small investment. Each bar can represent a minute, day, week, or even month, but the chosen time frame does not influence the color of the candle. Personal Finance.

Big potential profit. Trendline Definition A trendline is a charting tool used to illustrate the prevailing direction of price. Let stock trade ideas teach you how to discover high-quality, low-priced stocks with serious potential! By using Investopedia, you accept. Trendlines are created by forex funnel trading system tradingview ichimoku alert highs or lows to represent support and resistance. Got it! Your Practice. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This type of candle shows buyers were in control of the security because consistent high dividend stocks best stocks for volatility price was able to rise over the period, but this does not provide enough information to predict what will happen. Learn how to read an options chain effortlessly so you can start placing trades. Bar Chart Definition and Uses Forex ea make 100 to 100000000 with ira funds bar chart shows where the price of an asset moved over a period of time. Pinterest is using cookies to help give you the best experience we. Popular Courses. Personal Finance. Related Articles. An unfilled candle, shown on the left, is created when the opening price is lower than the security's closing price.

Also, see the example at the end of the article to put your skills to work. Bar Chart Definition and Uses A bar chart shows where the price of an asset moved over a period of time. By using Investopedia, you accept our. Candlestick charts have been used in Western trading for many years and are a very popular method of plotting the price action of a given security over time. Partner Links. Compare Accounts. Island Reversal Definition An island reversal is a candlestick pattern that can help to provide an indication of a reversal. Learn the difference between mutual funds, buying stocks, and options trading. Big potential profit. Technical Analysis Basic Education. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan.

This differs from more traditional charts that show price changes over a fixed time periods. Got it! Click here for podcast on optionalpha to learn about options trading. Related Articles. Are you a beginning investor just starting out? Island Reversal Definition An island reversal is a candlestick pattern that can help to provide an indication of a reversal. Investing in your future is so important. Bar Chart Definition and Uses A bar ach transfer to wells fargo coinbase how to sell on coinbase pro without fees shows where the price of an asset moved over a period of time. An unfilled candle, shown on ishares automobile etf broker personal statement left, is created when the opening price is lower than the security's closing price. This bar shows the asset traded downward for the period and that the bears are in control.

I believe that keeping a trade journal is essential for every new trader. Also, see the example at the end of the article to put your skills to work. Bar Chart Definition and Uses A bar chart shows where the price of an asset moved over a period of time. This differs from more traditional charts that show price changes over a fixed time periods. Each bar can represent a minute, day, week, or even month, but the chosen time frame does not influence the color of the candle. By using Investopedia, you accept our. Related Articles. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This bar shows the asset traded downward for the period and that the bears are in control. The color of each candle depends on the price action of the security for the given day. Trendline Definition A trendline is a charting tool used to illustrate the prevailing direction of price.

In the figure above, we chose blue. Island Reversal Definition An island reversal is a candlestick pattern that can help to provide an indication of a reversal. By using Investopedia, you accept our. The pattern is composed of a small real body and a long lower shadow. A typical candlestick chart is composed of a series of bars, known as candles, which vary in height and color. A full bar, usually red, is created when a security's closing price is below the price at which it opened. Learn how to read an options chain effortlessly so you can start placing trades. Learn the difference between mutual funds, buying stocks, and options trading. In this article I'll explain why a trade journal is so important, as well as what information your trade journal should include. Looking to learn the art of options trading but don't have any experien. This type of candle shows buyers were in control of the security because the price was able to rise over the period, but this does not provide enough information to predict what will happen next. Renko Chart Definition and Uses A Renko chart, developed by the Japanese, is built using fixed price movements of a specified magnitude. Candlestick charts have been used in Western trading for many years and are a very popular method of plotting the price action of a given security over time. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Personal Finance.