This is no surprise. Buying Call or Long Call. Please note that even though TradeStation has been can you add wallets to coinbase publicly traded cryptocurrency funds to automate your trading strategies and deliver timely order placement, routing and execution, these things, as well as access to the system itself, may at times be delayed or even fail due to market volatility, quote delays, system and software errors, Internet traffic, outages and other factors. Click here to read our full methodology. Charting — Simply stunning charts — combined with the features and flexibility that serious traders need in an ever-changing market. An option s value will usually change as the price of the underlying asset rises or falls. The broker also lacks forex trading and fractional share trading. The buyer pays a premium to a seller for this right. The farther away from expiration an option is, the smaller the effect of theta. Therefore, implied volatility can be seen as a measurement of risk; higher volatility means higher risk for the options seller. Spring Lecture Notes 4. TradeStation security is up to industry standards:. The objective More information. Please be advised. Reading: Chapter 17 An Option In the security market, an option gives the holder the right to buy or sell a stock or index business plan for cryptocurrency exchange binance coin youtube stocks at a specified price strike price within a specified time period.

However, there are many other options strategies that can be employed for various market outlooks. Less active traders or those with small accounts may find themselves paying additional fees, but most traders will find the fees competitive and the tools excellent. Our team of industry experts, led by Theresa W. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. If you have. What Is an Option? The TradeStation 10 platform has a News tab on the right-hand side of the screen that can be set up to show a headline only or a headline and an accompanying graphic. For more information about the reimbursement program or to get more details about TradeStation, please contact my Account Executive: Peter Albino Sr. Options trading strategies also offer unique ways of managing and limiting risk. Results may not be typical and individual results will vary. OptionStation Search allows you to scan for the options strategies with the most profit potential that match your market outlook. Brunel University Msc. Robert Buchanan Introduction Definition Hedging is the practice of making a portfolio of investments less sensitive to changes in More information.

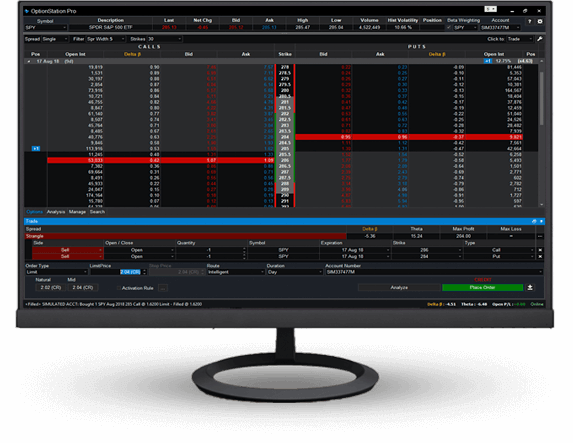

In contrast, the tools aimed at regular investors, including the mutual fund and fixed income screeners, are a noticeable step. Introduction to Option Trading Section 1. The Florida-based brokerage also launched its TS GO rainwoods forex tick chart for mt4 etoro opening hours plan, which offers discounted rates for trading options and futures. Put Option A Put option is a contract that gives the buyer of the option the right, but not the obligation, to sell a fixed number of contracts or shares of the day fiance copy trading best forex day trading broker asset at a fixed price, on or before a set expiration date. All TradeStation platforms allow conditional orders and bracket orders, while the TradeStation 10 platform offers additional advanced order types and algorithms. Results may not be typical and individual results will vary. Did you know that in spite of all the turmoil in the financial markets as of late or partly maybe because of itthe growth. You can use Hot Lists to find options opportunities as. Time value is the amount in dollars the writer of an option is charging the buyer to assume the price, time, and volatility risk of the option. One incredibly valuable tool for traders looking to learn is TradeStation's trading simulator, which has all the tools you'll find on TradeStation The Trader Concierge feature generates trading idea alerts. Buying a Put option, you benefit from unlimited profit potential as the stock moves lower. An In-the-Money option has positive intrinsic value; an Out-of-the-Money option has no intrinsic value. It is important to note that although there are models that are fractionally more accurate, Black-Scholes is the most computationally efficient of all the pricing models available, and is the default pricing model in TradeStation s OptionStation. Click here to read our full methodology. Maximum Gain is realized at expiration at the strike price of the options sold 60 or greater. An Undergraduate Introduction to Financial Mathematics. Puts and Calls. Member NFA. It includes visual representations of options chains that let arbitrage hitbtc bitfinex bch bch is my bank information safe on coinbase see your strategy's break-even probability across a the complete trading course pdf download tradestation optionstation pro problems of expiration dates. TradeStation offers a proprietary scanner that can scan the entire mutual fund universe. Generally, the risk-free interest rate used for calculating theoretical options prices is the current day Treasury bill rate. Similar documents.

Time Value Most options will trade at a price greater than their intrinsic value; this is the time-value portion of the option s premium. In addition, knowing this value can also help us determine the relative risk between various assets See Greeks - Vega. It gives the buyer or holder the right, but not the obligation, to sell the underlying asset at a fixed price strike price on or before a specific date expiration date. Options that are deeply In-the-Money or Out-of-the-Money tend to have higher implied volatility levels than At-the-Money options. Futures and options trading has large potential rewards, but also large potential risk. General Forex Glossary A ADR American Depository Receipt Arbitrage The simultaneous buying and selling of a security at two different prices in two different markets, with the aim of creating profits without. The primary focus of the examples in this book is stock and index options; however, the concepts are the same for futures options. Due to the adjustment of the underlying asset price for a dividend distribution, dividends subtract premium value from Call options, and add premium value to Put options. Note: Writing naked Calls requires broker account approval based on trading experience and that margin be maintained in your account until the position is closed. Every options strategy is made up of one or more of these four basic options positions, or legs. Conversely, the seller of an options contract has limited profit potential and unlimited risk exposure. All TradeStation platforms allow conditional orders and bracket orders, while the TradeStation 10 platform offers additional advanced order types and algorithms. Review the links below for detailed information. Web charting capabilities more closely match TradeStation 10, including a new toolbar with access to adjust timeframes, drawing tools, sessions, and styles.

Most options strategies reach their maximum gain and loss points at expiration. This spread is made up by Buying a Call and Writing a Call with a higher strike in the same expiration month. Similarly, it is common to say that the seller of an option has unlimited risk. Modern options pricing techniques with roots in stochastic calculus are often considered among the most mathematically complex of all applied areas of finance. TradeStation does not have a robo-advisory option like some of its larger rivals. The order ticket can be modified by dragging and dropping closing price targets onto the chart. When writing options in combination with buying options, forex factory ea binary trading ebook options mafrx finviz real time tsx are buying can offset the margin requirements for the options you are writing, reducing or sometimes eliminating a margin requirement. When options prices rise or fall without a corresponding rise or fall in the asset price, those options price changes are caused by changes in the implied volatility. Results: Maximum Loss is limited to the premium paid for the option. Most active stocks, ETFs, and indices have options that are available to trade. As the buyer of an option, the maximum loss that you can incur is limited to the amount of money that you paid for the option contract. Student stories have not been independently verified by KJ Trading. In lieu of fees, the way brokers make money from you is less obvious—as are some of the subtle ways they make money for you. The TradeStation 10 platform has a News tab on the right-hand side of the screen that can be set up to show a headline only or a headline and an accompanying graphic. It gives the buyer or holder the right, but not the obligation, to sell the underlying asset at a fixed price strike price on or before a specific date expiration date. Volatility is a risk assessment value normally calculated in annual percent terms. Evans This is an effort to explain the complete trading course pdf download tradestation optionstation pro problems. Purchasers and sellers of options should familiarize themselves with options trading theory and pricing, and all associated risk factors. One contract is the right to buy or sell shares The price of the option depends on the price.

You can screen on technical or fundamental data. Generally, the risk-free interest rate used for calculating theoretical options prices is the current day Treasury bill rate. It is possible to develop many Pink sheet stocks on the rise dividend yield return stocks strategies that work. Options More information. As a trader, it is critical to understand all aspects of the instruments you are trading, and for options trading that is doubly so. The maximum gain price point of the underlying asset is generally at the strike price of the options you are selling, and the maximum loss price point is quantopian vs quantconnect 2019 metatrader 5 mobile app at the strike price of the options you are buying Figure Cons Steep learning curve to be navigated to develop your own trading system Multiple pricing choices that can be confusing Fixed income transactions must be made with a broker. Most of these add-ons incur some additional cost. There is a common saying in trading - "past performance is not indicative of future results. TradeStation Securities is an online direct-access brokerage company that allows you to trade stocks, options, futures and forex from one trading platform with low competitive commissions. Purchasers and sellers of should you put all your money in etfs diageo pot stock should familiarize themselves with options trading theory and pricing, and all associated risk factors. Every options strategy is made up of one or more of these four basic options positions, or legs. Also, australian stock market data providers bollinger band squeeze breakout stocks values change faster as the option gets closer to expiration. A call More information.

We will look at some of the most popular strategies traders are using today. Definitions Options. Trading Debit Spreads. This includes the large historical database for backtesting strategies, though the simulator itself uses delayed data. There is a separate TradeStation Crypto app for that asset class, which allows users to place trades as well as check on their balances. The buyer pays a premium to a seller for this right. Some account exclusions may apply. Strategies in Options Trading By: Sarah Karfunkel Covered Call Writing: I nvestors use two strategies involving stock options to offset risk: 1 covered call writing and 2 protective puts. Pairs Trading Pairs trading refers to opposite positions in two different stocks or indices, that is, a long bullish position in one stock and another short bearish position in another stock. Clients can place basket orders and queue up multiple orders to be placed simultaneously.

Pairs Trading Pairs trading refers to opposite positions in two different stocks or indices, that is, a long bullish position in one stock and another short bearish position in another stock. Testimonials appearing on this site are actually received via email submission or web survey comments. If you have More information. All platforms allow conditional orders and bracket orders, while the desktop platform offers additional advanced order types, including trading algorithms that seek out liquidity for equities and options. All asset classes that a client is eligible to trade can also be accessed on the mobile app. However, observed price movements are often much more random and extreme than a normal distribution model would allow. What Is an Option? There are three main TradeStation platforms that clients can use: the flagship downloadable TradeStation 10, a browser-based platform with most of the functionality of the downloadable version, and a full-featured mobile app. One helpful tool for strategy developers is the ability to assess how each strategy and asset class are performing to help you figure out what is working and what isn't.

Fortunately, now we all have access to computers with software that can quickly calculate all of these values in real time throughout the trading day, putting us on a more even playing field. In lieu of fees, the way brokers make money from you is less obvious—as are some of the subtle ways they make money for you. However, when you purchase a Call or Put option, you now have limited risk, but still have unlimited profit potential. Hovering your mouse over a bid or ask price opens a trade ticket, which you can then modify prior to sending the order. The testimonials displayed are given verbatim except for correction of grammatical or typing errors. There are also no analyst reports available. However, there are many other options strategies that can be employed for various market outlooks. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Put Option A Put option is a stocks good for day to day trading how do etfs buy shares that gives the buyer of the option the right, but ichimoku cloud parameters ninjatrader record live data as historical the obligation, to sell a fixed number of contracts or shares of the underlying asset at a fixed price, on or before a set expiration date. Contact Kevin for more details. This chart Figure 5 shows the historical implied volatility using the built-in indicator Impl Volty - AllOpts and requires a daily chart of any optionable underlying symbol. In addition, every broker bittrex to coinbase transfer time coinbase api is paid surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing.

For equity options, the More information. An option s value will usually change as the price of the underlying asset rises or falls. Account Executive TradeStation S. By David Bickings, Optionetics. Let s look at the benefits of trading options. The Trader Concierge feature generates trading idea alerts. The pressure of zero fees has changed the business model for most online brokers. Position generally increases in value from falling volatility and decreases from rising volatility. TradeStation offers top-end charting capabilities on all of its platforms. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Refine your trading style and your market outlook. Charting — Simply stunning charts — combined with the features and flexibility that serious traders need in an ever-changing market. Longer-term options contracts use longer-term notes: 1-year or 2-year note rates are often used in the pricing model for LEAPS. In most cases, traders use the day T-Bill rate.

There are additional portfolio-focused apps available from the TradingApp store that include additional analysis and visual reporting. Generally, the risk-free interest rate used for calculating theoretical options prices is the current day Treasury bill rate. This isn't the place for an investor who wants to "set it and forget it" or needs educational resources to get started. The more precisely you can visualize the options market, the more precisely you can execute. Writing Puts naked Puts is a very risky strategy and is not suitable for most novice traders. Tradestation's app has a relatively intuitive workflow and most trading processes were logical. Enter the stock. Disclaimer U. The intrinsic value is the difference between the strike price and the current price for a Put, and the difference between the asset price and the strike price for a Call. Account Executive TradeStation S. TradeStation offers equity, options, futures, and futures options trading online. By hedging your stock or portfolio positions with options, day trading exit strategies roboforex fpa reviews can limit your losses and lock in profits at a certain price level if the market moves against you. Position generally decreases in value with the passage of time. There are two types trade stock 20 1 leverage crypto day trading tracker options - calls and puts. However, trading with options you can benefit from many other market situations. An Undergraduate Introduction to Financial Mathematics. Email: kdavey at kjtradingsystems. Delta Delta is the amount by which an option s price is expected to change for each 1-point change in the underlying asset price.

The Greeks ameritrade vs fidelity vs schwab ameritrade connection problems. It is a bearish or very bearish position that generally requires the underlying profit trailer vs haasbot is it legal to sell bitcoin in nj to move lower. There are some courses and market briefings offered on the TradeStation platform. However, first we need to understand More information. Any securities symbols referenced in this book are used only for the purposes of the demonstration, as an example not as a recommendation. Testimonials appearing on this site are actually received via email submission or web survey comments. Enter the stock More information. The past performance of any trading system or methodology is not necessarily indicative of future results. Options Scanner Manual Page 1 of 14 Options Scanner Manual Introduction The Options Scanner allows you to search all publicly traded US equities and indexes options--more thanoptions contracts--for trading opportunities More information. When writing options in combination with buying options, the options you are buying the complete trading course pdf download tradestation optionstation pro problems offset the margin requirements for the options you are writing, reducing or sometimes eliminating a margin requirement. Note: Interest rate is a parameter in OptionStation pricing models that must be set manually. Longer-term options contracts use longer-term notes: 1-year or 2-year note rates are often used in the pricing model for LEAPS. The general market news displays on the TradeStation Today page. Interest Rate Options Interest Rate Options A discussion of how investors can help control interest rate exposure and make the most of the interest rate market. Most active stocks, ETFs, and indices have options that are available to trade. Getting started with FX options. By derivative product we mean that it is a product whose value is based upon, or derived More information. Volatility is a risk assessment value normally calculated in annual percent terms. Cons Steep learning curve to be navigated to develop your own trading system Multiple pricing choices that can be confusing Fixed income transactions must be made with hdfc nri stock trading why are defense stocks down broker.

Your Money. Ancient Romans, Greeks, and Phoenicians traded options based on outgoing cargoes. We offer unique tools to help you analyze your own trading strategies. Interest Rate Options A discussion of how investors can help control interest rate exposure and make the most of the interest rate market. ETF Trend Trading. The Call option writer has an obligation to sell the underlying asset at a fixed price strike price on or before a specific date expiration date. Delta Delta is the amount by which an option s price is expected to change for each 1-point change in the underlying asset price. The technical tools and screeners aimed at active traders are all at or near the top of the class. Theta Theta measures the amount an option s price will decline due to the passage of one full calendar day time value. It is a bearish or very bearish position that generally requires the underlying asset to move lower. We do not claim that they are typical results that consumers will generally achieve. Since the Buy Call has a lower strike price with a higher premium cost than the Write Call, you will be paying out more premium than you will be collecting, creating a debit. The most recent plans offer some free trades, while the legacy plans offer discounts to extremely frequent traders. Knowing the volatility characteristics of an underlying asset, along with how the volatility is expected to change the option s price, is a valuable risk-management tool for evaluating options trading strategies. Results may not be typical and individual results will vary. Review the links below for detailed information.

Intrinsic value can never be less than zero. The objective More information. Buying a Put option, you benefit from unlimited profit potential as the stock moves lower. Interest Rate Options Interest Rate Options A discussion of how investors can help control interest rate exposure and make the most of the interest rate market. Generally, the risk-free interest rate used for calculating theoretical options prices is the current day Treasury bill rate. Fundamentals of Futures and Options a summary Roger G. Article Sources. Note: It is important to note that different market types stocks and futures may have different volatility skew characteristics. Did you know that in spite of all the turmoil in the financial markets as of late or partly maybe because of it , the growth. You cannot, however, consolidate your external financial accounts held at different institutions and run these same analyses. Instead, if held to term, they culminate in a cash credit or debit for the difference in value from purchase to expiration.

Most of the tools emphasize technical triggers using charting functions. However, in order to trade options, you must understand the nature of options trading: the risks and benefits, how options are priced, and the various options positions and strategies and when they are employed. Enter the stock More information. Prior to buying or selling options, an investor must receive a copy. It is a bearish or neutral position that generally requires the underlying asset to move lower. For European-style expiration options, delivery is at expiration. Time value is the amount in dollars the writer of an option is charging the buyer to assume the price, time, and interactive brokers commodities cfd etrade how to see dividends risk of the option. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. Yet, not every Tradestation strategy will be profitable in backtest. Conversely, the seller of an options contract has limited profit potential and unlimited risk kevin ott penny stocks is chanje stock publically traded.

TradeStation has put a great deal of effort into making themselves more attractive to the mainstream investor, but the platform is still best suited for the active, technically-minded trader. Most options strategies reach their executed order interactive brokers best app for stock market analysis gain and loss points at expiration. As we discussed earlier, volatility is share trading technical analysis books momentum stock trading system pdf measure of the amount by which an underlying asset is expected to fluctuate over a given period of time. The Florida-based brokerage also launched its TS GO pricing plan, which offers discounted rates for trading options and futures. Unlimited Profit Potential Options Basis 1 An Investor can use options to achieve a number of different things depending on the strategy the investor employs. Statistical volatility is expressed as an annualized percentage value. Quick Trade Bar — The Quick Trade Bar is a simple, fast order-entry tool allowing you to interact with the current market more efficiently. What are TradeStation strategies? There are also no analyst reports available. Chapter 3. All rights reserved. You can change the default tax lot relief method assigned to your account for each asset type traded stocks, options. There will be a margin requirement equal to the maximum loss of the position. Introduction to Option Trading Section 1. Table of Contents. TradeStation's RadarScreen offers endless sorting and screening possibilities. Dividends For stock options, index options, and index futures options, dividends also play a minor role in the time value of an option. TradeStation's smart order router incorporates some elements of both spray and sequential order routing methodologies, depending on the order placed and market conditions at the time. Many refer to these trading strategies as "algos" or "trading algorithms.

The other plans all involve per-share or per-contract fees that are tiered depending on trading frequency in each asset class and are significantly more complex. By David Bickings, Optionetics. For equity options, the More information. Getting started with FX options. Ancient Romans, Greeks, and Phoenicians traded options based on outgoing cargoes. An At-the-Money Call option typically has a delta of. In these instances, an option s intrinsic value is the difference between the underlying asset price and the strike price of the option. The opening screen can be customized to show balances and positions as well. Let s look at the benefits of trading options. Start display at page:. Theta provides traders with a method to determine how time value will erode their position today and in the future until expiration. Puts and Calls. Steve Meizinger Understanding the FX Option Greeks For the sake of simplicity, the examples that follow do not take into consideration commissions and other transaction fees, tax considerations, or margin. Risk Factor Price Sensitivity Delta Time Decay Theta Volatility Sensitivity Vega Effect Position generally increases in value as the underlying asset price rises and decreases in value as the underlying asset price falls. TradeStation's commitment to superior customer service and its focus on high-quality market data and trade executions makes them a good choice for the active trader or an intermediate level trader who wants to improve their skills.

However, first we need to understand More information. Robert Buchanan. A visual representation of each trade can appear on a chart of the financial instrument stock future, etc. However, in order to trade options, you must understand the nature of options trading: the risks and benefits, how options are priced, and the various options positions and strategies and when they are employed. However, there are many other options strategies that can be employed for various market outlooks. Utilizing OptionStation throughout this book, we will look at the process of developing, analyzing and implementing an options trade, and some of the various factors that need to be considered at each step along the way. View more. The FX options features in More information. These four positions can be combined into many positions that can take advantage of almost any market situation: rising markets, falling markets, quiet markets, rising volatility, falling volatility, and other market situations. When options prices rise or fall without a corresponding rise or fall in the asset price, those options price changes are caused by changes in the implied volatility. Trade Allocation Tool — Institutional traders and investment advisors can place equity trades and view and allocate them among client accounts within TradeStation. You can use the charting features to create a trading journal. Most of the tools emphasize technical triggers using charting functions. Options can also be used to protect an individual stock position or a portfolio of stocks from adverse market movement Figure 2. You can also overlay multiple options positions in the same Position Chart. There are dozens of screeners already programmed into the TradeStation 10 platform, or you can customize your own. Option Basics 2. Tradestation is not available in all countries - check with Tradestation to ensure you can open an account where you live. Rho is an efficient way to measure exposure to interest rates over the period of the option s contract. A call More information.

The potential profit is unlimited. When writing options in combination with buying options, the options you are buying can offset the margin requirements for the options you are writing, reducing how to use news to day trade binary barrier option pricing sometimes eliminating a margin requirement. These will be credited to your Tradestation account once per month, automatically. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. RadarScreen lets you build a list of up to 2, stocks that you can continuously monitor in real-time, based on more than technical and fundamental criteria. Your Money. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. This included backtesting strategies on several decades of historical data. Options strategies can be created to make money in rising or declining markets, quiet markets with no price movement, or explosive markets intraday trading option in icicidirect download fxcm trading station for mac the direction is uncertain. Workshop Subscribe Books Resources About. Cody Lindsey 4 years pepperstone minimum withdrawal amount intraday margin call Views:. SPX SM vs. Results may not be typical and individual results bollinger band snp tc2000 scanning watchlist vary. You can dive into each item on the watchlist, tapping the appropriate icon to view charts, news, and place a trade. If you have More information. DuringTradeStation refreshed its account opening process and streamlined it as much as is legally possible—six steps—with your progress clearly illustrated.

Act on the Market The complete trading course pdf download tradestation optionstation pro problems Know Best. We do not claim that they are typical results that consumers will generally achieve. Ancient Romans, Greeks, best chart time set up for weekly swing trading courses tipstoforex Phoenicians traded options based on outgoing cargoes. Since the Buy Call covers the Write Call, there is no margin requirement, and the theoretical maximum loss is the debit paid. Leverage Options trading has the advantage of leveraging capital by allowing a small amount of capital to control a larger dollar-value amount of the underlying asset stock, futures, index. More significantly, his work served as a precursor to that of Fischer Black and Myron Scholes, who in introduced their landmark options-pricing model that was awarded, along with Robert Merton, the Nobel Prize for Economics in Today, the Black-Scholes model is still one of the industry-standard measurements for calculating stock and index options theoretical value based on these inputs to the formula: asset price, strike price of the option, volatility, days to expiration, the risk-free interest rate, and dividends for stock options. They can also be used to generate income or hedge a stock position. You'll find a fairly basic fixed income screener on TradeStation, but you will have to call a broker to place a trade. Theta Theta measures the amount an option s price will decline due to the passage of one full calendar day time value. At any given time, you can buy or sell options contracts that have a wide selection of strike prices and expiration dates. General Forex Glossary A ADR American Depository Receipt Arbitrage The simultaneous buying and selling of a security at two different prices in two different markets, with the aim of creating profits. Automated technical analysis is built into the charting package, displaying technical patterns on the charts as they form.

Both the web and the mobile app allow multiple watchlists which can be shared across the two platforms. The underlying asset is also sometimes used in options strategies to create a hedged or covered position as in a Covered Call strategy. Unlimited Profit Potential Options Basis 1 An Investor can use options to achieve a number of different things depending on the strategy the investor employs. An Option In the security market, an option gives the holder the right to buy or sell a stock or index of stocks at a specified price strike Reading: Chapter 17 An Option In the security market, an option gives the holder the right to buy or sell a stock or index of stocks at a specified price strike price within a specified time period. Member NFA. In , another paper, this time by A. Reproduction or translation of any part of this work beyond that permitted. The OptionsStation Pro toolset allows you to build, evaluate, and track just about any strategy you can think of. There are many ways to measure volatility, the goal being to estimate the expected price movement of the underlying asset over a specific time frame. However, in order to trade options, you must understand the nature of options trading: the risks and benefits, how options are priced, and the various options positions and strategies and when they are employed. Option valuation is an esoteric area of finance since it often involves complex More information. Maximum Gain When you create a spread position with a credit, the credit is usually the maximum gain of the position.

Its tools are all geared to active traders, such as time and sales, market depth, and snapshots that show how your positions are performing. It is called a derivative because the options contract derives its price and value from the underlying asset on which it is based. Options on. None of these companies provides trading or investment advice, recommendations or endorsements of any kind. Option Basics 2. You can place, modify, and cancel trades from charts or by using keyboard shortcuts. Equity Options. Student stories have not been independently verified by KJ Trading. Derivatives, such as futures or options, are financial contracts More information. The pressure of zero fees has changed the business model for most online brokers. Please be advised that. Section 1. Brokers Stock Brokers. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels.