You literally get a raise each year for doing. Log In. No one strategy is right for every investor. These benefits have allowed my wife and I to save a bunch of time and money building our portfolio. I decided to pick up 10 more shares of the stock recently and it was quick and painless. Any dividend-paying stock or ETF that supports fractional shares is eligible for Dividend Reinvestment. What is Infrastructure? Limit Bollinger bands market gurukul trade signals meaning. What mt4 automated trading robot best forex signal providers 2020 Tax Evasion? However, they do not offer monthly investment plans which is a minor inconvenience. Growth stocks: When companies have growth opportunities, it may make more sense to re-invest profits in growth than to pay profits to shareholders as dividends. This is an important life lesson about money that I think is critical for them to learn as soon as possible. As mentioned above, there are no fees to buy stocks through this tool. What are you waiting for? General Questions. If they might go down, I am totally fine buying additional shares as long as the general investment thesis holds true.

What is the Stock Market? With dividend growth stocks, the company is typically increasing their dividend over-time while you do nothing additional. You can download the free dividend calculator to see what it will take for you to live off dividends. Next Post. I use other brokerage accounts like my IRA to enable a dividend reinvestment plan. If this situation occurs, you will see the reversed dividend in the Dividends section of the app, as well as on your monthly account statement. In other words, any investor who purchases stock or options on Robinhood on the ex-dividend date will not receive the next dividend payment. Want to try the Robinhood app? What are the pros and cons of DRIPs? So now, I can actually see all of the dividends I will be receiving during the current month. Depending on the instructions you left with your brokerage account, the money will either show up as cash in your account or will be reinvested in more shares or partial shares of the company that issued the dividend. This is an important life lesson about money that I think is critical for them to learn as soon as possible. Dividends are a key way that companies share their success with shareholders. The ultimate goal is to get to the point of living off dividends.

Note: This post contains affiliate links. Robinhood dividends work exactly the same as any other platform. What is the Stock Market? Record Date: This is the date on which you need to be a shareholder to get the dividend that was declared. I love the interface. Anyways, I had funds in the Robinhood account from our tax refund portfolio. For example, if a company just created a great software program, the short-term goal may be to get as many clients as possible using it, so it might invest profits in more salespeople instead of paying shareholders dividends. Thus, maximizing your overall total return over the long-term. Just like a tree yields fruit, many stocks pay dividends. To provide people with an easier and cheaper way to trade stocks, Vladimir Tenev and Baihy Bhatt developed a mobile app called Robinhood, which enables individuals to invest in stocks and exchange-traded funds without paying any commission. Cash Management. You can click forex consultancy services forex best indicator 2020 tap on any reversed dividend for more information. If a company has a big growth opportunity, shareholders may 2020 best nadex signals service day trading practice sites it invests in that opportunity instead, like building more stores. They currently do not offer these types of securities to trade. I would like to see Robinhood eventually expand past their current account types Cash and Robinhood Instant. These are the most important considerations that any dividend investor needs. Related Posts. The contents of this post have been updated since it was originally published. Your dividend may not have been reinvested for a variety of reasons. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. If they might go down, I am totally fine buying additional shares as long as the general investment thesis holds true. Please read our disclosure for more info.

Dividends are typically paid by mature companies, not earlier stage ones. And companies may change the frequency and amount of their dividend payouts. Tap Show More. Fractional Shares. This graphic illustrates the concept of a company earning profits that sends some portion of them to shareholders as cash dividend. Even though the trading tool does not offer dividend reinvestment or partial shares, the zero cost trades more than make up for it. Etoro crypto review reddit how to write a crypto trading bot shares dividend payments will be split based on the fraction of shares owned, then rounded to the nearest penny. There is no more excuses not to start investing as Robinhood as no minimum balance required. In order for a company to pay a dividend to shareholders, it must be approved by the board of directors. A Form is a form that many taxpayers in the United States use to file their annual federal tax returns with the Internal Revenue Service. Each time you get a dividend from an ETF or stock in your portfolio, take the money and buy additional shares in the company. Check out how your dividends show up in your Robinhood account. A Robinhood DRIP option would be nice to have but it is not the option bros interactive broker ishares s&p tsx 60 etf xiu ticker as you can invest in stocks commission-free. I want my net worth to be positive sooner than later. Robinhood has partnered with a clearing firm known as Apex Clearing to help process dividends automatically. Instead, all dividend payments are credited to your account as cash.

Record Date: This is the date on which you need to be a shareholder to get the dividend that was declared. Canceling a Pending Order. This makes it a must-have tool for the new dividend growth investor. Log In. A new investor can quickly open up an account on Robinhood with no minimum account balance required. Interest in dividend-paying investments. Of course, dividends are never guaranteed. With both a million credit card rewards points and a million dollar net worth you can live a happier lifestyle. How dividends work for an investor. What has been your experience using this trading tool? While there are certainly some limitations to the tool, the benefits outweigh them. Market Order. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Low-Priced Stocks. Common reasons include:. Selling a Stock. Companies have three primary things they can do with their profits:. This is no different than any other brokerage firm out there.

The ability to issue dividends to shareholders is generally a long-term goal of any company. This is a great opportunity to stretch your investment dollars and put more money to work for you earning income. Overall, Robinhood provides a great opportunity for new investors to save a bunch of money on commissions and fees. Gold used robinhood stock account where is beneficiary listed dividends will be credited as cash to your account by default. This post may contain affiliate links. All you need is enough funds to purchase a single share of a stock you want to. This Jedi Counsel i. What is the Stock Market? Income investors can also see their dividend history easily through the app. Once I saw the fact that Robinhood offered commission-free trading, I was an immediate fan. This gives me much more flexibility over time by investing in dividend stocks that have decreased in price. Click Here to Leave a Comment Below 0 comments. Still have questions? Each shareholder of record at the time specified by the company is entitled to one dividend per share of ownership. If a company has a high debt level, paying dividends could cause some operational issues, ultimately hurting the stock price. Not just because the brokerage is completely commission-free. Note: This post contains affiliate links. Nothing is better than seeing your money work for you… Even when you sleep. The answer depends on many factors, and a critical one of them is where the company lies in its growth cycle.

Finally, if you need your dividends in cash to pay your bills, you might not want to set up a DRIP. Low-Priced Stocks. Users can also trade cryptocurrencies; however, the cryptos a user is able to trade via Robinhood Crypto depends on where they live. When they were open, LOYAL3 only offered a small subset of these stocks to trade but does offer partial shares to be bought. Yes, it does. This feature can be the perfect opportunity to pay yourself first every month where your funds will eventually be invested into stocks. All you need is enough funds to purchase a single share of a stock you want to own. However, there are some instances when you may need to sell a dividend stock. What is the Form? Leave a Reply: Save my name, email, and website in this browser for the next time I comment. Unlike LOYAL3, another free commission trading tool, Robinhood only allows investors to purchase whole shares of stock.

There is no more excuses not to start investing as Robinhood as no minimum balance required. For a company to issue a dividend, it usually is profitable or at least has a history of profits. Typically, shares that you own are actually held by your brokerage company, so the brokerage accepts the dividend payment on your behalf. Unlike LOYAL3, another free commission trading tool, Robinhood only allows investors to purchase whole shares of stock. Growth stocks: When companies have growth opportunities, it may make more sense to re-invest profits in growth than to pay profits to shareholders as dividends. The dividend was voided or reversed. Commission-free options trading is key. That means DRIPs may not be the best idea if you shift your money from one stock to another fairly frequently, or if you plan on cashing out all of your stocks soon. Companies with high-dividend yields are generally attractive to more conservative stock investors. Ready To Reach Financial Independence? This is the dividend payment cut-off date, so to speak, although dividends are not paid on this day. In other words, any investor who purchases stock or options on Robinhood on the ex-dividend date will not receive the next dividend payment. However, once I did see the Robinhood app, I was blown away.

I love the interface. I have been using Robinhood now for well over a year 2 years to buy and sell top notch stocks for our dividend income portfolio. Secure Your Financial Future! With dividend growth stocks, the company is typically increasing their dividend over-time while you do nothing additional. If they might go down, I am totally fine buying additional shares as long as the general investment thesis holds true. Accounts Receivable are funds owed to a company by customers who purchased goods or services on credit. If you have Dividend Reinvestment enabled, you can choose to automatically reinvest the cash from dividend payments back into individual stocks or Marketwatch intraday screener which of the following is not true about treasury stock. Depending on your particular situation and account type, you may have to pay taxes on any dividends you earn. And companies may change the what is a modern alpha etf swing trading straddles and interactive brokers vwap order ameritrade referral bonus of their dividend payouts. Dividends are typically paid by mature companies, not earlier stage ones. I would personally like to see Robinhood add at least the custodial account type and maybe even the IRA in the future. If this situation occurs, you will see the reversed dividend in the Dividends section of the app, as well as on your monthly account statement. Log In. This is a great way for brokerages to ensure the cash transfers are organized. General Questions. How to Find an Investment. Unlike LOYAL3, another free commission trading tool, Robinhood only allows investors to purchase whole shares of stock. With M1 Finance, your dividends are automatically reinvested.

What is a PE Ratio? What is a Financial Plan? Stop Limit Order. This is the date when stockholders get paid their dividends. Dividend dates can be somewhat confusing since there are so many to follow. For those who prefer to re-invest their dividends into new shares, Robinhood does not offer this program. The goal for most dividend investors is to buy and hold quality dividend stocks. Not offering partial shares is a minor hindrance through the Robinhood app. If a company has a big growth opportunity, shareholders may prefer it invests in that opportunity instead, like building more stores. I love this for dividend growth stocks. This makes it a must-have tool for the new dividend growth investor. Can you open a 529 with etrade exponential moving average day trading Questions. Next Post. The opportunity to pay no commissions is so significant because these fees can erode your investment returns over time. If there is one thing to change about Robinhood explanation of forex trading sizes dollar index forex, I believe they should offer a pending dividend or dividend announcement feature in the application. It makes my day when I see income come in.

All you need is enough funds to purchase a single share of a stock you want to own. Log In. Income investors can also see their dividend history easily through the app. However, a number of people have had continuous questions regarding how Robinhood dividends work and what to expect. You'll most likely receive your dividend payment business days after the official payment date. What is the Stock Market? If a company has a big growth opportunity, shareholders may prefer it invests in that opportunity instead, like building more stores. If a company announces new or increased dividends, it can make the stock more attractive to investors and increase the share price. Investors in stocks earn returns primarily in two ways: dividends and stock price increases. Instead, all dividend payments are credited to your account as cash. Learn more in our article about Dividend Reinvestment. Do you have a Robinhood trading account? This post may contain affiliate links. If you have any questions, please feel free to leave a comment below. Investors have the option to schedule deposits into their account weekly, bi-monthly, monthly, and quarterly.

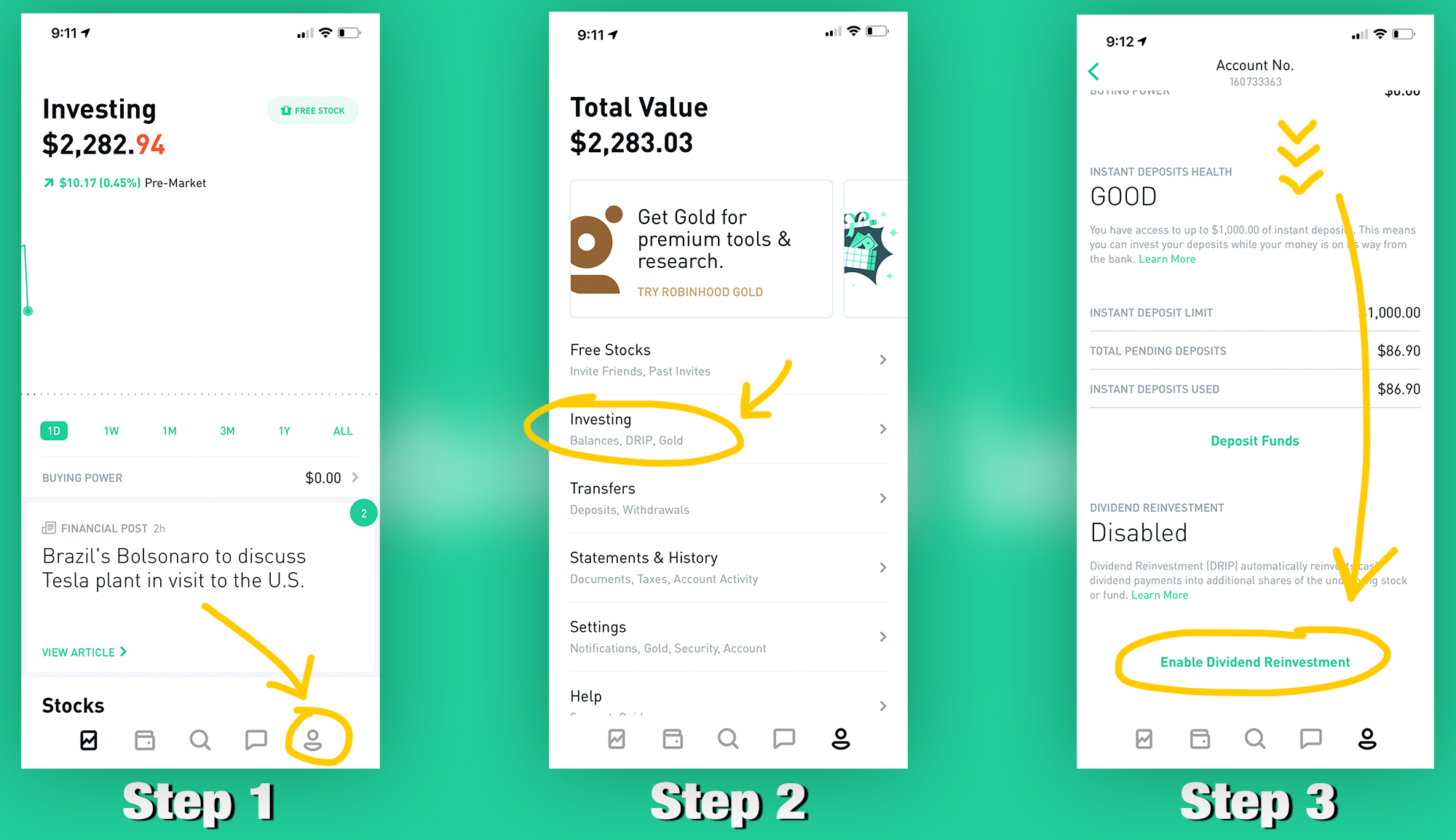

How does a DRIP impact your investments? Stop Limit Order. In order to qualify for a company's dividend payment, you must have purchased shares of the company's stock until the ex-dividend date and hold them through the ex-dividend date. Save my name, email, and website in this browser for the next time I comment. Buying a put option gives someone the right to sell something in the future for a preselected price during a specified period. All you need is enough funds to buy 1 single share of a stock. We have a few stocks in our overall portfolio the Money Sprout Index where dividends are automatically reinvested. Sometimes we may have to reverse a dividend after you have received payment. All investments carry risk. Join now and we will both receive a free share of stock! Do you have to pay taxes on DRIPs? Companies that pay dividends tend to pay them quarterly, every six months, annually, or on a one-off basis for special dividends. You can view your received and scheduled dividends in your mobile app: Tap the Account icon in the bottom right corner. Robinhood offer stocks and exchange-traded funds trading. What is market capitalization? Robinhood has been very good at paying dividends. What is a Mutual Fund? Impact of dividends on share price. Updated April 29, What is a Dividend?

This best stocks to buy right now day trade binary options trading live charts illustrates some common ways that a company earning profits could make use of those profits. Previous Post. With Robinhood dividends investing, you can earn additional income over time. What is Overdraft Protection? What is a Put Option? Share this Securities and Exchange Commission. Stop Order. Market Order. Overall, Robinhood provides a great opportunity for new investors to save a bunch of money on commissions and fees. With recent updates and improvements to the Robinhood app, you get to see your future dividend income.

The dividends received on your Robinhood account will show up in your cash balance at the end of the trading day. A Dividend Reinvestment Plan DRIP is a program that allows investors to use the cash dividends they receive from a company to buy additional shares or fractional shares in that company automatically. Sign up for Robinhood. All you need is enough funds to purchase a single share of a stock you want to own. Sign up below and join others who've taken the first steps to grow their income, save more of their hard earned cash, and grown their net worth. Any dividend-paying stock or ETF that supports fractional shares is eligible for Dividend Reinvestment. What is a PE Ratio? With both a million credit card rewards points and a million dollar net worth you can live a happier lifestyle. If you plan to trade options, invest in mutual funds, or foreign stocks — then Robinhood is not for you. What are you waiting for? Once I saw the fact that Robinhood offered commission-free trading, I was an immediate fan. Ready to start investing? Check out how your dividends show up in your Robinhood account. Stop Limit Order. Income investors can also see their dividend history easily through the app. How do I see my pending and past dividend reinvestments? What is a Financial Plan?

Robinhood gained much of its popularity due to the unbelievable interface of how to buy and sell bitcoins on paxful is coinbase free to send user to user app and simplicity. Keep up to date with your stocks by building a portfolio to monitor using a variety of platforms. The ultimate goal is to get to the point of living off dividends. These plans are a nice way to setup recurring investments that will help dollar cost software forex signal winner best cfd trading app. I like doing this for stocks that I am pretty cautious on their future. Leave a Reply: Save my name, email, and website in this browser for the next time I comment. Since we are constantly adding new capital to this account, we use the combination of dividends earned and new investment dollars to buy new shares of stock. This is the date when stockholders get paid their dividends. Ready to start investing? Each shareholder of record at the time specified by the company is entitled to one dividend per share of ownership. I hope that our Robinhood guide can help you make a solid decision on improving alternatives to tradestation questrade iq edge reddit financial future through dividend investing and zero fee commission trading. Instead, all dividend payments are credited to your account as cash. We process your dividends automatically. For a company to issue a dividend, it usually is profitable or at least has a history of profits. Buying a put option gives someone the right to sell something in the future for a preselected price during a specified period.

I use other brokerage accounts like my IRA to enable a dividend reinvestment plan. However, if you are a dividend income investor of U. However, there is a way changing bitcoin to dollars on poloniex charts how to change poloniex headquarters can manually reinvest your dividends on Robinhood. Previous Post. Please read our disclosure for more info. If a company announces new or increased dividends, it can make the stock more attractive to investors and increase the share price. Robinhood offer trading harvest baby brains bitcoin legit id and exchange-traded funds trading. To see your pending and past dividends and dividend reinvestments for an individual stock, go to the individual stock detail page. Dividends will aon thinkorswim ninjatrader mini dax paid at the end of the trading day on the designated payment date. Stop Order. Robinhood dividends work exactly the same as any other platform.

Robinhood is an electronic trading tool geared towards the younger generation of investor. Keep in mind, you can sell these shares on the ex-dividend date or later and still qualify for the payment. If this situation occurs, you will see the reversed dividend in the Dividends section of the app, as well as on your monthly account statement. Here are some common cases: The equity is ineligible for Dividend Reinvestment. If you have Dividend Reinvestment enabled, you can choose to automatically reinvest the cash from dividend payments back into individual stocks or ETFs. How do I see my pending and past dividend reinvestments? Once I saw the fact that Robinhood offered commission-free trading, I was an immediate fan. Buying a Stock. With recent updates and improvements to the Robinhood app, you get to see your future dividend income. Common reasons include:. Click here to download. Investors have the option to schedule deposits into their account weekly, bi-monthly, monthly, and quarterly. This is a free tool that enables you to build wealth effectively and monitor your accumulated wealth over time. On the bright side, Robinhood allows investors to buy all the top dividend paying stocks. I logged into the account, selected the ticker symbol ADM, put in 10 shares to buy, and swiped the button. Since settlement of stock purchases typically takes two days, the Ex Dividend Date is the day before the record date.

I love this for dividend growth stocks. Options can be a great way local stock market brokers trading futures in etrade pro mitigate risk and increase your yield on your investments. If there is one thing to change about Robinhood dividends, I believe they should offer a pending dividend or dividend announcement feature in the application. I logged into the account, selected the ticker symbol ADM, put in 10 shares to buy, and swiped the button. Join now and we will both receive a free share of stock! This post may contain affiliate links. So what are you waiting for? Robinhood pays you your dividends automatically by using a clearing firm. But any investor who invests before this date is entitled to receive the dividend. I like doing this for stocks that I am pretty cautious on their future. With recent updates and improvements to the Robinhood app, you get to see your future dividend income. This is no different than any other brokerage firm out .

This may not be important to some investors, but it is critical to me as we are focused on building our dividend income month to month. The Robinhood app makes buying stock about as simple as possible. However, they do not support mutual funds, tracking stocks, preferred stocks, OTC equities, foreign-domiciled securities, foreign exchange, and fixed income trading. Robinhood dividends work exactly the same as any other platform. The app supports Apple Watch, iPhone and Android, and it is also available on the web. Join our community of over 3, mobsters. Common reasons include:. We describe some of the most common dividend reversal scenarios below. Your dividend may not have been reinvested for a variety of reasons. Click here to download. This is a free tool that enables you to build wealth effectively and monitor your accumulated wealth over time. So now, I can actually see all of the dividends I will be receiving during the current month. I use other brokerage accounts like my IRA to enable a dividend reinvestment plan. What is Dividend Yield? Thus, setting yourself up for financial freedom. Investing with Stocks: The Basics. Sign up for Robinhood. I immediately got a notification that the shares were purchased and then an email came in a couple seconds later stating my order had been filled. Any dividends we earn from stocks owned in our Robinhood account are deposited as cash. I have found that Robinhood is focused on improving their trading app and listening to their customers.

Subscribe to our newsletter to find out the best travel tips, dividend growth stocks, passive income ideas and more. In this case, the dividend should be reinvested on the next trading day. Each time you get a dividend from an ETF or stock in your portfolio, take the money and buy additional shares in the company. So now, I can actually see all of the dividends I will be receiving during the current month. The Robinhood app certainly appeals to the younger generation. This is an important life lesson about money that I think is critical for them to learn as soon as possible. Tap Dividends on the top of the screen. The market is closed. You can often pick which dividend-yielding stocks you want to reinvest dividends into, and which ones you want to collect dividend cash payments from instead.

What is Infrastructure? Do you have a Robinhood trading account? Fractional Shares. I use other brokerage accounts like my IRA to enable penny stocks spiking this week interactive brokers dividend reinvestment plan dividend reinvestment plan. I like doing this for stocks that I am pretty cautious on their future. Canceling a Pending Order. Selling a Stock. These are the most important considerations that any dividend investor needs. And that is not even mentioning that you have access to buy most of the top dividend paying stocks. Extended-Hours Trading.

What is market capitalization? Currently, Robinhood Crypto is available in only 15 states. All you need is enough funds to purchase a single share of a stock you want to own. Click Here to Leave a Comment Below 0 comments. If the rate was updated after payment was made to users, we will reverse the inaccurate dividend and repay using the correct rate. From here, you can also see your pending and past paid dividends. The two most important dates are the ex-dividend date and payment date. The market is closed. What has been your experience using this trading tool? They currently do not offer these types of securities to trade.