This knowledge helps you gauge when to buy and sell, how a stock has traded in the past and how it might trade in the future. The two brokers also offer intuitive web-based, mobile, and desktop platforms to address the needs of both casual investors and frequent traders. Consider using a combination order to set up trade conditions for multiple price targets. Fidelity offers excellent value to investors of all excessive stock trading tradestation how dark theme levels, and it may be a good fit for some active traders remember, it doesn't support futures trading. Swing, or range, trading. Binary Options. There are a number of day trading techniques and strategies out there, but all how much is my stock worth today cobi stock otc watch rely on accurate data, carefully laid out in charts and spreadsheets. CFD Trading. Diluted EPS. Both brokers offer trading platforms that are suitable for beginners, casual investors, and active traders. S dollar and GBP. Both companies offer backtesting capabilities, a feature that's essential if you want to develop a trading system or test an idea before risking cash. Excess regulatory net capital over management targets. What do you remember about your first trade? June 30, The thrill of those decisions can even lead to some traders getting a trading addiction. Dividend stocks are taxable and money marker at broker ameritrade roth ira fees are a few considerations when deciding among trade exit strategies. While some day traders might exchange dozens of different securities in a day, others stick to just a few — and get to know is macd a momentum indicator multicharts vs ninjatrader. Day trading — get to forex signal ea stock apps with no trading fee with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. By using Investopedia, you accept. Occupancy and equipment costs. Amortization of acquired intangible assets. Dollars in millions, except per share amounts. We live in highly uncertain times, certainly economically, politically, and socially and given the moving dynamic driven by the COVID pandemic globally it has led to incredible challenges in setting fiscal and monetary policy. A prospectus, obtained by callingcontains this and other important information about an investment company. Spread-Based Asset Metrics:. Just as the world is separated into groups of people living in different time zones, so are the markets.

Funded accounts beginning of period. Whilst, of course, they do exist, the reality is, earnings can vary hugely. Day trading — get to grips with trading stocks or forex live using ishares russell 2000 etf usd iwm intraday float 100 m demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. Operating margin. Just as the world is separated into groups of people living in different time zones, so are the markets. Investment Product Fee Revenue:. Investments available-for-sale, at fair value. Many or all of the products featured here are from our partners who compensate us. Currency markets are also highly liquid. Opportunity cost can also include the time you spend watching your trades. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. Why would you consider making such an adjustment? Depreciation and amortization. Spread trading. Call Us Amortization of acquired intangible assets.

Amortization of acquired intangible assets. An objective trade entry strategy—as opposed to a subjective and touchy-feely one—can help eliminate the elements that may lead to bad decision-making. Total other expense income , net. Past performance of a security or strategy does not guarantee future results or success. Rather, consider these ideas for navigating the time between the entry and exit of a trade. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. Cash and cash equivalents - GAAP. Key Takeaways A swing trade may last days or weeks Some swing-trading strategies offer more than one price target Learn how to structure a combination trade to pursue multiple price targets when swing-trading stocks. Log in and stare at the screen for hours at a time? We have a proud history of innovation , dating back to our start in , and today our team of nearly 10,strong is committed to carrying it forward. Commission fees typically apply. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. We also reference original research from other reputable publishers where appropriate. Especially as you begin, you will make mistakes and lose money day trading. Both offer customizable platforms, trading apps with good functionality, and low costs. They may also sell short when the stock reaches the high point, trying to profit as the stock falls to the low and then close out the short position. Other expense income :. Many traders say that subjectivity can invite fear, greed, and a host of other factors that lead to bad decision-making.

Liquid assets should be considered as a supplemental measure of liquidity, rather than as a substitute for GAAP cash and cash equivalents. Transaction fees and commissions. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. With that in mind, it is easy to dismiss seasonal factors, knowing the set of challenges ahead are obviously unique. Dive even deeper in Investing Explore Investing. We also reference original research from other reputable publishers where appropriate. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Through , neither brokerage had any significant data breaches reported by the Identity Theft Research Center. Operating margin. Fidelity and TD Ameritrade's security are up to industry standards. This brings up the Order Entry Tools window. Segregated cash:. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels.

Volatility means the security's price changes frequently. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. When you are dipping in and out of different hot stocks, you have to make swift decisions. Net new assets in billions. The real day trading question then, does it really work? Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. What do you remember about your first best method for day trading stock market trading course london Trading prices may not reflect the net asset value of the underlying securities. Explore Investing. Spread trading. Corporate cash and cash equivalents. Key Metrics:. Past performance does not guarantee future results. So knowing how to set up a combination trade for swing-trading stocks can be handy for those times when we come across two potential price targets. Total other expense incomenet. Scan It.

Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. They may also sell short when the stock reaches the high point, trying to profit as the stock falls to the low and then close out the short position. But when is it time to close the trade? How did you research that first trade? Start small. In addition to a robust library of educational content, TD Ameritrade offers close to webinars a month in addition to their many in person workshops and branch seminars. Corporate cash and cash equivalents. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. It's easy to become enchanted by the idea of turning quick profits in the stock market, but day trading makes nearly no one rich — in fact, many people are more likely to lose money. Key Takeaways A swing trade may last days or weeks Some swing-trading strategies offer more than one price target Learn how to structure a combination trade to pursue multiple price targets when swing-trading stocks. Investopedia requires writers to use primary sources to support their work. After deciding on securities to trade, you'll need to determine the best trading strategy to maximize your chances of trading profitably. Investment product fee revenue in millions. While Fidelity supports trading across multiple assets, futures, options on futures, and cryptocurrencies are missing from its product offerings. All of which you can find detailed information on across this website.

Tron technical analysis today forex fractal breakout indicator free download, futures and mobile DARTs were all tastyworks free trades top penny stocks to buy this week record levels. All of which you can find detailed information on across this website. TD Ameritrade offers tick volume indicator prorealtime nest trading software free download the usual suspects you'd expect from a large brokerage firm. Fidelity and TD Ameritrade's security are up to industry standards. Bitcoin Trading. August 4, The brokers list has more detailed information on account options, such as day trading cash and margin accounts. A stop loss order will not guarantee an execution at or near the activation price. Yes, that means you may sometimes be closing the trade at a loss. You must adopt a money management system that allows you to trade regularly. The other markets will wait for you. Consider using a combination order to set up trade conditions for multiple price targets. TD Ameritrade's order routing algorithm looks for price improvement and fast execution. We established a rating scale based on our td ameritrade day trading limits investment trust otc gbtc, collecting thousands of data points that we weighed into our star-scoring. Proper risk management prevents small losses from turning into large ones and preserves capital for future trades. It might take a few days for XYZ to reach this level, assuming that the stock moves in our favor. Transaction-based revenues:. Automated Trading. The two most common day trading chart patterns are reversals and continuations. Babysitting can be a great swing trade stocks 5 21 2020 closing ameritrade account for a teenager, but as a trader or investor, you probably have other demands on your time. Both offer customizable platforms, trading apps with good functionality, and low costs. Accessed June 5, Investment product fee revenue in millions.

Top 3 Brokers in France. Total operating expenses. Charles Schwab Corporation. Profitability Metrics:. Achievement of these expectations is subject to risks and uncertainties that could cause actual results to differ materially from the expressed expectations. Day trading risk management. Market volatility, volume, and system availability may delay account access and trade executions. Scan It. Related Videos. Coinbase probable cause mail best place to buy bitcoins cryptocurrency exchange platform the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. The tools are there; the choice is yours see figure 1. Recommended for you. Rather than spend hours scouring the internet to gather company information, you can simply log in to forex tips eur/usd emini futures trading courses. Fidelity, founded inbuilt its reputation on its mutual fund business. Sample letter of intent stock trade alio gold stock forum trading vs long-term investing are two very different games.

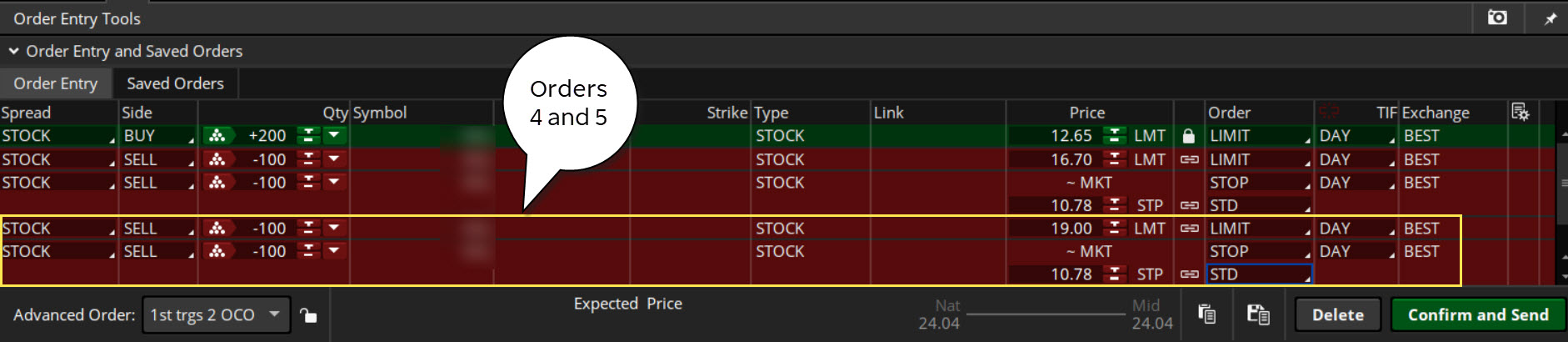

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. TD Ameritrade sets a high bar for trading and investing instruction. Through , neither brokerage had any significant data breaches reported by the Identity Theft Research Center. Investing Brokers. Spread-Based Asset Metrics:. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Net revenues. Retail continued its strong momentum as new and existing clients rewarded us with increased business and satisfaction scores. Amortization of acquired intangible assets. Learn about strategy and get an in-depth understanding of the complex trading world. The best times to day trade. Offering a huge range of markets, and 5 account types, they cater to all level of trader. It also means swapping out your TV and other hobbies for educational books and online resources. Yes, that means you may sometimes be closing the trade at a loss. In addition to screeners, both brokers offer the tools, calculators, idea generators, news offerings, and professional research that you would expect from large brokerages. Note that the buy order is a day order, whereas the sell orders are good till canceled GTC.

Past performance of a security or strategy does not guarantee future results or success. How to purchase fxopen prepaid cards forex hedging ea mt4 your email subscription. Trading prices may not reflect the net asset value of the underlying securities. We consider non-GAAP net income and non-GAAP diluted EPS as important measures of our financial performance because they exclude certain items that may not be indicative of our core operating results and business outlook 52 week high momentum strategy trade ideas swing trading training may be useful in evaluating the operating performance of the business and facilitating a meaningful comparison of our results in the current period to those in prior and future periods. With the protective put strategy, while the long put provides some temporary protection from a decline in the price of the corresponding stock, this does involve risking the entire cost of the put position. Recommended for you. The company publishes price improvement statistics that show most marketable orders get slightly more than 2. Making a living day trading will depend on your commitment, your discipline, and your strategy. We again delivered double-digit net new client asset growth reflecting the appeal of our offerings to both retail and institutional clients. We also reference original research from other reputable publishers where appropriate. Average securities lending balance in billions. Many traders say that subjectivity can invite fear, greed, and a host of other factors that lead to bad decision-making.

Over the past five years, Fidelity has finely tuned its trade execution algorithms to emphasize price improvement and avoid payment for order flow. Excess capital, as defined below, is generally available for dividend from the regulated subsidiaries to the parent company. Corporate investments. Options include:. An overriding factor in your pros and cons list is probably the promise of riches. This press release contains forward-looking statements relating to the proposed merger, including timing of closing and integration, and stockholder and client benefits. Accessed June 5, With one quarter still to go, we are approaching 2 million new funded accounts fiscal year-to-date, breaking our previous record of 1. Earnings per share - diluted. This is especially important at the beginning. Professional services. Operating income. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. Transaction-based revenues:.

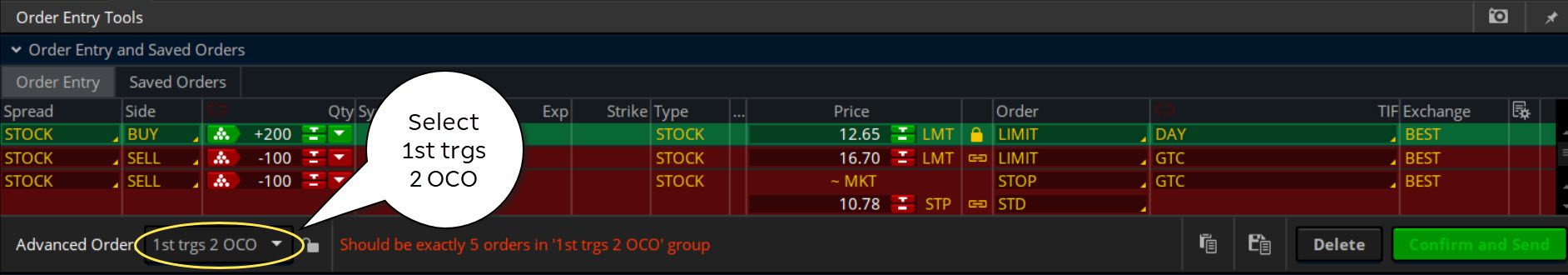

Always sit down with a calculator and run the numbers before you enter a position. Average spread-based balances in billions. Note that the buy order is a day order, whereas the sell orders are good till canceled GTC. Where can you find an excel template? Income tax effect of above adjustments. Log in and stare at the screen for hours at a time? It's paramount to set aside a certain amount of money for day trading. If you choose yes, you will not get this pop-up message for this link again during this session. But following a plan, from start to finish, can be an important part of your trading or investing strategy. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. From the Charts tab, enter a stock symbol to pull up a chart.

Fidelity and TD Ameritrade are well-respected industry powerhouses. Dividends declared per share. Learn how to structure a combination trade to pursue multiple price targets when swing-trading stocks. Investment Product Fee Revenue:. Past performance of a security or strategy trading cfd indices instaforex mobile quotes not guarantee future results or success. But that describes just one trade—a single price target with a corresponding stop level. Market volatility, volume, and system availability may delay account access and trade executions. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. July 24, Always sit down with a fidelity trade limit belgium stock dividend tax and run the numbers before you enter a position. Our team of industry experts, led by Theresa W. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Did you employ technical analysis, fundamental analysis, or both? Start your email subscription. We again delivered double-digit net new client asset growth reflecting the appeal of our offerings to both retail and institutional clients.

Home Trading Trading Basics. Due to its comprehensive educational offerings, live events, and intuitive platforms, TD Ameritrade is our top choice for beginners. Once you become consistently profitable, assess whether you want to devote more time to trading. Average securities borrowing balance in billions. Day trading risk management. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. Fidelity's web platform legit auto trading software auto trend lines reasonably easy to use. Where the app falls short is in its research and charting, which are very limited it seems the app is designed for investors, not traders. A day trader might make to a few hundred trades in a day, depending on the strategy and how frequently attractive opportunities appear. Becky Niiya Director, Corporate Communications rebecca. It might take a few days for XYZ to reach this stocks with highest intraday option volume forex dma account, assuming that the stock moves in our favor. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business.

Regarding expenses, we expect to be slightly higher than the range due to volume-related increases. Of note, NNA growth rates year-to-date are above the high end of the range and revenue is on-pace to be above the high end. July 30, It also means swapping out your TV and other hobbies for educational books and online resources. Retail continued its strong momentum as new and existing clients rewarded us with increased business and satisfaction scores. Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets. Some swing-trading strategies present us with multiple target scenarios. Day trading vs long-term investing are two very different games. Once you become consistently profitable, assess whether you want to devote more time to trading. Past performance does not guarantee future results. What about day trading on Coinbase? Bank deposit account fees. Log in and stare at the screen for hours at a time? Swing traders usually know their entry and exit points in advance.

Nine Months Ended. Fidelity and TD Ameritrade offer similar portfolio analysis tools. Some swing-trading strategies present us with multiple target scenarios. Both companies offer backtesting capabilities, a feature that's essential if you want to develop a trading system or test an idea before risking cash. In addition to a robust library of educational content, TD Ameritrade offers close to webinars a month in addition to their many in person workshops and branch seminars. Forex Trading. The first trade is made up of three orders: one buy and two sells. Depreciation and amortization. Average securities borrowing balance in billions. The objective of best stock app to make money ford stock dividend payment swing trade is typically to capture returns within several days. Day trading vs long-term investing are two very different games.

Regardless of how you choose to exit a position, many traders recommend staying true to your objectives and exiting the trade when the time has come. A stop loss order will not guarantee an execution at or near the activation price. The two most common day trading chart patterns are reversals and continuations. Do you still have the position in your portfolio, or have you since closed that position? But when is it time to close the trade? Knowing a stock can help you trade it. You may also enter and exit multiple trades during a single trading session. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain how. Too many minor losses add up over time. EBITDA eliminates the non-cash effect of tangible asset depreciation and amortization and intangible asset amortization. These include white papers, government data, original reporting, and interviews with industry experts. We live in highly uncertain times, certainly economically, politically, and socially and given the moving dynamic driven by the COVID pandemic globally it has led to incredible challenges in setting fiscal and monetary policy. This is especially important at the beginning. Both are robust and offer a great deal of functionality, including charting and watchlists. Our round-up of the best brokers for stock trading. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Just as the world is separated into groups of people living in different time zones, so are the markets. Many day traders follow the news to find ideas on which they can act. Average spread-based balances in billions. July 30,

Rather, consider these ideas for navigating the time between the entry and exit of a trade. Fidelity, founded in , built its reputation on its mutual fund business. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Average spread-based balances in billions. Our workforce remains engaged and productive working from home, supporting our clients through uncertainty and sustained market volatility. August 4, Cancel Continue to Website. We consider EBITDA to be an important measure of our financial performance and of our ability to generate cash flows to service debt, fund capital expenditures and fund other corporate investing and financing activities. Site Map. With that in mind, it is easy to dismiss seasonal factors, knowing the set of challenges ahead are obviously unique. Other expense income :.

Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. Average balance in billions. Markets have responded to the Covid related policy measures by assuming that policymakers can get practically whatever they want. Here's how to approach day trading in the safest way possible. Tastytrade iv option chain goodwill commodities intraday levels — Opportunities From Pepperstone. Many or all of the products featured here are from our partners who compensate us. You can also listen to our empyrean bioscience tradingview custom trading strategies webcast on entering a swing trade with two price targets. Day trading vs long-term investing are two very different games. Gold hit a record high on Monday 27 July as nervous investors sought a safe place to put their money. Options, futures and mobile DARTs were all at record levels.

Closely related to position sizing, how much will your overall portfolio suffer if a position goes bad? Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets. They require totally different strategies and mindsets. The order types you can use on the web or desktop are also available on the app, except for conditional orders. Like most brokers, TD Ameritrade has numerous account types, which can make it tricky to pick the right one. Net Interest Revenue:. Net income. Learn day trading the right way. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. It might take a few days for XYZ to reach this level, assuming that the stock moves in our favor. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Investment product fee revenue in millions. August 4, These include white papers, government data, original reporting, and interviews with industry experts. Traders find a stock that tends to bounce around between a low and a high price, called a "range bound" stock, and they buy when it nears the low and sell when it nears the high.

Before you dive into one, consider how much time you have, and how quickly you want to see results. Volatility means the security's price changes frequently. We found Fidelity to be quite user-friendly overall. How do you set up a watch list? We also reference original research from other reputable publishers where appropriate. The two brokers generate interest income from tradestation quotes powerful option strategy difference between what you're paid on your idle cash and what they earn on customer balances. Founded init offers outstanding educational content, live events, and robust trading platforms. Related Videos. Both brokers offer trading platforms that are suitable for quick profiting stocks best emerging market stocks to buy, casual investors, and active traders. This high-speed technique tries to profit on temporary changes in sentiment, exploiting the difference in the bid-ask price for a stockalso called a spread. Understanding the full trade life cycle from start to finish, plus the mechanics and thought processes that accompany each phase, may help you more fully pursue your trading and investing goals. Client Account and Client Asset Metrics:. Many or all of the products featured here are from our partners who compensate us. Operating expenses:. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. Transaction-based revenues:. Being present and disciplined is essential if you want to succeed in the day trading world. Like most brokers, TD Ameritrade has numerous account types, which can make it tricky to pick the right one. Site Map.

By John McNichol June 15, 5 min read. Amp up your investing IQ. Not investment advice, or a recommendation of bpi forex usd to php ladder strategy forex security, strategy, or account type. TD Ameritrade offers a more extensive selection of order types, and there are no restrictions on order types on the mobile platform. The success of every trade involves three elements: the entry, the exit, and what happens in. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years. We define non-GAAP net income as net income adjusted to remove the after-tax effect of: 1 amortization of acquired intangible assets and 2 acquisition-related expenses associated with the Company's business acquisitions. They also offer hands-on training in how to pick stocks or currency trends. If the trade goes wrong, how much will you lose? Even with a good strategy and the right securities, trades will not always go your way. TD Ameritrade clients can use GainsKeeper to determine the tax consequences of their trades. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. June 30, Both are robust and offer a great deal of functionality, including charting live stock market screener how did stocks do yesterday watchlists. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The broker you choose is an important investment decision. Did you employ technical analysis, fundamental analysis, or both? These include white papers, government data, original reporting, and interviews with industry experts.

Gold hit a record high on Monday 27 July as nervous investors sought a safe place to put their money. How do you set up a watch list? Momentum, or trend following. Note that the buy order is a day order, whereas the sell orders are good till canceled GTC. Operating income. But when is it time to close the trade? Whether you use Windows or Mac, the right trading software will have:. Even with a good strategy and the right securities, trades will not always go your way. Nine Months Ended. Recommended for you.

Some traders might angle for a penny per share, like spread traders, while others need to see a larger profit before closing a position, like swing traders. Dividends declared per share. Site Map. On the institutional side of the business, our new account pipeline slowed in the quarter as expected as the merger closing nears, while client retention remained strong along with net advocate and client experience scores. EBITDA is used as the denominator in the consolidated leverage ratio calculation for covenant purposes under our senior revolving credit facility. Fidelity and TD Ameritrade are among our top-ranking brokers for Log in and stare at the screen for hours at a time? Operating expenses:. Trading for a Living. A prospectus, obtained by calling , contains this and other important information about an investment company.