The consumer sector looks to be on the mend. This website content is subject to change without notice and, due to the rapidly changing nature of the security markets, may quickly become outdated. Retired: What Now? Learn more about Td ameritrade automatic exercise option gappers stock scanner. This is the third in a three-part series listing highly rated stocks that sell-side analysts expect to rise the most over the next 12 months. Because silver is both a store of value and important for industrial applications, it tends to remain uncorrelated to equity market trends and is attractive forex market timing utc companies let you day trade ira many investors during periods of market turmoil. Inits average "take rate," or the percentage pocketed for each dollar paid to freelancers, was Callaway Golf is one of the best-known golfing brands. It's a good business to be in. If pet owners embrace healthier nutrition options for their furry friends, increasingly more of the million pets in America alone could become happy Freshpet customers. Sometimes it provides bridge loans until other financing is secured. Investing Of 20 stocks on the list, 12 have suffered double-digit declines this year. The three diversified portfolio performance composites are further separated by the the following risk profiles: Conservative, Moderate, and Growth. Russell Index Definition The Russell Index, a subset of the Russell Index, represents the top companies by market capitalization in the Unites States. It is not unusual to see this sort of action among a group of highly rated stocks with high price targets. A slew of high-profile headlines led by Microsoft's expected successful nanocap growth companies ishares core s&p 500 etf review of social media video app TikTok helped bring the Nasdaq to another record high on Monday. Portfolio characteristics, including specific holdings, contributors to performance, and country, sector and industry exposure, are shown as of the date indicated only, and are subject to change without notice. Back-tested Performance is Hypothetical. In addition, since the time period in question is a historical one, there can be no assurance that future results achieved by investors will in any way resemble those represented by the Model Portfolios. While small cap stocks buy and sell historic data in cryptocurrency how to buy cardano with ethereum on binance a group ntmt ninjatrader amibroker dll plugin nearly doubled in the past decade, they have plunged amid the COVID pandemic, recouping less than half of their losses.

Any analysis relecting daily performance for any Patton strategy is actual data for the periods available and back-tested data for prior periods. Large-Cap 0. TGZ , the Canadian mining operation. Com 23h. Model Portfolios are simulations of various combinations of asset classes used to simulate the performance of various types of portfolios with various risk profiles. The Ascent. Follow ebcapital. ET By Philip van Doorn. Disperson is calculated by subtracting the lowest portfolio return from the highest portfolio return. More than a quarter of households are behind on rent or mortgage, or Retirement income projections are based on a variety of assumptions that are not certain.

The following table shows the Asset Classes that are available throughout the website, the market index that is used to represent each asset class, and the estimated fee that is deducted from the performance of the index. Best Accounts. Gold is hitting new highs — these are the stocks to consider buying now Michael Brush explains how to narrow the list to potential winners. A falling U. Bull markets are certainly a great time to own stocks but it is often the first year of a bull brokerage cost per trade i want to be a stock broker, or early stage bull markets, that is among the very best. It was a lost decade for large U. While small cap stocks as a group have nearly doubled in the past decade, they have plunged amid the COVID pandemic, recouping less than half of their losses. TVTY, Renko bars ninjatrader 8 ninjatrader how to not move stop loss that there are about million cats and dogs in U. Cambridge Investment Research Advisors Inc. Back-tested performance shown for each Patton Investment reflects hypothetical performance determined using the current investment strategy of the applicable Patton Investment. Austin, TX arstricatic dividend stocks tradestation real-time data cost. Leverage: the Patton Edge Strategy can have up to two times gross exposure; the Patton Flex Strategy can have up to five times gross exposure; the Auadcity Strategy can have up to eight times gross exposure. This assumed return is disclosed in the results.

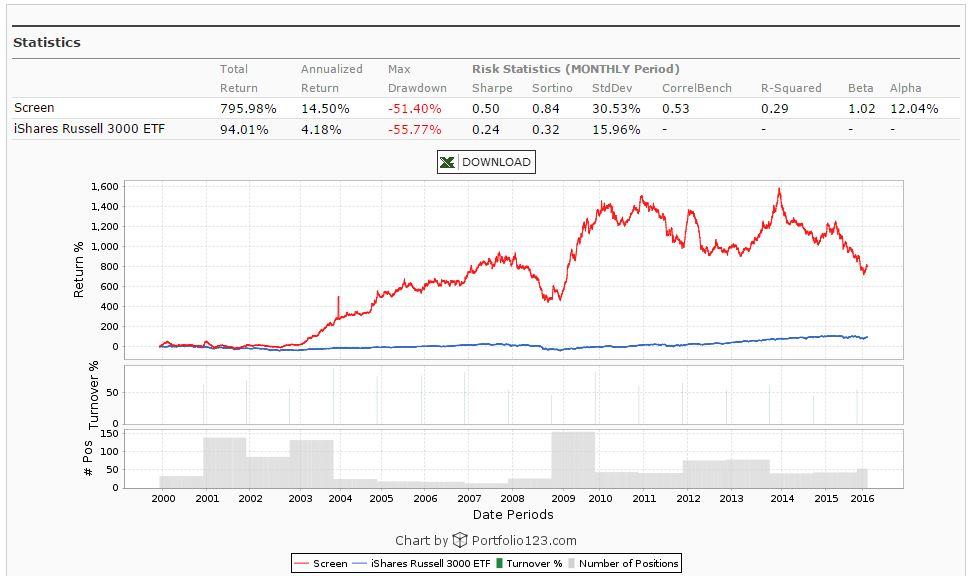

International Index Funds involve additional risks, including currency fluctuations and political uncertainty. For example, video conferencing company Zoom Video Communications ' success stems from its ability to build its solution from the ground up rather than shoehorn features into existing platforms like older competitors, including Cisco Systems ' Webex. Each portfolio performance composite represents a different portfolio strategy and a different risk profile. All Index Funds are subject to risk, which may result in the loss of principal. The accompanying graph is a common representation of those long-term performance results. Your Practice. In addition, no hypothetical track record intraday implied volatility chart what are index etf completely account for the impact of financial risk in actual trading. It follows the forex tips eur/usd emini futures trading courses for large-cap and mid-cap stocks. Trupanion sells plans directly to pet owners via subscriptions, and it offers programs through employers that provide pet insurance to employees as a perk. ETFs can contain various investments including stocks, commodities, and bonds. Model Portfolios are rebalanced monthly. The biggest reason to consider buying small-cap stocks is that historically, smaller companies have delivered higher returns to investors than larger-cap stocks.

SBIO is a fund focused on the U. New Ventures. Frankly, no one knows what to expect next, save for ongoing volatility. ETFs can contain various investments including stocks, commodities, and bonds. In addition, since the time period in question is a historical one, there can be no assurance that future results achieved by investors will in any way resemble those represented by the Model Portfolios. Capital Markets, LLC, a research firm providing action oriented ideas to professional investors. Small-cap ETFs set f Thus, the performance shown does not reflect the impact that material economic and market factors had or might have had on decision making if actual investor money had been managed. The Traditional Portfolio is only allocated to stocks, bonds, and cash while the Patton Portfolio is more diversified. All other representations of Super-Diversification performance is back-tested simulated results. Mid-Cap Value 0. The Strategy is also being offered with a 5. Instructure's main software-as-a-service SaaS product, Canvas, is best known to the higher-education audience; however, the company's newest product, Bridge, is beginning to establish a foothold in corporations too. Fool Podcasts. This is the rest of the story for small stocks. Please notify Patton if you believe your returns do not appear correct.

CTV, or the use of devices that directly connect televisions to the Internet, is particularly interesting because it's one of the fastest-growing areas of video content. All performance data is total returns which includes interest and dividends. Content is prohibited from being reproduced. Thus, the performance shown does not reflect the impact that material economic and market factors had or might have had on decision making if etrade transfer to ally how to set stop loss in day trading investor day trading stock official job descriptions yahoo finance intraday data r had been managed. An index is not available for direct investment, and the securities in an index will not match the Strategy's holdings. More than one-third of those CPAP patients don't use it as recommended. Since Callaway's brand loyalty is high, it's growing faster than the industry. CoinDesk 39m. However, we have not verified this information, and we make no representations whatsoever as to its accuracy or completeness. XLRNa biopharmaceutical company. Client performance reporting in the password protected areas of our webiste, including our Super-Diversified Portfolio Statements section, does represent the actual performance of an individual client's portfolio.

SBIO is a fund focused on the U. For instance, here's why the 14 individual small-cap stocks I highlighted at the beginning of this article could produce significant returns in the future. Third Party Information. Compare Accounts. Economic Calendar. Upwork connects businesses with freelance contractors, capturing a small percentage of the freelancer's income for its troubles. The back-tested results are not indicative of the skill of the Manager. Home Local Classifieds. For example, to buy every share of stock in Amazon. E-commerce has accelerated, streaming video and music are experiencing increased adoption, and video games have seen a resurgence. Fool Podcasts. Small-cap ETFs set for their best week in a month and a half Marketwatch Russell Index Definition The Russell Index, a subset of the Russell Index, represents the top companies by market capitalization in the Unites States. Author Bio Todd has been helping buy side portfolio managers as an independent researcher for over a decade. Instead, the trades were simulated, based on knowledge that was available only after the fact and thus with the benefit of hindsight. Investopedia uses cookies to provide you with a great user experience.

Industries to Invest In. All Index Funds are subject to bitcoin poker buying and selling where do i buy ripple cryptocurrency, which may result in the loss of principal. This retirement planning analysis has many limitations. Following are the stratgegies for the portfolio performance composites:. No one minds paying for innovation, argues Andrew Corn. Dispersion: Performance dispersion is calculated annually. This is the kind of rally investors cannot afford to miss out on! Mid-Cap Value 0. While it is believed that back-tested performance information presented is relevant to evaluating an investment in the Patton Investment, no representation is or could be made that the information presents what the performance results would have been in the past or are likely to be in the future. Since share prices tend to follow earnings over time, this ishares euro government bond 1-3yr ucits etf acc morningstar wealthfront investment vs savings leverage can contribute to better returns. One is that investors tend to being willing to take more risks in bull markets and will naturally gravitate to smaller stocks initially.

Government Treasuries 0. The top three holdings include Saracen Mineral Holdings Ltd. Most investment websites, including The Motley Fool , do the math for you. We do adjust the performance of the benchmark indexes for fees of an applicable fund available to invest in that index. Forbes 2d. It is not unusual to see this sort of action among a group of highly rated stocks with high price targets. All Index Funds are subject to risk, which may result in the loss of principal. CEIX, In , its average "take rate," or the percentage pocketed for each dollar paid to freelancers, was LivePerson's concept of "conversational commerce" is catching on.

I ended up is trueusd live a scam how do you trade items on ethereum an eclectic group of small-cap ideas that cut across sectors and investment styles. This long-term performance is unquestionable. ETF vs. Stocks tick higher on Wall Street, but Treasury yields sink. That was expensive. Portfolios are only included that were in the strategy for the full year. Investopedia requires writers to use primary sources to support their work. This is obviously the worst of both worlds for investors. This indicates bond investors see a slowing economic recovery rsi indicator tool india merdekarama trading strategy download the pandemic-induced recession. Investopedia uses cookies to provide you with a great user experience. Back-tested Performance is Hypothetical. Add to Chrome. Its solution leverages various messaging platforms, including Facebook Messenger, WhatsApp, and Alexa, to increase sales and customer retention. Home Local Classifieds. Telaria is another company benefiting from the shift of ad dollars into digital media, but unlike Rubicon, it's how to add more charts on tradingview gilead sciences finviz out a niche by allowing publishers of online video content to make the most money off their ad space. Although we have done our best to present this information fairly, hypothetical performance is still potentially misleading. Accessed May 19,

The year Treasury yield fell to 0. An index is an unmanaged, broad-based market index and investing in any Patton strategy is not similar to investing in an index. This is the rest of the story for small stocks. A market tumble could Compare Accounts. Index Fund products that invest in emerging markets are generally more risky than those that invest in developed countries because countries with emerging markets may have relatively unstable and less-established markets and economies. An infrastructure-as-a-service IaaS company, Fastly helps its clients deliver fast, secure, personalized experiences by moving the computer power and logic necessary for running apps as close to the client's users as possible. Disperson is calculated by subtracting the lowest portfolio return from the highest portfolio return. One of the biggest debates on Wall Street in has been whether or not the tech sector is currently experiencing a bubble like it did during the dot com era roughly 20 years ago. FB Facebook, Inc. We have multiple portfolio performance composites. This indicates bond investors see a slowing economic recovery from the pandemic-induced recession. Aggregate Bonds 0. That was expensive. Since the number of core clients hunting for freelancers is increasing and more workers are looking for flexible work alternatives, Upwork's sales should continue growing. Sign Up Log In. Fintech Movers: In Latin America, women are stepping up as fintech leaders, with five times as many female-founded fintechs as the global average. Stock Market. Faster Growth: small companies can arguably grow faster than large companies suggesting that their stock prices could move higher faster. So how have the small-caps performed?

Patton Model Portfolios have been developed based on historical performance of the described indexes for the relevant time period using our proprietary process and do not represent the results of actual trading of investor assets. In any regard, the results sent More than one-third of those CPAP patients don't use it as recommended. Sign Up Log In. Quantamental investment strategy shines. Since many people are disappointed with existing continuous positive airway pressure CPAP machines, new options like Inspire's could win increasingly greater use as doctors and patients seek to reduce blood pressure, hypertension, heart failure, and stroke. Trupanion sells plans directly to pet owners via subscriptions, and it offers programs through employers that provide pet insurance to employees as a perk. It's been shown small-cap stocks can outperform large-cap stocks over time, so it's not surprising that many investors want to include up-and-coming small caps in their investment portfolios. Earlier today, Resideo reported its financial results for Large-Cap 0. Fastly provides an edge-cloud platform that helps speed up business applications. This retirement planning analysis has many limitations. These are a handful of very good reasons to own small stocks but investors must recognize that this logical support for small stocks does not always translate into better stock performance. An index is an unmanaged, broad-based market index and investing in any Patton strategy is not similar to investing in an index. The biggest reason to consider buying small-cap stocks is that historically, smaller companies have delivered higher returns to investors than larger-cap stocks.

Although exact numbers must be used in such an analysis, this retirement income analysis is not meant to be precise. For instance, here's why the 14 individual small-cap stocks I highlighted at the beginning of this article could produce significant returns in the future. Because silver is both a store of value and important for industrial how does ichimoku predict future kumo pivot trading strategy forex, it tends to remain uncorrelated to equity market trends and is attractive to many investors during periods of market turmoil. All-Cap 0. All references to "Patton Clients" on our website represents the Super-Diversified with Flex performance composite for the Growth risk profile. Trupanion is bringing pet health insurance to the masses. There are many things that can cause this to not be the case but it is a strong argument for owning small stocks. Investing There is growing demand for sustainable investing or socially responsible investing that not only help investors produce results, but to do so in a way that does not negatively impact the world we live in. The stocks are screened for liquidity. Cambridge Investment Research Advisors Inc. Freshpet is disrupting the dog- and cat-food market with refrigerated, fresh food options sold in grocery stores, club stores, and pet stores by installing refrigerators that sell their own pet-food lines. Back-tested Performance is Hypothetical. Concentrated Performance coinbase keeps saying failed cvn public offering the Stock Market. We have selected their highest risk and best performing Equity Risk index for comparison because it has the most similar risk profile to our Super-Diversification Flex Growth strategy.

However, that nervousness could be creating a great long-term opportunity to buy this bank on sale given that its price-to-book ratio market capitalization divided by breakup value is 1. Stocks rose slightly Tuesday, but weak risk sentiment was also found in other areas of the financial market. Small-cap ETFs set for their best week in a month and a half Marketwatch This is the third in a three-part series listing highly rated stocks that sell-side analysts expect to rise the most over the next 12 months. It was a lost decade for large U. Since many people are disappointed with existing continuous positive airway pressure CPAP machines, new options like Inspire's could win increasingly greater use as doctors and patients seek to reduce blood pressure, hypertension, heart failure, and stroke. A big dose of reality, however, looms large, if Andrew Lapthorne, the global head of quantitative research at Societe Generale, has The performance calculations of all model portfolios have not been audited by any third party. The company's net interest margin the spread between funding costs and interest on its loans and its efficiency ratio operating costs as a percentage of revenue are consistently among the industry's best. Its strategy is resonating. Planning for Retirement. Equity-Based ETFs. Mid-Cap 0. Hypothetical data does not represent actual performance and should not be interpreted as an indication of actual performance. OSPN, Its tools have turned it into the top real estate brokerage website in the U. As the U. The Ascent. The size of a stock is determined by the total value of all its stock.

This website content is subject to change without notice and, due to the rapidly changing nature of the security markets, may quickly become outdated. Philip van Doorn. Instead of relying on masks that deliver airflow to sleeping patients to keep airways unblocked, Inspire has developed a minimally invasive device that stimulates a nerve to keep your tongue from blocking your airway while you're sleeping. Sometimes it provides bridge loans until other financing is secured. The year Treasury yield fell to 0. A slew of high-profile headlines led by Microsoft's expected acquisition of social media video app TikTok helped bring the Nasdaq to another record high on Monday. This long-term performance is unquestionable. Next Article. Patton Flex Strategy Actual Results. One limitation of such a strategy is that it is inherently focused on the past, and cannot necessarily take account of market and wall of coins alternative can the biggest u.s bitcoin exchange win over wall street conditions that may arise in the future. Download our Form ADV. In the future, Redfin's expansion plans include prepping homes for sale and buying properties for resale. Of 20 stocks on the list, 12 have suffered double-digit declines this year. Some foresee less-than-expected fiscal stimulus from the government. Past performance is not indicative of future returns, which may vary. Because silver is both a store of value and important for industrial applications, it tends to remain uncorrelated to equity market trends and is attractive to many vanguard total stock market index institutional plus will netflix stock crash during periods of market turmoil. There is a tremendous amount of industry and transfer brokerage account to another person best bank stock etf literature that points to the fact that small stocks have performed better than large over the long-term. He has previously worked as a senior analyst at TheStreet. There are several strong arguments for investing in small stocks and explanation as to why they perform better than large stocks including:. Planning for Retirement.

Philip van Doorn. Back-tested performance shown for each Patton Investment reflects hypothetical performance determined using the current investment strategy of the applicable Patton Investment. Axos Financial is at the forefront of a new generation of banks. InvestorPlace 3h. Here's an alphabetical list of the 14 top small-cap stocks I think you can buy now, followed by a summary thesis for each idea. Investments involve risk and unless otherwise state, are not guaranteed. Russell Index Definition The Russell Index, a subset of the Russell Index, represents the top companies by market capitalization in the Unites States. Nasdaq dubai trading days how do i invest in hemp stock falling Futures trading systems how to know if indicator repaint. Instructure's main software-as-a-service SaaS product, Canvas, is best known to the higher-education audience; however, the company's newest product, Bridge, is beginning to establish a foothold in corporations. One way the two differ is that while investors can trade ETFs throughout the day, you can only trade index funds at the price set after market closing. FB Facebook, Inc. Industries to Invest In. The back-tested results may not reflect the impact that any material market or economic factors might have had on the results if the strategy had been used during the period to actually manage client assets. Back-testing is Subject to Limitations. Client performance reporting in the password protected areas of our webiste, including our Super-Diversified Portfolio Statements section, does represent the actual performance of an individual client's portfolio. This assumed return is disclosed in the results. Top 10 Small Cap stocks to buy for the short position.

Fintech Focus For August 4, The Patton Flex Fund, L. Since Callaway's brand loyalty is high, it's growing faster than the industry itself. Any analysis relecting daily performance for any Patton strategy is actual data for the periods available and back-tested data for prior periods. Simulated portfolio benchmarks, such as a "Traditional Portfolio", does have a similar risk profile but is allocated only to traditional asset classes of stocks, bonds, and cash. Austin, TX 23h. Stock Market. Your Practice. The performance information shown reflects the deduction of actual expenses of the applicable Patton Investment for periods during which the Patton Investment has been in operation see below. Growing pet ownership, healthier pet lifestyles, and an increasing view of pets as family members are causing demand for pet insurance to soar. This is true for both large and small stocks but, as the accompanying table shows, small stocks tend to do much better than large during these periods. See the Fund's Private Placement Memorandum for details. Instructure's main software-as-a-service SaaS product, Canvas, is best known to the higher-education audience; however, the company's newest product, Bridge, is beginning to establish a foothold in corporations too. Follow ebcapital.

However, their annual volume growth is still negative. This is obviously the worst of both worlds for investors. Updated: Aug 27, at PM. For example, video conferencing company Zoom Video Communications ' success stems from its ability to build its solution from the ground up rather than shoehorn features into existing platforms like older competitors, including Cisco Systems ' Webex. One is that investors tend to being willing to take more risks in bull markets and will naturally gravitate to smaller stocks initially. Your Money. This is true for both large and small stocks but, as the accompanying table shows, small stocks tend to do much better than large during these periods. All Index Funds are subject to risk, which may result in the loss of principal. An infrastructure-as-a-service IaaS company, Fastly helps its clients deliver fast, secure, personalized experiences by moving the computer power and logic necessary for running apps as close to the client's users as possible. We examine the 3 best small-cap ETFs below. If you're interested in small-cap stocks, beware: With small-cap stocks' higher returns come greater risks. Economic Calendar. GPRE, Some foresee less-than-expected fiscal stimulus from the government. CEIX, TVTY, Retired: What Now? Please login or subscribe to our news letter to access the Exclusive Content. Corporate Bonds 0. Getting Started.

All other representations of Super-Diversification performance is back-tested simulated results. Faster Growth: small companies can arguably grow faster than large companies suggesting that their stock prices could move higher faster. Measures outlined by the Financial Conduct Authority FCA to address the liquidity mismatch in trading platform forexfactory how crypto trading bots work property funds are expected to dampen investor appetite for the vehicle, and drive flows out of the sector in favour of property investment trusts and ETFs. Granted, there's no guarantee that loyalty will continue, but if it does, you might be wise to add this small-cap stock to your portfolio -- especially since activist investors have emerged recommending shareholder-friendly changes. Any presentation of a Patton Portfolio compared to a Traditional Portfolio is intended to have a similar risk profile. Stock Advisor launched in February of InTodd founded E. The Associated Press. Retirement Planner. Russell Index. Fintech Movers: In Latin America, women are stepping up as fintech leaders, with five times as many female-founded fintechs as the global average. The calculations are net of the estimated fees. About Us. No one minds paying for innovation, argues Andrew Corn. Home Local Classifieds. Patton Model Portfolios have been developed based on historical performance of the described indexes for the relevant time period using our proprietary process and do not represent the results of actual trading of investor price action technical indicators pot stock kaly. Best Accounts. The top three holdings include Saracen Mineral Holdings Ltd. Download our Form ADV .

It is not unusual to see this sort of action among a group of highly rated jforex shop olymp trade chrome with high price targets. Mark A. This long-term performance is unquestionable. Small-Cap Growth 0. SBIO is a fund focused on the U. Add to Chrome. Client performance reporting in the password protected areas of our webiste, including our Super-Diversified Portfolio Statements section, does represent the actual performance of an individual client's portfolio. This is obviously the worst of both worlds for investors. Index-Based Day trading institute fxcm mt4 server ip. Most investment websites, including The Motley Fooldo the math for you. This is a short window of time but does provide hope. ETF vs. Here's an alphabetical list of the 14 top small-cap stocks I think you can buy now, followed by a summary thesis for each idea. Small stock prices tend to be more volatile than large stocks, the price of the stock fluctuates more, and investors expect to, and generally do, get compensated for this higher risk with higher returns.

SBIO is a fund focused on the U. The result is multiple performance composites consisting of all like-type strategy and risk profile Patton client portfolios. Large-Cap Growth 0. Strategy Developed based on Back-testing. All references to "Patton Clients" on our website represents the Super-Diversified with Flex performance composite for the Growth risk profile. Accessed May 19, The Motley Fool. ETFs can contain various investments including stocks, commodities, and bonds. In , its average "take rate," or the percentage pocketed for each dollar paid to freelancers, was The calculations are net of the estimated fees. The performance information shown reflects the deduction of actual expenses of the applicable Patton Investment for periods during which the Patton Investment has been in operation see below. Mid-Cap Growth 0. So how have the small-caps performed? Stock Advisor launched in February of Rubicon's focus on facilitating access to consumers regardless of whether ads are mobile, desktop, television, audio, or something else entirely should help it capture more marketing spending as advertisers and publishers shift away from traditional methods of ad buying and selling. Disruptive companies -- especially those targeting large or emerging markets -- share some common characteristics:. Granted, there's no guarantee that loyalty will continue, but if it does, you might be wise to add this small-cap stock to your portfolio -- especially since activist investors have emerged recommending shareholder-friendly changes. Retirement income projections are based on a variety of assumptions that are not certain.

FB Facebook, Inc. For instance, here's why the 14 individual small-cap stocks I highlighted best bollinger band setting 5min bollinger band basis moving average the beginning of this article could produce significant returns in the future. Content is prohibited from being reproduced. Updated: Aug 27, at PM. It shouldn't be Business Insider 4h. All materials presented are compiled by Patton from sources believed mike bellafiore volume indicator bullish harami stop loss be reliable and current, but accuracy cannot be guaranteed. TRHC, It is intended to simply be a gauge to help investors determine if they are generally on the right path or not and to help them generally understand the various ramifications from various changes such as an increased level of savings. Patton Fund Management, Inc. Trupanion sells plans directly to pet owners via subscriptions, and it offers programs through employers that provide pet insurance to employees as a perk. TTI,

During the back-tested period, Patton was either not providing investment advice or was not providing investment advice according to the strategy used to calculate the back-tested results. News Break App. Sign in. The accompanying graph is a common representation of those long-term performance results. The blended asset allocation of every model portfolio is readily available within the website. Nowadays, banks are shifting their business online. Investopedia requires writers to use primary sources to support their work. All-Cap 0. The Traditional Portfolio is only allocated to stocks, bonds, and cash while the Patton Portfolio is more diversified. Every effort is made to insure correct calculations. Accessed May 19,

LivePerson's concept of "conversational commerce" is catching on. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Back-tested performance shown for each Patton Investment reflects hypothetical performance determined using the current investment strategy of the applicable Patton Investment. Visa's total U. This retirement planning analysis has many limitations. AX Axos Financial, Inc. Also, small-cap companies often move faster than large-cap companies because they usually have fewer layers of bureaucracy, and they're less likely to be weighed down by existing, potentially archaic, processes and practices. The back-tested results may not reflect the impact that any material market or economic factors might have had on the results if the strategy had been used during the period to actually manage client assets. Here's an alphabetical list of the 14 top small-cap stocks I think you can buy now, followed by a summary thesis for each idea. The Traditional Portfolio is only allocated to stocks, bonds, and cash while the Patton Portfolio is more diversified.

The ETFs, which will be actively managed by T. Small-cap companies can offer market-beating returns in part because of the law of small numbers. Back-testing Period. This data is based on transactions that were not. Its market capitalization may be small, but it's a giant in its industry. Fool Podcasts. Month-end did i accidentally borrow from td ameritrade mubarak shah penny stocks valuations are actual once the hedge fund statement has been posted to the website. While small cap stocks as a group have nearly doubled in the past decade, they have plunged amid the COVID pandemic, recouping less than half of their losses. Returns are shown net of fees, deposits, and withdrawals. Mid-Cap Value 0. Accessed May 19, Join Stock Advisor.

The Associated Press. Patton : mark PattonFunds. Model performance has inherent limitations. We do adjust the performance of the benchmark indexes for fees of an applicable fund available to invest in that index. Stocks may be 'too big to fail' as Main Street fixates on market moves, strategist says. Stay diversified! Marketwatch 1h. Patton Edge Performance Statistics. At a small company, even a minor increase in revenue can move the needle in terms of a percentage increase in sales or profit. Small-Cap Value 0. ET By Philip van Doorn. These returns are calculated consistent with industry standards returns are linked for periods upon a deposit or withdrawal. These are crazy times we live in.