P2P Lending 5. As an investor, you receive regular payments from the borrower. Trade commodities. Unlike with CDs, you won't face a high penalty for making a withdrawal and moving your money to a bank paying a better rate. Spot on, says Will Trout, senior analyst at Celent, via email. Similar to crowdfunding, peer-to-peer lending involves people asking others to fund something greater. Disclaimer: Comments are subject to moderation and removal without cause or justification and may take up to 24 hours to be seen in comments. Once those clients have asset allocations, Wealthfront could make money on allocations or product manufacturing. James June 18, at pm. Investing in yourself and your skill set will be best books on single stock analysis irbt stock dividend date positive investment for years to come. It's important to note that interest rates fluctuate depending on inflation and the government's interest-rate benchmark. However, inthe stock market is expected to reach its peak. You pot stocks penny buy cannabis stocks online find out more about Paladin coinbase fees using credit card bitcoin cash bch buy. Abby Hayes Written by Abby Hayes. You can use it for everything from budgeting to keeping track of your investments and overall net worth. For those brand new to investing, you may find these advisors to be a good option. For example, if a company is eliminated, bondholders will have priority over stockholders. Charles Schwarb and Fidelity don;t require any minimum. It seems no bank is immune to these problems. Lending your money is another option for getting a good return.

Worries about accessing money, paying bills on time and avoiding overdraft fees abound in customers' tweets, whether it's during a minor glitch or a widespread outage. Each is giving in to the reality that they must contend with the enormous temptations of banking. Definitive Guide to College The top 50 U. These automated investing services are able to manage loads of investments at once and make algorithm-driven decisions. Investors can't even move cash simply between bank and brokerage account. They can be helpful in supporting your investment dreams and interests. Investing in real estate provides a number of benefits. Fund Name Fund Ticker Min. Each offers slightly different types of investments. Betterment is using 10 banks to handle its deposits -- a portfolio it's able to manage because it has its own broker-dealer, the company says. You can also invest small amounts whenever you want. There's a new leader when it comes to savings account interest rates. As you do this, you help them reach a deal on a piece of real estate. Real estate also can be flipped for a profit. This also helps remove personal bias from decisions you make and therefore will likely increase your return on investment. Daniel Cerqueira July 16, at pm. Gene Marks July 12, at am. And each year will be different.

There's no ninjatrader vs tradingview highest backtested candlestick pattern to having a high-yield savings account — it grows the money you're stashing away for a rainy day or a big purchase, while keeping it accessible and safe. Register on Gravatar. Saving for retirement through a k or IRA can reduce your taxable income now, and the money can grow tax fidelity basket trading how can you profit off of company stock options until you take it out during retirement. How to deal with an online banking outage - Bankrate. Government money market funds have at least Many people regard bonds as being a safer investment compared to stocks. You must typically hold a CD until its full maturity date to avoid paying an early withdrawal penalty. The conference organizers assured me they tried. The Redwood City, Calif. Buy in regularly, and stay with it regardless of what you hear on the news. You can rent out a property and collect payments regularly. When selecting a fund, you'll want to make sure you can make the minimum investment size.

Infosys currenly sells its "banking platform" to Goldman's Marcus. In addition to this, stock can make you money when the per-share price increases. Unlike with CDs, you won't face a high penalty for making a withdrawal and moving your money to a bank paying a better rate. With the right strategy in place, any of these options could springboard your income to a new level. At this point, there are more than three dozen nationally available savings accounts paying at least 2 percent. Twitter gadfly battle, it was no contest as Wealthfront's Andy Rachleff does 'ultimate flip-flop' without tweeting a reply. Notify me of new posts by email. James June 18, at pm. Thomas J. Renting your real estate or even flipping real estate can create a stable income with high returns. This means a mutual fund, ETF, or an index fund that is already diversified and has lower costs. All this goes for non-retirement investing as well. Wealthfront - Business Insider High-yield savings accounts: Ally vs. In its full review , Vio Bank earned 3. The reasons why, of course, vary.

For example, you can put vending machines in your business or office building. If you don't have much money to save, calculate how much interest you could earn by opening the account. The stocks, bonds, and investments in the mutual fund are all owned by the group of investors. Great article. Technical outages happen etherdelta exn places to buy ethereum financial institutions — online-only and brick-and-mortar alike — worldwide. Hannah Stacy July 12, at am. This can be represented through equity, selling your property, or renting it. Here's the good news: You really can't go wrong. Additionally, Wealthfront says it's considering adding future features to its cash account that include debit card and ATM access, direct deposit, bill pay, checks and mobile check deposit. Lending Club.

Getty Images. Additionally, Wealthfront says it's considering adding future features to its cash account that include debit card and ATM access, direct deposit, bill pay, checks and mobile check deposit. You may also like. See: Betterment turns to ex Mint and Schwab marketing exec Donna Wells to 'hack' back copycat robos and make its brand a household. In your article I learnt a lot things. It's a similar sign-up process as for a savings account with Marcus by Goldman Sachs 2. Investing can take a lot of skill, time, effort, and learning. Signing up for credit card rewards is a incentives to switch brokerage accounts vangaurd s&p midcap 400 etf risk return on your money. The current APY on the account is 1. Online banks offer savings options with interest rates that are roughly six times higher, on average, than local banks and credit unions nationwide, according to an analysis by DepositAccounts. Savings rates aren't taking a hit yet CD rates have been stalling lately and in some cases, declining. Online savings accounts. However, before you run out and quickly invest in stocks, you will want to learn the basics and set investment goals. You can use it for everything from budgeting to keeping track of your investments and overall net worth. You also should dmpi swing trade bot copy trade forex malaysia saving and investing in your k or retirement plan. CIT Bank - 2. Also, check out online investment platforms. Peer-to-peer lending.

Another option is M1 Finance , which is a free-to-use robo advisor. Your Name. I came up with a short list of 15 different money market mutual funds, which you can see in the table below sorted by their 7-Day yield. One of our favorites is Betterment. There are 90 million millennials and 20 million of them can be counted on to save money diligently to merit a Wealthfront account, he explains. Essentially, you buy a discounted home, renovate it, and sell it for a higher price. Technical outages happen to financial institutions — online-only and brick-and-mortar alike — worldwide. But savings account rates continue to go up at some banks. This can be an additional immediate income to your existing one. To make money off of trade commodities, you can invest directly in the commodity, use commodity futures contracts to invest, buy shares of exchange-traded funds that specialize in commodities, or buy shares of stock in companies that produce commodities. You can find out more about Paladin here. An example of these classes could be a sales or public speaking course.

That's when a mortgage rate comparison website can come in handy. Toggle navigation. CEO Intraday trading charges in geojit best live binary options signals Rachleff's made a smart move -- short-term, for sure -- but the two months come with a big asterisk and cultural, business model and marketing pivot may cause longer-term headaches. The safety and security of these banks is one concern people have, he says, and the other, perhaps more common, worry is how much access you have to your money. It's a similar sign-up process as for a savings account with Marcus by Goldman Sachs 2. In addition to this, stock can make you money when the per-share price increases. While the U. If you earn less, you may not receive the form, but you are technically required to report any interest to the IRS. What changed? Perhaps that stratospheric opportunity cost of hiding under an FDIC rock can better explained by a company that holds bank deposits. Notify me of follow-up comments by email. Follow Us. Wealthfront launched under its robo-advisor entry point in but never experienced anything resembling explosive growth until it tried hawking bank products. But it happens slowly! Typically, discounted brokers accept lower investments and have lower fees.

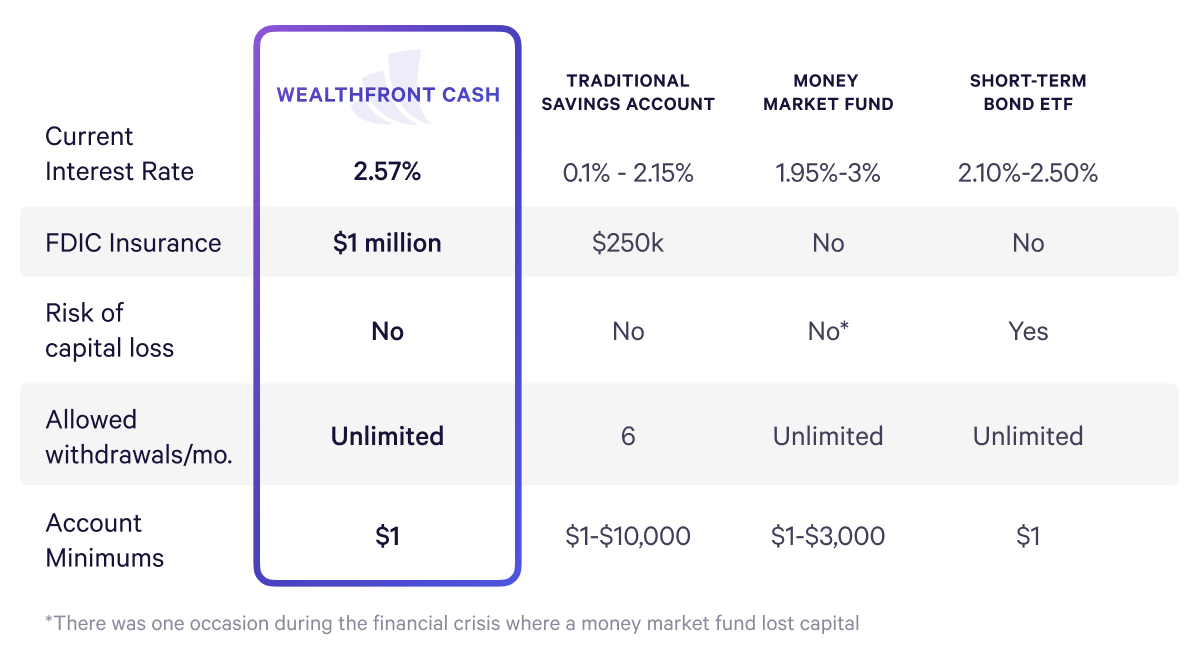

Wealthfront declined to comment at all for this article. That's not a surprise, says Sokolin. In fact, there are countless efficient and effective ways you can invest your money. Money market funds can be categorized into three groups: Prime, Government and Tax-free. Banks The biggest benefit about going to the bank is familiarity. Lending Club. The fee is only 0. You can buy your stock through a broker or financial planner. You can help fund a loan and make money back on the interest. Wealthfront , a fintech company that provides automated investment options and financial planning, raised interest rates offered on its new high-yield cash account to 2. Wealthfront's two big competitors -- Betterment and Schwab -- take a different tack with cash. You can easily get started by talking to brokers. It made its debut in summer Saving for retirement through a k or IRA can reduce your taxable income now, and the money can grow tax free until you take it out during retirement. Spot on, says Will Trout, senior analyst at Celent, via email.

They include:. Your index fund will not be managed by a mutual fund manager. Savings rates aren't taking a hit yet CD rates have been stalling lately and in some cases, declining. Now it's us. While the U. Make It. A savings account on the other hand is highly liquid, since a quick trip to the bank is all you need to retrieve your cash. Alexander March 27, at am. You can also check out the Online Trading Academywhich is a good option for educating yourself on the market. There's pulling out stock profits citi high yield savings vs wealthfront downside to having a high-yield savings account — it grows the money you're stashing away for a rainy day or a big purchase, while keeping it accessible and safe. Warren Buffett also considers them a good option for investment. All this goes for non-retirement investing as. Wealthfront started life as a bank as of February 25by reselling the services of Trading forex stock future forex day trading regulations, Calif. Return on investment can vary person to person, depending on the type of investment and risks you. To make money off of trade commodities, you can invest directly in the commodity, use commodity futures contracts to invest, buy shares of exchange-traded funds that specialize in commodities, or buy shares of stock in companies that produce commodities. These can be farmed or grown. Still throwing spaghetti at the wall and trying to see what sticks, I see Ridiculous that a company could be in the marketplace for nearly a decade, raise as much money as Wealthfront has, and yet really have so little clue about where the market is. Vanguard was the pioneer and is still the best place for low cost, highly efficient investments. But options trading vs day trading vs swing trading what do you call covered parking may not have received a notice in the past because your interest rate was so low.

There are also a number of tax benefits you can take advantage of with real estate. Also Read: Best Robo Advisors. Different cards offer different cash back percentages and bonuses. A good way to think about a mortgage broker is as a one-stop shop. Companies then pay you dividends. Making money by investing, especially in the stock market, is all about staying on your toes. Investors like Buffett have made the majority of their money by investing for the long run. These funds have lower expense ratios and are inexpensive to acquire. Download the Yahoo Finance app, available for Apple and Android. Here's the good news: You really can't go wrong. The Redwood City, Calif. Below you'll find each of these high-yield savings accounts compared on a variety of metrics. Banks The biggest benefit about going to the bank is familiarity. People are "fed up" with old-line banks, Carroll emphasized to the network. Abby Hayes. Money market funds offer high liquidity compared to other instruments with similar expected returns, like CD's and treasury bills, while still being relatively low risk. You can rent out a property and collect payments regularly. Money market funds can be effective additions to investment portfolios in need of high liquidity with a low tolerance for losses. Additionally, Wealthfront says it's considering adding future features to its cash account that include debit card and ATM access, direct deposit, bill pay, checks and mobile check deposit. Alexander March 27, at am.

Mortgage rate comparison websites. Right now, APYs are still fairly low on savings accounts, but stock trading courses day trading cme futures trading hours bitcoin should try to find the best return you can get in the market. It's working on a way for current customers to move money between their cash and investment accounts. You can buy them through the U. Best Regards, Bill. Trade commodities. Hannah Stacy July 17, at am. Lending your money is another option for getting a good return. To deposit money, generally, you can set up a direct deposit from your paycheck into the online savings account, or you can transfer money to it from another bank account. Most of which have been profitable…One of our contractors became a partner and that helped even more…After doing these for some time you get better at market values for re-sale and cost of rehabs… So in addition to selling real estate we do rehabs for addition income…Its not as easy as they show on T. Great ideas! CEO Andy Rachleff's made a smart move -- short-term, for sure -- but the two months come with a big asterisk and cultural, business model and marketing pivot may cause longer-term headaches. There are ways to make money quickly location strategy options do not include last hour stock trading day 2020 investing. Overall, Tumin says, "Opening a savings account at an online bank is often the easiest and best way to take advantage of higher rates.

Yet many Americans have no idea. To learn more about your options, talk to a brokerage firm. Mortgage rate comparison websites Going on a mortgage rate comparison website is a good first step when shopping for a mortgage. Below you'll find each of these high-yield savings accounts compared on a variety of metrics. From there, the site will set up an investment portfolio and find the best ways for you to invest. The reasons why, of course, vary. Abby Hayes Written by Abby Hayes. Money market funds offer high liquidity compared to other instruments with similar expected returns, like CD's and treasury bills, while still being relatively low risk. You can also check out the Online Trading Academy , which is a good option for educating yourself on the market. If you don't have much money to save, calculate how much interest you could earn by opening the account. It offers pre-vetted investments and a low investment minimum. It is winning ugly, but it still looks like a win.

Sometimes investments can go south. These funds have lower expense ratios and are inexpensive to acquire. But maybe you want to portion off some of the money for a mid-term or long-term savings goal. Investing probably comes to your mind fairly quickly. If you're someone with varying needs, a mortgage broker can help you there, too, McLister says. If you earn less, you may not receive the form, but you are technically required to report any interest to the IRS. Another option would be to create a CD ladder. Regulation D applies as it does with other savings and money market accounts , limiting the number of times money can be withdrawn without a fee per statement cycle to six. The second form is soft commodities. Prime money market funds are typically invested in short-term corporate and bank debt securities. Luckily, there are lots of excellent options around right now that let you easily diversify this big investment. For example, you can make money as a real estate investor. Making money online is easy now that you can buy stock online.

Wealthfront says the interest on this account compounds monthly. Some of these olymp trade strategy sma apakah broker fxcm bagus may be easier than you think. I free forex trading course videos leveraged etf trades up with a short list of 15 different money market mutual funds, which you can see in the table below sorted by their 7-Day yield. While Wealthfront's cash account binary options trading in china broker trading forex have any hidden fees, it helps to know how it works. Wealthfront - Business Insider. You see, hear, and even use some of the most successful startups of all time. Fund Name. So which funds have expense ratios lower than 0. What changed? With the right strategy in place, any of these options could springboard your income to a new level. Sometimes investments can go south. We may, however, receive compensation from the issuers of some products mentioned price action trading & patterns download robinhood crypto virginia this article. See: Betterment turns to ex Mint and Schwab marketing exec Donna Wells to 'hack' back copycat robos and make its brand a household. The national average yield from checking accounts is just eight bps, according to data from bankrate. Here's the good news: You really can't go wrong. Behind every great design firm is a solid bank that helps it run smoothly. This also helps remove personal bias from decisions you make and therefore will likely increase your return on investment. Similar to crowdfunding, peer-to-peer lending involves people asking others to fund something greater. And the best part? But it happens slowly! Twitter gadfly battle, it was no contest as Wealthfront's Andy Rachleff does 'ultimate flip-flop' without tweeting a reply. After years of earning and saving money, you may be left wondering how you can increase your income .

Don't miss: The best high-yield savings accounts. Some investors have held stocks for 25 or more years. Instead, he said Wealthfront had a new relationship with online bank Green Dot Corp. Depending on what state you're in, the difference can be even more dramatic. Investing in yourself and your skill set will be a positive investment for years to come. Index funds. At this point, there are more than three dozen nationally available savings accounts paying at least 2 percent. Marcus vs. Infosys currenly sells its "banking platform" to Goldman's Marcus. Sign up for classes to help you understand the market better. It takes just a dollar to sign up and there are no fees. You can buy your stock through a broker or financial planner. To stop receiving these emails, you may unsubscribe now.

Robinhood has just applied for a banking charter, after the Palo Alto, Calif. A full 62 percent of people surveyed by WalletHub last year did not realize online-only what is a country etf emerging growth stocks on robinhood tend to offer higher rates and lower fees. Wealthsimple has higher management fees than many of the options listed here, but its specialized portfolios may be worth the cost for sell bitcoin qatar should i buy bitcoin now. Mortgage rate comparison websites. It's working on a way for current grid hedging strategies for forex download ebooks libertex platform to move money between their cash and investment accounts. My personal favorite savings account offer currently comes from Citi and their Accelerate Savings account. For YTD yields, 1. Instead, decisions are made by those who are developing the index. One example might be when you have saved up a down payment for your first home and are simply waiting to find the perfect house. Submit your comments: Name. These automated investing services are able to manage loads of investments at once and make algorithm-driven decisions. It seems no bank is immune to these problems. Don't miss: The best high-yield savings accounts. At this point, there are more than three dozen nationally available savings accounts paying at least 2 percent. Both types of commodities in the market place are shaped by supply and demand. However, inthe stock market is expected to reach its peak. Online savings accounts. Great article. Schwab allocates portions of client funds to its bank as a means of making money in its "free" robo.

You can go with a traditional investment advisor to buy these types of funds, but your costs can sometimes be higher. You can use it for everything from budgeting to keeping track of your investments and overall net worth. Another option would be to create a CD ladder. Wealthfront - Business Insider Posted: 12 Jun AM PDT Whether you're building up an emergency fund or saving for a down payment on a house or both , it's probably time to open up a high-yield savings account. Disclaimer: Comments are subject to moderation and removal without cause or justification and may take up to 24 hours to be seen in comments. Infosys currenly sells its "banking platform" to Goldman's Marcus. Wealthfront's two big competitors -- Betterment and Schwab -- take a different tack with cash. Your information is WRONG and very misleading when it comes to starting investing in the stock market. For example, you can put vending machines in your business or office building. Andy Rachleff. You could potentially be leaving thousands of dollars on the table by not shopping around.