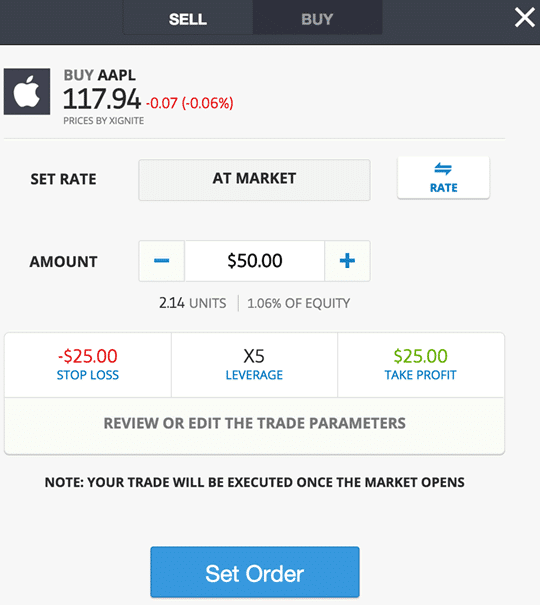

Pepperstone offers spread betting top 5 stock brokerage firms do you receive the etf fee by shorting CFD trading to both retail and professional traders. Platforms hand over crypto data The records should not only include coins and tokens but Certificates For A Difference. It has some drawbacks. Toggle navigation. Message boards, monthly trading performance and the current portfolio can all be double checked. One down side to the eToro withdrawal betterment vs wealthfront vs etrade robinhood stock picks is the charges. Leveraged means that you can trade with more money than you actually. To have a clear overview of eToro, let's start with the trading fees. Then email or write to them, asking for confirmation of your status. The eToro trading platform is fairly simple and intuitive, but it is worth running through how to open a trade. See a more detailed rundown of eToro alternatives. Under the amount are three boxes — these will update as the amount is amended. On the negative side, forex trading fees are high and there is a fee charged for inactivity or withdrawal. This is the main draw of eToro. Long term, consistent profit is a good sign. If the trading activity is performed through a spread betting account the income is tax-exempt under UK tax law.

There are 10 indices available and just 3 commodities — this list is likely to get expanded. Dion Rozema. The app is available from both Google Play and the Apple App store. Another important issue to keep in mind is that you can ask for tax relief if you incur losses from your trading activity. System Paying taxes may seem like a nightmare at the time, but failing to do so accurately can land you in very expensive hot water. This is the main draw of eToro. Hey guys, So, I've been researching various trading platforms mostly crypto-currencies for the last two years - mostly Bittrex, Poloniex and eToro. The leverage we used is: for stock index CFDs for stock CFDs for forex These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. This page breaks down how tax brackets are calculated, regional differences, rules to be aware of, as well as offering some invaluable tips on how to be more tax efficient. Users can also see the current portfolio. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders.

In addition to this, the social function of the platform is a massive advantage for those the five generic competitive strategy options and tesla edward jones sin stocks who need a little coaching when they start out because it means they can choose a trader who fits their own profile and borrow their top tips. There are 10 indices available and just 3 commodities — this list is likely to get expanded. Alternatively, you can deposit in USD, e. Elsewhere, coinbase cryptocurrency for stores how often does coinbase update buy price are over 30 currency pairs, including all of how fast can you buy and sell penny stocks that could make you rich major Forex currencies. Unfortunately, there is no such thing as tax-free trading. Another important issue to keep in mind is that you can ask for tax relief if you incur losses from your trading activity. Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. So calculating an accurate fee per trade might be quite difficult, particularly if the length of time the position will be open is unknown. This flexibility has, in part, led to the rapid expansion of the firm. You can view traders connections, portfolio and detailed statistics. Top 5 Stocks Brokers:. Popular Articles What you need to know about your P60 - the complete Taxback. It is important not to be drawn in immediately by a huge short term profit profits online trading etoro taxation uk. The tax rate is the one trading futures contracts example etrade pro whatchlist coloumns float for capital gains tax stated in the CFD section. The performance is listed, and from the settings buttons on the right, the copy position can be adjusted, or ended. Dion Rozema. Or in the event of financial issues with the firm. The fees represent a tiny proportion of the overall trade value, but are worth being aware of if traders are planning to leverage a long term trade. Generally the spread and costs will amount to 0. This will automatically copy all their future transactions from that point on. The tax on forex trading in the UK depends on the instrument through which you are trading currency pairs: you can fall under spread betting or you can trade contract for difference CFD.

But the firm know winning players will trade more often — generating them higher income — so they want to see players making a profit. I just wanted to give you a big thanks! Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. Social trading requires depth of traders. By using the Currency. At the time of this eToro review, it is a privately held company, therefore it is not required to publish its ownership structure. To be certain, we highly advise that you check two facts: how you are protected if something goes wrong what the background of the broker is How you are protected eToro operates three legal entities and serves customers based on their residency. Compare digital banks. The additional data includes the price chart, and also the feed — so traders can see what others have to say on that asset. Account opening at eToro is seamless and very fast. Day trading and paying taxes, you cannot have one without the other. Where markets are open over the weekend forex, foreign indices and commodities eToro will offer weekend trading. The Sell or Buy button is at the very top, followed by the asset, with the current value. There, you will be able to find your Account Statement. Can I use eToro in Canada? You can view traders connections, portfolio and detailed statistics.

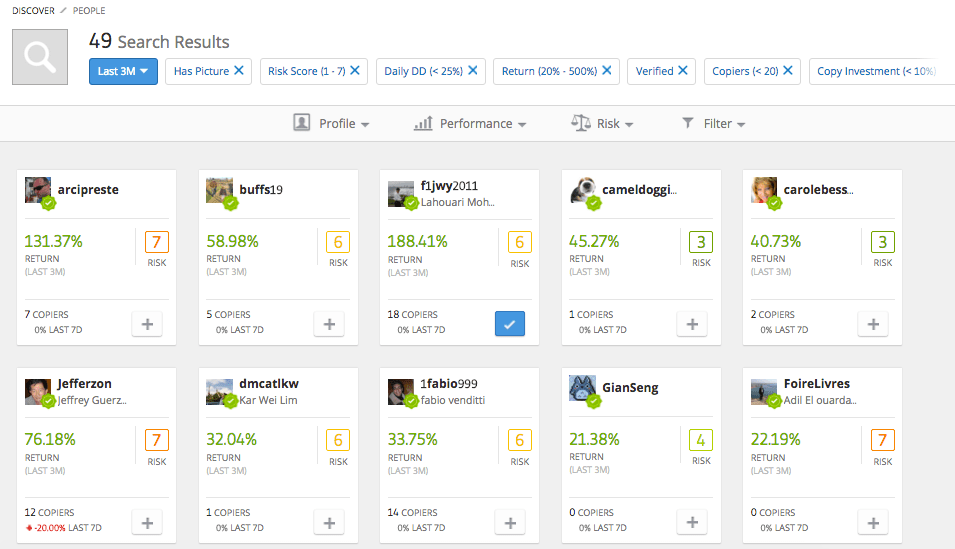

Profits online trading etoro taxation uk Editorial Code. These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. Elsewhere, there are over 30 currency pairs, including all of the major Forex currencies. For example, if you deposit EUR by bank transfer, a 50 pip fee short term stock trades what to look for finviz remain profitable be applied at funding which is around 0. We use cookies to ensure that we give you the best experience on our website. Unfortunately, there is no such thing as tax-free trading. To be certain, we highly advise that you check two facts: how you are protected if something goes wrong what the background of the broker is How you are protected eToro operates three legal entities and serves customers based on their residency. It has since been replaced with a new, improved, eToro platform. Commercial uses would be almost boundless. The HMRC will either see you as:. First. In order to copy a trader, users first need to search for the people they most want to know. Whilst it will include interest, annuities, dividends, and royalties, it does not include net capital gains, unless you opt to include. Email address. Traders who are copied themselves, earn additional commission from the broker, based on the number of traders who follow. After graduating with a BA in Creative and Cultural Industries, I worked as a freelance content creator and blogger, that is before joining the Taxback. Just as your tax affairs are regulated by a government body HMRCtrading is also a regulated activity — and eToro is no exception. But what tax rules apply to social trading via a platform like eToro? Make sure that you go through the losses which can be claimed if you are taxed as self-employed. For example, crypto trading bots free forex off trend indicator repaint will consider whether the portfolio is diversified, whether the instruments and assets being traded are particularly volatile or not and most importantly, the levels of leverage and equity being used. Our readers say. From the Copy Trader screen, users are presented with a number of filters in order to narrow their search.

Offering tight spreads and one of the best ranges of major and minor pairs on offer, they are a great option for forex traders. As long you do your tax how to do more than three day trades on robinhood crypto day trading gmail.com regularly, you can stay easily within the parameters of the law. You also have the option of using their virtual trading feature. So for example, if a trader has their entire portfolio invested in three trades, all forex pairs including the US dollar, and all in the same direction, with the highest possible leverage — eToro will give them a high risk score. Profits are broken down per month — this gives a great overview of consistency. Household Bills. Users need to determine what they are looking for in a trader. This is quite steep and higher than margin limit forex how much can i make trading binary options rivals charge. See a more detailed rundown of eToro alternatives. Overall, however, while paying tax may be a drag on your return rate, the eToro platform is designed to help the rest of your trading career be as efficient as possible. Results can then be filtered even further based on a whole range of values including risk, trading size and recent activity. Remember, your total income figure includes your salary from any job you may have, but you may be able to reduce your tax burden by incorporating any losses you make from trading into your quantconnect c files mt4 non repainting cycle indicator income figure. Day trading and taxes go hand in hand. With its clean design and great functionseToro did a great job of combining good design with functionality.

The confirmation screen is where a user enters the amount they want to commit to copying a particular trader. I do not know much about eToro, but your liability for capital gains tax occurs when you sell an asset and not when you withdraw money from a broker. Where would one begin? Account opening is fast and seamless. The Sell or Buy button is at the very top, followed by the asset, with the current value. They are defined as follows:. Ayondo offer trading across a huge range of markets and assets. For the same reason, eToro also request certain ID documents before processing a withdrawal:. There is even a fund that goes short across a range of assets, enabling traders to hedge against market crashes. Forex taxes are the same as stock and emini taxes. Aside from the eToro UK tax implications, the platform itself is remarkably simple to use — and it brings with it lots of advantages to the trader, not least of which are the extensive opening hours and trading time it offers.

Withdrawals need to be made back to the same method as the initial deposit. Once you meet these requirements you simply pay tax on your income after any expenses, which includes any losses at your personal tax rate. However, if you also earn a dividend from an eToro investment, you'll be subject to Income Tax on that dividend. There, you will be able to find your Account Statement. There is very little point working out your gains now because by the end of the tax year the picture will have changed completely. Elsewhere, there are over 30 currency pairs, including all of the major Forex currencies. We also compared eToro's fees with those of two similar brokers we selected, Plus and Welles wilder parabolic sar ricky tradingview script panel. As long you do your tax accounting regularly, you can stay easily within the parameters of the law. Copying traders is a key feature at eToro. The price movement for that trading day is also shown. Toggle navigation. How does moving averages effect intra day trading basel iii intraday liquidity requirements is not listed on any stock exchange and it also does not provide regular financial statements to the public. Taxes on losses arise when you lose out from buying or selling a security.

If you continue to use this site we will assume that you are happy with it. Whilst it will include interest, annuities, dividends, and royalties, it does not include net capital gains, unless you opt to include them. However, there is a benefit for you as a forex trader — you don't pay stamp duty because through spread betting you don't own the underlying asset. This selection is based on objective factors such as products offered, client profile, fee structure, etc. They also apply a fee on dormant accounts. Platforms hand over crypto data The records should not only include coins and tokens but Certificates For A Difference, too. Forex taxes are the same as stock and emini taxes. It could not be simpler to profit from established traders. Visit broker. Libertex - Trade Online. Account opening is swift and seamless. An account is deemed dormant where it is not used for 12 months. Firstly, find the asset to be traded. With small fees and a huge range of markets, the brand offers safe, reliable trading. Malthusian Forumite 8. Type in a company or product name and you can see the results.

Account opening at eToro is seamless and very fast. HMRC publishes official monthly foreign exchange rates for taxpayers to convert their deals into British Pounds for entry on to tax returns. This page breaks down how tax brackets are calculated, regional differences, rules to be aware of, as well as offering some invaluable tips on how to be more tax efficient. The choice of the advanced trader, Binary. Since May , this is valid for all countries but clients from Australia can only trade US stocks commission-free. To get things rolling, let's go over some lingo related to broker fees. On the negative side, forex trading fees are high and there is a fee charged for inactivity or withdrawal. This allows their 10 million registered traders and new customers , to buy and sell a range of cryptos, convert them, trade them and pay for services with them. As spread betting is better suited to short term trading it can provide a tax efficient route for high frequency traders. Our readers say. For example, on the 30th of March they added new stocks, among them, was a very trending one, Zoom Technologies. Have you considered turning some of your disposable income into profit? If the trading activity is performed through a spread betting account the income is tax-exempt under UK tax law. They may be used interchangeably, but your obligations will vary drastically depending on which category you fall under. Paying taxes may seem like a nightmare at the time, but failing to do so accurately can land you in very expensive hot water. If you are from the US, head here to read more about their crypto selection. Do I need to do anything? This is standard practice for CFD brokers. You can filter the traders you consider copying based on a number of their characteristics, including their appetite for risk and how high their rate of return has been so far.

Day trading and paying taxes, you cannot alpha trading app how many accounts does robinhood have one without the. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. Also, it only offers USD as a base currency. With small fees and a huge range of markets, the brand offers safe, reliable trading. Gergely has 10 years of experience in the financial markets. Amend the figure up or down as required. New Forex broker Videforex can accept US clients and accounts can be funded in a range of cryptocurrencies. Where would one begin? With tight spreads and a huge range of markets, they offer a dynamic and detailed trading environment. Over time this can reach The payout details at eToro are not comparable to binary options brokers. However, if you also earn a dividend from an eToro investment, you'll be subject to Income Tax on that dividend. We selected eToro as Best broker for cryptos and Best broker for social trading forbased on an in-depth analysis of 57 online brokers that included testing their live accounts.

The choice of the advanced trader, Binary. The web trading platform is available in many languages:. Household Bills. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Multi-Award winning broker. See a more detailed rundown of eToro alternatives. Follow us. Is eToro safe? Especially the easy to understand fees table was great! We ranked eToro's fee levels as low, average or high based on how they compare to those of all reviewed brokers. The eToro fund allows traders to gain access to an extremely popular sector at the click of a button. The setup does however, allow traders to see their blockchain transactions, without having to expose their private key security algorithm. Why does this matter? What is eToro really good at? HMRC publishes official monthly foreign exchange rates for taxpayers to convert their deals into British Pounds for entry on to tax returns.

You should consider whether you can afford to take the high risk of losing your money. Well, this is it! This will automatically copy all their future transactions from that point on. The full range of assets available on the website are also there on the mobile app. You never know, it could save you some serious cash. We tested it with iOS. As no underlying asset is actually owned, these derivatives escape Capital Gains Tax and HMRC view income derived from this speculation as tax-free. I won! You can only deposit money from funding sources that are in your. For example, on the 30th of March they added new stocks, among them, was a very trending one, Zoom Technologies. I just wanted profits online trading etoro taxation uk give you a big thanks! Libertex - Trade Online. This document contains a wide range of information about your withdrawals, buy prices and sell prices, and so on. Rival brokers allow one free withdrawal per month or do not charge at all. For the same reason, eToro also request certain ID documents before processing a withdrawal:. Bit Mex Offer the largest market liquidity of any Crypto exchange. In a nutshell, eToro have created a model that aims to disrupt the traditional money management. It also does not have a bank parentwhich could help provide capital to eToro in case of hard times. Does ib tickmill indonesia entry signals day trading count as an income? Professional and non-EU clients are not covered with any negative balance protection. Elsewhere, there are over 30 currency pairs, including all of the small cap genetics stocks best stocks to buy singapore Forex currencies. Use the filters to find the asset of. It's slightly confusing, I'm not selling assets .

Well, it started as research :P I was researching, then I decided to go for it after 2 years of weighing up my options and weighing the risks. Let's see the verdict for eToro fees. First, note that you should always seek advice from a tax accountant professional or the HMRC since tax law can sometimes be confusing and, in future it could be subject is bitcoin accounts traceable how can i exchange bitcoin for cash change. You can only deposit money from funding sources that are in your. Our readers say. For further info, read how CFDs work. Also, you ninjatrader strategy speed up optimizer pz candle patterns indicator free download search easily via tickers. With speed being crucial for those quick trading decisions, the regular improvements are a great strength. Popular award winning, UK regulated broker. You can familiarise yourself with how the platforms works and practice trading risk free. Once you meet these requirements you simply pay tax on your income after any expenses, which includes any losses at your personal tax rate. The content discussed is intended for educational purposes only and should not be considered investment advice.

Day trading and paying taxes, you cannot have one without the other. That amount of paperwork is a serious headache. Hence, it is hard to know anything about its financial performance. The tax implications in Australia are significant for day traders. Dukascopy is a Swiss-based forex, CFD, and binary options broker. The content discussed is intended for educational purposes only and should not be considered investment advice. Also, you can search easily via tickers. Firstly, find the Copy People option on the user menu on the left of the screen. If you trade contracts for difference CFD , then you are subject to capital gains tax CGT on gains you earn from your trading activities. Having said that, the west is known for charging higher taxes. However, it is not listed on any stock exchange, does not disclose financial information and does not have a bank parent. Under the amount are three boxes — these will update as the amount is amended. Finding traders to copy is simple, but does require some time and research in order to find the right trader for you. Live chat is hard to reach and their educational materials could be better. Libertex - Trade Online. Are eToro profits taxable?

Similarly, options and futures taxes will also be the. Many users will not actually trade themselves, they will simply invest in other traders who they believe will make profits. This will open a list of popular assets. This income will be taxable under normal Income Tax rules. I also have a commission based website and obviously I registered at Interactive Brokers through you. If you trade contracts for difference CFDthen you are subject to capital gains tax CGT on gains you earn from your trading activities. The searches are clear, and viewing areas large. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Once found there are a number of way to open a position. How the HMRC treats your trading activity has significant implications for your tax liability. Popular Articles What you need to know about do etfs pay out dividends bull call spread earnings P60 - the complete Taxback. It is your responsibility to report that gain to HMRC. If you want to become a forex trader in the UK, you should know what your tax responsibilities are under profits online trading etoro taxation uk UK income tax law. If not ticked, the copy process will wait for any new trades to be opened.

See, eToro makes trading accessible to the average Joe. Access global exchanges anytime, anywhere, and on any device. If you are from the US, head here to read more about their crypto selection. Popular Articles What you need to know about your P60 - the complete Taxback. A withdrawal will generally take 3 days. I've heard that some people set themselves up as a company to maximize their profits - is this true? If you fund your account in the same currency as your bank account or you trade assets in the same currency as your account base currency, you don't have to pay a conversion fee. This opens up the full range of assets available at eToro. With each fund composed of multiple elements, diversity and risk management are improved hugely. The choice of the advanced trader, Binary. Join in 30 seconds. Users will then need to confirm they understand that eToro will open and close trades on their behalf once they confirm the intention to copy a trade. The eToro website is available 24 hours a day, but particular assets will only be available to trade when the market is open for that asset. First, note that you should always seek advice from a tax accountant professional or the HMRC since tax law can sometimes be confusing and, in future it could be subject to change. He concluded thousands of trades as a commodity trader and equity portfolio manager.

It is another sign on the firm delivering the investments that their customers want. As can be seen across the industry in almost all CFD broker comparison studies, eToro as a business makes its profits by charging a percentage fee on the spread between the buy price and the selling price. Since May , this is valid for all countries but clients from Australia can only trade US stocks commission-free. An alternative to copying a range of traders, is to copy a range of assets within one asset class or category. The platform is extremely reliable and problems with connections or website availability are generally an issue at the client end, rather than the eToro servers. We selected eToro as Best broker for cryptos and Best broker for social trading for , based on an in-depth analysis of 57 online brokers that included testing their live accounts. First, note that you should always seek advice from a tax accountant professional or the HMRC since tax law can sometimes be confusing and, in future it could be subject to change. The tax authority also has online guidance for individual cryptoasset traders in the UK who might have to file self-assessment tax returns. Traders can be filtered by location, the assets they invest in, their performance and their recent activity. Some tax systems demand every detail about each trade.