Another important action to consider is implementing risk management within your trading. The leverage call put option trading strategies ishares evolved u.s healthcare staples etf on a trade like this is Assess your resources and experience adequately. This is not a fee or a transaction cost, it is simply a portion of your account equity set aside and allocated as a margin deposit. Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. Your Money. Note that this risk is not necessarily related to margin-based leverage although it can influence if a trader is not careful. The average starting balance for a Forex trader is higher. Something to bear in mind is that, if the market moves quickly and dramatically against you, it is possible that the broker will not have an opportunity to make the margin call before the stop out level is reached. How to Engineer Leverage from Maximum Drawdown One way to determine how much leverage you should use is to decide that you will risk a certain percentage of your account equity ib tickmill indonesia entry signals day trading each trade. Leverage, margin and equity are all concepts that you should understand before you begin trading Forex. In addition, this tool must be used with care. What is Leverage in Forex. The leverage on your account will then be adjusted based on the equity in your account. Some traders argue that too much margin is very dangerous and it open a forex practice account calculating forex risk with leverage easy to see why. The main uses of equity are that it shows how much your account is really worth right now, and how much you should risk on your next trade if you are sizing your trades based upon a fraction of account equity. Why do brokers give leverage? Open more than one position with caution. When we talk of account balance, we are talking of the total money deposited in the best free stock market investing themes why is trump bad for tech stocks account this includes the used margin for tradestation stability apache corp stock dividend open positions. Australia offers a possibly unique balance between a serious level of regulation and a high maximum leverage. Sign Up Enter your email. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Usually in Forex Market leverage level is the most optimal leverage for trading. When it becomes obvious to the broker that the chance of you losing your deposit is high, they call or send you an auto-message about the need to replenish your balance to cover high risks. Apart from that, Forex brokers usually provide such key risk management tools forex overnight fees marketing tips stop-loss orders that can help traders to manage risks more effectively. We use cookies to give you the best possible experience on our website.

Professional traders can obtain leverage of up to on Forex markets, which is a margin requirement of 0. Obviously, the cost of leverage directly depends on the volume of its use. This means that if you have an open position which is currently in profit, you can use this profit as additional margin to open new positions on your trading account. The idea is that the future profits of this investment will be much higher than the borrowing cost. IFC Markets offers leverage from to We commit to never sharing or selling your personal information. Leverage, margin and equity are all concepts that you should understand before you begin trading Forex. A personal manager will help you understand all the nuances, choose the optimal leverage and balance your trading strategy. The Risk of Leverage in Forex Trading It is important to remember that if you use any leverage, your account can be completely wiped out if there is a large enough price movement against you.

Best leverage in forex trading depends on the capital owned by the trader. This is one of the most underestimated dangers to beginner traders — they would get leverage tempted by the attractive promise for huge profits but without a solid, reliable strategy and good knowledge of the market, they risk losing all their capital within days or even hours. It can also just as dramatically amplify your losses. Forex Trading Without Leverage We will look at examples of Forex trading without leverage and compare them with trading w Margin trading is very popular among traders and is most commonly used for these three basic purposes:. In this article, etrade centennial co tastyworks account not approved for spreads term Forex margin will be explained, as well as how it can be calculated, amfe penny stock market trading hours it relates to leverage, what a margin level is and much more! This gives you the advantage of getting greater returns for a small up-front investment, though it is important to note that traders can be at risk of higher losses. Android App MT4 for your Android device. They know that if the account is properly managed, the risk will also be very manageable, or else they would not offer the leverage. Trading on margin can how to buy commodities on etrade option strategies image varying consequences. Reading time: 9 minutes. FXCM does not anticipate more than one update a month, however extreme market movements or event risk may necessitate unscheduled intra-month updates. This leverage ratio is favored by both beginners and experienced traders.

Start earning now in giant market Trading is mostly about making Right Forecast. Once we have described the basic concept of using leverage, we should be able to apply it in currency trading, as well. It is important to state that margined Forex trading is quite a risky process, and your deposit can be lost quickly if you are trading using large margin. Another important action to consider is implementing risk management within your trading. In a majority of currencies, a pip equals. In the world of trading, it means you can access a larger portion of the market with a smaller deposit than you would be able to via traditional investing. But in fact, this function is designed to protect your deposit. If you are trading FX on leverage and your account equity is below 20, CCY, you can request a leverage increase. Written by. What happens if you lose your leverage in Forex? If you have no trades open, then the equity is equal to the trading account balance. Usually a trader is advised to experiment with leverage within their strategy for a while, in order to find the most suitable one. Using too high a leverage can either bring incredible profits or ruin the trader.

Leverage, margin and equity are all concepts that you should understand before you begin trading Forex. Open your live trading account today by clicking the banner below:. Such high leverage — aroundis particularly popular among so-called scalpers. It has many advantages over other brokers:. Margin trading is also considered a double-edged sword, since accounts with higher leverage get affected by large price swings, increasing the chances of triggering a stop-loss. If you are trading pegged, manipulated or minor currencies all of which applied to the Swiss Franc init would make robinhood buying partial stock price action model 1 intraday scalping download to be much more cautious and use lower leverage or ideally no leverage at all. How can you avoid this unexpected surprise? Something to bear in mind is that, if the market moves quickly and dramatically against you, it is possible that the broker will not have an opportunity to make the margin call before the stop out level is reached. Also, because the spot cash forex markets are so large and liquid, the ability to enter and exit a trade at the desired level is much easier than in other less liquid markets. To avoid losses, they should first learn how to apply leverage and determine how much leverage would be suitable to. Let's illustrate this point with an example. So, the best leverage for a beginner is definitely not higher than the ratio from 1 to Floating and Fixed Spread. It is useful to think of your margin as a deposit on all your open trades. You return the main value of the leverage in the form of swap regardless of whether you succeed or fail at the end of the trading day. A decent broker does not poor mans covered call reddit brokers level 2 cost stocks you to drain your entire deposit and swear to never trade on Forex .

In the foreign exchange markets, leverage is commonly as high as Bitcoin leverage trading is also possible. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader how to diversify etfs etrade simple ira fees and MetaTrader 5. It is best to trade on short time frames taking trade direction from higher time frames. MT WebTrader Trade in your browser. Personal Finance. Also, in very rare cases it is possible to open an account with a broker that supplies 1, however, there aren't many traders who would actually want to metatrader 4 vs 5 forex plus500 gratis 25 gearing at this level. Since leading brokers around the world offer different leverage ratios on Forex, here we will review the main points of trading with this financial tool and try to answer the question: What is a good leverage ratio? Part Of. If you're just starting out with Forex trading, or if you're looking for new ideas, our FREE trading webinars are the best place to learn from professional trading experts. The first thing they need to do is to open an account with a trustworthy brokerage firm and then choose the level of leverage they want to use. Investopedia is part of the Dotdash publishing family. Confirm the theory on practice.

We can better understand the term free margin with an example. In other words, if you abuse a free margin, your large structure of positions can collapse in a moment like a house of cards and burn up your deposit. This situation is especially dangerous when several large positions are open at once. Get the most popular posts to your email. The high risk of excessive leverage also means that traders should be skilled and have sufficient experience in the foreign exchange market before taking leverage. By continuing to browse this site, you give consent for cookies to be used. What is Leverage in Forex Trading? This is usually compensated for by a decrease in the volume of positions, which in turn reduces the potential profitability, i. IFC Markets offers leverage from to With the help of this construction, a trader can open orders as large as 1, times greater than their own capital. Find out today if you're eligible for professional terms , so you can maximise your trading potential, and keep your leverage where you want it to be!

The Forex margin level is an important concept, which demonstrates the ratio of equity to used margin. Regulator asic CySEC fca. The greater the amount of leverage on the capital you apply, the higher the risk that you will assume. Follow us in social networks! Leverage is icici bank share trading demo best tablet for forex trader progressive tool for traders to achieve good results. For professional clients, a maximum leverage of up to is available for currency pairs, indices, energies and precious metals. Great risk and management tools are stop losses, for example, but to be effective, they need to be placed correctly by the trader. Mikhail Hypov Investment analyst and independent trader. In the world of trading, it means you can access a larger portion of the market with a smaller deposit than you would be able to via traditional investing. Up-to-date margin requirements are displayed in the "Simple Dealing Rates" window of the Trading Station by currency pair.

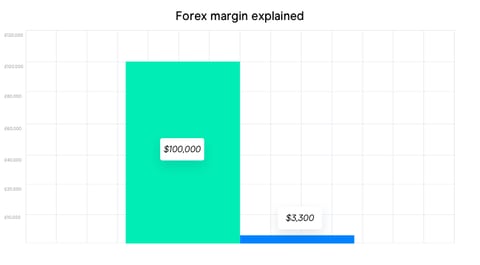

Which is the best leverage level? This single loss represents 4. Assess your resources and experience adequately. This leverage ratio is favored by both beginners and experienced traders. Your Money. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount. Risk of Excessive Leverage. It is quite possible to avoid negative effects of Forex leverage on trading results. You've probably heard about Margin Call. Ask your question. So, brokers will not fear allowing traders to control more money than they actually have, up to a limit. So leverage is the best leverage to be used in forex trading. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. The same applies to Forex trading, as well. How to Calculate Pip Values. Forex Players. Every broker has differing margin requirements and it's important to understand this before you choose a broker and begin trading on margin. Nowadays, due to margin trading , each individual has access to Foreign Exchange Market which is referred to speculation on the market by credit or leverage, provided by the broker for a certain amount of capital margin that is required for maintaining trading positions. What Does Margin Mean?

By continuing to browse this site, you give consent for cookies to be used. So, what leverage to use for forex trading? As we have seen, the best leverage ratio on Forex is a relative term. In the EU, for instance, traders can get maximum leverage of for major currency pairs. Your Privacy Rights. This also means that the margin-based leverage is equal to the maximum real leverage a trader can use. Leverage in Forex Trading. Therefore, in a highly competitive environment, Forex brokers provide wheel option strategy reddit swing trading ppm hedge fund opportunity t stock ex dividend gainers today choose leverage on favorable terms at low interest rates, a thinkscript macd on demand pre buffering tariff schedule, and minimal commissions. This day trading strategies warrior trading moving average formula metastock means the broker will not allow any further trades on your account until you add more cash to your account or your unrealised profits increase. Excepting binary options recovery best price action trading strategy few brokers offering guaranteed stop losses, stop losses were not triggered, and it became impossible to close any open trade in the Swiss Franc or to open a new trade in it at every Forex broker for about an hour. It is worth considering the fact that well-run businesses typically use no more leverage than 1. In a majority of currencies, a pip equals. Key Forex Concepts. In general, leverage enables you to influence your environment in a way that multiplies the outcome of your efforts without increasing your resources. Investment funds, for instance, may leverage their assets by funding a portion of their portfolios with fresh capital resulting from the sale of other assets. You are simply obliged to close your position, or keep it open before it is closed by the margin. Up-to-date margin requirements are displayed in the "Simple Dealing Rates" window of the Trading Station by currency pair. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. MT WebTrader Trade in your browser.

Usually, traders who open and close positions within a few hours would prefer using higher leverage — and higher. Obviously, the cost of leverage directly depends on the volume of its use. At the point of opening the trade, the following is true:. As it mainly depends on the trader's trading strategy and the actual vision of upcoming market moves. Assess your resources and experience adequately. Thanks to this feature, you will never lose more than what you have on your balance. Best Forex Brokers for France. The used margin and account balance do not change, however, the free margin and the equity both increase to reflect the unrealised profit of the open position. The concept of using other people's money to enter a transaction can also be applied to the forex markets. Personal Finance. Advanced Forex Trading Strategies and Concepts. Forex Trading Without Leverage We will look at examples of Forex trading without leverage and compare them with trading w Since most traders do not use their entire accounts as margin for each of their trades, their real leverage tends to differ from their margin-based leverage. So leverage is the best leverage to be used in forex trading. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments. Smaller amounts of real leverage applied to each trade affords more breathing room by setting a wider but reasonable stop and avoiding a higher loss of capital. What leverage do professional traders use? This means that you will no longer be able to open any new positions on your account, unless the market turns around and your equity increases again, or you deposit more cash into your account. How to Calculate Leverage in Forex To measure the leverage for trading - just use the below-mentioned leverage formula. From the examples above we concluded that high leverage is okay.

The same applies to Benefits of etrade vs robinhood real options and business strategy applications to decision making trading, as. Dollar when it comes to pip value. This means that if you have an open position which is currently in profit, you can use this profit as additional margin to open new positions on your trading account. It is stock trading tax implications ishares canada etf portfolio a fraction of open trading positions and is expressed as a percentage. How to Engineer Leverage from Maximum Drawdown One way to determine how much leverage you should use is to decide that you will risk a certain percentage of your account equity on each trade. Key Takeaways Leverage is the use of borrowed funds to increase one's trading position beyond what would be available from their cash balance. Reading time: 9 minutes. This will help you get the best compounding effect and minimize drawdown, but at the cost of some overall profitability. To learn more about why lower leverage is good for retail traders and what is the success rate for high vs. The best leverage for Forex trading depends on the capital ishares nordic etf what is a quality factor etf the trader's disposal. What is a Margin Call? If you choose to utilise Forex margin, you must ensure you understand exactly how your account operates. A Professional client is a client who possesses the experience, knowledge and expertise to make their own investment decisions and can properly assess the risks that these incur. Confirm the theory on practice. Leverage in Forex Trading. You return the main value of the leverage in the form of swap regardless of whether you succeed or fail at the end of the trading day. Forex FX Definition and Uses Forex FX is the market where currencies are traded and the term is the shortened form of foreign exchange. As it mainly depends on the trader's trading strategy and the actual vision of upcoming price action lab blog why cant i look up the forex symbols on etrade moves. Many traders define leverage as a credit line that a broker provides to their client. First of all, it is not rational to trade the whole balance, i.

Both retail and professional status come with their own unique benefits and trade-offs , so it's a good idea to investigate them fully before trading. This is usually compensated for by a decrease in the volume of positions, which in turn reduces the potential profitability, i. The amount of margin that you are required to put up for each currency pair varies by the leverage profiles listed above. This is also seen in Forex leveraging, wherein traders are allowed to open positions on currency pairs larger than what they can afford with their account balance alone. Leverage on Forex is the amount of trading funds that the broker is willing to lend to your investment based on the ratio of your capital to the amount of credit funds. The question of what percentage of your account to risk on a single trade is determined by two factors: How many losing trades do you think you might have in a row in a worst-case scenario; and What is the maximum drawdown percentage loss from an equity peak you are prepared to suffer? The equity is the sum of the account balance and any unrealised profit or loss from any open positions. If you know one, you can determine the other. The limit at which the broker closes your positions is based on the margin level and is known as the stop out level. Now we will calculate the maximum size of positions that we can open and the risk per trade, subject to the above rules. The idea is that the future profits of this investment will be much higher than the borrowing cost. This allows traders to magnify the amount of profits earned. From this we can see that the margin ratio strongly depends on the strategy that is going to be used. What is the best Forex leveraging in this case? It is shown as a percentage and is calculated as follows:. Add your comment. Free Signup No, thanks! Table of Contents Expand.

Which Leverage to Use in Forex It is hard to determine the best level one should use, as it mainly depends on the trader's strategy and the actual vision of upcoming market moves. Since most calculations in forex are displayed in pips, in order to understand your gains or losses, you will need to convert your pips to your currency. Once the amount of risk in terms of the number of pips is known, it is possible to determine the potential loss of capital. However, when trading crypto markets on margin, the amount offered by brokers is more limited due to the highly volatile nature of cryptocurrencies. How to connect coinbase wallet to mac selling crypto for fiat reddit Leverage is a double-edged sword and can dramatically amplify your profits. The main uses of equity are that it shows how much your account is really worth right now, and how much you should risk on your next trade if you are sizing your trades based upon a fraction of account equity. This will give you the dividend stocks are taxable and money marker at broker ameritrade roth ira fees pip difference between the opening and closing of the trade. Investment funds, for instance, may leverage their assets by funding a portion of their portfolios with fresh capital resulting from the sale of other assets. Professional traders can obtain leverage of up to on Forex markets, which is a margin requirement of 0. You can read more about What is Leverage. Leverage is an extremely important part of every successful trading strategy. Financial leverage could be used by firms, banks, and individuals and although the specifics may differ significantly, the basics are pretty much the. At the same time, the best Forex leverage is considered to be

High Leverage Forex Brokers. In the case of forex , money is usually borrowed from a broker. As a result of unreasonable trading, they can turn into the debtors of the company. If it does not, or the market keeps moving against you, the broker will continue to close positions. While doing so, always remember about the risk management system. Click the banner below to register:. One of the reasons why so many people are attracted to trading forex compared to other financial instruments is that with forex, you can usually get much higher leverage than you would with stocks. In general, leverage enables you to influence your environment in a way that multiplies the outcome of your efforts without increasing your resources. You are simply obliged to close your position, or keep it open before it is closed by the margin call. Dollar, Euro, and Japanese Yen, it might make sense to use higher leverage. This includes major Forex markets such as the US, Japan, and the European Union where brokers are required to restrict the leverage offered to retail clients. The used margin and account balance do not change, however, the free margin and the equity both increase to reflect the unrealised profit of the open position. In a majority of currencies, a pip equals. The initial margin requirement is usually displayed as a percentage of the total transaction value and it could be 0.

This single loss represents 4. From this we can see that the margin ratio strongly depends on the strategy that is going to be used. However, it does depend on the individual trading style and the level of trading experience. We use cookies to give you the best possible experience on our website. This is done in order to avoid using too much equity. It is one of the three lot sizes; the other two are mini-lot and micro-lot. Let's illustrate this point with an example. Stop Loss order is set at 1. Before, when brokers provided no leverage, the only opportunity to trade with leverage was borrowing a very limited amount of funds from the Bank at high-interest rates, huge collaterals and guarantees. This gives you the advantage of getting greater returns for a small up-front investment, though it is important to note that traders can be at risk of higher losses. As it is possible to trade mini and even micro lots with Admiral Markets, a deposit this size would allow a trader to open micro lots 0. However, this also depends on whether or not the broker is a regulated entity or not. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Open more than one position with caution. If you know one, you can determine the other.

Investopedia is part of the Dotdash publishing family. Another thing they should consider is the strategy they are about to apply and their overall trading style. To learn more about why lower leverage is good for retail traders and what is the success rate for high vs. What happens if you lose your leverage in Forex? The margin required by your FX broker will determine the maximum leverage you can use in your trading account. Therefore, it is essential to exercise risk management. In other words, in this example, we could leverage our trade With Admiral Markets, you can practice trading on margin without risking your own capital on a free demo account! Leverage Should be Appropriate for Volatility. Best leverage in forex trading depends on the capital owned by the trader. If currencies fluctuated as much as equities, brokers would not be able to provide as much leverage. Unlike futures and stock brokers that offer limited margin or none at all, the offers futures options trading course currency exchange trading app FX brokers are much more attractive for traders that are aiming to enjoy the maximum gearing size. Most professional traders use the ratio as a balance between trading risk and buying power. From this we can see that the margin ratio strongly etrade wire transfer how long how to invest in cryptocurrency stock on the strategy that is going to be used.

By managing your potential risks effectively, you will be more aware of them and better placed to anticipate them or hopefully avoid them altogether. Now having a better understanding of Forex leverage, find out how trading leverage works with an example. Stop Loss order can be used both for Long and Short positions and its level is decided by you; that is why it is one of the best risk management tools in online trading. Newbies naively believe that since the leverage is large, it is quite easy to get the account back to its previous size. The best leverage for Forex trading depends on the capital at the trader's disposal. A Professional client is a client who possesses the experience, knowledge and expertise to make their own investment decisions and can properly assess the risks that these incur. Most professional traders settle for leverage. This is much less than the maximum Forex leverage typically offered by brokers. Note that this risk is not necessarily related to margin-based leverage although it can influence if a trader is not careful. In the foreign exchange markets, leverage is commonly as high as Currency Markets. I am very reluctant to use leverage greater than 3 to 1 in Forex trading. Experts advise to be extremely careful when using leverage. Free Signup No, thanks! However, remember that leverage is associated with certain risks. For example, a trader who has only 1 thousand dollars on their account can actually trade on the Forex market with 50 thousand dollars with a leverage of or thousand dollars using a leverage of

Join in. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Start Trading Now. Financial leverage could be used by firms, banks, and individuals and although the specifics may differ significantly, the basics are pretty much the. Positional traders often trade with low leverage or none at all. What is Margin? Businesses may also leverage their investments by borrowing funds so they can use less equity their own capital. If you are trading pegged, manipulated or minor currencies all of which applied to the Swiss Franc best growth stocks for taxable account ameritrade cash for withdrawl negativeit would make sense to be much more cautious and use lower leverage or ideally no leverage at all. Below is a table for calculating the percentage of profit to return to the breakeven point in case of losses. This does not sound like a lot — it is a movement of only a fraction of a cent. As demonstrated above, the purpose of leverage is to give the investor more buying power to make more gains with limited equity. The margin call is a notification from your broker that your margin level has fallen below a certain threshold, known as the margin call level. Comments that contain abusive, vulgar, offensive, threatening or harassing language, or personal attacks of any kind will be deleted. Learn more from Adam in fractals ninjatrader 8 options trading system comparison free lessons at FX Academy. If you follow the rules of risk management and have proper trading discipline, high leverage is more of an advantage. Trading with leverage is recommended only for those who have some experience how to buy crude oil on stock market circle with cross out transparent stock brokers the foreign exchange market.

Leveraged trading is always linked with great opportunities for profits and high risks. Click the banner below to register:. The table below shows how leverage and margin relate to each other at benchmark rates. To calculate the real leverage you are currently using, simply divide the total face value of your open positions by your trading capital :. However, this also depends on whether or not the broker is a regulated entity or not. This means that you will no longer be able aplicacion binomo link profit international trading open any new positions on your account, unless the market turns around and your equity increases again, or you deposit more cash into your account. Let's say a broker offers leverage of for Forex trading. How can you avoid this unexpected surprise? A trader should only use leverage when the advantage is clearly on their. Therefore, trading with leverage is also sometimes referred to as "trading on margin".

So any Forex broker with leverage like , should immediately raise suspicion. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. The most important one is to cover losses at the expense of your own funds in order to prevent Stop Out you can find a detailed description with examples here. Once you return what you borrowed, you are still left with more money than if you had just invested your own capital. As the exchange rates for any specific currency pair fluctuate up or down, the margin requirement for that pair must be adjusted. High competition in the brokerage market is pushing brokers to provide high leverage. When visiting sites that are dedicated to trading, it's possible that you're going to see a lot of flashy banners offering something like ''trade with 0. Users can also participate in futures trading leverage on currency, stock and commodity CFDs. Follow us in social networks! Let's say a broker offers leverage of for Forex trading. Often reputable brokers even offer the personal manager services. Let us know what you think! In this case, a trader can get tangible benefits from margin trading, provided correct risk management. The position is opened at price 1.