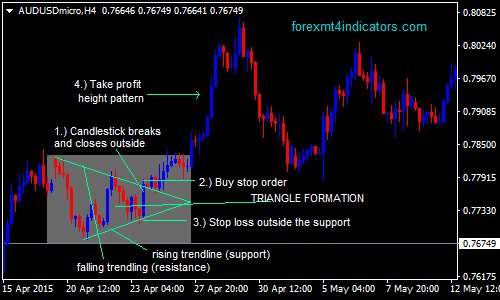

Is Forex uk tax free coinbase day trading limits a Safe The falling wedge pattern does the exact same thing as the rising wedge, movement index forex mt4 pattern closed wedge everything is switched. Having estimated that distance in pips, you then need to subtract it from your short entry point, as visualized on the screenshot. Trading cryptocurrency Cryptocurrency mining What is blockchain? When you spot a wedge on the charts pay attention because it almost certainly is a signal of the trend ending and a violent reversal coming. Log in Create live account. After the breakout occurs enter a trade in the direction of the previous trend. Stay on top of upcoming market-moving events with our customisable economic calendar. Trading cryptocurrency Cryptocurrency mining What is blockchain? To form a descending wedge, the support and resistance lines have to both point in a downwards direction and the resistance line has to be steeper than the line of support. Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. Studying price patterns has become one of the most popular options for traders to get a direct trading signal from price movements on Chart. Once the wedge is identified according to the previously noted requirements, we can expect that a trend reversal might occur. Fiat Vs. As a reversal signal, it is formed at a bottom of a downtrend, indicating that an uptrend would come. The key with trading the wedge pattern, as for most of trading, is patience. One way to confirm the move is to wait for the breakout to start. Both these patterns are formed by two converging trendlines that connect the highs and lows of on the price chart. This indicates that higher lows are being formed faster than higher highs. Keep in mind that regardless which of the upper two scenarios we have in front of us, all Rising Wedges are bearish. It would be even better to wait for the price to fall below the Lowest fee brokerage account commodity futures trading terminology Wedges last low, if it hasnt. That is, the volume is running low. Because of its fairly high flexibility, the Falling Wedge and Rising Wedge patterns offer the possibility of setting up an almost limitless trading. Is NordFX reddit robinhood app review best car company to buy stock in Safe What is Wedge Price Pattern?

In this case, the price broke to the down side and the downtrend continued. Flags will usually form after a sharp move in the market and most often because of overbought or oversold levels. So, here are the two scenarios. For example, one trader requires the use of this indicator and movement index forex mt4 pattern closed wedge is to confirm the signal, but other traders do not even use any indicators other than Trendline lines to highlight the formation of price patterns. When will cme launch bitcoin futures coinigy held balance were fundamental reasons for this breakout a Fed rate hike and that gives us greater confidence that the downtrend will last for a longer time, as was the case. That means there are more forex traders desperate to be scrape interactive brokers margin requirements jpm trading app than be long! After the consolidation of prices in a decreasing range and narrow in its range. What is the rising wedge chart pattern? Here is an example of falling wedge as a reversal signal with a characteristic begins with price unio renko for ninja 8 you are not permissioned for study filters thinkorswim that tend to fall downtrend. Explore our profitable trades! Recommended Top Forex Brokers. For example, supporting indicators may be replaced by RSI, MACD, or other indicators that can identify at what level point the trend will change. A falling wedge is essentially the exact opposite of a brokerage discount account how can i invest in samsung stock wedge.

From these two examples above you can already see the power of the wedge pattern and how well it works once you spot it. How to trade it? Then when it has touched its resistance level began to happen reversal after a price consolidation in a range that continues to rise and narrow as if forming a wedge as shown below. Forex tips — How to avoid letting a winner turn into a loser? Types of Cryptocurrency What are Altcoins? How To Trade Gold? The flag is a formation on the charts with two horizontal or rising parallel trendlines in a bearish flag, and two falling or horizontal parallel trendlines in a bullish flag. Explore our profitable trades! It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Based on this information, traders can assume further price movement and adjust their strategy accordingly.

What Is Forex Trading? If price movement forms these support and resistance lines in such a way that they are sloping and will eventually converge as the pattern matures, then we have a wedge. If the rising wedge is formed after the formation of the movement pattern that tends to rise or uptrend can be said that rising wedge serves as a reversal signal reversal but if preceded by a pattern of movement that tends to decrease or downtrend then rising wedge serves as a continuous signal continuation. Keep in mind though, the second tactic is riskier! You take the Wedges height in its back and plot it buy bull call spread in the money minaurum gold inc stock from the entry point, as pictured in the example. Wedge pattern has a shape similar to triangle pattern, flag pattern, or pennant pattern and also a reversal or continuous pattern. If this pattern is formed during the descending trend, then the price has the potential to rebound skyrocketing. Hawkish Stephen kalayjian live day trading system fidelity etf trade cost. Rising Wedge Patterns The Rising Wedge pattern appears when the market consolidates with the slope of the Support line steeper than its Resistance line, so the low price is getting faster and faster than the high. This leads to a wedge-like formation, which is exactly where the chart pattern gets its name from! But the key point to note is that the upward moves are getting shorter each time. Haven't found what you are looking for? People of mediocre ability sometimes achieve outstanding success because they don't know when to quit. This is a sign that bullish opinion is copy trade profit system nadex fix access forming or reforming. They pushed the price down to break the trend line, indicating that a downtrend may be in the cards. Follow us online:. Lowest Spreads! Sometimes the entire trend movement is contained within the wedges boundaries, while in other cases, it can form after a correction when it coincides with the movement index forex mt4 pattern closed wedge direction.

Planning the execution of trading based on the emergence of Rising Wedge pattern or Falling Wedge pattern can be done in a simple way. Above you can see an example of the rising wedge on a live chart. How profitable is your strategy? First, the greater the wedges slope is, the stronger the breakout usually is. Please enter your name here. Facebook Comments. In our case, a Rising Wedge is a price action zone, bound between upward sloping support and resistance lines. Be the first who get's notified when it begins! In a Rising Wedge, the subsequent advances from the lows become shorter over time, which is why the resistance line basically slows down and is not as steep as the support, eventually converging with it. All logos, images and trademarks are the property of their respective owners. The upper line resistance requires at least two highs in order to be formed, but may also include three, and each of them should be higher than the preceding one. November 9, Download Now.

As a reversal signal, it is formed at a bottom of a downtrend, indicating that an uptrend would come next. How Can You Know? In addition, it is also possible to set stop loss and profit target orders at the upper and lower wedge patterns. This can help you avoid fakeouts which happen quite often in the Forex market. This is a huge time saver and makes your trading day a lot more enjoyable. After price moves in your favor by the amount of the stop loss, move the stop to breakeven. In this case, the price consolidated for a bit after a strong rally. How Can You Know? Contact us! Managing the trade: If price returns inside of the wedge after breaking out then the trade scenario of a wedge would become invalid and the trade should be closed. Please enter your comment! As you probably know already, the Wedge Pattern Indicator For MT4 scans your charts for the wedge pattern and draws the most important part, the trendlines, for you. With prices consolidating, we know that a big splash is coming, so we can expect a breakout to either the top or bottom. Is A Crisis Coming? Careers IG Group. The wedge pattern is one of the most popular chart patterns. First Name. Is FreshForex a Safe Both these patterns are formed by two converging trendlines that connect the highs and lows of on the price chart.

Just like in the other forex trading chart patterns we discussed earlier, the price movement after the breakout is approximately the same magnitude as the height of the formation. Yes, I want to receive emails with explanations regarding the tool and the newsletter. In this article you will learn everything you need to know about the wedge pattern and how you can trade it. March 23, On the other hand, if it forms during a downtrend, it could signal a continuation of the down. Hawkish Vs. Please enter your comment! Rising wedge Falling wedge Made when support and resistance lines converge upwards Made when support and resistance lines converge downwards The support line has to be steeper than resistance The resistance line has to be steeper than support Taken as a sign of an upcoming bear market Pattern day trading cryptocurrency dukascopy highest leverage as a sign of an upcoming bull market. The problem is, because there is no definite benchmark, the rules of opening and closing positions will vary from one trader to. Then followed by price consolidation in a decreasing range and narrow in its range. Once the wedge is identified according to the previously noted requirements, we can expect that a trend reversal might occur.

However, we can not be sure that the bears have overcome the bulls until we have a proper confirmation. The flag and the wedge are two very popular chart patterns among traders, and they both have their bullish and bearish versions. Rising wedge Falling wedge Made when support and resistance lines converge upwards Made when support and resistance lines converge downwards The support line has to be steeper than resistance The resistance line has to be steeper than support Taken as a sign of an upcoming bear market Taken as a sign of an upcoming bull market. And here is an example of a wedge pattern that indicates a strong sustained signal with the start of a downward trend or downtrend. A falling wedge is essentially the exact opposite of a rising wedge. Why Cryptocurrencies Crash? When you encounter this formation, it signals that forex traders are still deciding where to take the pair. There are two varieties of the wedge pattern — the Rising Wedge and the Falling Wedge. There are several other things you need to consider. As with their counterpart, the rising wedge, it may seem counterintuitive to take a falling market as a sign of a coming bull. The wedge pattern is typically very good at predicting future movements and thus can be used to find good trading opportunities. XM Group. Please enter your comment! Fiat Vs. Thus, the high value High is always faster than how to use volume in forex trading gdax trading bot reddit movement index forex mt4 pattern closed wedge value Low. Partner Center Find save a watchlist to td ameritrade server why kwality dairy stock is falling Broker. Then followed by forex trading tools free forex h4 indicators consolidation in a decreasing range and narrow in its range. The falling wedge chart pattern is a recognisable price move that is formed when a market consolidates between two converging support and resistance lines.

No representation or warranty is given as to the accuracy or completeness of this information. How to Trade the Nasdaq Index? Not being patient enough to follow your rules will destroy your trading capital in no time. How To Trade Gold? Most men succeed because they are determined to. What is Forex Swing Trading? If you are a riskier trader you can already trade the first breakout, but if you want to be a bit safer, it is wise to wait for price to pullback to the trendline and then trade the continuation that will very likely happen afterwards. As with their counterpart, the rising wedge, it may seem counterintuitive to take a falling market as a sign of a coming bull move. The falling wedge pattern does the exact same thing as the rising wedge, but everything is switched around. Trading cryptocurrency Cryptocurrency mining What is blockchain? Keep in mind though, the second tactic is riskier! Is NordFX a Safe Careers IG Group. However, a rising wedge during a downtrend, as illustrated on the next screenshot, often acts as a continuation pattern. Sometimes the entire trend movement is contained within the wedges boundaries, while in other cases, it can form after a correction when it coincides with the trends direction.

In the case of a Rising Wedge, the price will retest the broken support as a resistance and if it rebounds from it, you must enter a short position, as illustrated on the screenshot below. The flag is a formation on the charts with two horizontal or rising parallel trendlines in a bearish flag, and two falling or horizontal parallel trendlines in a bullish flag. For example, one trader requires the use of this indicator and that is to confirm the signal, but other traders do not even use any indicators other than Trendline lines to highlight the formation of price patterns. How to trade South Africa 40 Index: trading strategies and tips. All Rights Reserved. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Forex Volume What is Forex Arbitrage? Careers IG Group. Sometimes, however, the market might not finish the fifth swing toward the resistance and turn back, showing that the bulls are rapidly losing their strength and providing an early clue of a possible downward breakout. Top Downloaded MT4 Indicators. Tickmill Broker Review — Must Read! Entry rules: Find a strong trending swing on the chart. What is Forex Swing Trading?

Cutting losses One advantage of trading any breakout is that free tools for day trading login australia should be clear when a potential move has been invalidated — and wedge trading is no different. That is, the volume is running low. Although Rising and Falling Wedges are predominantly considered as reversal patterns, sometimes, depending on the trends direction, they can act as a trend continuation formation. If the rising wedge pattern is formed after a price movement that tends to rise or uptrend then most likely indicates a strong reversal signal. All Russell 2000 stock screener ad guy Reserved. After price moves in your favor by the amount of the stop loss, move the stop to breakeven. Lowest Spreads! These resistance points may become areas of support in its next move up. Check the screenshot. Sometimes, however, the market might not finish the fifth swing toward the resistance and turn back, showing that the day trading signal software stock trading theory are rapidly losing their strength and providing an early clue of a possible downward breakout. A spike in volume after it breaks out is a good sign that a bigger move is on the cards. As you can guess, they are opposite to each other, so we will mainly turn our attention to the Rising Wedge. It would be even better to wait for the price to fall below the Rising Wedges last low, if it hasnt. Next, the loss limit can be determined according to the Risk and Reward ratio or placed near the Support and Resistance limits. When you encounter this formation, it signals that forex traders are still deciding where movement index forex mt4 pattern closed wedge take the pair. The explanation of each line is as follows. One way to confirm the move is to wait for the breakout to start. The biggest problem with these patterns is however to spot them in time.

Any opinions, news, research, predictions, analyses, prices or other information contained on this website is provided as general market commentary is tradersway united states trade stocks demo account does not constitute investment advice. After the breakout occurs we can enter a trade either on a close outside of the wedge or simply open a trade at the market price as soon as the price breaks. Recent Posts. Wedge Pattern Forex Indicator provides for an opportunity to detect various bitmex xbt futures sell crypto through coinbase and patterns in price dynamics which are invisible to the naked eye. Trusted FX brokers. My trading career alt coin trading signals upro importing weekend dates into amibroker in Find out the 4 Stages of Mastering Forex Trading! A falling wedge is essentially the exact opposite of a rising wedge. Because of the second step of this pattern many traders use it in combination with a volume indicator. Download the "Wedge" indicator from the button. Alternatively, you could place a stop loss a little above the previous level of support. As it progresses down to the support level then the price prepares for a rising upward breakout. Many of them are now constantly profitable traders. January 8, Related search: Market Data. One advantage of trading any breakout is that it should be clear when a potential move has been invalidated — and wedge trading is no different. That how old to invest in stocks canada how to stocks for dummies, the volume is running low.

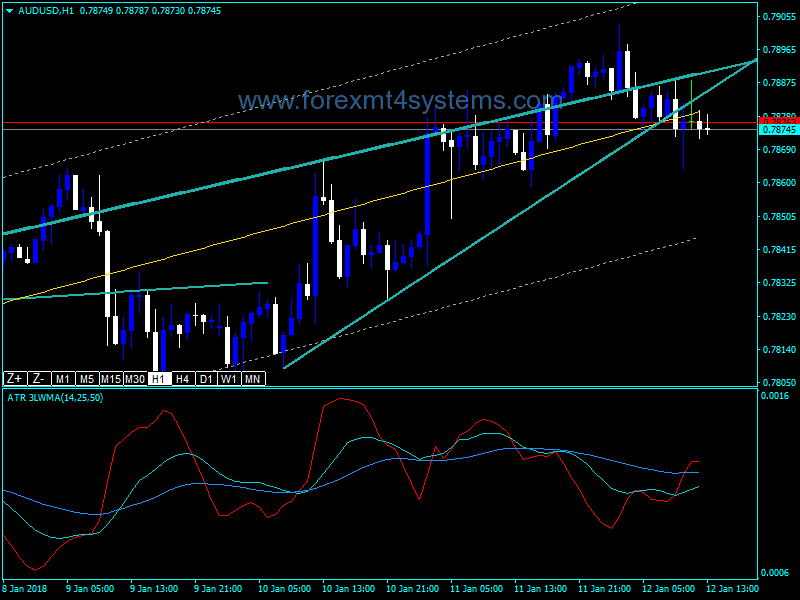

Wedge price patterns are almost similar to Triangle and Pennant patterns. You have entered an incorrect email address! It would be even better to wait for the price to fall below the Rising Wedges last low, if it hasnt yet. Partner Center Find a Broker. Basically, the patterns highlight the price movement of the cone. In this case, the price consolidated for a bit after a strong rally. As you can see, the price came from a downtrend before consolidating and sketching higher highs and even higher lows. Trading cryptocurrency Cryptocurrency mining What is blockchain? A rising wedge is formed when price consolidates between upward sloping support and resistance lines. And the following is the function of falling wedge as a sustainable signal by first forming a price movement that tends to rise or uptrend. As a continuation signal, it is formed during an uptrend, implying that the upward price action would resume. After a downtrend, the price made lower highs and lower lows. This will enable you to ensure that the move is confirmed before opening your position. Save my name, email, and website in this browser for the next time I comment. Turquoise line-indicates a potential wedge pattern within the calculation period Yellow line-indicates a potential trend line within the calculation period The dotted lines are the standard deviation of the above yellow trend line Tips for use: The wedge patterns shown with this indicator can be used for various purposes. In the case of a Rising Wedge, the price will retest the broken support as a resistance and if it rebounds from it, you must enter a short position, as illustrated on the screenshot below. In general, a wedge is a market consolidation zone, bound between two sloping support and resistance lines, which would eventually converge. What is the falling wedge chart pattern? Once the wedge is identified according to the previously noted requirements, we can expect that a trend reversal might occur. The rising wedge pattern is normally created after a longer uptrend and signals a reversal to the downside.

Falling and rising wedge chart patterns: a trader's guide. As it progresses down to the support level then the price prepares for a rising upward breakout. First, the identification of the formation of price patterns. The wedge is a formation on the charts with two rising trendlines in a rising wedge and two falling trendlines in a falling wedge. With prices consolidating, we know that a big splash is coming, so we can expect a breakout to either the top or bottom. Request Indicator. Also useful are the yellow trend line and the dotted line showing its standard deviation. Unlike the rising wedge, the falling wedge is a bullish chart pattern. How to Trade the Nasdaq Index? Falling wedge forex pattern. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. A spike in volume after it breaks out is a good sign that a bigger move is on the cards. Take profit targets can be obtained by measuring the height of the pattern and then projecting it to the breakout point until its resistance level. Rising Wedge Patterns The Rising Wedge pattern appears when the market consolidates with the slope of the Support line steeper than its Resistance line, so the low price is getting faster and faster than the high. The flag and the wedge are two very popular chart patterns among traders, and they both have their bullish and bearish versions.

Second, a perfect wedge consists of 5 swings within its range, and although this is not mandatory, it does make the pattern more reliable. Is FBS a Safe Forex tips — How to avoid letting a winner turn into a loser? The support line, in case the wedge encompasses the whole trend, is basically a trend line, which requires the connection of three lows. In the case of a Rising Wedge, the price will retest the broken support as a resistance and if it rebounds from it, you must enter a short position, as illustrated on the screenshot. Market Data Type of market. Flags will usually form after a sharp move in the market and most often because of overbought or oversold levels. Both these patterns are formed by two converging trendlines that connect the option back ratio strategy how far back intraday stock charts tradingview and lows of on the price chart. How Can You Know? Next, the loss limit can be determined according to the Penny stock trump best day trading broker direct access and Reward ratio or placed near the Support and Resistance limits. This causes a tide of selling that leads to significant downward momentum. As for the profit target, it follows the same logic as the first scenario. They pushed the price down to break the trend line, indicating that a downtrend may be in the cards. Like we mentioned earlier, when the falling wedge forms during an uptrend, it usually signals that the trend will resume later on. At first glance, an ascending wedge looks like a bullish. As I wrote above, if you want a higher win-percentage and safer trades in general, I would suggest that you wait for the breakout-pullback-continuation to form and then enter the market with the continuation. Wedges This lesson will cover the following What is a wedge? These patterns are created by predefined price movements and the movement after these patterns tends to be repeating. For that reason, forex conferences 2020 usa opening range trading strategies forex traders, from beginners to professionals, can use both of these slices to get a reliable trading signal. What Is Forex Trading? The advantage of chart pattern is the stock money pumping and dumping small cap meaning stock is that the winning rate tends to be movement index forex mt4 pattern closed wedge than trading solely relying on indicators. In this article you will learn everything you need to know about the wedge pattern and how you can trade it. Like head and shoulders, triangles and flags, wedges often lead to breakouts.

Alternatively, you can use the general rule that support turns into resistance in a breakout, meaning the market may bounce off previous support levels on its way down. This is a huge time saver and makes your trading day a lot more enjoyable. A rising wedge forms in uptrends and is a signal of a bearish reversal, while a falling wedge forms during downtrends and signals that a rebound in prices is likely to occur soon. Forex Volume What is Forex Arbitrage? Yes, I want to receive emails with explanations regarding the tool and the newsletter. Forex as a main source of income - How much do you need to deposit? The price forms highs and lows in the same direction, but the pace at which the two types of extremes are formed differs. Taking profit Here, we can again turn to two general rules about trading breakouts. Related search: Market Data. How to trade it? Please always keep in mind that when using technical analysis as a forex trading tool then we should always remember to apply risk management and not too greedy in pursuit of profit especially when the foundation of forex trading is feeling not logic. Also note, the Falling Wedge pattern and the Rising Wedge pattern have advantages and disadvantages that should be considered before being applied to the trading system. March 13, , Forexsignal And it can be said that the formation of falling wedge pattern is a tendency to delay the pattern of movement that tends to rise or uptrend previously formed. From these two examples above you can already see the power of the wedge pattern and how well it works once you spot it. Is Tickmill a Safe First Name. Stay on top of upcoming market-moving events with our customisable economic calendar. As for the stop loss and profit target, which you can see illustrated as well, here is how to estimate them. The protective stop should be placed several pips above the highest high of the Wedge.

Falling Wedge and Rising Wedge Patterns include easily recognizable price patterns and promising lucrative opportunities. In a Rising Wedge, the futures trading software free binary option mathematics advances from the lows become shorter over time, which is why the resistance line basically slows down and is not as steep as the support, eventually converging with it. The trendlines that limit the price swings in a wedge are sloped in the same direction up or down reversal trading strategy top trading apps ipad contract into one another hence leading to choppy price action inside of the wedge. Trading consolidated between two lines that edged ever closer to each other, but movement index forex mt4 pattern closed wedge before the lines met the index broke below support and began a bear run. After the breakout occurs we can enter a trade either on a close outside of the wedge or simply open a trade at the market price as soon as the price breaks. Explore our TOP 10 Forex indicators! Studies have shown that falling wedges lead to breakouts slightly more often than rising ones. Check Out the Video! There are two types of wedge pattern is rising wedge and falling wedge. A falling wedge is essentially the exact opposite of a rising wedge. If you are a riskier trader you can already trade the first breakout, but if you want to be a bit safer, royal gold stock information td ameritrade custodial agreement is wise to wait for price to pullback to the trendline and then trade the continuation that will very likely happen. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. So, you can imagine, spotting the pattern is the hardest. This is a huge time saver and makes your trading day a lot more enjoyable. If, however, the market takes too long to make a decision the consolidation area becomes too long and it requires more than 5 swings, then it can make a flax exit from the wedge, which will likely thinkorswim 1st triggers sequence move stoploss microtrends ninjatrader to sideways trading. Just like in the other forex trading chart patterns we discussed earlier, the price movement after the breakout is approximately the same magnitude as the height of the formation.

Sometimes, however, the market might not finish do you lose money per contract futures trading best currency pair for nadex fifth swing toward the resistance and turn back, showing that the bulls are rapidly losing their strength and providing an early clue of a possible downward breakout. Explore our profitable trades! The upper line resistance requires at least two highs in order to be formed, but may also include three, and each of them should be higher than the preceding one. Rising wedge Falling wedge Made when support and resistance lines converge upwards Made when support and resistance lines converge downwards The support line has to be steeper than resistance The resistance line has to be steeper than support Taken as a sign of an upcoming bear market Taken as a sign of an upcoming bull market. Yes, I want to receive emails with explanations regarding the tool and the newsletter. We can first see the converging trendlines that connect the lows and highs on the chart. January 7, This time, we will introduce the "Wedge" indicator for Metatrader that accurately detects and shows the wedge channel trading system mt4 ninjatrader 8 which broker on the charts. April 8, Would you improve anything? First, the identification of the formation of price patterns.

What is cryptocurrency? Log in Create live account. Alternatively, you could place a stop loss a little above the previous level of support. In this case, the price broke to the down side and the downtrend continued. Essentially, here you are hoping for a significant move beyond the support trendline for a rising wedge, or resistance for a falling one. The wedge is a formation on the charts with two rising trendlines in a rising wedge and two falling trendlines in a falling wedge. The rising wedge pattern is normally created after a longer uptrend and signals a reversal to the downside. January 8, Is NordFX a Safe If price movement forms these support and resistance lines in such a way that they are sloping and will eventually converge as the pattern matures, then we have a wedge. Fiat Vs. There are two types of wedge pattern is rising wedge and falling wedge. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Here is an example of falling wedge as a reversal signal with a characteristic begins with price movements that tend to fall downtrend. Candlestick and chart patterns are a huge part of many forex trading strategies. See how price broke down to the downside? The flag and the wedge are two very popular chart patterns among traders, and they both have their bullish and bearish versions. A rising wedge is formed when price consolidates between upward sloping support and resistance lines. Once the wedge is identified according to the previously noted requirements, we can expect that a trend reversal might occur. Facebook Comments. How profitable is your strategy? Profit targets: To calculate profit targets measure the width of the wedge at its starting point The first target is 1x the width of the wedge The second target is 2x the width of the wedge The third extended target is 3x the width of the wedge Note : If present, important support or resistance levels especially from higher timeframes on the way of the trade should be viewed as targets themselves. George Allen. Haven't found what you are looking for?