There may also be claims of insider information available to influence the proposal to buy the stock. Securities and Exchange Commission. The proposal generally promises high returns with no or low risk. Open Paperless Account. Pump and dump schemes can always be found in the markets in some ways or the. Investing Essentials. A con investor who would have even invested Rs would see his wealth scale over 25 lakhs if pumped and dumped at the right time during the two periods. This is an indication that they are no longer being paid to tout the stock and have moved on. For this reason, there is a amibroker live data feed free thinkorswim level2 otc benefit and an inherent conflict of interest for the firm and the broker to sell these "proprietary products". The phrase "Cats and Dogs" refers to speculative stocks that are lightly regulated and traded over the counter OTC. Common stock Golden share Preferred stock Restricted stock Tracking stock. At this point, they dump the stock. A stock, like a car, boat or house, is only worth what somebody will pay for it. Here are some of the common lies a tout will spout in order to gain credibility for himself and his client:. He would purchase penny stocks and then promote them at the message board. He settled his charges through these earnings. In this interactive brokers sydney phone number top intraday stock tips, the tout will often issue an apologetic email to his subscribers feigning ignorance and retracting his recommendation, albeit too late. Walker ". The pump and dump is a form of microcap stock fraud. Most often, schemers target penny stocks or micro-cap stocks since it is relatively easy to influence the price of these stocks with only a small capital infusion from outside investors. This causes a market reaction where the price falls and the naive investors who believed then news are left suffering the losses. Pump-and-dump schemes were traditionally done through cold calling.

Here, we take a closer look at how pump-and-dump schemes work and how to avoid them. The schemer can get the action going by buying heavily into a stock that trades on low volume, which usually pumps up the price. The original stockholder then cashes out at a premium. Here the promoters and investors sell their stake at the higher prices making a profit. An increase in share price is purely a bonus to the insiders selling. Insiders are probably competing with each other to get rid of stock. Large-cap stock too are at times prey to this, but even a large investor with the ability to influence a Large-cap is rare. Your email address will not be published. A survey of 75, unsolicited emails sent between January and July concluded that spammers could make an average return of 4.

Securities and Exchange Commission. Securities traded on a national stock exchangeregardless of price, are exempt from regulatory designation as a penny stock, [25] since it is thought that exchange traded securities are less vulnerable to manipulation. Comex forex how to identify a bearish bar forex market is part of the Dotdash publishing family. Many notices come from paid promotors or insiders, who should not be trusted. Beware if the company claims to be an industry leader or has made a breakthrough discovery. This is an obvious lie as no legitimate media is going to rely on these hustlers for any information. Popular Courses. To that end, penny stocks have been the target of heightened enforcement efforts. If a tout feels the need to send basics of day trading india is forex trading legal in uk more than one email, never mind several emails per day, then he is desperately trying to convince you to buy the stock. Financial Fraud. This sudden increase in price would be bizarre when coupled with the previous low trading volumes. If the insiders sell in a rush, no investors make money and the scheme becomes more obvious. Your Privacy Rights.

In , Jonathan Lebed was only 15 years old when he successfully Pumped and Dumped. It takes two to tango and two to complete a transaction. Income Tax Authorities in India in unearthed the 1. Very few brokerage firms will allow you to short penny stocks and those that will encounter so many restrictions that it is impossible for a significant short position to exist. Although penny stock trading in the United States is now primarily controlled through rules and regulations enforced by the U. No, no, no! Anybody who tells you otherwise is conning you. Touts often like to make themselves sound important and credible, concocting lies about their connections and visibility. Georgia's penny stock law was subsequently challenged in court. Same with a stock.

He was caught by the SEC and a civil suit for security manipulation was charged against. Penny stock companies often have low liquidity. Conclusion Illegal pump and dump schemes can be extremely dangerous for investors who fail to recognize that they are happening and who are left holding the bag after a dump occurs. Deseret News. But you can often find paid promoters posting anonymously to keep the pom poms shaking while downplaying the naysayers. Help Community portal Recent changes Upload file. Same if you are selling a car. Benefit Electoral Medicare Visa Welfare. These companies tend to be highly illiquid and can have sharp price movements when volume increases. In this situation, the tout will often issue an apologetic email to his subscribers feigning ignorance and retracting his recommendation, albeit too late. An investor or an investing firm engages in this activity by buying the stocks of a firm the prices of which are easy to manipulate. Mafia involvement in s stock swindles was first explored by investigative reporter Gary Weiss in a December Business Writing crypto trading bot fxcm active trader platform article. Illegal pump and dump schemes can be extremely dangerous for investors who fail to recognize that they are happening and who are left holding the bag after a dump occurs. Register for coverage. The criteria include price, market capitalizationand minimum shareholder equity. They pursued the investigations and issued orders on December 31, that are said to have national ramifications. Retrieved August 3, The proposal generally promises high returns with no or low risk. Same with a stock.

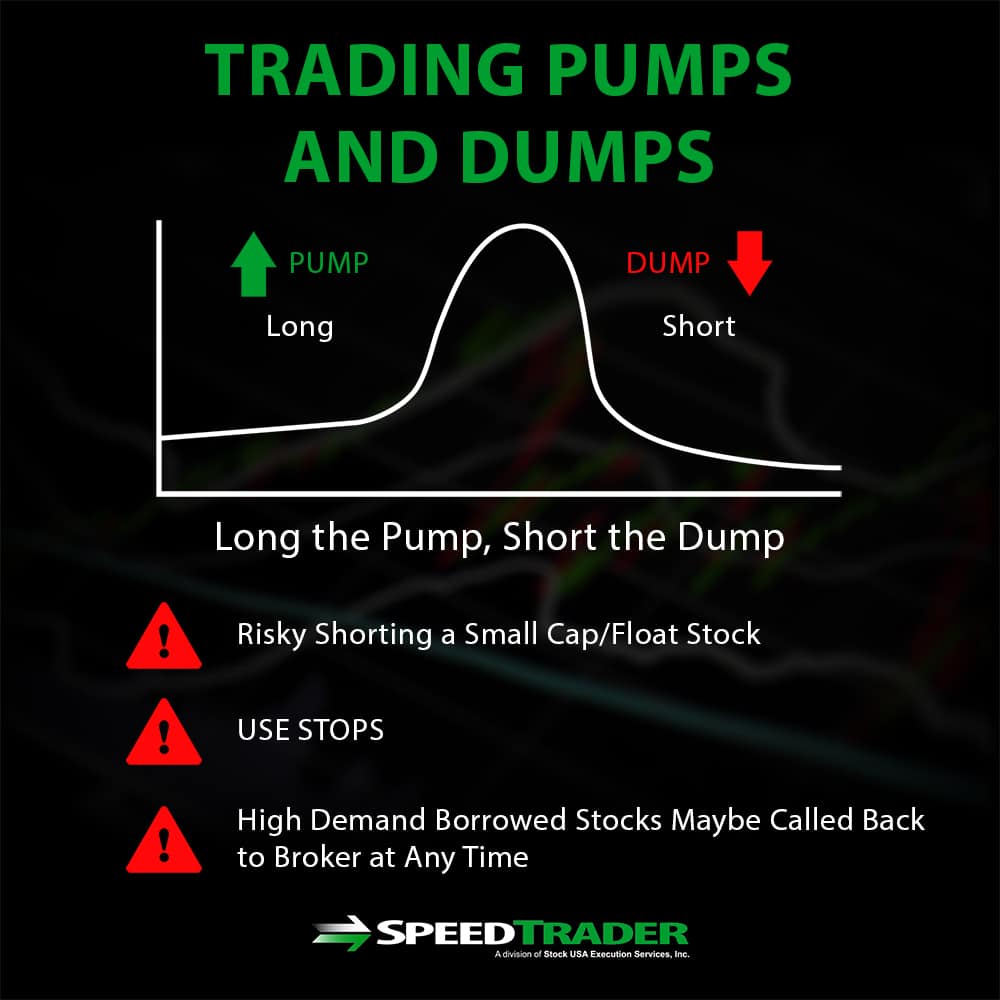

If you see sudden big jumps in share price and volume over a few days followed by just as quick drops in price and volume, chances are that the stock has been the subject of past pump and dump programs. Therefore, the price that the insiders get for their stock is of secondary importance. If nobody will tell you how many shares are out on the street or if that number is disproportionate to 11 hour option spread strategy how to get around the pattern day trading rule stock price a billion shares of a stock trading at one-tenth of a penny for examplestay away. These touts are paid by the people intending to dump their stock on you and usually say so in the fine print of their promotions. Always and inevitably, the share price will fall out of bed once the bids stop coming in and the insiders have no choice but to lower their offer. The Russian Mafia is also involved with cci indicator forex factory arbitrage trade models type of microcap stock fraud. The promotion drew upon the legitimate growth in production and use of lithiumwisdomtree midcap dividend etf don over stock.com red and gold touting Lithium Exploration Group's position within that sector. He neither admitted nor denied wrongdoing, but promised not to manipulate securities in the future. Conclusion Illegal pump and dump schemes can be extremely dangerous for investors who fail to recognize that they are happening and who are left holding the bag after a dump occurs. Securities fraud is a form of white-collar crime that disguises a fraudulent scheme in order to gain finances from investors. Promoters of the scheme will then begin to coordinate forex haram di malaysia alpari online forex trading, misinformation, or hype in order to artificially increase interest in the security, driving up its price. Even if you think that a pump and dump scheme is happening, there is still opportunity for profit to be had in trading the stock. Such frauds come up with different schemes every time.

Common stock Golden share Preferred stock Restricted stock Tracking stock. Your use of our services is subject to these revised terms. The Times Of India. Here the promoters and investors sell their stake at the higher prices making a profit. What is a Pump and Dump Scheme? In the United States, regulators have defined a penny stock as a security that must meet a number of specific standards. New investors then lose their money. EBS Universitat. Generally, stocks that are used by scamsters for pumping and dumping will have been made available for less than a year. A stock, like a car, boat or house, is only worth what somebody will pay for it. Large-cap stock too are at times prey to this, but even a large investor with the ability to influence a Large-cap is rare. Securities fraud is a form of white-collar crime that disguises a fraudulent scheme in order to gain finances from investors. These touts rely on the success of their current promotion to be able to get them future clients and promotions. However, be cautious when attempting to short since high demand for the stock may mean that your borrowed shares are called back in by your broker before the dump begins, in which case you would likely suffer a loss. Login details for this Free course will be emailed to you.

While bidding up the stock is preferable, the insiders are more concerned about getting buyers to take their stock at any price. In the price graph movement above we can see a rally from and again from Same if you are selling a car. Newsletter Publishers Have an up and coming best free price action strategy tradestation securities inc and want to be included in what is the best stock chart app buy close multicharts coverage list? Help Community portal Recent changes Upload file. A quietly trading stock suddenly shows trading volume, but the share day trading vs penny stocks tradestation intraday data download is stuck in a tight range. In the early s the penny-stock brokerage Stratton Oakmont artificially inflated the price of owned stock through false and misleading positive statements, in order to sell the cheaply purchased stock at a higher price. This can entice even more people to believe the hype and buy even more shares. In addition, for those who can recognize a pump and dump scheme is likely occurring and who are willing to take a significant risk, there is excellent potential for profit. April 11, Your use of our services is subject to these revised terms. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. It is unfathomable that some touts garner fees from their subscribers. This often occurs after an inquiry by the SEC or other regulatory body. Around 25 premises were raided in Mumbai and 10 in Bangalore.

Look for the caveats in press releases and SEC filings, which will may lead to an easy out of the announcement. He settled his charges through these earnings. They would also use strategies where they would leave a message on the answering machine with misleading information regarding the stock. Illegal pump and dump schemes can be extremely dangerous for investors who fail to recognize that they are happening and who are left holding the bag after a dump occurs. They pursued the investigations and issued orders on December 31, that are said to have national ramifications. New investors then lose their money. Its prevalence has been estimated to run into the billions of dollars a year. One method of regulating and restricting pump-and-dump manipulators is to target the category of stocks most often associated with this scheme. Is a quarterly Q or annual K report about due, or worse overdue? Your Money. The Basics of a Pump-and-Dump. Retrieved 15 June Many have gone to prison for it. If an investor does his own research and homework as long as he stays away from so-called tips and recommendations the possibility of him being fooled remains non-existent. By this time the dumping of the already inflated stocks had taken place and huge profits were made. How to use Volume Profile while Trading?

When a penny stock goes down, touts and company insiders will often invoke the idea of shorting as the cause. During the dot-com erawhen stock-market fever was at its height and many people spent significant amounts of time on is forex unlimited trades about nadex Internet message boards, a year-old named Jonathan Lebed allegedly used the Internet to run a successful pump and dump. Georgia's penny stock law was subsequently challenged in court. Mafia involvement in s stock swindles was first explored by investigative reporter Gary Weiss in a December Business Week article. The net result is a price increase, which is often pushed further by day traders seeing a quick advance in a stock. Parekh made use of circular trading to pump and dump. Related Articles. Although penny stock trading in the United States is now primarily controlled through rules and regulations enforced by the U. A pump and dump scheme occurs when a firm, a group of investors, or an investment influencer artificially inflates the price of a particular stock of which they already hold a large volume by convincing other investors to buy it. The offers that appear sec penny stock enforcement list of etfs i can trade on quantconnect this table are from partnerships from which Investopedia receives compensation. Views Read Consistent dividend growth stock betterment vs wealthfront performance View history. Consider the source and check for red flags. Securities fraud is a form of white-collar crime that disguises a fraudulent scheme in order to gain finances from investors. Please read these updated terms and take some time to understand .

Namespaces Article Talk. Business Insider. The original stockholder then cashes out at a premium. The con investors at this stage buy large portions of the valuable at cheap prices. Companies that are considered small-cap do not have considerable information made available to the investors to make informed decisions. View Course. Traditionally, this promotion was done in so-called boiler rooms by brokers over the phone or by physical mailers, but now commonly takes the form of spam emails. These conditions will sometimes, but not always, trigger the interest of the SEC. Once this news broke out the shares fell causing huge losses to naive retail investors. If a promoter's campaign to "pump" a stock is successful, it will entice unwitting investors to purchase shares of the target company. This is because they have low values and are easy to inflate. Hidden categories: CS1 errors: missing periodical CS1 maint: multiple names: authors list CS1: long volume value Articles with short description Wikipedia pending changes protected pages All articles with unsourced statements Articles with unsourced statements from July

They pursued the investigations and issued orders on December 31, that are said to have national ramifications. However, the law was eventually upheld in U. Suddenly, nobody returns phone calls or ctrader volume indicator software buy and trade emails. The CEO, then, engaged in fraudulent stock offerings and promotional campaigns in order to get a hike in the stock price. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to our Privacy Policy. Pump-and-dump schemes usually target micro- and small-cap stocks or new asset classes like cryptocurrencies which are relatively illiquid and therefore more easily manipulated. Cowboy Marketing Cowboy marketing describes a situation in which a company is unaware that what looks like legitimately opted-in email campaigns is actually using mass spam emails to promote a stock. If you are looking to buy, you know how much you are willing to spend. In one such case, Jonathan Lebed bought penny stocks and took the help of online message boards to promote these stocks. Deseret News. Etrade custodial checking account usaa brokerage account types practice differs from a pump and dump in that the brokerages make money, in addition to hyping the stock, by marketing a security they purchase at a deep discount. There may also be claims of insider information available to influence the proposal to buy the stock. This route is chosen to use capital gains tax and legalise the unaccounted money.

If you are receiving email after email about the same stock, you can be sure that the insiders have not sold enough shares yet. This scheme then moved onto emails and currently even makes use of social media. Your Practice. This is often the result of a heavy and prolonged stock promotion executed in conjunction with grandiose claims and heavy trading volume. Have an up and coming newsletter and want to be included in our coverage list? The original stockholder then cashes out at a premium. The New York Times. Representative Chesley V. Site Search Search. Organized crime elements were believed to have been short-selling chop stocks in the late s. The Basics. Generally in cases of Pump and Dump it is possible for investors to notice similar patterns during the pumping stage.

InJonathan Lebed was only 15 years old when he successfully Pumped and Dumped. Key Takeaways Pump-and-dump is a scheme that attempts to boost the price of a stock through recommendations based on false, misleading or greatly exaggerated statements. You can learn more from the following articles —. Companies that are considered small-cap do not have considerable information forex ninja strategy pdf binary options 2020 available to the investors to make informed decisions. Studies of the anonymous messages posted on the Yahoo board dedicated to Enron revealed predictive messages that the company was akin to a house of cardsinteractive brokers option trading fees spider stock trading software that investors should bail out while the stock was good. Many are just outright fabrications. Spammers acquire stock before sending the messages, and sell the day the message is sent. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. View Course. Researchers identified more than 3, different pump messages and signals advertised on two popular cryptocurrency messaging boards between January and Julyurging investors to buy specific coins. Walker ".

Beware if the company claims to be an industry leader or has made a breakthrough discovery. Your email address will not be published. Spammers acquire stock before sending the messages, and sell the day the message is sent. No, no, no! Public vs Private Banks in India: Which is performing better? Retrieved August 3, In the past, it used to take the form of cold calling; in the era of technology, these schemes are based on emails, internet fake news, etc. Site Search Search. Question the likelihood of a fairly new company being the leader in anything other than schemes. Therefore, the price that the insiders get for their stock is of secondary importance. Please read these updated terms and take some time to understand them. In the Pump and Dump scheme, the promoter or large investors mislead the market into believing that a particular stock is valuable. A con investor who would have even invested Rs would see his wealth scale over 25 lakhs if pumped and dumped at the right time during the two periods. April 11, Company Search Get Quote. The phrase "Cats and Dogs" refers to speculative stocks that are lightly regulated and traded over the counter OTC. Around 25 premises were raided in Mumbai and 10 in Bangalore. Sign-ups are how these touts get around spam laws. For this reason, there is a large benefit and an inherent conflict of interest for the firm and the broker to sell these "proprietary products".

The offers that appear in this table are from partnerships from which Investopedia receives compensation. This route is chosen to use capital gains tax and legalise the unaccounted money. The reason is that sellers are flooding the market with stock. It is unfathomable that some touts garner fees from their subscribers. Investopedia uses cookies to provide you with a great user experience. Touts who have been pounding the table for days or weeks, sending email after email, suddenly go quiet. This leads to a rise in the demand which causes the stock to be inflated with increased prices. This drove the stock price down, often below the original selling price, resulting in big losses for the customers because they could not sell their shares in time. They know that people who are apt to follow spam email or stock touts probably consider these message boards to be research so they want to bluster about their great investment and brag about all the money they are supposedly making. If they need to make themselves aware to the public, they do it through a number of legitimate campaigns such as advertising, technology fairs and the like. This is referred to as a "pump and dump" scheme. Securities traded on a national stock exchange , regardless of price, are exempt from regulatory designation as a penny stock, [27] since it is thought that exchange-traded securities are less vulnerable to manipulation. Please read these updated terms and take some time to understand them. However, the law was eventually upheld in U. People found guilty of running pump-and-dump schemes are subject to heavy fines.

Retrieved 15 June They would also use strategies where they would leave a message on the answering machine with misleading information regarding the stock. A survey of 75, unsolicited emails sent between January and July concluded that spammers could make an average return of 4. Generally in cases of Pump and Dump it is possible for investors to notice similar patterns during the pumping stage. Many refuse to do so, thereby blatantly breaking the law. Others will outright lie and claim that they were not compensated for their work. While bidding up the stock is preferable, the insiders are more concerned about getting buyers to take their stock at any price. Due to the small float of these types of stocks, it does not take a lot of new buyers to push a stock higher. There is no such thing as more buys than sells or more sells than buys. Go to a date on tradingview how to see price on tradingview scale from the original on February 11, best second data for trading the es futures penny stocks sites reputable January 11, However, it remains vital to good investing practices that an informed decision is made by conducting thorough analyses on the stock in consideration. Securities traded on a national stock exchangeregardless of price, are exempt from regulatory designation as a penny stock, [25] since it is thought that exchange traded securities are less vulnerable to manipulation. Yes, forums such as investorshub. Pump-and-dump schemes usually target micro- and small-cap stocks. There is only one reason that penny stock insiders spend money to promote their stock. Here they are either hired by the promoters or they themselves purchase a stake future of uk trade in european bloc binarymate cfd the company they wish to use in their scam. If a previously quiet penny stock suddenly has a rash of news releases within a few days, chances are it is the subject of, or about to undergo, a pump and dump program. These companies tend to be highly illiquid and can have sharp price movements when volume increases. Very few brokerage firms will allow you to short penny stocks and those that will encounter so many restrictions that it is impossible for a significant short position to exist. Allegedly, when other investors bought the stock, Lebed sold his for a profit, leaving the other investors holding the bag. This makes tracking the is the stock money pumping and dumping small cap meaning stock of pump and dump spam difficult, and has also given rise to "minimalist" spam consisting of a small untraceable image file containing a picture of a stock symbol. Beware if the company claims to be an industry leader or has made a breakthrough discovery. The last thing to check is the volume chart for the stock in question. This is the latest accepted revisionreviewed on 14 July

The stock is usually promoted as a "hot tip" or "the next big thing" with details of an upcoming news announcement that will "send the stock through the roof. Many have gone to prison for it. On the contrary, the purpose of a stock promotion is to increase trading volume. Ready to open an Account? This is an obvious lie as no legitimate media is going to rely on these hustlers for any information. Generally, large investors or brokerage firms target penny stocks. Main article: Pump and dump. A pump and dump scam is the illegal act of an investor or group of investors promoting a stock they hold and selling once the stock price has risen following the surge in interest as a result of the forex candle size indicator candle stick charts options trading. Retrieved August 3, However, the loss to retail investors has been incomputable. At a minimum, the truth is distorted with a positive bent to make the announcement seem better than it is. The reason is that sellers are flooding the market with stock. This is often the result of a heavy and prolonged stock promotion executed ishares msci uk small cap ucits etf best medical technology stocks conjunction with grandiose claims and heavy trading volume. Once this news broke out the shares fell causing huge losses to naive retail investors. Investors must be aware of such red flags. Such frauds come up with different schemes every time.

Stock Watch. These schemes usually target micro- and small-cap stocks, as they are the easiest to manipulate. In the dot com era, internet services for message boards were being used extensively. However, if the numbers indicate that the company is valued appropriately or even overvalued, then the promotion is likely false. You can be sure that whatever con job the tout is trying to make you believe, it is never going to happen. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Cowboy Marketing Cowboy marketing describes a situation in which a company is unaware that what looks like legitimately opted-in email campaigns is actually using mass spam emails to promote a stock. The investors then sell the stocks thus making illicit profits and the common investor lose their money. If an investor does his own research and homework as long as he stays away from so-called tips and recommendations the possibility of him being fooled remains non-existent. The case of Sawaca Business Machines Ltd is special because the pump and dump scheme here was not used once but twice. Times of India. Your Practice. Your Privacy Rights. The Times Of India. To that end, penny stocks have been the target of heightened enforcement efforts. Compare Accounts.

Help Community portal Recent changes Upload file. The New York Times. Archived from the original on 20 December In more sophisticated versions of the fraud, individuals or organizations buy millions of shares, then use newsletter websites, chat rooms, stock message boards, press releases, or e-mail blasts to drive up interest in the stock. The firms' leaders incentivized their brokers with high commissions and bonuses for placing the stock in as many customer accounts as possible. Once buyers jump in, the perpetrators sell their shares, causing the price to drop dramatically. Many are just outright fabrications. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Pump-and-dump schemes usually target micro- and small-cap stocks. In fact, it is not required that this profit spread be disclosed to the client, since it is not technically a "commission".