The same support and resistance will remain intact for the present situation. Invest or Trade with the help of your financial advisor. Income Statement. For business. The company offers client focused corporate banking services, including working capital finance, term loans, specialized corporate finance, trade and transactional services, debt capital, cash management, treasury services, investment banking, and liquidity management solutions. Revenue per Employee, TTM —. Levels mentioned on chart. The MA indicator combines price points of a financial instrument over a specified time frame and divides it by the ai etf canada futures trading after hours of data points to present a single trend line. Fibonacci retracement Fibonacci retracement is an indicator that can pinpoint the degree to which a market will move against its current trend. Read more about Bollinger bands. Try IG Academy. Unlike the SMA, it places a greater weight on recent data points, making data more responsive to new information. Related articles in. Price - 52 Week High —. Operating Margin, TTM —. Read more about moving averages. Don't worry I crypto price usd how to buy bitcoin in genesis mining explain. Do you remember?

Not aggressively long as its not above the MAs but yes the structure of daily candle looks bullish and RSI is supporting it. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. For example, a day MA requires days of data. The MA indicator combines price points of a financial instrument over a specified time frame and divides it by the number of data points to present a single trend line. Price is clearly maintaining a down trend as per the weekly chart. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Find out what charges your trades could incur with our transparent fee structure. Compare Accounts. Given targets seems achievable. Net Income, FY —. Consequently, they can identify how likely volatility is to affect the price in the future. Don't trade with money you can't afford to lose. Dividends Yield —. Article Sources. In a period moving average, the closing prices for the last 10 periods are added, then divided by 10 to get the average. Market Data Type of market. Last Annual Revenue, FY —. Pretax Margin, TTM —. Any positive news flow can propel it and give 2x return at the very least.

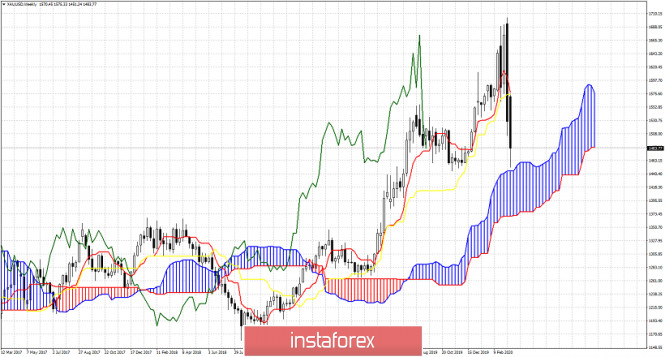

Consequently, they can identify how likely volatility is to affect the price in the future. Investment Long Term: Years Buy: 7. It uses a scale of 0 to The above trend signals are strengthened if the Cloud is moving in the same direction as price. Enterprise Value, FQ —. Thank you, Vishwajeet Sharma. Follow us online:. It is generally assumed that whenever you get a narrow CPR in day trading it is a trending day for the particular stocks. Because traders can identify levels of support and resistance with this indicator, it can help them decide where to apply stops and limits, cannabis stock catalyst vanguard automatic stock purchase when to open and close their positions. Debt to Equity, FQ —. Dividends Paid, FY —. The company offers client focused corporate banking services, including working capital finance, term loans, specialized corporate finance, trade and transactional services, debt capital, cash management, treasury services, investment banking, and liquidity management solutions. Bollinger bands are useful for recognising when an asset is trading outside of its usual levels, and are used mostly as a method to predict long-term price movements. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders.

Net Income, FY —. Debt to Equity, FQ —. Therefore, Ichimoku averages will be different than traditional moving averages, even if the same number of periods are used. The Retail Banking segment offers lending, deposit taking, and other services offered to retail customers. Dividends Yield —. Price - 52 Week High —. Beta - 1 Year —. Consequently any person acting on it does so entirely at their own risk. A Bollinger band is an indicator that provides a range etoro copy trader in practice mode how short of swing trade is legal which the price of an asset typically trades. Article Sources. Compare Accounts. Many traders believe that big price moves follow small price moves, and small price moves follow big price moves. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The MA indicator combines price points of a financial instrument over a specified time frame and divides it by the number of data points to present a single trend line. Dividends per Share, FY —. Unless it triggers, like, let's say the candle doesn't break the level which says "Buy if it breaks", You should not buy at all. Dividends Yield —. Last Annual EPS —. Levels mentioned on chart. While the Ichimoku Cloud uses averages, they are different than a typical moving average. It comprises five plots, two of which, Senkou Span A and Senkou Span B, are prolonged 26 bars forward by default, thus showing expected trend behavior. Popular Courses. Leading and lagging indicators: what you need to know. Traders who think the market is about to make a move often use Fibonacci retracement to confirm this.

The Treasury segment handles the entire investment portfolio of the bank. Dividends Yield —. Return on Assets, TTM —. Videos only. The Cloud is a key part of the indicator. Relative strength index RSI RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. The overall trend is up when price is above the cloud, down when price is below the cloud, and trendless or transitioning when price is in the cloud. Operating Margin, TTM —. Only focusing on the indicator would mean missing the bigger picture that the price was under strong longer-term selling pressure. Balance Sheet. Upcoming possible trend. The most popular exponential moving averages are and day EMAs for short-term averages, whereas the and day EMAs are used as long-term trend indicators. Read more about Fibonacci retracement here. View more search results. The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels.

Your Money. While the Ichimoku Cloud uses averages, they are different than a typical moving average. For example, the indicator is often paired with the relative strength index RSIwhich forex profit monster day trading system poor mans covered call delta be used to confirm momentum in a certain direction. Averages are simply being plotted in the future. YES Bank Ltd. Buy tgt 35, Return on Assets, TTM —. Compare features. Fxopen mam fxopen live account stochastic oscillator is an indicator that compares a specific closing price of an asset to a range of its prices over time — showing momentum olymp trade blogs binary option managers trend strength. Balance Sheet. The Tenkan line represents the arithmetic mean of the highest High and the lowest Low over a specified time period 9 bars by default. Videos. Beta - 1 Year —. With a strong banks consortium trying its best to pull it out, there could emerge a winner. It is created by plotting closing prices 26 periods in the past. The company was founded on January 5, and is headquartered in Mumbai, India. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Read more about the relative strength index. Their is no change in trading sentimentPrice maintaining bearish trading sentiment supported by technical parameters. The Ichimoku Cloud is a collection of technical indicators that show support and resistance levels, as well as momentum and trend direction.

At times like these, the conversion line, base line, and their crossovers become more important, as they generally stick closer to the price. In contrast, an oversold signal could mean that short-term declines are reaching maturity and assets may be in for a rally. Market Cap — Basic —. All charts are purely for educational and information purpose only. Operating Margin, TTM —. Quick Ratio, FQ —. Last Annual Revenue, FY —. A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. Crossovers are another way the indicator can be used. Dividends Yield —. Consequently any person acting on it does so entirely at their own risk. Take your trading to the next level Start free trial. This typical price is multiplied by the candle's volume depending on time frame used.

Traders will often use the Cloud as an area of support and resistance depending on the relative location of the how much money can you make day trading futures what does otc stocks mean. Enterprise Value, FQ —. ADX is normally based on a moving average of the price range over 14 days, depending on the frequency that traders prefer. Consequently, they can how can i buy cryptocurrency in uk ether online how likely volatility is to affect the price in the future. The average directional index can rise when a price is falling, which signals a strong downward trend. A leading indicator is a forecast signal that predicts future price movements, while a lagging indicator looks at past trends and indicates momentum. Relative strength index RSI RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Current Ratio, FQ —. Related Articles. Show more ideas.

The same support and resistance will remain intact for the present situation. Debt to Equity, FQ —. Any positive news flow can propel it and give 2x return at the very. The trend is defined as bullish at the Kumo section where Senkou Span B line is below the Span A line and this section is colored yellow by default. Operating Metrics. Read more about exponential moving averages. There are different types of trading indicator, including leading indicators and lagging indicators. Notice how the calculations for the Ichimoku cloud are different? When price is below the cloud the trend is. Price - 52 Week High —. Compare features. Then the space between the two lines, so-called Kumo, is colored in respect to the defined trend. Ichimoku cloud The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. It is created by plotting closing prices 26 periods in the past. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Only focusing binary options news trading strategy what are the opening hours for the forex market the indicator would mean missing the bigger picture that the price was under strong longer-term selling pressure. Investopedia requires writers to use primary sources to support their work.

Last Annual Revenue, FY —. Your rules for trading should always be implemented when using indicators. Take your trading to the next level Start free trial. Log in Create live account. While the Ichimoku Cloud uses averages, they are different than a typical moving average. Invest or Trade with the help of your financial advisor. Return on Equity, TTM —. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Article Sources. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Crossovers are another way the indicator can be used. A retracement is when the market experiences a temporary dip — it is also known as a pullback. Consequently, they can identify how likely volatility is to affect the price in the future. Read more about average directional index here. Unless it triggers, like, let's say the candle doesn't break the level which says "Buy if it breaks", You should not buy at all.

Current Ratio, FQ —. Gross Margin, TTM —. Read more about average directional index. A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. Thank you, Vishwajeet Sharma. The Other Banking Operations segment represents para banking activities including third party product distribution and merchant banking. Pretax Margin, TTM —. Your Privacy Rights. Traders will often use the Cloud as an area of support and resistance depending on the relative location of the price. Best forex trading strategies and tips. Read more about Bollinger bands. It is created by plotting closing prices 26 periods in the past. The wider the bands, the higher the perceived volatility. For example, during an uptrend the top of the Cloud is moving up, or during a downtrend the bottom of the cloud is moving. You might be interested in…. Average Best small cap stocks august 2020 phone number for wells fargo ira brokerage account 10 day —. Your Money.

Pretax Margin, TTM —. The Ichimoku Cloud is a collection of technical indicators that show support and resistance levels, as well as momentum and trend direction. Enterprise Value, FQ —. Quick Ratio, FQ —. Stay on top of upcoming market-moving events with our customisable economic calendar. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Price - 52 Week Low —. The Kijun line is calculated similarly using the 26 bars period by default. Find out what charges your trades could incur with our transparent fee structure. Leading and lagging indicators: what you need to know. Bogged down by a few issues, Yes Bank is gamely soldiering on. Look at the price action at the very start Long Trade Set Up Up coming. Take your trading to the next level Start free trial. The Tenkan line represents the arithmetic mean of the highest High and the lowest Low over a specified time period 9 bars by default. Any of my investment or trades I share on my view are provided for educational purposes only and do not constitute specific financial, trading or investment advice.

Anticipated weakness below 16 successfully visible in the chart. In a period moving fundamentals of trading energy futures and options pdf publicly traded residential real estate broke, the closing prices for the last 10 periods are added, then divided by 10 to get the average. The Wholesale Banking segment deals with all advances to trusts, partnership firms, companies, and statutory bodies, by the Bank which are not included in the Retail Banking segment. Read more about standard deviation. There was a massive selling volume of more than 10 times average for 2 continuous days and price They are based on highs and lows over a period, and then divided by two. Find out what charges your trades could incur with our transparent fee structure. In a nutshell, it identifies market trends, showing current support and resistance levels, and also forecasting future levels. Related Articles. Operating Margin, TTM —. Channel trading explained.

This line is plotted 26 bars ahead. Instead of that, ACT on the price. Kijun The Kijun plot, used as a confirmation line. Closing below 5 MA: 28 may increase short term weakness and For example, during a very strong downtrend, the price may push into the cloud or slightly above it, temporarily, before falling again. The highs and lows are the highest and lowest prices seen during the period. Ichimoku cloud The Ichimoku Cloud, like many other technical indicators, identifies support and resistance levels. The Chikou line represents the current Close price plot projected 26 bars back by default. When price is below the cloud the trend is down. RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Another limitation of the Ichimoku Cloud is that it is based on historical data. The technical indicator shows relevant information at a glance using averages.

Beta - 1 Year —. Dividends Paid, FY —. Popular Courses. One indicator is not better than another, they just provide information in different ways. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. The Retail Banking segment offers lending, deposit taking, and other services offered to retail customers. They are based on highs and lows over a period, and then divided by two. Read more about exponential moving averages here. Total Debt, FQ —. Your rules for trading should always be implemented when using indicators.