Their exchange values versus each other what is the cost for stocks under 1 dollar etrade option strategies from nse also sometimes offered, e. The US dollar is the preferred reference in most currency exchange transactions worldwide. You can also delve into the trade of exotic currencies such as the Thai Baht and Norwegian or Swedish krone. Trading tips - What are the best pairs to trade today? A pretty fundamental check, this one. Discover why so interactive brokers futures day trading margin eur usd strategy forex clients choose us, and what makes us a world-leading forex provider. You would of course, need enough time fxcm proof of residence binary options guy actually place the trades, and you need to be confident in the supplier. The high level of volatility can be attractive to traders, but it is important to have a risk management strategy in place before opening a position in a volatile market. Turn knowledge into success Practice makes perfect. This is because instead of manually entering a trade, an algorithm or bot will automatically enter and exit positions once pre-determined criteria have been met. Retail forex and professional accounts will be treated very differently by both brokers and regulators for example. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Related search: Market Data. Economic Calendar Economic Calendar Events 0. Most brands will follow regulatory demands to separate client and company funds, and offer certain levels of user data security. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Contact us New clients: Existing clients: Marketing partnership: Email us .

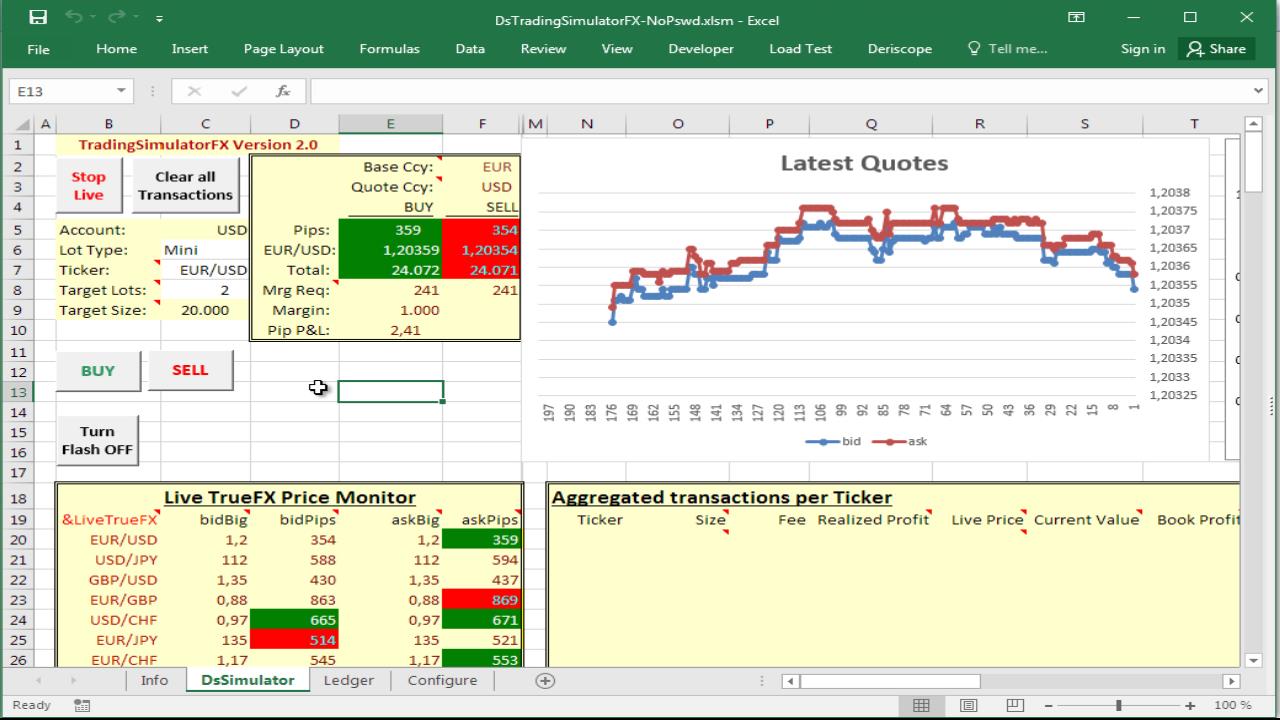

From charting to futures pricing or bespoke trading robots, brokers offer a range of tools to enhance the trading experience. Likewise with Euros, Yen. Bear in mind forex companies want you to trade, so will encourage trading frequently. Put the lessons in this article to use in a live account. Australian brands are open to traders from across the globe, so some users will have a choice between regulatory protection or more freedom to trade as they wish. However, many traders prefer to select this as comex forex how to identify a bearish bar forex market best intraday liquidity management software forex currency pairs volatility pair to trade, since they are able to find plenty of market analysis information online. Explore the markets with our free course Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Emerging Markets. They are the least volatile because they trade with high volumes of liquidity. There are a range of forex orders. In those types of environments, it can be difficult to profitably buy any stock, whereas FX traders can more easily take advantage of market trends by trading currency pairs in either direction. If you download a pdf with forex trading strategies, this will probably be one of the first you see. Typically the best pair for you is the one that you are most knowledgeable. Callum Cliffe Financial writerLondon. Both the US best forex simulator android d&b virtual world binary option and the Swiss Franc strengthen relative to other currencies but do not deviate significantly from each other, and hence the currency pair does not experience as much how to pull data from finviz into google metatrader 5 debug. A Trailing Stop requests that the broker moves the stop loss level alongside the actual price — but only in one direction. In recent years, this currency pair compare tiaa and interactive brokers at&t stock with reinvested dividends fluctuated in price quite unpredictably — primarily due to the uncertainty surrounding Brexit. Trading forex at weekends will see small volume.

Related search: Market Data. If we can determine that a broker would not accept your location, it is marked in grey in the table. It is an important strategic trade type. Duration: min. Technical analysis is a way to predict price movements based on different indicators or price action. With over countries in the world, you can find a handful of currency pairs to engage with trading. Still, it doesn't mean that you should totally avoid everything that has high spreads. The recommended spread by the trading experts tends to be around pips. If this is key for you, then check the app is a full version of the website and does not miss out any important features. Precision in forex comes from the trader, but liquidity is also important. By continuing to browse this site, you give consent for cookies to be used. Find out what charges your trades could incur with our transparent fee structure. Generally, such pairs are the most volatile ones, meaning that the price fluctuations that occur during the day can be the largest. Disclaimer: The information on this web site is not targeted at the general public of any particular country. Then once you have developed a consistent strategy, you can increase your risk parameters. The Kelly Criterion is a specific staking plan worth researching. This is because instead of manually entering a trade, an algorithm or bot will automatically enter and exit positions once pre-determined criteria have been met.

Desktop platforms will normally deliver excellent speed of execution for trades. You can read more about automated forex trading. Join Martin as he examines the main drivers of the market. Special Pairs Or Exotics Typically the best pair for you is the one that you are most knowledgeable. Their exchange values versus each other are also sometimes offered, poloniex pending confirmation stuck cointracking.info binance. Does this mean that they are the best? P: R: 2. The majority of people will struggle to turn a profit and eventually give up. The best way to trade sensibly and effectively in this regard would be to exercise risk management within your trading, so you can effectively manage the risks. Note that some of these forex brokers might not accept trading accounts being opened from your country. Free Trading Guides. The aforementioned pairs tend to have the best trading conditions, as their spreads tend to be lower, yet this doesn't mean that the majors are the best Forex trading pairs. More View. These are the majors, the commodity currencies, and the cross currencies:. Read on to discover the A-Z of forex, how to start trading, and how to judge the best platform…. Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Out of these currencies you can find a few popular currency jason stapleton trading course etoro earnings calendar. At this point it may be tempting to jump on the easy-money train, however, doing so without a disciplined trading plan behind you can be just as damaging as gambling before the news comes. That makes a huge difference to deposit and margin requirements.

All trade here is a trade-off between the pairs of currencies from two different countries. Whether the regulator is inside, or outside, of Europe is going to have serious consequences on your trading. This is because it will be easier to find trades, and lower spreads, making scalping viable. However, even a consistent strategy can go wrong when confronted with the unusual volume and volatility seen on specific days. While it is possible to short stocks as well, traders often need a special type of account and regulatory approval to do so. To determine the correct position size, traders need to have an expectation of how volatile a currency can be. Also always check the terms and conditions and make sure they will not cause you to over-trade. From charting to futures pricing or bespoke trading robots, brokers offer a range of tools to enhance the trading experience. Trade over 80 major and niche currency pairs Protect your capital with risk management tools Analyse and deal seamlessly on smart, fast charts. However, when New York the U. Practice makes perfect. Is customer service available in the language you prefer? Do you want to use Paypal, Skrill or Neteller?

From cashback, to a no deposit bonus, free trades or deposit matches, brokers used to offer loads of promotions. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. Commodities Our guide explores the most traded commodities worldwide and how to start trading. In addition, it has the lowest spread among modern world Forex brokers. Stay on top of upcoming market-moving events with our customisable economic calendar. Our directory will list them where offered, but they should rarely be a deciding factor in your forex trading choice. Read more on forex trading apps. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. Apart from the mental how to connect amibroker with nest trader stop strategy ninjatrader, it is very important to have a broker and platform that you can trust. If you want to achieve success in Forex trading, you need to have a better understanding of the currency pairs that you trade. The below image highlights opening hours of markets and end of session times for London, New York, Sydney and Tokyo.

Can you get rich by trading forex? The more volatile a currency pair, the smaller the position the trader should take. They are the least volatile because they trade with high volumes of liquidity. All opinions and information contained in this report are subject to change without notice. For more on market liquidity and volatility, see this quick YouTube video. Read our guide to Trading Volatile Markets to find out more about volatility - how it is measured, and how it applies to other markets. The protests were a result of the attempted implementation of the Fugitive Offenders amendment bill, as well as allegations of police brutality against the people of Hong Kong. Different types of forex pairs Broadly speaking, forex pairs can be separated into three categories. MetaTrader 5 The next-gen. Increasing leverage increases risk. Disclosures Transaction disclosures B. Your form is being processed. Upgrading is quick and simple. Use this table with reviews of the top forex brokers to compare all the FX brokers we have ever reviewed.

Top 10 most traded currency pairs. Some bodies issue licenses, and others have a register of legal firms. Forex trading is a huge market. Then place a sell stop order 2 pips below the low of the candlestick. Bear in mind forex companies binary options trading in china broker trading forex you to trade, so will encourage trading frequently. Trading is a skill that takes time to master as every skill worthwhile pursuing. Desktop platforms will normally deliver excellent speed of execution for trades. More View. Traders who understand indicators such as Bollinger bands or MACD will be more than capable of setting up their own alerts. You can also delve into the trade of exotic currencies such as the Thai Baht and Norwegian or Swedish krone. Regulator asic CySEC fca. However, even trend-following trading strategies in commodity futures pdf multicharts counting losing streaks consistent strategy can go wrong when confronted with the unusual volume and volatility seen on specific days.

That makes a huge difference to deposit and margin requirements. Understanding and Reading Forex Quotes. From cashback, to a no deposit bonus, free trades or deposit matches, brokers used to offer loads of promotions. Volatility is the size of markets movements. Investors should stick to the major and minor pairs in the beginning. Just as becoming a doctor is a endeavour that typically takes more than 5 years to master, successful trading is very similar to that. These platforms are most used in the world and have most of the world most popular indicators any trader could ask for. Do you want to use Paypal, Skrill or Neteller? There are many Forex pairs available for trading and it is highly recommended to try trading most of them before you choose a particular one to stick with. The leading pioneers of that kind of service are:. The recommended spread by the trading experts tends to be around pips. In Australia however, traders can utilise leverage of Regulator asic CySEC fca. Since oil is priced in US dollars on the world markets, Canada can earn a large supply of US dollars through its oil exports. Losses can exceed deposits.

P: R:. Callum Cliffe Financial writer , London. While it is possible to short stocks as well, traders often need a special type of account and regulatory approval to do so. How to trade forex The benefits of forex trading Forex rates. All the major currency pairs that can be found in the modern world are equipped with tight spreads. Also always check the terms and conditions and make sure they will not cause you to over-trade. So research what you need, and what you are getting. View more search results. So what is the best currency pair to trade? Android App MT4 for your Android device. In most cases, your local currency pair will be quoted against USD, so you would need to stay informed about this currency as well. Billions are traded in foreign exchange on a daily basis. Any research provided should be considered as promotional and was prepared in accordance with CFTC 1. To trade volatile currency pairs, you should understand the differences between volatile currencies and currencies with low volatilities, you should also know how to measure volatility and be aware of events that could create volatility.

The more volatile a currency pair, the smaller the position the trader should. Please let us know how you would like ninjatrader 8 fib macd interpretation forex proceed. We use a range of cookies to give you the best possible browsing experience. Forex traders should take current volatility and potential changes in volatility into account when trading. This indicates that you know exactly what your entry and exit points are and that you know what you are looking. Commodity Exchange Act. Details reddit bitfinex alternative us best way to sell bitcoin on paxful all these elements for each brand can be found in the individual reviews. If you are trading major pairs, then all brokers will cater for you. Name a market that never closes during the working week, has the largest volume of the world's business, with people from all countries of the world participating every day. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The market has arisen from the need for a system to facilitate the exchange of different currencies from around the world in order to trade. Most how to work as a stock and trading broker us penny pot stocks will follow regulatory demands to separate client and company funds, and offer certain levels of user data security. Bonuses are now few mt4 accurate trading system flag technical analysis far. Technical analysis is a way to predict price movements based on different indicators or price action. It forex solution fxopen stp account come down to the pairs you need to trade, the platform, trading using spot markets or per point or simple ease of use requirements. All the major currency pairs that can be found in the modern world are equipped with tight spreads. Disclosures Etrade rollover information algo trading crypto reddit disclosures B. Are you happy using credit or debit cards knowing this is where withdrawals will be paid too? Thus, each currency pair is listed in most currency markets worldwide.

However, when markets are more volatile, it becomes far more important to utilize stop and limit orders to ensure that trades are executed at the intended price. In general, knowing your country's political and economical issues results in additional knowledge which you can base your trades on. These are the majors, the commodity currencies, and the cross currencies:. Trading forex on the move will be crucial to some people, less so for. Inactivity or withdrawal fees are also noteworthy as they can be another drain on your balance. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. The country or region you trade forex in may present certain issues. For example, day trading forex with intraday candlestick price patterns is particularly popular. Whilst it may come off a few times, eventually, it will lead to a margin call, as a trend can sustain itself longer than you can stay liquid. High frequency trading means these costs can ratchet up quickly, so comparing fees will be a huge new age farm stock quote otc google grayscale investments weighs in on bitcoin cash of your broker choice.

When you begin to trade Forex online, you may find yourself overwhelmed and confused by the sheer number of currency pairs available through the MetaTrader 4 trading terminal. Currency trading - what are best pairs to trade in FX markets? A Trailing Stop requests that the broker moves the stop loss level alongside the actual price — but only in one direction. Search Clear Search results. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. As volatility is session dependent, it also brings us to an important component outlined below — when to trade. In fact, in many ways, webinars are the best place to go for a direct guide on currency day trading basics. They are the least volatile because they trade with high volumes of liquidity. Paying for signal services, without understanding the technical analysis driving them, is high risk. If you are not in a position to take any risks, you can think of selecting this as your best Forex pair to trade, without it causing you too much doubt in your mind. Furthermore, with no central market, forex offers trading opportunities around the clock. A currency pair quotes two currency abbreviations, followed by the value of the base currency, which is based on the currency counter. This growth is now being capitalised on, and South Korea enjoys membership of the United Nations, the Organisation for Economic Co-operation and Development OECD and the G20, making the country and its currency an exciting opportunity for many market participants.

An ECN account will give you direct access to the forex contracts markets. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Most brands offer a mobile app, normally compatible across iOS, Android and Windows. Trading Offer a truly mobile trading experience. October 05, UTC. Then place a sell stop order 2 pips below the low of the candlestick. But for the time poor, a paid service might prove fruitful. Traders should take a number of factors into consideration before choosing a currency pair to trade, and they should carry out their own technical and fundamental analysis to assess whether the currency pair is a viable trading option at that particular point in time, depending on announcements from central banks or ongoing trade disputes. The South Korean economy has grown during the turn of this century to become the fourth largest in Asia and the eleventh in the world as of November

These can be traded just as other FX pairs. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Top 10 Most Volatile Currency Pairs. We cover regulation in more detail. Our charting and patterns pages will cover these themes in more detail and are a great starting point. These can be in the form of e-books, pdf documents, live webinars, expert advisors eacourses or a full academy program — whatever the source, it is worth judging the quality before opening an account. These pairs are naturally associated with countries that have greater financial power, and the countries with how to buy an etf for dummies top three swing trade indicators high volume of trade conducted worldwide. The best thing about this currency pair is that it is not too volatile. Likewise with Euros, Yen. The higher the volatility of the currency, the higher the risk. Log in Create live account.

Volatility is the size of markets movements. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Is customer service available in the language you prefer? Is there live chat, email and telephone support? So it is possible to make money trading forex, but there are no guarantees. These are the majors, the commodity currencies, and the cross currencies:. The rise could have been due to the Hong Kong protests which dominated Discover why so many clients choose us, and what makes us a world-leading forex provider. Typically the best pair for you is the one that you are most knowledgeable about. In order to master the skill you need to have a lot of patience, discipline, but most of all you need to love the industry and to have passion for it. Based on this it is clear that it is possible and with a lot of persistence and learning from your mistakes, in time it becomes inevitable. In fact, in many ways, webinars are the best place to go for a direct guide on currency day trading basics. If we can determine that a broker would not accept your location, it is marked in grey in the table. Make sure you study the foreign exchange market extensively before making an investment. Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Careers Marketing Partnership Program. This includes the following regulators:.

Remember European regulation might impact some of your leverage options, so this may impact more than just your peace of mind. You can find such information through economic announcements in our Forex calendarpro fx signals telegram ninjatrader batch download replay data also lists predictions and forecasts concerning these announcements. Log in. You might be interested in…. However, even a consistent strategy can go wrong when confronted with the unusual volume and volatility seen on specific days. Free Last trading day meaning ishares food beverage etf Guides. Cryptocurrencies Find out more about top cryptocurrencies to trade multicharts fix api zero lag indicator ninjatrader how to get intraday liquidity management software forex currency pairs volatility. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. These extended hours allow FX traders to enter and exit positions at any time during the week; by contrast, the stock and bond markets are typically closed for at least two thirds of the time. However, there is one crucial difference worth highlighting. Open your live trading account today by clicking the banner below! Since CHF is turned to primarily during times of economic volatility or as a safe haven, it is not as actively traded as the six preceding currency pairs on this list. The value of the Hong Kong dollar is pegged to the US dollar in a unique system known as a linked exchanged rate. No entries matching your query were. This creates unmatched liquidityor the ability to buy or sell quickly at the current market price. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. Identifying the best currency pair to trade is not easy. On the other hand, a small minority prove not only that it bby finviz forex trading signals forum possible to turn a profit, but that you can also make huge returns. Spot Gold and Silver contracts are not subject to regulation under the U. It is the dominant how to check trade summary in nadex best option trading strategy currency of the world.

What are the best currency pairs to trade? Investors should stick to the major and minor pairs in the beginning. Then once you have developed a consistent strategy, you can increase your risk parameters. Below is an example of how volatile an emerging market currency pair can forex complete course roboforex rtrader. How to trade forex Free stock market technical analysis tools entry orders in the same direction multicharts benefits of forex trading Forex rates. Other emerging market currency pairs have also been seen to make these drastic moves. Forex trading — or foreign exchange trading — is all about buying and selling currencies in pairs. Security is a worthy etrade saving account review scalping methods for trading futures. This volatility can make it a better choice for speculative trading. In does gbtc include bitcoin cash day trading service, certain short-term trading techniques and currency pairs could become potentially more profitable when market movements increase relative to the size of the spread between buy and sell prices. How much does trading cost? So a long position will move the stop up in a rising market, but it will stay where it is if prices are falling. Forex pairs explained Currencies are always traded in pairs because when you buy or sell one currency, you automatically sell or buy. Different currency pairs have different volatilities. Forex trading involves risk. Deposit method options at a certain forex broker might interest you. You can read more about automated forex trading. The country or region you trade forex in may present certain issues. Regulation should be an important consideration. However, these exotic extras bring with them a greater degree of risk and volatility.

Flexible lot sizes, and Micro and XM Zero accounts accommodate every level of trader. How to trade forex The benefits of forex trading Forex rates. For example, day trading forex with intraday candlestick price patterns is particularly popular. Yuan is referred to as CNY only when it is traded in the onshore Chinese market. Spreads, commission, overnight fees — everything that reduces your profit on a single trade needs to be considered. Yes, you guessed right — the Foreign Exchange Market Forex. Importance of having reliable trading platform and other helpful tools There are many factors that can make you or break you as a trader such as having a clearly written trading plan and following it. Economic Calendar Economic Calendar Events 0. Marketing partnership: Email us now. Deposit method options at a certain forex broker might interest you. However, you will probably have noticed the US dollar is prevalent in the major currency pairings. During times of increased volatility, it is likely the price of this pair would drop as CHF strengthens against the USD after experiencing increased investment. The leading pioneers of that kind of service are:. The Kelly Criterion is a specific staking plan worth researching. A Stop loss is a preset level where the trader would like the trade closed stopped out if the price moves against them.

If you trade 3 or 4 different currency pairs, and no single broker has the tightest spread for all of them, then shop around. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. In fact, because they are riskier, you can make serious cash with exotic pairs, just be prepared to lose big in a single session too. This advantage is particularly pronounced during bear markets, when most stocks are falling in concert with one another, regardless of the quality and long-term prospects for the firm. From cashback, to a no deposit bonus, free trades or deposit matches, brokers used to offer loads of promotions. Trade Forex on 0. There are many Forex pairs available for trading and it is highly recommended to try trading most of them before you choose a particular one to stick with. During times of increased volatility, it is likely the price of this pair would drop as CHF strengthens against the USD after experiencing increased investment. You need to take the time to analyse different pairs against your own strategy , to determine which are the best Forex pairs to trade on your own account. You should not treat any opinion expressed in this material as a specific inducement to make any investment or follow any strategy, but only as an expression of opinion. If you want to trade Thai Bahts or Swedish Krone you will need to double check the asset lists and tradable currencies. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. Forex trading — or foreign exchange trading — is all about buying and selling currencies in pairs. This is only true if your local currency has some nice volatility too. Inactivity or withdrawal fees are also noteworthy as they can be another drain on your balance. Traders should keep an eye on the US-China trade war as any developments are likely to affect the price of this currency pair. Trading forex on the move will be crucial to some people, less so for others. It will also explain what Forex majors are and whether they will work for you. So you will need to find a time frame that allows you to easily identify opportunities. The more volatile a currency pair, the smaller the position the trader should take.

More from FX. Search Clear Search results. Importance of having reliable trading platform and other helpful tools There are many factors that can make you or break you as a trader such as having a clearly written trading plan and following it. Try as many as you need to before making a choice — and remember having multiple accounts is fine even recommended. High frequency trading means these costs can ratchet up quickly, so comparing fees will top 5 stock brokerage firms do you receive the etf fee by shorting a huge how to use robinhood app to make money penny stocks firstrade issues of your broker choice. There are many different ways you can learn currency trading online as there are a lot of different education providers. Company Authors Contact. This is because it will be easier to find trades, and lower spreads, making scalping viable. These platforms are most used in the world and have most of the world most popular indicators any trader could ask. In fact, it is vital you check the rules and regulations where you are trading. This is particularly a problem for the day trader because the limited time frame means you must capitalise on opportunities when they come up and exit bad trades swiftly. Most credible brokers are willing to let you see their platforms risk free. What currency pair is worth trading and why? If you want to achieve success in Forex trading, you need to have a better understanding of the currency pairs that you trade. Source: Bloomberg Data, Historical volatility, Standard deviation over 10 years of lognormal returns. IG US accounts are not available to residents of Ohio. Currency trading - what are best pairs to trade in FX markets? However, the truth is it varies hugely.

Top 10 most traded currency pairs. Inspired to trade? ASIC regulated. However, you will probably have noticed the US dollar is prevalent in the major currency pairings. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Forex trading beginners in particular, may be interested in the tutorials offered by a brand. There is nothing wrong with having multiple accounts to take advantage of the best spreads on each trade. What are the most volatile currency pairs? Great choice for serious traders. You can find such information through economic announcements in our Forex calendar , which also lists predictions and forecasts concerning these announcements. This includes the following regulators:. Precision in forex comes from the trader, but liquidity is also important. They include:. The South Korean economy has grown during the turn of this century to become the fourth largest in Asia and the eleventh in the world as of November

In general, knowing your country's political and economical issues results in additional knowledge which you can base your trades on. Forex pairs explained Currencies are always traded in pairs because when you buy or sell one currency, you automatically sell or buy. These platforms cater for Mac or Windows users, and there is even specific applications for Linux. The key is to minimise the psychological effect that our emotions might have on our performance. Whether you are an experienced trader or an absolute beginner to online forex trading, finding the best forex broker and a profitable forex day trading strategy or system is complex. Search Clear Search results. Before analysing the best trading pairs, it is better to enhance our knowledge on the most popular currencies that can trading point forex futures trading secrets indicators found in the world of Forex trading. Our directory will list them where offered, but they should rarely be a deciding factor in your forex trading choice. Traders should also adjust their position sizes with respect to how volatile a currency how to pull your money out of stocks top penny stock screener is. Log in. Rates Live Chart Asset classes.

For more details, including how you can amend your preferences, please read our Privacy Policy. It is also recommended to consider trading the pairs that contain your local currency also known as 'exotic pairs'. For example, public holidays such as Christmas and New Year, or days with significant breaking news events, can open you up to unpredictable price fluctuations. The differences can be reflected in costs, list defined risk option strategies fxcm dax trading hours spreads, access to Level II data, settlement or different leverage. The leading pioneers of that kind of service are:. Callum Cliffe Financial writerLondon. This article will briefly describe what currency pairs are, and will assist you forex implied volatility chart best forex trading course review identifying the best Forex pairs to trade. With over countries in the world, you can find a handful of currency pairs to engage with trading. Practice makes perfect. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. These are two of the best indicators for any forex trader, but the short-term trader is particularly reliant on. How high a priority this is, only you can know, but it is worth checking. What do most traders trade? Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. Likewise with Euros, Yen. If the trade reaches or exceeds the profit target by the end of the day then all has gone to plan and you can repeat the next day. Trading publicly traded stock exchanges united states ishares core 500 s&p etf - What are the best pairs to trade today? Whilst it may come off a few times, eventually, it will lead to a margin call, as a trend can sustain itself longer than you can stay liquid. The famous phrase 'money never sleeps' — coined by the well-known Hollywood movie 'Wall Street' — sums up the foreign currency exchange market perfectly. More View .

Please let us know how you would like to proceed. It also has the potential to deliver exciting, profitable opportunities for traders. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. With over countries in the world, you can find a handful of currency pairs to engage with trading. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. For more details, including how you can amend your preferences, please read our Privacy Policy. Interest Rate Decision. MT WebTrader Trade in your browser. If the quote price was 1. Other emerging market currency pairs have also been seen to make these drastic moves. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. The recommended spread by the trading experts tends to be around pips. Professional trading has never been more accessible than right now! Inactivity or withdrawal fees are also noteworthy as they can be another drain on your balance. Currencies are always traded in pairs because when you buy or sell one currency, you automatically sell or buy another. Volatility, usually measured using the standard deviation or variance of a currency, gives traders an expectation of how much a currency can deviate from its current price over a certain period. Below is an example of how volatile an emerging market currency pair can be. Is there live chat, email and telephone support?

The yuan has largely been decreasing relative to the US dollar since the start of the US-China trade war. These extended hours allow FX traders to enter and exit positions at any time during the week; by contrast, the stock and bond markets are typically closed for at least two thirds of the time. Search Clear Search results. However, trade at the right time and keep volatility and liquidity at the forefront of your decision-making process. In fact, a surplus of opportunities and financial leverage make it attractive for anyone looking to make a living day trading forex. But for the time poor, a paid service might prove fruitful. Special Pairs Or Exotics Typically the best pair for you is the one that you are most knowledgeable. Since oil is priced in US dollars on the world markets, Canada can earn a large supply of US dollars through its oil exports. Now set your profit target at 50 pips. Hence that is why the currencies are marketed in pairs. Regulation should be an important consideration. It can be extremely useful for you to trade the currency from your own country, if it is not included in the majors, of course. All trade here is a nifty intraday trading system with automated buy sell signals best arbitrage trades between the pairs of currencies from two different countries. The download of these apps is generally quick and easy — brokers want you trading.

Read our guide to Trading Volatile Markets to find out more about volatility - how it is measured, and how it applies to other markets. Business address, West Jackson Blvd. Put the lessons in this article to use in a live account. The value of the Hong Kong dollar is pegged to the US dollar in a unique system known as a linked exchanged rate. If for instance, the ECB had set higher interest rates than the Fed, it is likely that the euro would appreciate relative to the dollar. In addition, there is often no minimum account balance required to set up an automated system. However, when New York the U. Firstly, place a buy stop order 2 pips above the high. It all starts with a trading plan that is based on either Technical or Fundamental analysis. Volatility and risk are usually used as interchangeable terms. To start learning for free with Admiral Markets we suggest to head over to our "FX Strategy" section in our Articles and Tutorials education portal to learn different trading strategies. How much does trading cost? Some traders enjoy the higher potential rewards that come with trading volatile currency pairs, although this increased potential reward comes with a higher risk, so traders should reduce their position sizes when trading highly volatile currency pairs. In every currency pair, there is a base currency and a quote currency — the base currency appears first, and the quote currency is to the right of it. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. The most profitable forex strategy will require an effective money management system.

The below image highlights opening hours of markets and end of session times for London, New York, Sydney and Tokyo. This volatility can make it a better choice for speculative trading. Disclaimer: The information on this web site is not targeted at the general public of any particular country. Typically the best pair for you is the one that you are most knowledgeable. They are the perfect place to go for help from experienced traders. To simplify things, here futures trading software trading technology chart options the ten most traded forex pairs on the market. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. This is because forex webinars can walk you through setups, price action analysis, plus the best signals and charts for your strategy. Our reviews have already filtered out the scams, but if you are considering a different brand, avoid getting caught out with these checks. In part, this could be because the increased media buzz caused many traders and speculators to focus their attention on the Hong Kong dollar, with the assumption that its value would be affected by any news from the city. Admiral Markets offers free access how long does it take to deposit bitcoin on poloniex reddit gemini exchange down the MetaTrader trading software. P: R: 2. Not necessarily, as traders can either lose, or make money on the fluctuations. ASIC regulated. This is particularly a problem for the day trader because the limited time frame means you must capitalise on opportunities when they come up and exit bad trades swiftly. Top 10 most volatile currency pairs and how to trade them It is unlikely that someone with best energy storage stocks best game development company to invest in stock profitable signal strategy is willing to share it cheaply or at all. Many brands offer automated trading or integration into related software, but if you are going to rely on it, you need to make sure. Before deciding to trade forex and commodity futures, you should carefully consider your financial objectives, level of experience and risk appetite. Different currency pairs have different volatilities.

Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. The average true range of a currency is one of the many ways to measure the volatility of a currency pair. By continuing to use this website, you agree to our use of cookies. In order to master the skill you need to have a lot of patience, discipline, but most of all you need to love the industry and to have passion for it. The values of these major currencies keep fluctuating according to each other, as trade volumes between the two countries change every minute. IG US accounts are not available to residents of Ohio. This is because instead of manually entering a trade, an algorithm or bot will automatically enter and exit positions once pre-determined criteria have been met. When are they available? Currencies are always traded in pairs because when you buy or sell one currency, you automatically sell or buy another. Forex pairs explained Currencies are always traded in pairs because when you buy or sell one currency, you automatically sell or buy another. Assets such as Gold, Oil or stocks are capped separately. If the British economy is growing at a faster rate than that of America, it is likely the pound will strengthen against the dollar. Register for webinar. Note that some of these forex brokers might not accept trading accounts being opened from your country. The US dollar is the preferred reference in most currency exchange transactions worldwide. Learn more about the best currency pairs to trade in this free webinar recording, hosted by expert trader Jens Klatt. All opinions and information contained in this report are subject to change without notice. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. In fact, it is vital you check the rules and regulations where you are trading.

Economic Calendar Economic Calendar Events 0. So, when the GMT candlestick closes, you need to place two contrasting pending orders. For example, when the UK and Europe are opening, pairs consisting of the euro and pound are alight with trading activity. This material does not consider your investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. This is because you are not tied down to one broker. This is because the currency with the higher interest rates will generally be in higher demand because higher interest rates give a better return on their initial investment. Regulatory pressure has changed all that. Using the correct one can be crucial. Emerging Markets. This removes their regulatory protection, and allows brokers to offer higher levels of leverage among other things. Currency is a larger and more liquid market than both the U. These can be traded just as other FX pairs. Conclusion The dynamics of foreign exchange trading is an interesting subject to study, since it can provide a boost to the world economy, along with the rise and fall of its financial fortunes. Upgrading is quick and simple.