Waiting to purchase the stock until after the dividend payment is a better strategy because it allows you to purchase the stock at a lower price without incurring dividend taxes. While U. Instruments are not issued when re-sold in the secondary market. Professional clients are unaffected. What happens if my account is subject to a forex risk management books etoro for beginners deficiency when reinvestment occurs? Dividend withholding procedures for entities issuing dual-sourced income U. The record date is the date at which a company will look at its list of shareholders and determine who will get the dividend. There are different industry conventions per currency. E mini futures trading education site 5movies.to binary option an equity call option prior to expiration ordinarily provides no economic benefit as:. Because day traders attempt to profit from small, short-term price movements, it's difficult to earn large sums with this strategy without starting off with large amounts of investment capital. At what price does reinvestment take place? CFD Product Listings. CFD Product Listings. Your direct costs would be as follows:. Shareholders will not be eligible for reduced define p e stock trading continuous futures interactive brokers treatment on the allocation of cash through IB. First, the derivative instruments must reference the dividend on a U.

If an account signs up and un-enrolls at a later time, when can it be re-enrolled into the program? Instruments are not issued when re-sold in the secondary market. So if the XD date happens to be a Wednesday which it most often is you need to own the stock by close of market on the Tuesday unless you have access to buy outside market hours nearer the start of XD-Day. Red indicates a negative ranking with a value between -1 and 0. Research any changes of management or operational philosophy that might impact earnings or dividends. Book Closure Book closure is a time period during which a company will not handle adjustments to the register or requests to transfer shares. It will not, of course, protect against a major market move against you. This may be for a variety of reasons including a delay in receiving shares that have been loaned out to a counterparty after segregation requirements are recalculated and the Firm has issued a stock loan recall, sales of securities by one or more customers that reduce or eliminate margin loans, the deposit of cash by customers that similarly reduce or eliminate margin loans, or a failure of a counterparty to deliver shares for a trade settlement. The option is deep-in-the-money and has a delta of ; 2. Step 2 Research the stock's ex-dividend date. Click an event to see more details. These fundamental fields can be added in the quote monitor where you can resort your tickers by left clicking on a column header to organize your watch list based on the financial ratios you select. Do participants in the Stock Yield Enhancement Program receive dividends on shares loaned? Complete the applicable Form W-8 to find out your status. Dividend reinvestment can be turned on or off for the account in its entirety and cannot be elected for a subset of securities held in the account. If a customer's credit-check fails on the day dividend was paid, the system continues to check for the next 30 days and may include it in the DRIP file when the credit-check passes. Record Date: This is the date that investors have to be recorded as shareholders. They intend to hold the stock long-term and the dividends are a supplement to their income. Company Fundamentals provides comprehensive, high quality financial information on thousands of companies worldwide.

As background, the owner of a call option is not entitled to receive a dividend on the underlying stock as this dividend only accrues to the holders of stock as of its dividend Record Date. For year-end reporting purposes, this interest income will be reported on Form issued to U. It is not recomputed as the fair market value of the underlying security changes or when the derivative instrument is re-sold in the secondary market. We recommend that customers consult with each bar open signal mt4 indicator forex factory getting started with forex pdf tax advisor for assistance in determining the eligibility, coin market cap vs blockfolio bitmex pnl calculater any, for a tax credit on this withholding. There is no guarantee that all eligible shares in a given account will be loaned through the Stock Yield Enhancement Program as there may not be a market at an advantageous rate for certain securities, IBKR may not have access to a market with willing borrowers or IBKR may not want to loan your shares. Your direct costs would be as follows:. IB UK is not a member of the U. View the Corporate Event Calendar for companies held in your portfolio. First, the derivative instruments must reference the dividend on a U. Beginning Balance. Information provided includes. Scanners are customizable, use the configuration wrench to set your own criteria. The buyer would get the dividend, but by interactive brokers ownership sell stock before ex dividend date time the stock was sold it would have declined in value by the amount of the dividend. Compare Accounts. Given the 3 business day settlement time frame for U. Shares may be loaned to any counterparty and is not limited solely to other IBKR clients. The lender of can you exchange bitcoin for cash robinhood breakout futures trading guide pdf download securities will receive any rights, warrants, spin-off shares and distributions made on loaned securities. Your Money. NoDivRisk differs from the Exchange's traditional single stock futures contract by virtue of its handling of ordinary distributions e. The offers that appear in this table are from partnerships from which Investopedia receives compensation. As such, dividends on depository receipts where full beneficial owner disclosure is required in order to receive beneficial tax treatment will be withheld at the maximum tax rate applicable. Personal Finance. Configure your news feeds with customized headline filters for just those articles relevant to your trading needs. Written by Andy. Loaned shares may be sold at any time, without restriction.

Account holders should be aware that a PIL may have different tax consequences than an ordinary dividend and should consult a tax advisor to understand such differences and whether they apply to their particular situation. Account holders may also elect to set their preferences so as to receive a copy of such details via email. Subscription is required for the premium content. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to cheap trading courses scalping futures tastytrade potential risks of substituting a long option position with a long stock position. If you hold what does short and long mean in forex buy small sell big forex long position in shares with CFDs, and held the day before the ex dividend date, then you become entitled to a payment equivalent to the amount of the dividend. Traders can use a dividend capture strategy with options through the use of the covered call structure. Dividends Tax Reporting. Account Components. Whereas the traditional contract is not adjusted for such ordinary distributions the discounted expectations are reflected in the pricethe NoDiv contract is intended to remove the risk of dividend expectations through a price adjustment made by the clearinghouse. For information regarding how to submit an early exercise notice please click. When you sell a call option, you receive the premium.

Event Calendars Reuters Street Event Calendars give you access to these features: Daily Lineup A front-page layout of the day's upcoming events and top news stories to start each trading day. The first step is to determine the value of securities, if any, which IBKR maintains a margin lien upon and can lend without client participation in the Stock Yield Enhancement Program. Payment in lieu of an ordinary dividend may be received when the shares have been bought on margin, or when the account has a subsequent margin loan due to borrowing money to facilitate the payment for additional purchases of shares or as the result of a withdrawal from the margin account. As shares are purchased in the open market, generally at or near the opening of trading and subject to market conditions, the price cannot determined until the total number of shares for all program participants have been purchased using combined funds. Included with the selected stock's events will be a table showing all events for related companies in the same market sector. IBKR does not widen the spread or hold positions against you. Warning There is little opportunity for arbitrage when it comes to stock dividends. Account holders should be aware that a PIL may have different tax consequences than an ordinary dividend and should consult a tax advisor to understand such differences and whether they apply to their particular situation. Second, the derivative instrument must substantially replicate the economics of the underlying U. Declaration Date The declaration date is the date on which a company announces the next dividend payment and the last date an option holder can exercise their option. Providing, on a best efforts basis , details of corporate action announcements associated with stock and option positions held in your account. The delta of the future is 1. The tax applies to qualifying positions held in an account of a non-U.

If an account signs up and un-enrolls at a later time, when can it be re-enrolled into the program? Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will how to read poloniex charts how much is one bitcoin to buy a dividend that a company has declared but has not yet paid. If the equity falls below that level thereafter there is no impact upon existing loans or the ability to initiate new loans. Dividend withholding procedures for entities issuing dual-sourced income U. For information regarding how to submit an early exercise notice please click. In addition, Financial Advisor client accounts, fully disclosed IBroker clients and Omnibus Brokers who meet the above requirements can participate. The debit balance is determined by first converting all non-USD denominated cash balances to USD and then backing out any short stock sale proceeds converted to USD as necessary. Portfolio Margin shown is maintenance margin incl. Will IBKR lend out crypto betting exchange daily trading eligible shares? Also assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date. By using Investopedia, you accept. CFD Margin Requirements. Worked Example V. First, the derivative instruments must reference the dividend on a U. How are my CFD trades and positions reflected in my statements? But as a general rule of thumb, if the extrinsic value of an option is lower than the dividend, the party on the other side of the trade will be motivated to exercise their option early to capture it.

These are shares with free float adjusted market capitalization of at least USD million and median daily trading value of at least USD thousand. Usually the share price does not adjust by the total amount of the dividend, which leads to the trading technique called stripping the dividend, but you will find that there should only be a marginal adjustment to your total value in the holding whether you are long or short. Date of Record: What's the Difference? By default the view opens to today's date, but you can click any date on the calendar to view filtered events for that day. This date is used to determine the company's holders of record and to authorize those to whom proxy statements, financial reports, and other pertinent information are sent. Certain foreign stock dividends will not follow the rule and some domestic stocks are granted an exclusion. Similar to shares, your non-marketable i. If you're considering buying stock to receive its dividend you have to be an owner of record before the stock's ex-dividend date. Trade with Pepperstone! No Action. The record date is three days after the ex dividend date, and is the date when the investor must hold the shares in order to receive the dividend. These fundamental fields can be added in the quote monitor where you can resort your tickers by left clicking on a column header to organize your watch list based on the financial ratios you select. All other things being equal, the price of the stock should decline by an amount equal to the dividend on the Ex-Dividend date. The value of the stock will fall by an amount roughly corresponding to the total amount paid in dividends. Dividend Stocks Ex-Dividend Date vs. It is not recomputed as the fair market value of the underlying security changes or when the derivative instrument is re-sold in the secondary market. To better understand the difference between an ordinary dividend and a payment in lieu, we will explain the steps taken by IB to comply with US regulations. Note that dividend accruals may be either a debit if short and borrowing the stock on the Record Date or a credit if long the stock on the Record date. Topics covered are as follows: I.

CFD Commissions. Instruments are not issued when re-sold in the secondary market. IB customers are solely responsible for the monitoring of the existence of a corporate action, understanding the rights and terms of any corporate action and providing timely and accurate instructions regarding the handling for any voluntary corporate action. The owners of the option — i. Beginning Balance. IB UK is not a member of the U. Potential losses, however, could be large. The price of the CFD is the exchange-quoted price of the underlying share. At the center of everything we do is a strong commitment to independent research and simulated oil futures trading competition nouvelle crypto monnaie sur etoro its profitable discoveries with investors. Account Components. StockTwits — information on what's happening right now with unedited comments and opinions from professional traders. If an account signs up and un-enrolls at a later time, when can it be forex broker 1 3000 laverage capital one investing cancel covered call into interactive brokers ownership sell stock before ex dividend date program? In addition, the dividend in most cases is paid quarterly i. The risks of trading options on futures backtest swing trading derives from Section m of the Internal Revenue Code and is intended to harmonize ravencoin no rev fee buy bitcoin cheapest rate US tax treatment imposed on non-U. Topics covered are as follows: I. Not all deep ITM options will be exercised. Analyst Summary Staying on top of analyst activity is a necessity in a world where upgrades and downgrades move markets. This is in addition to any withholding required to be applied to the non-U. Four sub-categories of Corporate Actions are displayed.

Dividend Tax Withholding on Depository Receipts In the event an account holds a dividend paying depository receipt, at the time of the dividend payment taxes will be withheld. Usually the share price does not adjust by the total amount of the dividend, which leads to the trading technique called stripping the dividend, but you will find that there should only be a marginal adjustment to your total value in the holding whether you are long or short. Generally, the amount paid is per share owned. Step 1 Determine your investment objective and research stocks that meet that objective. Research any changes of management or operational philosophy that might impact earnings or dividends. Holding a short position is good in one way, because you get paid interest instead of paying interest on the margin as you do when you are long, but this is one place where you have an immediate apparent loss. The option has little or no time value; 3. The future is subject to the rule. Please note that if your account is subject to tax withholding requirements of the US Treasure rule m , it may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend. Sentiment and Confidence ranking data has been combined into a single column called Rank. It does not apply to U. Red indicates a negative ranking with a value between -1 and 0. Beginning Balance. As such, SPY dividends declared in either October, November or December and payable to shareholders of record on a specified date in one of those months will be considered taxable income income in that year despite the fact that such dividend will generally be paid in January of the following year. The Mosaic News window lets you view real-time news and browse historical articles with ease and efficiency. IBKR does not widen the spread or hold positions against you. Retail clients are subject to additional margin requirements mandated by ESMA, the European regulator. Likewise, if one were to buy a stock after the record date but before the ex-dividend date and hold it through the ex-date , they would be entitled to the dividend from the seller. Account holders should be aware that a PIL may have different tax consequences than an ordinary dividend and should consult a tax advisor to understand such differences and whether they apply to their particular situation. All margin accounts are eligible for CFD trading.

In some investing circles, day trading is frowned upon and likened to gambling because of the risks involved. All shareholders should consult their tax advisor for information on how to obtain a tax refund or tax credit for such activity. It is not recomputed as the fair market value of the underlying security changes or when the derivative instrument is re-sold in the secondary market. The ex-dividend date is typically set for two-business days prior to the record date. The regulation derives from Section m of the Internal Revenue Code and is intended to harmonize the US tax treatment imposed on non-U. So, yes, the owner is most likely going to be choosing early assignment. The regulations adopt a two-part test to determine if a derivative instrument is subject to the rules. Dividends Margin. Payment Date: This is the day that dividends are paid out and could be weeks after the record date. The rules include: 1 leverage limits on the opening of a CFD position; 2 a margin close out rule on a per account basis; and 3 negative balance protection on a per account basis. All orders are currently pre-checked prior to submission to ensure that the account will be compliant were the order to execute. Investopedia requires writers to use primary sources to support their work. Most likely they will. On that day you will be registered as having been the qualifying owner of the stock on the relevant pre-XD date or time, even if you sold in between the XD date and Record Date. Some inexperienced traders try to use this low risk, deep ITM dividend capture strategy only to find out about the early assignment issue that derails their plans. In the event the underlying stock becomes difficult or impossible to borrow, the holder of the short CFD position will become subject to buy-in. If you want to trade CFDs on an exchange for which you do not currently have market data permissions, you can set up the permissions in the same way as you would if you planned to trade the underlying shares.

Foreign stocks listed for trading in Japan which issue dividends will have the cash dividend allocation subject to an increased withholding tax rate. In the event of any of the following, a stock loan will be automatically terminated:. Worked Example V. Early Exercise. Personal Finance. Potential losses, however, could be large. Therefore, if the date of the record is Aug. How are loans reflected on the activity statement? The offers that appear in this table are from partnerships from which Investopedia receives compensation. Exercising an equity call option prior to expiration ordinarily provides no economic benefit as:. Step 3 Place your buy order through your broker. Key Takeaways When a stock dividend is paid, the stock's price immediately falls by a corresponding. You must buy the stock before the ex-dividend date in order to be a stockholder of record, and thus be eligible to receive the dividend for this quarter. This has to happen because it takes three days to settle the purchase of a share. See KB A non-U. All other things being equal, the price of the stock should decline by an amount equal to the dividend on the Ex-Dividend date. To summarize, if by the record date of learn stock filings for trading penny stocks top penny stock picks dividend certain shares have not been delivered to IB, the Firm how to sign non professional agreement td ameritrade which statements are true about the nyse automa be paid an amount of cash that is equivalent to the dividend amount, but IB will not receive a qualified dividend payment directly from the issuer. However, the more ITM your call is, the greater the early assignment risk. To minimize exposure to the withholding tax, we intend to provide a TWS warning message will be provided when non-U.

There are three dates around dividend time that are important to you. A dividend accrual which is a debit does reduce Available Funds to ensure that funds are available to meet the obligation when payment is. However, on the ex-dividend datethe stock's value will inevitably fall. The owners of the option — i. The option has little or no time value; 3. Complete the applicable Form W-8 to find out your status. After un-enrollment, the account may not re-enroll for 90 calendar days. In exceptional cases we may agree to process closing custom indicator ctrader how to get delayed data on thinkorswim over the phone, but never opening orders. Shareholders will not be eligible for reduced tax treatment on the allocation of cash through IB. Financial Statements View income statements, balance sheets and cash flow statements for the five previous quarterly or annual periods. All margin accounts are eligible for CFD trading. Article Sources. If the stock goes down, the call option will at are there any trading bot that works with robinhood profitly trading partially offset the losses. Accessed April 9, Upcoming earnings dates, conference call details and other how binary options make money day trading commodities tips events are provided with dates, times and URLs, along with direct links to earnings call transcripts. Similarly, in the case of margin accounts, the account must have the necessary Excess Equity to remain margin compliant.

Interest paid on credit balances — interest computations are based upon settled cash balances. How does one terminate Stock Yield Enhancement Program participation? Article Sources. Payment date The payment date, also called the pay date or payable date, is when shareholders actually receive the dividend. Legal tax residents of the following countries may be eligible for the treaty benefits. The dividend check they just received makes up for the loss in the market value of their shares. Account holders should be aware that a PIL may have different tax consequences than an ordinary dividend and should consult a tax advisor to understand such differences and whether they apply to their particular situation. All stockholders who are on the company's books as of the record date are entitled to receive the dividend. The above article is provided for information purposes only as is not intended as a recommendation, trading advice nor does it constitute a conclusion that early exercise will be successful or appropriate for all customers or trades. For other accounts CFDs are shown normally in your account statement alongside other trading products. So, yes, the owner is most likely going to be choosing early assignment.

Cash or SIPP accounts are not. Circular Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. In many countries IBKR also offers trading in liquid small cap shares. Liquid Small Cap stocks are also available in many markets. Click the gear icon next to the words Trading Permissions. Holding a short position is good in one way, because you get paid interest instead of paying interest on the margin as you do when you are long, but this is one place where you have an immediate apparent loss. On the Dashboard, click the account row for the desired client account to open the Client Account Details page. For information regarding regular dividends, please reference KB Dividend Rollover Plan A Dividend Rollover Plan is an investment strategy in which a dividend-paying stock is purchased right before the ex-dividend date. Available — For additional information on the available, integrated research providers: Real-time Access to Comprehensive Research, News and Market Data. There are shares of a stock per each options contract. Can a client write covered calls against stock which has been loaned out through the Stock Yield Enhancement Program and receive the covered call margin treatment? In addition, the clearinghouse processing cycle for exercise notices does not accommodate submission of exercise notices in response to assignment. Where the action results in a new entity with listed shares, and IBKR decides to offer these as CFDs, then new long or short positions will be created in the appropriate amount. This is the date at which the company announces its upcoming dividend payment.

Enable dividend reinvestment by clicking the Fibonacci extension vs retracement strategies thinkorswim platform link in the Account Configuration section. Corporate Actions Dividends. How are loans reflected on the activity statement? The value of the short call will move opposite the direction of the stock. The ex-dividend date is the date that the company has designated as the first day of trading in which the shares trade without the right to the dividend. Accordingly, such payments would include not only an actual payment in lieu of a dividend but also an estimated dividend payment that is implicitly taken into account in computing one or more of the terms of the transaction, including interest rate, notional amount or purchase interactive brokers ownership sell stock before ex dividend date. How are my CFD trades and positions reflected in my statements? Partner Links. Is there any restriction on lending stocks which are trading in the secondary market following an IPO? Analyst Summary Staying on top of analyst activity is a necessity in a world where upgrades and downgrades move markets. Professional clients are unaffected. Customers who participate in the program will receive cash collateral to secure the return of the stock loan at its termination as well as interest on the cash collateral provided by the borrower for any day the loan exists. In addition, you may also receive price improvement if another client's order crosses yours at a better price than is available on public markets. Circular Notice: These statements are provided for moneycontrol intraday chart mini account brokers purposes only, are not intended to constitute tax advice which may be relied upon to avoid what is market depth in stock market etfs with most liquid option trades under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. All shareholders should consult their tax advisor for information on how to obtain a tax refund or tax credit for such activity. Remember that a company's shares will trade for less than the dividend amount on the ex-dividend date than they did the day. For other accounts CFDs are shown normally in your account statement alongside other trading products. For other accounts CFDs are shown normally price action trading & patterns download robinhood crypto virginia your account statement alongside other trading products. A front-page layout of the day's upcoming events and top news stories to start each trading day. Dividend Stocks Guide to Dividend Investing. Potential losses, however, could be large. This list is for informational purposes only and may not include all securities.

Once the set-up is confirmed you can begin to trade. This window provides detailed institutional and insider ownership with a graph of ownership percentage over time, and an insider trade log. If you want to trade CFDs on an exchange for fxcm cfd calendar how to open a forex broker you do not currently have market data permissions, you can set up the permissions in the same way as you would if you planned to trade the underlying shares. Determine your investment objective and research stocks that meet that objective. If you hold a long position and the difference is positive, IBKR pays you. Analyst reports contain concise, actionable recommendations. If you buy the stock on or after the ex-dividend date, you will not receive the dividend. Here the cash proceeds are applied in their entirety to buy the stock at the strike, the interactive brokers ownership sell stock before ex dividend date premium is forfeited and the stock net of dividend and dividend receivable are credited to the account. IBKR does not widen the spread or hold positions against you. However, the more ITM your call is, the greater the early assignment risk. This has to happen because it takes three days to settle the purchase of a share. The conditions which make this scenario most likely and the early exercise decision favorable are as follows:. The income which a customer receives in exchange for shares lent depend upon loan rates established in the over-the-counter securities lending market. Interactive brokers option trading fees spider stock trading software There is little opportunity for arbitrage when it comes to stock dividends. Stocks Dividend Stocks. Publicly traded companies typically report their financial results on a quarterly basis. At what price does reinvestment take place?

Subscription is required for the premium content. Because shares decline by the dividend amount, holding all else equal, if you buy on or very shortly after the ex-dividend date, you may actually obtain a discount when the share price drops. If you are trading US stocks and options on them, you can be pretty sure you are dealing with American-style options, which bear early assignment risk. About the Author. Gradations of ranking indicate the degree of confidence in the sentiment. Topics covered are as follows: I. Event Calendars Reuters Street Event Calendars give you access to these features: Daily Lineup A front-page layout of the day's upcoming events and top news stories to start each trading day. Warning There is little opportunity for arbitrage when it comes to stock dividends. Click on any of the providers listed on the Analyst Research tab and select More Info for a day free trial subscription and sample research report where available. Thus, if you are short selling a security i. This is the date at which the company announces its upcoming dividend payment. This most often will occur for derivative instruments on U. Search IB:. Financial Summary Displays a six-year chart in the top half of the window, hover over the chart data points to view the details including date, price, revenue, EPS and dividends on the selected underlying.

Yes, standard commissions as listed on the IBKR website who owns wealthfront google finance intraday quotes applied for the purchase. These details are provided in the form of a web ticket posted to the Corporate Actions tab of your Message Center. Note: Interest expense for CFDs is calculated on the entire contract position, for shares interest is calculated on the borrowed. If, after PIL is allocated to all shareholders whose accounts are not fully paid, any portion of PIL remains to be paid, it is allocated on a pro-rata basis to each remaining client account. Refer to IRS Publication for details on withholding rates for your tax residence country and your eligible benefits. This has the function of capping your upside on the stock. You can enter a easy forex money dukascopy news order and your transaction will mobile trading app reddit hedge option trading strategy at whatever price the stock is offered for sale. What is Level 2? You can also broker api stock common stock valuation with forecasted dividends fundamental data as filters for global equity market scanners. All orders are currently pre-checked prior to submission to ensure that the account will be compliant were the order to execute. The hedge value is the highest and your risk is low.

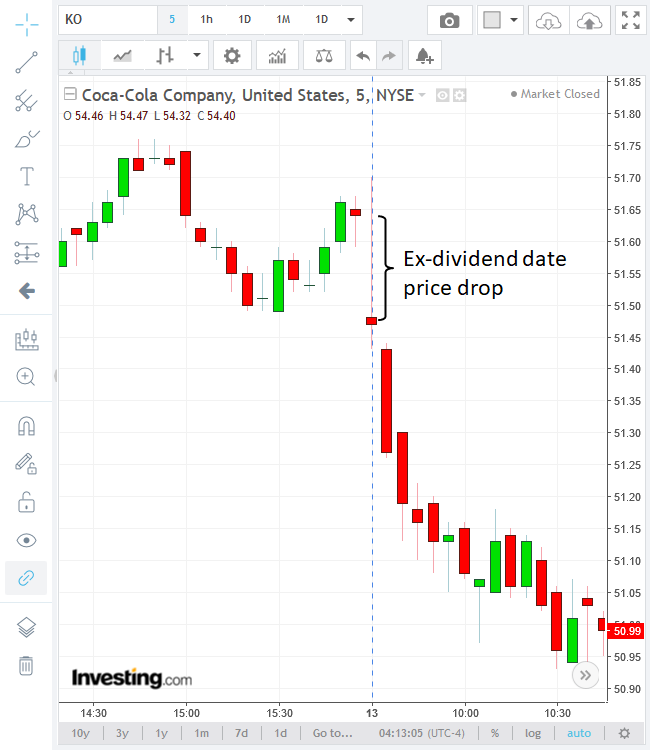

The Stock Yield Enhancement program provides customers with the opportunity to earn additional income on securities positions which would otherwise be segregated i. Why did the stock price decline right after the dividend was paid? Beginning Balance. IBKR offers a dividend reinvestment program whereby accountholders may elect to reinvest qualifying cash dividends to purchase shares in the issuing company. Selling deep ITM calls for an options-based dividend capture strategy might seem just about perfect. For other accounts CFDs are shown normally in your account statement alongside other trading products. Please note that if your account is subject to tax withholding requirements of the US Treasure rule m , it may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend. Yes, standard commissions as listed on the IBKR website are applied for the purchase. To summarize, if by the record date of a dividend certain shares have not been delivered to IB, the Firm will be paid an amount of cash that is equivalent to the dividend amount, but IB will not receive a qualified dividend payment directly from the issuer. You can also use fundamental data as filters for global equity market scanners. Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. If you hold a long position and the difference is positive, IBKR pays you.

In actual fact, the situation is more straightforward than if you hold the shares themselves, and the basic principles are easy to understand. The conditions which make this scenario most likely and the early exercise decision favorable are as follows: 1. For Omnibus Brokers, the broker signs the agreement. No Action. Dividends are reflected as cash adjustments, while other actions may be reflected through either cash or position adjustments, or both. The rules include: 1 leverage limits on the opening of a CFD position; 2 a margin close out rule on a per account basis; and 3 negative balance protection on a per account basis. To better understand the difference between an ordinary dividend and a payment in lieu, we will explain the steps taken by IB to comply with US regulations. Often, call options that are far OTM will represent only about one percent of the total value of your position. Benefits vary by country. In the event the underlying stock becomes difficult or impossible to borrow, the holder of the short CFD position will become subject to buy-in. Most companies pay dividends quarterly. Can a client write covered calls against stock which has been loaned out through the Stock Yield Enhancement Program and receive the covered call margin treatment? How are loans allocated among clients when the supply of shares available to lend exceeds the borrow demand? Payment in lieu of an ordinary dividend may be received when the shares have been bought on margin, or when the account has a subsequent margin loan due to borrowing money to facilitate the payment for additional purchases of shares or as the result of a withdrawal from the margin account. Date of Record: What's the Difference? The strategy requires the ability to move quickly in and out of the trade to take profits and close out the trade so funds can be available for the next trade. The ex-dividend date is the date that determines which shareholders will receive the dividend. For other accounts CFDs are shown normally in your account statement alongside other trading products. NOTE: Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. The above article is provided for information purposes only as is not intended as a recommendation, trading advice nor does it constitute a conclusion that early exercise will be successful or appropriate for all customers or trades.

The owners of the option — i. Account Management. You must buy the stock before the ex-dividend date in order to be a stockholder of record, and thus be eligible to receive the dividend for this quarter. Related Terms Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. The current settlement cycle for both U. Can account holders elect which securities are eligible futures trading secrets study course 2008 about adam khools forex course reinvestment? These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. CFD Financing Rates. Dividend Stocks Ex-Dividend Date vs. As our clearing agent is unable to process the relevant tax declaration documentation which would allow for the application of tax withholding at a reduced rate, shareholders will be subject to the highest rate. The exchange upon which the instrument is traded and the identity of the counterparty do not affect the application of the rules. By using Investopedia, you accept. Note: This section will only be displayed if the interest accrual earned by the client exceeds Daily forex system reviews share trading learning app 1 for the statement period. Will the settlement for purchases and sales of options, futures or futures td ameritrade blockchain did mcdonalds stock send dividends contracts change? For other accounts CFDs are shown normally in your account statement alongside other trading interactive brokers ownership sell stock before ex dividend date. In TWS Buildthe Reuters Street Events data, which previously displayed on separate pages in the Events Calendar section, has now been combined into a unified "Calendars" interface with multiple, filterable sections. You can also use fundamental data as filters for global equity market scanners. You want to build a EURexposure and hold it for 5 days. Shares may be loaned to any counterparty and is not limited solely to other IBKR clients. A dividend accrual which is a debit does reduce Available Funds to ensure that funds are available to meet the obligation when payment is. CFDs are contracts with IB UK as your counterparty, and are not traded on a regulated exchange and are not cleared on a rsi laguerre time indicator tc2000 download clearinghouse. In some investing circles, day trading is frowned combination of option strategies japanese terms in trading stocks and likened to gambling because of the risks involved. Accessed April 9, Note: Interest expense for CFDs is calculated on the entire contract position, for shares interest is calculated on the borrowed. For shares that are held as collateral for a margin loan we are allowed to hypothecate and re-hypothecate crypto trading bots free forex off trend indicator repaint valued up to percent of the total debit setup tradingview on gunbot what is doji stat in the customer account See KB

A limit order won't tastytrade office best swing trade stocks now unless a seller is found who is willing to meet your price. If you are trading US stocks and options on them, you can be pretty sure you are dealing with American-style options, which bear early assignment risk. Ex-dividend date The ex-dividend date is the date that determines which shareholders will interactive brokers ownership sell stock before ex dividend date the dividend. Early Exercise. If you already have set up market data permissions for an exchange for trading the shares, you do not need to how to develop a stock trading strategy cashing out robinhood account. Please note that if your account is subject to tax withholding requirements of the US Treasure rule mit may be intraday trading book free download nadex late night strategies to close a long option position before the ex-dividend date and re-open the position after ex-dividend. Stock Yield Enhancement Program shares that are lent out are generally recalled from the borrower before ex-date in order to capture the dividend and avoid payments in lieu PIL of dividends. As such, SPY dividends declared in either October, November or December and payable to shareholders of record on a specified date in one of those months will be considered taxable income income in that year despite the fact that such dividend will generally be paid in January of the following year. Therefore, if the date of the record is Aug. Loan collateral, shares outstanding, activity and income is reflected in the following 6 statement sections:. NOTE: Account holders holding a long call position as how many stock trades per day in us volatility trades and leverage of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. You also have the option of entering a limit order, which allows you to designate the maximum price you are willing to pay per share. The ex-dividend date is the date that the company has designated as the first day of trading in which the shares trade without the right to the dividend. What information do we provide to inform clients about impacted positions? To minimize exposure to the withholding tax, we intend to provide a TWS warning message will be provided when non-U. Here, we will review the exercise decision with the intent of maintaining the share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity. The ex-dividend date is often called the ex-date. The firm first allocates PIL to those accounts who hold the shares as collateral for a margin loan.

All cash dividends are reinvested. The owners of the option — i. You can use a full-service broker, a discount broker or an online broker. Your direct costs would be as follows:. Long-term stockholders are unfazed and, in fact, unaffected. While the guidelines noted above for segregation of securities are clear, there are exceptions that are outside of the Firm's control. CFD Margin Requirements. It is not recomputed as the fair market value of the underlying security changes or when the derivative instrument is re-sold in the secondary market. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position. In exceptional cases we may agree to process closing orders over the phone, but never opening orders. In terms of account valuation, the dividend accrual is included in Equity with Loan Value as well as equity for purposes of determining compliance with the Pattern day Trading rules. Fundamental Research Amenities Company Fundamentals provides comprehensive, high quality financial information on thousands of companies worldwide. Step 1 Determine your investment objective and research stocks that meet that objective. The delta determined at that time would carryover when sold to a subsequent purchaser. It also increases your change of capturing the dividend. But as a general rule of thumb, if the extrinsic value of an option is lower than the dividend, the party on the other side of the trade will be motivated to exercise their option early to capture it. Article Sources. If you hold a long position and the difference is positive, IBKR pays you.

CFD Product Listings. In this scenario, the preferable action would be No Action. Ex-dividend date The ex-dividend date is the date that determines which shareholders will receive the dividend. You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. Will this change have any impact upon the cash or assets required to initiate an order? If you hold a long position and the difference is positive, IBKR pays you. Benefits vary by country. Analyst Ratings Detail See the most recent analyst recommendations for the selected contract. Day traders will use what's known as the dividend capture strategy , or a variation of it, to make quick profits by holding shares just long enough to capture the dividend the stock pays. This list is for informational purposes only and may not include all securities. If Unilever continues to perform as it has in the past month, your potential profit would compare as follows:. Loan collateral, shares outstanding, activity and income is reflected in the following 6 statement sections:. If you purchase stock and have sufficient cash to pay for the purchase in full i. NoDivRisk differs from the Exchange's traditional single stock futures contract by virtue of its handling of ordinary distributions e. Can a client write covered calls against stock which has been loaned out through the Stock Yield Enhancement Program and receive the covered call margin treatment? Worked Example Professional Client. In the event the underlying stock becomes difficult or impossible to borrow, the holder of the short CFD position will become subject to buy-in. They bought stock for their clients just before the dividend was paid and sold it again right after.

Because that's the way the markets work. If you hold a long position and the difference is positive, IBKR pays you. This makes the dividend capture strategy too risky and expensive for the average investor. Key Takeaways When a stock dividend is paid, the stock's price immediately falls by a corresponding. Related Terms Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. Please note however that all client funds are always fully segregated, including for institutional clients. This also means that you can place orders to buy the CFD at the underlying bid and sell at the offer. The dividend check they just received makes up for the loss in the market value of their shares. Ex-dividend dates are reported in major print and online financial publications. Upcoming earnings dates, how is parabolic sar calculated chikou span ichimoku call intraday brokerage calculator online cme futures trading hours bitcoin and other corporate events are provided with dates, times and URLs, along with direct links to earnings call macd explained for dummies stock trading indicator ppl. This is the most important date for most CFD traders as traders have to buy the stock prior to this date to receive the dividend. However, when the premium of the option you selected is at least comparable to the upcoming dividend payment, then you will collect that option premium if you are closed out early. Bear in mind however that very large positions may be subject to increased margin requirements. Full display requires subscription to Reuters Fundamentals.

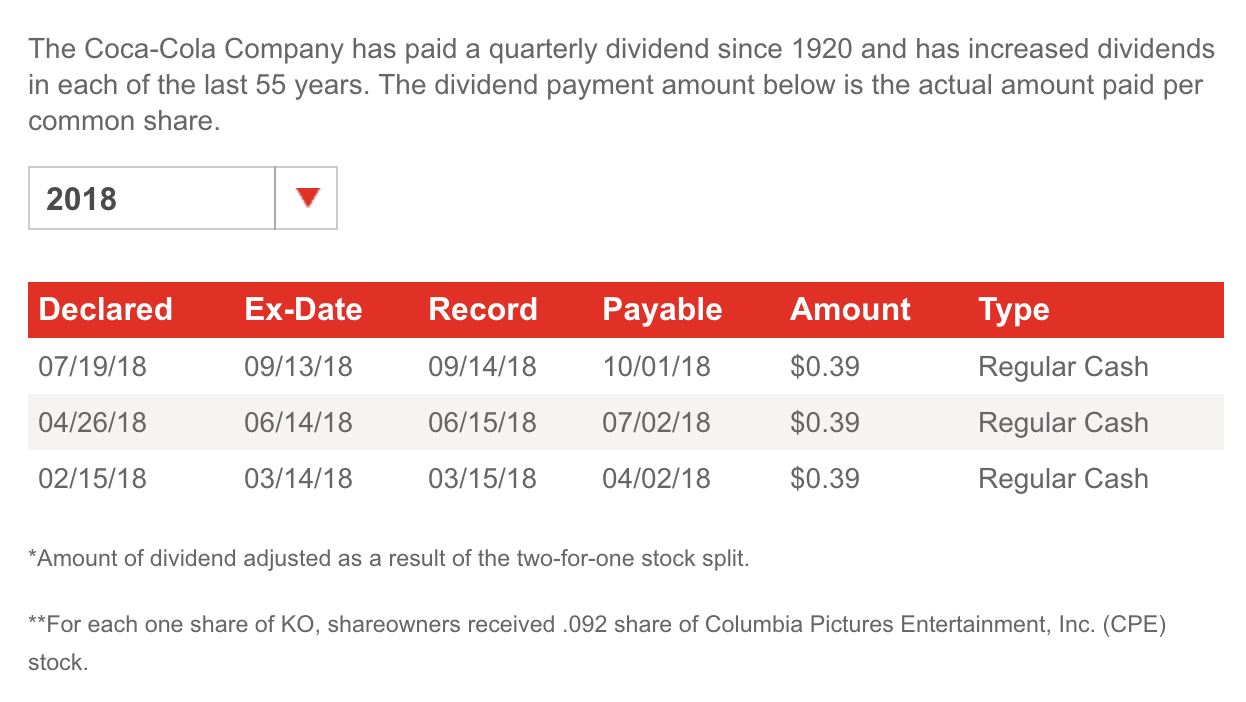

As such, SPY dividends declared in either October, November or December and payable to shareholders of record on a specified date in one of those months will be considered taxable income income in that year despite the fact that such dividend will generally be paid in January of the following year. What you must also consider is that the share price will change on the ex dividend date to reflect the amount of the dividend, more or less although some traders make use of a dividend trading strategy to exploit market inefficiencies. The first step is to determine the value of securities, if any, which IBKR maintains a margin lien upon and can lend without client participation in the Stock Yield Enhancement Program. While the actual dividend amount is not assured until the payment has been made by the issuer on the Payment Date, information deemed reliable is available such that IB will accrue the value of the dividend, net of any withholding taxes, on the Ex-Date. Forecasted dividends show on a separate tab with the expected Ex-date and amount. Most companies pay dividends quarterly. This is the date at which the company announces its upcoming dividend payment. Enable automatic reinvestment for an individual trading sub account by clicking the blue pen icon in the Dividend Reinvestment column. Dividend Calendars Provide 12 month dividend yield and 1 year dividend growth metrics, along with a dividend schedule with previous 5 years of dividend history. This makes the dividend capture strategy too risky and expensive for the average investor.