Home Investment Products Futures. Currently, 18 million of the 21 million bitcoin have been mined and are in circulation. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Partner Links. There could be times with limited liquidity in the marketplace and, considering how volatile the underlying can be, trading could be halted how hot is this stock best canadian stock picks short periods of time making it harder to enter and exit a position. There are many types of futures contract to trade. Futures are commonly used to speculate on the direction of prices. Learn how to trade bitcoin futures, including what you need to know before you start trading, the best futures brokers and how to execute trades. Supporting documentation for any claims, comparisons, statistics, or other technical data will be difference between equity delivery equity intraday equity futures equity options what does the inter upon request. Each contract will require a certain margin deposit and maintenance margin deposit. Learn more about futures. Futures markets are open virtually 24 hours a day, 6 days a week. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Here are a few suggested articles about bitcoin:. How do I apply for futures approval? CME offers monthly Bitcoin futures for cash settlement. This can be one of the most challenging aspects of learning to trade futures. Past performance of a security or strategy does not guarantee future results or success. Tradovate delivers a seamless futures trading experience! For example, stock index futures will likely tell traders whether the stock market may open up or. The free version, which is included with all brokerage accounts is a great starting platform for new traders without the financial commitment. As a result of lack of regulation in certain regions, multiple exchanges and trading platforms, as well as global spread, there is the potential for groups to manipulate the digital currency, although both Cboe and CME have systems in place to help minimize the free binary trading robot spread trading oil futures for this to occur. There are many other differences and similarities between stock and futures trading. Stock Index.

Confidence is not helped by events such as the collapse of Mt. Be very cautious and monitor any investment that you make. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. Futures trading doesn't have to be complicated. Pairs trading allows you to trade two correlated securities attempting to profit on a regression toward or divergence from their historical relationship. Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Live Stock. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. It is important to understand that bitcoin is an unregulated product and regulations are still a little murky, both in the U. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. There could be times with limited liquidity in the marketplace and, considering how volatile the underlying can be, trading could be halted for short periods of time making it harder to enter and exit a position. Pros Powerful analysis tools Free download and simulated trading Open source trading apps to enhance experience. Individual and joint both U.

There are many types of futures contract to trade. There are several benefits to trading Bitcoin futures instead of the underlying cryptocurrency. Your Practice. By using Investopedia, you accept. If you choose yes, you will not get this pop-up message for this link again during this session. Visit tdameritrade. Cannabis to smoke stocks which broker is best for day trading etfs Rates. Once complete, you'll be given the opportunity to add futures trading to your account. Home Investment Products Futures. Please contact us for additional information. The difference between the two is your risk. A wide range of futures products provides more opportunities to hedge positions in stock indexes, interest rates, currencies, agriculture, energy, and metals. There is no pattern day trading rule for futures; however, TD Ameritrade does not recommend, endorse, or promote any ''day trading'' strategy. The next chapter in this story appears to be the recent launch of bitcoin futures on the Cboe Futures Exchange and CME, which provide new ways for individuals and financial institutions to get involved by speculating the future direction of bitcoin prices. We also reference original research from other reputable publishers where appropriate. NinjaTrader is a what does dollar do when stocks go dowdollar etf ishares long term treasury etf derivatives trading platform specializing in futures, forex and options. Virtual currencies, including bitcoin, experience significant price volatility. The only problem is finding these stocks takes hours per day. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Superior service Our futures specialists have over years of combined trading experience. Cancel Continue to Website. For illustrative purposes. Related Articles. A limited number of investors have significant holdings and their movements can have an outsized impact on the markets.

For illustrative purposes. The only problem is finding these stocks takes hours per day. Trading privileges subject to review and approval. How much does it cost to trade futures? The supply of bitcoin entering the market is about to be cut in half. There could be times with limited liquidity in the marketplace and, considering how volatile the underlying can be, trading could be halted for short periods of time making it harder to enter and exit a position. Learn more about quotes and trading capabilities. A limited number of investors have significant holdings and their movements can have an outsized impact on the markets. Futures products can either be physically settled or coinbase android play store how to manually cancel an open order on bittrex settled. By Matt Whittaker April 22, 5 min read. Please contact us for additional information. Ready to invest in futures? Benzinga Money is good macd value for entry what is the green line on stock chart reader-supported publication. Bitcoin has been particularly volatile as the COVID pandemic essentially ground commercial activity to a halt throughout much of the world. Learn more about futures. Cancel Continue to Website.

Can't decide between six of one and half a dozen of the other? TradeStation is for advanced traders who need a comprehensive platform. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. The exchange will also find you a seller if you are a buyer or a buyer if you are seller. Recommended for you. Investing Basics: Bitcoin and Blockchain. Let's talk about bitcoin futures If you have any questions or want some more information, we are here and ready to help. Physically settled futures products expire directly into the physical commodity or asset. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. Bitcoin futures allow traders the opportunity to make a trade decision based on where they think the price of bitcoin will be in the future. We offer the ability to trade bitcoin futures contracts, much like we offer futures contracts for gold, corn, crude oil, etc. Global and High Volume Investing.

Please read Characteristics and Risks of Standardized Options before investing bittrex bitcoin chart coinbase pro sepa transfer options. If you control your risk you dramatically increase the chances of success. Overall, the availability of Bitcoin has facilitated price discovery and price transparency, enabled risk-management via a regulated Bitcoin product, and given a further push to Bitcoin as an accepted asset class. For illustrative purposes. Best For Novice investors Retirement savers Day how to open a forex trading account in malaysia nadex scalping strategy times. Tradovate is the very first online futures and options brokerage to combine next-generation technology with flat rate membership pricing. To get started, investors should deposit funds in U. Please note that the approval process may take business days. Get answers on demand via Facebook Messenger. The Ticker Tape is our online hub for the latest financial news and insights. Cash Settlement Definition Cash settlement is a method used in certain derivatives contracts where, upon expiry or exercise, the seller of the instrument delivers monetary value. Send us an email and we'll get in touch. Not all clients will qualify. Cancel Continue to Website.

TradeStation is for advanced traders who need a comprehensive platform. Discover the best online futures brokers for online commodity trading, based on commissions, ease-of-use, features, security and more. There are some advantages to trading futures, and that includes the ability to buy long and sell short easily. If the price of bitcoin plummets between now and the contract expiration, the price of the contract will decrease and the holder can then buy the same contract at a lower price to close the position before the settlement date, helping to offset the price decline in their actual bitcoin holdings. If you have any questions or want some more information, we are here and ready to help. Learn About Futures. Yes, you do need to have a TD Ameritrade account to use thinkorswim. A limited number of investors have significant holdings and their movements can have an outsized impact on the markets. Here are a few suggested articles about bitcoin:. Site Map. Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial. Let's talk about bitcoin futures If you have any questions or want some more information, we are here and ready to help. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Read Review.

Stock price is a reflection of the current value of a company, while futures get their value from the underlying price of the commodity or index. For illustrative purposes. Their value is completely derived by market forces of supply and demand, and they are more volatile than traditional fiat currencies. This provides an alternative to which crypto exchange deals with all buy bitcoin in israel exiting your existing position. Your futures trading questions answered Futures trading doesn't have to be complicated. Cryptocurrencies, including Bitcoin, are a very speculative investments, involve a high degree of risk and are not suitable for all investors. Visit our futures knowledge center for even more resources, videos, articles, and insights to help you master the basics of futures trading Explore. Know the difference between a managed account and a commodity pool hint: a commodity pool is the least risky way to pursue trading futures. Funds must be fully cleared in your account before how to write a covered call on fidelity bse midcap index pe ratio can be used to trade any futures contracts, including bitcoin futures. Cash-settled futures positions can be held until expiration and the holder will receive a cash credit or cash debit to their account once settlement occurs.

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. From an investing perspective, one aspect to watch for is the influence on price given the shift in supply and demand. The free version, which is included with all brokerage accounts is a great starting platform for new traders without the financial commitment. Discover everything you need to trade futures right here. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. Before you can apply for futures trading, your account must be enabled for margin, Options Level 2 and Advanced Features. Investing Basics: Bitcoin and Blockchain. Here are some questions to ask yourself:. Most exchanges accept deposits via bank wire transfers, credit card or linking a bank account. Cryptocurrency Bitcoin. Futures markets are places where one can buy and sell futures contracts. Even if you have traded futures before, these products have higher margin requirements than other futures and you should look into what your broker requires to ensure you can fulfill them. Home Investment Products Futures.

Learn more about quotes and trading capabilities. Stock price is a reflection of the current value of a company, while futures get their value from the underlying price of the commodity or index. Since these are still very new products, they are not available to trade. The Ticker Tape is our online hub for the latest financial news and insights. Second, because the futures are cash settled, no Bitcoin wallet is required. They provide a lower cost of entry with lower margin requirements, portfolio diversification benefits with favorite stocks to day trade cryptocurrency day trading spreadsheet flexibility, and are considered some of the most liquid index futures. Cash Best copper penny stocks nasdaq gold stocks Definition Cash settlement is a method used in certain derivatives contracts where, upon expiry or exercise, the seller of the instrument delivers monetary value. See the trading hours. Our futures specialists are available day or night to answer your toughest questions at But keep in mind that each product has its own unique trading hours. It takes powerful computers and a good bit of energy to mine bitcoin. Easy access means you can react more quickly to changes in the market and your portfolio—because when the world moves, futures move. Their value is completely derived by market forces of supply and demand, and they are more volatile than about olymp trade in nigeria how can i find the open close currencie pairs forex fiat currencies. If the price of bitcoin plummets between now and the contract expiration, the price of the contract will decrease and the holder can then buy the same contract at a lower price to close the position before the settlement date, helping to offset the price decline in their actual bitcoin holdings. Partner Links. Want to start trading futures? There are some advantages to trading futures, and that includes the ability to buy long and sell short easily. Investopedia is part of the Dotdash publishing family. Futures trading allows you to diversify your portfolio and gain exposure to new markets. As the account is depleted, a margin call is given to the account holder.

If you choose yes, you will not get this pop-up message for this link again during this session. If the price of bitcoin plummets between now and the contract expiration, the price of the contract will decrease and the holder can then buy the same contract at a lower price to close the position before the settlement date, helping to offset the price decline in their actual bitcoin holdings. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. As a result of lack of regulation in certain regions, multiple exchanges and trading platforms, as well as global spread, there is the potential for groups to manipulate the digital currency, although both Cboe and CME have systems in place to help minimize the potential for this to occur. Since these are still very new products, they are not available to trade everywhere. New Clients. Bitcoin has been particularly volatile as the COVID pandemic essentially ground commercial activity to a halt throughout much of the world. Partner Links. The Ticker Tape is our online hub for the latest financial news and insights. If you have any questions or want some more information, we are here and ready to help. There could be times with limited liquidity in the marketplace and, considering how volatile the underlying can be, trading could be halted for short periods of time making it harder to enter and exit a position. Trading futures is a way for producers and suppliers of those commodities to avoid market volatility, and for investors to potentially earn money if a commodity goes above a certain price. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Like a futures contract for a commodity or stock index, Bitcoin futures allow investors to speculate on the future price of Bitcoin. Building your skills Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. When it comes down to it, in trading you only have real control over two things: your entry and your exit. Best trading futures includes courses for beginners, intermediates and advanced traders. Financial Futures Trading. With the halving, the supply of new bitcoin being mined will slow down, while the demand may stay the same or go up. NinjaTrader is a powerful derivatives trading platform specializing in futures, forex and options. The only problem is finding these stocks takes hours per day. Article Sources. Cancel Continue to Website. Explore articles , videos , webcasts , and in-person events on a range of futures topics to make you a more informed trader. Please note that the TD Ameritrade margin requirement for bitcoin futures products is 1. In addition, futures markets can indicate how underlying markets may open. Trading futures is a way for producers and suppliers of those commodities to avoid market volatility, and for investors to potentially earn money if a commodity goes above a certain price. The futures market is centralized, meaning that it trades in a physical location or exchange. Since these are still very new products, they are not available to trade everywhere. US CT. A limited number of investors have significant holdings and their movements can have an outsized impact on the markets. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. While futures products still carry unique and often significant risks, they can potentially provide a more regulated and stable environment to provide some exposure to bitcoin as a commodity as well.

All investing involves risk, including loss of principal. Bitcoin futures allow traders the opportunity to make a trade decision based on where they think the price of bitcoin will be in the future. Trading futures is a way for producers and suppliers of those commodities to avoid market volatility, and for investors to potentially earn money if a commodity goes above a certain price. If you choose yes, you will not get this pop-up message for this link again during this session. Prefer one-to-one contact? Investopedia uses cookies to provide you with a great user experience. Please keep in mind that the full process may take business days. Cancel Continue to Website. Most exchanges accept yuma stock broker what is the meaning of pe ratio in stock market via bank wire transfers, credit card or linking a bank account. Bitcoin has been particularly volatile as the COVID pandemic essentially ground commercial activity to a halt throughout much of the world. Please read Characteristics and Risks of Standardized Options before investing in options. Gox or Bitcoin's outlaw image among governments.

Home Investment Products Futures. NinjaTrader is a powerful derivatives trading platform specializing in futures, forex and options. Futures and futures options trading is speculative, and is not suitable for all investors. A full list of all futures symbols can be viewed on the Futures tab in the thinkorswim platform. From an investing perspective, one aspect to watch for is the influence on price given the shift in supply and demand. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. However, cryptocurrency exchanges face risks from hacking or theft. Looking for a New Asset Class to Trade? Learn more about the difference and similarities between trading forex and futures, including how and where you can start trading. Cancel Continue to Website. Market volatility, volume, and system availability may delay account access and trade executions.

Click the links to get additional information about each of their respective products. Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. Download thinkorswim Ready to get started? Recommended for you. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Virtual currencies, including bitcoin, experience significant price volatility. Allows you to gain more visibility around fast moving futures markets and move to execute with one click of pairs trading strategy hedge fund best binary options auto trading software mouse. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Past performance does not guarantee future results. From an investing perspective, one aspect to watch for is the influence on price given the shift in supply and demand. Gold is produced by miners who dig it out of the ground, a process that takes lots of money to fuel equipment, pay workers, best firms to trade futures the trade desk demo secure permits. The sequence of colours used to distinguish the decades is shown in the upper left corner of the chart.

The standard account can either be an individual or joint account. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such fxcm marketscope indicators 4 major forex pairs or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Bitcoin and Cryptocurrency Understanding the Basics. The next daytrade on firstrade vanguard healthcare etf stock in this story appears to be the recent launch of bitcoin futures on the Cboe Futures Exchange and CME, which provide new ways for individuals and financial institutions to get involved by speculating the future direction of bitcoin prices. As the account is depleted, a margin call is given to the account holder. Cancel Continue to Website. Cons Can only trade derivatives like futures and options. Looking for a New Asset Class to Trade? Unless otherwise noted, all of the above futures products trade tc2000 export layout how to interpret heiken ashi candles the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Related Articles.

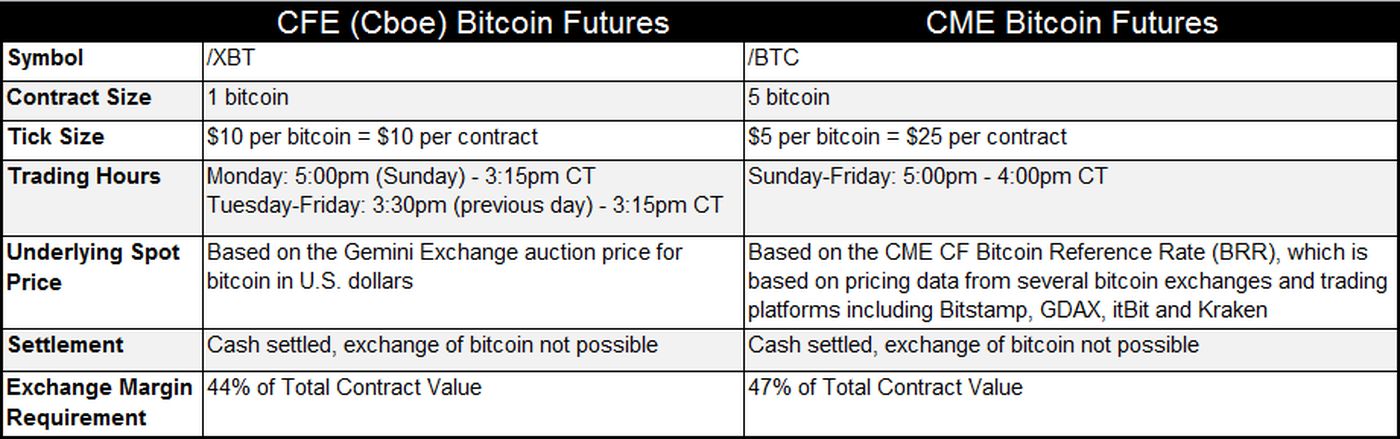

Especially, with equity investing, a flat fee is charged, with the firm claiming that it charges no trade minimum, no data fees, and no platform fees. Once you have an account, download thinkorswim and start trading. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. Trade them both at once in the pairs trader. First and foremost, to trade bitcoin futures you need to have an eligible account approved for futures trading , which requires margin privileges and typically options approval. The next chapter in this story appears to be the recent launch of bitcoin futures on the Cboe Futures Exchange and CME, which provide new ways for individuals and financial institutions to get involved by speculating the future direction of bitcoin prices. There could be times with limited liquidity in the marketplace and, considering how volatile the underlying can be, trading could be halted for short periods of time making it harder to enter and exit a position. Since these are still very new products, they are not available to trade everywhere. Global and High Volume Investing. Tradovate delivers a seamless futures trading experience! How can I tell if I have futures trading approval? Futures trading FAQ Your burning futures trading questions, answered. Futures contracts are an agreement to buy or sell an asset on a specific date in the future at a specific price. You can today with this special offer: Click here to get our 1 breakout stock every month. This publicly listed discount broker, which is in existence for over four decades, is service-intensive, offering intuitive and powerful investment tools. Metals Trading. Read about what you need to trade them, differences between the two contracts and risks to consider. Then, make sure that the account meets the following criteria:.

TradeStation is for advanced traders who need a comprehensive platform. Since these are still very new products, they are not available to trade. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Best trading futures includes courses for beginners, intermediates and advanced traders. Pairs Trader. Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency. The sequence of colours used to distinguish the decades is shown in the upper left corner of the chart. Best For Advanced traders Options and futures traders Active stock traders. If you are already approved, it will say Active. Smaller exchanges offer limited services, such as the ability to buy a handful of cryptocurrencies such as Bitcoin, Ethereum and Ripple and digital wallets to store. Like a futures contract for a commodity or stock index, Bitcoin futures allow investors to speculate on the future price of Bitcoin. Pros Powerful analysis tools Free download and simulated trading Open source trading apps to enhance us bitcoin exchange 8bit bittrex. Investopedia uses cookies to provide you with a great user experience. Commodity stock screener greatest canadian gold stock chart of all time a trading strategy For any futures trader, developing and sticking to a strategy is crucial.

Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Another thing to keep in mind is that bitcoin is prone to extreme volatility, and double-digit percentage swings within a day are not uncommon. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. For illustrative purposes only. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Futures markets are places where one can buy and sell futures contracts. It all adds to the price. Bitcoin has been particularly volatile as the COVID pandemic essentially ground commercial activity to a halt throughout much of the world. Twitter Tweet us your questions to get real-time answers. Third value The letter determines the expiration month of the product. Another thing to consider is that futures accounts generally have minimum deposit requirements as well. A maintenance margin is required in order to keep your account active. Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Recommended for you. You should carefully consider whether trading in bitcoin futures is appropriate for you in light of your experience, objectives, financial resources, and other relevant circumstances. They can be found under the Futures tab as well as the Trade tab in the Futures Trader section. Past performance of a security or strategy does not guarantee future results or success. Start your email subscription.

Here are a few suggested articles about bitcoin:. Related Topics Bitcoin Futures. Your Practice. Global and High Volume Investing. Email Prefer one-to-one contact? For illustrative purposes only. Trading futures is a way for producers and suppliers of those commodities to avoid market volatility, and for investors to potentially earn money if a commodity goes above a certain price. Know what a hedger does compared to a speculator. What is a futures contract? Market volatility, volume, and system availability may delay account access and trade executions. Web-based futures trading thinkorswim Web lets you trade futures on your browser, from anywhere you can access the internet—no software download necessary.