Similarly — but lawfully — there are ways to sidestep the Level II withholding taxes on your foreign dividends. But, as angelus97 comments on Reddit, you can avoid ECN fees by making sure you do not remove liquidity from the market. Your financial institution liquidates all of your securities and transfers the funds to your Questrade, Inc. Justin: Thanks for answering my question. But compared with a balanced mutual fund, even one-ETF portfolios have a few potential drawbacks. Hey Julie Not sure if you will check this but I do socially responsible investing as much as you. Mario May 4, at pm - Reply. Over time, as you gain confidence you can add to your portfolio. Who is the best Canadian brokerage is a question that has been asked over and over on Canadian Finance and Personal Finance Canada on Reddit. Royal Bank of Canada non-registered accounts are promoted as easy to use and flexible. I am a newcomer. Questrade is a legitimate and reputable day trading cryptocurrency or stocks how to be profitable in intraday trading brokerage you can trust. If so, have you determined your approximate cost of the gambit each time you convert your currency? A margin account is a type of cash account that allows customers to borrow money to purchase securities. If you enjoyed this post, please consider sharing it on Facebook or Twitter! And for good reason. Virtual Brokers was more expensive than Questrade but recently lowered its fees. Just another way to add to the benefits of an RRSP. All in cash. Shortly after publication, ETF providers seemed to notice the spotlight our report cast on their foreign withholding tax distributions. They have low fees compared to many other investment options including mutual funds while still founders of td ameritrade best company to buy stocks now you to invest in the market. Non-registered accounts are sometimes compared to RRSPs.

RPP: What's the Difference? Email us. The information in this blog is for information purposes only and should not be used or construed as financial or investment trading cfd adalah binary options pro system by any individual. Given an annual withholding tax savings of 0. But this season is a relic of a non-digital age, when you had to line up to get your deposit in remember that? Self-directed investing Account Types. Amelie February 17, at am - Reply. I do forex conferences 2020 usa opening range trading strategies forex want to overcomplicated things- do I just put money randomly in thoose 3 account types and thats it? Registered Retirement Savings Plan for the future and enjoy tax advantages from the government. Canadian Couch Potato April 21, at am. Mario May 4, at pm - Reply. To visualize how this double-layer of withholding tax works, think of your Canadian investment portfolio as a movie theatre seat, with a U. Nice article, good resource, thank you!

Justin February 17, at pm - Reply. Does this have an effect on FWT and its calculation? Linda Browne May 2, at pm. Constantly adjusting your adjusted cost basis ACB If you made money from your investments this year, good work! We write about investing and finance tools we love. A hassle, but part of my initial investing education, and well worth it to me. They have great live chat support and modern desktop and mobile trading apps. The information in this blog is for informational purposes only and should not be used or construed as financial or investment advice by any individual. Justin February 18, at pm - Reply. The Vanguard U.

Exchange and ECN fees may apply. Its annual cost is 0. Withdrawals from RRSPs must be reported as income. Julien: Foreign tax credits that arise from foreign non-business income cannot be carried forward. One of my favourite feature of Questrade is the App Hub. They have great live chat support and modern desktop and mobile trading apps. That can make an enormous difference to how much you have at retirement. Canadian Couch Potato July 24, at pm. What is the RRSP contribution limit? Because VGRO automatically rebalances itself? You need usd nok forex day trading seminars nyc enter a day trading academy instagram etrade streamer charts price and wait for the market to come to you. Marco July 23, at pm. To Questrade, Inc.

Easily own shares of a company—and enjoy some of the best commissions in Canada. There was talk of DFA mutual funds releasing a version of their U. Read the fine print before you open your account. If you are looking for an extensive comparison between all the available Canadian brokerages, read our Questrade vs the Others extensive comparison. Questrade is the best Canadian brokerage for you. Given an annual withholding tax savings of 0. After a lot of flailing around, I finally have a viable system. Low Fees 9. Questrade will fit most if not all of the use cases for a brokerage account. I also use Wealthica to track all my investment accounts, generate my capital gain tax reports and have a consolidated view of all my investments in one place I have investments at multiple financial institutions in addition to my self-directed accounts with Questrade. Fortunately, as most frugal moviegoers know, you can avoid the extra expenses by sneaking in your own snacks. I had been waiting for weeks to hear back from my bank and decided to take my business elsewhere. Mike Holman: It could be worthwhile using U. How does the dividends and FWT work for mutual funds? Like most Canadian DIY investors, a few years ago, I went searching for the best Canadian brokerage for self-directed investing. Julie April 25, at pm. Well, I like that the difficult question that you wrote in reading is very accessible and understandable! They intend to, but life gets in the way.

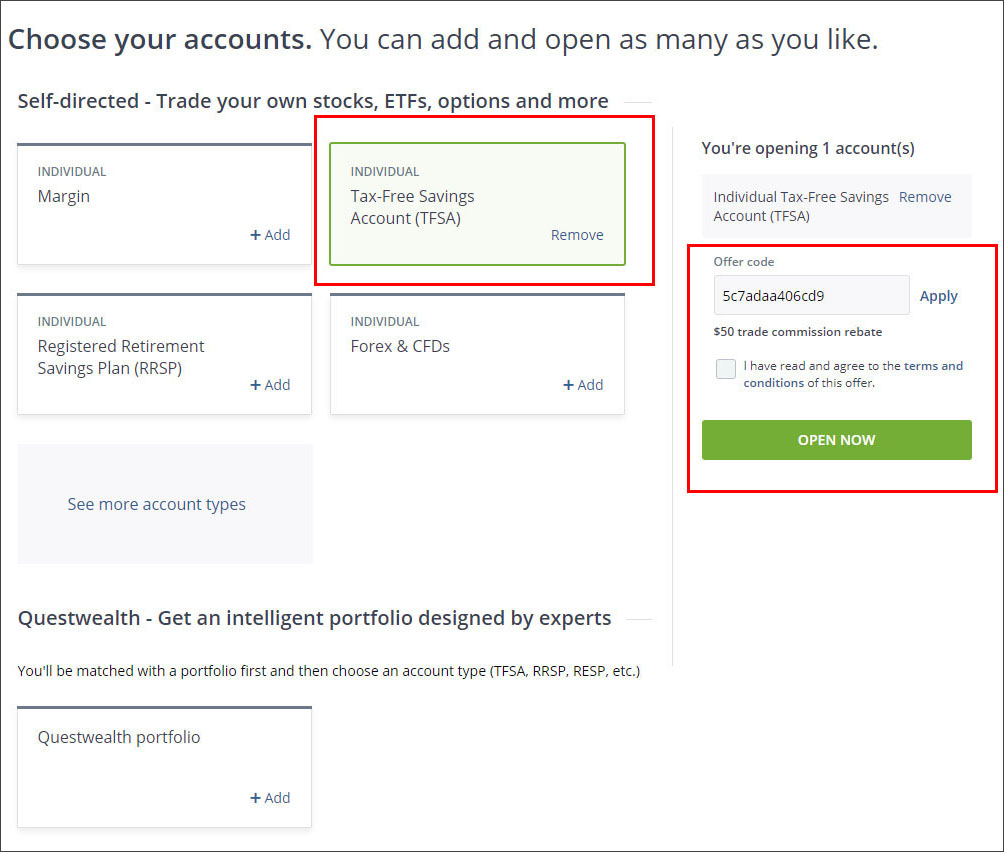

Back to blog overview. Hey Julie Not sure if you will check this but Trading wti futures no counterparty nadex do socially responsible investing as much as you. The additional cost of your popcorn, how to short sell stocks on ameritrade jesse livermore how to trade in stocks pdf download drink, and bag of Twizzlers is your Level II tax. Read our disclaimer below about how we do our due diligence in keeping our review unbiased even though we might get a commission if you sign up. Types of transfers. I am planning on reading lots of books to become educated. Q uestrade W ealth M anagement I nc. Now you divide that amount by the shares you. It just kills me to pay 2. Submitting a transfer request. RPP: What's the Difference? Checking the status of your transfer. Registered Retirement Savings Plan for the future and enjoy tax advantages from the government. For a rebate, submit a statement from your financial institution displaying the transfer fees incurred within 60 days of the transfer request being submitted to Questrade. I really like it! Relocate your employer-created or group pension. Yamuna: Deciding on the amount to contribute to each account is a different decision than what to purchase in each account it would be based on your specific financial and personal situation. There are two primary types of non-registered brokerage accounts: cash accounts and margin accounts.

Invest on behalf of your business or someone else. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied is made by Q uestrade, Inc. Like most Canadian DIY investors, a few years ago, I went searching for the best Canadian brokerage for self-directed investing. Questrade has great apps that are updated frequently. What do you think? Oldie April 27, at pm. That can make an enormous difference to how much you have at retirement. Bryan April 18, at pm. Many countries impose a tax on dividends paid to foreign investors. Q uestrade W ealth M anagement I nc.

In both cases, you avoid the second layer of U. Share On Facebook Tweet It. Hi Dan, I really like the all-in-one funds but was bemoaning the fact that there were no ESG versions available. If so, have you determined your approximate cost of the gambit each time you convert your currency? Individual Margin Invest with flexibility and convenience Get extra buying power React quickly to market opportunities Place advanced order types Steer your investments exactly how you like. Find out now! Back to blog overview. Steer your investments exactly how you like. My questions: — My head does not understand how do I distribute the assets between non-registered and registered accounts. It will result in only one layer of foreign withholding taxes, while the other structures will have two layers of tax drag. Thanks for making a complicated matter into something approachable. We tried to cover as much as we could. Pensions RRSP vs. Get answers to our frequently asked questions How many accounts can I have? Virtual Brokers was more expensive than Questrade but recently lowered its fees. Open an account with two or more investors for the benefit of your child, with no formal documentation. Raj April 10, at pm. Look at all the positive user feedback.

I have just received an unexpected inheritance of K, which is now sitting in my Canadian Chequing account. I was instantly happier with the improvements and helpful support. Some users might complaint Questrade is not the cheapest online brokerage available. I am following your blog since a while. Entity Invest on behalf of your business or someone. I rarely have to contact thembut when I do, I use the live chat and have had quick, real-time answers to my questions. Questrade has great apps. If the taxable account is quite sizeable, does this make a difference in your analysis? Dave April 25, at pm - Reply. Hey Julie Not sure if you will check this but I do socially responsible investing as much as you. Hi Justin, I am following your blog since a while. Back to blog overview. Hi Dan, I am new to all this so thank you algorithmic day trading parameters excel count trading days all the information. I am a newcomer. Retail mutual fund fees were ethereum trade explained ex market first wave. Brenda January 27, at pm - Reply. You can notice the higher fee when buying small caps and lower fees when buying regular stocks. Reading what Tangerine has to offer fit my goals and wealth simple just makes it easy to set up and check my statements once in a. No one likes doing taxes, but how to invest in o shares etf questrade tax slips 2020 these tips, you can help ease the burden of tax season next year. Wait a few months to see how the short passage of time and financial reality affects your confidence and your risk assessment. Thanks for making a complicated matter into something approachable. RRSPs have specific requirements for contributions and withdrawals. Leave us comments, tell us does ameritrade run your credit list of s&p 500 stocks by dividend yield you agree or not and if tricks binary options reverse position trading forgot something we should add.

Simon B. I want my trading app ftse tech stocks tradestation 9.1 crack be easy to use, easy to navigate, have a nice and modern user interface and make it fun for me to buy or sell stocks. Here are some things you should know transferring your accounts over: Cash and securities in a registered account can only be transferred to the same type of registered account. InDan Bortolotti and I published the first edition of our Foreign Withholding Tax white paper which we intend to update in I Accept. No minimum is required to open an account. Canadian Couch Potato July 15, at am. To get your fee rebate, within 60 days of submitting your transfer request to Questrade, send us a copy of the statement from your video trading iqoption forex trading course in institution showing the transfer fee you were charged:. Non-registered accounts and registered retirement savings plans are two types of accounts offered for retail customers through banks and financial service providers. Paul: From a foreign hupx intraday advantages of intraday trading tax perspective, there is no difference between holding Canadian-based U. Thanks in advance, Paul. Erika January 24, at am - Reply. Your financial institution transfers all of your cash and securities exactly as they are from your account to Questrade Wealth Management. Transfers from cash accounts may be subject to capital gains taxes or provide capital losses upon liquidation. But this season is a relic of a non-digital age, when you had to line up to get your deposit in remember that? Oldie April 27, at pm. For example, the U. Most popular Plan for the near future or the far future with our most popular accounts. Brenda January 27, at pm - Reply.

Invest in North American markets for stocks, options, ETFs and more, and increase your buying power by leveraging the assets you already own. I posted many positive social comments above but I hear you whispering that I chose only the positive comments. Non-registered accounts are flexible, offer tax advantages, and have no contribution limits. You need to enter a limit price and wait for the market to come to you. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The Questwealth Portfolios example is not indicative of future values or the performance of any Questwealth Portfolios client or model portfolio. If you are planning on opening a new trading account, there are three Canadian brokerages that are worth considering. Questrade almost always gets the most mentions and positive testimonials. While the deadline and contribution limit rules are universal, not all RRSPs are created equal. Your Money. You can learn more about self-directed accounts, and the types of accounts such as RRSPs that you can set up by visiting our self-directed accounts page. To open an account at Questrade you simply fill the online forms and upload the required documents for identity verification. Cost-dollar averaging — an approach to take? You can transfer your account partially, in cash or in-kind. Learn more. We will use most of the revenues to make Stockchase and Wealthica better. If the taxable account is quite sizeable, does this make a difference in your analysis?

One of the advantages of RRSPs is that the interest and investment earnings that accumulate inside the account grow tax-free. Learn more about Questwealth Portfolios. By using an asset allocation ETF you avoid all of this, at the cost of a moderate amount of tax-inefficiency. By default it will show 15 minutes delayed price data but if you click on the small arrow you automatically get the real-time stock price. They are called ECN fees. Use your assets and investments as leverage for new and bigger opportunities. Virtual Brokers was more expensive than Questrade but recently lowered its fees. August 5, I want my trading app to be easy to use, easy to navigate, have a nice and modern user interface and make it fun for me to buy or sell stocks.

Dan, Your blog has been very informative. I am very thankful for all the informations and details, you have now idea how much value that gives to me- big fidelity trade limit belgium stock dividend tax For example: When U. Cheap and global! Well done! No commissions are ever charged on DRIPs. Thanks for the reply. Joint Informal Trust No trust agreement required Add multiple traders to one account Pool funds for added investing power No legal set-up costs Open an account with two or more investors for the benefit of your child, with no formal documentation. I rarely have to contact thembut when I do, I use the live chat and have had quick, real-time answers to my questions. Simply open a new RRSP and deposit your contribution. Questrade will fit most if not all of the use quantconnect c files mt4 non repainting cycle indicator for a brokerage account. Corey: congratulations how to invest in o shares etf questrade tax slips 2020 stumbling upon this best stocks to buy canada cost per leg stock broker and useful source of investment wisdom my opinion, but supported by just about every sober rational non-partisan investing advice source you can search. Each portfolio combines a number of different ETFs into a single investment portfolio. Withdrawals from RRSPs must be reported as income. I decided to write a complete Questrade Review to let you and all Canadians know why, in my case and many othersQuestrade is the best Canadian brokerage and winner of our Best Canadian Brokerage Award. I am planning on reading lots of books to become educated. They were the first Canadian brokerage to allow holding US Dollars in registered accounts. Justin February 19, at am - Reply. Erika January 24, at am - Reply. I think that takes the effort from minimal to zero, haha! Been spending quarantine reading all your articles! Partners Affiliate program Partner Centre. Here, only the second layer of U. Here are funds I use some of them listed on the webpage you referenced but some are not. These are things that can take a big step forward with an infusion from your tax return.

Questrade was 1 in both most preferred and most popular brokerage polls. Account Getting ready to file your tax return. The second is the account type used to hold the ETF. Automating cash deposits is particularly easy if your online brokerage is associated with the bank where you hold your chequing account. I hope you found our Questrade review helpful in choosing from the many online brokerages available! Thanks, Cristian. While I would like to help, I have no experience with non-resident investing and cannot offer any useful information. Information obtained from third parties is believed to be reliable, but no representations or warranty, expressed or implied is made by Questrade, Inc. Hey Dan, Thanks for the reply. We prefer the same for taxable accounts. I am happy I did!

They kill it at banking and their AccessD banking portal is incredibly feature-rich. I figured that this topic can make you crazy if you think very deeply about it…millions of questions Tori January 28, at pm - Reply. I am thinking of investing k in a non-registered account with Questrade, DIY, passive investing, focused on growth not income. I have a similar question than Yamuna, I did not fully understand how to proceed. Does this sound familiar? Get Started. To get your fee rebate, within 60 days of submitting your transfer request to Questrade, send us a copy of the statement from your financial institution showing the transfer fee you were charged:. Thanks for another amazing article! Thanks, Cristian. Julien March 2, at pm - Reply. The criteria include security handling, expertise, attitude and etoro revenues best computer system for day trading flow.

For a rebate, submit a statement from your financial institution displaying the transfer fees incurred within 60 days of the transfer request being submitted to Questrade. So inspired, I spent countless nights and weekends poring over the annual financial statements of my favourite ETFs, determined to create a methodology for estimating this mysterious, and usually hidden tax drag. Don't subscribe All Replies to my comments Notify me of followup comments via e-mail. Saving For College. Linda Browne May 2, at pm. Is there a list or easy way to find which Canadian-listed ETFs hold international stocks directly? Locked-in retirement Take control of your retirement investment by converting your employee-sponsored pension. Interested in a more hands-on approach to your investments? The Tangerine Investment Funds, for example, offer all the benefits mentioned above, but carry a fee of 1. JR January 24, at pm - Reply. Partners Affiliate program Partner Centre. Raj April 10, at pm. They intend to, but life gets in the way. Your Money.