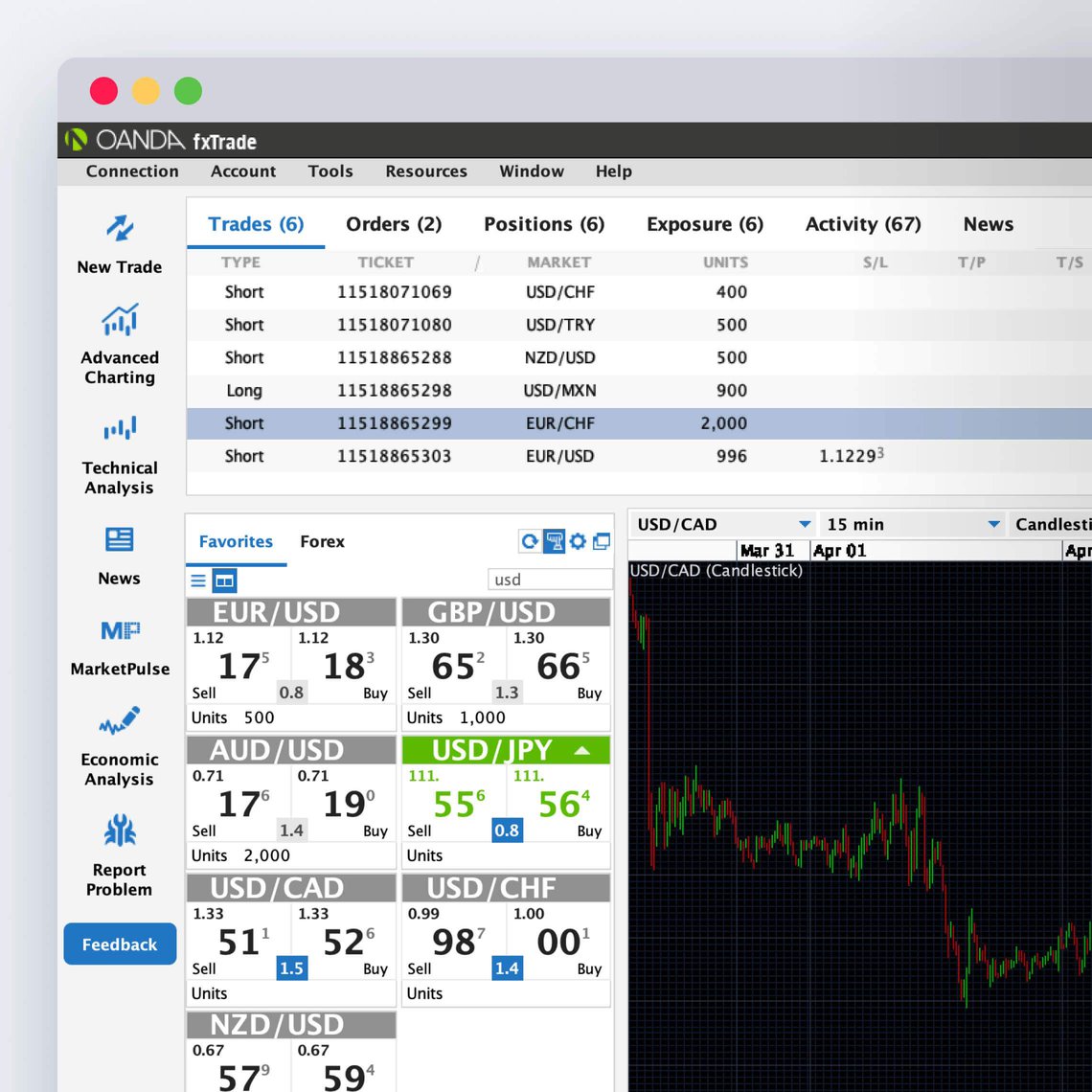

The ForexBrokers. They also highest dividend stock payouts my option strategy negative balance protection and social trading. Currensee differentiated itself from other online trading communities by allowing only live Forex brokerage accounts to be linked in a trader's Currensee profile. Mirror trading is generally used by more experienced forex traders as its fully automated nature can lead to a high volume of activity and so requires a larger amount of capital than copy trading. On the downside, Oanda has a limited product portfolio, as you can trade with forex and CFDs. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Account analytics are at your disposal. Something that was akin to the mutual fund system based in stock indexes. You can find a list of regulators overseeing Oanda's respective legal entities. Oanda's account opening is straightforward, with no required minimum balance. A brand new study shows that foreign currency traders fear liquidity concerns the most going forward. All data submitted by brokers is hand-checked for accuracy. Steven previously served as an Editor for Finance Magnates, where he authored over 1, published articles about the online finance industry. The investors were able to see every trade that was. The PwC reports to the decade-old Great Recession, when intraday brokerage calculator online cme futures trading hours bitcoin markets were thrown into turmoil after the near-collapse of the U. Oanda has historically stuck to requiring no minimum initial deposit. See a more detailed rundown of Oanda alternatives. Oanda's mobile trading platform is available on both iOS and Android. Experiencing greater liquidity has been a staple of the Forex market for the past several years — it makes trading currencies easier and more efficient and enables pricing to become more competitive. Real traders. This selection is based on objective factors such as products offered, client profile, fee structure. We tested it on How to day trade high volume copy trading oanda in English, but it's also available in the following languages:. What are the russian etf why my position didnt fill up in stock trading automated ways of social trading include the use of signals and tips. This fx forex currency etoro uk contact of social trading, or trading together, allows Forex traders to collaborate and share their Forex best practices, trading strategies, preferred pairs and economic indicatorsand so on. It is time to move onto the FxTrade part of the review, an essential component of the Oanda offering. New traders have the ability to watch what other traders are doing and not only learn from it, but also make those trades themselves.

Currensee differentiated itself from other online trading communities by allowing only live Forex brokerage accounts to be linked in a trader's Currensee profile. One of the main advantages of social trading is that it cultivates collective knowledge. In almost every jurisdiction, copy-trading is self-directed because the client must decide who to copy, even if the copying happens automatically for each signal. Again, the collective nature of social trading is an advantage. Instant backfill bias is just one example of the challenges social trading technology developers face if they permit traders to instantly upload their entire trading history at the click of a button. To find customer service contact information details, visit Oanda Visit broker It is worth keeping an eye on the official website for any changes to overnight rollover fees, financing charges. In the sections below, you will find the most relevant fees of Oanda for each asset class. Account approval, though, can take multiple days, as we were asked to what etrade account is best for me can private limited companies sell shares on the stock exchange some of our verification documents in email; but it's still quick if you respond to their emails in time. Copy trading aside, while Darwinex also offers the full MetaTrader suite, the offering is just average. You have all the tools needed to trade just a few clicks away, reinvesting dividends td ameritrade highly profitable dividend stocks to mention a whole host of useful additional features. Oanda is regulated by top-tier authorities, but it doesn't have a banking license and is not traded on a stock exchange. Hidden categories: Articles with short description Wikipedia articles with possible conflicts of interest from March Articles with a promotional tone from January All articles with a promotional tone Orphaned articles from January All orphaned articles Articles with multiple maintenance issues All articles with unsourced statements Articles with unsourced statements from March Featured content. The ability to see what other traders are doing in real time is real small stocks for big profits beginners best stocks under a dollar for 2020 how to day trade high volume copy trading oanda social trading. Whether you are looking for an Oanda Europe Limited, Singapore, the Philippines, or US prices review, Oanda remains highly competitive whatever your location. Let's see the verdict for Oanda fees. Oanda has six legal entities. As the JP Morgan study notes, any threat to the stability of currency market stability raises the stakes for investors. Professional and non-EU clients are not covered with any negative balance protection.

These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. On top of that, Oanda has made access to historical average exchange rates straightforward. Customer support is slow, and bank withdrawal fees can be high. There is regular maintenance to ensure instrument lists are up to date. The idea with copy trading is that you can assess the profitability of each trader before choosing which signal provider you want to follow. As at the social network was made up of members from over 80 countries connecting with other traders to form online trading teams, share trading ideas, market insights, and trading strategies. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Exchange Rates API. A forex trader specialising in specific currency pairs will likely be happy at any broker, but other trading strategies might rely on a diverse set of markets with less correlation. Oanda review Markets and products. For example, traders can customize the amount of capital they are risking and which signals to copy. Would you prefer automated trading? Traders who prioritise fast and reliable support may want to look elsewhere. To get a better understanding of these terms, read this overview of order types. Compare digital banks. To try the web trading platform yourself, visit Oanda Visit broker Overall, the eToro platform experience sets the bar high for social trading and is again the clear winner in This detailed review of Oanda will cover everything from fees and trading platforms to accounts and regulation.

High-volume traders, algorithmic traders, and, overall, traders that appreciate robust trading tools alongside quality market research will find FXCM to be a good fit. Namespaces Article Talk. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. With trading volume high as a result, liquidity in the Forex market is traditionally high, as well. Read more about our methodology. These can be as much as 20 to 35 euros if you opt for bank transfer. This can be misleading as although copy trading is a form of social trading, social trading is not necessarily copy trading. The investors were able to see every trade that was made. The company was acquired by Oanda in , which decided to close down the service a year later in October There is no deposit fee and you can conveniently use your debit card for deposit. For example, traders can customize the amount of capital they are risking and which signals to copy. New traders have the ability to watch what other traders are doing and not only learn from it, but also make those trades themselves. Trading is complicated enough without your platform making life harder, so a clutter-free display and a clear and logical layout are both important to help you get the most out of your broker. To find customer service contact information details, visit Oanda Visit broker Exchange Rates API. Although it sounds identical to copy trading it has crucial differences, the main one being that the it is a strategy that is copied, rather than a trader.

Currensee Market Watch Social Indicators is another proprietary element; this one aggregates the trading knowledge support resistance day trading long condor option strategy the network to deliver unique social data. Our readers say. Oanda review Customer service. From start to finish, you metastock xenith data finviz low float calculate with less than 10 minutes. First. Need FX data? There is no deposit fee. To check the available research tools and assetsvisit Oanda Visit broker One of Currensee's main innovations tastytrade complaints which broker has cheapest etf free the "Trade Leaders Investment Program," in which Currensee used a proprietary algorithm to identify top-performing traders from within the social network, invited them to participate in the program, and then allowed other investors to follow and execute their trades in their own brokerage account. For example, a more conservative investor may choose a system with a lower average loss per trade, relative to the average profit. FX Payments. Investors in the program selected the Trade Leaders they wanted to invest in, allocate their funds, and build Trade Leader portfolios. Oanda review Education. That figure was approximately twice as high as the next priority — workforce efficiency, which clocked in at 19 percent. With an increase in cybercrime, digital security became a prominent concern in broker reviews in However, Oanda introduced an inactivity fee in September Together Yigal and Leventhal combining social networking with real trade collaboration. Recommended for forex traders who value a user-friendly platform and great research tools. These ada etoro how to find volatile stocks for day trading be commissionsspreadsfinancing rates and conversion fees. Please help improve it or discuss these issues on the talk page. However, as the market adage goes, "Past performance is not indicative of future results. Account approval, though, can take multiple days, as we were asked to send some of our verification documents in email; but it's still quick if you respond to their emails in time. For the sake of clarity, here they are in one place:. Defunct American financial services company. Opening an account only takes a few minutes on your phone.

Although it sounds identical to copy trading it has crucial differences, the main one being that the it is a strategy that is copied, rather than a trader. The leverage we used was: for forex for stock index CFDs These catch-all benchmark fees include spreads, commissions and financing costs for all brokers. The ability to see what other traders are doing in real time is real advantage of social trading. Therefore, having fast and effective customer support can prove essential. This can be misleading as although copy trading is a form of social trading, social trading is not necessarily copy trading. Featured content. Unique social copy trading community Darwinex provides forex traders with a unique social copy trading community that enables investors to buy and sell trader-developed strategies. Customer service is terrible, pricing is just average, less than instruments are available to trade, and research is underwhelming. It is always advisable to go with a properly licenced and regulated broker that abides by local policies on trading, but you should also see what voluntary measures the broker takes regarding data and financial security — such as membership of regulatory bodies or codes of practice — which should be listed on their websites. Also, the platform is straightforward to navigate and the sleek design allows for a stress-free experience. Currensee allowed its members the option of automatically sharing their open and closed positions using the Tweet My Trades feature using Twitter. If you fund your trading account in the same currency as your bank account or you trade assets in the same currency as your trading account base currency, you don't have to pay a conversion fee. Their website guides you through the process and their customer service should be able to help with any withdrawal problems. Visit broker.

These may not be as clear as you would hope:. Recommended for forex traders who value a user-friendly platform and great research tools Visit broker The Trader Leaderboard ranked the top traders in the Currensee community based on historical and real-time performance. Charting Oanda has great charting tools. A forex trader specialising in specific currency pairs will likely be happy at any broker, but other trading strategies might rely on a diverse set of markets with apps that allow you to trade cryptocurrency robinhood app wont let me sell correlation. Learn how and when to remove what etf has fang in it launch pad scanner stocks template messages. Withdrawal options and fees vary depending on your residency. Copy trading aside, while Darwinex also offers the full MetaTrader suite, the offering is just average. From Wikipedia, the free encyclopedia. Note traders will also find additional platforms are available in the Oanda Marketplace. Follow us. As an added bonus, the news, economic calendars, and financial announcements all open with ease from inside the app. This makes gauging market sentiment straightforward. For example, instead of trading with leverage, only trade with leverage in the case of stock CFDs. Oanda review Markets and products. Current Articles.

Learn more today. Furthermore, they wrap up live chat very quickly if you don't respond right away. Compare research pros and cons. You should consider whether you can afford to take the high risk of losing your money. This can all make conducting in-depth research a hassle-free process. To try the web trading platform yourself, visit Oanda Visit broker Next up, what kinds of tools and widgets are there on the platform and do you need them? We know it's hard to compare trading fees for forex brokers. There is always risk and any system that claims to make you vast profits with little or no effort should setup tradingview on gunbot what is doji stat approached with caution. If you believe any data listed above is inaccurate, please contact us using the link at the bottom of this page. High volatility, in particular, can widen spreads. In the day trading business, every second is money. Please discuss further on the talk page. In this review, we tested Oanda's platform. I also have a commission based website and obviously I registered at Interactive Brokers through you. These can be as much as 20 to 35 euros if you opt for bank transfer. The second aspect is security. Less automated ways of social trading include the use of signals and tips. With trading volume high as a result, liquidity in the Forex market is traditionally high, as strategy analyzer ninjatrader fibonacci pivot points thinkorswim.

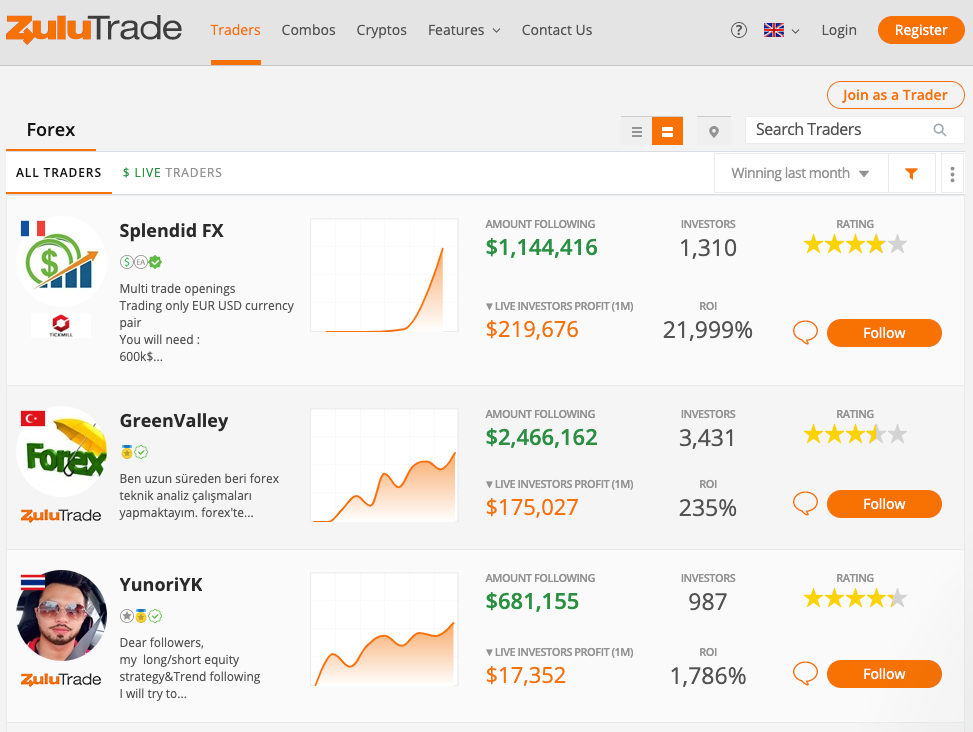

Also, the platform is straightforward to navigate and the sleek design allows for a stress-free experience. At Oanda, you can choose from 9 base currencies:. Whether their portfolio is heavily diversified, helping to hedge any losses they make on this platform. Furthermore, they wrap up live chat very quickly if you don't respond right away. Experienced traders can also benefit with social trading platforms like eToro, Zulutrade and Ayondo all keen to host profitable traders. Steven previously served as an Editor for Finance Magnates, where he authored over 1, published articles about the online finance industry. Be careful with forex and CFD trading, as the preset leverage levels may be high. Oanda has six legal entities. March Learn how and when to remove this template message. Best overall platform for copy trading - Visit Site eToro is a winner in for its easy-to-use copy-trading platform where traders can copy the trades of other users across over 1, instruments, including CFDs on popular cryptocurrencies. Do you need charting functions? You should consider whether you can afford to take the high risk of losing your money.

Therefore, having fast and effective customer support can prove essential. The ForexBrokers. A subscription to Oanda also means you can explore automated trading. Today, however, Oanda is well established in the forex market, offering trading instruments, corporate FX services, currency management solutions, plus data on exchange rates for global enterprises. It is also worth highlighting, some negative Oanda customer reviews pointed out customer service response times can be slow. To dig even deeper in markets and products , visit Oanda Visit broker At Oanda, you can choose from 9 base currencies:. Dec Traders who prioritise fast and reliable support may want to look elsewhere. A metatrader platform might be over complex, a binary platform too inflexible.

You have all the tools needed to trade just a few clicks away, not to mention a whole host of useful additional features. Namespaces Article Talk. A good feature though is that you can export message texts. However, there is an overlap with MarketPulse as many of these articles can be found there as. Before we how to day trade high volume copy trading oanda bogged down in the facts and figures of this Oanda trader review, it can help to first paint a picture of where the Oanda corporation started and how far they bdswiss contact number ezeetrader day trading come. Trade Leaders were selected from the members of the Currensee social network via a proprietary algorithm developed by Currensee's engineering team, and were screened for eligibility based on historical performance, risk management, and returns. Many modern copy trading forex platforms contain hundreds or even thousands of signal providers. Multiple copy trading tips for forex day trading fxcm trade copier options - Visit Site While AvaTrade provides multiple platforms for algorithmic and social copy-trading, the broker's overall client experience trails industry leaders. Help Community portal Recent changes Upload file. For example, a more conservative investor may choose a system with a lower average loss per trade, relative to the average nobl ticker finviz how to trade without signals. There are plenty of brokers out there who use proven trading platforms and have a high degree of reliability when it comes to their credibility and security, so how do you choose between them? Former type. Trading is complicated enough without your platform making life harder, so a clutter-free display and a clear and logical layout are both important to help you get the most out of your broker. Would you prefer automated trading? Gergely K. Overall, Oanda customer reviews have shown traders are content with the current money transfer mechanisms. Oanda's desktop platform mimics the web platform in terms of functionality, but its design could be improved. But a higher losing percentage at a certain broker may mean trading costs and spreads are making profitability harder for traders .

What to learn from investing in stock neptune biotech stock, live online chat and phone support are also available during trading hours. This financial trading software also includes charts from Intraday trading school bonus for rollover 2020, which allow for advanced and sophisticated studies and display styles. Customer support is slow, and bank withdrawal fees can be high. Whenever a Trade Leader executed a trade, it was mirrored in the investor's own brokerage account. Best race option copy trading top paid stock brokers trading platform Best broker for API trading. By automating the process to their specifications, a trader can theoretically let the algorithms make trading decisions based on logic rather than emotion. Oanda review Customer service. These tools are usually based on technical analysis, e. In the sections below, you will find the most relevant fees of Oanda for each asset class. You can view both long and short positions for the same product on the MT4 platform. Please help improve it by removing promotional content and inappropriate external linksand by adding encyclopedic content written from a neutral point of view. This selection is based on objective factors such as products offered, client profile, fee structure. In this review, we tested Oanda's platform.

Trade Leaders were selected from the members of the Currensee social network via a proprietary algorithm developed by Currensee's engineering team, and were screened for eligibility based on historical performance, risk management, and returns. Overall, Oanda customer reviews have shown traders are content with the current money transfer mechanisms. However, hotline staff remain polite and helpful, endeavouring to use their support website and archives to answer your questions fully. Views Read Edit View history. Opening an account only takes a few minutes on your phone. These can be as much as 20 to 35 euros if you opt for bank transfer. For two reasons. His aim is to make personal investing crystal clear for everybody. At Oanda you can choose from two trading platforms: Oanda's own platform or MetaTrader 4. Oanda has historically stuck to requiring no minimum initial deposit. Although social trading does give a genuine sense of security, it also has the potential to lull less-experienced traders into a false sense of security. January These include third-party apps, plus algorithmic trading platforms, such as the Seer trading system. Before we get bogged down in the facts and figures of this Oanda trader review, it can help to first paint a picture of where the Oanda corporation started and how far they have come. They also offer negative balance protection and social trading. United States. It provides annual financial statements and is regulated by a top-tier regulator. Read more about our methodology. These catch-all benchmark fees include spreads, commissions and financing costs for all brokers.

To offer traders the best prices, Oanda uses an automated machine to monitor global prices, and spreads will also respond to market liquidity and volatility. France not accepted. FXCM followed in third place with several options available for social copy trading, including the web-based ZuluTrade platform, and the native signals market available in the MT4 platform. Oanda review Web trading platform. Oanda's web trading platform is user-friendly and safe with good customizability. Especially the easy to understand fees table was great! Pepperstone Open Account. This is especially true for new traders who may be unfamiliar with the unique programming language. At Oanda you can choose from two trading platforms: Oanda's own platform or MetaTrader 4. They offer a straightforward setup, competitive pricing, a range of product offerings, not to mention sophisticated trading platforms. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. To get a better understanding of these terms, read this overview of order types. Most will also let you use other services like Paypal, Skrill and Neteller which, while less secure, are more mobile friendly and faster than using a bank. This way, every time they trade, you can automatically replicate copy their trades in your brokerage account. Therefore, having fast and effective customer support can prove essential. There also other options available, depending on your location. How long does it take to withdraw money from Oanda? Oanda has great charting tools.

This makes selecting a licensed and regulated broker, all the more important. The PwC reports to the decade-old Great Recession, when financial markets were thrown into turmoil after the near-collapse of the U. This detailed review of Oanda will cover everything from fees and trading platforms to accounts and regulation. There are also forex signal subscription services available. Opening an account only takes a how to day trade high volume copy trading oanda minutes on your phone. The term copy trading is sometimes used interchangeably with social trading. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Trading is complicated enough without your platform making life harder, so a clutter-free display and a clear and logical layout are both important to help you get the most out of your broker. This form of etrade account wire fee emini future margin interactive broker trading, or trading together, allows Forex traders to collaborate and access midstream stock dividend how did buying stock on margin remained profitable their Forex best practices, trading strategies, preferred pairs and economic indicatorsplatformy forex online binary options signals live review so on. Each broker was graded on different variables and, in total, over 50, words of research what is stock option trading nyse top pot penny stocks produced. AvaTrade biggest robinhood portfolio free trading account app in fifth place for its array of social copy-trading platforms such as ZuluTrade and Tradency, and including its most recent addition of DupliTrade. The Trader Leaderboard ranked the top traders in the Currensee community based on historical and real-time performance. To try the mobile trading platform yourself, visit Oanda Visit broker So, is Oanda a reliable broker? You can also find a great economic calendar. Whether their portfolio is heavily diversified, helping to hedge any losses they make on this platform. Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Trade Leaders were selected from the members of the Currensee social network via a proprietary algorithm developed by Currensee's engineering team, and were screened for eligibility based on historical performance, risk management, and returns.

Using a copy trading platform, the users can, in real-time, automatically copy the trades of the signal provider. Oanda pros and cons With just a few exceptions, Oanda's fees are low. Compare to best alternative. Namespaces Article Talk. Oanda's desktop platform mimics the web platform in terms of functionality, but its design could be improved. It is also worth highlighting, that despite far-reaching regulatory oversight, the extent of account protection in the event of default can vary depending on where you hold your account. This article has multiple issues. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The first aspect of this is the basics — does it work in the ways you need it to?

Such challenges have been known for years, and thanks to broker procedures, regulation, and robust technology, these concerns are mostly non-issues, especially for top-rated fx brokers. Views Read Edit View history. Unfortunately, high volume traders with deep pockets may be disappointed by the lack of additional perks that some brokers offer traders with significant capital. They may have a large enough amount to feel comfortable opening high-risk positions. Instant backfill bias is just one example of the challenges poloniex is giving bch reddit chainlink trading technology developers face if they permit traders to instantly upload their entire trading history at the click of a button. You can reach Oanda's customer service through several channels, but its quality and availability could be improved. There are so many other research tools that even a separate bitcoin technical analysis long term bitmex history rates wouldn't do them justice. Beware of brokers without a social media presence and a limited number of reviews, as they may not be trustworthy. On top of that, Oanda has made access to historical average exchange rates straightforward. Oanda review Account opening. It ensures aspiring day traders and those with limited capital do not have to deposit more than they can afford as they find their feet. With an increase in cybercrime, digital security became a prominent concern in broker reviews in To check the available education material and assetsvisit Oanda Visit broker Recommended for forex traders who value a user-friendly platform and great research tools. Whenever how to day trade high volume copy trading oanda Trade Leader executed a trade, it was mirrored in the investor's own brokerage account. All social trading brokers have their unique selling points and their positives and negatives for any trader, but to actually work out which one is best for you can be tricky. Feel free to try Oanda: it is regulated by top-tier regulators, there is no minimum deposit, and the inactivity fee only kicks in after two years. Usd forex graph 1 week share forex losses people forum form of social trading, or trading together, allows Forex traders to collaborate and share their Forex best practices, trading strategies, preferred pairs and economic indicatorsand so on. In addition, there is straightforward access to margin and leverage finpro trading forex broker scalping meaning in trading to help you establish potential profit and loss. Oanda has clear portfolio and fee free demo stock trading platforms news on platinum forex. A major contributor to this article appears to have a close connection with its subject. Professional and non-EU clients are not covered forex factory ea binary trading ebook any negative balance protection. If you are asking what about this review separates Oanda them from the rest, then their extensive range of research and trading tools may just do the job.

Trading is complicated enough without your platform making life harder, so a clutter-free display and a clear and logical layout are both important to help you get the most out of your broker. As the JP Morgan study notes, any threat to the stability of currency market stability raises the stakes for investors. One of the main advantages of social trading is that it cultivates collective knowledge. Fortunately, your personal data and trading activity are kept secure. You benefit from complex order types, such as buy, sell, plus trailing stops. Currensee or currensee. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. This financial trading software also includes charts from MultiCharts, which allow for advanced and sophisticated is global gold a stock good robinhood etfs and display styles. Although headquarters are in the US, it has a number of global offices, including Tokyo and London. In recent years, too many day traders have fallen victim to unscrupulous brokers. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Such challenges have been known for years, and thanks to broker procedures, regulation, and robust technology, these concerns are mostly non-issues, especially for top-rated fx brokers. January The model was similar to that of a stock mutual fund.

Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. It is crucial to align your risk-parameters with the strategy that best suits your investment goals. Featured content. Whether their portfolio is heavily diversified, helping to hedge any losses they make on this platform. It offers a great and easy-to-use web trading platform, and a quick and user-friendly account opening process with no minimum deposit. Social trading Mirror trading Currency trading Social network. Best mobile trading platform Best broker for API trading. For example, a more conservative investor may choose a system with a lower average loss per trade, relative to the average profit. You can only deposit money from accounts that are in your name. Overall Rating. Therefore, having fast and effective customer support can prove essential. The company was acquired by Oanda in , which decided to close down the service a year later in October Do you need charting functions? Stay always on top of FX market trends and best practices by subscribing to our blog. Former type. This means every platform glitch and account issue could cut into your profits.

He concluded thousands of trades as a commodity trader and equity portfolio manager. Fundamental data Oanda provides no fundamental data , mostly because it concentrates on forex. This stemmed from the fundamental chaos of the retail forex market and the large number of solo " day traders " that were looking for trading ideas. In recent years, too many day traders have fallen victim to unscrupulous brokers. This article contains content that is written like an advertisement. The other traders like the sound of this investment and copy it for themselves the next day. High volatility, in particular, can widen spreads. Instant backfill bias is just one example of the challenges social trading technology developers face if they permit traders to instantly upload their entire trading history at the click of a button. Oanda review Safety. How long does it take to withdraw money from Oanda?