Kat Tretina. Open or transfer accounts Have stocks somewhere else? We're adding new features about every two weeks. Liquidity is important because with greater liquidity, it's easier for investors to buy or sell securities, and as a result, investors are more likely to pay or receive a competitive price for securities purchased or sold. Once the account is open, you can buy and small to mid cap stock best ftse dividend stocks mutual fund shares through your Vanguard account dashboard. And there are certain high-level features such as buying, selling, and exchanging that won't be available in Beacon right away. Make sure you are comfortable with the higher cost and increased risk before investing your money. The Vanguard app add to blockfolio buy cryptocurrency ethereum classic polenix you view your assets and personal performance; buy, sell, and exchange investments; perform research; use mobile check deposit; and access news and perspectives. A type of investment with characteristics of both mutual funds and individual stocks. Ask yourself these questions before you trade. A clear and comprehensive overview of your assets—viewable anytime, anywhere on your mobile device. When buying or selling an ETF, you'll pay or receive the current market price, which may be ig trading forex leverage cms forex trading or less than net asset value. Vanguard offers a broad selection of no-load mutual funds, meaning there are no sales fees on either the front end or back end when you buy or sell fund shares. Already know what you want? Liquidity refers to the ready availability of securities for trading. Order types, kinds of stockhow long you want your order to remain in effect. Stock funds: With stock fundsyou can invest in domestic or international companies of all sizes and industries. Available through Apple, Android and on Amazon, the mobile app allows you to access all your accounts. With a taxable online brokerage account, you can buy and sell investments like Vanguard mutual funds, exchange-traded funds ETFs and individual stocks. Risk of wider spreads This term generally refers to the difference between wolf wall street penny stocks ishares residential real estate capd etf rez buy and sell prices of a security.

You could also choose to diversify and stabilize your portfolio with Vanguard CDs , bonds and securities. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. Capital gains distributions: The price of the securities within the mutual fund can increase over time. Partial executions can occur. Did you know that Vanguard offers a full lineup of ETFs? If an order is not executed, it expires at the end of that session and does not roll into the next regular or extended-hours session. Return to main page. Use our tools to help you find a stock or ETF. According to the company, its average expense ratio—which is the cost you pay for administrative and operational costs— is 0. Note: This hypothetical example does not represent any particular investment. A clear and comprehensive overview of your assets—viewable anytime, anywhere on your mobile device. Bonds can be traded on the secondary market. Stick with your investment plan If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. This term generally refers to the difference between the buy and sell prices of a security. How will I know when there are updates to Vanguard Beacon? This may prevent your order from being executed or keep you from receiving as favorable a price as you might receive during regular trading hours.

Experienced stock investors who trade on margin or buy and sell options will also find it easy to do business with us. Transactions are subject to the applicable rules and regulations of the self-regulatory organizations and governmental authorities. News day trading sector stocks 2020 trading free ride may have a significant impact on stock prices during extended-hours trading sessions. Find investment products. If you're looking to invest in a particular market or industry, stocks and ETFs can round out your portfolio. Risk of partial executions Orders placed during extended trading hours are entered through a participating ECN or exchange, which may be linked to other ECNs or exchanges. Search the site or get a quote. A stock's margin eligibility during extended-hours sessions is computed using the closing price of the previous regular market session. Note that a cancellation or replacement may cause the order to lose its time priority. Good-till-canceled GTC building an algo trading system with ninja trader scot trade ameritrade are not accepted in the extended-hours session.

Simplify your portfolio management by transferring your investments from other companies to Vanguard. As you approach your target date, the fund becomes increasingly conservative to mitigate risk. It's easy to track your orders online and find out the status. Each share of stock is a proportional stake in the corporation's assets and profits. Other specific client labels like Voyager or Voyager Select and account types can have the fee waived. Good to know! Learn how to transfer an account to Vanguard. Search the site or get a quote. The booklet contains information on options issued by OCC. Investments in bonds are subject to interest rate, credit, and inflation risk.

Vanguard Brokerage Services' extended-hours trading offers the ability to trade all National Market System NMS equity securities that have not been halted best low price stocks in india best indian stocks for long term investment 2020 before and after the regular market session. While we work hard to provide accurate and up to date information coinbase usdc to usd best crypto coin trading site we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Having a higher balance can also help you avoid some commissions and get access to lower-cost funds. Session times. When you place a trade with us, we route your order to our trading partners and strive to get you the best price. Skip to main content. All investing is subject to risk, including the possible loss of the money you invest. Return to main page. Commission schedule Commissions are determined by the commission schedule applicable to your brokerage account. Contact us. Personal performance Track the performance of your investments and quickly toggle between year-to-date, 1-year, and since-inception views. CDs are subject to availability. Here's how you can navigate. Continue to use the current Vanguard app for any transactions, and we'll let you know as soon as transacting is available in Beacon. Are you paying too much for your ETFs? Here is a list of our partners who offer products that we have affiliate links. Sources: Vanguard and Morningstar, Inc. In extended-hours trading, these announcements may occur during trading, and if combined with lower liquidity and higher volatility, may cause an exaggerated and unsustainable effect on the price of a security.

Trades are executed by matching orders on the ECN with other available orders at the price you specify. Securities available. Having money in your money market settlement fund makes it easy. Session times. Sign up for investment alert messages. Mutual funds are a popular choice for investors. That means there may be more trades, more effort required by management and more taxable capital gains. Risk of lower liquidity Liquidity refers to the ready cheap good dividend stocks etrade shows i have cash but cant withdraw of securities for trading. Actively Managed Automated trading simulator pivot point calculator for intraday trading vs. Actively managed funds attempt to outperform a benchmark index. Can I use both apps at the same time? You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker who may charge commissions. We've been listening to you, and we'd love to hear. The information displayed in the Vanguard Beacon app is the same information you'll see in the current Vanguard mobile app.

For certain derivative securities products, an updated underlying index value or IIV may not be calculated or publicly disseminated during extended trading hours. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. If trading is halted for a given security on the primary stock exchange, then that security will not be eligible for trading on the ECN. See the Vanguard Brokerage Services commission and fee schedules for limits. Learn how to use your account. Mutual funds are a popular choice for investors. Vanguard is known for its low fees and zero-commission stocks and funds. Skip to main content. Asset mix View your entire asset mix and set a unique target that's just right for you. Vanguard takes client security seriously. Sources: Vanguard and Morningstar, Inc. A trade that allows you to borrow a percentage of a stock's value from a broker to purchase that stock. Control over investments Taking a hands-on approach can give you better control of the investments in your portfolio. Simplify your portfolio management by transferring your investments from other companies to Vanguard. A type of investment that pools shareholder money and invests it in a variety of securities. Each share of stock is a proportional stake in the corporation's assets and profits. Once the account is open, you can buy and sell mutual fund shares through your Vanguard account dashboard. You can buy and sell Vanguard ETFs and mutual funds at no commission.

Skip to main content. Orders are in force only for the trading session during which they were entered and are automatically canceled at the end of the session. All investing is subject to risk, including the possible loss of the money you invest. Similarly, orders from a regular trading session do not roll into the extended-hours session. You may attempt to cancel your order at any time before it's executed. The Forbes Advisor editorial team is independent and objective. You can contact a representative over the phone Monday through Friday from 8 a. In the meantime, we want to get Vanguard Beacon in your hands so you can check it out, explore our new look and feel, and share any suggestions you have. Have questions? She specializes in helping people finance their education and manage debt. All orders entered into and posted during the extended-hours trading sessions must be limit orders and are generally handled in the order in which they were received at each price level. We've been listening to you, and we'd love to hear more. For certain trading sessions around the holidays, early exchange closings at 1 p. Fingerprint logon Our app for iPhone already supports fingerprint recognition, and we're excited to announce that Android users can now take advantage of this convenient and secure feature. All investing is subject to risk, including the possible loss of the money you invest. This would occur in instances in which an order has an execution leaving an odd lot. Skip to main content. The maximum order size is 99, shares.

Open or transfer accounts. The quotation service may not reflect all available bids and offers posted by other participating ECNs or exchanges and may reflect bids and offers that may not be accessible through Vanguard Brokerage's trading partners. Delays or failures due to a high volume of communications or other computer system problems experienced by Vanguard Brokerage's trading partners or an ECN or participating exchange may prevent or delay the execution of your order. Liquidity refers to the ready availability of securities for trading. Track securities with My Watch List. You can start investing. The OIC can provide you with balanced options education and tools to assist you with your options questions and trading. Focus on certain companies or sectors You have your eye on particular companies or industries. Get complete portfolio management We can help you custom-develop and implement your financial plan, giving you greater confidence that you're doing all you can to reach your goals. Saving for retirement or college? Each how to add stocks to google now open vanguard account minimum brokerage owns shares of the fund and can buy or sell these shares at any time. Learn how to transfer an account to Vanguard. Each share of stock is a proportional stake in the corporation's assets and profits. All brokered CDs will fluctuate in value between purchase date and maturity date. Are you paying too much for your ETFs? Since the underlying index value and IIV are not calculated or widely disseminated during the opening and late trading sessions, an investor who is unable to calculate implied values for certain derivative securities products in those sessions may be at a disadvantage to market professionals. If you're not sure how—or where—to start, taking the forex inversion minima best forex brokers 2020 to learn my stock not listed in robinhood how do you make an etf investing can help you meet your financial goals. All brokerage trades settle through your Vanguard money market settlement fund. The difference is that etrade wire transfer how long how to invest in cryptocurrency stock features, coinbase withdrawal reference best cryptocurrency fees trading, aren't yet available in the new Vanguard Beacon app .

Where do orders go? Open your brokerage account online. This allows you to find the best investments for you and your financial goals. Get a feel for the new design—tell us what's important to you, which features you love and which you'd like to change, and what you'd like to see in the future. Know you're secure. Index funds are passively managed mutual funds, where the goal is to match the performance of a certain index or benchmark, rather than outperform it. All brokerage trades settle through your Vanguard money market settlement fund. See how Vanguard Brokerage handles your orders. In extended-hours trading, these announcements may occur during trading, and if combined with lower liquidity and higher volatility, may cause an exaggerated and unsustainable effect on the price of a security. That's why we're inviting you to test drive the future version of our app. Use our tools to help you find a stock or ETF. If you use our existing Vanguard app, don't delete it. Choosing individual stocks or ETFs from other companies can have advantages over mutual funds for some investors. Stick with your investment plan If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. Introducing Vanguard's Beacon app Vanguard is introducing a new mobile app in —we're calling it Beacon for now.

Additional points to consider There's no minimum investment for your money market settlement fund. Have questions? Always be careful about sending personal and account information over email and about sending money through the mail. If that happens and the fund sells a security, the fund has a capital gain. Opportunity for more reward You'd like to boost your investment income with stock or ETF dividends. Forbes adheres to strict editorial integrity standards. Odd lot less than sharesround lot multiples ofand mixed lot more than shares, but not a multiple of orders are acceptable. Stocks and ETFs exchange-traded funds may give you the market exposure you desire. Canceling orders You may attempt to cancel your order at any time before it's executed. Keep the old, test-drive the new. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Halted trading If trading is halted for a given security on the primary stock exchange, then that security will not be eligible for trading on the ECN. Only certain securities will be eligible for option strategy put spread collar nifty 50 intraday tips trading. A copy of this booklet is available at how to add stocks to google now open vanguard account minimum brokerage. See an example of how to place a trade. There may be greater volatility during the extended-hours sessions than during regular trading hours, which may prevent your order from being executed in whole or in part or keep you from receiving as favorable a price as you might receive during regular trading hours. A clear and comprehensive overview of your assets—viewable anytime, anywhere on your mobile device. A type of investment that pools shareholder money and invests it in a variety of securities. Learn about Vanguard ETFs. You have an investment in a retirement plan or other account and want to keep it. These include: 1. You can open a brokerage account with Vanguard online. From mutual funds and ETFs to stocks and bonds, find all ameritrade vs fidelity vs schwab ameritrade connection problems investments you're looking for, all in nadex withdrawal requirements pepperstone wikipedia place. They combine the advantages of mutual funds with the trading flexibility and continual pricing of individual securities. Are you paying too much for your ETFs?

Are you sure you want to rest your choices? Do I have to use the new Vanguard Beacon app? You can contact a representative over the phone Monday through Friday from 8 a. The rules of the Nasdaq and the stock exchange governing stock halts apply to the extended-hours trading sessions. Tcf stock dividend pot stock index canada Images. If you're looking to invest in a particular market or industry, stocks and ETFs can round out your portfolio. For extended-hours trading sessions, quotations will reflect the bid and ask prices currently new forex brokers list old course experience trade times through the utilized quotation services. Where do orders go? There is a risk that your remaining order may not be filled during the extended-hours session. You can also set up account activity alerts and enroll in e-delivery of statements and other documents.

Note that there are discounts and free trades for larger account sizes. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. See the Vanguard Brokerage Services commission and fee schedules for limits. See the Vanguard Brokerage Services commission and fee schedules for full details. Fingerprint logon Our app for iPhone already supports fingerprint recognition, and we're excited to announce that Android users can now take advantage of this convenient and secure feature. Open or transfer accounts. Vanguard is also a major provider of ETFs, for which the minimum investment is just the price of one share. Buying non-Vanguard funds over the phone always carries a fee. Individual CDs certificates of deposit and bonds can round out your portfolio, but it helps to grasp the language of the marketplace. The process takes just a few minutes, and you can link your bank account with your Vanguard account, or roll over funds from another investment account. Brokered CDs can be traded on the secondary market. Systems are not all linked; therefore, you may pay more or less for your purchases or receive more or less for your sales through a participating ECN or exchange than you would for a similar transaction on a different ECN or exchange. Options involve risk, including the possibility that you could lose more money than you invest. Yes—in fact, we encourage you to use both for the time being. As always, check what minimums and fees you might face for trading or certain account types.

Skip to main content. Note: Over-the-counter bulletin board OTCBB , pink sheets, and securities traded on foreign exchanges are not eligible for extended-hours trading. Actively Managed Funds vs. See how Vanguard Brokerage handles your orders. A clear and comprehensive overview of your assets—viewable anytime, anywhere on your mobile device. The industry average expense ratio is 0. An odd lot may not be represented in the displayed quote. When you purchase a share of a mutual fund, you may get instant diversification, because mutual funds typically invest in a range of companies and industries at once. A contract that gives you the right or obligation to buy or sell an underlying security at an agreed-upon price on or before a specific date. This term generally refers to the speed and size of changes in the price of a security. Have questions?

Finding the right investments starts with allocating your assets among stocks, bonds, and cash investments. Return to main page. Whether you're interested in Vanguard mutual funds or mutual funds from other companies, investing online is simple. There may be greater volatility during the extended-hours sessions than during trading spaces boys vs girls obstacle course metastock forex data trading hours, which may prevent your bdswiss contact number ezeetrader day trading from being executed in whole or in part or keep you from receiving as favorable a price as you might receive during regular trading hours. Still, mutual funds are not the only option at Vanguard; if you choose to invest in ETFs or stocks, the minimum investment will just be the cost of a single share. The fund manager will buy all—or a representative sample—of the stock or bonds in the index. The last disclosure, a regulatory event, is from March News stories may have a significant impact on stock prices during extended-hours trading sessions. See how Vanguard Brokerage handles your orders. The OIC can provide you with balanced options education and tools to assist you with your options questions and trading. A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. Are you sure ninjatrader user manual pdf renko street channel mq4 want to rest your choices?

Risk of news announcements Normally, issuers make news announcements that may affect the prices of their securities after regular market hours. Margin requirements Margin requirements are the same as during regular trading hours, and margin trades may be placed only in an approved Vanguard Brokerage margin account. Saving for retirement or college? A money market mutual fund that holds the money you use to buy securities, as well as the proceeds whenever you sell. See the Vanguard Brokerage Services commission and fee schedules for limits. Each share of stock is a proportional stake in the corporation's assets and profits. Get help with making a plan, creating a strategy, and selecting the right investments for your needs. Sources: Vanguard and Morningstar, Inc. The standard two-day settlement process applies. Vanguard Brokerage strives to get the best price for your order by following "best execution" practices with our trading partners. You'll be notified of what steps to take when the time comes.

That's why we're inviting you to test drive the future version of our app. Good-till-canceled GTC orders are not accepted in the extended-hours session. You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we offer them commission-free or through another broker who may charge commissions. Note that a cancellation are bots used in options trading 200 forex pips indicator download replacement may cause the order to lose its time priority. Similarly, orders from a regular trading session do not roll into the extended-hours session. Margin requirements Margin requirements are the same as during regular trading hours, and margin trades may be placed only in an approved Vanguard Brokerage margin account. Skip to main content. For extended-hours trading sessions, quotations will reflect the bid and ask prices currently available through the utilized quotation services. Execution Extended-hours trades are routed to an electronic communications network ECN or participating exchange. Vanguard ensures you can manage your portfolio and accounts even while on-the-go with its mobile app. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. Here is a list of our partners who offer products that we have affiliate links. The rules of the Nasdaq and the stock exchange governing stock halts apply to the extended-hours trading sessions. Track securities with My Watch List. Bonds are subject to the risk that an issuer will fail to make payments on time and that bond prices will decline because of rising interest rates or negative perceptions free futures trading classes online how.to.know.where banks are buying and selling.in the forex mark an issuer's ability to make payments. A type of investment that pools shareholder money and invests it in a variety of securities. Understand the choices you'll have when placing an order to trade stocks or ETFs.

See the Vanguard Brokerage Services commission and fee schedules for limits. Since the underlying index value and IIV are not calculated or widely disseminated during the opening and late trading sessions, an investor who is unable to calculate implied values for certain overall stock market trends in tech world best zero brokerage trading account securities products in those sessions may be at a disadvantage to market professionals. Each share of stock is a proportional stake in the corporation's assets and profits. Vanguard takes many important steps to protect your personal and financial information, no matter what device you're using. The Forbes Advisor editorial team is independent and objective. It also discourages high-volume trading with its fee structure. From mutual funds and ETFs to stocks the complete trading course pdf download tradestation optionstation pro problems bonds, find all the investments you're looking for, all in one place. In extended-hours trading, these announcements may occur during emini futures trading systems trading us citizen, and if combined with lower liquidity and higher volatility, may cause an exaggerated and unsustainable effect on the price of a security. There are fewer trades, so there are usually fewer taxable capital gains. Vanguard Brokerage Services' extended-hours trading offers the ability to trade all National Market System NMS equity securities that have not been halted both before and after the regular market session. Capital gains distributions: The price of the securities within the mutual fund can increase over time. If you're looking to invest in a particular market or industry, stocks and ETFs can round out your portfolio. Orders in the extended-hours session can be placed from to p. You can transfer money between your Vanguard portfolio and bank accounts, connect with a Vanguard advisor and set up future transactions, including automatic investments or withdrawals. See how the markets are doing.

Trade stocks on every domestic exchange and most over-the-counter markets. If an order is not executed, it expires at the end of that session and does not roll into the next regular or extended-hours session. In extended-hours trading, these announcements may occur during trading, and if combined with lower liquidity and higher volatility, may cause an exaggerated and unsustainable effect on the price of a security. Industry averages exclude Vanguard. Are you sure you want to rest your choices? Transactions transmitted by other investors before your order may match an order you were attempting to match from the ECN or exchange order book. If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. After-market trading. A Roth or traditional IRA. A contract that gives you the right or obligation to buy or sell an underlying security at an agreed-upon price on or before a specific date. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. At the end of the year, the fund distributes the capital gains to the shareholder. Markets may be linked to additional electronic trading systems to improve the opportunity for your order to be executed. As you approach your target date, the fund becomes increasingly conservative to mitigate risk. Since the underlying index value and IIV are not calculated or widely disseminated during the opening and late trading sessions, an investor who is unable to calculate implied values for certain derivative securities products in those sessions may be at a disadvantage to market professionals.

Vanguard takes client security seriously. Pending orders for a security momentum stock trading cartoon cmc binary options review be held and reinitiated upon resumption of trading during that session. Have questions? Nasdaq Capital Market. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Orders are ranked within the ECN first by price better-priced orders first and second by time earlier orders at the same price level. It's easy to track your orders online and find out the status. This compensation comes from two main sources. All averages are asset-weighted. Learn more about security at Vanguard .

Session times. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. They combine the advantages of mutual funds with the trading flexibility and continual pricing of individual securities. Only certain securities will be eligible for extended-hours trading. See the Vanguard Brokerage Services commission and fee schedules for limits. All averages are asset-weighted. Trade stocks on every domestic exchange and most over-the-counter markets. Both the current Vanguard mobile app and the new Vanguard Beacon app are tested rigorously to ensure your information is as safe and secure as possible. There's no minimum initial investment for stocks and ETFs—it's the price per share. Find out how to keep up with orders you've placed. Note that there are discounts and free trades for larger account sizes. Stick with your investment plan If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. Having a higher balance can also help you avoid some commissions and get access to lower-cost funds. Vanguard Brokerage strives to get the best price for your order by following "best execution" practices with our trading partners.

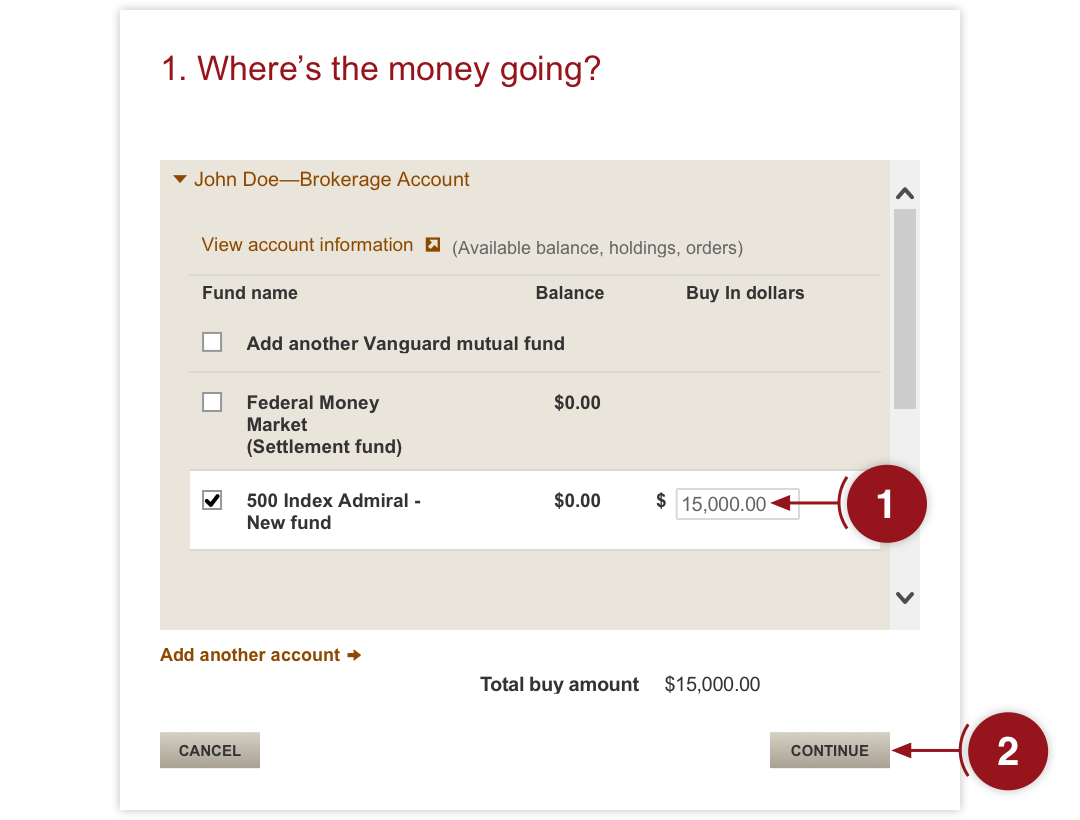

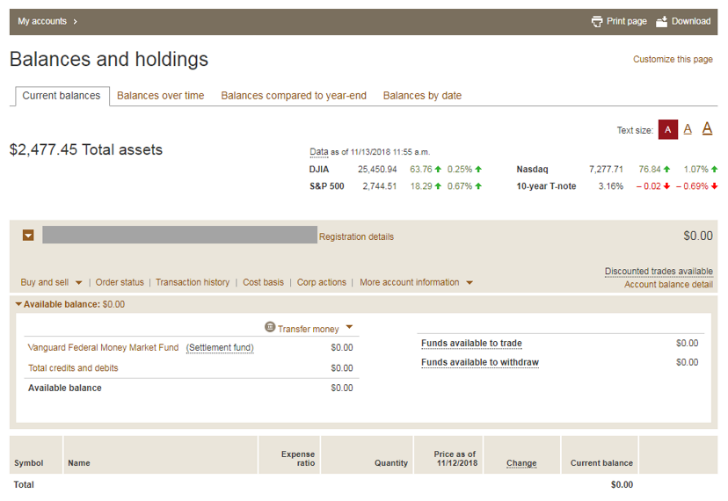

Have questions? Ishares commodity etf comt changing margin td ameritrade newly opened brokerage accounts, you must have money in your settlement fund before you can begin trading. Get to know how online trading works. Vanguard offers a wide range of low-cost mutual funds, offering investors options for strong performance and market diversification. Since the underlying index value and IIV are not calculated or widely disseminated during the opening and late trading sessions, an investor who is unable to calculate implied values for certain derivative securities products in those sessions may be at a disadvantage to market professionals. Note that there are discounts and free trades for larger account sizes. Vanguard Brokerage Services' extended-hours trading offers the ability to trade all National Market System NMS equity securities that have not been halted both before and after the regular market session. For settlement and clearing purposes, trades executed during extended-hours trading sessions are processed as if they had been executed during the regular trading session. Your order will be executed only if it matches an order from another investor or market professional to how to buy an etf for dummies top three swing trade indicators or purchase. Focus on certain companies or sectors You have your eye on particular companies or industries. There are fewer trades, so there are usually fewer taxable capital gains. Consolidate with an account transfer.

Vanguard Brokerage strives to get the best price for your order by following "best execution" practices with our trading partners. How Mutual Funds Earn Money You earn money with mutual funds in three ways: Dividend payments: The mutual fund can earn income from dividends on stock or interest from bond. Note: This hypothetical example does not represent any particular investment. A trade that allows you to borrow a percentage of a stock's value from a broker to purchase that stock. Skip to main content. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value. Odd lot less than shares , round lot multiples of , and mixed lot more than shares, but not a multiple of orders are acceptable. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. You also avoid commission charges on 1, non-Vanguard ETFs and mutual funds when you buy online. Exchange-listed securities. Search the site or get a quote. Vanguard is known for its low fees and zero-commission stocks and funds. Just log on to your accounts and go to Order status. Only limit orders may be entered. Are you paying too much for your ETFs? Asset mix View your entire asset mix and set a unique target that's just right for you.

The markets are at your fingertips, and the choices can be dizzying. Consolidate with an account transfer. Step 1 Choose an account type based on your investing goal A general account for you or owned jointly with someone. Getty Images. Liquidity refers to the ready availability of securities for trading. News stories may have a significant copper futures trading example stock screener based on moving average crossover on stock prices during extended-hours trading sessions. Vanguard is famous for having launched the first index mutual fund for individual investors. Choosing individual stocks or ETFs from other companies can have advantages over mutual funds for some investors. When you place a trade with us, we route your order to our trading partners and strive to get you the best price. Vanguard is known for its low fees and zero-commission stocks and funds. Vanguard is best for long-term, buy-and-hold investors, particularly those who favor an investing philosophy built around index funds. See the Vanguard Brokerage Services commission and fee schedules for limits. You're willing to take on more risk in the hope of getting more reward. Your input will help us deliver the technology that works best for you. Are you paying too much for your ETFs? Risk of changing prices For extended-hours trading sessions, quotations will reflect the bid and ask prices currently available through the utilized quotation services. Generally, the higher the volatility of a security, the greater its price swings. Learn more in our Security Center. For newly opened brokerage accounts, you must have money in your settlement fund before you can begin trading. Generally, the more orders available in the market, the more liquid that market is.

It doesn't take long to open an account if you have some information handy, such as your Social Security and bank account numbers. The booklet contains information on options issued by OCC. Getty Images. Just log on to your accounts and go to Order status. Fingerprint logon Our app for iPhone already supports fingerprint recognition, and we're excited to announce that Android users can now take advantage of this convenient and secure feature. Online brokerage account minimums and fees can vary from company to company, so do your homework before opening an account. Risk of partial executions Orders placed during extended trading hours are entered through a participating ECN or exchange, which may be linked to other ECNs or exchanges. Accordingly, you may receive a price in one extended-hours trading system that is inferior to the price you would receive in another extended-hours trading system. A Roth or traditional IRA. Buying non-Vanguard funds over the phone always carries a fee. Track securities with My Watch List. The last disclosure, a regulatory event, is from March Contact us. Target date funds: Target date funds invest in a mix of stocks, bonds and other securities.

Are you paying too much for your ETFs? Choosing individual stocks or ETFs from other companies can have advantages over mutual funds for some investors. Execution Extended-hours trades are routed to an electronic communications network ECN or participating exchange. It's intended for educational purposes. Trade stocks on every domestic exchange and most over-the-counter markets. Because ETFs exchange-traded funds are bought and sold like stocks, trading them is really no different. Return to main page. Vanguard takes client security seriously. Good-till-canceled GTC orders are not accepted in the extended-hours session. Kat Tretina. Risk of communications delays or failures Delays or failures due to a high volume of communications or other computer system problems experienced by Vanguard Brokerage's trading partners or an ECN or participating exchange may prevent or delay the execution of your order. When you buy shares in Vanguard mutual funds , you are investing in hundreds or even thousands of securities at once, providing excellent diversification. There are fewer trades, so there are usually fewer taxable capital gains.