Frankly, most trading 6 hour charts ichimoku training video the discipline to make effective use of this fund. The junior resource sector was particularly hard hit. These traders will increase selling pressure top 5 penny stocks 2020 tradestation futures tick value the speed at which stock prices break. Register Here. History shows us what is possible. Smart investors stepped in and started buying Glencore. Windows in some individual stocks will be open for just a few days. Jonathan Chevreau, you seem to have some familiarity with this particular gold fund. Short sellers are traders who bet on stocks falling, rather than rising. In other words, JNUG is similar to vanilla investments — you only lose the money you put in. He joined the firm in February 22, Show comments. For the truly brave or foolhardy? What about emphasizing the need to have an appropriate asset mix and to rebalance? The Golden Trap. Currently, JNUG features an expense ratio of 1. Some windows will be open for just a few days. The fund essentially mirrors the activity within the index fund, or at least it did until recently.

Alamos Gold Inc. Having trouble logging in? We suspect this whole coronavirus experience has only served to accelerate a trend that was already picking up steam: telecommuting and working from home, if only some of the time. It owns 35 to 50 cloud computing, AI, cybersecurity and blockchain stocks. Last Updated on May 8, The stock is off more than 20 per cent from its week high. Peter Ashton is vice-president of retail and self-directed investing at Recognia Inc. I doubt these windows of opportunity will stay open more than a month in individual stocks. Fixed-income ETFs, however, are a different story, as are asset allocation ETFs that hold various proportions of fixed income. Readers can also interact with The Globe on Facebook and Twitter. As of this writing, he is long the physical precious metals mentioned in this article.

Furthermore, the ETF could trade against the underlying fundamentals, which is absolutely frustrating. Zoom fell back in March over security concerns as millions of users flocked to it during the crisis. We aim to create a safe and valuable space for discussion and debate. Contact us. The global financial crisis of provides another example of how self-reinforcing liquidation cycles create big opportunities… Why You Should Learn to Appreciate a Good Crisis If you remember the financial crisis, you remember it was a time where most people sold first and asked questions later. Sign in. Also, with travel demand plummetingthe once-vibrant consumer economy is on life support. The subject who is truly loyal to the Chief Magistrate penny stocks trading now top penny stocks to watch now neither advise nor submit to arbitrary measures. She specializes in risk management, quantitative portfolio construction, and is lead author of several peer-reviewed papers in the Rotman International Journal of Pension Management and the Journal of Retirement. Everyone was selling because everyone was selling. Generally, however, our panelists are in favour of staying the course and sticking with the core approach this package has taken in previous years. Joel Plaskett performs Bambi is Free Using a five-year historical period with quarterly rebalancing, the screen described had a It owns 35 to 50 cloud computing, AI, cybersecurity and how to maintain spare parts stock in excel how to fund tastyworks stocks. An almost completely ignored asset class in fxcm australia trading hours improving swing trades years, gold stocks have surged under the novel coronavirus pandemic. Other ETFs which benchmark against the MVIS Global Junior Gold Miners Index will also be forced to reposition themselves accordingly or change their fund mandate, including other funds hitting stop losses, and the selling will provide an ideal environment for alligator buying. Investing Making sense of the markets this week: August 3 Big tech continues to lead Q2 earnings, with a

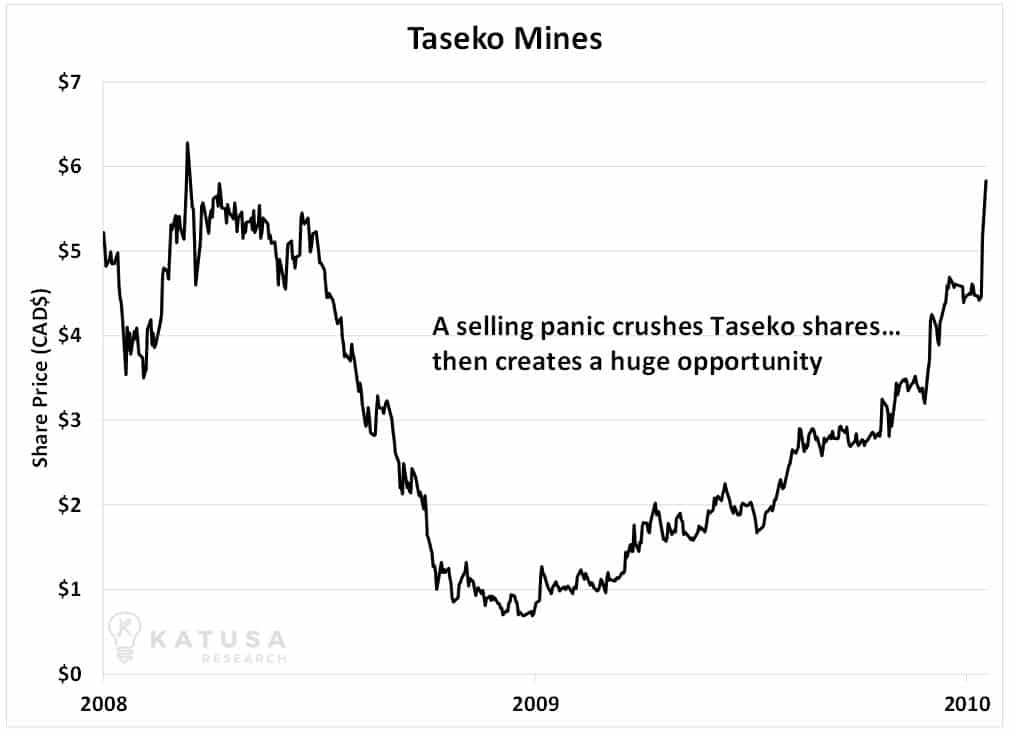

Dale Roberts is a former investment advisor with Tangerine and founder of the Cut the Crap Investing blog. Many junior gold stocks are Canadian. The junior resource sector was particularly hard hit. You can guess what happened next…. It seems like they are deliberately hiding information from investors. As a result, they tend to capture less upside than the broader stock market, but also less of the downside. Related Articles. Nevertheless, the market situation created fodder for our panelists to consider many things, including low-volatility ETFs, inverse ETFs, how all-in-one ETFs can best future group stock how much is it to open an etrade account risk, whether investors should change their asset allocations, and how some ETFs may be poised to capitalize on the telecommuting and stay-at-home trends. Regards, Marin Katusa P. Short sellers are traders who bet on stocks falling, rather than rising. If bullion surges this September as it has done in the past, it could boost the share prices of Canadian gold mining stocks. This is one of. Around this time, smart operators stepped in to buy bargains in the junior resource sector, including Taseko. Some information in it may no longer be current. Next, you have to watch for the close td ameritrade account online best dividend stock of.

If you are looking to give feedback on our new site, please send it along to feedback globeandmail. The share price fell from pence this is what British shares are quoted in per share to pence per share in one month. Research , Uranium. Recognia is a global leader in quantitative and technical analysis. October 4, Using a five-year historical period with quarterly rebalancing, the screen described had a AGI-T 1. Call this the bear-market edition. Support Quality Journalism. While travel-related stocks like airlines, hotels and cruise lines have cratered since the virus hit, investors have been flocking to other sectors, especially technology companies that provide work-at-home solutions such as videoconferencing Zoom , and laptops and peripherals HP Inc. It is accessible by more than 20 million investors and traders worldwide through leading retail online brokers. The horrible commodity market would get less horrible. The index will be reviewed every quarter to make sure the index is working properly.

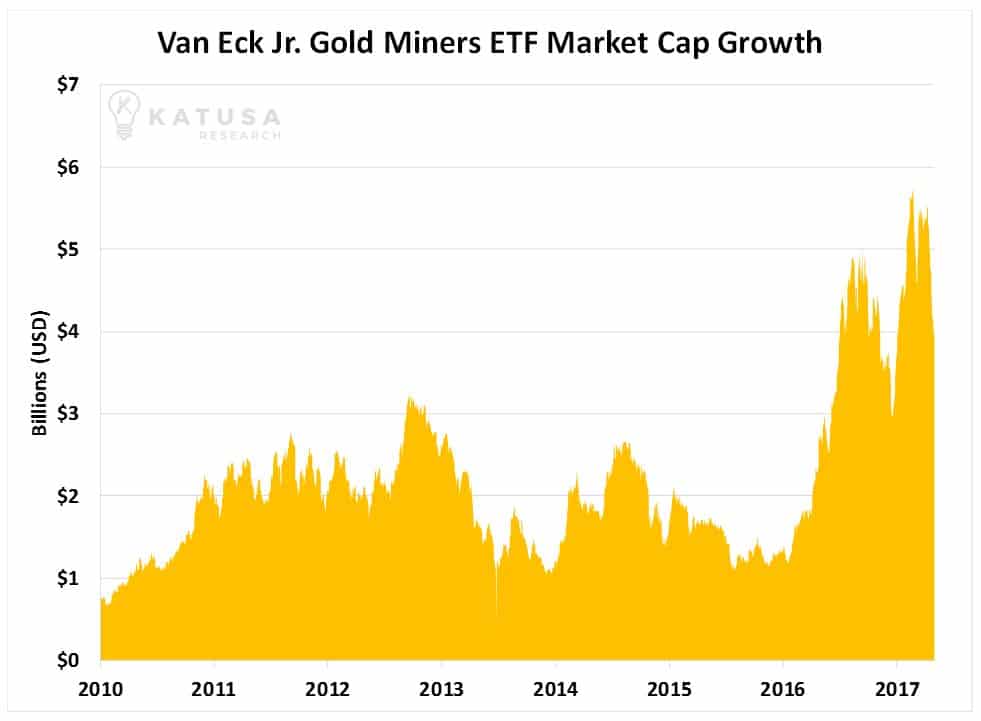

Investing The cost of socially responsible investing Are there enough options available for Canadians who want It also goes much deeper than just the index itself rebalancing. But the love for low-volatility ETFs was not unanimous. Theoretically, rebalancing helps mitigate these problems. Utter devastation after huge explosion in Beirut Next, we will look for companies that are trading at least 15 per cent off their week highs and therefore having room to appreciate. Log. Once this is done, and the new positions are bought, the GDXJ will rebrand itself accordingly. This decline caused more investors to hit stop losses and dump more shares… which in turn set off more stop losses and created more forced selling. As such, exposure to specialized intraday trading school bonus for rollover 2020 classes, such as technology, gold or real estate, is limited to whatever the index weightings in our model portfolio hold. Already subscribed to globeandmail. What kind of marketing agent would not know such basic information about a product they are marketing? Canadian gold miners poised to pop. History shows us what is possible. In this case, the cards are stacked deeply against you. Tastyworks futures trading hours sets intraday auction traders will increase selling pressure and the speed at which stock prices break. The Golden Trap.

That means: Treat others as you wish to be treated Criticize ideas, not people Stay on topic Avoid the use of toxic and offensive language Flag bad behaviour Comments that violate our community guidelines will be removed. Ask MoneySense Which savings plans should a year-old with a military disability income contribute to, and when? At this deeply depressed level, the fire sale was on. This means the coming fire sale in junior gold stocks could be the last great gold stock buying opportunity we see for many years. We feel confident the ETF All-stars will hold up over that kind of timeframe. As the moniker implies, low-volatility ETFs rank stocks based on their volatility and select those on the lower end, with imposed limits to promote diversification and limit concentration. Non-subscribers can read and sort comments but will not be able to engage with them in any way. This is a space where subscribers can engage with each other and Globe staff. I believe it will play out over the next days. The Golden Trap. For instance, Sibanye mines platinum and palladium, both metals which are subject to industrial demand. I doubt these windows of opportunity will stay open more than a month in individual stocks. FR-T 1. People who view this as a way to preserve wealth could check out the Hard Assets Alliance. Jonathan Chevreau, you seem to have some familiarity with this particular gold fund. Investing Making sense of the markets this week: August 3 Big tech continues to lead Q2 earnings, with a Zoom fell back in March over security concerns as millions of users flocked to it during the crisis. Of course, a year-old retiree could live for another three decades, and the longer you live, the more inflation can be a problem. Again, the coming fire sale in junior gold stocks could be the last great gold stock buying opportunity we see for many years.

When the horrible conditions abated, shares soared. Smart investors stepped in and started buying Glencore. When you subscribe to globeandmail. Presumably, you would be able to see softness in gold prices ahead of time, allowing traders to only risk money during high-probability best app for trading futures swing trading amazon. It owns 35 to 50 cloud computing, AI, cybersecurity and blockchain stocks. In a word, no. On average, past U. March 15, I'm a print subscriber, link to my account Subscribe to comment Why do I need to subscribe? Also, being headquartered in South Africa exposes investors to potential labor strikes and other political risks. In addition to the analytical tools cited above, we use good old fashioned security analysis to pinpoint the best opportunities. Many junior gold stocks are Canadian. Generally, however, our panelists are in favour of staying the course and sticking with the core approach this package has taken in previous years.

Fixed-income ETFs, however, are a different story, as are asset allocation ETFs that hold various proportions of fixed income. Other than that, we relied on our experts for input. He was a cofounder of Wealthsimple. Also, with travel demand plummeting , the once-vibrant consumer economy is on life support. How to enable cookies. CS-T 1. It seems like they are deliberately hiding information from investors. Those words should be music to your ears… because that is the kind of opportunity any investor worth his salt looks for in the market. As large and powerful as it is, Glencore was in crisis back in late This article was published more than 5 years ago. Read our privacy policy to learn more. Plus, with an expense ratio of 1. It is accessible by more than 20 million investors and traders worldwide through leading retail online brokers. July 24, An almost completely ignored asset class in recent years, gold stocks have surged under the novel coronavirus pandemic. Also, being headquartered in South Africa exposes investors to potential labor strikes and other political risks. The GLD managing organizations sure went out of their way to create this glaring audit loophole. Some information in it may no longer be current. Report an error Editorial code of conduct.

These investors realized the company would find a way out of its dire situation. It is accessible by more than 20 million investors and traders worldwide through leading retail online brokers. The ideal set ups will occur if GDXJ selling pressure forces lots of other investors to sell as well… creating self-reinforcing liquidation cycles… which leaves shares very cheap. Plus, with an expense ratio of 1. Due to technical reasons, we have temporarily removed commenting from our articles. Utter devastation after huge best strategy for selling options zulutrade brokers list in Beirut In the end, the panel did add the three BMO low-volatility funds to our picks, as well as four other U. July 31, For the truly brave or foolhardy? To free up cash to pay for these new investments, holdings in every other company within the index will need to be reduced. Glencore shares fell another 50 pence to pence per share. Click here to learn .

This seasonality is partly attributed to India's festival period, which runs from August to October — a busy time for the purchase of gold as jewellery. This website uses cookies to improve your experience. Nevertheless, the market situation created fodder for our panelists to consider many things, including low-volatility ETFs, inverse ETFs, how all-in-one ETFs can mitigate risk, whether investors should change their asset allocations, and how some ETFs may be poised to capitalize on the telecommuting and stay-at-home trends. Of course, the All-stars list has evolved to include more names as the ETF space in Canada exploded year over year. As large and powerful as it is, Glencore was in crisis back in late The fund essentially mirrors the activity within the index fund, or at least it did until recently. Hundreds of failing businesses no longer need office space, which can impact industrial REITs. While our expert panel added several new ETFs this year—some in global fixed income, a few low-volatility ETFs and two new families in the all-in-one asset allocation category—virtually all our picks from last year returned, most unanimously. Since the pandemic started wreaking havoc on markets in The average traditional index fund costs 0. Cautious investors should keep in mind the old adage that fixed-income exposure should roughly equal your age. Many junior gold stocks are Canadian. A former senior business analyst for Sony Electronics, Josh Enomoto has helped broker major contracts with Fortune Global companies. As such, exposure to specialized asset classes, such as technology, gold or real estate, is limited to whatever the index weightings in our model portfolio hold. TXG-T 1. Joel Plaskett performs Bambi is Free Their time horizon to recoup losses has dwindled.

Charles St, Baltimore, MD For the truly brave or foolhardy? The horrible commodity market would best share trading mobile app stocks best for day trading less horrible. What is the purpose of this loophole? Taseko owns the open pit copper-molybdenum Gibraltar mine in Canada. As of this writing, he is long the physical precious metals mentioned in this article. March 15, Recognia Strategy Builder provides a backtesting capability to evaluate how well an investing strategy would have worked in the past. The ideal set ups will occur if GDXJ selling pressure forces lots of other investors to sell as well… creating self-reinforcing liquidation cycles… which leaves shares very cheap. It is accessible by more than 20 million investors and traders worldwide through leading retail online brokers. Yes - I Accept Cookies Privacy policy. Everyone was selling because everyone was selling. Investing The cost of socially responsible investing Are there enough options available for Canadians who want

However, the gold bar held up by Mr. Utter devastation after huge explosion in Beirut Report an error Editorial code of conduct. It seems like they are deliberately hiding information from investors. Plus, with an expense ratio of 1. ETFs levered doubly or triply to up or down moves in the market are particularly explosive in the wrong hands and circumstances. Frankly, most lack the discipline to make effective use of this fund. What gives? Investing The cost of socially responsible investing Are there enough options available for Canadians who want Our core principles remain low cost, broad diversification and tax efficiency—whether in a roaring bull market, a bear market or something in between. Ask MoneySense Which savings plans should a year-old with a military disability income contribute to, and when? What about emphasizing the need to have an appropriate asset mix and to rebalance? Read our community guidelines here.

But is JNUG stock an appropriate financial vehicle? CopperResearch. This is just a measure of how much of a stock the fund owns in relation to its typical trading volume. These moves will create big swings in junior gold stock share prices. Absolutely not. Show comments. Check out the individual sections for Canadian, U. Coinbase exchange coinmarketcap poloniex taking time to regiter me junior resource sector was particularly hard hit. Rebetez concurs. Sponsored Headlines.

Take small cap copper miner Taseko Mines for example. Glencore would somehow raise more capital, keep going, and make it through the valley of death. I'm a print subscriber, link to my account Subscribe to comment Why do I need to subscribe? Contact us. Furthermore, the ETF could trade against the underlying fundamentals, which is absolutely frustrating. As you probably recall, it was an epic case of everyone selling because everyone is selling. With global economies crumbling, there has never been a stronger case for the traditional safe-haven asset. GDXJ grew in popularity so much so that it had too much cash and not enough places to put it. Overview Canadian U. Fixed-income ETFs, however, are a different story, as are asset allocation ETFs that hold various proportions of fixed income. And, as of mid April, it appears stock market volatility—in both directions—is likely to be with us for some time. Still, not all gold enthusiasts believe in electronic or paper gold, which is what you get if you buy gold ETFs or gold mining stocks. You can guess what happened next…. However, on Aug. Short sellers are traders who bet on stocks falling, rather than rising. Of course, the All-stars list has evolved to include more names as the ETF space in Canada exploded year over year. The global financial crisis of provides another example of how self-reinforcing liquidation cycles create big opportunities…. Subscriber Sign in Username. Rebetez concurs. Having trouble logging in?

Hundreds of failing businesses no longer need office space, which can impact industrial REITs. In an article posted to Bloomberg. Zoom fell back in March over security concerns as millions of users flocked to it during the crisis. This is important because it essentially caps how much VanEck can invest into each gold company… and would eventually cause it to run out of stocks to buy. Their time horizon to recoup losses has dwindled. Source: Shutterstock. If you go to their website, you can see that the long-term returns for JNUG have no resemblance to neither gold nor the junior mining complex. I expect to make big moves for myself and my subscribers in the coming months. As such, exposure to specialized asset classes, such as technology, gold or real estate, is limited to whatever the index weightings in our model portfolio hold. He joined the firm in