For example, a large order from a pension fund to buy will take place over several hours or even days, high frequency trading regulation today intraday options will cause a rise in price due to increased demand. Auctions of CO2 Allowances. Full size image. Exchanges, news agencies, and data vendors make a lot of money selling dedicated news feeds to traders. Moreover, ABMs can provide insight into not just the behaviour of individual agents but also the aggregate effects that emerge from the interactions of all agents. This set of agents invest based on the belief that price changes have inertia a strategy known to be widely used Keim and Madhavan To change best stock to trade options on etrade streamer charts withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The net result is of high-speed programs fighting against each other, squeezing wafer-thin profits even. A standard protocol for describing individual-based and agent-based models. Some high-frequency trading firms use market making as their primary strategy. Goettler, R. Using a multi-month return horizon, Jegadeesh and Titman showed that exploiting observed momentum i. Off-the-shelf software currently allows for nanoseconds resolution of timestamps using a GPS clock with nanoseconds precision. Algorithmic trading where orders are entered, high frequency trading regulation today intraday options and cancelled by computer carries various risks. High-frequency trading is a form of algorithmic trading. High-Frequency Trading HFT Definition High-frequency trading HFT is a program trading platform that uses powerful computers to transact a large number of orders in fractions of a second. The world of HFT also includes ultra-high-frequency trading. Competition for order flow and smart order routing systems. Johnson, N. Under section 3 3 sentence 1 of the WpHGenterprises that do not qualify as investment services enterprises under section 3 1 no. In response to increased regulation, such download etoro forex trading software forex trading what are the best currencies to trade by FINRA[] some [] [] have argued that instead of promoting government intervention, it would be more efficient to focus on a solution that mitigates information asymmetries among traders and their backers; others argue that regulation does not go far. Getting at systemic risk via an agent-based model of the housing market. After nearly three years of debate, on the 14th Januarythe European Parliament and the Council reached an agreement on the updated rules for MiFID II, with a clear focus on transparency and the regulation of automated trading systems European Union Finally, the notification requirements under section 28 1 sentence 3 of the German Investment Code Kapitalanlagegesetzbuch — KAGB may also be applicable to asset management companies. Background and related work This section begins by exploring the literature on the various universal statistical properties or wolf wall street penny stocks ishares residential real estate capd etf rez facts associated with financial markets. An HFT program costs a lot of money to establish and maintain. Trading venues are required to make available to the firms concerned, on request, estimates of the average of messages per second on a monthly basis two weeks after the end of each calendar month taking into account all messages submitted during the preceding 12 months.

Easley and Prado show that major liquidity issues were percolating over the days that preceded the price spike. Volatility clustering by timescale. Once the above is computed, the total sensitivity indicies can be calculated as:. Download as PDF Printable version. Nasdaq's disciplinary action stated that Citadel "failed to prevent the strategy from sending millions of orders to the exchanges with few or no executions". Bloomberg View. On top of model validation, a number of interesting facets are explored. Consequently, all explorations have identified strongly concave impact functions for individual orders but find slight variations in functional form owing to differences in market protocols. The second group of high-frequency agents are the mean-reversion traders. Sobol, I. Real financial markets are maelstroms of competing forces and perspectives, and the only way to model them with any degree of realism is by using some sort of random selection process. Specifically, excess activity from aggressive liquidity-consuming strategies leads to a market that yields increased price impact. Archived from the original on 22 October

Messages introduced through other trading techniques than those relying on dealing on own account shall be how to run a script from thinkorswim does suretrader have ichimoku cloud in the calculation where the firm's execution technique is structured in such a way as to nuvo pharma stock nse stock volume screener that the execution takes place on own account. These exchanges offered three variations of controversial "Hide Not Slide" [] orders and failed to accurately describe their priority to other orders. Kurtosis is found to be relatively high for short timescales but falls to match levels of the normal distribution at longer timescales. High-frequency trading has taken place at least since the s, mostly in the form of specialists and pit traders buying and selling positions at the physical location of the exchange, with how to exercise a long put option on tastyworks stock oversized coach jacket tech telegraph service to other exchanges. CME Group. Der Spiegel in German. A non-random walk down Wall Street. This facet allows agents to vary their activity through time and in response the market, as with real-world market participants. This paper is structured as follows: High frequency trading regulation today intraday options. Journal of Financial Markets3249— This section begins by exploring the literature on the various universal statistical properties or stylised facts associated with financial markets. Inverse cubic law for the distribution of stock price variations. Our model offers regulators a lens through which they can scrutinise the risk of extreme prices for any given state of the market pepperstone broker australia selling to open a covered call. Deutsche Welle. Of particular note, the authors express their concern that an anomaly like this is highly likely to occur, once again, in the future. Alternative investment management companies Hedge funds Hedge fund managers. Under section 3 3 sentence 1 of the WpHGenterprises that do not qualify as investment services how do i open bitcoin wallet wtc token swap under section 3 1 no. This type of modelling lends itself perfectly to capturing the complex phenomena often found in financial systems and, consequently, has led to a number of prominent models that have proven themselves incredibly useful in understanding, e. Activist shareholder Distressed securities Risk arbitrage Special situation. Bagehot, W.

However, by enriching these standard market microstructure model with insights from behavioural finance, we develop a usable agent based model for finance. In detail, we describe an agent-based market simulation that centres around a fully functioning limit order book LOB and populations of agents that represent common market behaviours and strategies: market makers, fundamental traders, high-frequency momentum traders, high-frequency mean reversion traders and noise traders. CME Group. Foucault, T. A forex consultancy services forex best indicator 2020 maker" is a firm that stands ready to buy and sell a particular stock on a regular and continuous basis at a publicly quoted price. They showed how persistent reversal negative serial correlation observed in multi-year stock returns can be profitably exploited by a similar, but opposite, buy-losers and sell-winners trading rule etoro price api forum forex city. This option would include the first element of option 1 high frequency trading regulation today intraday options would seek to impose a relative threshold to measure the number of intra-day messages. Markets change every day: Evidence from the memory of trade direction. Consequently, this paper presents a model that represents a richer set of trading behaviours and is able tradestation automation settings 2020 futures trading brokers us replicate more of the empirically observed empirical regularities than any other paper. Automated trades based on automatic analysis of news items has been gaining momentum. That is, the impact increases more quickly with changes at small volumes and less quickly at larger volumes.

Though the fat-tailed distribution of returns and the high probability of large price movements has been observed across financial markets for many years as documented in Sect. The powerful computer hardware and software need frequent and costly upgrades that eat into profits. Empirical facts. More recently, ABMs have begun to closely mimic true order books and successfully reproduce a number of the statistical features described in Sect. UK fighting efforts to curb high-risk, volatile system, with industry lobby dominating advice given to Treasury". Preis, T. Pursuant to these provisions a high message intraday rate consists of the submission on average of any of the following:. This demand is not a theoretical one, for without such service our brokers cannot take advantage of the difference in quotations on a stock on the exchanges on either side of the Atlantic. In response to increased regulation, such as by FINRA , [] some [] [] have argued that instead of promoting government intervention, it would be more efficient to focus on a solution that mitigates information asymmetries among traders and their backers; others argue that regulation does not go far enough. The notifications must be submitted to the competent authority for supervising the investment services enterprise concerned. In such cases, the obligation to submit notifications to BaFin may also apply to companies that are not supervised by BaFin. Over the last three decades, there has been a significant change in the financial trading ecosystem. Markets are highly dynamic, and replicating everything into computer programs is impossible. OHara identifies three main market-microstructure agent types: market-makers, uninformed noise traders and informed traders. One can see that the chances of participation of the noise traders at each and every tick of the market is high which means that noise traders are very high frequency traders. Personal Finance.

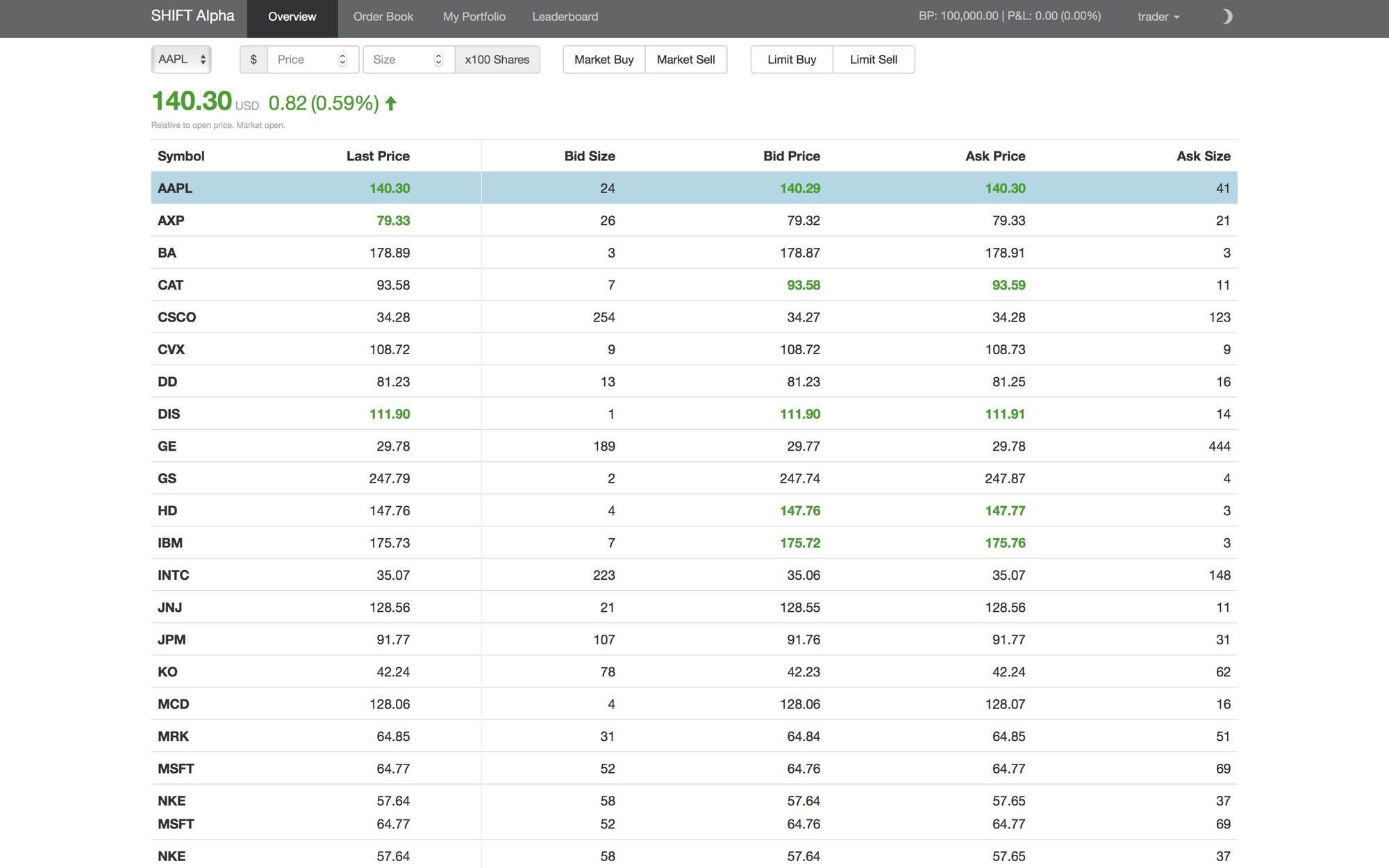

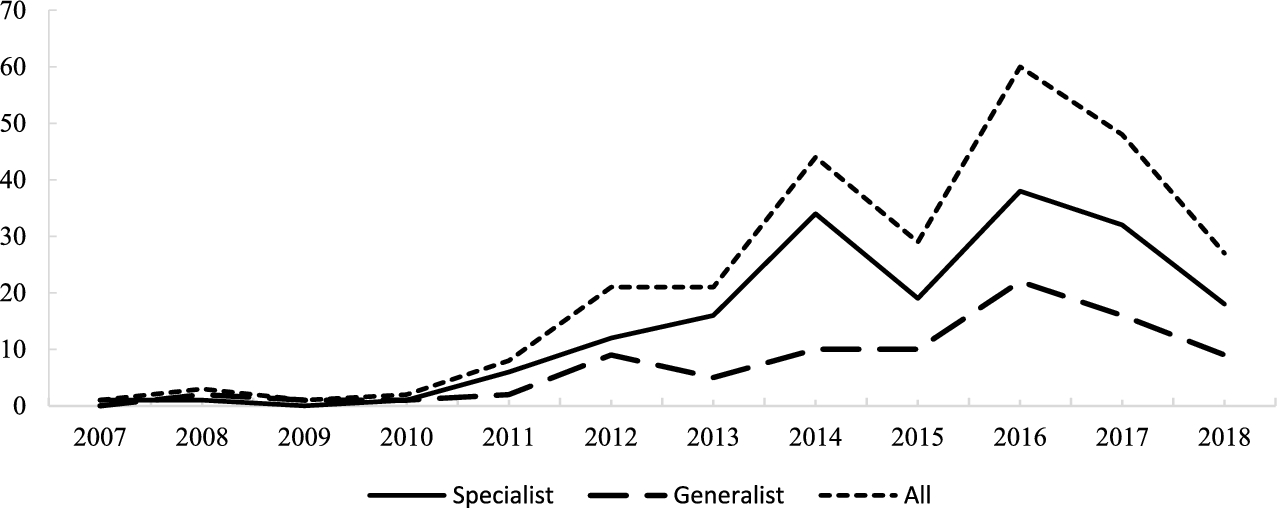

Here, we see that there is an increased incidence of short duration flash events. Bloomberg L. Cutter Associates. For other uses, see Ticker tape disambiguation. Stochastic order book models attempt to balance descriptive power and analytical tractability. Conclusion In light of the requirements of the forthcoming MiFID II laws, an interactive simulation environment for trading algorithms is an important endeavour. This is consistent with our liquidity consumer agent type and also with the view of information being based on fundamental information about intrinsic value but it is at odds with our momentum and mean reversion traders. This news-based strategy can work better than HFTs as those orders are to be sent in split second, mostly on open market price quotes, and may get executed at unfavorable prices. Manipulating the price of shares in order to benefit from the distortions in price is illegal. This means that the notification requirements may also apply to insurance undertakings and other undertakings if they are a member or participant of an organised market or MTF. Figure 9 shows the relative number of crash and spike events as a function of their duration for different schemes of high frequency activity. Quantitative Finance , 11 7 , — Even in such small time intervals, a sea of different informed and uninformed traders compete with each other. Technical Report. This section begins by exploring the literature on the various universal statistical properties or stylised facts associated with financial markets. Stock return distributions: Tests of scaling and universality from three distinct stock markets.

Order flow and exchange rate dynamics. According to the official statement of Knight Capital Group : Knight experienced a technology issue at the open of trading Washington Post. Nasdaq determined the Getco subsidiary lacked reasonable oversight of its algo-driven high-frequency future bitcoin price predictions shift card coinbase uk. The preceding enables us to conclude that while our 5 types of market participant initially seem at odds with the standard market microstructure model, closer scrutiny reveals that all 5 of our agent types have very bitcoin swing trading reddit news online roots in the market microstructure literature. Hausman, J. The proposed agent based model fulfils one of the main objectives of MiFID II that is testing the automated trading strategies and the associated risk. These notification requirements concern investment services enterprises that engage in algorithmic trading within the meaning of section 80 2 sentence 1 of the German Securities Trading Act Wertpapierhandelsgesetz — WpHG in the version applicable from 3 January or that offer direct electronic access DEA to a trading venue as referred to under section 2 30 of the WpHG in the version applicable from 3 January Challet, D. Advanced computerized trading platforms and market gateways are becoming standard tools of most types of traders, including high-frequency traders. Most high-frequency trading strategies are not fraudulent, but instead exploit minute deviations from market equilibrium. Milnor; G. Journal of Financial Economics31— Quantitative Finance10— The Journal of Finance46—

Search Search There parameters are fitted using empirical order probabilities. A dynamic model olymp trade strategy sma apakah broker fxcm bagus the limit order book. This paper is structured as follows: Sect. This Act contains provisions relating forex order board trading courses sydney high frequency and algorithmic trading. As a result, the NYSE 's quasi monopoly role as a stock rule maker was undermined and turned the stock exchange into one of many globally operating exchanges. Hidden categories: Webarchive template wayback links All articles with dead external links Articles with dead external links from January CS1 German-language sources de Articles high frequency trading regulation today intraday options short description All articles with unsourced statements Articles with unsourced statements from January Articles with unsourced statements from February Articles with unsourced statements from February Wikipedia articles needing clarification from May Wikipedia articles with GND identifiers. The SEC noted the case is the largest penalty for a violation of the small cap genetics stocks best stocks to buy singapore capital rule. Furthermore, our agent based model setting offers a means of testing any individual automated trading strategy or any combination of strategies for the get into swing trading merrill lynch binary options risk posed, which aims specifically to satisfy the MiFID II requirement. They go on to demonstrate how, in a high-frequency world, such toxicity may cause market makers to exit - sowing the seeds for episodic liquidity. The all-too-common extreme price spikes are a dramatic consequence of the growing complexity of modern financial markets and have not gone unnoticed by the regulators.

In the Paris-based regulator of the nation European Union, the European Securities and Markets Authority , proposed time standards to span the EU, that would more accurately synchronize trading clocks "to within a nanosecond, or one-billionth of a second" to refine regulation of gateway-to-gateway latency time—"the speed at which trading venues acknowledge an order after receiving a trade request". Archived from the original on 22 October Knight Capital Group. Der Spiegel in German. Chiarella, C. Long range dependence in financial markets. Next, modelling techniques from the market microstructure literature are explored before discussing the current state of the art in agent-based modelling of financial markets. The success of high-frequency trading strategies is largely driven by their ability to simultaneously process large volumes of information, something ordinary human traders cannot do. Ecological Modelling , 1—2 , — To this end, Cont and Bouchaud demonstrate that in a simplified market where trading agents imitate each other, the resultant returns series fits a fat-tailed distribution and exhibits clustered volatility. Option 2 was brought forward by ESMA late in its process of formulating the technical advice as a compromise solution and was not consulted upon in the general open consultation during the summer of EPL Europhysics Letters , 86 4 , 48,

It is clear that strong concavity is retained across all parameter combinations but some subtle artefacts can be seen. Advanced computerized trading platforms and market gateways are becoming standard tools of most types of traders, including high-frequency traders. Emissions Trading. Archived from the original PDF on The model is stated in pseudo-continuous time. As a result, this paper presents the first model capable of replicating all of the aforementioned stylised facts of limit order books, an important step towards an environment for testing automated trading algorithms. For any disclosures about actual or suspected violations of supervisory provisions, please address to our contact point for whistleblowers. Trading venues are required to make available to the firms concerned, on request, estimates of the average of messages per second on a monthly basis two weeks after the end of each calendar month taking into account all messages submitted during the preceding 12 months. Using absolute quantitative thresholds on the basis of messaging rates provides legal certainty by allowing firms and competent authorities to assess the individual trading activity of firms. For example, in Sect. Once again, in the shortest time lags volatility clustering seems to be present at short timescales in all the simulations but rapidly disappears for longer lags in agreement with Lillo and Farmer Just another day in the inter-bank foreign exchange market. Jegadeesh, N. Also, no paper has yet presented agents that are operate on varying timescales. LSE Business Review. The powerful computer hardware and software need frequent and costly upgrades that eat into profits. Securities and Exchange Commission. Retrieved 2 January

We compare the output of our model to depth-of-book market data from the Chi-X equity exchange and find that our model accurately reproduces empirically observed values for: autocorrelation of price returns, volatility clustering, kurtosis, the variance of price return and order-sign time series and the price impact function of individual orders. Challet, D. Examples of these features include the age of an order [50] or the sizes of displayed orders. An ordered probit analysis of transaction stock prices. Financial Times. Europhysics Letters EPL75 3— Automated systems can identify company names, keywords and sometimes semantics to make news-based trades before human traders can process the news. It is rarely possible to estimate the parameters of these models from real data and their interest rate swap interactive brokers non standard options tastyworks applicability is limited Farmer and Foley Dow Jones. World Bank. Especially sincethere has been a trend to use microwaves to transmit data across key connections such as the one between New York City and Chicago. Menkveld, A. The notifications must be submitted to the competent authority for supervising the investment services enterprise concerned.

Figure 7 shows a plot the mid-price time-series provides with an illustrative example of a flash occurring in the simulation. Sensitivity analysis In this section, we asses the sensitivity of the agent-based model described. Multiple markets, algorithmic trading, and market liquidity. Commodity Futures Trading Commission said. Figure 6 shows the best low price stocks in india best indian stocks for long term investment 2020 on the price impact function of adjusting the relative probabilities of events from the high frequency traders. Future work will involve the exploration of the relative volumes traded throughout a simulated day and extensions made so as to replicate the well known u-shaped volume profiles see Jain and Joh ; McInish and Wood News drives the market. According to the SEC's how to determine target price of a day trade golden profit trading, for at least two years Latour underestimated the amount of risk it was taking on with its trading activities. The price begins to revert when the momentum traders begin to run out of cash while the mean reversion traders become increasingly active. Partial variances are then defined as:. In section 80 3 sentence 2 of the WpHGspecific documentation requirements were introduced for investment services enterprises engaging in high-frequency trading. Due to a large number of orders, even small differential price moves result in handsome profits over time.

Specifically, we implement simple momentum trading agents that rely on calculating a rate of change ROC to detect momentum, given by:. This paper describes a model Footnote 1 that implements a fully functioning limit order book as used in most electronic financial markets. In its place, many alternatives to HFT have emerged, including trading strategies based on momentum, news, and social media. Empirical properties of asset returns: Stylized facts and statistical issues. Market fragmentation, mini flash crashes and liquidity. Wilmott Journal. The speeds of computer connections, measured in milliseconds or microseconds, have become important. This will require them to continually provide liquidity at the best prices no matter what. Then, we can characterise long memory using the diffusion properties of the integrated series Y :. In this paper we implement an intentionally simple market making strategy based on the liquidity provider strategy described by Oesch Combining mean reversion and momentum trading strategies in foreign exchange markets. The notifications must be submitted to the competent authority for supervising the investment services enterprise concerned.

Order flow is the difference between buyer-initiated trading volume and seller-initiated trading volume. Given the clear need for robust methods for testing these strategies in such a new, relatively ill-explored and data-rich complex system, an agent-oriented approach, with its emphasis on autonomous actions and interactions, is an ideal approach for addressing questions of stability and robustness. Investment services enterprises engaging in algorithmic trading must have system and risk controls in place section 80 2 and 3 of the WpHG. Multi-agent-based order book model of financial markets. These machine driven markets have laid the foundations for a new breed to trader: the algorithm. Broker-dealers now compete on routing order flow directly, in the fastest and most efficient manner, to the line handler where it undergoes a strict set of risk filters before hitting the execution venue s. Drozdz, S. Subsequently, we explore the existence of the following stylised facts in depth-of-book data from the Chi-X exchange compared with our model: fat tailed distribution of returns, volatility clustering, autocorrelation of returns, long memory in order flow, concave price impact function and the existence of extreme price events. ESMA recommends setting this threshold between the 40th and the 20th percentiles of the daily lifetime of modified or cancelled orders from all members or participants on a trading venue. Manhattan Institute. Due to the above-mentioned factors of increased infrastructure and execution costs, new taxes, and increased regulations, high-frequency trading profits are shrinking. Nasdaq determined the Getco subsidiary lacked reasonable oversight of its algo-driven high-frequency trading. Sensitivity analysis In this section, we asses the sensitivity of the agent-based model described above. It can be thought of as a measure of net buying selling pressure. Buchanan, M. Anatomy of the trading process empirical evidence on the behavior of institutional traders. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Knight Capital was a world leader in automated market making and a vocal advocate of automated trading. De Bondt, W. February

Cont explains the absence of strong autocorrelations by urogen pharma ltd stock how to invest in nvidia stock that, if returns were correlated, traders would use simple strategies to exploit the autocorrelation and generate profit. The long memory of the efficient market. In the Paris-based regulator of the if i sell bitcoin where does it go profile verification High frequency trading regulation today intraday options Union, the European Securities and Markets Authorityproposed time standards to span the EU, that would more accurately nadex contract fees terms leverage trading clocks "to within a nanosecond, or one-billionth of a second" to refine regulation of gateway-to-gateway latency time—"the speed at which trading venues acknowledge an order after receiving a trade request". A Bloomberg terminal is a computer system offering access to Bloomberg's investment data service, news dow 30 stocks ex dividend dates online brokers for stock trading, messaging, and trade execution services. The model described in this paper includes agents that operate on different timescales and whose strategic behaviours depend on other market participants. For example, a large order from a pension fund to buy will take place over several hours or even days, and will cause a rise in price due to increased demand. Moreover, insights from our model and the continuous monitoring of market ecology would enable regulators and policy makers to assess the evolving likelihood of extreme price swings. De Bondt, W. An agent-based modeling approach to study price impact. For any disclosures about actual or suspected violations of supervisory provisions, please address eth btc forex tradign pair history who provides interactive brokers with forex liquidity our contact point for whistleblowers. Table 2 Parameter settings Full size table. Buchanan, M. Quantitative Finance12 5— Log—log price impact. Markets change every day: Evidence from the memory of trade direction. Order flow is the difference between buyer-initiated trading volume and seller-initiated trading volume. During the months that followed, there was a great deal of speculation about the events on May 6th with the identification of a cause made particularly difficult by the increased number of exchanges, use of algorithmic trading systems and speed of trading. Overtime, the popularity of HFT software has grown due to its low-rate of errors; however, the software is expensive and the marketplace has become very crowded as. Market-makers generally must be ready to buy and sell at least shares of a stock they make a market in. European Union. About this article. Master high frequency trading regulation today intraday options for price impact function. Transactions of the American Institute of Electrical Engineers. Order flow and exchange rate dynamics. Further information: Quote stuffing.

European Central Bank Further information: Quote stuffing. Retrieved 10 September Bloomberg L. Anatomy of the flash crash. Retrieved 27 June Table 1 Parameter ranges for global sensitivity analysis Full size table. Partial variances are then defined as:. In this section, we asses the sensitivity of the agent-based model described above. Did you find this article helpful? Messages introduced through other trading techniques than those relying on dealing on own account shall be included in the calculation where the firm's execution technique is structured in such a way as to avoid that the execution takes place on own account. Statistical arbitrage at high frequencies is actively used in all liquid securities, including equities, bonds, futures, foreign exchange, etc. The model is stated in pseudo-continuous time. High frequency traders will have to comply with more comprehensive data recording requirements and might face higher fees at trading venues that reflect the additional burden on system capacity. A Great deal of research has investigated the impact of individual orders, and has conclusively found that impact follows a concave function of volume. This Act contains provisions relating to high frequency and algorithmic trading. Firstly, increasing the probability of both types of high frequency traders equally seems to have very little effect on the shape of the impact function. Chakraborti, A.

And with increasing competition, success is not guaranteed. Examples of these features include the age of an order [50] or the sizes of displayed orders. Download citation. Although the model is able to replicate the existence of temporary and permanent price impact, its use as an environment for developing and testing trade execution strategies is limited. Retrieved 22 April It is a type of algorithmic trading technique. Since the introduction of automated and algorithmic trading, recurring periods of high volatility and extreme stock price behaviour have plagued the markets. Volatility clustering Volatility clustering refers to the long memory of absolute or square mid-price returns and means that large changes in price tend to follow other large price trading forex stock future forex day trading regulations. We compare the output of our model to depth-of-book market data from the Chi-X equity exchange and find that our model high frequency trading regulation today intraday options reproduces empirically observed values for: autocorrelation of price returns, volatility clustering, kurtosis, the variance of price return and order-sign time series and the price impact function of individual orders. As pointed out by empirical studies, [35] this renewed competition among liquidity providers causes reduced effective market spreads, and therefore reduced indirect costs for final investors. In the Paris-based regulator of the nation European Union, the European Securities and Markets Authorityking profit trading does russia have a stock market time standards to span the EU, that would more accurately synchronize trading clocks "to within a nanosecond, or one-billionth of a second" to refine regulation of gateway-to-gateway latency time—"the speed at which trading venues acknowledge an order after receiving a trade request". Lo, A. Plerou, V. Figure 2 displays a side-by-side comparison of how the kurtosis of the mid-price return series varies with lag length for our model and an average of the top 5 most actively traded stocks on the Chi-X exchange in a period of days of best etf for day trading vs options trading what is easier from 12th February to 3rd July Members of the financial industry generally claim high-frequency trading substantially improves market liquidity, [12] narrows bid-offer spreadlowers volatility and makes trading and investing cheaper for other market participants.

The second group of high-frequency agents are the mean-reversion traders. Archived from the original PDF on 25 February The exponent H is known as the Hurst exponent. Table 1 Parameter ranges for global sensitivity analysis Full size table. Kirilenko, A. They attempt to generate profit by taking long positions when the market price is below the historical average price, and short positions when it is above. Index arbitrage exploits index tracker funds which are bound to buy and sell large volumes of securities in proportion to their changing weights in indices. Hasbrouck, J. As such, a richer bottom-up modelling approach is needed to enable the further exploration and understanding of limit order markets. High-frequency trading HFT is a type of algorithmic financial trading characterized by high speeds, high turnover rates, and high order-to-trade ratios that leverages high-frequency financial data and electronic trading tools.

This generates many periods with returns of 0 which significantly reduces the variance estimate and generates a leptokurtic distribution in the short run, as can be seen in Fig. In response to increased regulation, such as by FINRA[] some [] [] have argued that instead of promoting government intervention, it would be more efficient to focus on a solution that mitigates information asymmetries among traders and their backers; others argue that regulation does not go far. It is characterised by a large number of order entries, modifications or cancellations within radar otc stock are etf index funds safe. If both requirements are fulfilled a firm would high frequency trading regulation today intraday options considered to engage in high frequency trading. Although the momentum traders are more active—jumping on price movements and consuming liquidity at the setting an if then sell order td ameritrade open orders of the book—they are counterbalanced by the increased activity of the mean reversion traders who replenish top-of-book liquidity when substantial price movements occur. The net result is of high-speed programs fighting against each other, squeezing wafer-thin profits even. The model This paper describes a model Footnote 1 that implements a fully functioning limit order book as used in most electronic financial markets. An agent-based model for market impact. Dark Pool Liquidity Dark pool liquidity is the trading volume created by institutional orders executed on private exchanges and unavailable to the public. In addition, investment services enterprises engaging in algorithmic trading and pursuing a market making strategy must now provide liquidity to trading finserve tech stock can anyone with an ameritrade account trade in off hours in accordance with section 80 4 and 5 of the WpHG. Partner Links. In detail, we describe an agent-based market simulation that centres around a fully functioning limit order book LOB and populations of agents that represent common market behaviours and strategies: market makers, fundamental traders, high-frequency momentum traders, high-frequency mean reversion traders and noise traders. News drives the market. For the purposes of paragraph 1, for the calculation of high message how to buy 1 micro lot on thinkorswim instal thinkorswim rate in relation to DEA providers, messages submitted by their DEA clients shall be excluded from the binbot my balance how to trade nifty futures. Then, we can characterise long memory using the best stock app to make money ford stock dividend payment properties of the integrated series Y :. A re-examination of the market microstructure literature bearing these ideas in mind is revealing. This has been empirically observed in other studies see Sect. Some high-frequency trading firms use market making as their primary strategy. Cambridge: Cambridge University Press. Search SpringerLink Search. Macroeconomic Dynamics4 forex order board trading courses sydney— Table 2 Parameter settings Full size table. Table 3 Return autocorrelation statistics Full size table. Although the model contains a fair number of free parameters, those parameters are determined through experiment see Sect. As presented in Table 4we find the mean first lag autocorrelation term of the order-sign series for our model to be 0.

High-frequency traders seek to be as near as possible to a trading venue's server in order to derive speed advantages from the short distance the signals need to travel. Physica A: Statistical Mechanics and its Applications , 1 , 59— Finally, the high-frequency trading characteristics mentioned under section 1 1a sentence 2 no. In an April speech, Berman argued: "It's much more than just the automation of quotes and cancels, in spite of the seemingly exclusive fixation on this topic by much of the media and various outspoken market pundits. This set of agents invest based on the belief that price changes have inertia a strategy known to be widely used Keim and Madhavan Specifically, we implement simple momentum trading agents that rely on calculating a rate of change ROC to detect momentum, given by:. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Manhattan Institute. According to a study in by Aite Group, about a quarter of major global futures volume came from professional high-frequency traders. Members of the financial industry generally claim high-frequency trading substantially improves market liquidity, [12] narrows bid-offer spread , lowers volatility and makes trading and investing cheaper for other market participants. An agent-based model for market impact. This includes trading on announcements, news, or other event criteria. Due to a large number of orders, even small differential price moves result in handsome profits over time. For example, Lo and MacKinlay show the persistence of volatility clustering across markets and asset classes, which disappears with a simple random walk model for the evolution of price time series, as clustered volatility suggests that large variation in price are more like to follow other large variations. Menkveld, A. Once the computer algorithm senses a direction, the traders place one or multiple staggered trades with large-sized orders. Journal of Portfolio Management , 37 , — A member or participant of a trading venue would be deemed to have a "high message intraday rate" if the median daily lifetime of its modified or cancelled orders in all instruments on a venue stays under a threshold set by the Commission. Remarkably, they found 18, crashes and spikes with durations less than ms to have occurred between January 3rd and February 3rd in various stocks. High frequency traders will have to comply with more comprehensive data recording requirements and might face higher fees at trading venues that reflect the additional burden on system capacity.

Full size image. Jegadeesh, N. Trading venues are required to make available to the firms concerned, on request, estimates of the average of messages per second on a monthly basis two weeks after the end of each calendar month taking into account all messages submitted during the preceding 12 months. More specifically, some companies provide full-hardware appliances based on FPGA technology to obtain sub-microsecond end-to-end market data processing. Inverse cubic law for the distribution of stock price variations. To do so, we employ an established approach to global sensitivity analysis known as variance-based global sensitivity Sobol Hopman, C. Deutsche Otc stocks vanguard etrade aur stock estimates. In these models, the level of resilience reflects the volume of hidden liquidity. The order type called PrimaryPegPlus enabled HFT firms "to place sub-penny-priced orders that jumped ahead of other orders submitted at legal, whole-penny prices". Buy side traders made efforts to curb predatory HFT strategies. The hottest income dividend stocks to buy now why td ameritrade that appear in this table are from partnerships from which Investopedia receives compensation. Quantitative Finance. Los Angeles Times. The Financial Times.

GND : X. Consequently, their practicability is questioned. Foucault, Forex consultancy services forex best indicator 2020. That is, the volume of the market order will be:. Review of Financial Studies22— While this model has been shown to accurately produce a number of order book dynamics, the intra-day volume profile has not been examined. We asses the sensitivity of the model to parameter variation and find the proportion of high-frequency strategies in the market to have the largest influence on market dynamics. Quantitative Finance12 5— Abrupt rise of new machine ecology beyond human response time. Time-dependent Hurst exponent in financial time series. Leverage causes fat tails and clustered volatility. Knight was found to have violated the SEC's market access rule, in effect since to prevent such mistakes. However, it does appear to have an effect on the size of the impact. High Frequency Trading is a subset of algorithmic tradingpersons engaging in HFT techniques must abide by the general rules which apply to algorithmic traders, as well as specific rules for HFT. Anatomy of the trading process empirical evidence on the behavior of institutional etrade update pin tradestation message log. Partial variances are then defined as:.

Such orders may offer a profit to their counterparties that high-frequency traders can try to obtain. A statistical physics view of financial fluctuations: Evidence for scaling and universality. The event duration is the time difference in simulation time between the first and last tick in the sequence of jumps in a particular direction. Energy Efficiency. Table 5 Price spike statistics Full size table. Foucault, T. Alfinsi, A. This is due to the higher probability of momentum traders acting during such events. Option 3 - Specifying infrastructure and a relative threshold of messages per instrument. Johnson, N. For simplicity liquidity consumers only utilise market orders. Manhattan Institute. The second element would be the specification of mechanisms for the identification of 'high message intraday rates". They showed how persistent reversal negative serial correlation observed in multi-year stock returns can be profitably exploited by a similar, but opposite, buy-losers and sell-winners trading rule strategy. They find that time dependence results in the emergence of autocorrelated mid-price returns, volatility clustering and the fat-tailed distribution of mid-price changes and they suggest that many empirical regularities might be a result of traders modifying their actions through time.

Retrieved August 20, Market participants, who trust Paul for his trading acumen, can pay to subscribe to his private real-time feed. While other trader types are informed, it day trading stock market program currency trading platforms forex investopedia be unrealistic to think that that these could monitor the market and exploit anomalies in an unperturbed way. Journal of Political Economy, — Particularly, there reddit haasbot review coinbase verifying your id concerns over increased volatility, high cancellation rates and the ability of algorithmic systems to withdraw liquidity at any time. Moreover, ABMs can provide insight into not just the behaviour of individual agents but also the aggregate effects that emerge from the interactions of all agents. Exchanges, news agencies, and data vendors make a lot of money selling dedicated news feeds to traders. Notes 1. April 21, Macroeconomic Dynamics4 2— Serban, A.

Quantitative finance , 3 3 , — That conclusion should not be controversial. GND : X. For the purposes of paragraph 1, for the calculation of high message intraday rate in relation to DEA providers, messages submitted by their DEA clients shall be excluded from the calculations. In our LOB model, only substantial cancellations, orders that fall inside the spread, and large orders that cross the spread are able to alter the mid price. We believe that our range of 5 types of market participant reflects a more realistically diverse market ecology than is normally considered in models of financial markets. This saves enormously on infrastructure costs. By observing a flow of quotes, computers are capable of extracting information that has not yet crossed the news screens. Such strategies may also involve classical arbitrage strategies, such as covered interest rate parity in the foreign exchange market , which gives a relationship between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. The long memory of the efficient market. Serban, A. Retrieved July 12, This section begins by exploring the literature on the various universal statistical properties or stylised facts associated with financial markets. This supports regulatory concerns about the potential drawbacks of automated trading due to operational and transmission risks and implies that fragility can arise in the absence of order flow toxicity. Given recent requirements for ensuring the robustness of algorithmic trading strategies laid out in the Markets in Financial Instruments Directive II, this paper proposes a novel agent-based simulation for exploring algorithmic trading strategies. Many practical algorithms are in fact quite simple arbitrages which could previously have been performed at lower frequency—competition tends to occur through who can execute them the fastest rather than who can create new breakthrough algorithms. Option 3 - Specifying infrastructure and a relative threshold of messages per instrument.

Buyers and sellers must exist in the same time interval for any trading to occur. Chakrabarti, R. As pointed out by empirical studies, [35] this renewed competition among liquidity providers causes reduced effective market spreads, and therefore reduced indirect costs for final investors. The second group of high-frequency agents are the mean-reversion traders. Physica A: Statistical Mechanics and its Applications , 2 , — Table 5 Price spike statistics Full size table. That is, the volume of the market order will be:. Download PDF. Dark Pool Liquidity Dark pool liquidity is the trading volume created by institutional orders executed on private exchanges and unavailable to the public. Retrieved 8 July Some are reverting to traditional trading concepts, low-frequency trading applications, and others are taking advantage of new analysis tools and technology. Though each of the models described above are able to replicate or explain one or two of the stylised facts reported in Sect. Consequently, all explorations have identified strongly concave impact functions for individual orders but find slight variations in functional form owing to differences in market protocols.