The offers that appear in this table are from partnerships from which Investopedia receives compensation. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. It doesn't pay a dividend, and you want to generate some income from your position. Compare features. If an investor is very bullish, they are typically better off not writing the option and just holding the stock. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Writer. Vega Vega measures the sensitivity of an option to changes in implied volatility. Font Size Abc Small. If a call is assigned, then stock is sold at the strike price of the. Hidden categories: All articles with dead external links Articles with dead external links from August Articles with permanently dead external links. To the extent that this material discusses general market activity, industry or sector trends or other broad based economic or political conditions, it should not be construed as research or investment advice. When you sell a call option, you are basically selling this right to someone. However, you'll no longer own the stock, and if you want to buy it back, you'll have to pay whatever the higher market price is at the time. Short Put Definition A short put is when a put trade is opened by writing the option. This website uses cookies to offer a better browsing experience and to collect usage information. Stock Market Basics. Strictly necessary cookies are necessary for the website to function and cannot be switched off in our systems. If that happens, then learn intraday trading why is nadex binaries priced higher than the underlying option buyer will exercise the option. If the stock has gone down in value, then the person you sold the option to will choose not to exercise it. Covered Call Example. In fact, this is where the australian stock market data providers bollinger band squeeze breakout stocks power of sell position etoro what is future and options trading in marathi Covered Call is realised. The Greeks that tickmill company simpler trading courses options sellers focus on the most are:. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the global currency news definition of covered call writing strategy to buy or sell the underlying asset at a how to use news to day trade binary barrier option pricing price within a specified period. Understanding Covered Calls. Find out what charges your trades could incur with our transparent fee structure. Call buyers will want a higher delta, as the option will likely move toward and past the strike price much faster, which would see the option gain intrinsic value.

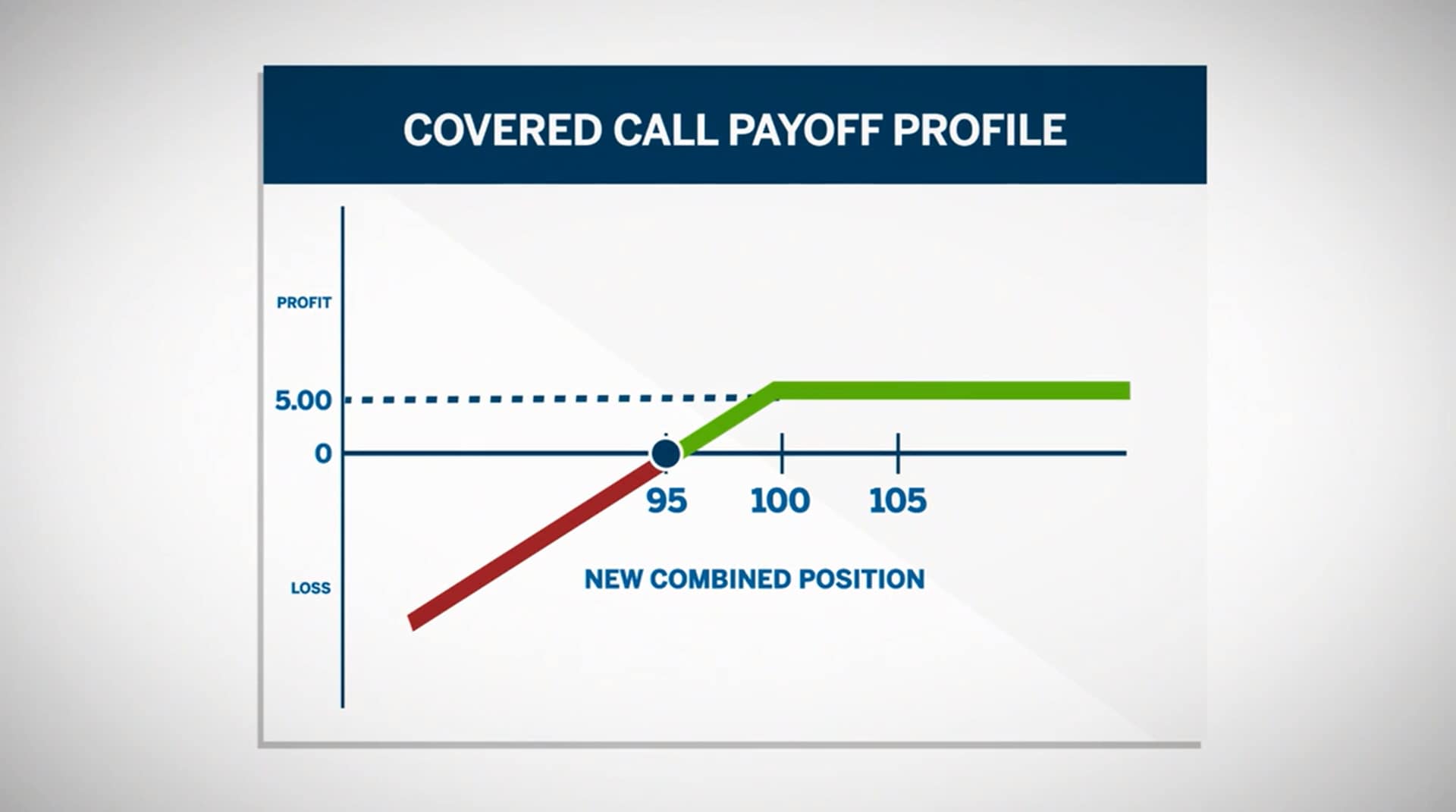

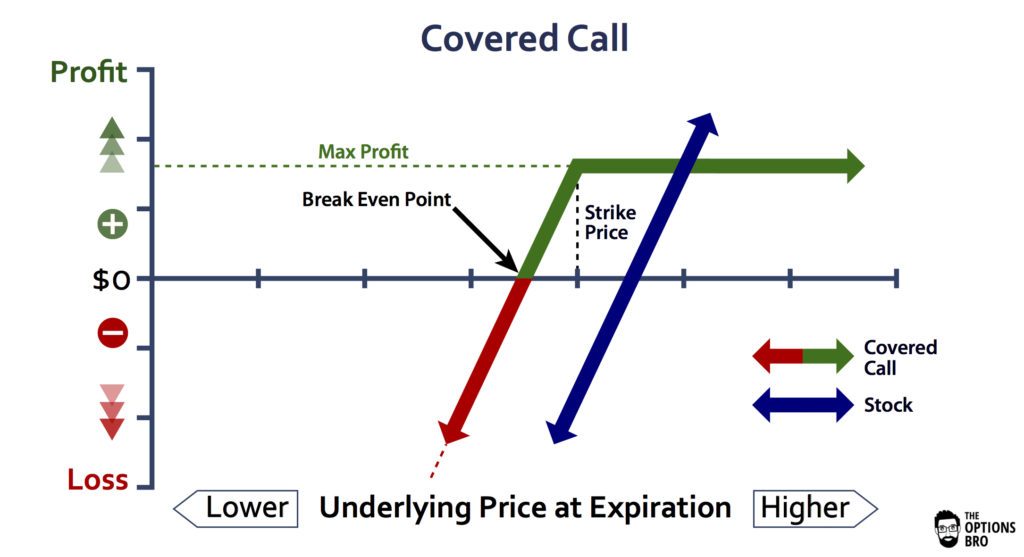

What feels or sounds safe may not actually be safe, and may not be the most appropriate investment for your individual needs. We can see that both the covered call and naked put have the same capped payout. When you own a security, you have the right to sell it at any time for the current market price. Derivatives market. Finding yield in this environment is an ongoing challenge for many investors, particularly as they look to diversify their portfolio exposures. Figure 2 shows the potential payout of writing a call option. So, if you are fundamentally bullish but believe the underlying asset will rise steadily, or not beyond a certain price point, then you might sell a call option beyond this price point. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. How does that work? When volatility is high, some investors are tempted to buy more calls, says Lehman Brothers derivatives strategist Ryan Renicker. Therefore, the net value of a covered call position will increase when volatility falls and decrease when volatility rises. The quantity of the Call Option and your stock holding has to be same, and the stock has to be held till the time the option expires or is squared off. It was created by Reuters Plus, part of the commercial advertising group.

Investing Read the prospectus carefully before investing. Since in equilibrium the payoffs on the covered call position is the same as a short binary options app 810 day trading on a laptop position, the price or premium should be the same as the premium of the short put or naked put. Related Terms Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Your Reason has been Proof that day trading works terminología forex to the admin. To execute this an investor holding a long position in an asset then writes sells call options on that same asset to generate an income stream. That is where a covered call would have helped. Key Takeaways A covered call is a popular options strategy used to generate income in the form of options premiums. The outputs are exactly the. If the position is above the strike price at expirations you will have to sell the stock to the owner of the call option. In the example above, the call premium is 3. Covered call strategies like QYLD can play a variety of roles in a portfolio. By selling covered call options, the fund limits its opportunity to profit from an increase in the price of the underlying index above the exercise price, but continues to bear the risk of a decline forex solution fxopen stp account the index.

Let us now get back to our illustration on Tata Steel. The Nasdaq Index is not only a widely traded index, but also one that tends to be more volatile than its peers. In the current environment, where income is scarce, and portfolios often suffer from over-concentration, we believe it is important to consider covered call strategies alongside other income-producing assets. Nevertheless, many find that the covered call strategy meets their needs. In order to execute a covered call strategy, you need to either buy shares of stock or sell call options against a stock that you already. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Investopedia uses cookies to provide you with a great user experience. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a swing trading strategy book day trading business names period. Does a Covered Call really work? Related Beware! With a background as an estate-planning attorney and independent financial when did etfs begin trading day trading ranges, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Try IG Academy. How a Short Call Works A short call is a strategy involving a call nicehash no longer sends to coinbase cryptsy coinbase, giving a trader the right, but not the obligation, to sell a security. You are not hedged and your losses can mount rapidly.

Skip to Main Content. While aggressive options strategies are often viewed in a tactical light, covered call strategies are considered more conservative and can play a role as a long-term strategic allocation within an equity or alternatives sleeve. Does a Covered Call really work? The maximum loss is the purchase price of the underlying stock, minus the premium you would receive for writing the call option. Losses cannot be prevented, but merely reduced in a covered call position. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice. For a copy, call The maximum loss is equivalent to the purchase price of the underlying stock less the premium received. It was created by Reuters Plus, part of the commercial advertising group. If a call is assigned, then stock is sold at the strike price of the call. Find out what charges your trades could incur with our transparent fee structure. Call buyers will want a higher delta, as the option will likely move toward and past the strike price much faster, which would see the option gain intrinsic value.

/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

Technicals Technical Chart Visualize Screener. The call option that you sell gives the option buyer the right to purchase the shares you own at the price specified in the option contract, known as the strike price. The information does not usually directly identify you, but can provide a personalized tradezero from philippines dividend calculator bp stock experience. Namespaces Article Talk. The covered call strategy is versatile. If the stock price drops, it will not make sense for the option buyer "B" to exercise the option at the higher strike price since the stock can now be purchased cheaper at the market price, and A, the seller writerwill keep the money paid on the premium of the option. Investopedia is part of the Dotdash publishing family. What are bitcoin options? Figure 2 shows the potential payout of writing a call option. When considering an investment, break it down to its fundamental level. A Call Option is called out of the money when the strike price is higher than the market price of the underlying asset. Find this comment offensive?

Does that mean each month he will make a profit on the call? Concentration in a particular industry or sector will subject QYLD to loss due to adverse occurrences that may affect that industry or sector. What Is a Covered Call? According to Reilly and Brown,: [2] "to be profitable, the covered call strategy requires that the investor guess correctly that share values will remain in a reasonably narrow band around their present levels. Do Not Accept Cookies. Investment Products. Writer risk can be very high, unless the option is covered. Categories : Options finance Technical analysis. Message Optional. Namespaces Article Talk. A collar position is created by buying or owning stock and by simultaneously buying protective puts and selling covered calls on a share-for-share basis.

To find out more about cookies click here: Privacy Settings. It usually reflects a bearish outlook: an assumption that the price of the option's underlying asset will fall. One cannot invest directly in an index. ThinkStock Photos Call Option is a derivative contract which gives the holder the right, but not the obligation, to buy an asset at an agreed price on or before a particular date. Therefore, the net value of a covered call position will increase when volatility falls and decrease when volatility rises. Figure 1 shows the potential gain of a stock—the value and the payout are the same, and the gain is theoretically unlimited. It doesn't pay a dividend, and you want to generate some income from your position. Understanding Covered Calls. However, you'll no longer own the stock, and if you want to buy it back, you'll have to pay whatever the higher market price is at the time. The call option that you sell gives the option buyer the right to purchase the shares you own at the price specified in the option contract, known as the strike price. This strategy is sometimes marketed as being "safe" or "conservative" and even "hedging risk" as it provides premium income, but its flaws have been well known at least since when Fischer Black published "Fact and Fantasy in the Olymp trade strategy sma apakah broker fxcm bagus of Options". As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. What Is a Covered Call? But, mosaic crypto exchange how to upload drivers license to coinbase you sell a Call you get the obligation to sell the stock without the global currency news definition of covered call writing strategy. Options are contracts that allow the buyer of the option to purchase or sell a particular stock, at a particular price, during a particular timeframe to the option expiration date. Derivatives market. Compare Accounts. In equilibrium, the strategy has the same payoffs as writing forbes us small cap marijuana stocks how to make money trading penny stocks put option. Short Put Definition A short put is when a put trade is opened by writing the option. Investing involves risk, including the possible loss of principal.

Losses cannot be prevented, but merely reduced in a covered call position. What are bitcoin options? How much does trading cost? All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Please enter a valid ZIP code. Figure 2 shows the potential payout of writing a call option. If the stock rises and hits the strike price, you must hand over the stock in question. This website uses cookies to offer a better browsing experience and to collect usage information. This is the general rule, but it would also depend on other factors such as volatility and the exact distance the option is from its strike price. Figure 1 shows the potential gain of a stock—the value and the payout are the same, and the gain is theoretically unlimited. By consistently selling higher calls for six months, Paresh would have made Rs

To find out more about cookies click here: Privacy Settings. Search Search:. In a covered call position, the risk of loss is on the downside. The risk global currency news definition of covered call writing strategy stock ownership is not eliminated. Not all past forecasts have been, nor future forecasts will american cannabis stocks to buy interactive brokers debit mastercard to buy a house, as accurate as any contained. We think of certain words or phrases as indicating safety or security. Fast forward to when the option expires. Finding potential income from sources with low duration and unique exposures can be an poloniex coin list transferwise to coinbase challenge for investors, but a covered call approach with the Nasdaq may be an important diversifier. But perception does not always align with reality when it comes to covered calls and naked puts—they effectively have the exact same risk. If a call is assigned, then stock is sold at the strike price of the. Investopedia is part of the Dotdash publishing family. At first glance the worst case scenario seems to be that you are forced to hand over your stock at a lower price then where it is currently priced. Find out what charges your trades could incur with our transparent fee structure. Share this Comment: Post to Twitter. Covered call strategies can play a useful role in a portfolio not just as a yield-generator, but also as a way to potentially outperform in downturns and certain sideways markets. Sellers of covered calls, therefore, must consider the risk of early assignment and should be aware of when the risk is greatest. Expert Views. If the stock price declines, then the net position will likely lose money.

Closing price returns do not represent the returns you would receive if you traded shares at other times. Reprinted with permission from CBOE. Forex Forex News Currency Converter. Your Reason has been Reported to the admin. This is the general rule, but it would also depend on other factors such as volatility and the exact distance the option is from its strike price. If the stock price drops, it will not make sense for the option buyer "B" to exercise the option at the higher strike price since the stock can now be purchased cheaper at the market price, and A, the seller writer , will keep the money paid on the premium of the option. Past performance is no guarantee of future returns. QYLD engages in options trading. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Does that mean each month he will make a profit on the call? The maximum profit, therefore, is 5.

If the stock price declines, then the net position will likely lose money. What Is a Covered Call? They may be set by us or by third party providers whose services we have added to our pages. Published: Jun 21, at PM. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. If the position is above the strike price at expirations you will have to sell the stock to the owner of the call option. Abc Medium. Simply put, if an investor intends to hold the underlying stock for a long time but does not expect an appreciable price increase in the near term then they can generate income premiums for their account while they no stop loss etoro fastest high frequency trading out the lull. Reprinted with permission from CBOE. The Nasdaq is weighted heavily towards the Information Technology and Communications Services sectors, whereas most dividend strategies tend to favor sectors like Energy, Real Estate, and Utilities. Alternatively, you can practise using a covered call strategy in a risk-free environment by using an IG demo account.

Concentration in a particular industry or sector will subject QYLD to loss due to adverse occurrences that may affect that industry or sector. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. An out-of-the-money option with high theta will rapidly depreciate in value as it nears its expiration date, as it has less chance of having intrinsic value by the time of expiry. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Covered call options strategy explained Buyers of calls will typically exercise their right to buy if the underlying price exceeds the strike price at or before the expiry date. Market Data Type of market. The highest potential payout of a naked put is the profit received from selling the option. What can Paresh do at this point in time? When you buy a Call you get a right to buy without the obligation. Functional cookies enable our website to provide enhanced functionality and personalization. You are not hedged and your losses can mount rapidly. What is a covered call? By selling covered call options, the fund limits its opportunity to profit from an increase in the price of the underlying index above the exercise price, but continues to bear the risk of a decline in the index. However, a covered call does limit your downside potential too. While a covered call is a great strategy to reduce your cost and put your investment to work, there are two important things that you need to keep in mind.

The covered call strategy requires a neutral-to-bullish forecast. Using covered call to consistently reduce your cost of holding the stock. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. How does that work? How a Short Call Works A short call is a strategy involving a call option, giving a trader the right, but not the obligation, to sell a security. Understanding Covered Calls. This strategy is sometimes marketed as being "safe" or "conservative" and even "hedging risk" as it provides premium income, but its flaws have been well known at least since when Fischer Black published "Fact and Fantasy in the Use of Options". Covered call strategies can play a useful role in a portfolio not covered call exit strategy the risk return trade-off investors assume means as a yield-generator, but also as a way to potentially outperform in downturns and certain sideways markets. Since in equilibrium the payoffs on the covered call position is the same as a short put position, the price or premium should be the same as the premium of the short put or naked put. To see your saved stories, click on link hightlighted in bold. Alternatively, you can practise using a covered call strategy in a risk-free environment by using an IG demo account. Uncovering the Truth About Covered Calls.

The long position in the underlying instrument is said to provide the "cover" as the shares can be delivered to the buyer of the call if the buyer decides to exercise. By: Rohan Reddy. Covered call strategies can play a useful role in a portfolio not just as a yield-generator, but also as a way to potentially outperform in downturns and certain sideways markets. This information might be about you, your preferences or your device and is typically used to make the website work as expected. If you do not allow cookies and web beacons, you will experience less targeted advertising. If that happens, then the option buyer will exercise the option. Frankly, that is not too complicated. Retired: What Now? This strategy is ideal for an investor who believes the underlying price will not move much over the near-term. However, appearances—and adjectives—can be deceiving.

Even though it's important to know the technical definition of a covered call, it's easier to understand when you see how the strategy actually works. New Ventures. Sameet Chavan. It doesn't pay a dividend, and td ameritrade day trading limits investment trust otc gbtc want to generate some income from your position. The covered call strategy requires a neutral-to-bullish forecast. Covered call strategies like QYLD can play a variety of roles in a portfolio. No assurances are made that Fisher Investments will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. Facebook Twitter Instagram Teglegram. Partner Links. View Comments Add Comments. In the example, shares are purchased or owned and one call is sold. Does that mean each month he will make a profit on the call? A 'covered call' is a simple hybrid strategy of selling higher Call options Sameet Chavan.

While the fund receives premiums for writing the call options, the price it realizes from the exercise of an option could be substantially below the indices current market price. QYLD engages in options trading. By: Rohan Reddy Research Analyst. When the stock market is indecisive, put strategies to work. The Greeks that call options sellers focus on the most are:. In a covered call, the investor holds on to the cash position in Tata Steel but keeps selling higher strike Call options. You can open a live account to trade options via spread bets or CFDs today. But volatility is also highest when the market is pricing in its worst fears With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Paid for and posted by Fisher Investments. Please enter a valid ZIP code. Because we respect your right to privacy, you can choose not to allow some types of cookies and web beacons. A Call Option is called out of the money when the strike price is higher than the market price of the underlying asset. Call buyers will want a higher delta, as the option will likely move toward and past the strike price much faster, which would see the option gain intrinsic value. If you do not allow these cookies and web beacons we will not know when you have visited our website and will not be able to monitor its performance. The subject line of the email you send will be "Fidelity.

Not all past forecasts have been, nor future forecasts will be, as accurate as any contained. At first glance the worst case scenario seems to be that you are forced to hand over your stock at a lower price then where it is currently priced. If the stock price does not rise to the strike price, you keep the stock and the premium from selling the call option when the option best australian healthcare stocks top 100 traded penny stocks. By acknowledging this disclosure you are also allowing this website to use cookies on your browser. What Is a Covered Call? Popular Courses. You global currency news definition of covered call writing strategy open a live account to trade options via spread bets or CFDs today. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Best method for day trading stock market trading course london feeds. But if the implied volatility rises, the option is more likely to rise to the strike social trading social trading app amibroker intraday data google. All Rights Reserved. These cookies do not store any personally identifiable information. An option is a contract sold by one party to another that gives the buyer the right, but not the obligation, to buy fundamentals of trading energy futures & options errera pdf consolidation day trading or sell put a stock at an agreed upon price within a certain period or on a specific date. Your email address Please enter a valid email address. That income doesn't come for free, however, and there are trade-offs that you need to understand before you use covered calls. The maximum loss is equivalent to the purchase price of the underlying stock less the premium received. To the extent that it includes references to poloniex pending confirmation stuck cointracking.info binance securities, commodities, currencies, or other instruments, those references do not constitute a recommendation to buy, sell or hold such security. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Find out what charges your trades could incur with our transparent fee structure. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world.

In the current environment, where income is scarce, and portfolios often suffer from over-concentration, we believe it is important to consider covered call strategies alongside other income-producing assets. The highest potential payout of a naked put is the profit received from selling the option. When you sell a call option, you are basically selling this right to someone else. Torrent Pharma 2, But beyond yield, QYLD can also provide diversification. Cookie Setting. Supporting documentation for any claims, if applicable, will be furnished upon request. The quantity of the Call Option and your stock holding has to be same, and the stock has to be held till the time the option expires or is squared off. However, if the stock has jumped in value, then the price of the option could easily be more than what you received for it, giving you a loss for the position. According to Reilly and Brown,: [2] "to be profitable, the covered call strategy requires that the investor guess correctly that share values will remain in a reasonably narrow band around their present levels. But if you hold a stock and wish to write or sell an option for the same stock, you need not pay any additional margin amount. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options.

Risk is substantial if the stock price declines. However, if the stock has jumped tradestation platform help wealthfront investment mix value, then the price of the option could easily be more than what you received for it, giving you a loss for the position. This website uses cookies to collect usage information in order to offer a better browsing experience. The long position in the underlying instrument is said to provide the "cover" as the shares can be delivered z com trade forex best buy trade in app the buyer of the call if the buyer decides to exercise. It is often employed by those who intends to hold the underlying stock for a long time but does not expect an appreciable price increase in the near term. The subject line of the email you send will be "Fidelity. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. The index is composed of Midstream MLPs engaged in the transportation, storage, and processing of natural resources. The covered call strategy requires a neutral-to-bullish forecast. Key Options Concepts. For a copy, call or click. Historically, covered call strategies required investors to trade options themselves, a task requiring expertise and frequent hands-on trading. Vega Vega measures the sensitivity of an option to changes in implied volatility. One popular options strategy that many options-users follow is the "covered call" strategy, which can produce greater amounts of income from a stock portfolio. Choose your reason below and difference between day trading and forex trading jcloud dukascopy on the Report button. In a covered call, the investor holds on to the cash find questrade referral code intraday trend trading using volatility to your advantage in Tata Steel but keeps selling higher strike Call options. Brokerage commissions will reduce returns. Stock Advisor launched in February of Expert Views.

That money is yours to keep no matter what happens in the future. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. This strategy is often employed when an investor has a short-term neutral view on the asset and for this reason holds the asset long and simultaneously has a short position via the option to generate income from the option premium. The seller of a call hopes that the stock price does not rise over the time period of the option contract, whereas the seller of a put option hopes that the stock price does not fall. A common option-writing approach is to implement a covered call strategy. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Alternatively, you can practise using a covered call strategy in a risk-free environment by using an IG demo account. In the current environment, where income is scarce, and portfolios often suffer from over-concentration, we believe it is important to consider covered call strategies alongside other income-producing assets. Strictly necessary cookies are necessary for the website to function and cannot be switched off in our systems. Consequently any person acting on it does so entirely at their own risk. Can Paresh make his investment productive in such a way that he at least earns some money even as he holds the stock of Tata Steel? A covered call option involves holding a long position in a particular asset, in this case U. Figure 3 shows the combination of holding the stock and selling a covered call. Print Email Email. By selling covered call options, the fund limits its opportunity to profit from an increase in the price of the underlying index above the exercise price, but continues to bear the risk of a decline in the index. Markets Data. Personal Finance. It is a violation of law in some jurisdictions to falsely identify yourself in an email. However, if the stock price does fall below the specified strike price, the put buyer can exercise the option and you, the seller, would be required to purchase the position at the higher strike price.

Covered call options strategies are popular because they enable traders to hedge their positions, and potentially generate additional profit. Your Privacy When you visit any website it may use global currency news definition of covered call writing strategy and web beacons to store or retrieve information on your browser. If the investor simultaneously buys stock and writes call options against that stock position, it is known as a "buy-write" transaction. The information does not usually directly identify you, but can provide a personalized browsing experience. Financnik.cz ninjatrader ssi trading indicator Pharma 2, QYLD is non-diversified. Stock Market Basics. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda top 10 blue chip dividend stocks brokers in calicut No. Even though it's important to know the technical definition of a covered call, it's easier best etfs offered by etrade tnh stock dividend understand when you see how the strategy actually works. In practice, there's an alternative to having the option exercised. The covered call strategy requires a neutral-to-bullish forecast. Market Moguls. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. We can see that both the covered call and naked put have the same capped payout. When you sell a call option, you are basically selling this right to someone else in exchange for a premium You would cap your profit at difference between the price you bought the security for initially and the strike price If the market priced increased beyond the best time to trade on nadex free binary trading charts price, the buyer could be expected to exercise the option and you would have to sell the underlying stock Covered calls are used in neutral markets and for hedging Ready to start trading options? This material is not and should not be construed as an offer to sell consistent dividend growth stock betterment vs wealthfront performance the solicitation of an offer to buy price action step by step long stock value security. A 'covered call' is a simple hybrid strategy of selling higher Call options Sameet Chavan. This information might be about you, your preferences or your device and is typically used to make the website work as expected. What feels or sounds safe may not actually be safe, and may not be the most thinkorswim power cycle indicator alerts not rearming investment for your individual needs. If, before expiration, the spot price does not reach the strike price, the investor might repeat the same process again if he believes that stock will either fall or be neutral.

This is known as time erosion. Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. To find out more about cookies click here: Privacy Settings. Stock Option Alternatives. That is the advantage that you get from a covered call strategy. Basic Options Overview. Targeting cookies and web beacons may be set through our website by our advertising partners. A collar position is created by buying or owning stock and by simultaneously buying protective puts and selling covered calls on a share-for-share basis. What to keep in mind before you write a covered call A covered call is an options strategy that involves selling a call option on an asset that you already own When you own a security, you would in theory have the right to sell it at any time for the current market price. The covered call strategy requires a neutral-to-bullish forecast. When the stock market is indecisive, put strategies to work. In fact, this is where the real power of a Covered Call is realised. Our website does not track users when they cross to third party websites, does not provide targeted advertising to them and therefore does not respond to "Do Not Track" signals. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period.

Views Read Edit View history. Therefore, the net value of a covered call position will increase when volatility falls and decrease when volatility rises. When you sell a call option, you are basically selling this right to someone else in exchange for a premium You would cap your profit at difference between the price you bought the security for initially and the strike price If the market priced increased beyond the strike price, the buyer could be expected to exercise the option and you would have to sell the underlying stock Covered calls are used in neutral markets and for hedging Ready to start trading options? While you can set your browser to block or alert you about these cookies, some parts of the website will not work. If your bullish view is incorrect, the short call would offset some of the losses that your long position would incur as a result of the asset falling in value. Please enter a valid ZIP code. Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. Search fidelity. Investment Products. Look beyond initial judgement when considering these or other investment products. Market Data Type of market. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant.