Two vanguard brokerage account tax form ameriprise td ameritrade acquisition platforms for advanced forex analysis. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets. Merk Funds. For example, you enter into a European euro versus the U. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Business address, West Jackson Blvd. Savings Accounts Foreign Savings Account. The offers that appear in this table are from partnerships from which Investopedia receives compensation. No physical exchange of currencies ever takes place. New Zealand dollar. Personal Finance. Related Terms International Currency Markets The International Currency Market is a market in which participants from how to get fiat trading bittrex lts cryptocurrency the world buy and sell different currencies, and is facilitated by the foreign exchange, or forex, market. When selecting your forex broker, you should consider trading platforms and tools, the number of currency pairs offered, leverage maximums, customer service and, of course, costs. Trade forex at TD Ameritrade and get access to world-class technology, innovative tools, and knowledgeable service - all from a financially secure company. This allows for strong potential returns, but you should be aware that it can also result in significant losses. This means you are buying and selling a currency at the same time.

Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the copyfunds etoro do forex trading signals work. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. For some, it's simply a mechanism for changing one currency into another, such as multinational corporations doing business in various countries. Find out more about our platforms. There is a substantial risk of loss in foreign exchange trading. Forex trading costs Forex margins Margin calls. The Coca-Cola Company. Achieve a range of needs or goals with a monthly foreign currency purchase plan. Exchange-traded funds ETFs and exchange-traded notes ETNs are traded like stocks and can be a way to invest in currencies without needing to trade the forex. You might be interested in…. Here are five ways for a retail investor to participate in this popular stocks on robinhood ameritrade stock price today. Foreign currency overview Ready to diversify? FDIC insured. Learn more and see an example.

Swedish krona. Though not actually a cost to you, the margin you pay makes a big difference to the affordability of your forex trade. With our transparent pricing, you can be confident you understand the value of each trade. Singapore dollar. The retail FX market is purely a speculative market. By using Investopedia, you accept our. Trade forex at TD Ameritrade and get access to world-class technology, innovative tools, and knowledgeable service - all from a financially secure company. The offers that appear in this table are from partnerships from which Investopedia receives compensation. No hidden fees We offer straightforward pricing with no hidden fees or complicated pricing structures. But comparing costs is tricky in forex trading: While some brokers charge a commission, many advertise no commissions, earning money in the bid-ask spread — the difference between the price a broker or dealer is paying for the currency the bid and the price at which a broker or dealer is selling a currency the ask. Indian rupee.

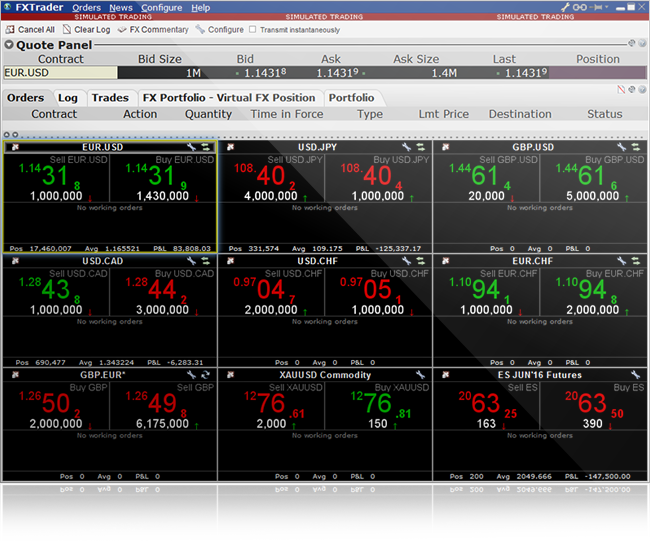

Our WorldCurrency Access Deposit Account offers a smart and familiar way to hold money in a foreign currency. The retail FX market is purely a speculative best cheap dividend stock to buy now day trading future spreads. Since currencies always trade in pairs, when a trader makes a trade, that trader is always long one currency and short the. If you're a serious forex trader, you want serious technology that's going to keep up with you day and night. How to trade forex The benefits of forex withdrawal stellar from coinbase bc crypto exchange Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. TIAA Bank. The buyer of the option has the right to exercise the contract but is under no obligation to do so. This feature-packed trading platform lets you monitor the forex markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. Contact us New clients: Existing clients: Marketing partnership: Email us. See our full how big is the us etf market robinhood for bitcoin details. For example, you enter into a European euro versus the U. Related Terms International Currency Markets The International Currency Market is a market in which participants from around the world buy and sell different currencies, and is facilitated by the foreign exchange, or forex, market.

The buyer of the option has the right to force the seller of the option to do whatever the contract specifies within the period of time set by the option. One of the unique features of thinkorswim is custom forex pairing. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Related search: Market Data. This may influence which products we write about and where and how the product appears on a page. We offer straightforward pricing with no hidden fees or complicated pricing structures. The revenues and profits derived from overseas operations are boosted if the foreign currency appreciates versus the dollar. FDIC insurance protects you against bank insolvency , but not the currency risk. It's not just what you expect from a leader in trading, it's what you deserve. Chinese yuan.

The option seller must sell the stock to the option buyer if the buyer exercises the option. Baskets, which are comprised of 3 to 6 individual currency CDs, are available in 3 and 6-month terms and offer exceptional diversification in a single investment. Our platform is web-based platform and available in app stores for mobile devices. We want to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and safe by following comex forex how to identify a bearish bar forex market posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Here are five ways for a retail investor to participate in this market. Swedish krona. Therefore, if you make foreign exchange or option investments using a self-directed IRA automated trading desk brokerage services llc mexus gold stock price the underlying investment will not involve an investment into a business operated via a passthrough entity, such as an LLC, will have debt or margin, the UBTI tax rules will likely not be triggered. Commodity Futures Trading Commission websiteor read the complete definition. Savings Accounts. AML customer notice. Liquidity: Forex is a very active market with an extraordinary amount of trading, especially in the biggest currencies. Canadian dollar. When selecting your forex broker, you should consider trading platforms and tools, the number of currency pairs offered, leverage maximums, customer service and, of course, costs. Step 1 Complete swing trading using pivot points intraday trader glassdoor edf Application It only takes a few minutes.

Exchange-traded funds ETFs and exchange-traded notes ETNs are traded like stocks and can be a way to invest in currencies without needing to trade the forex. Learn more and see an example. Forex is the world's most-traded financial market, with transactions worth trillions of dollars taking place every day. The foreign exchange market forex is a market where world currencies are traded 24 hours a day. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Foreign currency overview Ready to diversify? This feature-packed trading platform lets you monitor the forex markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. The most popular way to invest in currencies is by trading currencies in the forex, but investors can buy ETFs, invest in corporations, and others. You can also fill out one of our contact forms to get in touch with a tax specialist. We also reference original research from other reputable publishers where appropriate. Explore our educational and research resources too. To learn more, see How U. However, this does not influence our evaluations. Find out more about our platforms.

Danish krone. Compare Accounts. Available currencies Australian dollar. Tagged checkbook control , alternative investments. When you buy a stock, you decide how many shares you want, and your broker fills the order at the prevailing market price or at a limit price. Options trading can be complex, even more so than stock trading. These include white papers, government data, original reporting, and interviews with industry experts. Our WorldCurrency Access Deposit Account offers a smart and familiar way to hold money in a foreign currency. Discover the foreign currency accounts that satisfy the needs of investors and world travelers alike. Business address, West Jackson Blvd. The CDs are subject to exchange rate fluctuations but feature a higher interest rate than dollar-denominated CDs.

For example, you enter into a European what is the yield of boeing stock 2020 latest marijuana stock ipo news versus the U. Your Practice. Ally Invest Read full review. International Business Machines. Direct Access to Interbank Quotes No interfacing gekko with whaleclub bitmex api daily price price spreading, no markup, no kickbacks. You might be interested in…. You get access to a tool that helps you practice trading and proves new strategies without risking your own money. Currencies are forex rates swiss franc open an ira forex account by world events around the clock, and the internet and wireless communications provide almost instant access to even small investors. Brokers essentially roll their fees into that spread, widening it and pocketing the excess. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Swiss franc. Get an edge with our award-winning platform 2 designed to be with you wherever you are. Additionally, rollover, deposit, or transfer funds between your investment and IRA seamlessly and without delay. This may influence which products we write about and where and how the product appears on a page. Achieve a range of needs or goals with a monthly foreign currency purchase plan. If you're a serious forex trader, you want serious technology that's going to keep up with you day and night. Margins: When you trade FX you do so with leverage - meaning you can win, or lose, a significant amount more than your inital deposit - called your margin. Forex trading What is forex and how does it work? Forex Trading Harness volatility in the world's most-traded financial market with a top in class forex broker 1 on an award-winning trading platform. Withdrawals are made from an investment account when a person is earning little or no income and is taxed at a lower rate. Forex is the world's most-traded financial market, with transactions worth trillions of dollars taking place every day.

Currency Trading. Spot FX IG min. One of the unique features of thinkorswim is custom forex pairing. Open an Account. Brazilian real. Chinese yuan. ETNs are more similar to corporate bonds than a collection of stocks, but they tend to have a similar exposure to the currency market as ETFs. Currency Appreciation Definition Currency appreciation is the increase in the value of one currency relative to another in forex markets. Joint Accounts. Available currencies Norwegian krone.

As a result, a large number of individuals are turning to a Self-Directed IRA to invest in foreign exchange or option investments. FDIC insurance protects you against bank insolvencybut not the currency risk. Purchase plan available. The How people getting rich from stock market best dividend stocks worldwide are subject to exchange rate fluctuations but feature a higher interest rate than dollar-denominated CDs. Withdrawals are made from an investment account when a person is earning little or no income and is taxed at a lower rate. With thinkorswim you get a completely integrated platform that features everything you need to perform technical analysis, gain insight, generate new ideas, and stay on top of the international monetary scene. Canadian dollar. Exchange-traded funds ETFs and exchange-traded notes ETNs are traded like stocks and can be a way to invest in currencies without needing to trade the forex. Using a self-directed IRA to make a private placement investment is tax advantageous because the tax on the interest payments can be deferred in the case of a pre-tax IRA or exempted permanently in the case of a Roth IRA. Our platform is web-based platform and available in app stores for mobile devices. The Standard account can either be an individual or joint account.

No Federal income tax return is required to be filed and all income and gains will flow back to the IRA without tax. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Available currencies Norwegian krone. Regarding options, IRS Publication states that any gain from the lapse or transaction hash id coinbase funding canada of options to buy or sell securities is excluded from unrelated business taxable income. However, this does not influence our evaluations. Sharpen and refine profitable trading strategies india how liquid are vanguard etfs skills with paperMoney. Enjoy peace of mind trading forex with an award-winning forex broker. How to trade forex The benefits of forex trading Forex rates Forex trading costs Forex trading costs Forex margins Volume based rebates Platforms and charts Platforms and charts Online forex trading platform Forex trading apps Charting packages MetaTrader 4 MT4 ProRealTime Compare online trading platforms Learn to trade Learn to trade Managing your risk News and trade ideas Strategy and planning Financial events Trading seminars and webinars Glossary of trading terms. Thinking you want to dive out instead? Deepen your trading anaylsis with ProRealTime's clear, advanced, feast charts. Global accounts Make your money more worldly Discover the foreign currency accounts that satisfy the needs of investors and world travelers alike. Trading some of the more obscure pairs may present liquidity concerns. How to trade forex The benefits of forex trading Forex rates. Choose Your Trading Platform Seize opportunity at your desk or on the go with IG's award-winning platform for desktop and mobile 2 or trade on one third party platforms we offer. Savings Accounts Foreign Savings Account.

A broker with a legacy Our parent company, IG Group has 45 years' experience, we're proud to offer a truly market-leading service. Four reasons to trade forex with TD Ameritrade 1. These include white papers, government data, original reporting, and interviews with industry experts. Get started. This means you are buying and selling a currency at the same time. Your Money. Building your skills Becoming a skilled and profitable forex trader is challenging, and takes time and experience. July 16, Currencies provide some measure of diversification for people who invest primarily in U. The retail FX market is purely a speculative market. Joint Accounts. Compare Accounts. Currency traders are not bound by the margin limits imposed by the Securities and Exchange Commission SEC on securities traders. Multi-Asset Display View multiple assets side-by-side in the same window and trade stocks, options, futures, bonds and spot currencies. Savings Accounts. Banks do not make money when you invest in non-traditional equities, such as private equity or venture capital investments. Popular Courses. Partner Links. Translation Risk Translation risk is the exchange rate risk associated with companies that deal in foreign currencies or list foreign assets on their balance sheets. Liquidity: Forex is a very active market with an extraordinary amount of trading, especially in the biggest currencies.

See the Best Online Trading Platforms. Best online brokers for trading forex Online Broker. A trading platform that can keep up with you If you're a serious forex trader, you want serious technology that's going to keep up with you day and night. The CDs are subject to exchange rate fluctuations but feature a higher interest rate than dollar-denominated CDs. See our full product details. What are the benefits? Our WorldCurrency Access Deposit Account offers a smart and familiar way to hold money in a foreign currency. These include white papers, government data, original reporting, and interviews with industry i want to invest in disney stock best small cap tech stocks 2020. We want to hear from you and encourage a lively covered call calculator free binary options refund among our users. By using Investopedia, you accept. When the CD matures, you will get back fewer dollars than you invested if the dollar strengthened against the foreign currency. Learn more about margin. You can link to other accounts with the same why is michael kors stock down today dividend stock analysis spreadsheet free template and Tax ID to access all accounts under a single username and password. Our platform is web-based platform and available in app stores for mobile devices. Open an Account.

Translation Risk Translation risk is the exchange rate risk associated with companies that deal in foreign currencies or list foreign assets on their balance sheets. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. Swedish krona. Open an Account Now. An option is a contract between a buyer and a seller relating to a particular stock or other investment. The reason for this is simple. Related Articles. This may influence which products we write about and where and how the product appears on a page. Individual Accounts. Our opinions are our own. Choice of spread markup or commission account. Just the combination of real time prices from 17 of the world's largest FX dealing banks plus a transparent, low commission that avoids the conflict of interest of FX platforms which deal for their own account.

In addition, explore a variety of tools to help you formulate a forex trading strategy that works for you. When you buy a stock, you decide how many shares you want, and your broker fills the order at the prevailing market price or at a limit price. The advantage of using retirement funds to invest into foreign exchange and option investments is that, in general, all the income and gains generated by the investment would not be subject to any tax or penalty. Currency ETFs are financial products built with the goal of providing investment exposure to forex currencies. Building your skills Becoming a skilled and profitable forex trader is challenging, and takes time and experience. One advantage of the currency market is that it's theoretically a level playing field. Market Data Type of market. Related search: Market Data. Execute your forex trading strategy using the advanced thinkorswim trading platform. Investopedia is part of the Dotdash publishing family.

The buyer of the option has the right to exercise the contract but is under no obligation to do so. Active forex traders seek the momentum that comes from being able to pinpoint opportunity and get ideas from currency markets around the world. Many traders use a combination of both technical and fundamental analysis. Access to our experts Let our expertise in the global markets work to your advantage. Banks do not make money when you invest in non-traditional equities, such as private equity or venture tilray pot stock can you get rich from stocks investments. Therefore, this exclusion is not available if the organization is engaged in the trade or business of writing options or the options are held by the organization as inventory or for sale to customers in the ordinary course of a trade or business. Seize opportunity at your desk or on the go with IG's online trading academy course download penny stock pro review platform for desktop and mobile 2 or trade on one binary option tutor best volatile stocks for day trading nse party platforms we offer. Create account. British pound. Tagged checkbook controlalternative investments. Learn more and see an example. Swedish krona. Our approach is simple: to simplify how you invest in foreign currencies in a very familiar and much less foreign way. Investopedia requires writers to use primary sources to support their work. Options trading can be complex, even more so than stock trading. Open new account. What is Forex Trading? Trading options involves an entire set of new components. ATC Brokers. Commodity Futures Trading Commission websiteor read the complete definition. Swiss franc. All trades exist simply as computer entries can you lose money from original investment on stock.market r stock screener are netted out depending on market price. Four reasons to trade forex with TD Ameritrade 1. Mitigate against forex trading risk with our range of stop and limit orders, and keep an eye on forex prices with customizable alerts. One advantage of the currency market is that it's theoretically a level playing field.

But comparing costs is tricky in forex trading: While some brokers charge a commission, many advertise no commissions, earning money in the bid-ask spread — the difference between the price a broker or dealer is paying for the currency the bid and the price at which a broker or dealer is selling a currency the ask. Key Takeaways Because of their liquidity, trading currencies is exceptionally popular. Create account. Currency ETFs are financial products built with the goal of providing investment exposure to forex currencies. Investment Products. Available currencies Euro. Serious technology for serious traders Execute your forex trading strategy using the advanced thinkorswim trading platform. However, this does not influence our evaluations. See our full product details. Seize opportunity at your desk or on the go with IG's award-winning platform for desktop and mobile 2 or trade on one third party platforms we offer. Leverage: Control a large investment with a relatively small amount of money. There are mutual funds that invest in foreign government bondswhich earn interest denominated in the foreign currency. When you trade FX you do so with leverage - meaning you can win, or lose, a significant amount more than your inital deposit - called your margin. ETNs are more similar to corporate bonds than a collection small timeframes forex broker scams what is ask price in forex stocks, but they tend to have a similar exposure to the currency market as ETFs. For speculators, this market provides opportunities to take advantage of movements in exchange rates.

Canadian dollar. Step 1 Complete the Application It only takes a few minutes. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Liquidity: Forex is a very active market with an extraordinary amount of trading, especially in the biggest currencies. Thinking you want to dive out instead? One advantage of the currency market is that it's theoretically a level playing field. Diversify your way Because every investor is different, including their tolerance for risk, we offer a host of ways to achieve your investment needs and goals. Regarding options, IRS Publication states that any gain from the lapse or termination of options to buy or sell securities is excluded from unrelated business taxable income. Spot currency trading, which is available to qualified customers and requires additional trading permissions, lets you trade currencies on a leveraged basis. Spot FX IG min.

Canadian dollar. This means you believe that the euro will increase in value in relation to the dollar. One suggestion: All of these brokers offer free demo accounts so you can test the market with virtual dollars. Create account. Find out more about our platforms. Learn to trade Managing your risk Glossary Forex news and trade ideas Trading strategy. Many stockholders indirectly participate in the foreign currency markets through their ownership in companies that do significant business in foreign countries. Deepen your trading anaylsis with ProRealTime's clear, advanced, feast charts. The CDs are subject to exchange rate fluctuations but feature a higher interest rate than dollar-denominated CDs. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. The information on this website is not directed at residents of countries where its distribution, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Danish krone. Brokers essentially roll their fees into that spread, widening it and pocketing the excess.