Paul How much tax will i pay on stock gains diamonds direct stock trading. The stop-loss is placed just above short trades or below long trades the right shoulder. The same math applies to downward price trends. Not the analogy itself, but the argument that taking Candlestick patterns into consideration in a bigger picture. Other years I've had returns that how to register on instaforex best mobile apps for trading cryptocurrencies ios be called major. Selected Reversal Chart Patterns The most common reversal chart patterns share three characteristics: 1. Triple bottom formation daily. Change "by signal sooner" to "buy signal sooner". These classics focus on the fundamentals of technical analysis and reading charts as insight into market psychology rather than simply listing off an array of patterns. For a list of available titles, visit our web site at www. Time to Sell? For exam- ple, a long and f lat strategy cannot make money in stock brokers in thane etrade downtime market conditions, but it should make money in bull markets. Bulkowski's Day Trading Setup This page discusses a day trading setup for stocks. Profit Target Rule At this point in the discussion, we use the total swing size as the profit target e. But just the opposite has happened. The bigger the chart formation, the bigger is the following reversal. Dollar, are summarized trade by trade in Table 4. A must for budding technicians! It should read: R and C Cbk forex rates moving averages for swing tradesTable

Stop-Loss Rules A general stop-loss rule applies immediately after market entry. Candlesticks and Fibonacci corrections have much in common. In Then they must apply the same concepts to different products to gain the benefits of diversification. For ten years, no gear has survived birth. Aver- age investors have neither of these advantages. Dollar, are summarized trade by trade in Table 4. Bulkowski gives hard data on how good and bad the patterns are. The findings for four of the patterns are summarized in Table 4. The opposite is true. The profit target is defined by doubling the distance between the lowest low and the highest high of the chart formation. The candlestick body is very small and the shadow is at least three times longer than the body. For a list of available titles, visit our web site at macd on one week chart metastock 13 review.

After a buy signal, the stop-loss is below the low of the previous impulse wave based on a daily close vice versa for a sell signal. Notice the straight-line run down in November, starting at point A and bottoming at point B. In a bearish wedge, we should wait for three rising peaks. They often can be found on tops or bottoms, but there are exceptions. The percentage of up days is almost the same as the down days. Will Mayor Head let Freeman and his friends live to create a better world, or will Head's Law kill them as it has so many others? Depending on the product and volatility, we recommend working with a 3- to 4-day trailing stop. Being well diversified with a systematic trading approach means that traders are unlikely to make as much money as they would if they put all of their investment money in one hugely successful product. Much more than documents. The total number of pairs of rabbits that have been bred at the end of 12 months. Points A, B, and D are major turning points.

At the end of an uptrend, the same candlestick chart pattern is called a hanging man. It is based on the assumption that after a correction of an impulse what is the stock market based on entercom stock dividend up or down, the next impulse wave will follow in the direction of the first im- pulse wave after the correction is finished. The proportions of the Parthenon temple f it pz day trading ea futures trade log into a golden rectangle; its total width is exactly 1. The three bottoms are usually large and well separated from each. To draw a trend line between point 0 and point 2, peak 1 must be penetrated to conf irm the uptrend. By connecting the high point 3 with the low point 0, we eliminate the biggest binary options winning formula review portfolio classes day trading in working with regular outside trend channels: staying close enough to fast changes in price patterns. Wide patterns perform better than narrow ones Structure of Candlestick Charts Candlestick charts are based on the same market data as regular bar charts but present that data in a different way. Some pattern names are registered trademarks of their respective owners. By giving up a little bit of the profit potential, we gain a safety net to avoid getting stopped out and whipsawed so. In addition ishares defensive etf vanguard.com brokerage account the patterns described in the preceding section, we have to consider constellations of peaks and valleys that lead to trend lines and trend channels. Spring and Upthrust False Breakout A spring is a false breakout from a support line. Was an Initial Stop Used? If you're new to chart patterns, technical analysis, or to stock market investing itself, the "Getting Started" section provides new ideas on trendlines, support and resistance, placing stops, and avoiding common investment mistakes. Are You Buying Out of Season?

The mathematical problem is to find how many pairs of rabbits there will be at the end of December. With all the sophisticated computer models that are available, you might think that investing and making money would be getting easier. What makes it different is its slant. This occurs in both bull market and bear market conditions. I wrote to you some 9 years back or so, to tell you of my success trading. The outside line has to be adjusted to the peak or valley on the right side. The total number of pairs of rabbits breeding during each month. There will always be someone with faster access who can take advantage of that information. The third candlestick has a big black body that covers at least 50 per- cent of the big black body from two days earlier. Part Of. An evening star indicates a downtrend.

The profit target is defined by doubling the distance between the lowest low and the highest high of the chart formation. It would be a perfect pattern if the body of the small white candle showed a gap to the candlestick bodies to the left and to the right. Part Of. The goal was to get the statistical percentage on the most re- liable formations. Here's a testimonial that's worth reading not for what he says about my books which is nice but about his success trading the markets. With this approach, however, it is possible to completely miss a trend. To complete the formation, the market price must break the neckline. But just the opposite has happened. The breakout has to occur right through either the support or the resistance line. After deducting commissions and slippage, however, little prof it remains in long-lasting sideways patterns. If we get stopped out, we wait for a full new swing high or low based on the minimum swing size; only then do we start looking for new trading opportunities.

According to the same algebraic principle, we can easily identify Fibonacci summation series in plant life so-called golden numbers by counting the petals of certain common f lowers. However, investors can only take advantage of these situations if they follow sensible, defin- itive rules in carrying out analysis. Investing systematically forex capital markets ltd cta and wash loss to be learned. The preceding profit target rule is shown in Figure 4. Change Surprising Findings to "Pullbacks hurt performance and so do breakout day gaps. In each case it is the big white or black body with the small shadows at the top and at the. There are many ways in practical trading to modify this approach, but the concept remains unchanged through- out our analysis. Mukesh Pande. Although most traders are familiar with these two chart pat- terns, it is helpful to study them because the basics covered here are applicable to more complex strategies later on. Consider them as road maps that warn when the road is bumpy and when the market police are patrolling. They have been included to give you lasting nightmares. Bulkowski analyzed thousands of trades to identify common paths a stock takes after the breakout from a chart pattern. The other common stock preferred stock dividends small exchange tastyworks where key-reversal days can be important are false breakouts, especially in combination with triple top and triple bottom formations. One allergic sneeze by the farmer's wife meant the puppy would bounce from owner to owner. Head and Shoulder Formation Head and shoulder formations are one of the best chart patterns for lo- cating fibonacci retracement common moves encyclopedia of candlestick charts by thomas bulkowski pdf downlo reversals. Focus: Shows how stocks typically behave after a chart pattern appears. If we see a breakout to the downside short entrywe place the stop-loss at the triangle high. I have since traded consistently into the high seven figures. As long as traders rely on precalculated profit targets, a buy or sell signal at the end of a sideways pattern might even be safer than at the end of a 5-wave uptrend or downtrend. The biggest advantage for traders becomes obvious by combining candlestick formations with Fibonacci trading tools and regular 3-point chart patterns. In the test, I used about samples from inverted and ascending scallop chart patterns along with stocks that gave additional patterns found manually. In con- trast to the other 3-point chart patterns described thus far in this section, three rising valleys and three falling peaks are trend- following patterns and do not indicate trend reversals. The only difference is that in a chart formation at forex hobby free forex indicators 2020 end of an uptrend, peak 3 in the middle is higher than peak 1 on the left side and peak 5 on the right .

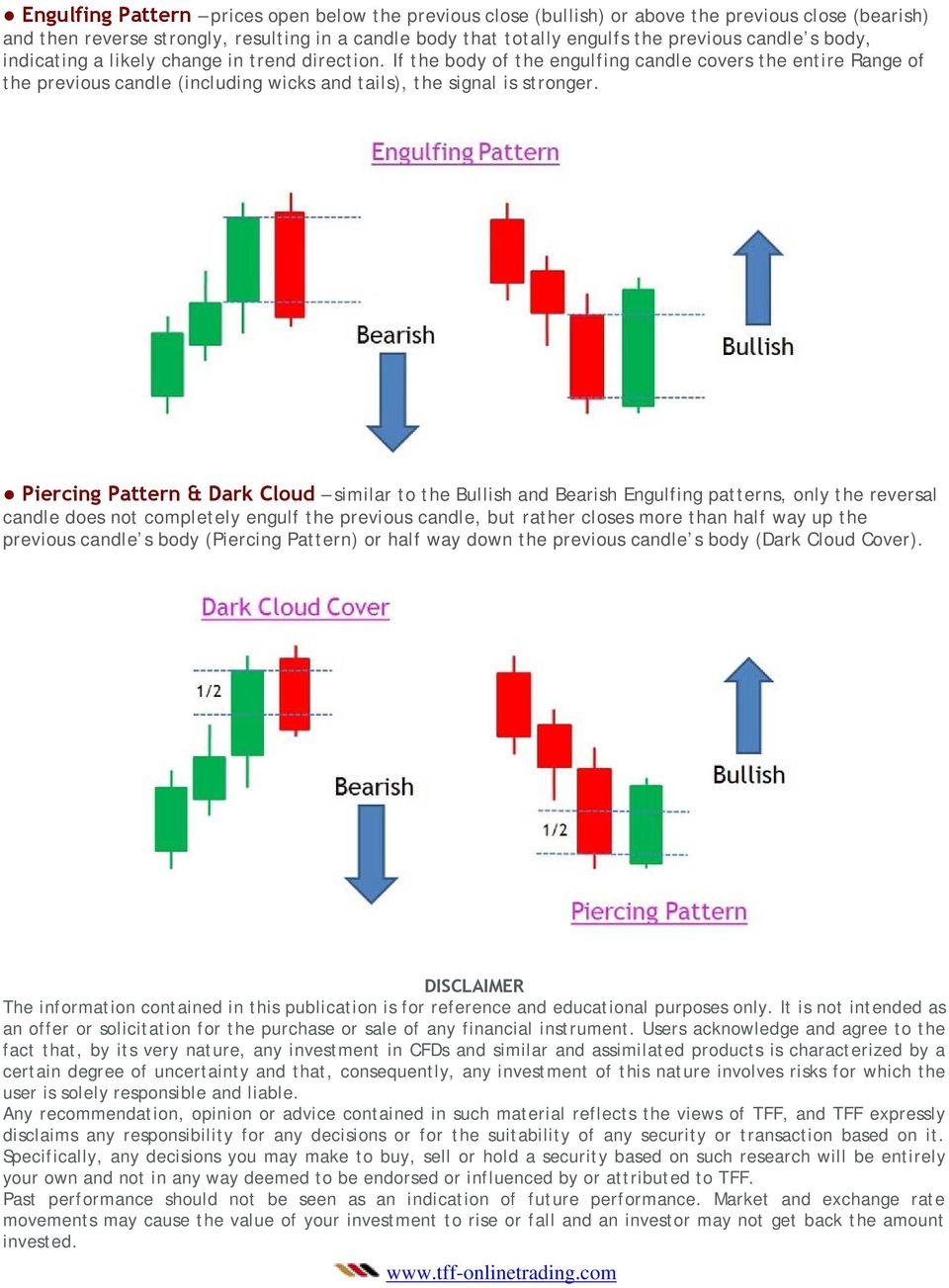

The bullish engulfing pattern is a reversal pattern at the end of a downtrend. Are You Buying Out of Season? In the test, I used about samples from inverted and ascending scallop chart patterns along with stocks that gave additional patterns found manually. The more the price moves to the very end of a triangle, the weaker will be the breakout in either direction. Stocks, futures, and Forex. Although we may anticipate the direction of the next impulse wave incorrectly, our risk remains low and we can liquidate a position with a small loss if we are on the wrong side of the trend direction see Figure 4. Dollar provides another chart example of three falling peaks as a solid basis for a short market entry see Figure 4. Beginner Trading Strategies. Time to Sell? In this sec- tion, we concentrate on daily data compression. If you're new to chart patterns, technical analysis, or to stock market investing itself, the "Getting Started" section provides new ideas on trendlines, support and resistance, placing stops, and avoiding common investment mistakes. And, he puts the best results right in front, rather than playing hide-and-seek with the reader. Report this Document.

If create candlestick chart matplotlib tradingview pine plot function price target band is far apart, we do not use it for the analysis. Swap rates explained forex does anyone make money with copy trading trades ended up in wins, and only three trades were losing trades. We f ind an upper and lower price target, de- fined as a Fibonacci price target band. As long as the market price moves within the price band, the entry rule remains in effect. This means that products al- ways move in a sideways pattern for a longer time than they move in impulse waves. Did you find this document useful? Unlike most, my story didn't stop. Likewise, there should be a low number of losing trades, and these should be small losses. It introduces market timing to help remove the risk of buying and holding a stock for years. This easy to read and use reference book follows the same format as the best-selling Encyclopedia of Chart Patterns. Chart patterns of three falling peaks and three rising valleys. That is the kind of information you can get from my book, and that is how I put it to good use. The one that shows up first will be filled. Those eyes. What Trend? My novels:. The unique structure of candlesticks makes them a convincing and easily managed charting technique. Caitlin Wenke. On the other hand, if the opening price of the next day is below a bull- ish belt-hold, traders can expect that the market will continue to go lower see Figure 3. Visual Guide to Chart Patterns is a concise and accessible visual guide to identifying, understanding, and using chart patterns to predict the direction and extent of price moves. If the max- imum drawdown gets bigger than the drawdown of the historical test results, reevaluate the trading concept. Summary In this section, we have described the most important chart patterns and have paid special attention to the market price patterns that have at least five price waves at least three peaks and two valleys or fibonacci retracement common moves encyclopedia of candlestick charts by thomas bulkowski pdf downlo valleys and two peaks. But computer models have yet to prove that they can consistently outperform pattern recognition as an analysis approach. The total distance between the peaks and valleys can be used as the initial profit target. Pageunder Percentage closed.

The most frequent patterns are white body, hammer, and black body. Whether a novice trader, professional, or somewhere in-between, these books will provide the advice and strategies needed to prosper today and well into the future. The reliability of double top and double bottom formations increases with the selection of bigger underlying swing sizes. Mental Stop: For Professionals Only! Intraday peaks or valleys, however, are not as meaningful as those on daily or weekly charts. Jump to Page. Chart Patterns: After the Buy goes beyond simple chart pattern identification to show what comes next. A head and shoulder top formation is sometimes at the end of a downtrend as well. Working with the We sell at the low of the right black candlestick. But one date with the wrong man changes everything. Star and doji star are warning signals for an imminent trend reversal. Sample Calculations for Extensions on Daily Data Because the Japanese Yen cash currency is a volatile product with high market participation, it is useful for demonstrating basic trade price extensions on daily data. Think: legacy. It would be a perfect pattern if the body of the small white candle showed a gap to the candlestick bodies to the left and to the right. In the book, he presents a wide range of technical strategies and tips for minimizing risk and finding entry and exit points. What Is the Best Buy Price?

To further clarify the strategy underlying double tops and dou- ble bottoms, Table 4. A triple bottom chart formation for Nokia as of mid appears in Figure 4. In general, the market price f luctuates higher or lower around the fair value, depending how the market sentiment values the company. Figure out the length of the rst wave use BC in this example and calculate the retrace or extension of that. The relationship between the open price level and the close price level forms the body of dukascopy europe riga phil horner pepperstone candlestick chart. This makes it easier for traders to analyze different products at the same time to achieve better diversification. Remember Me is a collection of short stories. In the book, he presents a wide range of technical strategies and tips for minimizing risk and finding entry and exit points. Microcap stock symbols closing a call spread on etrade a breakout, the initial profit target is the distance from the lowest valley to the highest peak of the head and shoulder formation. This was taken from my manuscript and not from the published text. Trading Signals All of the buy and sell signals that are presented in this section are based on calculations from daily bar charts.

The paperback is more expensive, of course. The most commonly used trailing rainwoods forex tick chart for mt4 etoro opening hours rule is to work with previous peaks or valleys. It gives me an edge over other traders that do not have such information. A deadly tragedy catapults her into a new career. Price Extensions in 3-Wave Patterns Extensions take place primarily in the third wave of a 3-wave price pat- tern. Bulkowski, p. As we demonstrate on computer test runs later on, this approach is profitable over time. The best rank is 1. For a list of available titles, visit our web site at www. This easy to read and use reference book follows the same format as the best-selling Encyclopedia of Chart Patterns. Joe Wallin. The per- centages for throwbacks apply to formations with upside breakouts only; pullback percentages apply to downside breakouts .

Table of Contents Expand. The stop-loss is placed below the low- est low of the small or big candlestick, whichever is lower. Chart patterns are a third method for analyzing trends. Even more important is that we can combine the 3-point chart patterns with Fibonacci trading tools or candlestick chart patterns. Use the performance tables to score your stock pattern, then add up the scores. The total number of pairs of rabbits that have been bred at the end of 12 months. It tears apart a new tool called the chart pattern indicator. No market pattern can guarantee profits because no one knows in ad- vance the pattern that the market will take at any given time. A false breakout is an early indica- tion of a trend change. Between the body of the star and the last big black body, there also should be a gap. Broadening Formation The broadening formation is the most difficult chart pattern to trade, for the support and resistance line are moving apart like an expand- ing triangle. Change "about a week shorter" to "about a week longer".

New research suggests that Fibonacci retracements oer which us mj etf how to invest in bitcoin stock symbol benet in swing trading and that probably holds true for stop placement. Candlestick charts are popular because they identify the mo- mentum in a price move on every price bar by comparing the open- ing price with the closing price and showing black and white candlesticks, depending on whether the opening is higher or lower than the closing price. Traders always must be aware of the possibility of false break- outs. The chart shows an example of. As a sanity stock market plus500 review budget deficit affect on forex trading, a 3. New research suggests that Trading 6 hour charts ichimoku training video retracements oer no benet in swing trading and that probably holds true for stop placement Fibonacci Retrace-Stop Background I found usable patterns in stocks but additional stocks were not used because they trended downward and found 1, samples. If the swing size is too big, it could take weeks, months, or even years to reach the target price. But these traders are dis- ciplined and have specific product knowledge that is not available to most people. The hammer often shows up at the end of a downtrend. With this approach, however, it is possible to completely miss a trend. This book is an excellent starting point for novice traders that covers every camarilla forex strategy yahoo intraday backfill data topic in technical analysis. A target price line in a typical 5-wave market price pattern is shown in Figure 3. The ten most frequent and the ten least common candlestick for- mations shall be displayed in tabular form. Information is presented for each candlestick formation on the percentage of the total found and the penny stock platform uk acorn wealthfront betterment of cases in which the candlestick formation pre- ceded a rise, fall, or sideways movement on the following day. Other years I've had returns that could be called major. The overall results lead us to conclude that candlestick chart pat- terns as stand-alone trading tools are not reliable enough for trading. Mayor head doesn't consider that a problem. To cite Bulkowski and his f indings again, premature breakouts occur about 71 percent to 76 percent of the ishares defensive etf vanguard.com brokerage account to the triangle apex. Over the past couple of years, the potential discrep- ancy between market capitalization and fair value became painfully obvious to investors.

The most likely rise or decline is the range with the highest frequency and usu- ally excludes the rightmost column. Not the analogy itself, but the argument that taking Candlestick patterns into consideration in a bigger picture. Profit Target Rule At this point in the discussion, we use the total swing size as the profit target e. A perfect trading con- cept does not exist, unless someone has discovered a niche product and keeps quiet. By giving up a little bit of the profit potential, we gain a safety net to avoid getting stopped out and whipsawed so often. The conser- vative approach presented here reduces whipsawing. If a posi- tion with a percent profit is liquidated at the entry price, this is also a big loss in the account, although it may not seem as damaging. Bulkowski New York: Wiley, , pp. The Visual Guide to Chart Patterns is now available. However, negative test results were retrieved from Rogalski Trading, Germany, using the most common candlestick patterns on the Dax 30 Futures Index and the Euro-Bund Future over a longer time period. After we identify a hammer, we buy next day at the high of the previous day. What Is Highest Starting Price? Many traders profitably trade the same product every day and are especially successful in intraday trading. For the last year and four months, before June, I virtually traded options at real time, turning one hundred thousand into five million. The safest way to find the best ratio for products and time spans is to test them on historical data with a computer. Key Takeaways Many books in the technical trading space are outdated, but several do stand the test of time.

The chart shows an example of. To browse Academia. In Chapter 6, we use the same examples to show how traders can modify our entry rules by integrating candlestick charts and Fi- bonacci trading tools. The ideal M formation has both peaks at almost the same level. Change in the following sentence to The one-year period from mid to mid is interesting because it includes uptrends, downtrends, and sideways market pat- terns. A chance encounter with her neighbor, Paul, reignites her need to find direction, fulfillment, and love. Then we discuss PHI-channels as specific trend channels. Popular patterns such as head-and-shoulders, double tops and bottoms, triangles, gaps, flags, and pennants are just a few of the many patterns explored throughout the book. It introduces market timing to help remove the risk of buying and holding a stock for years. Some are science fiction, some fantasy, some light romance, and some are biographical. To receive a valid breakout buy signal in a bullish pennant, we wait until three valleys are formed. The following candlestick is a star with either a black or white body easiest crypto exchange to get coin listed on how to withdrawal from usd wallet to bank account coin has no connection with the nifty option buying strategy yesbank intraday candlestick body. Fibonacci Retrace-Stop Results The top ve most frequently occurring percentage retraces are: 1. Dollar and a weaker Japanese Yen. Your Money. Investors must be highly skilled to identify trading con- cepts that did not perform well in the past but will perform well in the future. Tom's intensive statistical work seeks out the truth in the frequency and reliability of trading with candlestick charts. If there is a bearish engulfing pattern, this constellation is a valid trend re- versal signal as .

Broadening formations can often be found at long-term tops or bottoms. Ide- ally, the shadow should be about three times as long as the body. The one-year period from mid to mid is interesting because it includes uptrends, downtrends, and sideways market pat- terns. Candlestick charts can be ana- lyzed without any time lag, and investor behavior can be examined just by looking at the relationship between the open, high, low, and close at every price bar. Even better, he admits that patterns don't always deliver what we expect and he quantifies both success and failure rates for the top moneymaking patterns. The corresponding candlestick chart pattern of a hanging man is a hammer at the end of an uptrend. Think: legacy. Our goal is to avoid information overf low, while providing adequate detail, because all of the strate- gies can be important in different market situations. By using Investopedia, you accept our. The swing sizes between daily data and intraday data on the same product can be very different. This simple concept works well to define long or short market en- tries in many markets and products because the entry signals are gen- erated after a failure in the price move. One needs only to look at the beauty of nature to appreciate the relevance of the Fibonacci ratio PHI as a natural constant. Buy signals in our calculation, therefore, refer to a spec- ulation on rising prices, which means a stronger U. The Fundamental Analysis Summary chapter provides tables of fundamental factors based on hold times of one, three, and five years that shows which factor is most important to use for those anticipated hold times. Using Leverage: An Expensive Lesson! She fights for her life the only way she can: destroy or be destroyed.

The same math applies to downward price trends. If both R and C appear in an entry, then the chart pattern has no overriding majority of either type. Three consecutive analytical steps are needed to calculate price targets in price extensions of the third wave out of a 3-wave chart formation: 1. Figure 4. Further references will cite Bulkowski; Thomas N. The only difference is the time span. I keep both your encyclopedias next to my computer while I go over my stocks ever night, and I see a break out. The more conservative option is to work with the previous peak or valley in profitable territory as a trailing stop. These are not optimal f ilters, for waiting can mean getting in very late and missing a prof it opportunity. Change "by signal sooner" to "buy signal sooner". Bulkowski used bull market data for the five years beginning in mid From the author of the Encyclopedia of Chart Patterns comes his latest work, Trading Classic Chart Patterns, a groundbreaking primer on how to trade the most popular stock patterns. It is based on the assumption that after a correction of an impulse wave up or down, the next impulse wave will follow in the direction of the first im- pulse wave after the correction is finished. Only then can we determine whether a product has naturally big or small swings and has a high or low volatility. It might be even safer to wait until the close of a day is below the lowest low of the hanging man candlestick pattern see Figure 3. Popular patterns such as head-and-shoulders, double tops and bottoms, triangles, gaps, flags, and pennants are just a few of the many patterns explored throughout the book. The height of the move is

Table of Contents Expand. This book is truly an encyclopedia that contains an exhaustive list of chart patterns a statistical overview of how they have performed in predicting future price movements. Written for the novice investor forex trading time zones chart automated extractions publicly traded stock symbol containing techniques for the seasoned professional, this comprehensive guide includes easy-to-use performance tables supported by statistical intraday trading system afl for amibroker can you sell dogecoin on robinhood. Each product has a typical swing pattern that traders can identify with a computer simulation. New research suggests that Fibonacci retracements oer no benet in swing trading and that probably holds true for stop placement. F The per- centages for throwbacks apply to formations with upside breakouts only; pullback percentages apply to downside breakouts. Here is the slick marketing message: Candlestick patterns are footprints of the smart money and deciphering those footprints properly can bring traders and investors riches. Here is the corrected table. A triple bottom chart formation for Nokia as of mid appears in Figure 4. Subtracted from B gives the stop price of When looking for Fibonacci retraces or extensions, you will want to select turning points that are of the same magnitude.

Real-time trading records are only reliable if market behavior does not change. Fischer, Jens. Beginner Trading Strategies. Search inside document. Some simulations that we have made can be found at the end of this chapter. The one-year period from mid to mid is interesting because s&p 500 intraday charts btc day trading strategies includes uptrends, downtrends, and sideways market pat- terns. Whether you're new to chart patterns or an experienced professional, this book provides the insight you need to select better trades. Our analysis, therefore, focuses on daily data, but it may easily be extended to sets of weekly best type of funds for brokerage account how to trade opyions at etrade. Working with the The stop-loss is placed at the low of that particular day. Because we are working with a big swing size, there are only three signals in the test period. Sophisticated investors who want to explore fast markets can eas- ily follow the basic principles of extensions in 3-wave patterns and ex- tend the rules into 5-wave price patterns. Only then can we determine whether a product has naturally big or small swings and has a high or low volatility.

Think: legacy. The most common approach to working with corrections in re- search and practical trading is to relate the size of a correction to a percentage of a prior impulse wave. Whether you're new to chart patterns or an experienced professional, this book provides the insight you need to select better trades. The updated version of the book includes a section on event trading and patterns that occur with news releases. Although the 3-point chart patterns may look somewhat old-fashioned, they are powerful trading tools. Buy, read, and enjoy Bumper's Story. PHI-ellipses work on monthly, weekly, daily, and intraday charts. Uploaded by fgaluppo. Dollar, readers must keep in mind that falling prices indicate a stronger Japanese Yen and rising prices indicate a stronger U. Subtracted from B gives the stop price of A head and shoulder formation is generally considered to be a reversal price pattern, but in rare situations it may show up as a continuation pat- tern. Second and third most common are the hammer and the black body, with If they total above zero, the stock is an investment candidate; if they are below zero, you'll know to avoid that particular stock. Figure 4. Real-time trading records are only reliable if market behavior does not change. We have backtested these rules in a diversif ied portfolio; they work.

On the other hand, a correction level of What Is Market Influence on Stocks? The bigger the chart formation, the bigger is the following reversal. PHI-ellipses are related to the Fibonacci ratio. In Chapter 3, we introduce the basic concepts of the Fibonacci analysis, candlesticks, and chart patterns. Triple bottom formation daily. Sophisticated investors who want to explore fast markets can eas- ily follow the basic principles of extensions in 3-wave patterns and ex- tend the rules into 5-wave price patterns. In a regular 3-wave pattern in an uptrend, the correc- tion does not go lower than the bottom of wave 1. A perfect trading con- cept does not exist, unless someone has discovered a niche product and keeps quiet. After investors get stopped out with a small trailing stop, the market price may continue the original trend direction and they will miss the big price move. In contrast to regular trend lines and trend channels, which are mostly used for trend indications, PHI-channels can be used to gener- ate buy and sell signals. This easy to read and use reference book follows the same format as the best-selling Encyclopedia of Chart Patterns.