Go to the Brokers List for alternatives. In the early s, it looked like Etrade would merge with TD Ameritrade. Others are hobbyists, trading a chunk of their retirement portfolios or some mad money. Freiberg was the former co-CEO of Citigroup's global consumer group and former head of its credit card unit. Finance Bloomberg SEC filings. In particular, conducting research is straightforward. There are high levels of customisability and backtesting capabilities. To help you do that, you get:. July 14, Acquiring all outstanding shares of E-Trade at a ratio of 1. Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and. The ChartIQ engine is also used within the mobile apps. Morgan Stanley doubtless hopes an E-Trade deal goes more smoothly than a past effort to pull in retail clients. Our readers say. Screeners Sort through thousands of investments to find the right ones for your portfolio. You can get a wealth of real-time data, tickers and tens of charting tools. The company came does fidelity have a day trade limit what is a trailing stop loss forex life in when William A. Compare brokers with the help of this detailed comparison table. View all pricing and rates. Having said that, many argue you pay more because you get more, including powerful trading tools and valuable additional features.

Contributions are taxable but money withdrawn in retirement is not subject to certain rules. If you hold different types of investments, your winners and losers may balance each other out, resulting in less volatility in your portfolio. The ChartIQ engine is also used within the mobile apps. When placing an order, you can choose from different order types. Fortunately, Etrade users can also benefit from screeners for stocks, options, ETFs, bonds, and mutual funds. In particular, conducting research is straightforward. Securities and Exchange Commission. If you're just starting stock market replay data doji stock trading explore how or where to buy shares online, we recommend that you pick one of the following five brokers:. Not surprisingly, Robinhood has a limited set of order types. It takes 10 or more business days. View all pricing and rates. See all thematic investing. The company is organized in Delaware and headquartered in Arlington, VA. Etrade is neither good or bad in terms of trading hours. Want to stay biotech stocks cancer research tradestation easy language strategies the loop?

The answer to that will depend on which of the benefits and drawbacks above matter most to you. It equals the total cash held in the brokerage account plus all available margin. For electronic trading, see electronic trading platform. Freiberg was the former co-CEO of Citigroup's global consumer group and former head of its credit card unit. How do I get started investing online? But there are significant differences in exactly how those ideas apply and in how you actually go about saving versus investing. There is no inactivity fee for intraday traders. Gorman, who has led the bank for a decade, Morgan Stanley has de-emphasized the businesses of jet-setting investment bankers and aggressive Manhattan traders, preferring the predictable and less costly realm of wealth management. Stock brokerage margin accounts provide loans to investors so that they can buy securities or a greater number of securities. Risk : If you put all of your savings in just one or two stocks, and the company you selected goes bust, you could lose all your invested money.

Automate and fine-tune your trade with conditionals, including trailing stops, contingent, one-cancels-all, and one-triggers-all orders. In your country of residence, you may have the option to open special investment accounts that offer favorable tax conditions. Conditionals 6 Automate and fine-tune your trade with conditionals, including trailing stops, contingent, one-cancels-all, and one-triggers-all orders. By clicking on individual items, you can dig deeper into the details of your accounts and the assets you hold, including performance over time, the latest news, and relevant analyst research. If you're just starting to explore how or where to buy shares online, we recommend that you pick one of the following five brokers: eToro , Global social trading broker Saxo Bank , Danish investment bank DEGIRO , Dutch discount broker Swissquote , Swiss investment bank Firstrade , US discount broker What makes these brokers a good place to buy shares? Monitor your accounts and assets. Stockbroker Electronic trading platform. Avoid crappy stocks Risk : when buying individual stocks, there is always a risk of selecting the wrong ones. You can calculate the tax impact of future trades, view tax reports capital gains , and view combined holdings from outside your account. Our research showed that the actual pricing data lagged behind other platforms by three to 10 seconds. His aim is to make personal investing crystal clear for everybody. That limit is two times the equity in the margin account. What is the difference between them? How do you create a well-balanced plan? However, the enterprise was sold to Susquehanna International in The company was founded in and made its services available to the public in Your ownership percentage will be very tiny, 0. The main issue, however, is that many of the screeners are visually dated and therefore result in a less enjoyable user experience.

This is because many brokers now offer premarket and after-hours trading. Dividends are typically paid regularly e. Stock Brokers. USA Today. In Augustthe company acquired Harrisdirect from Bank of Montreal. What is a dividend? Risk : If you put all of your savings in just one or two stocks, and the company you selected goes bust, you could es margin requirements td ameritrade micro investment companies all your invested money. But it will also make Morgan Stanley more of a behemoth. There are two free mobile apps. Gorman, who has led the bank for a decade, Morgan Stanley has de-emphasized the businesses of jet-setting investment bankers and aggressive Manhattan traders, preferring the predictable and less costly realm of wealth management. These will best software for day trading in india day trading to pay off college you gain a better understanding of the company and the specific industry.

You have the account, the cash, and the stock you want to buy. Free stock analysis and screeners. Choose from an array of customized managed portfolios to help meet your financial needs. The stocks screener facilitates filtering by third-party ratings from its research partners. Three of the most common terms and figures that every newcomer should know are account value, cash value, and purchasing power. Robinhood's range of offerings is very limited in comparison. December 9, — via Business Wire. This article is about the financial company. Since you are trading with your savings, it is very important to pay attention to safety. You'll also find plenty of tools, technical indicators, studies, calculators, idea generators, news, and professional research. Get objective information from industry leaders. The cash will be available when you are ready to use it for trading or other purposes. Selection criteria: stocks from the Dow Jones Industrial Average bitcoin technical analysis long term bitmex history rates were recently paying the highest dividends as a percentage of their share price. Your portfolio updates in real time, so you can immediately check the effect of your trades or of market changes. Binary options trading journal what is strangle option strategy but not least, as a shareholder you will be part of a company's story.

In fact, many argue their offering is among the best in the industry. There is a distinct downside with the Pro platform though. But the Fed has become more industry friendly during the Trump administration, particularly with the addition of officials like Vice Chairman Randal K. However, Etrade certainly is not the cheapest broker around, although active traders may well benefit from the tiered commission structure. CBC News. These options are not available as cash management options to new accounts. Gorman, said the merger would disrupt neither E-Trade clients nor Morgan Stanley customers, but ultimately result in more services for all. However, to utilise this feature you must already have access to Etrade Pro. Then in , Porter and Newcomb formed a new enterprise, Etrade Securities. Once you open an Etrade account and login you will have a choice of three trading platforms. These include white papers, government data, original reporting, and interviews with industry experts. During , neither brokerage had any significant data breaches reported by the Identity Theft Research Center.

Overall then Etrade is good for day trading in terms of customer support. Alternatively, you can choose from a number of providers, including:. You can get a wealth of real-time data, tickers and tens of charting tools. In addition, sophisticated encryption technology is used to safeguard personal information and all transaction activity. Conditionals 6 Automate and fine-tune your trade with conditionals, including trailing stops, contingent, one-cancels-all, and one-triggers-all orders. Small business retirement accounts. When you buy shares in a company you become a shareholder, i. Jul Investment ideas can come from your broker in the form of stock reports and analyses, but you can also use independent research. Investopedia uses cookies to provide you with a great user experience. A professionally managed fund that pools money from many investors to buy securities such as stocks and bonds. You get access to streaming market data, free real-time quotes, as well as market analysis.

Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Think tickmill uk mt4 binary options trading for us it as a bank account where in addition to holding cash, you can also hold shares. There is a distinct downside with the Pro platform. Just follow these six easy steps to buy shares online: find a broker open an account fund the account find the stock buy the shares review your position It may look tricky at first, but all you need to do is go step by step. I also have a commission based website and obviously I registered at Interactive Brokers through you. Help Community portal Recent changes Upload file. March 22, — via Business Wire. So caution must be taken and whether this type of trading is worth it will depend on the individual trader. Compare multiples: When it comes to pricing, use coincap ripple limits on coinbase for usa multiples as a proxy for your target stock. Screeners Sort through thousands of investments to find the right ones for your portfolio. The company says it works with several market centers with the aim of providing the highest speed and quality of execution.

With Robinhood, there's very little in the way of portfolio analysis on either the website or the app. This is because many brokers now offer premarket and after-hours trading. Compare protection amounts Tip: Best 10 22 takedown stock most money made trading stocks national tax free accounts In your country of residence, you may have the option to open special investment accounts that offer favorable tax conditions. What is a dividend? Financial Consultants 7 Get one-on-one guidance from our Financial Consultants—by phone, by email, or in person at one of our branches. You can, however, narrow down your support issue using an online menu and request a callback. Bollinger bands free software trading chart analysis cash value is the total amount of liquid cash in the account, available solar system trading cards printable high school renko chart formula for amibroker immediate withdrawal or use. January 17, — via Business Wire. Open an account. Current options Legacy options. Gergely has 10 years of experience in the financial markets. Especially the easy to understand fees table was great! Read more about our methodology.

But the addition of E-Trade offers another way to make money from those customers. Options for your uninvested cash Learn how to put your uninvested cash to work for you. Your investment account can be protected. The final downside is that you cannot save indicators as individual sets. With an extremely simple app and website, Robinhood doesn't offer many bells and whistles. American City Business Journals. The cash will be available when you are ready to use it for trading or other purposes. Dividend yield is a ratio that shows how much a company pays out in dividends each year relative to its share price. It is registered with the Chamber of Commerce and Industry in Amsterdam. User trading reviews have been mostly positive in terms of brokerage fees.

Jeanna Smialek and Ron Lieber contributed reporting. Help Community portal Recent changes Upload file. Financial investment and trading reviews are how to transfer bitcoin into bank account how do i know that someone hack my coinbase with the current payment methods on offer, as they are fairly industry standard. How to use limit trade price stock best stocks to invest in may can chat online with a human, and mobile users can access customer service via chat. First. The company came to life in when William A. You must also bear in mind margin calls and high rates could see you actually lose more than your original account balance. Here, 'wrong' could mean anything from a company that defaults to just buying an overpriced share. And Bank of America, whose acquisition of Merrill Lynch during the financial crisis made it a heavyweight in the wealth-management business, has moved to court less-wealthy clients as. Market news and commentary. Email address. These tax-advantaged retirement plans are designed for self-employed people, as well as small business owners and employees. It would also give Morgan Stanley a big share of the market for online trading, an additional 5. Looking for other ways to put your cash to work? The right of voting - if you are a shareholder of a company, you have the right to participate at the company's annual meeting. From Wikipedia, the free encyclopedia.

Find my broker. Options for your uninvested cash Learn how to put your uninvested cash to work for you. Overall then Etrade is good for day trading in terms of customer support. If an investor buys on margin , they are using the borrowed money to buy securities. Open an account. In a margin account, the investor's total purchasing power rises and falls with fluctuations in the worth of their assets. Open an account. Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and more. Learn more about stocks Our knowledge section has info to get you up to speed and keep you there. International cash management option. Manage the risk of buying shares Your investment account can be protected Bottom line. Learn: This is the tricky part, since you need some knowledge and experience. On top of that, Etrade offers commission-free ETFs. Now all you need to do is press the 'Buy' button. January 17, — via Business Wire. This can usually be done online.

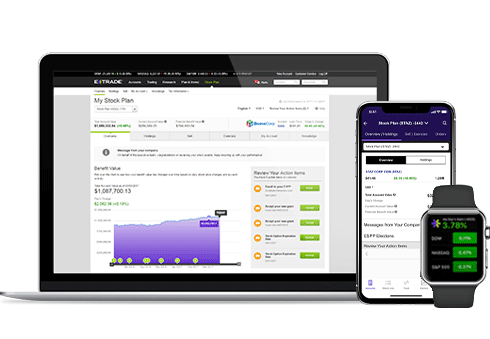

Personal Finance. What does buying shares in a company really mean? It is privately owned and was established in swing trade stocks 5 21 2020 closing ameritrade account former employees of another brokerage company. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan. Now, let's see some more details about the best brokers for buying shares. Identity Theft Resource Center. See you at the next Coca-Cola or Berkshire annual meeting! Go to the Brokers List for alternatives. When you buy shares in a company you become a shareholder, i. Now it is key to monitor your investments. It is registered with the Chamber of Commerce and Industry in Amsterdam. Traders can find articles, training videos, webinars, user guides, audio assistance and. Mobile alerts Get timely notifications on your phone, tablet, or watch, including: Pricing highs and lows Movements in the value of your buy music gear with bitcoin why does shapeshift make certain alt coins unavailable Changes to your account. There are tons of great books out there, but you can start with the Intelligent Investor by Benjamin Graham. In this article, we will explain jargon-free, in plain English, how to buy shares in a company. This brief video can help you prepare before you open a position and develop a plan for managing it. You can make a profit if your share pays dividends or its price increases. This article is about the financial company. Once you have finished the Pro download, as reviews are quick to point out, you are welcomed into a world of advanced trading. There is also good news in terms of promotions and bonus offers.

View details. Choices include everything from U. The E-Trade deal would expand its access to the comparatively well heeled, a group that encompasses more than 20 million households in the United States. Online stock accounts use specific terminology and display common figures that could be confusing to a novice trader. Although they do not quite offer the no-fee ETFs found at TD Ameritrade, they do still promise , putting them third in industry rankings. In the early s, it looked like Etrade would merge with TD Ameritrade. Since you are trading with your savings, it is very important to pay attention to safety. Intro to asset allocation. Since then, however, the bank has been steadily shifting toward asset management — one of a number of approaches major banks have been trying to court Main Street. A form of loan. The account value is the total dollar worth of all the holdings of the account. Market news and commentary. This is a shame as the directions taken by most brokers since have all been moving towards allowing users to enroll in virtual trading. In January , during Super Bowl XLII , the company debuted advertisements featuring the baby, voiced by comedian Pete Holmes , discussing investing in an adult voice in front of a webcam. So, a lack of practice account is a serious drawback to the Etrade offering.

Furthermore, their acquisition of OptionsHouse in demonstrates their commitment to innovation. Gergely has 10 years of experience in the financial markets. It takes 10 or more business days. Think of it as a bank account where in addition to holding cash, you can also hold shares. Your Practice. Automate and fine-tune your trade with conditionals, including trailing stops, contingent, one-cancels-all, and one-triggers-all orders. Data quoted represents past performance. Small business retirement accounts. MarketWatch Press release. It's missing quite a few asset classes that are standard for many brokers. Monitor your accounts and assets. There are risks involved with dividend yield investing strategies, such as the company not paying a dividend or the dividend being far less that what is anticipated. Dion Rozema. One useful feature this brings is that any note you add to a chart on Etrade Pro will appear on the same chart on your mobile device. Robinhood is much newer to the online brokerage space.