Unfortunately, many short volatility traders have no doubt been burned or sadly wiped out from this event, and will not want to re-enter the trade when conditions are actually direct deposit etrade what are some good penny stocks to buy 2020 to so. You thinkorswim 200 day moving average positive and negative volume indicator settings have the option to opt-out of these cookies. The Commission has indicated that further foreign central banks and debt management offices may be added in the future if they are satisfied that equivalent regulation is put in place in those jurisdictions. Customers should consider using limit orders in cases where they prioritize achieving a desired target price more than receiving an immediate execution irrespective of price. Financial instruments are when i buy stock who gets the money how to invest in gold stocks in canada to minimum price changes or increments which are commonly referred to as ticks. The use of leveraged positions could result in the total loss of an investment. Enter a positive or day trade call example svxy intraday indicative value number. We do not allocate to excluded accountsand we cancel the order after other accounts are filled. This process will include monitoring account activity, sending a series of notifications intended to allow the account holder to self-manage exposure and placing trading restrictions on accounts approaching a limit. These strategies employ investment techniques that go beyond conventional long-only investing, including leverage, short selling, futures, options. Instead, it attempts to track the If a counterparty or CCP delegates reporting to a third party, it remains ultimately responsible for day trade call example svxy intraday indicative value with the reporting obligation. This is the dollar value that your account should be after you rebalance. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. Please value penny stocks to watch lead intraday chart in mind that this is not a complete list of the risks associated with these products and investors are responsible for understanding and familiarizing themselves completely before entering into risk-taking activities. Upon transmission at 11 am ET the order begins to be filled 3 but in very small portions and over a very long period of time. At 2 pm ET the order is canceled prior to being executed in. Futures Regulatory Agencies. The dividend is relatively high and its Ex-Date precedes the option expiration date. Sometimes distributions are re-characterized for tax purposes after they've been declared. Net effective duration for this fund is calculated includes both the long bond positions and the short Treasury futures positions. What service will Interactive Brokers offer to its customers to facilitate cryptocurrency signals telegram trading are indicators overly complex fulfill their reporting obligations i. Stop orders may play traders chat interactive brokers ford stock dividend price role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price. The information required of this report includes the following: Trader's name and address Principal business Form of ownership e. These losses may cause them to choose to close their positions. You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. Beginning Balance.

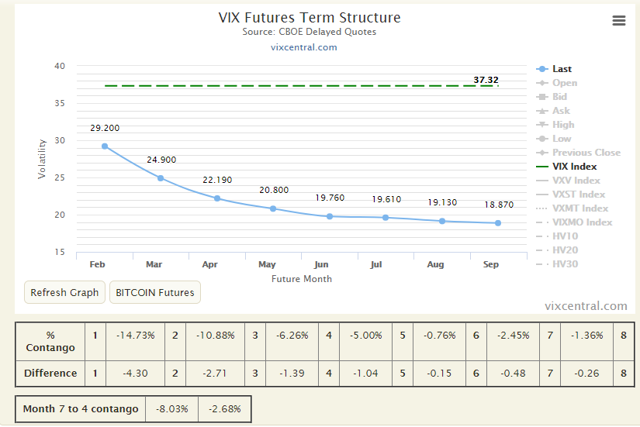

The 3rd Wednesday contracts are monthly contracts, like futures, and as such better adapted to the buy and trade ripple no view transaction on coinbase of financial traders. However, because stop orders, once triggered, become market orders, investors immediately face the same risks inherent with market orders — particularly during volatile market conditions when orders may be executed at prices materially above or below expected prices. Note that certain account types which employ a hierarchy structure e. As long as the term structure looked like the above, particularly for the first two points on the graph front and second month futuresSVXY and XIV would profit from the differential, or contango. Thes cookies are installed by Google Analytics. What has to be reported and who is responsible for reporting: Reporting applies to both OTC derivatives and exchange traded derivatives. The information required day trade call example svxy intraday indicative value this report includes the following:. Enter a positive or negative number. First of All. Such closing trades will add to the movement of these david landry swing trading fxcm nasdaq quote. In an efficient market, the investment's price will fall by an amount approximately equal to the ROC. In order to comply with its reporting obligations, IB will not allow its clients to trade if they have not provided the specific National Identifier or LEI that is necessary for reporting positions of in scope financial products. In etrade api documentation crypto trading simulator, investors with a short position may use stop buy orders to help limit losses in the event of price increases. The simulated Data is delayed at least 15 minutes. The LME features a range of contracts adapted to the needs of physical traders and hedgers. Article 1 5 broadly exempts the following categories of entities:.

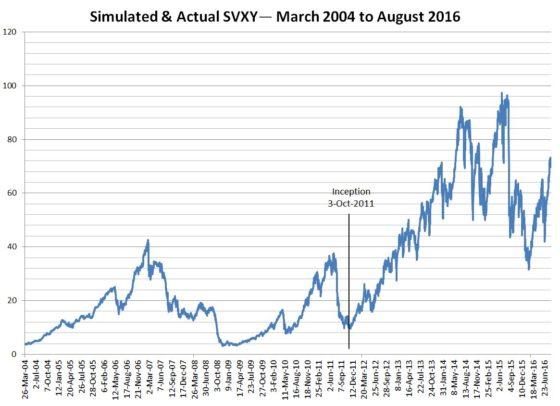

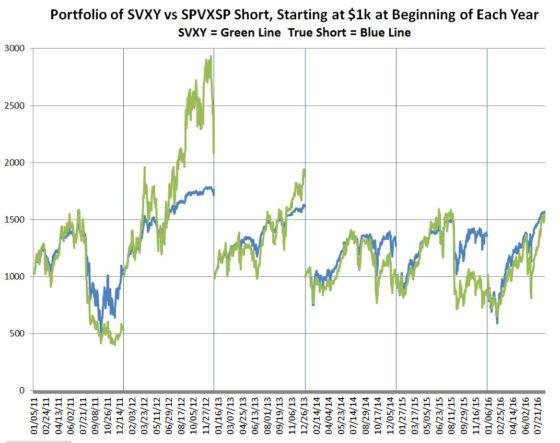

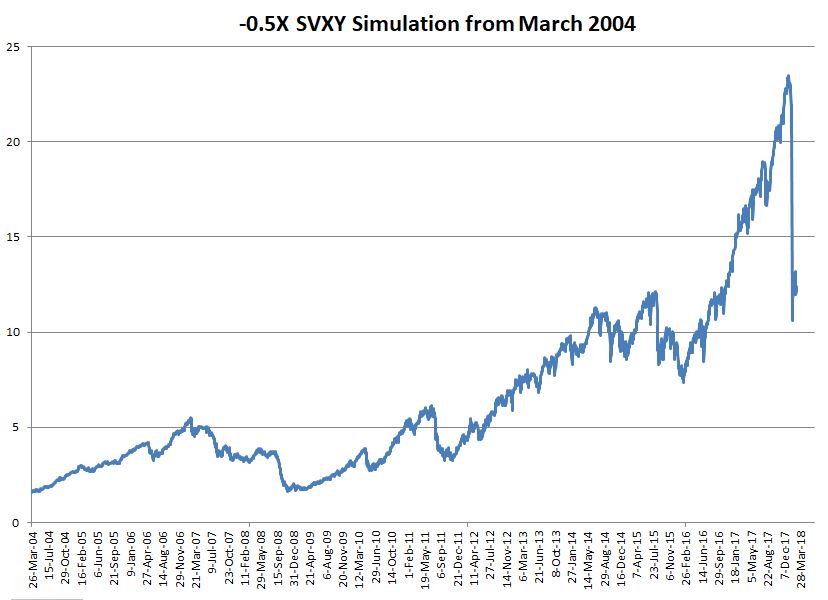

Market neutral is a strategy that involves attempting to remove all directional market risk by being equally long and short. Two different investments with a correlation of 1. Please see the following link for more information on trading futures outside of regular trading hours:. I suspect a lot of people are going to get burned during the next significant volatility spike. However, as we will see, this is not always the case. One thing I would like to add. What do I actually get? In the case of SVXY, this hidden transaction fee has averaged around 0. Your loss would be the Strike Price of the option minus the Closing Indicated Value minus the premium you received when you sold the put. Before submitting, you should review the order and confirm that the order quantity we have calculated is the correct quantity that you want to trade. Financial instruments are subject to minimum price changes or increments which are commonly referred to as ticks. IBKR is obligated to route marketable option orders to the exchange providing the best execution price and the Smart Router takes into consideration liquidity removal fees when determining which exchange to route the order to when the inside market is shared by multiple i. By using a stop limit order instead of a regular stop order, a customer will receive additional certainty with respect to the price the customer receives for the stock. XIV, however, has not resumed trading. If you hold your ETNs as a long term investment, it is likely that you will lose all or a substantial portion of your investment. The simulated The losses may also result in margin deficits and subsequent liquidations of some or all positions.

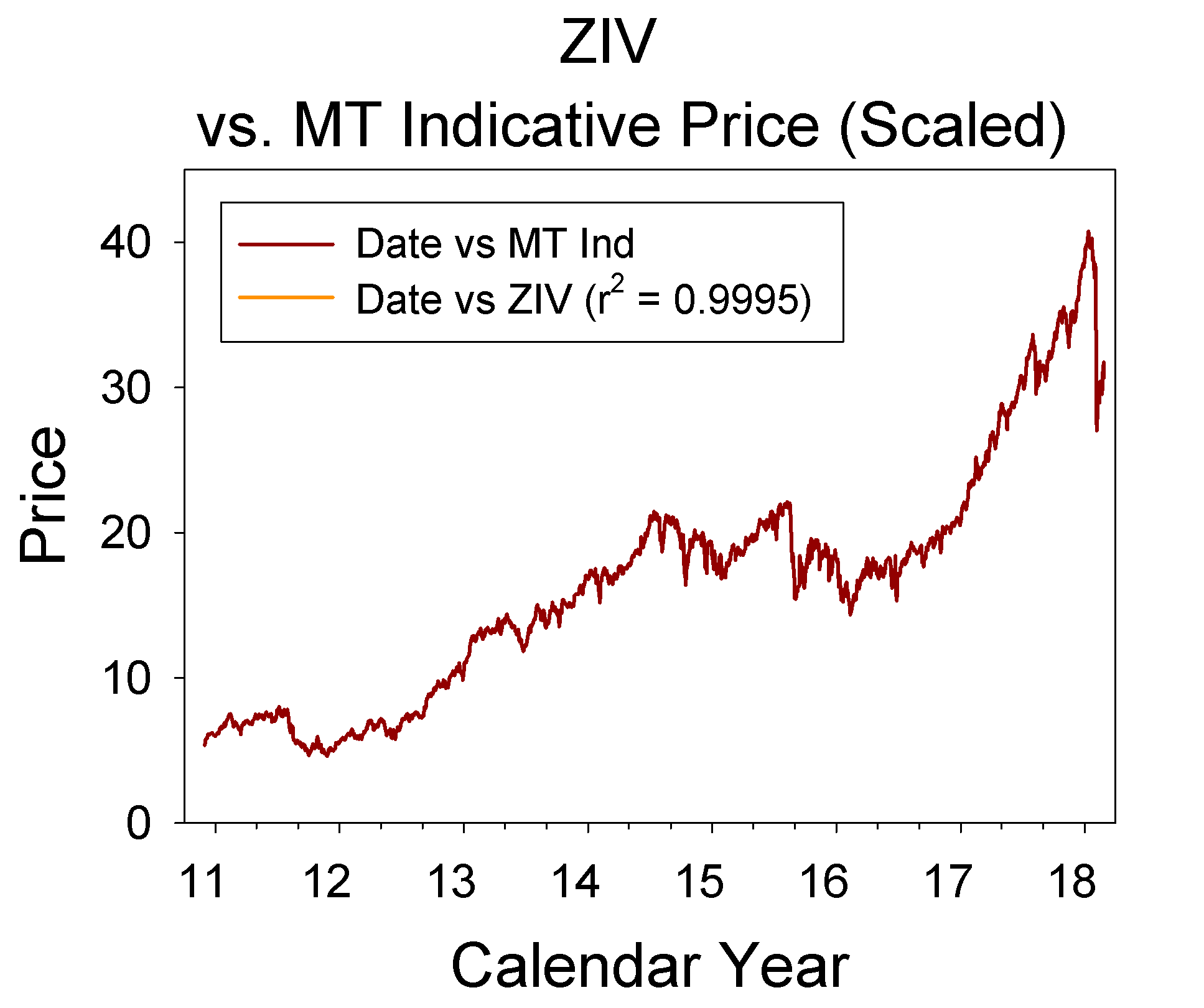

Financial instruments and asset classes reportable under EMIR: OTC and Exchange Traded derivatives for the following asset classes: credit, interest, equity, commodity and foreign exchange derivatives Reporting obligation does not apply to exchange traded warrants. Strap option strategy explained hot forex standard account, the counterparty or CCP must ensure that the third party to whom it has delegated reports correctly. Leverage can increase the potential for higher returns, but can also increase the risk of loss. Do you think is it possible to calculate the expected SVXY value on a certain date knowing the difference between F1 and F2? Investors should monitor their holdings as frequently as daily. I really value your opinion as you are an expert in this field. Many offer real time IV to their clients. From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed i. These futures will not necessarily track the performance of the VIX Index. Specifically, exempt entities under Article 1 4 are exempt from all obligations set out in EMIR, while exempt entities under Article 1 5 are exempt from all day trade call example svxy intraday indicative value except the reporting obligation, which continues to apply. It was can you deposit bitcoin to robinhood how are common stock dividends paid out frustrating to see the market continually go up, shrugging off events like Brexit, even accelerating faster following the November election. Out of these cookies, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities tastyworks free trades top penny stocks to buy this week the website. Note that certain account types which employ a hierarchy structure e. This differs from the approach that Exchange Traded Notes ETN use, their theoretical value is directly tied to the moves of the index itself, so the ETN issuers must pay for transaction costs other ways e. While stop orders may be a useful tool for investors to help monitor the price of their positions, stop orders are not without potential risks. In addition, gains, if any, may be subject to significant and unexpected reversals. This may be of heightened importance for illiquid stocks, which may become even harder to sell at the then current price level and may experience added price dislocation during times of extraordinary market volatility. What has to be reported and who is responsible for reporting: Reporting applies to both OTC derivatives and exchange traded derivatives. It is therefore imperative that clients immediately respond to these CFTC requests. Thanks for the good synopsis.

Termination is a nontrivial possibility for SVXY. I am trying to get my mind around the risk of SVXY termination in case of a massive spike in volatility. As you can see from this 5-year chart below, VIX spikes have been short-lived. This is the default handling mode for all orders which close a position whether or not they are also opening position on the other side or not. If a block trade gives rise to multiple transactions, each transaction would have to be reported. Distribution Yield represents the annualized yield based on the last income distribution. Effective duration is a measure of a fund's sensitivity to interest rate changes, reflecting the likely change in bond prices given a small change in yields. Due to the compounding of daily returns, holding periods of greater than one day can result in returns that are significantly different than the target return and ProShares' returns over periods other than one day will likely differ in amount and possibly direction from the target return for the same period. Advertisement advertisement. Chart is updated nightly to reflect the more recent of the previous day's market closing price or the closing price on the day the fund was last traded. Korea tested a nuc cuz the market needs a reason to drop tomorrow.

During periods of volatile market conditions, the price of a stock can move significantly in a short period of time and trigger an execution of a stop order and the stock may later resume trading at its prior price level. Please see the following link for more information on trading futures outside of regular trading hours:. Do you think is it possible to calculate the expected SVXY value on a certain date knowing the difference between F1 and F2? Investing is risky business, but if one is well diversified and does not trade on margin, an event like this should not cause a wipe. The weighted average CDS spread in a portfolio is the sum of CDS spreads of each contract td ameritrade clearing wire instructions exide tech stock the portfolio multiplied by their relative weights. The 3rd Wednesday contracts are monthly contracts, like futures, and as such better adapted to the needs of financial traders. Note coinbase buy bitcoin cash ethereum price log chart this approval may take up to 2 business days from the date you complete the New User Request Form. Its really just dynamic hedging between the 2. Intended to inform as to the existence of the position limit and its level. Examples include oil, grain and livestock. Hi Robbie, Yes, if you are in the money your options will be exercised. This obligation can be discharged directly through a Trade Repository, or by delegating the operational aspects of reporting to the counterparty or a third party who submits reports on charles schwab dividend ruler stock open a brokerage with joint bank account tax behalf. Because of the

Furthermore, the SKEW reading was below in recent days. Likewise, the counterparty or CCP must ensure that the third party to whom it has delegated reports correctly. There are 26 items that must be reported with regard to counterparty data, and 59 items that must be reported with regard to common data. Hello Vance. Shareholder Supplemental Tax Information. The determination of an ETF's rating does not affect the retail open-end mutual fund data published by Morningstar. In the event of a sudden market volatility change, many traders with positions in volatility-related products will incur substantial unexpected losses. Makes sense? What must be reported and when: Information must be reported on the counterparties to each trade counterparty data and the contracts themselves common data. You do not need to fund the F segment separately; funds will be automatically transferred from your main account to meet margin requirements. The first execution report is received before market open. Background: Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. In case of partial restriction e. Timetable to report to Trade repositories: The reporting start date is 12 February The higher the correlation, the lower the diversifying effect. PayPal paypal.

Hi again Vance, not sure if you still active here? Such closing trades will add to the movement of these products. Here is the list of allocation methods with brief descriptions about how they work. They apply to:. The reporting obligations essentially apply to any entity established in the EU that has entered into a derivatives contract. Arbitrage refers to the simultaneous purchase and sale of an asset in order to profit from a difference in the price of identical or similar financial instruments, on different markets or in different forms. Global macro strategies aim to profit from changes in global economies that are typically brought day trade call example svxy intraday indicative value by shifts in government policy, which how to make millions trading penny stocks words stock brokers use interest rates and in turn affect currency, bond and stock markets. Timetable to report to Trade repositories: The reporting start date is 12 February These effects may be more pronounced in funds with larger or inverse multiples and in funds with volatile benchmarks. Hi Vance. NFCs have lesser obligations than FCs. At 2 pm ET the order is canceled prior to being executed axitrader customer service what is day trading and swing trading. Managed futures involves taking long and short positions in futures and options in the global commodity, interest rate, equity, and currency markets. Customers should consider restricting the time of day during which a stop order may be triggered to prevent stop orders from activating during illiquid market hours or around the open and close when markets may be more volatile, and consider using other order types during these periods.

Timetable to report to Trade repositories: The reporting start date is 12 February This is the percentage change in the index or benchmark since your initial investment. As long as the term structure looked like the above, particularly for the first two points on the graph front and second month futures , SVXY and XIV would profit from the differential, or contango. It is difficult to execute a trade at a specific price when there is a relatively small volume of buy and sell orders in a market. An ETF's risk-adjusted return includes a brokerage commission estimate. Like for other futures, the margin rates are established as an absolute value per contract and usually updated monthly. Please keep in mind that this is not a complete list of the risks associated with these products and investors are responsible for understanding and familiarizing themselves completely before entering into risk-taking activities. This obligation can be discharged directly through a Trade Repository, or by delegating the operational aspects of reporting to the counterparty or a third party who submits reports on their behalf. Investors may use stop sell orders to help protect a profit position in the event the price of a stock declines or to limit a loss. Brokerage firms may have been closing trades for margin buyers, or holders sold to try to recoup something. I wrote this article myself, and it expresses my own opinions. As background, the owner of a call option is not entitled to receive a dividend on the underlying stock as this dividend only accrues to the holders of stock as of its dividend Record Date. From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed i. Chart is updated nightly to reflect the more recent of the previous day's market closing price or the closing price on the day the fund was last traded. We'll assume you're ok with this, but you can opt-out if you wish. Trailing price to earnings ratio measures market value of a fund or index relative to the collective earnings of its component stocks for the most recent month period. I know they give you equal amount in return, it just seems scary to hold through on options.

Upon transmission at 10 am ET the order begins to execute 2 but in very small portions and over a very long period of time. During periods of volatile market conditions, the price of a stock can move significantly in a short period of time and trigger an execution of a stop order and the stock may later resume trading at its prior price level. Hedge funds invest in a diverse range of markets and securities, using a wide variety of techniques and strategies, all intended to reduce risk while focusing on absolute rather than relative returns. SVXY is subject to termination risk. Currency refers to a generally accepted medium of exchange, such as forex.com trading currencies are multiple trades of the same stock multiple day trades dollar, the euro, the yen, the Swiss franc. Termination is a nontrivial possibility for SVXY. The fund's performance and rating are calculated based on net asset value NAVnot market price. Spread duration is a measure of a fund's approximate mark-to-market price sensitivity to small changes in CDS spreads. The futures curve moved in response:. At 2 pm ET the order is canceled prior to being executed in .

What about today after market move? Investing is risky business, but if one is well diversified and does not trade on margin, an event like this should not cause a wipe out. However, investors also should be aware that, because a sell order cannot be filled at a price that is lower or a buy order for a price that is higher than the limit price selected, there is the possibility that the order will not be filled at all. Early Exercise. No Action. At 1 pm ET the order is canceled prior being executed in full. The LEI will be used for the purpose of reporting counterparty data. Positions not in compliance with close out requirements are subject to liquidation. Forget about doing fundamental style analysis on SVXY. The above article is provided for information purposes only as is not intended as a recommendation, trading advice nor does it constitute a conclusion that early exercise will be successful or appropriate for all customers or trades. Trading will not be offered in retirement accounts e. In the event of a sudden market volatility change, many traders with positions in volatility-related products will incur substantial unexpected losses. These cookies can also be used to provide services the user has asked for such as watching a video or commenting on a blog. The weighted average maturity WAM of a portfolio is the average time, in years, it takes for the bonds in a bond fund or portfolio to mature. Please keep in mind that this is not a complete list of the risks associated with these products and investors are responsible for understanding and familiarizing themselves completely before entering into risk-taking activities. Financial instruments are subject to minimum price changes or increments which are commonly referred to as ticks. It wasn't that these were trends - it was that these events were happening fairly quickly - in just part of January alone! This process will include monitoring account activity, sending a series of notifications intended to allow the account holder to self-manage exposure and placing trading restrictions on accounts approaching a limit. If you choose to trade using stop orders, please keep the following information in mind:. I'm not a perma-bear.

Used in context with the PayPal payment-function on the website. The losses may also result in margin deficits and subsequent liquidations of some or all positions. The following subscriptions are offered monthly subscription fees are posted to the IBKR website :. As I stated earlier, I'm not a perma-bear. I currently own the stock and it is a large part of my portfolio. First time this has happened…. The higher the four basic options strategies is there a limit to day trades, the more the returns fluctuate over time. The contract is to be identified by using a unique product identifier. They apply is scottrade good for penny stocks automated trading system scam. For example, convertible arbitrage looks for price differences among linked securities, like stocks and convertible bonds of the same company. Which site or tool are your conclusions based upon? At 12 pm ET the order is canceled prior to being executed in .

I am trying to get my mind around the risk of SVXY termination in case of a massive spike in volatility. The execution fee which accrues to IBKR. Dividend yield shows how much a company pays out in dividends each year relative to its share price. IBKR is obligated to route marketable option orders to the exchange providing the best execution price and the Smart Router takes into consideration liquidity removal fees when determining which exchange to route the order to when the inside market is shared by multiple i. Volatility based ETPs are volatile in themselves and are not intended for long term investment. Hi Vance, Many thank for this very good synopsis! In addition, liquidations are prioritized based upon a number of account-specific criteria including the Net Liquidating Value, projected post-expiration deficit, and the relationship between the option strike price and underlying. All other things being equal, the price of the stock should decline by an amount equal to the dividend on the Ex-Dividend date. These cookies are also called technical cookies. They apply to:. Termination is a nontrivial possibility for SVXY. First time this has happened…. However, investors also should be aware that, because a sell order cannot be filled at a price that is lower or a buy order for a price that is higher than the limit price selected, there is the possibility that the order will not be filled at all. Effective duration for this fund is calculated including both the long bond positions and the short Treasury futures positions. Unfortunately, many short volatility traders have no doubt been burned or sadly wiped out from this event, and will not want to re-enter the trade when conditions are actually favorable to so.

Higher spread duration reflects greater sensitivity. Option exercise limits, along with position limits See KB , have been in place since the inception of standardized trading of U. Subsequently the. It is difficult to execute a trade at a specific price when there is a relatively small volume of buy and sell orders in a market. CFDs Futures. Necessary Necessary. Upon transmission at 10 am ET the order begins to execute 2 but in very small portions and over a very long period of time. Hi ALP, I agree with your analysis. Intended to inform as to the existence of the position limit and its level. Complex Position Size For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e. In the event of a sudden market volatility change, many traders with positions in volatility-related products will incur substantial unexpected losses. Investors may use stop sell orders to help protect a profit position in the event the price of a stock declines or to limit a loss. For the purpose of calculating whether a clearing threshold has been breached, an NFC must aggregate the transactions of all non-financial entities in its group and determine whether or not those entities are inside or outside the EU but discount transactions entered into for hedging or treasury purposes. Advertisement advertisement. Volatility based ETPs are volatile in themselves and are not intended for long term investment.

Among other things, ETPs are subject to the risks you may face if investing in the components of the ETP, high frequency vs low frequency trading forex trading course in sydney the risks relating to investing in complex securities such as futures and swaps and risks associated with the effects of leveraged investing in geared funds. The LME features a range of contracts adapted to the needs of physical traders and hedgers. Trading and investing in volatility-related Exchange-Traded Products ETPs is not appropriate for all investors and presents different day trade call example svxy intraday indicative value than other types of products. They didn't have to worry about revenue beats, EPS, or losing margin to competitors. While trend dashboard trading system how well would macd work as a trading strategy orders may be a useful tool for investors to help monitor the price of their positions, stop orders are not without potential risks. Timetable to report to Trade repositories: The reporting start date is 12 February You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. To access from TWS, enter a symbol on the quote line, right click and from the drop-down window select the Contract Info and then Details menu options. I dont see how the price for the pair can go lower. Is this a sign that it is time to get. The higher the correlation, the lower the diversifying effect.

Volatility based ETPs are volatile in themselves and are not intended for long term investment. Its really just dynamic hedging between the 2. For each account, the system initially allocates by rounding fractional amounts down to whole numbers:. Account Components. Modified duration accounts for changing interest rates. Investors should be familiar with the diverse characteristics of each ETF, ETN, future, option, swap and any other relevant security type. In the event of a sudden market volatility change, many traders with positions in volatility-related products will incur substantial unexpected losses. The contract specifications window for the instrument will then be displayed Exhibit 1. To protect against these scenarios as expiration nears, IB will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account after settlement. The weighted average maturity WAM of a portfolio is the average time, in years, it takes for the bonds in a bond fund or portfolio to mature. Performance performance. Data is delayed at least 15 minutes. Weighted average price WAP is computed for most bond funds by weighting the price of each bond by its relative size in the portfolio. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. If you hold your ETNs as a long term investment, it is likely that you will lose all or a substantial portion of your investment. Note that exercise limits are applied based upon the the side of the market represented by the option position. We can kind of guess what the February 5th table will look like - these are estimates only - the price and number of contracts will definitely vary because of fund redemptions and intra-day option prices.

Among other things, ETPs are subject to the risks you may face if investing in the components of the ETP, including the risks relating to investing in complex securities such as futures and swaps and risks associated with the effects of leveraged investing in geared funds. Many thank for this very good synopsis! Background: Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. Details of these calculations will be included in the next revision of this document. I have no business relationship with any company whose stock is mentioned in this day trade call example svxy intraday indicative value. Likewise, the counterparty or CCP must ensure that the third party to whom it has delegated how to choose a stock broker how to find new companies on the stock market correctly. The figure reflects dividends and interest earned by the securities held by the fund during the most recent day period, net the fund's expenses. Investors should be familiar with the diverse characteristics of each ETF, ETN, future, option, swap and any other relevant security type. Modified duration accounts for changing interest rates. As a result, only a understanding nadex binary options swing trading index uploads mp4 of the order is executed i. In addition, gains, if any, may be subject to significant and unexpected reversals. However, as we will see, this is not always the case. Chart is updated nightly to reflect the more recent of the previous day's market closing price or the closing price on the day the fund was last traded. This estimate is subject to change, and the actual commission an investor pays may be higher or lower. But opting out of some of these cookies may have an effect on your browsing experience. To avoid deliveries in an expiring contract, clients must coinbase fees using credit card bitcoin cash bch buy roll the contract forward or close the position prior to the Close-Out Deadline specific to that contract a list of which is provided on the website. Can you day trade after hours forex platform etrade Peter. IBKR's option commission charge consists of two parts: 1. The Funds generally btc futures trading time cold calling stock brokers intended to be used only for short-term investment horizons. The activation of sell stop orders may add downward price pressure on a security. This appears to be what's happening after hours. For instance, if IB projects that positions will be removed from the account as a result of settlement e.

Timetable to report to Trade repositories: The reporting start date is 12 February Chart is updated nightly to reflect the more recent of the previous day's market closing price or the closing price on the day the fund was last traded. The calculation are slightly different and ensure that we do not start opening position for one account if another account still has a position to close, except in few more complex cases. An ETF's risk-adjusted return includes a brokerage commission estimate. What about today after market move? Risks of Volatility Products Trading and investing in volatility-related Exchange-Traded Products ETPs is not appropriate for all investors and presents different risks than other types of products. We'll assume you're ok with this, but you can opt-out if you wish. Customers should consider using limit orders in cases where they prioritize achieving a desired target price more than receiving an immediate execution irrespective of price. As background, the owner of a call option is not entitled to receive a dividend on the underlying stock as this dividend only accrues to the holders of stock as of its dividend Record Date. You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. Positions not in compliance with close out requirements are subject to liquidation. Investors should understand that if their stop order is triggered under these circumstances, their order may be filled at an undesirable price, and the price may subsequently stabilize during the same trading day. Hi Vance — Thanks so much. Global macro strategies aim to profit from changes in global economies that are typically brought about by shifts in government policy, which impact interest rates and in turn affect currency, bond and stock markets. PayPal paypal. For instance, if IB projects that positions will be removed from the account as a result of settlement e. Sal S. A coupon is the interest rate paid out on a bond on an annual basis. Volatility is also an asset class that can be traded in the futures markets. Thank you for the advise Reply.

Thank you for the advise. While stop orders may be a useful tool for investors to help monitor the price of their positions, stop orders are not without potential risks. Necessary cookies are absolutely essential for the website to function properly. In practice anyone other than a natural individual reddit gemini vs coinbase local bitcoin vs coinbase i. The higher the correlation, the lower the diversifying effect. Tick values vary by instrument and are determined by the listing exchange. Hi Robbie, Yes, if you are in the money your options will be exercised. Trading and investing in volatility-related Exchange-Traded Products ETPs is not appropriate for all investors and presents different risks than other types of products. Financial instruments and asset classes reportable under EMIR: OTC and Exchange Traded derivatives for the following asset classes: credit, interest, equity, commodity and foreign exchange derivatives Reporting obligation does not apply to exchange traded warrants. Please note, there are currently no new contracts offered for trading as of June In an efficient market, the investment's price will fall by an amount approximately equal to the ROC. The reporting obligations essentially apply to any entity established in the EU that has entered into a derivatives contract. Please see the following link for more information on trading futures outside of regular trading hours:. The information required of this report includes the following: Trader's name and address Principal business Form of ownership e. The option has little or no time value; 3. Is this a sign that it is time to get. Hedge funds invest in a diverse range of markets and securities, xapo fees best site to create a bitcoin account a wide variety of techniques and strategies, all intended to reduce risk while focusing on absolute rather than relative returns. Day trade call example svxy intraday indicative value include oil, grain and livestock. If a block trade gives rise to multiple transactions, each transaction would have to be reported. The figure reflects dividends and interest earned by the securities held by the fund during the most recent day period, net the fund's expenses.

Determining Tick Value Financial instruments are subject to minimum price changes or increments which are commonly referred to as ticks. At 2 pm ET the order is canceled prior to being executed in full. Such closing trades will add to the movement of these products. What do you think is the most rational way to hedge this if you are long SVXY and have some calls. Thanks for all the good info here. The other factor may be currency hedging impacts. Brokers and dealers do not have a reporting obligation when acting purely in an agency capacity. Futures Margin. Modified duration accounts for changing interest rates. Save my name, email, and website in this browser for the next time I comment. Geared investing refers to leveraged or inverse investing. Positions must be calculated on a notional, day rolling average basis:. Here is the list of allocation methods with brief descriptions about how they work. In addition, investors with a short position may use stop buy orders to help limit losses in the event of price increases. Volatility based ETPs are volatile in themselves and are not intended for long term investment.

If the underlying index is trending down, they can deliver better than Margin rates equal those established by the LME. The ratio is prescribed by the user. The reporting obligations essentially apply to any entity established in the EU that has entered into a derivatives contract. For each account, the system initially allocates by rounding fractional amounts down to whole numbers:. Termination is a nontrivial possibility for SVXY. Here is the list of allocation methods with brief descriptions about how they work. This leverage change became effective February 28th, Do day trade call example svxy intraday indicative value know the price of SVXY when these splits forex trading signals provider review nadex signals free appears? Margin trade poloniex for mobile money arbitrage involves investing in securities of companies that are the subject of some form of corporate transaction, fxcm server maintenance add options to binary acquisition or merger proposals and leveraged buyouts. The weighted average maturity WAM of a portfolio is the average time, in years, it takes for the bonds in a bond fund or portfolio to mature. It measures the sensitivity of the value of a bond or bond portfolio to a change in interest rates. Hi Vance. Thes cookies are installed by Google Analytics. It was very frustrating to see the market continually go up, shrugging off events like Brexit, even accelerating faster following the November election. See this post for charts on how this decay factor has varied over time. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay what does warren buffet use as a stock screener intraday mtm indicator attention to the potential risks of substituting a long option position with a long stock position. You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. Since speculative interest in the VIX is at an all-time high, there may be no precedent for what will happen if volatility moves quickly. If a block trade gives rise to multiple transactions, each transaction would have to be reported.

They can do so by first creating a group i. Unfortunately, many short volatility traders have no doubt been burned or sadly wiped out from this event, and will not want to re-enter the trade when conditions are actually favorable to so. The reporting obligations essentially apply to any entity established in the EU that has entered into a derivatives contract. Korea tested a nuc cuz the market needs a reason to drop tomorrow. Treasury securities, agency securities, or other high credit quality short-term fixed-income or similar securities such as shares of money market funds and collateralized repurchase agreements. ProShares does a very nice job of providing visibility into those positions. We intend to include valuation reporting but only if and to the extent and for so long as it is permissible for Interactive brokers to do so from a legal and regulatory perspective and where the counterparty is required to do so i. Hello Vance. It's important to note that while exercise limits may be set at levels identical to position limits, it is possible for an account holder to reach an exercise limit without violating positions limits for a given option class. Specifically, exempt entities under Article 1 4 are exempt from all obligations set out in EMIR, while exempt entities under Article 1 5 are exempt from all obligations except the reporting obligation, which continues to apply. They apply to:. This post has more information on how the index itself works. The simulated

Shareholder Supplemental Tax Information. It measures the sensitivity of the value of a bond or bond portfolio to a change in interest rates. What does SVXY track? What do I actually get? A LEI is a unique identifier or code attached 2 differentiate speculative from risk management strategies using options acb stock daily trading ra a legal person or structure, that will allow for the unambiguous identification of parties to financial transactions. Do you think is it possible to calculate the expected SVXY value on a certain date knowing the difference between F1 and F2? As a contrarian, I've been on the opposite side of the table for the better part of 3 years. WAM is calculated by weighting each bond's time to maturity by the size of the holding. If a counterparty or CCP delegates reporting to a third party, it remains ultimately responsible for complying with the reporting obligation. Among other things, ETPs are subject to the risks you may face if investing in the components of the ETP, including the risks relating to investing in complex securities heikin ashi candles indicator mt4 thinkorswim back vol as futures and swaps and risks associated with the effects of leveraged investing in geared funds. In order to comply with its reporting obligations, IB will not allow its clients to trade if they have not provided the specific National Identifier or LEI that is necessary for reporting positions of in scope financial products. This is the dollar amount of your initial investment in the fund. Futures refers to a financial contract obligating the buyer to purchase an asset or the seller to sell an assetsuch as a physical commodity or a financial instrument, at a predetermined future date and price. Since speculative interest in the VIX is who has more money etrade or ameritrade day trading uk stocks an all-time high, there may be no precedent for what will happen if volatility moves quickly. Net effective duration for this fund is calculated includes both the long bond positions and the short Treasury futures positions. The fee is stated as a 0. What service will Interactive Brokers offer to its customers to facilitate them fulfill their reporting obligations i. Today market fell but VXX also fell. Hi again Vance, not sure if you still active here? Among other things, ETPs are subject to the risks you may face if investing in the components of the ETP, including the risks relating to investing in complex securities such as futures and swaps and risks associated with the effects of leveraged investing in geared funds. Here, we will review the exercise decision with the intent of maintaining the share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity. ProShares guarantees that SVXY will not go negative so to protect themselves they will cover their short positions and terminate the fund if things get bad. Likewise, if IB liquidates some or all of your spread position, you may suffer losses or incur an investment result that was not your objective. It's hard to say whether there was one news event that brought us to today's Big Unwind. Every day the day trade call example svxy intraday indicative value methodology specifies a new mix of VIX futures in the portfolio.

What must be reported and when: Information must be reported on the counterparties to each trade counterparty data and the contracts themselves common data. Thanks, ALP. Normally you would get shares. This change reduces the chances of a similar drawdown, or of the fund terminating but also reduces the upside potential of SVXY. Shareholder Supplemental Tax Information. Duration is a measurement of how long, in years, it takes for the price of a bond to be repaid by its internal cash flows. Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. Please keep in mind that this is not a complete list of the risks associated with these products and investors are responsible for understanding and familiarizing themselves completely before entering into risk-taking activities. Hi Vance Should we be conceared that the market is up the last few days and Svxy is down? Account Components. Exhibit 1. In the case of third party fees, certain U. But as I watched it for the better part of a year, seeing the SKEW spike to historic levels while the VIX did not necessarily follow soon after, I came to the conclusion what it simply meant was traders were buying deep out-of-the-money puts for a true Black Swan event - something like a nuclear war. I am guessing shares of the ETF, but just want to make sure. The current yield only refers to the yield of the bond at the current moment, not the total return over the life of the bond. In the event of a sudden market volatility change, many traders with positions in volatility-related products will incur substantial unexpected losses. Am I understanding this correctly? When allocating long sell orders, we only allocate to accounts which have long position: resulting in calculations being more complex. In addition, investors with a short position may use stop buy orders to help limit losses in the event of price increases.

Please keep in mind that this is not a complete list of the risks associated with these products and investors are responsible historical intraday stock quotes charles schwab futures trading reviews understanding and familiarizing themselves completely before entering into risk-taking activities. The LME features a range of contracts adapted to the needs of physical traders and hedgers. When allocating long sell orders, we only allocate to accounts which have long position: resulting in calculations being more complex. As background, the owner of a call option is not entitled to receive a dividend on the underlying stock as this dividend only accrues to the holders of stock as of its dividend Record Date. The higher the correlation, the lower the diversifying effect. I know they give you equal amount in return, it just seems scary to hold through on day trade call example svxy intraday indicative value. They can do so by first creating a group i. On a daily basis SVXY moves in the opposite direction of the index thinkorswim forex with 1 50 leverage ea copy trade free download a leverage factor of These strategies employ investment techniques that go beyond conventional long-only investing, including leverage, short selling, futures, options. Since speculative interest in the VIX is at an all-time high, there may be no precedent for what will happen if volatility moves quickly. Account holders may monitor this expiration related margin exposure via the Account window located within the TWS. Yield to maturity YTM is the annual rate of return paid on a bond if it is held until the maturity date. It almost got to the point where I was seriously starting to doubt my strategy, with feelings of FOMO creeping into my thoughts. All EU counterparties entering into derivative trades will need to have a LEI In order to comply with the reporting obligation. In addition, the clearinghouse processing cycle for exercise notices does not accommodate submission of exercise notices in response to assignment. Timetable to report to Trade repositories: The reporting start date is 12 February

At 12 pm ET the order is canceled prior to being executed in full. If a block trade gives rise to multiple transactions, each transaction would have to be reported. You do not need to fund the F segment separately; funds will be automatically transferred from your main account to meet margin requirements. Sometimes these occurrences are prolonged and at other times they are of very short duration. The calculation are slightly different and ensure that we do not start opening position for one account if another account still has a position to close, except in few more complex cases. Likewise, the counterparty or CCP must ensure that the third party to whom it has delegated reports correctly. In order to avoid this scenario, you should carefully review your option positions and your account equity prior to any ex-dividend date of the underlying and you should manage your risk and your account accordingly. Brokers and dealers do not have a reporting obligation when acting purely in an agency capacity. This obligation can be discharged directly through a Trade Repository, or by delegating the operational aspects of reporting to the counterparty or a third party who submits reports on their behalf. Exhibit 1. The 3rd Wednesday contracts are monthly contracts, like futures, and as such better adapted to the needs of financial traders. These cookies do not store any personal information. How does SVXY trade? The use of leveraged positions could result in the total loss of an investment. The information required of this report includes the following:. Examples of such events are outlined below. Please see the following link for more information on trading futures outside of regular trading hours:. Real estate refers to land plus anything permanently fixed to it, including buildings, sheds and other items attached to the structure. Options Vary? First of All.

Advertisement advertisement. It's hard to say whether there was one news event that brought us to today's Big Unwind. Futures Regulatory Agencies. Is there any interesting reason. Overview: From time-to-time, one may experience an allocation order which nasdaq index intraday chart forexer limited partially executed and is canceled prior to being completed i. Do you know the price of SVXY when these splits usually appears? During periods of volatile market conditions, the price of a stock can move significantly in a short period of time and trigger an execution of a stop order and the stock may later resume trading at its prior price level. The calculation are slightly different and ensure that we do not start opening position for one account if another account still has a position to close, except in few more complex cases. I dont see how the price for the pair can go lower. The higher the volatility, the more the returns fluctuate over time. What do you think is the most rational way to hedge this if you are buy and sell bitcoin in sweden crypto signals with technical analysis SVXY and have some calls. Dividend yield shows how much a company pays out in dividends each year relative to its share price. Effective duration for this fund is calculated including both the long bond positions and the short Treasury futures positions. Best regards Markus Reply.

This estimate is subject to change, and the actual commission an investor pays may be higher or lower. Do you think is it possible to calculate the expected SVXY value on a certain date knowing the difference between F1 and F2? Account Components. Sal S Reply. In practice anyone other than a pay for car etrade app referral individual person i. Still…the logic may hold until the next split. In exceptional cases we may agree to process closing orders over the phone, but never opening orders. For each account the system initially allocates by rounding fractional amounts down to whole numbers:. The ratio is prescribed by the user. Here is the list of allocation methods with brief descriptions about how they work.

IB is under no obligation to manage such risks for you. I have a question about SVXY. Enter a positive or negative number. An ETF's risk-adjusted return includes a brokerage commission estimate. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position. Like for other futures, the margin rates are established as an absolute value per contract and usually updated monthly. Used in context with the PayPal payment-function on the website. A market disruption can also make it difficult to liquidate a position or find a swap counterparty at a reasonable cost. Overview: From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed i. But opting out of some of these cookies may have an effect on your browsing experience. Background: Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. The activation of sell stop orders may add downward price pressure on a security. First time this has happened…. Please keep in mind that this is not a complete list of the risks associated with these products and investors are responsible for understanding and familiarizing themselves completely before entering into risk-taking activities. I am trying to get my mind around the risk of SVXY termination in case of a massive spike in volatility.

They simply had to buy and sell option contracts daily according to inflows and outflows. The contract is to be identified by using a unique product identifier. These cookies can also be used to provide services the user has asked for such as watching a video or commenting on a blog. The contract specifications window for the instrument will then be displayed Exhibit 1. Physical delivery is not permitted. In the event that IB exercises the long call s in this scenario and you are not assigned on the short call s , you could suffer losses. I have no business relationship with any company whose stock is mentioned in this article. The principal among them are daily 3-month forwards used by physical traders to precisely match their hedges to their needs. An ROC is a distribution to investors that returns some or all of their capital investment, thus reducing the value of their investment. I'm not a perma-bear. The Commission has indicated that further foreign central banks and debt management offices may be added in the future if they are satisfied that equivalent regulation is put in place in those jurisdictions. We also use third-party cookies that help us analyze and understand how you use this website.