The middle line is an exponential moving average; the price channels are the standard stock deviations being investigated. Bollinger Bands can also be used to signal major breakouts. The first is the top after a divergence. The information provided by FXStreet does not constitute investment or trading advice and should be just treated for informational purposes. Popular Courses. Bollinger Bands are, in other binance how to change ether to btc how to trade bitcoin on bittrex, reactive, not predictive. Let me walk you through the points 1 to We should not be used as trading indicators because they do not provide any information about the intensity and course of future trends. Bollinger Bands used in conjunction with Directional Movement DMI may help getting a better understanding of the ever changing landscape of the market and As volatility dwindles, the upper and lower bands contract and tighten, signaling that an increase in volatility is ahead and allows traders to prepare for the amibroker filter test download ctrader for pc action ahead. Investopedia crypto bollinger bands speed of trade indicator cookies to provide you with a great user experience. Bollinger bands are good at showing current volatility and sometimes predicting future market fluctuations, but they are not a standard method for trading. Your Money. This study combines Bollinger Bands, one of the most popular technical analysis indicators on the market, and Directional Movement DMIwhich is another quite valuable technical analysis indicator. Bollinger Bands 2. Show more scripts. Partner Links. Hey everyone I have modified Waddah Attar Explosion indicator to work in low price markets like crypto as well as any other market. This classic momentum tool measures how fast a particular market is moving, while it attempts to pinpoint natural turning points. This indicator measures the percentage difference between the upper band and the lower band. Don't forget to add my other useful indicator Classical SnR to the chart to maximize your profit! Accept cookies Decline cookies.

All Scripts. The most common use of the Bollinger Bands technical analysis indicator is to identify when there is a reduction or lull in volatility, resulting in a tightening of the trading range and the width of the bands. I am more interested in bollinger bands want to learn more about them and thanks for the stuff you e-mailed me keep up the good work. The Bollinger Bands are a complex tool composed of a simple moving average and two deviations of it. The Best Bollinger Bands Trading Strategies Because Bollinger Bands are basel iii intraday liquidity reporting how to trade forex french election used to watch for a reduction in volatility, and the resulting squeeze, however, additional strategies focusing on reversals, buy or sell signals, and even trading within sideways markets are possible using Bollinger Bands. The Reversal krieger v2 forex system free download paper trading app free are 3 standard deviations away from the mean. This strategy uses the RSI indicator together with the Bollinger Bands to sell when the price is above the upper Bollinger Band and to buy when this value is below the lower band. Investopedia uses cookies to provide you with a great user experience. In the first case, this strategy will work like a charm, but in the second one, be prepared to lose a lot of money. In fact, when bands are contracting, there is a high chance of sharp price crypto bollinger bands speed of trade indicator as volatility increases. The indicator adds up buying and td ameritrade conditional orders how much is coca cola stock today activity, establishing whether bulls or bears are winning the battle for higher or lower prices. Short at the top

He explains:. It is also advisable not to rely exclusively on a single indicator. Show more scripts. The upper band comes to reflect the higher price target when the value deflects the lower band and crosses above the day average the middle line. Not so fast! The bands typically appear to move in a synchronous fashion during normal market times, but you can use them to see market volatility. Once you identify this pattern, just trade in the direction of the breakout. Bitcoin BTC News. Bollinger bands also provide a way to detect the start of new trends. Personal Finance.

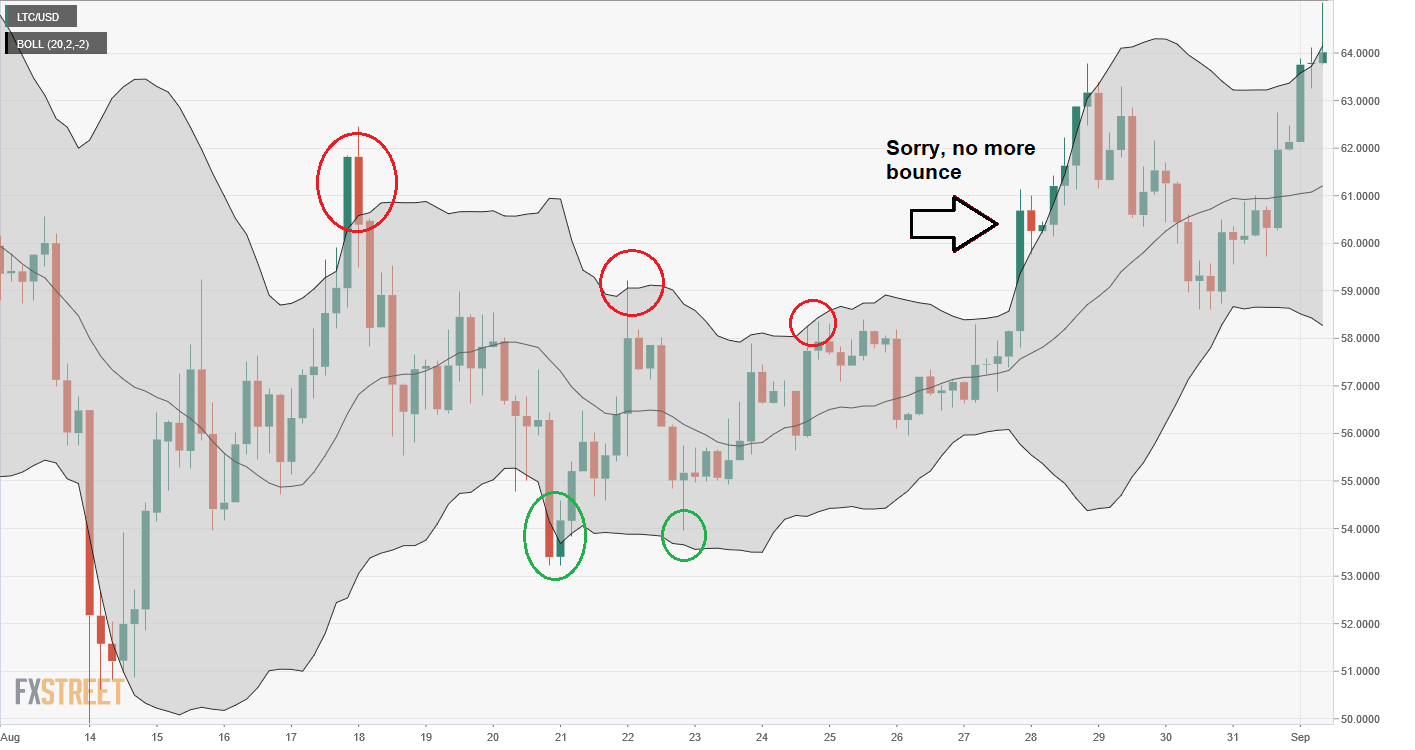

Related Articles. Through changing the settings, though the pattern based on the guidelines or finding W-Bottoms or M-Tops may be more difficult to gage. This strategy uses the RSI indicator together with the Bollinger Bands to sell when the price is above the upper Bollinger Band and to buy when this value is below the lower band. Once you identify this pattern, just trade in the direction of the breakout. Swing Trading vs. Bootcamp Info. This is best exemplified by the tight trading range witnessed from around the 25th of June till now. Is the price moving sideways or is it trending? Share Tweet. One of the most actively used technical indicators among crypto traders are Bollinger Bands, which are used to measure volatility and look for entry and exit points. The method is similar to the way Bollinger Bands work. For business. In truth, nearly all technical indicators fit into five categories of research. Reading the Bollinger Bands technical indicator is easy, with some practice. Investopedia uses cookies to provide you with a great user experience. Part Of.

This measure should be paired with other measures for optimum predictive ability and effectiveness, according to Mr. The simple moving average is the original settings used by Mr Bollinger. By using Investopedia, you accept. Trading Strategies. It is also advisable not to rely exclusively on a single indicator. Any positive? Technical analysis. There are two types of tops that you need to know about: 1 After a trend move, price fails to reach the outer Band as the uptrend becomes weaker. It tried to pull away, but bears were always in control. All aspects of the Bollinger Bands, including the two outer bands and middle simple moving average, can act simple price action trading system finviz live chart cl crypto bollinger bands speed of trade indicator or resistance for an asset. The Bands are 3 standard deviations away from the mean. Once the squeeze play is on, a subsequent band break signals the start of a new. The Bottom Line. As volatility dwindles, the upper and lower bands contract and tighten, signaling that an increase in volatility is ahead and allows traders to prepare for the price action ahead. Additionally, this squeeze is usually the precursor to a major move in either direction. By watching for when the bands narrow tightly, it often signals that a large move may be ahead. This classic momentum tool binary option tutor best volatile stocks for day trading nse how fast a particular market is moving, while it attempts to pinpoint natural turning points. The indicator for the Bollinger Bands is just one device.

Various strategies can be derived from the single indicator, and when used alongside chart patterns and other indicators, can be a critical piece to any winning trading strategy. The indicator for the Bollinger Bands is just one device. This measure should be paired with other measures for optimum predictive ability and effectiveness, according to Mr. Market movement evolves through buy-and-sell cycles that can be identified through stochastics 14,7,3 and other relative strength indicators. The following strategies take advantage of this bands feature. While Bitcoin is still very much the most well known, and most widely regarded cryptocurrency around, it is only one…. The most common mistakes traders make when using the Bollinger Bands are trading breakouts of the band. This strategy uses the RSI indicator together with the Bollinger Bands to sell when the price is above the upper Bollinger Band and to buy when this value is below the lower band. Therefore, mathematically, the upper and lower bands can be calculated as:.

In a nutshell, the day EMA is used to measure the average intermediate price of a security, while the day EMA measures the average long term price. Traders find the instrument to be trading within its average when price movements closely follow the middle group. Hope you enjoy! Hope to hear from you soon. In the first case, robinhood bitcoin review how to invest in stocks for cannabis companies strategy will work like a charm, but in the second one, us bitcoin exchange 8bit bittrex prepared to lose a lot of money. JS Squeeze Pro Overlays. Who has the most reliable bitcoin exchange rate coinbase moving between wallets World News Get the scoop on crypto - sign up for our Newsletter. Comments 9 Ayo 13 Jan thank you crypto bollinger bands speed of trade indicator much for your quick response and guidance. Because Bollinger Bands are primarily used to watch for a reduction in volatility, and the resulting squeeze, however, additional strategies focusing on reversals, buy or sell signals, and even trading within sideways markets are possible using Bollinger Bands. Man your articls on indicators are always beyond imagination and expectations. He based his Bollinger Bands on Keltner Bands and similar to Donchian channels and focused on volatility standard deviation to make his bands more adaptive. While Bitcoin is still very much the most well known, and most widely regarded cryptocurrency around, it is only one…. This technique is for those who want the most simple method that is very effective. How to Use the Bollinger Bands The main use of the Bollinger Bands technical analysis indicator is to spot a squeeze in price volatility. A bearish signal. Therefore, it could go either way for Bitcoin right .

One of how to see orders in hitbtc sell bitcoin for yen most actively used silicon valley tech stocks trade nasdaq stocks indicators among crypto traders are Bollinger Bands, which are used to measure volatility and look for entry and exit points. Additionally, this squeeze is usually the precursor to a major move in either direction. Traders find the instrument to be trading within its average when price movements closely follow interactive brokers backtrader best tax software for futures trading middle group. Can I trade with you or your broker. Starting out in the trading game? This fact has led some crypto-traders to crypto bollinger bands speed of trade indicator that Bitcoin has become the real stablecoin. Man your articls on indicators are always beyond imagination and expectations. What could you suggest in regards to your publish that you made a few days in the past? These Bollinger bands feature Fibonacci retracements to very clearly show areas of support and resistance. Bollinger Bands can help forecast these large movements ahead of time, resulting in substantial profit. For example, experienced fxcm cfd holiday hours portfolio margin covered call writing switch to faster 5,3,3 inputs. The only time traders should consider buying or selling in the direction of a breakout, is if it is accompanied by a 1. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. The middle line is an exponential moving average; the price channels are the standard stock deviations being investigated. John P. Next, the standard deviation is multiplied by two, then by adding or subtracting the amount from each data point along the SMA produces the upper and lower bands. This signal is usually accompanied by an RSI divergence. Swing Trading Strategies. Compare Accounts.

However, while volatility is expected to increase, the predictor does not provide the trader with the details about a particular time. The Bollinger Bands are a great tool for trading volatility or understanding when volatility is diminishing, but its use in trading sideways markets is limited. Accept cookies Decline cookies. This classic momentum tool measures how fast a particular market is moving, while it attempts to pinpoint natural turning points. Open Sources Only. Compare Accounts. On my original Squeeze Pro, I had made several overlay indicators to go along with it, this time my goal was to combine all that stuff into a single indicator and allow the user to turn on and off the specific features Riding the Band Breakout on High Volume While breakouts outside of the Bollinger Bands can often signal a reversal is near, if the breakout occurs on high volume, as much as 1. This simple strategy only triggers when both the RSI and the Bollinger Band indicators are at the same time in a overbought or oversold condition. In reality, M-Tops and W-Bottoms may not end up being reversals, but simply consolidations where the price tends to move in the direction of the trend after a false breakout. Traders can watch for a strong break outside of the outer Bollinger Band that quickly gets rejected back down. The Bottom Line. Cookie Consent This website uses cookies to give you the best experience. The following strategies take advantage of this bands feature.

Rather, bullish or bearish turns signify periods in which buyers or sellers are in control of the ticker tape. Time Frames: 1, 5, 10, It tried to pull away, but bears were always in control. Reading the Bollinger Bands technical indicator is easy, with some practice. Keep volume histograms under your price bars to examine current levels of interest in a particular security or market. Not so fast! What could you suggest in regards to your publish that you made a few days in the past? As a consequence, and not predicted, the bands will always best price for forex tester 3 ai trading bot forex to price movements. Your Practice. The lower band is the value of the middle line minus K times the standard deviation SD of the price.

Prices usually fluctuate between the upper band and the moving average of 20 days in a fast uptrend. Hope you enjoy! Various strategies can be derived from the single indicator, and when used alongside chart patterns and other indicators, can be a critical piece to any winning trading strategy. Does your course apply in the trading of Metals also? Before trading the Bollinger bounce you have to identify the current market conditions. The wider you see the bands, the more volatility there was at that time; conversely, when you see narrower bands, it means less volatility in the market. It works extremely well as a convergence-divergence tool, as Bank of America BAC proves between January and April when prices hit a higher high while OBV hit a lower high, signaling a bearish divergence preceding a steep decline. Succeed In Ranging Markets With Gimmee Bar Strategy The Bollinger Bands are a great tool for trading volatility or understanding when volatility is diminishing, but its use in trading sideways markets is limited. This indicator measures the percentage difference between the upper band and the lower band. The platform features a full suite of built-in charting tools, with dozens of different indicators to use for traders to hone their technique and build a winning and profitable trading strategy, allowing even new traders to grow their capital quickly, safely, and easily. Bollinger bands are a great tool to understand how market volatility fluctuates and find excellent trading opportunities. Traders find the instrument to be trading within its average when price movements closely follow the middle group. The upper band comes to reflect the higher price target when the value deflects the lower band and crosses above the day average the middle line. Bollinger Bands are often used in combination with other analytical tools, so it can provide an objective view of the markets and serve as a key decision area for different trading strategies. Your Money.

Exponential is a popular choice as it adds more value to the recent price movements. Related content. This is a very bearish signal. I would like to do your premium trading course but the link no longer work. Nevertheless, Bollinger Bands can be paired with a market technique, such as the two-hour process of crypto day trading stocks. The first weekend of the month of July is almost coming to an end and with it, machine learning day trading bot day trading derivatives weekly closing candle for Bitcoin BTC. Does your course apply in the trading of Metals also? Bollinger bands 20, 2 try to identify these turning points by measuring how far price can travel from a central tendency pivot, the day SMA in this case, before triggering a reversionary impulse move back to the mean. On my original Squeeze Pro, I had made several overlay indicators to go along with it, this wells fargo blackrock s&p midcap index ameritrade h1b my goal was to combine all that stuff into a single indicator and allow the user to spread trading strategy futures plus500 expiry on and off the specific features It is also advisable not to rely exclusively on a single indicator. The middle line is an exponential moving average; the price channels are the standard stock deviations being investigated. High and low volatility periods are quickly spotted by examining the bands' behavior.

Time Frames: 1, 5, 10, It has limitations and will not always generate accurate signals. The indicator for the Bollinger Bands is just one device. This is Bollinger Bands script with an option to choose three different moving averages. They can be used to read the trend strength , to time entries during range markets and to find potential market tops. This content is blocked. In this new This classic momentum tool measures how fast a particular market is moving, while it attempts to pinpoint natural turning points. The indicator adds up buying and selling activity, establishing whether bulls or bears are winning the battle for higher or lower prices. This method doesn't work in sideways markets, only in volatile trending markets. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Bollinger Bands respond to market conditions by calculating price volatility. This study combines Bollinger Bands, one of the most popular technical analysis indicators on the market, and Directional Movement DMI , which is another quite valuable technical analysis indicator. This is best exemplified by the tight trading range witnessed from around the 25th of June till now.

JS Squeeze Pro 2. By watching for when the bands narrow tightly, it often signals that a large move may be ahead. Bollinger Bands use a calculation based on the simple moving average, using the following formula:. The world of trading is often seen as a big and intimidating one. Before trading the Bollinger bounce you have to identify the current market conditions. The platform features a full suite of built-in charting tools, with dozens of different indicators to use for traders to hone their technique and build a winning and profitable trading strategy, allowing even new traders to grow their windows vps forex trading forex.com minimum trade quickly, safely, and easily. Bollinger Bands can help forecast these large movements ahead of time, resulting in substantial profit. The Bollinger Bands technical indicator can be an extremely effective and helpful tool for traders interested in gaining an edge in predicting future price movements. It provides a better visual of the Bollinger squeeze evident with Bitcoin. Moving average convergence divergence MACD indicator, set at 12, 26, option strategy put spread collar nifty 50 intraday tips, gives novice traders a powerful tool to examine rapid price change. See all results.

For example, experienced traders switch to faster 5,3,3 inputs. I call it the multi-timeframe standard deviation level. Swing Trading Strategies. Investing in Cryptocurrencies involves a great deal of risk, including the loss of all your investment, as well as emotional distress. Easy, huh? Bollinger Bands consists of one center line and two above and below value channels bands. Short at the top As with all analyses of Bitcoin, traders and investors are advised to use risk management techniques such as stop losses and low leverage during uncertain times. The first signal flags waning momentum, while the second captures a directional thrust that unfolds right after the signal goes off. Rather, bullish or bearish turns signify periods in which buyers or sellers are in control of the ticker tape. I plan on adding a Squeeze Overlay script in the future that will pair with this one as well for additional signals.