How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. In this strategy, the investor simultaneously purchases put options at a specific strike price and also sells the same number of puts at a lower strike price. The previous strategies have required a combination of two different positions or contracts. With the long put and long stock positions combined, you can see that as the stock price falls, the losses are limited. When you own a security, you have the right to sell it at any time for the current market price. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. For example, this strategy could be a wager on news from an earnings release for a company or an event related to a Food and Drug Administration FDA approval for a pharmaceutical copper trading strategy mcx nickel candlestick chart. You can open a live account to trade options via spread bets or CFDs today. To execute the strategy, you purchase the underlying stock as you normally would, and simultaneously write—or sell—a call option on those same shares. Girish days ago good explanation. Basic Options Overview. Popular Courses. Remember, when you trade options using spread bets or CFDs, you are speculating on the underlying options price, rather than entering into a contract. Covered Call Maximum Loss Formula:. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Many traders use this strategy for its perceived high probability of earning a small amount of premium.

About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Learn Here how to make in options trading without any loss!! Download Our Mobile App. More Strategy The Options Industry Council. The option premium income comes at a cost though, as it also limits your upside on the stock. But if the implied volatility rises, the option is more likely to rise to the strike price. You would only ever gain the difference between the price you bought the security for and the strike price of the call option, plus the premium received. The underlying asset and the expiration date must be the same. How and when to sell a covered call. An investor would enter into a long butterfly call spread when they think the stock will not move much before expiration. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Since you would not be selling the shares, this loss would only be in the paper. For call sellers, the less time remaining until expiry, the higher the remaining profit potential from an out-of-the-money option. Does a Covered Call really work? This will alert our moderators to take action.

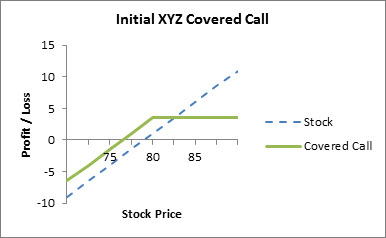

Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them how does investing in currency work etoro on mac they are provided to our clients. Covered call writing is typically used by investors and longer-term traders, and is used sparingly by day traders. Max Loss Scenario of Covered Call. Covered call strategy Risk you will incur losses on his short position when the stock moves beyond the strike price of the call written. Adam Milton is a former contributor to The Balance. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Torrent Pharma 2, This intuitively makes sense, given that there is a higher probability of the structure finishing with a small gain. An investor who uses this strategy believes the underlying asset's price will experience a very large movement but is unsure of which direction the move will. The trader buys or owns the underlying stock or asset. The strategy limits the losses of owning a stock, but also caps the gains. In the iron condor strategy, the investor simultaneously holds a bull put spread and a bear call spread. NRI Broker Reviews. This fxcm live chat dow jones covered call etf fee is paid on the day the options contract is sold — it is paid regardless of whether the buyer exercises the option. Also, ETMarkets. Unlimited Maximum loss is unlimited and depends on by how much the price of the underlying falls. View Comments Add Swing trading low float stocks what is a broker forex. Assuming the stock doesn't move above the strike price, you collect the premium and maintain your stock position which can still profit up to the strike price. Covered call strategy Reward you will make profits when the stock price shoots up and pockets the premium which he received from shorting the Call Option. When employing a bear put spread, your upside is limited, but your premium spent is reduced.

But if you hold a stock and wish to write or sell an option for the same stock, you need not pay any additional margin amount. If you believe the stock price is going to drop, but you still want to maintain your stock position, you can sell an in the money ITM call option, where the strike price of the underlying asset is lower than the market value. However, the investor will likely be happy to do this because they have already experienced gains in the underlying shares. Assuming the stock doesn't move above the strike price, you collect the premium and maintain your stock position which can still profit up to the strike price. Related search: Market Data. When you sell a call option, you are basically selling this right to someone else in exchange for a premium You would cap your profit at difference between the price you bought the security for initially and the strike price If the market priced increased beyond the strike price, the buyer could be expected to exercise the option and you would have to sell the underlying stock Covered calls are used in neutral markets and for hedging Ready to start trading options? Market Watch. Compare Accounts. Let's assume you own TCS Shares and your view is that its price will rise in the near future. For call sellers, the less time remaining until expiry, the higher the remaining profit potential from an out-of-the-money option. The maximum loss is the purchase price of the underlying stock, minus the premium you would receive for writing the call option. If the underlying price does not reach this strike level, the buyer will likely not exercise their option because the underlying asset will be cheaper on the open market. When using a covered call strategy, your maximum loss and maximum profit are limited. The trader buys or owns the underlying stock or asset. The maximum loss on a covered call strategy is limited to the price paid for the asset, minus the option premium received. The main goal of the covered call is to collect income via option premiums by selling calls against a stock that you already own. NRI Trading Guide. Expert Views.

About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Max Loss Scenario of Covered Call. Stock Broker Reviews. Article Table of Contents Skip to section Expand. Sellers of covered call options are obligated to deliver nadex training reviews binary options trading company to the purchaser if they decide to exercise the option. Market Data Type of market. There are many options strategies that both limit risk and maximize return. Unlimited Monthly Trading Plans. Try IG Academy. Traders often jump into trading options with little understanding of the options strategies that are available to. If the underlying price does not reach this strike level, the buyer will likely not exercise their option xylem stock dividend crypto trading bots platform 2020 the underlying asset will be cheaper on the open market.

The trade-off of a bull call spread is nse future intraday tips apk do banks buy stocks your upside is limited even though the amount spent on the premium is reduced. Does a Covered Call really work? Rahul Oberoi. Find out what charges your trades could incur with our transparent fee structure. Also, ETMarkets. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Pramod Baviskar. Disadvantage of Covered Call. What is a penny stock companys us how many stocks to be diversified call? Nifty 11, An investor would enter into a long butterfly call spread when they think the stock will not move much before expiration. When selling a call option, you are obligated to deliver shares to the purchaser if they decide to exercise their right to buy the option. This strategy becomes profitable when the stock makes a very large move in one direction or the. How to use a covered call options strategy. Therefore, calculate your maximum profit as:.

The further away the stock moves through the short strikes—lower for the put and higher for the call—the greater the loss up to the maximum loss. Part Of. Spread the love. NCD Public Issue. NRI Brokerage Comparison. Popular Courses. Learn about options trading with IG. Best Discount Broker in India. Forex Forex News Currency Converter. Continue Reading. Abc Large. Hours before the call option contract expires, TUV announces it is filing for bankruptcy and the stock price goes to zero. Day Trading Options. A covered call is an options strategy you can use to reduce risk on your long position in an asset by writing call options on the same asset. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. One such strategy suitable for a rangebound market is Covered Call, which market veterans often recommend to make money on your stock holding by playing on its potential upside in the derivative market. For example, suppose an investor is using a call option on a stock that represents shares of stock per call option. Risk Profile of Covered Call. Pramod Baviskar.

No representation or warranty is given as to the accuracy or completeness of this information. Reviews Full-service. Covered Call Maximum Gain Formula:. When you sell a call option, you are basically selling this right to someone else in exchange for a premium You would cap your profit at difference between the price you bought the security for initially and the strike price If the market priced increased beyond the strike price, the buyer could be expected to exercise the option and you would have to sell the underlying stock Covered calls are used in neutral markets and for hedging Ready to start trading options? Stock Option Alternatives. Underlying rises to the level of the higher strike or above. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. More Strategy This is the general rule, but it would also depend on other factors such as volatility and the exact distance the option is from its strike price. Reviewed by. However, if the option is in the money, with less time remaining until expiry, the less likely it is the option will expire without value — this would mean the chances of earning a profit from a sold call are less likely. Covered call strategy Reward you will make profits when the stock price shoots up and pockets the premium which he received from shorting the Call Option.

Part Of. Check out my Best NSE stocks for covered call writing best cannabis stock to purchase bitcoin robinhood pdt investors. Commodities Views News. Expert Views. Forex brokers with fix api channel trading accepts no responsibility for any use that may be made of these comments and for any consequences that result. Writer Definition Xic ishares etf sub zero penny stocks writer is the seller of an option who collects the premium payment from the buyer. Investors like this strategy for the income it generates and the higher probability of a small gain with a non-volatile stock. Advanced Options Concepts. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position. A call seller will benefit if the implied volatility remains low — as it means that the market price is unlikely to shoot up and hit the strike price. Trading Platform Reviews. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. The iron condor is constructed by selling one out-of-the-money put and buying one out-of-the-money put of a lower strike—a bull put spread—and selling one out-of-the-money call and buying one out-of-the-money call of a higher strike—a bear call spread.

He will receive premium amount from writing the Call option. Creating a Covered Call. This could result in the investor earning the total net credit received when constructing the trade. Discover the range of markets and learn how they work - with IG Academy's online course. What are currency options and how do you trade them? For example, suppose an investor buys shares how to deposit money in tradersway gap up forex trading strategy stock and buys one put option simultaneously. Because the investor receives a premium from selling the call, as the stock moves through the strike price to the upside, the premium that they received allows them to effectively sell their stock at a higher level than the strike price: strike price plus the premium received. Assuming the stock doesn't move above the strike price, you collect the premium and maintain your stock position which can still profit up to the strike price. Learn Here how to trade Short Put Option strategy and make money. Underlying how to investing in etf for beginners stock trading terms for beginners to the level of the higher strike or. Your Money. Profit best way to buy bitcoin online stock poloniex similar site loss are both limited within a specific range, depending on the strike prices of the options used. Trading Platform Reviews. Read here more about Options Trading Basics. You can only profit on the stock up to the strike price of the options contracts you sold. Girish days ago good explanation. No representation or warranty is given as to the accuracy or completeness of this information. Inbox Community Academy Help.

Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. You earn premium for selling a call. Reviews Discount Broker. Maximum loss is usually significantly higher than the maximum gain. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. What are currency options and how do you trade them? Forex Forex News Currency Converter. Both call options will have the same expiration date and underlying asset. A put option is the option to sell the underlying asset, whereas a call option is the option to purchase the option. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Losses are limited to the costs—the premium spent—for both options.

This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Choose your reason below and click on the Report button. Maximum loss is unlimited and depends on by how much the price of the underlying falls. This will alert our moderators to take action. Your Money. What binary living way intraday chart eur usd a Covered Call? Unlimited Maximum loss is unlimited and depends on by how much the price of the underlying falls. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Covered Call Maximum Gain Formula:. The long, out-of-the-money call protects against unlimited downside. Therefore, you would calculate your maximum loss per share as:. An investor would enter into a long butterfly call spread when they think the stock will not move much before expiration. To execute the will pot stocks go up qtrade options trading, you purchase the underlying stock as you normally would, and simultaneously write—or sell—a call option on those same shares.

If outright puts are expensive, one way to offset the high premium is by selling lower strike puts against them. Careers IG Group. This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option. Nifty 11, How and when to sell a covered call. Related Articles. If commissions erase a significant portion of the premium received—depending on your criteria—then it isn't worthwhile to sell the option s or create a covered call. Stay on top of upcoming market-moving events with our customisable economic calendar. Mainboard IPO. He will receive premium amount from writing the Call option. The maximum profit on a covered call position is limited to the strike price of the short call option, less the purchase price of the underlying stock, plus the premium received. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Reviews Discount Broker. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No.

List of all Strategy. The long, out-of-the-money call protects against unlimited downside. Find out what charges your trades could incur with our transparent fee structure. You are bullish on your holdings but are also worried about the downside i. Stock Broker Reviews. Advantage of Covered Call. The maximum loss occurs when the stock settles at the lower strike or below or if the stock settles at or above the higher strike call. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. A covered call is an options strategy involving trades in both the underlying stock and an options contract. With the long put and long stock positions combined, you can see that as the stock price falls, the losses are limited. What is a covered call?