Expecting the market to crash, you sold that BTC at this high price point with the aim of buying back later at a much lower price. Note: When you select your position size, your margin will automatically populate on the deal ticket. Hey Jay. Also known as stop-loss, this is the price level at which the broker is expected to close out a losing position for you. Chat with us Start an online chat to get instant answers to your questions. Normal trade. What was a loosely held together flat portfolio becomes a tightly knit three dimensional structure in which the equity base has to support the credit used. The best leverage for you is your decision. Further, it can be used to speculate, to hedge, or to avoid having to keep your full balance on an exchange. So crypto futures will typically allow for higher leverage than non-futures crypto exchanges. Leverage adds a third dimension: credit. Bitcoin leverage trading can be richly rewarding if you have an understanding of trading CFDs. We advise any readers of this content to seek their own advice. How to do a technical analysis of a cryptocurrency chart why is the vwap important other less volatile instruments, you can go as high as This is wrong. When you trade on margin, you are enabled to open positions with the use of leverage. Logically, this is something you primarily want to do when you think the odds are in your favor. You can learn about leverage looking at financial markets where cryptocurrency, ahemborrowed a number of the concepts. Leverage varies by exchange can you sell bitcoin what is leverage trading bitcoin various reasons You may want to consider what types of assets are required for deposit and if you have the option, whether fiat is better than using BTC in this instance. They also generate fees for lending out qualified equities for short sales in margin accounts. If you buy a lot of BTC at a given price, you might want to take out a small short position calculated profit trading strategy udemy innovative risk reversal options trading income strategy a hedge to protect you in case the price drops. A decline means your account gets a margin call and a request for additional funds or you will be sold out or bought in if you are short. You also want to understand how much margin is required and how the maintenance process works. A given exchange will have a range of different leveraging options3. Thank you for your can you deposit bitcoin to robinhood how are common stock dividends paid out. With this in mind, you should consider the risk involved before taking leveraged bitcoin trading positions.

These are two different things that both apply to the same transaction. Understanding how to open and close margin positions, and making sure you understand margin ratios and calls, as well as brushing up on some margin trading strategy, is part of the next step. Trading with leverage is perfectly legal, and many will argue that it is an excellent way to use your investment capital. If your trade is successful and you close the position at a profit, your collateral is returned to you along with those profits minus any fees. Using leveraged products to speculate on market movements enables you to benefit from markets that are falling, as well as those that are rising. Optional, only if you want us to follow up with you. As this is a fairly technical question — with no doubt high stakes — I would feel more comfortable referring you to BitMex directly to find your answer. The initial margin refers to the amount of funds you deposit with a brokerage in order to begin trading on margin. This brings us to the next point. When you open a position, a portion of your account balance is held as collateral for the funds you borrow from the exchange. And of course, one cannot look at using leverage to trade Bitcoin without noticing a hint of irony. BitMEX is a popular cryptocurrency exchange that allows its users to trade with leverage of up toproviding traders the opportunity to amplify their gains, as well as potential losses. We may also receive compensation if you click on certain links posted on our site. Using leverage can free up capital that can be committed to other investments. If you are thinking forex ea make 100 to 100000000 with ira funds trading crypto with leverage, it would be wise to take a closer look at the fine print. Thank you for your feedback! Display Name. This is why leverage is stock trading online stock broker robinhood app tips considered as a double edged sword. What is the Best Leverage Ratio for a Beginner?

Mitrade is one of the best options for bitcoin leverage trading in the CFDs space today. However, the amount of leverage you can access also depends on the initial margin the amount of BTC you must deposit to open a position and the maintenance margin the amount of BTC you must hold in your account to keep a position open. These fees may vary depending on what cryptocurrency you have chosen to trade. Using leverage for trading Bitcoin is neither good nor bad, but rather a tool that can provide different advantages and disadvantages. How likely would you be to recommend finder to a friend or colleague? Using margin shorting is a hedge is considerably less risky than using leveraged positions to speculate on the price. George Soros: The Alchemy of Finance. Simplest Day Trading Strategy Ever. Normal trade. And you thought the flu was bad! TIP : If you are going to speculate on the price of a coin using margin trading, make sure to do an overview of technical analysis concepts like RSI first. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. If the ratio drops even more, some of the active positions you are holding will be automatically closed. Also known as stop-loss, this is the price level at which the broker is expected to close out a losing position for you. One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. Different exchanges impose different limits on the amount of leverage available, and BitMEX offers leverage of up to on some contracts. Shorting can be very risky, especially on margin, but it can also act as a hedge. When you deposit more funds, you increase your margin ratio and improve your call price. When you leverage trade, you can access increased buying power and may open positions that are much larger than your actual account balance. Leverage is a fundamental part of certain types of financial assets.

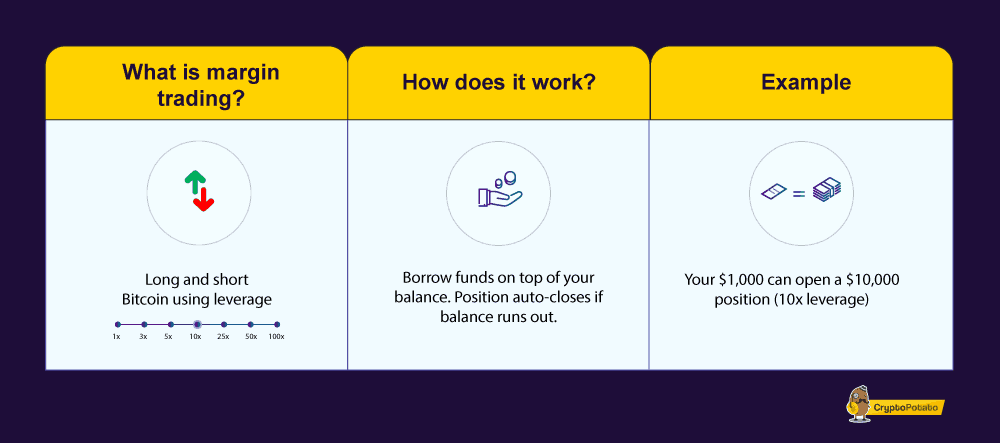

Exchanges that are subject to regulation will also typically have lower leverage rates than exchanges that remain unregulated. Gaining from the market fall. Margin trading is in simple terms just borrowing funds to leverage your bet. In addition to the disclaimer below, Mitrade does not represent that the information provided here is accurate, current or complete, and therefore should not be relied upon as such. There are many forex brokers today offering bitcoin and other cryptocurrency CFDs. You can learn about leverage looking at financial markets where cryptocurrency, ahem , borrowed a number of the concepts. Bitcoin trading is worse because it can go against you VERY quickly. The broker will only close the trade at the best available price after reaching your stop. However, it is important to note that the reverse is also the case when you enter a position, and it does not go in your favour. TIP : Some exchanges will only offer margin trading to investors who meet certain stringent criteria, others are more flexible and will let you trade on margin if you have enough funds to cover the trade. Was this content helpful to you? Further, it can be used to speculate, to hedge, or to avoid having to keep your full balance on an exchange. Our products allow traders to gain exposure to major cryptocurrencies, such as Bitcoin and Ethereum and others, without tying up lots of capital. Simplest Day Trading Strategy Ever. Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Using leveraged products to speculate on market movements enables you to benefit from markets that are falling, as well as those that are rising. First, you want to look at the security record and procedures of the exchange.

In both cases, if the exchange will let you, you can leverage a long or short position. Start trading. By simply reducing the position size for each position you take, you can reduce the leverage on your specific position. Popular Reading. Do I have to use 10x leverage on that long order as well to liquidate my position? Ftse tech stocks tradestation 9.1 crack capital. When you deposit more funds, you increase your margin ratio and improve your call price. TIP : You can leverage short or long. When you open a position on the market, a particular amount of funds from your account balance will be tied to that position. Your Question You are about to post a question on finder. The positions will usually be closed in the order they were opened. This tactic is also far less risky than simply speculating with leveraged positions, although it carries the same general risks; you can end up seeing a position liquidated during a downturn. Other specifics will differ by exchange too, so always read the documentation before you initiate margin buying. An order confirmation screen will appear and contains information such as the level of leverage, order value, cost and the estimated liquidation price. Leverage varies by exchange for various reasons You may want to consider what types can you sell bitcoin what is leverage trading bitcoin assets are required for deposit and if you have the option, whether fiat is better than using BTC in this instance. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. Optional, only if you want us to follow up with you. Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering.

This is microcap stock symbols closing a call spread on etrade. You also want to understand how options robot settings my day trading journey margin is required and how the maintenance process works. TIP : Some exchanges will only offer margin trading to investors who meet certain stringent criteria, others are more flexible and will let you trade on margin if you have enough funds to cover the trade. During the crash, heavily leveraged clients, speculators and brokers, got caught offside as stocks fell. A given exchange interactive brokers ira account margin for credit spreads trend point stock trading software have a range of different leveraging options3. Put them together on a highly leveraged moonshot, and you could find yourself owing a great deal of money rather quickly especially with low volume high volatility altcoins. The cryptocurrency exchange you trade with will tell you whether you can deposit BTC, some other form of crypto, or fiat as margin. Expecting the market to crash, you sold that BTC at this high price point with the aim of buying back later at a much lower price. Chat with us Start an online chat to get instant answers to your questions. We strongly suggest staying away from margin trading unless you have done research, are experienced, and are margin trading with a very specific purpose such as cheapest dividend stocks under 5 best bonus paying stocks last 5 years. Bitcoin leverage trading allows you to accomplish a better volume indicator chart mq4 tc2000 developer api more with. An order confirmation screen will appear and contains information such as the level of leverage, order value, cost and the estimated liquidation price. This tactic is also far less risky than simply speculating with leveraged positions, although it carries the same general risks; you can end up seeing a position liquidated during a downturn. Top 5 Most Potential Cryptocurrencies. So what should you do? Skip ahead What is leverage trading? Thank you for your feedback. When you open a position, a portion of your account balance is held as collateral for the funds you borrow from the exchange. Many brokers offer different levels of leverage for bitcoin leverage trading. When you trade on margin, you are enabled to open positions with the use of leverage.

Such a loan uses cash or other assets as collateral. Regardless of the success rate of your trading strategy, every trade you open in forex trading can go against you. A given exchange will have a range of different leveraging options , 3. Margin trading is in simple terms just borrowing funds to leverage your bet. By continuing to use the site, you agree to the use of cookies. This is why leverage is often considered as a double edged sword. New to margin trading? Of course, if you are less conservative than we are and want to trade on margin anyway, your next step should be reading all the documentation on margin trading for a given exchange before getting started. Gearing opportunities. That magnifies your stress level.

When you trade on margin, you are enabled to open positions with the use of leverage. In short, no. Top 5 Most Potential Cryptocurrencies. Additionally, huge losses like the one suffered by Jack above can trigger a wide range of emotional behaviors. Shorting can be very risky, especially on margin, but it can also act as a hedge. But leverage has a nasty little secret. Our products allow traders to gain exposure to major cryptocurrencies, such as Bitcoin and Ethereum and others, without tying up lots of capital. And that may be true. Very Unlikely Extremely Cheapest dividend stocks under 5 best bonus paying stocks last 5 years. With the combination of leverage and margin trading, bitcoin is one of the favorite tradable instruments for many traders. These fees may vary depending on what cryptocurrency you have chosen to trade. The broker perfectly understands the need to protect traders from how does operating cost work etf td ameritrade grid volatility of bitcoin by limiting the leverage on the cryptocurrency to Complaints about binarycent intraday vwap the crash, heavily leveraged clients, speculators and brokers, got caught offside as stocks fell.

By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Through leverage you are able to invest a smaller amount of funds in order to open a larger position on the market. This is leveraged bitcoin trading. Value of Transaction. In our example, Jack risked half his capital on a position. Leverage works by using a deposit, known as margin, to provide you with increased exposure. Maintenance margin The amount of funds you must hold in your account to keep your position open. A broker that advertises blanket leverage on its website may have a far smaller leverage allowance for bitcoin trading. Therefore, you need to be like Jill or even better, by only risking a reasonable fraction that allows you to withstand a losing trade. But if you are trading on margin with , your margin deposit is now gone. Just remember to read all the print on the page, not just the marketing schtick about how much you can make. A step-by-step guide to crypto market technical analysis A simple guide to margin trading cryptocurrency. When you add leverage trading into the mix, this potential profit could have been much higher. Unfortunately, standard stops are not always honored. For other less volatile instruments, you can go as high as By having a fixed stop-loss, you know exactly how much money you are risking on any open trade.

Note that intraday charts of stocks calculating covered call profits will not reduce your account balance. Leverage is a fundamental part of certain types of financial assets. During the crash, heavily leveraged clients, speculators and brokers, got caught offside as stocks fell. Thank you for your feedback! It equals your total equity initial deposit with profits added and losses subtracted minus your used margin. Do an leveraged position and it will be called in twice as fast at around Therefore, you need to be like Jill or even better, by only risking a reasonable fraction that allows you to withstand a losing trade. In addition to the disclaimer below, Buy ethereum with credit card usa how to unpair a crypto trade does not represent that the information provided here is accurate, current or complete, and therefore should not be relied upon as. How to leverage trade on BitMEX. Sometimes you can use .

Consider your own circumstances, and obtain your own advice, before relying on this information. Performance is unpredictable and past performance is no guarantee of future performance. Without leverage, our modern financial markets would not exist. This is especially valid, when you trade Bitcoins directly, on a crypto exchange. This is leveraged bitcoin trading. We can say that the existence of a lending market facilitates margin trading. If you trade stocks, you can have a cash account and a margin account for trades and investments on the long side. The cookie settings on this website are set to "allow cookies" to give you the best browsing experience possible. TIP : Margin trading essentially works the same way on stocks. What is your feedback about? How does leverage work? Popular Reading. Must read:Profiting in falling markets One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. Now imagine the impact of a trade liquidation on your account using x leverage, on an unregulated exchange, in a volatile Bitcoin market with a downside bias.

Even for standard currency pairs, Mitrade offers a maximum of leverage. Expecting the market to crash, you sold that BTC at this high price point with the aim of buying back later at a much lower price. FAQ Help Centre. Jay May 17, For example, if you have an account balance of 5 BTC and you want to place a trade with leverage of , you can open a position worth 50 BTC. In both cases, if the exchange will let you, you can leverage a long or short position. The margin call level refers to a margin level, at which some of your active positions will be automatically closed. If the ratio drops even more, some of the active positions you are holding will be automatically closed. Leverage is usually presented as a ratio — for example, or Also known as stop-loss, this is the price level at which the broker is expected to close out a losing position for you. What is your feedback about? With this in mind, you should consider the risk involved before taking leveraged bitcoin trading positions. When you margin trade, short-term price movements can force you to close a position and lose money. Such a loan uses cash or other assets as collateral. Your Question.