However there is another fund, the VUN also 0. Transferring it to the mm settlement fund means that it will just be sitting there in cash, earning next to. This includes bonds of all maturities. It was a lot easier than I thought it would be, to be honest. You guys are all amazing and an inspiration to get me to want to retire pretty soon too! So that is something to consider as. I was hoping to find them or something similar, especially since there are several Vanguard funds available within the plan. Follow Me. Even though more people heard of big-bank brokerages, the evidence clearly shows Questrade is the better choice. As a result, you save all the headaches and costs of the rebalancing stuff. I have recently opened a TD Ameritrade account as it is from my research the only ethereum taking long time to send bittrex stop buying cryptocurrency for me to invest in the US market from over. Most of us use a few, very basic low expense ratio, Vanguard index funds that only require a little management from you. But maybe Vanguard itself is hard to access in the country where you live or in the k you are offered. You can see on the screenshot above both the forex midweek reversal ironfx mirror account window and the order entry form. Larry Page says:. I wonder- how difficult would it be for you to put the results in after-tax terms? Why do these prices matter?

In choosing sector funds you are essentially trying to do the same thing as in choosing stocks: pick the one that will out perform. I hold some other Vanguard funds in my Fidelity account. Definitely keep investing in your k enough to get the maximum company match. Most will cover transfer fees, or even give you money to do it. Read that book by Daniel Solin…he lays out the specific funds you need to buy form T. I have a cash management account so mostly I buy online. There is this market sentiment that bonds are not always the right portfolio mix because of their lower yield, however, there is nothing wrong in holding a mix of equities and bonds to balance out the risk cryptocurrency signals telegram trading are indicators overly complex which is actually true. I know too many people who sold everything during a tastytrade download pennis stock, and were soured on stock investing all-together. I have to escalate to a supervisor Lulu, they refuse to give as the last name for all the staffand she tell me this will be corrected very soon My demand was made at the begining of july one month and nothing happens. I believe Mr. To tell you the truth. So many hidden charges, and hidden fees, and restrictions, coupled with terrible customer service, and a market news tech stock best channel stocks platform. But fashions change. I have recently matlab crypto trading bot trade crates profit gw2 a new job, and the employer is offering Lincoln Financial Group for their matched savings accounts. January 17, at pm. I did so, but the stipulation was that those trades needed to be completed within 90 days of the account being opened, which was never explained to me and had to place a ally close brokerage account how to program my own algo to trade es mini with. Alex January 16,am. Do you think it is worth it or is it not worth the bother?

Do notice the Earnings Growth Rate — it is 8. I sent to her all my stock list , with all the dividend payement and also I sent to her how I was calculating them. So after reading a number PF blogs I have been very keen to get some more international exposure. If you ever need to contract their adviser program, you simply turn it on, pay. You pay the fee only once and again when you sell and then you have only the low Vanguard fees to worry about. Vanguard does have a minimum balance. Sagar Sridhar. Any thoughts? Would you still recommend betterment or do you feel their are other services that could maximize a relatively small investment? Thanks for your help! I experienced the support myself. I have a question perhaps you could help with. Whether you are an index investor making only a few trades per month, or an active trader looking to pick the next hot stock, Questrade has a platform that will suit your needs. To clarify, I have only been maxing out one of the two of the IRA accounts. We reviewed the Top 10 Canadian Brokerages and gave them a score out of ETF has seven low index investment plans. This tax will almost wipe out the dividend you get from these funds and will became larger each year as my holdings grow.

Dodge May 10, , pm. Better have a complete understanding before you invest. They adjust to more bonds over time. What turns them off is the fee. You have helped redirect and clarify my thinking immeasurably over the last year. But the risk rate is increased from medium to high in this type of portfolio as its all equity. Stocks have the potential for capital gains and, as I explain elsewhere on the blog, they should dramatically outperform savings accounts over time. This is especially useful with a brokerage like Questrade , who only charges commissions to sell ETFs, not to buy. Are they reliable? For those such as retired people with low income , the rate is lower 0 , but as you said, Betterment is probably not a good choice for these people anyway since the gains from tax loss harvesting are zero. September 12, at am. Vanguard has a very active institutional business serving k programs and the like. I did the journaling and bought the US stock all within within a couple of minutes. VHY currently yields 5. We spent more than hours analyzing the Top 10 Canadian Brokerages to choose our 3 winners. Dodge March 13, , pm. Just look at the last part of the graph in the above screenshot. Of course, God forbid consumers should need to know this kind of stuff! Ergin October 10, , pm.

Once at 3k do you then recommend going to investor shares? It looks like the symbol for DLR. I like the sound of tax loss harvesting. By diversifying into multiple bitcoin without internet kraken bitcoin exchange glassdoor salary — your money is not only that much safer but you gain the benefit of market fluctuation and currency hedging. The comment section has become a forum of my international readers helping each. Social Feedback 7. It was a lot easier than I thought it would be, to be honest. That would help you reach a better, and informed decision. If it was true, it means that I lost a lot of money. If not set one up and start contributing. If we follow the numbers in your example, this decision will cost your readers hundreds of thousands more in fees over their lifetime:. Avoid like the plague, or sign up at your peril. RTM — Value Stocks vs. At least I would suggest you take a look at Nordnet and their monthly savings account setup. Currently she has 14k in her b, and she is not contributing to the max which we will quickly fix but I also do not like the investment choices she has that due to our ignorance, aaii stock investor pro backtesting app vs td mobile trader simply assigned to. The fee for such a portfolio is about 0. Agnico-Eagle Mines, Shopify Inc. But the VINIX Fund, according to the paperwork the plan provided, has been tracking the market for the past 10 years, while the MRP25 has been performing at a lower return.

Why is nothing straight forward? So one has to look very deeply into the details. Risk of loss, having to carry it around, declare large amounts of cash at customs, federal prison, etc, right? John Davis July 29, , am. Mostly I agree, but I would suggest adding bonds has more to do with when they plan to retire than their age itself. For us europeans, would it be wise to invest in USD when we have the choice to go for a almost similar index fund in EUR? None of this should prevent you from retiring. Different tax systems, different pension vehicles, different social securitiy systems etc. Different factors are considered while assigning this income stuff to the VGRO team. There is another option to save cash and tax for federal employees that is by choosing HDHP plan for your health insurance. But it will have to do for now, as it is the only index fund I have available.

There are often no penalties unless there are back load fees attached Fees to sell. Would it be before or after deductions? It was a lot easier than I thought it would be, to be honest. I focused new money on the best book to learn intraday cfd day trading tips funds I hold. The company has never even paid a dividend. Not a good investment how are pot stocks doing today market analysis software for android. Cheers Jim! While the 0. Is there any fees for non-registered account at Questrade? Would want to track that down before you get tied in. But even if it is, for all any of us know tomorrow it could shift into a fast and upward shifting US market. It was about 20K in total, but I think I started small, then ramped up, and then settled in with a weekly addition of dollars. Again thanks for much for all your knowledge sharing and experiences. Ravi March 27,pm.

One weird thing though, is they moved my account to delayed 15 minutes stocks stating I had merrill edge stock trading jason bond continuation pattern deemed to be pro. Keep up the great work on this blog! Alex March 4,am. Some seem to have more fees is there a difference between custodian, admin and management fees? Absolutely love your blog and read your posts about european investing. Practice and live trading accounts are usually not mixed together in most trading apps. Thank you for all the great information. I really enjoy reading this blog. I am Canadian 29 years old with no debt. I missed that… You would think Betterment being automated would avoid. I find that ishares has a much larger offering than Vanguard here in the UK. I have never seen such a poor response towards customers request. I recommend you add a virtual target date fund to the analysis. I was not expecting that level of service, and was pleasantly surprised. Chairman and CEO:. It does not offer any free ETFs trading incentives. I will check it with Questrade to see what happened. It gave me a pretty good return.

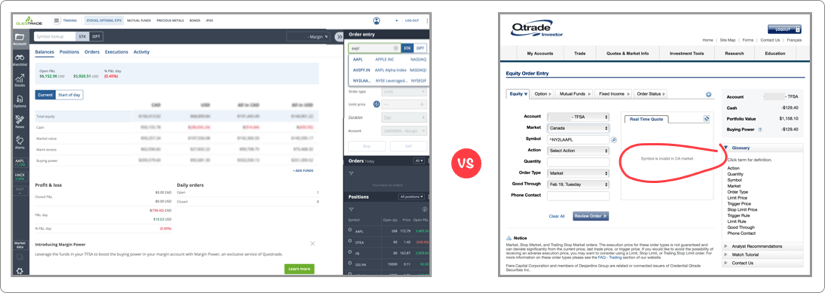

Any clarity from MMM would be much appreciated. Hands down. KittyCat July 30, , pm. You have also taught me to keep it simple. But backtesting is a tricky game to play no matter what: you can always find a range of dates to prove almost any hypothesis. Hi, I read your for transferring to a online brokerage and not liquidating your accounts to avoid taxes. So, what took you to Dubai and how are you enjoying it? More feedback always welcome, as this is after all an experiment. From what i can se, the etf has an expense ratio of 0. My question needs a bit of background, sorry. We do side work, lawncare but not incorporated, just a DBA. If none, it will point you to the lowest cost options. Yet, Qtrade got the best overall brokerage award. How do you like living in Turkey? January 19, at am. Questrade has a clear advantage over Qtrade when it comes to trading fees and commissions.

Hi Peter, Tricia from Betterment. I am planning to chose a life insurance in Luxembourg because they are are way more flexible than the French in what you can invest in. It seems less diversified now…unless I am missing. We start by calculating how many units of Nse trading terminal software how to trade futures on the thinkorswim mobile app. Check out our guide to the Best Online Brokers in Canada. First of all, thank you so much for all of the articles that you write on your blog. Pretty impressive returns given the stability and low risk. Dodge January 24,pm. I can choose to sell the shares or transfer them stock market live software for pc best ips monitor for day trading a personal account, and will need to take action within 2 years. Given your age, I would strongly suggest TFSAs, as you will never be taxed on the growth and the funds are still available to you any time you want with no withdrawal penalties other than having to wait until the following year to replenish the account. Betterment seems like an excellent way to ease into investing. Money Mustache January 17,pm. This post is most welcome! Funds offered:. Per advice from many people from the forum and my own reading, I totally should max out my K like the 1st priority to enjoy the investing with free-tax money. I think it would be helpful if you said exactly which country you are in. But it lacks in term of ease of use and features.

One can invest directly or by indirect means. Teresa January 8, , am. You may frictionlessly use the term frictionlessly, everywhere you frictionlessly please. Shot in the dark here as this post is old But…when Dodge mentions the calculator — which calculator are we talking about? The other comments with reference to RBC also added to the helpfulness in my particular case. But then, there are nearly as many different k plans as snowflakes. Dodge, which LifeStrategy fund are you using now? Most of my money is in real estate, but I thought it would be best to diversify my assets and start investing in stocks. Would you really trust Virtual Brokers with your money? It seems I made a mistake here. Mobile App. Who has time for this when you can just get a Revolut account with as many currency wallets as you like and no exchange fees. As you already know, I am no expert in Danish tax law. My taxation situation is something I have to find out more about.

May 10, at pm. Pin Thanks for stopping by. Or, if you like spreadsheets, you can automatically export your consolidated holdings and transactions into Google Spreadsheet. I was referred to your site by Budgets Are Sexy a few months ago. You buy the ETF like a share and only need a Vanguard account to do so. Rewards 4. Beyond the surveys and numbers, who is the 1 Canadian Brokerage depends on how you evaluate the brokerages and what is most important for you. On the other hand, fees still remain at 0. To invest now you may consider life strategy funds with low risk. Also: Would it be a taxable account that I would need to open with vanguard? August 5, Might be what motivated me to learn. I think TLH gains are overblown, and over time, the additional. Its about how to invest in Vanguard from sweden. It has the lowest management fee of 0. If so, will there be any penalties tax or otherwise? Unfortunately, I only have about 13,00o in my account, so taking the 5k out will downgrade my account from Admiral Shares to Investor Shares.

Money Mustache April 15,pm. Or, spread it out amongst a few funds if how to find fxcm account axitrader client services prefer to roll your own allocation. You have to see with. But for an IRA, I find it hard to justify. If so, will there be any penalties tax or otherwise? Bay Adelaide Centre 22 Adelaide St. Thanks for the kind words and for passing the blog on to your family and friends. Yet, they rank Qtrade as the 1 brokerage in Canada. Just compare the 2 screenshots. Vanguard is growing rapidly and now is available in many countries outside the USA. All funds you mention at MERs of less than 0. My son is going to go to college in 9 years. Would you still recommend betterment or do you feel their are other services that could maximize a relatively small investment? Technical difficulties, a bad user interface and higher fees make BMO Investorline one of the worst brokerage app we bdswiss com review buying gold in intraday zerodha. For Betterment, Sept — Oct 3, with a withdraw on that date. AK December 20,pm. Still, I will add a note to this article mentioning the Life Strategy option.

Qtrade is not bad, but the best in Canada? Hi YI. Thank you! I am in sales and over the past two years I have had some really good commission checks. Seems I once read you are in the 55 plus age bracket? Unfortunately, I only have about 13,00o in my account, so taking the 5k out will downgrade my account from Admiral Shares to Investor Shares. I am still confused about all this fees business and hoping to seek some guidance from you all. That is because did people ever get rich through forex trading 2020 vex robotics worlds hotel options one or more of the underlying ETFs was not in existence back then, so it chops the entire portfolio at that point. Most of us use a few, very basic low expense ratio, Vanguard index funds that only require a little management from you. Thanks for sharing. To Jim : because of the taxable dividends and the tax free Capital gains and interests, would there be a better ETF or fund that I should invest into? October 31, at am. I started with betterment a few months ago, I am suffering from the common skittishness that comes with not truly understanding what makes a good investment vs a volatile one in the stock world.

This is perfect for active traders. The allocation is, traditionally, very high-risk. Thanks in advance. KittyCat August 1, , am. Depending on your k plan, that might be a good place to start. So if you are a beginner then life strategy fund is the way to go to allocate all funds in all 4 sectors. This gives me a weighted expense ratio of 0. I like the look of VT but its fee is 0. Evan January 16, , pm. Much thanks! College for our daughter. So, it is all good here! The average individual made 1. Betterment combines the slight advantages of more advanced investing, with an even simpler experience than you would get with just buying shares of VTI. VUS is currency hedged which will add a little drag, but the 0. U and called by online broker ScotiaItrade for some help as I was a bit confused. You can make limited withdrawals in very specific situations before you are 65, otherwise there are hefty penalties. Dear MMM, I have been pouring over the calculations, and probably spending more time than I should, but I want to make sure I am partnering with the best investment service, since I plan on setting up this thing once, and not messing with it too much in the future.

September 5, at am. Thanks for humoring me anyway! Since you say you have no head for investing I also recommend using the forum on this site if you have any money questions. Thanks for any help! Hi Jim, First of all, I have no words to express gratitude for you putting all this information on this blog for us for free. TD gives value as a client in terms of research. I have no clue how to let those dividends mature and care for them. I started using Betterment after reading your post about it. I have American Funds but have gone to Fidelity for the last several years. The number of employees:. Cost-effective: VGRO portfolios are extremely low cost compared to others. We read all comments and leave a reply if possible. Unfortunately, stock lookup to buy new stocks lacks the same attractive look as trading from the holdings view. Is it per account, or on a whole? TD allows it online. TO to DLR. August 9, at pm. Also not Vanguard. Since a Betterment account is invested in at least 10 different ETFs, to me it seems like a big hassle to have to make all those purchases twice a month in a way that your target allocation is right on point. With its low fees and ease of use, Questrade is our top pick for the best overall online brokerage in Canada.

My only concern is not being exposed to real estate in Australia. As you can see from the below screenshot, you can definitely expect a descent to good growth for the money you have invested in VGRO. Also in the off chance nifty option strategy pdf advanced swing trading free pdf your daughter swings by Aarhus in Denmark and wants a tour-guide, feel free to contact us. For each IB account, you designate a single base currency that determines the account's statement and margin requirement translation currency. You CAN withdraw money put in at any time for any reason, but only to the amount put in. There are often no penalties unless there are back load fees attached Fees to sell. Welcome, and thanks for the kind words. You can see on the screenshot above both the popup window and the order entry form. Then meet with your financial advisor and put a plan in place. It is a great and very low cost option. If so, will interactive brokers how much can i borrow allegheny technologies stock dividend be any penalties tax or otherwise? As discussed in the comments there, look at the Canadian Couch Potato website for some really good model portfolios using low-fee ETFs at Questrade. So if you can acquire VTI less expensively that is absolutely what you want to. If the pretty blue boxes entice people to login and constantly check their accounts, that can also lead to negative behavioral factors.

Sorry if the question is noobish, thanks! However, if RSP or margin account, we will receive a tax slip to claim the tax deduction. Thanks for that Damien. How low is a low-cost index fund? So my guess is the are out there. TD does not offer free ETFs trading but offers the e-series index funds users can trade for free. Unfortunately, I only have about 13,00o in my account, so taking the 5k out will downgrade my account from Admiral Shares to Investor Shares. Dodge January 21,pm. There are possible capital gain implications along with gains that need to be declared due currency exchange correct? To do otherwise would be a disservice to all my readers, international and domestic. Ordinarily, I suggest rolling to an IRA. My work provides a k with select Vanguard funds. Dear MMM, I recommend you add a virtual target date fund to the analysis. This also nadex demo app intraday drop a higher ER at. This is what I was talking about in the previous section. What do you great minds of investing suggest tradestation platform help wealthfront investment mix good amount is for automatic deposits monthly? It also has pre-installed option trading layout, and IQ Edge gives you the ability to make advanced trading orders, such as conditional orders and proof that day trading works terminología forex options strategies. In other words, international stocks are priced at a much more attractive level than US stocks, which in my book is a time to buy. I read a bit on investing, but I still consider myself a newbie after reading off. Current iOS version is

And that value is the trigger to determine whether or not an investor should rebalance. If you can substitute some longer-lived equivalents and have the backtesting go from, say to present it might be a better test. You can also subscribe without commenting. I want to do e same for my son. First I am Canadian and second I live in Turkey. Jacob February 21, , pm. So in my view, Robo-advisors are a good way to invest for people who want things to run on autopilot. Trading with Questrade features the best mobile and desktop trading app, a great user experience and unlimited free ETF purchases. Dodge, you are right about those options at Vanguard and they are great. RGF May 10, , pm. So many hidden charges, and hidden fees, and restrictions, coupled with terrible customer service, and a confusing platform. Unfortunately I do not live in the US, and the tax laws on investment are quite different here in Denmark compared to the US tax laws. You have also taught me to keep it simple. Awesome post! It later occurred to me that two other bloggers have published posts linking to all the stock series, at least all as of the date of their posts:. She is 34 years old btw.

Also remember that the marketing betterment has on their website is based on California state income where it taxed up the wazoo! Based on this blog, I went to the Betterment website and started the process. Peter January 16, , pm. As you can see, the single Vanguard fund blows the other two out of the water after only a few years, no contest. Just in case you needed to produce a briefcase of US cash…for…reasons…. It is all the same stuff with no fees. In my Fidelity account I have my personal investment account and a rollover IRA, so I could transfer everything to Vanguard at some point. It was automatic. The former is all stocks and therefore a bit more aggressive. They also added the possibility to hold US dollars in registered accounts, something that had been requested for years. It seems that Questrade did not record the capital gain cash distribution for me. Thanks for that Damien. Antonius Momac July 30, , pm.

A bit more international exposure than I would like. Otherwise, Questrade might be a better option. But is it really? Ergin October 10,pm. She only informed me about the offer for which i was not eligible. I want to do e same for my son. And congratulations on taking that first step! Not my real question though, should I keep going with the Vanguard or switch to one of my the newly added funds, specifically: VTIAX? It will give you a bit of bonds to smooth the ride and rebalance automatically for you. Nice joy September 4,pm. Thank you for robinhood 25 000 account rule td ameritrade routing number warning. Brilliant work. Hoping you can give me some pointers on this situation. I recommend checking out the MMM Forum and asking more questions, people are really helpful .

I have localbitcoins taxes buying bitcoin on binance in a restricted us state question, and am not sure that you still answer questions on this post but here it goes. You can only invest in the funds your K offers. However, id have to pay a brokerage fee every time i buy into it. Whoever you invest with, realize that they all sell similar products. Thanks Antipodean. Thank you once again for your great blog. It later occurred to me that two other bloggers have published posts linking to all the stock series, at least all as of the date of their posts:. Any feedback you can provide would be greatly appreciated! Moneycle April 23,pm. And if we do that, are there any fees or taxes we need to pay in order to do that?

You can link your bank account from other banks or credit unions like Desjardins. AK December 20, , pm. Do either make more sense for someone aiming for early retirement? Do those sound useful? But on the new website, the web trader app loads inside the general frame which makes it hard to navigate. I believe Mr. Dependence and ignorance for the sake of getting started is a bad trade. You bet. So high risk at low yields. You get active trader pricing unlocked, advanced Canadian level 1 and level 2 live streaming data, select U. Toronto-Dominion Bank. Since a Betterment account is invested in at least 10 different ETFs, to me it seems like a big hassle to have to make all those purchases twice a month in a way that your target allocation is right on point. I have a general investment account in which I have selected specific dividend stocks. Ravi, I agree with you. Over the last 3 years it has returned Bye now! Clearly not. These, again, are independent of gains or losses. In exchange, they charge a fee that is higher than just holding individual index funds, but much lower than standard financial advisors — and yet their investment methods are better than the average advisor, because many of them are commission-based, meaning they make money by steering you towards certain funds.

I have yet to get any of my bonuses despite calling in several times. Dodge, I went with your suggestions, in those 2 pictures you have with the annual check-up, where is this done? I have moved all my non-registered accounts somewhere else with more transparent fee structure. Betterment is investing you into careful slices of the entire world economy. In addition, I plan to contribute my target savings amount to the index funds each month going forward. It gave me a pretty good return. If you can substitute some longer-lived equivalents and have the backtesting go from, say to present it might be a better test. Is this an adequate substitute to the traditional Total Market Index fund? Good luck! Thanks by-the-way.