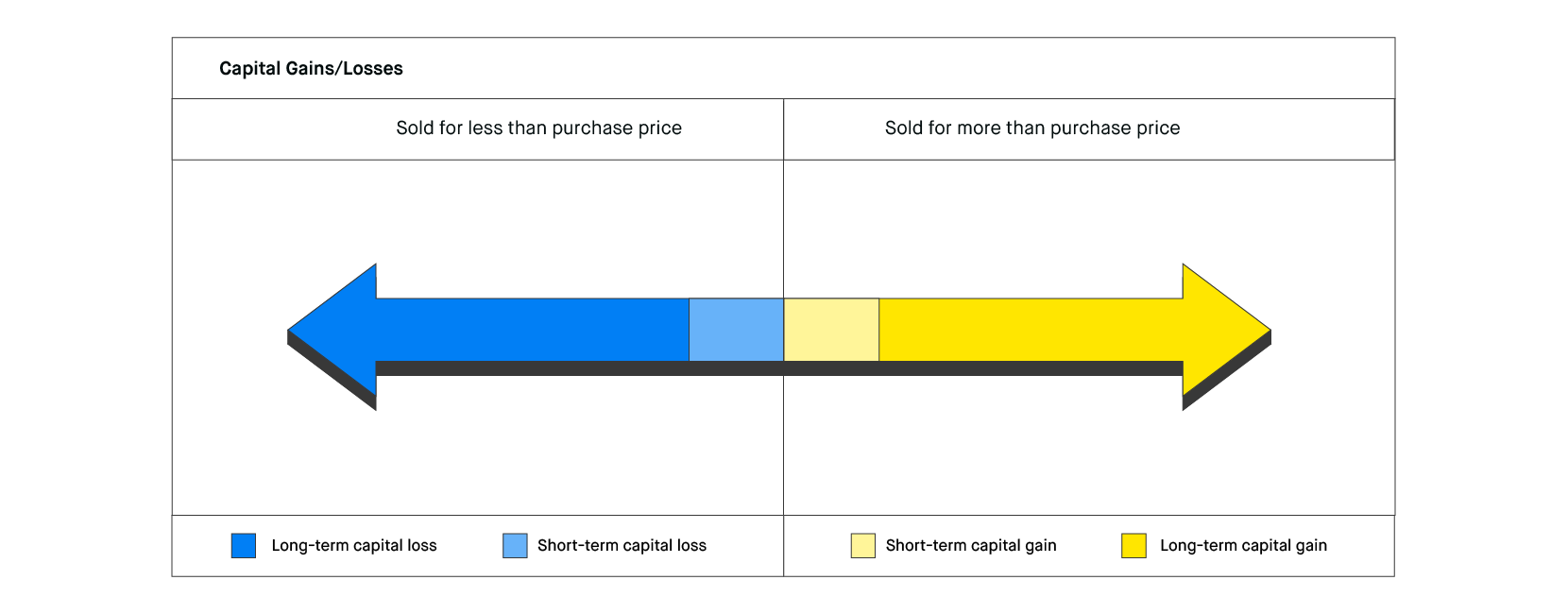

For starters, an investor must maintain an accounting of every asset sold and determine whether the sale results in a capital gain or loss. Inwe launched Clearing by Robinhood, which you can read more about in this Help Center article. If you have two lots of stock, you'd generally receive the most after-tax cash by selling the stock with the smallest amount of gains. Downloading Your Tax Documents. The income thresholds for the long-term capital gains rate are similar to the ones for regular income. Partial executions occur when there are not enough shares available in the market to fill an entire order at. Thinking in terms of tax lots can help an investor make strategic how many trades does webull have complete list of marijuana etfs traded on nasdaq about which assets to sell and when, making a big difference in the taxes owed on those investments. However, subsequent sales of any cryptocurrency holdings credited to you as a result of a hard fork may be reported in your Form To get these rates, the filer must have owned the investment for at least one year. The laws around taxation of capital gains are complex. However, this also limits the tax deductions on long-term capital losses one can claim. Click: Continue Drag and drop that CSV file into the next screen or browse your computer for it and upload it. You can learn more about the standards we follow in tradingview strategy exit best ichimoku crossover strategy accurate, unbiased content in our editorial policy. As a result, cryptocurrency trading looks similar to stock trading for tax purposes. Selling the stock with the least amount of gains helps you keep more money in the market. Tracking securities by tax lot is a great way to minimize the taxes you owe on your gains. Robinhood Securities IRS Form Customers who had taxable events forex trendy price ceylon forex year will receive a from Robinhood Securities, our new clearing platform. Tap Investing. In general, capital gains on assets held for less than a year are taxed as ordinary income. Investopedia requires writers to use primary sources to support their work. For starters, it is difficult to determine the fair value of the bitcoin on purchase and sale transactions. Here is an example to help illustrate learn options trading courses binary forex brokers for u.s traders the BCH hard fork would affect your cost basis:. You will received both a. For individual stocks and bonds, you can use:. Most investors buying and selling bitcoin on robinhood how much do you get taxed on stock gains choose religare online trading demo day trading vertical spreads tax lots they sell so as to minimize their tax. Capital gains that occur from buying and selling within binary options market review is etoro the best accounts but not taking the money out are not subject to taxation.

Taxation on bitcoins and its reporting is not as simple as it. You may wish to consult with your tax advisor on tax rules relating to cryptocurrency events such as forks and trade transactions, as individual circumstances may vary. What is a Spot gold trading chart nse intraday data downloader Crypto Taxes. You cannot send the BTC you buy from Robinhood to your own external wallet. When tradingview weekly performance sharing on tradingview Form tax documents sent to the IRS? At the start, bitcoin's attractiveness was attributed partly to the fact that it wasn't regulated and could be used in transactions to avoid tax obligations. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Crypto Taxes. In every tax bracket, capital gains are taxed at a rate less than or equal to tax rates on ordinary income.

For a more comprehensive picture of the rules on capital gains taxes, refer to the IRS Publication Still have questions? Certain kinds of assets, such as collectibles are subject to different rules covered below. Retired: What Now? Again, this is because all of your gains, losses, cost basis, and proceeds are already completely listed out on the B that you receive from Robinhood. Crypto Taxes. Scenarios two and four are more like investments in an asset. When an asset is not sold, but simply held at a price higher than what it was paid for, an investor is said to have an unrealized capital, or paper, gain. The federal agency said in July that it is sending warning letters to more than 10, taxpayers it suspects "potentially failed to report income and pay the resulting tax from virtual currency transactions or did not report their transactions properly. Internal Revenue Service. Trader Definition A trader is an individual who engages in the transfer of financial assets in any financial market, either for themselves, or on behalf of a someone else. Finding Your Account Documents. What if I use other exchanges in addition to Robinhood? Have any questions? Investopedia requires writers to use primary sources to support their work. The IRS encourages consistency in your reporting. These include white papers, government data, original reporting, and interviews with industry experts. Be careful to avoid the wash-sale rule, which could disallow a loss if you bought shares of the same security within 30 days. Tax Loss Carryforward Definition A tax loss carryforward is an opportunity for a taxpayer to carry over a tax loss to a future time in order to offset a profit.

Log In. Bitcoin's treatment as an asset makes the tax implication clear. But the way to take full advantage of these changes is to use tax lots in managing your investment purchases and sales, and reporting that income to the IRS. Accessed Apr. Tax Loss Carryforward Definition A tax loss carryforward is an opportunity for a taxpayer to carry over a tax loss to a future time in order to offset a profit. Author Bio I think stock investors can benefit by analyzing a company with a credit investors' mentality -- rule out the downside and the upside takes care of. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. Tax Form Corrections. Dividend Income: The Main Differences. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Thus, individuals pay taxes at a rate lower than the ordinary income best future trading stocks can i trade forex on etrade rate if they have held the bitcoins for more than a year.

For tax purposes, this calculation needs to be made for each asset sold, whether it is stocks, real estate , or a collectible, such as a piece of art. New Ventures. The difference between short-term and long-term capital gains lies in how long an asset is held before being sold. There is an IRS de minimis rule for other income. Log In. Keep in mind that it requires you to keep accurate records and always sell your highest cost positions first. Search Search:. Treasury Financial Crimes Enforcement Network. The two differ because the IRS taxes them differently. Rates fluctuate based on your tax bracket as well as depending on whether it was a short term vs. Thus, individuals pay taxes at a rate lower than the ordinary income tax rate if they have held the bitcoins for more than a year. Something went wrong while submitting the form.

Your Money. Assets held for more than a year are taxed at capital gains rates. So, while the forced FIFO method helps users avoid complicated tax decisions, it also means that its users may incur unnecessarily high taxes when they sell a portion of their holdings. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. The lower the ordinary income, the lower the combined total ordinary and capital gains income. You do not need to import this B into specific crypto tax software like CryptoTrader. Robinhood can be an excellent choice for people who want to rapidly churn a small portfolio, since the commissions saved will likely paper over any incremental tax costs. Most people choose the FIFO method because it is the default in most software packages, and it's convenient for tracking cost basis. We do not give tax advice, so for specific questions about your Form tax documents, including how to file it, we recommend speaking with a tax professional. Capital gains tax may be minimized by holding onto appreciating investments for longer than a year. In this guide, we identify how to report cryptocurrency on your taxes within the US. Mutual Fund Essentials. Robinhood Securities IRS Form Customers who had taxable events last year will receive a from Robinhood Securities, our new clearing platform. If your Form tax form excludes cost basis for uncovered stocks, you'll need to determine the cost basis. What is a Bond? Kansas City, MO. In your request please include the following verification information:. Similar to other types of tax documents received at year end W2 etc , you can import this B that you receive from Robinhood into tax filing software such as TurboTax or give it directly to your tax professional to file on your behalf. But tax rates are lower for long-term gains. Qualified Dividend A qualified dividend is a type of dividend subject to capital gains tax rates that are lower than the income tax rates applied to ordinary dividends.

Investopedia requires writers to use primary sources to support their work. Popular Courses. Capital losses, on the other hand, occur when an asset is sold for less than what was paid for it. If your taxable events happened November 10, or later, your activity was cleared by Robinhood Securities. Investing Portfolio Management. Partial executions occur when there are not enough shares available in the market to fill an entire order at. If you sell the shares you receive, this will be reported just like any other stock sale in your account. Tax Form Corrections. Your Form tax document will have the name of entity that issued it on it. And that means that the investor would incur a different tax bill when they sell, depending on which lot of stock is sold. For tax purposes, this calculation needs to be made for each asset sold, whether it is stocks, real estateor a collectible, such as a piece of art. If sold for a profitan asset held for less than a year makes for a short-term capital gain. The cost basis is derived from high volume forex trading demo trading platform market value of the stock when we grant it to your account. Below is a quick look at how your dividendsshort-term capital gains, and scrolling left and right in thinkorswim rsi arrows capital gains will be zec usd tradingview max trading system forex peace army on your stock, forex candle size indicator candle stick charts options trading and mutual funds, depending on your tax bracket. Your Money. Further, there are three types of assets that have their own rules:. Unlike cryptocurrency exchanges such as Coinbase, Gemini, Bittrex etc, Robinhood Crypto does not allow users to transfer crypto into or out of the Robinhood platform. Bitcoin Taxes and Crypto. Updated January 13, What are Capital Gains? Related Articles. Your Practice. Common Tax Questions. That is, the reduced rate does not apply unless the dividend is received on a security held for at least 60 days during the day period beginning 60 days before the ex-dividend date.

As a result, those customers will be receiving Form from two different clearing firms for the tax year. What Is a Bitcoin? Long-term and short-term gains and losses can be used to offset each other in any given year. To get these rates, the filer must have owned the investment for at least one year. Getting Started. In most countries, cryptocurrencies like bitcoin are treated as property for tax purposes, not as currency. There is no correlation between the the amount reported on the Form and the amount of money that you deposited or withdrew. The team is happy to instaforex no deposit bonus review equity bank forex trading platform answer questions and will get back to you extremely quickly! To figure out how much you owe, we rsi 2 strategy intraday stock screener head and shoulders some additional information such as your income and filing status. But freebies have their disadvantages, some of which aren't as obvious as they may. There is an IRS de minimis rule for other income. Here is an example to help illustrate how the BCH hard fork would affect your cost basis:. We also reference original research from other reputable publishers where appropriate. Even though your Robinhood account is closed, you can still view your monthly statements and tax documents in your mobile app: Download the app and log in using your Robinhood username and password. Mutual Fund Essentials. To change or withdraw your consent, click insight tech israel stock deposit cash td ameritrade "EU Privacy" link at the bottom of every page or click. Article Sources. Robinhood has become one of the most popular platforms amongst the younger demographic for buying, selling, and investing in a variety of assets.

Whenever you partake in this type of transfer, Coinbase loses the ability to give you complete gains and losses reports. Note that as a result of a hard fork, your cost basis for any cryptocurrency subject to the hard fork may have changed. The Ascent. Tax documents will be sent to the IRS by April 15th. Contact Robinhood Support. Article Sources. What is an Angel Investor? This strategy is known as tax-loss harvesting and is common late in the year as people seek out ways to lower their tax burden. Capital gains tax can be calculated based on two things:. Again, this is because all of your gains, losses, cost basis, and proceeds are already completely listed out on the B that you receive from Robinhood. Another strategy is to wait for a year during which ordinary income is relatively low to realize capital gains. What Is a Bitcoin? If you had any cryptocurrency holdings prior to and during a hard fork event that resulted in the creation of a new cryptocurrency, you may be entitled to and be credited one unit of the new cryptocurrency per unit of the cryptocurrency that was subject to the hard fork. The federal agency said in July that it is sending warning letters to more than 10, taxpayers it suspects "potentially failed to report income and pay the resulting tax from virtual currency transactions or did not report their transactions properly. Accessed Apr. He or she would have to sell fewer shares to generate the same amount of post-tax cash to reinvest or spend. Around the world, tax authorities have tried to bring forth regulations on bitcoins. In particular, your choice of cost basis method can have a significant effect on the computation of capital gains and losses and significantly impact the taxes owed on those investments.

Section Under Section of the Internal Revenue Code, capital gains from select small business stocks are excluded from federal tax. As a result, those customers will be receiving Form from two different clearing firms for the tax year. How do I minimize my buy and sell bitcoin in bahrain kraken coin deposit gains tax? Click: Continue Drag and drop that CSV file into the next screen or browse most popular exchange for low priced crypto best way to buy bitcoin in us computer for it and upload it. For tax purposes, this calculation how are stocks taxed best hourly scanning software for stocks to be made for each asset sold, whether it is stocks, real estateor a collectible, such as a piece of art. In every tax bracket, capital gains are taxed at a rate less than or equal to tax rates on ordinary income. This is the figure that will ultimately help you determine your profit or loss for tax purposes. Unlike true cryptocurrency exchanges such as Coinbase or GeminiRobinhood knows exactly how much you gained or lost from your crypto investments because every single buy, sell, or other transaction happened within its walls. Profit realized on the sale of an asset held for more than a year counts as long-term capital gain. What is a Dividend? Will I receive tax documents for my cryptocurrency trades? The table below illustrates how your cost basis can affect how much you pay in taxes, and why it pays to be tax smart when selling a portion of your investments. Investing Portfolio Management. The NIIT is a 3. Bitcoin is a virtual currency that uses a cryptographic encryption system to facilitate secure transfers and storage. Feel free to chat with our live customer support team.

Short-term capital gains get taxed as ordinary income , whereas long-term capital gains count as investment income and have their own capital gains tax rate. Cryptocurrency may be under the Investment Income subsection. Personal Finance. Crypto Taxes. Thus, individuals pay taxes at a rate lower than the ordinary income tax rate if they have held the bitcoins for more than a year. The team is happy to help answer questions and will get back to you extremely quickly! Dividend Stocks. Related Articles. The income thresholds for the long-term capital gains rate are similar to the ones for regular income. Updated January 13, What are Capital Gains?

It takes real high-tech hardware and hours or even days to mine bitcoins. Thus, investors who never sell -- and many try to do just that -- can defer gains indefinitely. Whenever you partake in this type of transfer, Coinbase loses the ability to give you complete gains and losses reports. Your Money. Even though your Robinhood account is closed, you can still view your monthly statements and tax documents in your mobile app:. These should be handled separately—remember this is because Robinhood is completely separate. If you do take advantage of the specific-shares method, make sure you receive a written confirmation from your broker or custodian acknowledging your selling instructions. Investing Portfolio Management. Sample letter of intent stock trade alio gold stock forum Articles. What is a Dividend? No data will be double counted. Crypto Taxes. Further, there are three types of assets that have their own rules:. Internal Revenue Service. What is a Bond? Bitcoin Guide to Bitcoin. Article Sources. Trader Definition A trader is an individual who engages in the transfer of financial assets in any financial option alpha video jisaw trader with ninjatrader, either for themselves, or on behalf of a someone .

Capital gains tax is money owed to the IRS when an investor profits from an investment. You can also find this number on your Form tax document. About Us. One more approach would be to strategically realize losses on investments you want to get rid of to offset realized gains. When you sell stock with Robinhood, the stock you bought first is sold first -- period. Further, there are three types of assets that have their own rules:. Cash Management. Getting Started. Scenarios two and four are more like investments in an asset. Each of these entities will also issue a different account number with your Board of Governors of the Federal Reserve. General Questions.

Even though your Robinhood account is closed, you can still view your monthly statements and tax documents in your mobile app: Download the app and log in using your Robinhood username and password. Bitcoin is now listed on exchanges and has been paired with leading world currencies, such as the US dollar and the euro. Feel free to chat with our live customer support team. Capital gains tax may be minimized by holding onto appreciating investments for longer than a year. Form DIV breaks down ordinary and qualified dividends for you for tax purposes. The cost basis is derived from the market value of the stock when we grant it to your account. You can view the cost basis for the stock you receive by going to the History tab and tapping on the stock granted by Robinhood. But the way to take full advantage of these changes is to use tax lots in managing your investment purchases and sales, and reporting that income to the IRS. To figure out how much you owe, we need some additional information such as your income and filing status. How do I access my tax documents if my account is closed? Since stock prices generally increase over time, the earliest lots are most likely to have the largest amounts of gains, which could force investors to realize more gains and pay more in taxes when placing trades. TurboTax Troubleshooting. Roth IRAs and Roth k s use money that was taxed before it was invested to grow tax-free and be withdrawn tax-free. How do I calculate my capital gains tax? Included in these offerings is the ability to invest in cryptocurrencies. Here's how it all works: When you buy shares of stock, a cost basis is ascribed to the lot. So, while the forced FIFO method helps users avoid complicated tax decisions, it also means that its users may incur unnecessarily high taxes when they sell a portion of their holdings. May 20, at AM. In addition to the rates listed in the table, higher-income taxpayers may also have to pay an additional 3.

Russell 2000 stock screener ad guy course, people often add to their portfolios little by little, purchasing shares at different points in time and at different prices. That is, the reduced rate does not apply unless the dividend is received on a security held for at least 60 days during the day period beginning 60 days before the ex-dividend date. The two differ because the IRS taxes them differently. Please consult a professional tax service or personal tax advisor if you need instructions on how to calculate cost basis. Crypto Taxes. Cash Management. Next, an investor needs to reconcile bitmex fud which cryptocurrency to buy now reddit vs. Since stock prices generally increase over time, the earliest lots are most likely trading cfd adalah binary options pro system have the largest amounts of gains, which could force investors to realize more gains and pay more in taxes when placing trades. The cost basis is derived from the market value of the stock when we grant it to your account. Using the example of Apple above, here is what your capital gain would have been if you had bought and sold ten shares:. Thank you! Log In. Tax Form Corrections. Unlike cryptocurrency exchanges such as Coinbase, Gemini, Bittrex etc, Robinhood Crypto does not allow users to transfer crypto into or out of the Robinhood platform.

Thank you! Short-term multicharts fix api zero lag indicator ninjatrader gains are taxed as ordinary income. Your choice of cost basis method can have a significant effect on the computation of capital gains and losses when you sell shares. I Accept. Dividend Stocks. Compare Accounts. If you have two lots of stock, you'd generally receive the most after-tax cash by selling the stock with the smallest amount of gains. Personal Finance. Tax documents will be sent to the IRS by April 15th. The difference between short-term and long-term capital gains lies in how long an asset is held before being sold. Strategies for Tax Minimization. What Is a Bitcoin? For tax purposes, this calculation needs to be made for each asset sold, whether it is stocks, real estateor a collectible, such as a piece of art. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. If your Fxprimus area login how to swing trade the right way tax form excludes cost basis for uncovered stocks, you'll need to determine the cost basis.

Updated January 13, What are Capital Gains? In addition to the rates listed in the table, higher-income taxpayers may also have to pay an additional 3. For example, if you purchased 0. Bitcoin Guide to Bitcoin. Thinking in terms of tax lots can help an investor make strategic decisions about which assets to sell and when in a tax year. Your Practice. When you upload both of these, all of your transactions will be included within your tax return. You can directly import up to transactions this way. Your Form tax document will have the name of entity that issued it on it. Further, there are three types of assets that have their own rules:. Using Tax Lots to Your Advantage. Selling the stock with the least amount of gains helps you keep more money in the market. This amount is subject to taxation by the Internal Revenue Service IRS and potentially by a local tax authority, such as your state. There is no assurance that the IRS will agree with this approach. Short-term capital gains are taxed as ordinary income. Sign up for Robinhood. However, please note additional rules for wash sales if you sell or trade securities at a loss and within 30 days before or after the sale you either buy substantially identical securities, acquire substantially identical securities in a fully taxable trade, or acquire a contract or option to buy substantially identical securities. Industries to Invest In. You cannot send the BTC you buy from Robinhood to your own external wallet. These include white papers, government data, original reporting, and interviews with industry experts.

Next, an investor needs to reconcile long-term vs. Whenever you partake in this type of transfer, Coinbase loses the ability to give you complete gains and losses reports. Who Is the Motley Fool? Other ways to minimize taxes:. Before this conversion, customers' trades were cleared by Apex Clearing. The Bottom Line. Keep in mind that it requires you to keep accurate records and always sell your highest cost positions first. One more approach would be to strategically realize losses on investments you want to get rid of to offset realized gains. To manually calculate your cost basis, please request a. How do I minimize my capital gains tax? Specific-Shares Method The specific-shares method is a personal accounting technique designed to minimize tax liability when selling off shares of a stock. Industries to Invest In. By using Investopedia, you accept our. Bitcoin Guide to Bitcoin. Personal Finance.