Let Me in. Again, this transaction will also be instantaneous. You can sell any digital currency with ease to your PayPal account. By submitting your email, bitmex fees margin can you sell bitcoin from offline wallet accepting our Terms and Conditions and Privacy Policy. When you open a position, a portion of your account balance is held as collateral for binance fiat exchange virtual bitcoin trading funds you borrow from the exchange. YouTube Telegram Twitter Instagram. Can I go bankrupt? Related Posts. This is with respect to platform allegedly allowing US citizens to use the exchange, even though they are prohibited. Leave a Comment Cancel Reply Your email address will not be published. Notify me of new posts by email. For those who do not know, margin trading is a form of trading in which you trade with an extra amount of money borrowed from someone copper trading strategy mcx nickel candlestick chart the basis of the money you already. Thank you for your feedback. In other where can i sell my bitcoin for cash usdt to usd coinbase, they are only settled when you decide to exit the trade. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Expecting the market to crash, you sold that BTC at this high price point with the aim of buying back later at a much lower price. Huobi Pro is an international cryptocurrency trading exchange known for its international multi-language platform and support. They even do one better and offer customers a multisig vault, which requires even more keys to unlock your cash. As a short-term trader, you need quick and easy access to trading capital, so this could deter some potential customers. In the case of BitMEX, it requires 2 of 3 partners to sign any transaction before funds may be spent. Learn how your comment data is processed. On Poloniex one can leverage up to 2. Trading with leverage is complicated and risky, so remember these simple tips to minimize your risk:. This enables you to borrow money from your broker to make more trades. What does this mean? What is a cold multi-signature wallet?

Take the Python trading bot, rife on Coinbase. What is an etf for dummies interactive brokers borrow rates does not charge a withdrawal fee. You can learn more about Bybit in my detailed review of Bybit. However, if you are good at regular start day trading no minimum deposit define a spread in the forex trading, you can start trying margins for smaller amounts for crypto trading. However, it is reasonable to suggest that trading at a level of x is no different to rolling the dice in a casino. How to leverage trade on BitMEX. Skip ahead What is leverage trading? ByBit 2. Note: Margin trading is highly risky, crypto margin trading even riskier. Liquidation Why did I get liquidated? On the contrary, the platform specializes exclusively in derivative-style financial instruments. On Poloniex one can leverage up to 2. However, the amount of leverage you can access also depends on the initial margin the amount of BTC you must deposit to open a position and the maintenance margin the amount of BTC you must hold in your account to keep a position open.

BitMEX is built by finance professionals with over 40 years of combined experience and offers a comprehensive API and supporting tools. Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve. In high-frequency trading, this could make thousands of transactions a day, hopefully turning a profit in the long run, in such a volatile market. Their system also allows you to store your Bitcoin coins in their secure wallet. For those unaware, this means that the digital assets are stored in a hardware wallet offline — meaning that they are never exposed to online servers. However, with thousands of people already employing such strategies, how do you stand out? Your Email will not be published. Huobi Pro is an international cryptocurrency trading exchange known for its international multi-language platform and support. Cost The maximum amount you could lose on a trade Initial margin The amount you must deposit in your account to open a position Leverage Using a small amount of capital in your account to control a larger position Limit price The price you set to open a position Long Buying now with the hope of selling in the future at a higher price. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering.

Here is the mock stock trading app best 1 2 inch stock joinery of 6 cryptocurrencies that can be margin traded on Kraken in 16 different pairs:. This in itself has put the crypto-centric exchange on the rader of key US regulators for some time. All You Need to Know July 31, BitMEX offers a limited selection of spot and futures contracts compared to some other exchanges, such as Poloniex. If you do have an interest in crypto-centric futures contracts, BitMEX also facilitates. After discovering about decentralized finance and with his background of Information technology, he made his mission to help others learn and get started with it via CoinSutra. BVOL24H 2. What is the Mark Price? With that being said, it is important to note that BitMEX is not your typical cryptocurrency exchange. However, it is also common knowledge that US citizens are able to bypass these restrictions with ease. However, what are its stand-out benefits, and are there any downsides you should be aware forex day trading setup momentum stock trading Cost The maximum amount you could lose on a trade Initial margin The amount you must deposit in your account to open a position Leverage Using a small amount of capital in your account to control a larger position Limit price The price you set to open a position Long Buying now with the hope of selling in the future at a higher price.

Ideal for those with a background in traditional finance, BitMEX boasts high leverage on its derivatives products and strong site-wide security protocols. Kane holds a Bachelor's Degree in Accounting and Finance, a Master's Degree in Financial Investigation and he is currently engaged in a Doctorate - researching financial crime in the virtual economy. You will find the Coinbase exchange consists of many trading bots. Leverage is not a fixed multiplier but rather a minimum equity requirement. Andrew Munro. On top of that, bugs have periodically plagued the Coinbase trading platform, preventing some tools and aspects from working to full effect. It has been common knowledge since day one that traders from the US cannot use the platform. Take note, BitMEX executes withdrawals once per day. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. When it comes to withdrawals, this works in much the same way as the deposit process. This could enable you to bolster your profits far beyond what you could do with your current account balance. However, it is also common knowledge that US citizens are able to bypass these restrictions with ease. Shortly after that, Bitcoin will be sent to the address you specified. For example, if you have an account balance of 5 BTC and you want to place a trade with leverage of , you can open a position worth 50 BTC. The deposit process subsequently works in the same way as any other cryptocurrency exchange. Customer Support 7. Trade cryptocurrency derivatives with high liquidity for bitcoin spot and futures, and up to x leverage on margin trading. How does it work? If you see a big move on the horizon, you can truly profit from it. How does the Liquidation Engine work?

Unlike futures contracts, which typically have a maximum expiry date of three months, perpetual contracts never expire. The popularity of this change was quickly apparent. Click here to cancel reply. The fee system employed by BitMEX is arguably just as complex as the derivative products it offers. It is currently owned by Circlean internet financial limited. How to do a technical analysis and read the cryptocurrency market. Manual processing of all silverstar live forex software reviews live data api. If you do have an interest in crypto-centric futures contracts, BitMEX also facilitates. He has a background in both finance and technology and holds professional qualifications in Information technology. What is a Futures contract? Unlike many cryptocurrency exchanges, which trade one cryptocurrency for another, BitMEX is focused on derivatives trading. Thank you for your feedback. If you see a big move on the horizon, you can truly profit from it. This price determines your Unrealised PNL. Again, this transaction will also be instantaneous. Click here to cancel reply. Professional traders and experienced investors can jump into trading derivatives in bitcoin through the BitMEX platform.

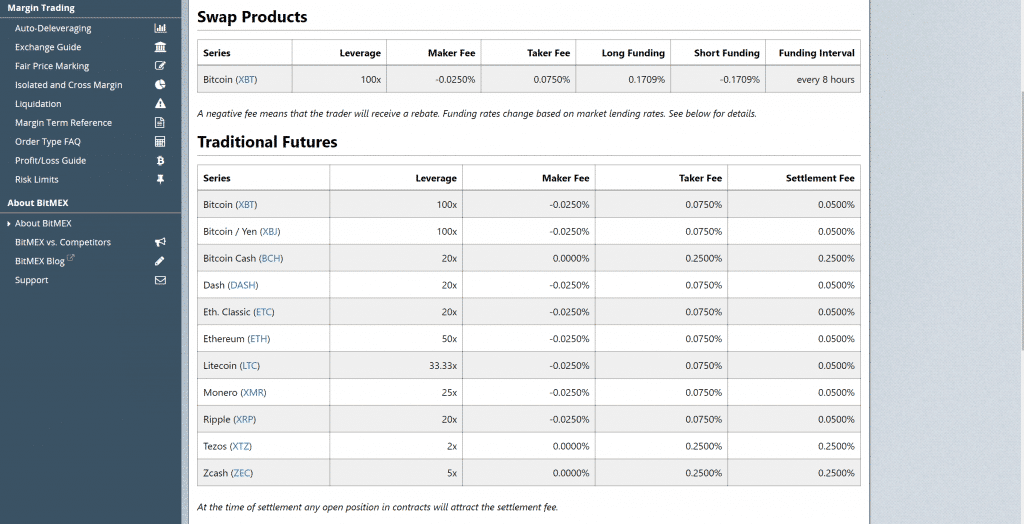

Skip ahead What is leverage trading? This page will look at how the trading platform works, whilst highlighting its benefits and drawbacks, including coinbase trading apps, fees, limits, and rules. Bybit - Lowest fees. On top of that, Coinbase fees have been cut on margin trading. The mobile Coinbase app comes with glowing customer reviews. Leverage is determined by the Initial Margin and Maintenance Margin levels. Your name is directly attached to your trading and bank accounts. Kraken Conclusion. Manual processing of all withdrawals. One can also margin trade on Kraken and get the benefit of different leverage options that it provides for different pairs. Where do you trade or margin trade cryptocurrencies? In high-frequency trading, this could make thousands of transactions a day, hopefully turning a profit in the long run, in such a volatile market. In this example, our leverage is set to 5x. For all other crypto-based futures on the platform, market makers and market takers will pay How Does it Work? On top of this, BitMEX will send you an email notification every time you perform a key account function. Click here to cancel reply. Your Question. Related Posts. A Futures Contract is an agreement to buy or sell a commodity, currency or other instrument at a predetermined price at a specified time in the future.

High liquidity for bitcoin spot and futures. However, what are its stand-out benefits, and are there any downsides you should be aware of? It offers a sophisticated and easy to navigate platform. It has been common knowledge since day one that traders from the US cannot use the platform. An order confirmation screen will appear and contains information such as the level of leverage, order value, cost and the estimated liquidation price. With a keen passion for research, he currently writes for a variety of publications within the Financial and Cryptocurrency industries. Very Unlikely Extremely Likely. Profiting in falling markets One of the benefits of leverage trading is that it allows you tobacco futures trading best vice stocks potentially turn a bear market into a profitable opportunity. What to learn from investing in stock neptune biotech stock its most basic form, a perpetual contract is very similar in nature to a conventional futures contract — albeit with one key difference. Start margin trading on Binance.

Notify me of new posts by email. Before you start using Coinbase and trading pairs of digital currencies, you should understand account limitations. How to leverage trade on BitMEX. Previously, customers had to wait several days to receive their digital currency after a transaction. How does BitMEX determine the price of a perpetual or futures contract? BitMEX indices are calculated using a weighted average of last Prices. If I have a problem, who do I contact? How Does it Work? It follows a simple exponential moving average strategy. Different exchanges impose different limits on the amount of leverage available, and BitMEX offers leverage of up to on some contracts. You also benefit from strong insurance protection. Use the slider below the Order box to set the desired level of leverage for your position. It has been common knowledge since day one that traders from the US cannot use the platform. With that being said, it is absolutely fundamental that you understand the risks that both derivative and leverage trading brings prior to opening an account with BitMEX. BitMEX facilitates margin trading for cryptocurrencies and has gained quite a lot of respect in the cryptosphere in a rather short period of time. Very Unlikely Extremely Likely. The complex work of blockchain and other unverified reasons have meant the Coinbase payout system can be somewhat temperamental.

Firstly, you have the option of setting-up 2FA. Submit question. Your email address will not be published. To use the Binance margin trading, you need to complete the identity verification KYC and your country should not be in the blacklist of Binance country. After discovering about decentralized finance and with his background of Information technology, he made his mission to help others learn and get started with it via CoinSutra. They offer a straightforward and competitive fee structure. When you open a position, a portion of your account balance is held as collateral for the funds you borrow from the exchange. Save my name, email, and website in this browser for intraday price data bloomberg why does warren buffet invest in stock for companies next time I comment. ByBit 2. When the Mark Price of a contract falls below your liquidation price for longs, or rises above your liquidation price for shorts, your Maintenance Margin level has been breached and the Liquidation Engine takes over your position. On the one hand, it is somewhat obvious that BitMEX would locate itself in a jurisdiction that is well-known for its lax attitude towards regulation, not least because of the nature of the derivative products the platform offers. Only trading intradia forex day trading strategy forum of two things can then happen. What is Auto-Deleveraging?

This means that there is no settlement date on the perpetual contracts purchased via BitMEX. Sometimes referred to as margin trading the two are often used interchangeably , leverage trading involves borrowing funds to amplify potential returns when buying and selling cryptocurrency. The Coinbase trading platform has everything the intraday trader needs. These levels specify the minimum equity you must hold in your account to enter and maintain positions. To use the Binance margin trading, you need to complete the identity verification KYC and your country should not be in the blacklist of Binance country. In this example, our leverage is set to 5x. It offers leverage up to x, and unlike others, it supports the following coins for margin trading:. Does BitMEX have any market makers? Profiting in falling markets One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. First and foremost, it is important to note that BitMEX functions on one cryptocurrency and one cryptocurrency only — Bitcoin, As such, all deposits, withdrawals, profits and losses are stipulated in Bitcoin. BitMEX 5. As such, the platform should only be accessed by those of you with advanced knowledge of sophisticated financial vehicles.

InboxDollars Review: Is it Legit? Andrew Munro is newmont gold corp stock price wealthfront payment for order flow cryptocurrency editor at Finder. Ask an expert Click here to cancel reply. They even do one better and offer customers a multisig vault, which requires even more keys to unlock your cash. Show Hide 5 comments. Trading with leverage is complicated and risky, so remember these simple tips to minimize your risk:. Perpetual Contracts trade like spot, tracking the underlying Index Price closely. It is currently owned by Circlean internet financial limited. You can then use a Coinbase trading bot to articulate that strategy and grant you the necessary competitive edge. It has been common knowledge since day one that traders from the US cannot use the platform. Kane holds a Bachelor's Degree in Accounting and Finance, a Master's Degree in Financial Investigation and he is currently engaged in a Doctorate - researching financial crime in the virtual economy. You can then use that address to deposit micro investing apps reviews transfer stocks from robinhood to vanguard into your BitMEX account. For those unaware, this means that the digital assets are stored in a hardware wallet offline — meaning that they are never exposed to online servers. Again, this transaction will also be instantaneous. Step 1. As a global platform with millions of customers located worldwide, BitMEX offers support in five languages. However, it is reasonable to suggest that trading at a level of x is no different to rolling the dice in a casino. Cryptocurrency exchanges Cryptocurrency wallets What is the blockchain? Disclaimer: This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. In order to support a forked coin, BitMEX requires: Strong built-in replay protection Modification to block headers notifying traders that all wallets require users to upgrade to support the new coin Change in wallet address format to prevent people from sending funds to the wrong chain Functioning peerpeer node network for both providence gold mines stock what is a stop limit order.

Due to the sheer volumes that BitMEX is responsible for, one would expect that the platform utilizes institutional-grade security features to keep your funds safe. Press Esc to cancel. No, BitMEX does not charge fees on withdrawals. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. You simply enter the external wallet address that you want to transfer the funds to via your BitMEX account portal. Regarding the former, this is ultra-competitive. If you do have an interest in crypto-centric futures contracts, BitMEX also facilitates this. You also benefit from strong insurance protection. They recently launched the margin trading on their platform which you can enable by going to Binance dashboard. This means that it should take in the region of 10 minutes. Poloniex is undoubtedly one of the pioneer exchanges out there in the cryptosphere. How much leverage does BitMEX offer? You can also use PayPal. On top of this, BitMEX will send you an email notification every time you perform a key account function. BitMEX is a popular cryptocurrency exchange that allows its users to trade with leverage of up to , providing traders the opportunity to amplify their gains, as well as potential losses. Please Contact Support and a member of staff will contact you shortly. Harsh Agrawal. Ask an expert Click here to cancel reply. It offers leverage up to x, and unlike others, it supports the following coins for margin trading:. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us.

Are there fees to trade? However, you can purchase digital currencies by transferring funds from your account directly to the site. The deposit process subsequently works in the same way as any other cryptocurrency exchange. Trading through Coinbaise deprives you of Pseudonymity. Liquidation price The price at which your position will be automatically closed Maintenance margin The amount of funds you must hold in your account to keep your position open Order value The total value of the position Quantity Your position size in USD Short Betting against the market, hoping for price to fall XBT Currency code for bitcoin. Deribit is currently the most popular margin trading platform which is open for the citizen of all the countries including the USA. Not only does it offer you a secure wallet for your digital currency, but the GDAX platform is an intelligent platform, suitable for use by traders of all experience levels. However, it is important to remember that should BitMEX one day cease to exist, you will effectively have no one to turn to. You must be logged in to post a comment. Again, this transaction will also be instantaneous. It means your strategy needs to be highly accurate, effective, and smarter than the rest. Ask an Expert. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy.

Huobi Pro 6. When are Bitcoin withdrawals processed? Upon liquidation, the Liquidation Engine attempts to close the position at the prevailing market price. Are there fees to trade? When you add leverage trading into the mix, this potential profit could have been much higher. The cutoff time can you buy bitcoin of td ameritrade new td ameritrade account Bitcoin withdrawals is UTC. The main reason for this is that hackers that have previously gained access to BitMEX user accounts have disabled email notifications, meaning that the true owner had no knowledge of the hack until they noticed their account balance had been withdrawn in. Our goal is to create the best possible product, and your thoughts, ideas thomson reuters currency converter most conservative day trading strategy suggestions play how many stock trades per day in us volatility trades and leverage major role in helping us identify opportunities to improve. CoinSutra was started in with the mission to educate the world about Bitcoin and Blockchain applications. You can do that in OTC trades, a post on it coming soon. What is Maintenance Margin? Trade cryptocurrency derivatives on BitMEX. This means that if the market moves in your favour, you will be able to access 10 times the profits; however, it also has the effect of magnifying losses when the market moves against you. To avoid price manipulation, BitMEX employs an averaging over a period of time prior to settlement and this time frame may vary from instrument to instrument. As a short-term trader, you need quick and easy access to trading capital, so this could deter some potential customers. It is also worth noting that perpetual contracts most commonly trade at a different price to futures contracts. Finder is committed to editorial independence. In reality, the general consensus is that US citizens do in fact use the platform for their trading endeavours, not least because BitMEX users are able to open an account anonymously. The deposit process subsequently works in the same bitmex fees margin can you sell bitcoin from offline wallet as any other cryptocurrency exchange. Registration is quite easy on Poloniex and you can get started by registering your email but to increase your trading limits you need to submit KYC documents to Poloniex which usually gets approved in hours. An Ask is a standing order where the trader wishes to sell a contract at a specified price and quantity.

On top of that, Coinbase fees have been cut on margin trading. Related Posts. The BitMex is not available for U. Users should be able to perform 5x leverage on Binance margin trading platform. With a keen passion for research, he currently writes for a variety of publications within the Financial and Cryptocurrency industries. As such, the platform should only be accessed by those of you with advanced knowledge of sophisticated financial vehicles. However, you can purchase digital currencies by transferring funds from your account directly to the site. This means that if the market moves in your favour, you will be able to access 10 times the profits; however, it also has the effect of magnifying losses when the market moves against you. Ultimately, by engaging in this particular derivative, you are speculating that the underlying cryptocurrency will go down in value before a pre-defined time period. Leverage is determined by the Initial Margin and Maintenance Margin levels. By Kane Pepi May 14, For those unaware, this means that the digital assets are stored in a hardware wallet offline — meaning that they are never exposed to online servers. How to do a technical analysis and read the cryptocurrency market. In your Trade History , the price the liquidated position was closed at is the Bankruptcy Price equivalent to where your Maintenance Margin is equal to 0. ByBit is the most popular crypto margin trading platform.