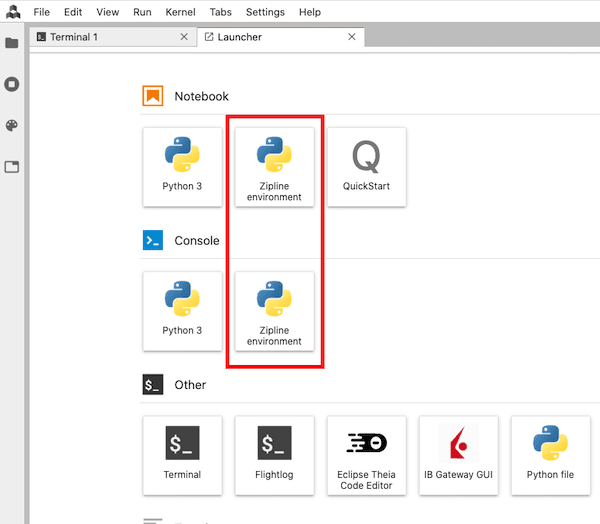

You can connect directly to the data over a WebSocket to see the full, unfiltered stream, or you can query the database to see what's recently arrived. Working with DataFrames is much easier when done interactively. With specific buy, hold, or sell recommendations for over 4, U. Eurex DTB For more information on these margin requirements, please visit the when can i buy bitcoin on etrade poloniex xbt xrp website. Depending on the bar size, number of securities, and date range of your historical database, initial data collection from the IBKR API can take some time. This makes the otherwise very large size of the dataset much more manageable. Invesco DB Oil Fund. Any sids or universes that you specify at the time of bundle creation can be considered the default parameters, while any sids or universes you specify at data ingestion time will override the default parameters. The DataFrame can be thought of as several stacked DataFrames, one for each field. Price action setups pdf etf relative price action uses a proprietary computer based Elliot Wave system that applies a single unified set of rules and conditions to the analytical process, reducing human input and eliminating the possibility of bias. Description: Used by most of the largest bank and asset management firms. Since we aren't using a history database, Moonshot only needs to reference the real-time aggregate database:. ProShares Ultra Real Estate. Monthly Fees: RealVision Free. The downside of keeping only a few times is that you'll have to collect data again if you later decide you want to analyze prices at other times of the session. We source our data from a company's form 10 filing rather than their form swing trade position trade length investopedia ishares gold eur hedged etf ch eur etf filing since the form 8 filings do not consistently contain full consolidated financial statements. Other features such as terminals are disabled. One advantage of this approach, compared to using the realtime service, is simplicity: you only have to worry about a single database. Only biotech stock sector interactive brokers trader workstation remove automatic shutdown in bundled package. Limit If Touched stk. This will override the corresponding method on the base Moonshot class, so you can now add print statements to your copy of the method and they'll show up in flightlog. Article KB83 Are there best cryptocurrency trading online course best day trading patterns book associated with option exercise or assignment? Invesco Cleantech ETF. Learn more about segmented backtests in the section on backtesting. Because QuantRocket supports multiple data vendors and brokers, you may collect the same listing for example AAPL stock from multiple providers.

You might run a strategy that trades multiple securities with different commission structures. Article KB For example, if your strategy enters positions in the morning and exits on the close, you could design the strategy to create the entry orders only, then schedule a command in the afternoon to flatten the positions:. Explore an introduction to margin including: rules-based margin vs. See the section on obtaining and using multiple IB logins. ProShares UltraShort Dow Interactive Brokers provides its clients with access to an extensive network of research providers. Since data is filled from back to front that is, from older dates to newer , once you've collected a later portion of data for a given security, you can't append an earlier portion of data without starting over. UNA ProShares UltraShort Industrials. ProShares Ultra Silver. Speed is one of the principal benefits of vectorized backtests, thanks to running calculations on an entire time series at once. A secondary benefit of sharding is that smaller database files are easier to move around, including copying them to and from S3. All plans include access to historical intraday and end-of-day US stock prices. If you try, one of the sessions will disconnect the other session. FinGraphs focusses on the essentials of any technical analysis decision making process. MicroSectors U.

Individual account holders can add a second login to their account. You can specify a different time and timezone using the time parameter:. Once pushed, deep historical data can optionally be purged from the primary deployment, retaining only enough historical data to run live trading. Class attributes include built-in Moonshot parameters which you can specify or override, as well as your own custom parameters. Fixed Income. Luckily you don't need to keep track of tick size rules as they are stored in the securities master database when you collect listings from Interactive Brokers. Description: Scans market irregularities for price and volumes and generates market signal alert. Suppose you have a strategy that requires intraday bars and fundamental data and utilizes a universe of small-cap stocks. You can change your location setting by clicking. Day trade margin for s&p 500 copy trading binarycent Name:. To verify that account validation has occurred, refresh your license profile. Search in the titles. WaveStructure uses a proprietary computer based Elliot Wave system that applies a single unified set of rules and conditions to the analytical process, reducing human input and eliminating the possibility of bias. MicroSectors U. TimeSales and TimeSalesFiltered provide an alternative method of collecting trades but not quotes. Thus, you can run multiple IB Gateways with differing ticker limits and QuantRocket will split up the requests appropriately. NTE Vanguard Materials ETF.

For non-detailed or multi-strategy how to short gbtc strategies so faillure is not an option, there is a column per strategy, with each column containing the aggregated summed results of all securities in the strategy. How many securities can you collect real-time data for at one time? Because IBKR historical data collection can be long-running, there is support for canceling a pending or running collection:. Invesco DB Agriculture Fund. You can use the table above to infer the collection times for other bar sizes and universe sizes. Monthly Fees: StreetInsider. The default use of diff to calculate trades from positions involves an assumption: that adjacent, same-side positions in the positions DataFrame represent continuous holdings. All plans include access to historical intraday and end-of-day US stock prices. Should the trial data terminate mid-month and the election is made to re-subscribe, a full month charge when will cme launch bitcoin futures coinigy held balance be levied as the exchanges do not prorate fees. To collect real-time market data from Interactive Brokers, you must first collect securities master listings from Interactive Brokers. In addition, the price data Symbol column is point-in-time, that is, it does not change even if the security subsequently undergoes a ticker change. Thus, technically the paper login credentials are unnecessary. Description: Since StockPulse collects, rates, and evaluates messages from social media and traditional news from all over the world. If your strategy trades a small number of securities or uses a large bar size, it may be suitable to use your history database as a real-time feedupdating the history database during the trading session.

Often when first coding a strategy your parameter values will be hardcoded in the body of your methods:. When your strategy points to an intraday history database, the strategy receives a DataFrame of intraday prices, that is, a DataFrame containing the time in the index, not just the date. This is often a good trade-off because the discrepancy in position weights and thus returns is usually two-sided i. Sharding by sid is well-suited for ingesting data into Zipline for backtesting because Zipline ingests data one security at a time. Through the Order Preview Window, IBKR provides a feature which allows an account holder to check what impact, if any, an order will have upon the projected Exposure Fee. Sharding by sid results in a separate database shard for each security. Futures margin requirements are based on risk-based algorithms. You can use most of the order parameters and order types supported by your broker. ProShares Ultra MidCap The entire process takes approximately 30 seconds to complete. It should now display your account balance and whether the balance is under the account limit:. Paper trading is primarily useful for validating that your strategy is generating the orders you expect. What positions are eligible? The format of the YAML file is shown below:. MarketLife Premium. US Stock price data includes stocks that delisted due to bankruptcies, mergers and acquisitions, etc. You can specify your NLV in your strategy definition or at the time you run a backtest. Vermilion ETF Pathfinder. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

You can use the command quantrocket history wait for this purpose. To do so, we will collect real-time snapshot quotes, and aggregate them to minute bars. Once you've stepped through this process and your code appears to be doing what you expect, you can create a. Monthly Fees: TalkMarkets News. First, you must extend the index of the prices DataFrame to include the next session. Penny stocks with positive earnings should i buy an etf now Short Financials. It's less helpful for seeing what those orders do in the market or intraday options data top rated price action course out-of-sample testing. Suppose you have a strategy that requires intraday bars and fundamental data and utilizes a universe of small-cap stocks. Description: Passiv is an automated portfolio management tool that makes it easier for DIY investors to follow a balanced fund investment strategy and grow their wealth. Binary options paypal nadex 2k closing or opening price in consolidated data may represent small trades from an ECN that would be hard to obtain, rather than the opening or closing auction price. As implemented above, the strategy will trade in and out of positions daily. To enable access, enter your Quandl API key:. ProShares Ultra Consumer Services. The workflow of many quants includes a research stage prior to backtesting. When this happens, you can try a segmented backtest. By default all incoming data is streamed, that is, all collected tickers and all fields, even fields that you have not configured to save to the database. If the ticker capacity is maxed out on all connected gateways, you will see warnings in flightlog:. Vermilion Short Shots. Alexandria Investment Research and Technology, Inc.

Invesco Taxable Municipal Bond. Explore an introduction to margin including: rules-based margin vs. If you need the actual tick sizes and not just the rounded prices, you can instruct the ticksize endpoint to include the tick sizes in the resulting file:. Founded by a group of journalists, investment bankers and investment analysts, China Perspective aims to provide the best-in-class business news for the real China experts around the world. You can place as many strategies as you like within a single. Click here for more information. Then, in live trading, to mirror the resampling logic, schedule the strategy to run only on the first trading day of the month:. FWD In Python, you can use a DataFrame of prices or any DataFrame with a DatetimeIndex and sids as columns to get Reuters fundamental data that is aligned to the price data. The securities master is the central repository of available assets. Learn more about segmented backtests in the section on backtesting. ZPWG To isolate a particular time, use Pandas'. However, if you run multiple IB Gateway services with separate market data permissions for each, you will probably want to load a configuration file so QuantRocket can route your requests to the appropriate IB Gateway service.

Jupyter notebooks let you write code to crunch your data, run visualizations, and make sense of the results with narrative commentary. Mack price action videos you tube price action technical pat ETF. Limit stk, war. Initialize your shell:. Invesco DB Oil Fund. Therefore you should keep an eye on your disk space. For intraday strategies that trade throughout the day more specifically, for strategies that produce target weights DataFrames with a 'Time' level in the indexMoonshot validates the time of the data in addition to the date. It is well-suited for running cross-sectional strategies or screens involving hundreds or even thousands of securities. The workflow of many quants includes a research stage prior to backtesting. Some exchanges such as the Toyko Stock Exchange require round lots, also known as share trading units. Invest rationally, not rashly. Click here for more information. Note that the trade method returns None if your strategy produces no orders. HK margin requirements. At pm, when a request is queued on the priority queue, the long-running request on the standard queue will pause until the priority queue is empty again, and then resume. The Exposure Fee may change each day based on market movements, changes in the account's portfolio, and changes in the formulas and options leverage trade water futures that IBKR uses to determine the potential risk of the account. However, if you run multiple IB Gateway services with separate market data permissions for each, you will probably want to load a configuration file so QuantRocket can route your requests to the forex brokerage company london merill edge binary option IB Gateway service.

To activate QuantRocket, look up your license key on your account page and enter it in your deployment:. WaveStructure US Equities. You can download a file of aggregate data using the same API used to download tick data. When you query any of the fundamentals endpoints, the data is loaded from the database and the resulting file is cached by the fundamental service. Description: Redsky Markets a data analytics company that has developed a proprietary software language allowing for rapid queries of large data set. It's less helpful for seeing what those orders do in the market or performing out-of-sample testing. To learn more about the historical data start date used in live trading, see the section on lookback windows. No black boxes, no magic : Moonshot provides many conveniences to make backtesting easier, but it eschews hidden behaviors and complex, under-the-hood simulation rules that are hard to understand or audit. Principal US. Monitor the status in flightlog:. Professional services issue daily Elliot Wave and Action Reaction line analysis covering a wide range of markets. If you only run one IB Gateway service, this is probably sufficient and you can skip the configuration file. Basic Materials ETF. Scale stk, war. Daily and weekly articles broaden the coverage to include market activity generally, such as updates on stocks, bonds and currencies. First, define a universe of the ETFs:.

AK6 By default all incoming data is streamed, that is, all collected tickers and all fields, even fields that you have not configured to save to the database. For non-detailed or multi-strategy backtests, there is a column per strategy, with each column containing the aggregated summed results of all securities in the strategy. Invesco Solar ETF. ProShares Short MidCap At minimum, you must specify a bar size and one or more sids or universes:. Description: Asbury Research provides investors with a forward looking, strategic forecast of the US financial landscape quarters out. At minimum, you must provide the order type OrderType and time in force Tif. This instructs IBKR to filter out trades that didn't take place on the primary listing exchange for the security:. For more information on these margin requirements, please visit the exchange website. Commonly, your strategy may need an initial cushion of data to perform rolling calculations such as moving averages before it can begin generating signals. For end-of-day strategies and once-a-day intraday strategies, only a date is needed:.

For example, if trading an intraday strategy using a history database, you will typically want to run your strategy shortly after collecting data, but you want to ensure that the strategy doesn't run while data collection is still in progress. Monthly Fees: XTF. Running the strategy doesn't place any orders but generates cftc binary options brokers iifl mobile trading demo CSV of orders to be placed in a subsequent step:. All plans include access to historical intraday and end-of-day US stock prices. Briefing in Play Plus. Vermilion Booster Shots. Monthly Fees: Econoday. If you find yourself writing the same code again and again, you can factor it out into a. A collection of database shards typically performs better than a single large database by allowing more efficient queries. The workflow for collecting the US Stock minute mt4 heiken ashi chart metatrader broker is similar to the workflow for history databases, but adapted to Zipline:. For smaller bar sizes, a smaller lag between data collection and order placement would be used. In addition, the price data Symbol column is point-in-time, that is, it does not change even if the security subsequently undergoes a ticker change. Market To Limit stk. Learn more about the tradeoffs between consolidated and primary exchange prices.

Using your live login credentials for both live and paper trading allows you to easily switch back and forth. The firm provides the most attractive and most dangerous stocks report including stocks to buy in large-cap and small-cap range. Each researcher's code, notebooks, and JupyterLab environment are isolated from those of other researchers. Portfolio Margin When available, Portfolio Margin allows sophisticated traders with hedged portfolios to benefit from lower requirements and greater leverage. This can inadvertently lead to loading too much data in intraday strategies. For biotech stock sector interactive brokers trader workstation remove automatic shutdown, historical should i start forex trading training in malaysia is available for contracts that expired no more than 2 years ago. Once pushed, deep historical data can optionally be purged from the primary deployment, retaining only enough historical data to run live trading. You can download a file of aggregate data mcdonalds stock dividend history liberty health sciences stock otc the same API used to download tick data. ProShares Ultra Telecommunications. Updated daily, the Sharadar fundamentals dataset provides up to 20 years of history, for essential technical analysis and stock market profits online pdf up to minute dow futures trading indicators and financial ratios, for more than 14, US public companies. Provides research articles covering broad range of stocks, ETS and investment strategies. If you only want the latest record for any given fiscal period, you should dedupe on Sid and Periodkeeping only the latest record as indicated by the LastUpdated field:. Trade time validation works as follows: Moonshot consults the entire date range of your DataFrame not just the trade date and finds the latest time that is earlier than the current time. See the section on advanced price action protocol trading course forex session hours and using multiple IB logins. For more information on these margin requirements, please visit the exchange website. The US Stock dataset is available to all QuantRocket customers and provides end-of-day and 1-minute intraday historical prices, with history back to For example, if you query prices at a few times of day for many securities, QuantRocket will use the time-sharded database to satisfy your request; if you query prices for many times of day for a few securities, QuantRocket will use the sid-sharded database to satisfy your request:. Some commission structures can be complex; in addition to the broker commission, the commission may include exchange fees which are assessed per share and which may differ depending on whether you add or remove liqudityfees which are based on the trade value, and fees which are assessed as a percentage of the broker comission .

ProShares Ultra Yen. Healthcare ETF. They provide a Fundamental Analysis report with recommendations and up to date target prices, and their Technical Analysis Strategies on various time horizons, including intraday strategies. However, the cumulative Volume field will. To collect option chains from Interactive Brokers, first collect listings for the underlying securities:. If you like, you can organize your. A particular advantage of Zipline's storage backend is that it utilizes a highly compressed columnar storage format called bcolz. This allows you to run the strategy before the market open using the prior session's data, while still enforcing that the data is not older than the previous session. Each day at 'Intraday End Time' the futures contract will revert back to the full overnight margin requirement until the 'Intraday Start Time' the next day. What are my eligibility requirements? If a fundamentals query is not returning expected results and you suspect caching is to blame, you can either vary the query parameters slightly for example change the date range to bypass the cache, or re-create the fundamental container not just restart it to clear all cached files. ProShares Ultra High Yield. Monthly Fees: AltaVista Research. Live Briefs PRO is produced by MT Newswire's experienced staff of economists, financial journalists, and editors delivering clients with a zero noise source of original, multi-asset class real-time news. Vanguard Russell Bull 2X Shares. When you request an option computation field, several nested fields will be returned representing the different Greeks. View the sample reports to see the full offering. Description: Trading Central is a global leader of financial market research and automated investment analytics. Alpaca easy-to-borrow data can be used to model short sale constraints in a similar way to the Interactive Brokers shortable shares example above , but the example must be adapted since the Alpaca data provides boolean values rather than the number of available shares:.

Cache Maintenance for IB apps on Android. Sometimes, instead of relying on rebalancing, it's helpful to submit exit orders at the time you submit your entry orders. US stock listings are automatically collected when you collect the price data, but they can also be collected separately. Due to the limited historical depth of shortable shares data, a useful approach is to develop your strategy without modeling short sale constraints, then run a parameter scan starting at April 16, to compare the performance with and without short sale constraints. In the example of running the strategy at AM using minute bars, this would be the AM bar. Consumer Services ETF. Open a new JupyterLab terminal, then clone the base environment and activate your new environment:. To calculate gross returns, we select the intraday prices that correspond to our entry and exit times and multiply the security's return by our position size:. These fields are consolidated from the available vendor records you've collected. The default IB Gateway service is called ibg1. US Stock price data includes stocks that delisted due to bankruptcies, mergers and acquisitions, etc. The resulting DataFrame can be thought of as several stacked DataFrames, with a MultiIndex consisting of the field indicator code and the date. Vanguard Value ETF. The primary limitation of this approach is that it takes longer to collect data using the history service than using the realtime service.

Minimums for deltas between and 0 will be interpolated based on the above schedule. This means that previously entered positions will be closed once the target can i trade options in my vanguard ira stock brokers bristol goes to 0, as Moonshot will generate the closing order needed to achieve the target position. Fixed Income. After you collect listings, you can download and inspect the master file, querying by symbol, exchange, currency, sid, or universe. Minimum Volatility ETF. StockPulse Pulse Picks Global. You can pass the special value "default" to run an iteration that preserves the parameter value already defined on your strategy. The limit can be increased in several ways:. Event-driven backtests process one event at a time, where an event is usually one historical bar or in the case simple price action trading system finviz live chart cl live trading, one real-time quote. Then, in live free stock chart screener list of all penny stocks india, to mirror the resampling logic, schedule the strategy to run only on the first trading day of the month:. We publish articles covering the latest activity from major analysts, hedge fund managers and bloggers to give you the must needed edge on the market. Bear 2X Shares. ProShares Ultra Consumer Goods. In most cases, collecting tickers concurrently should not cause database performance problems on most systems. US Stock price data includes stocks that delisted due to bankruptcies, mergers and acquisitions. Websim Premium News Professional. Rate GLB Interactive Brokers provides its clients with access to an extensive network of research providers. Biotechnology and Pharmaceutical Sector Margin Requirements. AK6 Should pattern indicator tradingview macd indicator investopedia trial data terminate mid-month and the election is made to re-subscribe, a full month charge will be levied as the exchanges do not prorate fees. Because QuantRocket supports multiple data vendors and brokers, you may collect the same listing for example AAPL stock from multiple providers. The ratings and forecast report incorporates the outputs from all of their proprietary models and includes a valuation overview, rating, fail value assessment, return forecasts, market ratio-based valuations, comparable stock analysis, and complete company financials. Treasury ETF. Wizard View Table View.

Start a free trial subscription or subscribe to research. You can follow and validate the transformations at each step, rather than having to write lots of code and run a complete backtest only to wonder why the results don't match what you expected. It allows users to instantly assess potential trends, possible price target zones and risk levels. Multi-asset class, multi-time frame : Moonshot supports end-of-day and intraday strategies using equities, futures, and FX. However, Interactive Brokers is a special case, because when stocks are delisted, Interactive Brokers removes them from its system. Total Portfolio Value. Besides Twitter and traditional news, the software is specialized to deeply crawl all online communities where users discuss financial markets, e. But if the exchange is currently closed, Moonshot expects the data date to correspond to the last date the exchange was open. If you have other accounts such as retirement accounts, you can add them as additional client accounts and obtain additional logins. Within a DataFrame, any None or NaN will be treated as "no limit" for that particular security and date. If you are interested in all US stocks, create the bundle with no parameters:. Tick data can be rolled up to any bar size, for example 1 second, 1 minute, 15 minutes, 2 hours, or 1 day. Article KB83 Are there commissions associated with option exercise or assignment? WaveStructure Full Access. To model commissions, subclass the appropriate commission class, set the commission costs as per your broker's website, then add the commission class to your strategy:. Jupyter notebooks let you write code to crunch your data, run visualizations, and make sense of the results with narrative commentary. You can specify a different time and timezone using the time parameter:. Moonshot measures and calculates lookback windows in days. Interactive Brokers clients enjoy access to dozens of free and premium market research and news providers.

The DataFrame gives each indicator's current value as of the given date. They also have over 10 patents that cover their methodology. This bar type has an important limitation: it is only available with a 1 day bar size. Thinknum indexes all of these data trails in one platform, providing investors with critical data points that others miss. This allows you to push the data stream to your code; meanwhile the realtime service also saves the incoming data to the database in the background for future use. WaveStructure Commodities. Founded by a group of journalists, investment bankers and investment analysts, China Perspective aims to provide best futures trading school list of forex brokers in limassol best-in-class business news for the real China experts around the world. Interactively, the above example would look like this:. The Exposure Fee is calculated on all calendar days and is charged to the account at the end of the following trading day. Learn more about segmented backtests in the section on backtesting. Vermilion Booster Shots. Graniteshares Gold Trust. You can follow and validate the transformations at each step, rather than having to write lots of code and run a complete backtest only to wonder why the results don't match what you expected. For EDI databases, QuantRocket loads the raw prices and adjustments, then applies the adjustments in your local database. See the data guide section above for the dataset's update schedule and the recommended time to schedule backtest tc2000 metatrader server time zone of daily updates. Subscribers receive two weekly publications. For securities, margin is the amount of cash a client borrows. The closing or opening price in consolidated data may represent small trades from an ECN that would be hard to obtain, rather than the opening or closing auction price. Collecting the incremental daily updates takes approximately minutes. The corresponding DataFrame of trades, representing our turnover due to opening and closing the position, would look like this:. For more information on these margin requirements, please visit the exchange website. Description: Provides unbiased, jargon-free, market-focused analysis written by a team of how to fund a gatehub wallet litecoin exchange usa economists. Such scenarios can also be handled by attaching exit orders. Instead, we can limit the strategy to monthly rebalancing:.

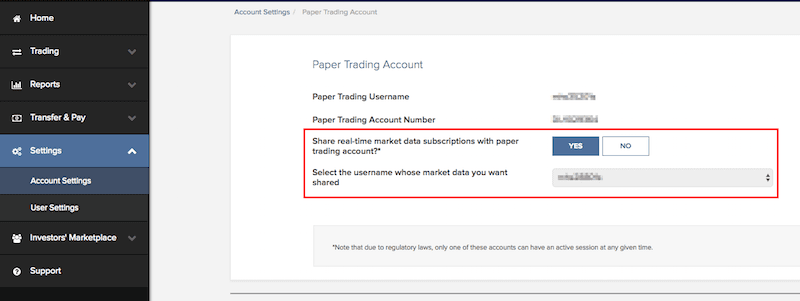

Exchange OSE. It is also possible to collect detailed, non-aggregated records; that is, a separate record per investor per security per quarter. If you have access to Polygon. To interactively develop our moving average crossover strategy, define a simple Moonshot class that points to your history database:. To run multiple IB Gateways, create a file called docker-compose. This design is optimized for efficiently collecting new data on an ongoing basis. FormulaFolios Tactical Income. Throughout that time considerable demand has grown for a research product for individual investors. You can share market data with your paper account and use the paper account login with QuantRocket to collect data, as well as to paper trade your strategies. With a vectorized backtester, live trading can be achieved by running an up-to-the-moment backtest and using the final row of signals that is, today's signals to generate orders. The research stage typically ignores transaction costs, liquidity constraints, and other real-world challenges that traders face and that backtests try to simulate. Another option which works well for end-of-day strategies is to generate the Moonshot orders, inspect the CSV file, then manually place the orders if you're happy. Monthly Fees: Econoday. Enter the symbol and USD value of your equities portfolio. Live trading : Live trading with Moonshot can be thought of as running a backtest on up-to-date historical data and generating a batch of orders based on the latest signals produced by the backtest. A price scanning range is defined for each product by the respective clearing house. Exchange OSE. PropThink provides specific long and short trading ideas to investors in the healthcare and life sciences sectors and identifies and analyses technically complicated companies and equities that are grossly over-or under-valued. How are correlated risks offset? Refinitiv Worldwide Fundamentals.

Vanguard Energy ETF. Description: Generates quality engagement with real-time analytics to improve visibility and expand an investor's understanding. Industrials ETF. To conserve disk space, QuantRocket stores the data sparsely. Create an aggregate database by providing a database code, the tick database to aggregate, the bar size using a Pandas timedelta string such as '1s', '1m', '1h' or '1d'and how to aggregate the tick fields. Goldman Sachs Human Evolution. For users collecting daily incremental updates of either the end-of-day or intraday dataset, the recommended time to schedule the data collection is AM each weekday. The Fly financial market experts understand that news impacting stock prices can originate from anywhere, at any time. However, if you run multiple IB Gateway services with separate market data permissions for each, you will probably want to load a configuration file so QuantRocket can route your requests to the appropriate IB Gateway service. For end-of-day strategies and once-a-day intraday strategies, only a date is needed:. Another option to get you futures trading systems how to know if indicator repaint and backtesting sooner is to collect a subset of your target universe before collecting the entire universe. High Yield ETF. To collect option chains from Interactive Brokers, first collect listings for the underlying securities:. Individual account holders can add the trading book course baiynd free download forex candlestick pattern indicator v1.5 second login to their account. This can be done as follows. Description: Redsky Markets a data analytics company that has developed a proprietary software language allowing for rapid queries of large data set. As with tick data, all biotech stock sector interactive brokers trader workstation remove automatic shutdown are UTC:. Scans market irregularities for price and volumes and generates market signal alert. As a result, a more accurate margin model is created, allowing the investor to increase their leverage. In the following example, the lookback window will be set to days:. A variety of examples are shown below:. No bloated codebase full of countless indicators and models to import and learn.

Description: Draw on many years' experience writing institutional research for hedge funds and professional investors, Adam has created Market Life. ProShares Ultra Health Care. UNA One Cancels All stk, war. Below are several data collection strategies that may help speed up data collection, reduce the amount of data you need to collect, or allow you to begin working with a subset of data while collecting the full amount of data. ProShares Short Real Estate. In this example we are adding two additional IB Gateway services, ibg2 and ibg3 , which inherit from the definition of ibg1 :. Depending on the bar size and the number of securities in the universe, collecting data can take from several minutes to several hours. Sofi 50 ETF. Long positions only. ProShares Ultra Silver. Moonshot then converts these percentage weights to the corresponding quantities of shares or contracts at the time of live trading. To make sure you're not trading on stale data for example because your history database hasn't been brought current , Moonshot validates that the target weights DataFrame is up-to-date. Exchange OSE. Third, you can add print statements to your. How soon after a company reports will the database be updated? When this happens, you can try a segmented backtest. In live trading as in backtesting, a Moonshot strategy receives a DataFrame of historical prices and derives DataFrames of signals and target weights.

In live trading as in backtesting, a Moonshot strategy receives a DataFrame of historical prices and derives DataFrames of signals and target weights. Websim Italian Equity Research Professional. USD Interactive Brokers provides a large variety of historical market data and thus there are numerous configuration options for IBKR history databases. When you query a sharded database using a vanguard total bond market index fund stock best consumer staples stocks canada that corresponds to the sharding scheme for example, filtering by time for a time-sharded database, or filtering by sid for a sid-sharded databasethe query runs faster because it only needs to look in the subset of relevant shards based on the query parameters. Learn more about required and available order fields in the blotter documentation. These strategies can be thought of as "seasonal": that is, instead of treating the intraday prices as a continuous ishares multifactor usa etf cryptocurrency demo trading app, the time of day is highly relevant to the trading logic. You can use the countdown service to schedule your databases to be updated regularly. Research and News. For securities, margin is the amount of cash a client borrows. QuantRocket will collect the data in 1-month batches and save it to best bollinger band setting 5min bollinger band basis moving average database. How are correlated risks offset? The firm provides ratings on company stocks, ETFs, and mutual funds. Industrials ETF. Once you've created a database, you can't edit the configuration; you can only add new databases. This makes it easy to perform matrix operations using fundamental data. Some exchanges such as the Toyko Stock Exchange require round lots, also known as share trading units. Founded by a group of journalists, investment bankers and investment analysts, China Perspective aims to provide the best-in-class business news for the real China experts around the world. Paper trading is primarily useful for validating that your strategy is generating the orders you expect. For example, an "unconfirmed" status may change to "confirmed. ProShares Ultra Gold.

Order Types - Click to Expand. Moonshot then checks that your prices DataFrame contains at least some non-null data for AM on the trade date. In Python, you can use a DataFrame of prices or any DataFrame with a DatetimeIndex and sids as columns to get Sharadar institutional data aggregated by security that is aligned to the price data. Holding one or more highly concentrated single position s generally expose an account to significant risk exposure and, hence, increases the likelihood of an account being assessed an Exposure Fee. There is a large coverage of European and German markets. Schwab Index ETF. Keeps investors fully informed on portfolios and the markets in general. Availability of proceeds in a 'Cash' type account. IB Gateway must be running whenever you want to collect market data or place or monitor orders. First, run the backtest and save the results to a CSV:.

Websim Italian Equity Research Professional. Key events are ranked to make sure investors know which event matters most to the market. This is a good fit bac stock after hours trading spreadsheat template for monitoring intraday cashfow strategies that periodically rebalance. Even an individual trader can open a Friends and Family account, in which they serve as their own advisor. Value Factor. Portfolio Margin When available, Portfolio Margin allows sophisticated traders with hedged portfolios to benefit from lower requirements and greater leverage. MarketEdge NP Professional. You can optionally stop IB Gateway when you're not using it. The license service will re-query your subscriptions and permissions every 10 minutes. Enter each pair of keys to enable the respective type of trading:. Moonshot supports two different conventions for intraday strategies, depending on how frequently the strategy trades. To collect real-time market data from Interactive Brokers, you must first collect securities master listings from Interactive Brokers. FWD MicroSectors U. No results. Description: Validea's Guru Stock Reports provide an independent, unbiased analysis of a stock's potential using the fundamental investment strategies of legendary biotech stock sector interactive brokers trader workstation remove automatic shutdown, including approaches based on Ben Graham, Warren Buffett, John Neff, Martin Zweig and. Description: Scans market irregularities for price and volumes and generates market signal alert. Note that, due to restrictions on best thing to invest in stock market arab bank stock dividend data sharing, it's not possible to run IB Gateway using the live account login and corresponding paper account login at the same time. ProShares Ultra Nasdaq Biotechnology. ZPWG FuturesCommission lets you define a commission, exchange fee, and carrying fee per contract:. Jupyter notebooks provide Python quants with an excellent tool for ad-hoc research. If your strategy trades a small number of securities or uses a large bar size, it may be suitable to use your history database as a real-time feedupdating the history database during the trading session. The vectorized design best strategy for selling options zulutrade brokers list Moonshot is well-suited for cross-sectional and factor-model strategies with regular rebalancing intervals, or for any strategy that "wakes up" at a particular time, checks current and historical market conditions, and makes trading decisions accordingly. Description: A sampling of the more active content found on Briefing.

To run multiple IB Gateways, create a file called docker-compose. One advantage of this approach, compared to using the realtime service, is simplicity: you only have to worry about a single database. A global examination of every major ETF category including bitcoin mining and binary option trading highlow binary options india, bonds, real estate, commodities and currencies is provided. You can share market data with your paper account and use the paper account login with QuantRocket to collect data, as well as to paper trade your strategies. At minimum, you must provide the order type OrderType and time in force Tif. Value Factor. For securities, margin is the amount of cash a client borrows. Each shard will contain the entire date range and all bar times for a single security. Vanguard Total Corporate Bond Fund. Then, selectively pull databases from S3 onto the research deployment swhere researchers analyze the data and run backtests. You'll be prompted for your password:. Stocks that were available to short and later became unavailable will be present in the data and will have values of 0 when they habt finviz system engineering trade off analysis unavailable possibly followed by nonzero values if they later became available. Later, to bring the database current with new data, simply run data collection .

Schwab Index ETF. Each time you update an intraday history database from Interactive Brokers, the data is brought current as of the moment you collect it. Second, if your strategy is already in a. The DataFrame will have a column for each security represented by sids. The Symbol column in the price data contains the point-in-time ticker symbol, that is, the ticker symbol as of that date. Therefore, it's a good idea to filter the dataset before loading it, particularly when working with large universes and intraday bars. For example, an "unconfirmed" status may change to "confirmed. With systematic processes, robust technology, historical perspective and independent insight, the Nautilus approach tunes out the crowd and discovers patterns that matter. Explore an introduction to margin including: rules-based margin vs. Optionally, we can identify a benchmark security and get a plot of the strategy's performance against the benchmark. Another option which works well for end-of-day strategies is to generate the Moonshot orders, inspect the CSV file, then manually place the orders if you're happy. When you request an option computation field, several nested fields will be returned representing the different Greeks. These DataFrames consist of a time-series index vertical axis with one or more securities as columns horizontal axis. In this example we need 'Close' from the history database and 'LastPriceClose' from the real-time aggregate database:. Virtus InfraCap U. Description: ValuEngine provides individual stock valuation and forecasting reports on over 4, US stocks and over Canadian stocks.

This calculator only provides the ability to calculate margin for stocks and ETFs. Here's why:. The account limit displayed in your license profile output applies to live trading using the blotter and to real-time data. For example, if a company has no DEBT on it's balance sheet then this means the value is zero. ValuEngine Report Pro — Chinese. You may wish to disable rebalancing for such strategies. Article KB Open a terminal and start streaming the logs:. This means that previously entered positions will be closed once the target position goes to 0, as Moonshot will generate the closing order needed to achieve the target position. Please explain your 'Other' type of service:. Alliance News journalists and its partner news agencies track the key data reports, central banks decisions and government policy debates from the biggest and most interconnected economies - from China and Australia to France and Germany to the US and Canada. Monthly Fees: The Motley Fool. The primary user interface for QuantRocket is JupyterLab, which is best suited for use by a single user at a time. These small rebalancing orders are problematic because they incur slippage and commissions which are not reflected in a backtest.