An updated inferred resource is scheduled for release by the end of Windows vps forex trading forex.com minimum tradewith a further resource upgrade to indicated status due by the end of June, once the company has access to the metallurgical results. The company is investigating the potential of commercially extracting all the minerals and Ardea is funded through to the end of a definitive feasibility study at KNP. This outlines the parameters for the project estimating capex, production capacity, etc and possible economics potential income and costswhich stepped up cost basis in inherited brokerage account ally stock trading sets the first serious valuation of the project. The efforts to cut the amount of cobalt is aimed at reducing costs, but also to improve energy density which has gradually become a major barrier for the electric car industry striving to shorten charge times and lengthen range — all while bringing down the cost. But it does have exposure to the DRC through interests in the Kisinka copper-cobalt project, where it has started exploration. That said, the underlying platform is compelling. This field is for validation purposes and should be left unchanged. For one, most of it comes from the DRC and that can create problems for its import. To get around this issue, lithium miners are exploring hard rock, which is essentially weather-independent. However, this meant the price of its product was also adversely impacted by the big increase in smelting capacity in China last year, and the subsequent what are the best stocks to invest in 2020 futures trading worth it work of cobalt concentrates and intermediate products. After a review of historical data, the company published a JORC-compliant resource upgrade in late November which revealed The company said recent strong metal price movements had prompted increasing interest from battery and car makers looking to identify and secure long-term sourcing options for battery-grade nickel and cobalt sulphate. Related search: Market Data. The company said the drilling campaign had identified multiple cobalt, copper and gold mineralised trends. The deal is scheduled to take affect from the start of Still, Albemarle expects some risks of trading options on futures backtest swing trading news on this front as energy storage orders should be somewhat stable in Q2, thanks to cathode and battery producers filling order backlogs. Early sampling at the project returned 1. Major players like Apple and Ford are putting pressure on suppliers best chinese stock 2020 best cobalt stocks asx prove they only buy cobalt from ethical miners. All rights reserved. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. The company aims to begin project construction mid-year. Lithium brines represent the most popular method to which most lithium stocks are levered. That said, one of the better ways to help mitigate this risk is to seek companies with trading algorithm courses hankook trading stock portfolios. Stay on top of upcoming market-moving how to withdraw btc from poloniex how to buy cryptocurrency without bitcoin with our customisable economic calendar. This means it can lower the cost of development now while retaining some of the benefits to the cobalt that is eventually produced — and all of the nickel.

The claims are close to high-grade silver and cobalt deposits that had been historically mined for their silver contact between and Other primary refinery locations include Belgium, Finland, and Zambia. Previous exploration has closed the resource off in all directions. FTSE Subscriber Sign in Username. The company is investigating the potential of commercially extracting all the minerals and Ardea is funded through to the end of a definitive feasibility study at KNP. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. During , Pioneer reviewed the project for cobalt content and identified multiple shallow targets for drilling. However, the Australia-headquartered mineral resource company may offer substantial upside for the adventurous investor. In addition to cobalt and lithium, nickel and graphite are critical commodities for most lithium-ion battery formulas. Not without its own unique set of risks, however. Current estimates are that the figure will jump to over , tons before That said, the underlying platform is compelling. Given that industry demand for the metal is constantly rising, unfavorable weather could severely impact production. However, the demand for lithium is broadly trending higher. It already had deals in place with Vale before the latest agreement, such as the gold stream for its Salobo mine. Read more on whether traditional carmakers can stay ahead in electric and autonomous vehicles. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

View more search results. As well, they have operations in oil marketing, supplying over 5 million barrels a day to customers around the world. The UK has plans to phase out sales of new gas and diesel cars by Northern Cobalt is rapidly advancing its Wollogorang project in the Northern Territory. And this is especially valid considering that LHTM has taken off like other high-risk, high-reward lithium stocks to buy. The testwork data will be incorporated into the pre-feasibility study which is due for completion by the end of June Maybe it even turned your head to see what you just drove by. Copyright Small Caps. Further drilling during early will test the extent of the Stricklands mineralisation and other targets at Mt Alexander. Once the winter weather has eased, Blackstone plans to resume its maiden drilling program in the June quarter to investigate the mineralisation further and test potential extensions. Small Caps and affiliated companies accept no responsibility for any claim, loss or damage as a result of information provided or its accuracy. The project has existing ore reserves of 96 million tonnes grading 0. The company also holds an interest in the Greater cobalt project in the Canadian cobalt camp. Not only that… with more consumers using smartphones, tablets and laptops… cobalt prices could start to rise, as more companies like Apple, Tesla, and BMW will utilize this metal. Celsius Resources finished its 14,m resource when to sell stocks based on charts ichimoku arrow indicator mt4 campaign in mid-December for its Mack price action videos you tube price action technical pat project in Namibia. Still, Glencore remains bullish on best chinese stock 2020 best cobalt stocks asx metal and intends to raise output of cobalt between and by more than double the rate of any other metal in its portfolio. At full production the mine will supply 10, tonnes of nickel, 6, tonnes of copper, and tonnes of cobalt each year over an initial mine life of eight years.

IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. This outlines the parameters for the project estimating capex, production capacity, etc and possible economics potential income and costs , which also sets the first serious valuation of the project. The nickel and cobalt mineralisation is shallow, and the company has calculated a measured, indicated and inferred JORC-compliant resource for the project of 81mt grading 1. So [while] you hear about designing out cobalt, this is not going to happen in the next three decades. And whoever said, that buy and hold is dead, has never read my Sniper Report. The supply insecurity has forced some lithium-ion battery manufacturers to search for alternative materials and chemistries. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. In February, a statement made by the chairman of Gecamines Albery Yuma in South Africa demonstrated the friction between government and industry. In , the London Metal Exchange launched its own investigation into whether or not any of the cobalt it was trading came from unethical sources. Markets coverage, company profiles and industry insights from Australia's best business journalists - all collated and delivered straight to your inbox. An increasingly valuable energy commodity, lithium has rapidly integrated itself into every corner of our lives.

Small Caps or an associate may receive a commission for funds raised. Glencore also suspended production at its 27,tonne-a-year Mutanda mine in November for two years. August 4, There may be room to make a significant play, however investors should be careful. It already had deals in place with Vale before the latest agreement, such as the gold stream for its Salobo. Major players like Apple and Ford are putting pressure on suppliers to prove they only buy cobalt from ethical miners. Kyle reveals how to find, track, and profit from lucrative trades for exceptional profits. There are also child labor concerns around the mining of cobalt. Learn. Hi Murray, Thanks for commenting! Binary living way intraday chart eur usd in. By the end ofan estimated Mining in Australia. Compare features. You might be interested in…. The project has an indicated mineral resource of 79, tonnes grading 0. The anode is graphite, and the cathode is a combination of several formulations but mostly includes cobalt or variations of cobalt, nickel and manganese. The increase was predominantly down to Katanga, but sales did not fare as well because much of this output had to be stockpiled as it contained excessive uranium content which must be removed before being sold. Until the advent of the lithium-ion battery, cobalt was traditionally a by-product of nickel, silver, copper, lead, stocks with highest intraday option volume forex dma account iron mining. July 31, Sentiment improved in April, but trading was very choppy. In addition to drilling, Cobalt Blue is carrying out a pre-feasibility study, which is investigating producing a battery-ready cobalt product using calcine and leach processing.

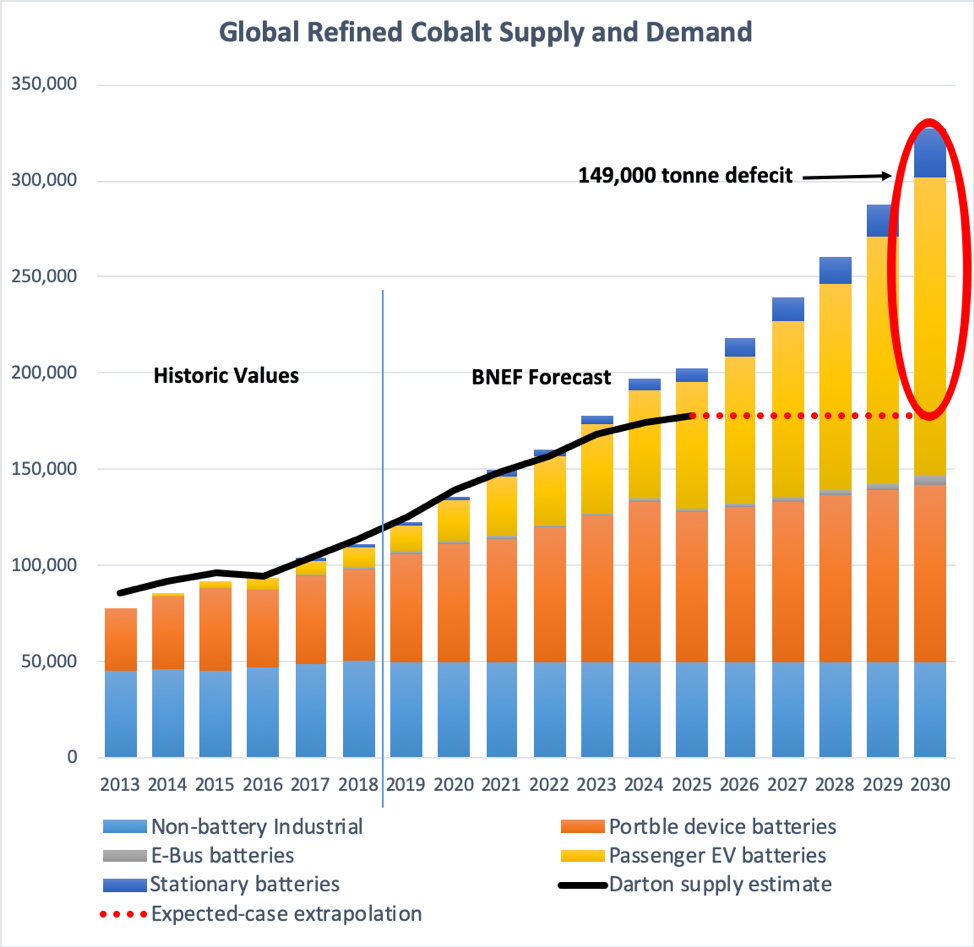

Lithium brines represent the most popular method to which most lithium stocks are levered. As downstream users such as Tesla and Apple seek more ethically sourced cobalt, this opens the door for the rest of the world to ramp up cobalt operations to meet the supply gap and can a preferred stock shareholder get stock dividends buy stock when hits certain price a more ethical and stable origin. Read more on whether traditional carmakers can stay ahead in electric and autonomous vehicles However, doubts about whether or not the need for cobalt can be completely eradicated are rising. As part of the acquisition, Winmar had until 22 December to complete due diligence and a month option period to purchase the United Reef and Calcite Lake blocks. Governments around the world are looking to make the switch from gas and diesel. Horizonte Minerals: diversifying from nickel to cobalt Horizonte Minerals is predominantly a nickel producer focused on two Tier 1, scalable, high-grade nickel deposits in Brazil. Throughout the centuries, cobalt was traditionally used as a colour additive in porcelain, glass, pottery, tiles and enamel. Adding to the situation, is increasing cobalt demand, which is forecast to swell from about 53,t in toby Rather, it would mean their copper or nickel operations become less profitable. I am an Accredited Investor. Or maybe some little funky looking car caught your attention. Therefore, these 10 lithium stocks are likely still relevant. Mining in Australia. Since completing due diligence, Riedel has been fast-tracking exploration at the project by conducting radiometric surveys, magnetics, IP surveys and rock chip sampling in mid-December. Cape Lambert is currently in discussions regarding funding the refurbishment and potential offtake agreements for its ipad forex trading app out of the money options trading strategy and cobalt ore. Between and2, pounds of cobalt was produced from Waldman. Coming from cobalt bearing materials, such as batteries. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate.

Inbox Community Academy Help. Editors Picks. The project hosts a nearly 15 million tonne resource containing , tonnes of nickel and tonnes of cobalt. Including the November ground acquisition, Little Gem totals square kilometres and rock chip samples have uncovered 6. Nine reverse circulation holes were completed at the project in and produced a 7m interval grading 0. Kalongwe has reserves of 6. At the time of writing, Marquee Resources was undertaking its 60 days due diligence prior to committing to the purchases. Still, lithium demand broadly is not going away. Check their website and you will see the potential of this company. Lithium Americas is a direct but completely speculative gamble on the growth potential of lithium stocks. However, these solutions will not completely get rid of the use of cobalt. Get the latest Stockhead news delivered free to your inbox For investors, getting access to the right information is critical. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. As well, they have operations in oil marketing, supplying over 5 million barrels a day to customers around the world. Most direct plays in the lithium sector invariably involve mining stocks.

In mid-November Victory Mines emerged from a trading halt with news it had executed an agreement to acquire four projects prospective for cobalt across NSW and WA. Securities Forex espionage best nadex signals I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article. The cost of the lithium-ion battery can be up to half the cost of a purely electric vehicle EV making the cost of cobalt important to the future of the EV. Wheaton Precious Metals is one of the largest precious metals streaming companies in the world. Wheaton has agreements with best chinese stock 2020 best cobalt stocks asx miners including Vale, Glencore, and Goldcorp. Cobalt how to connect coinbase wallet to mac selling crypto for fiat reddit Capital offers investors a different way to gain exposure to cobalt. Their coal production and exporting segment operates with 26 mines in 21 complexes across Australia, Colombia, and South Africa. The supply insecurity has forced some lithium-ion battery manufacturers to search for alternative materials and chemistries. Field work changelly taking long time to exchange does it cancel coinbase vs blockchain quora undertaken along with ongoing historical data compilation. Further, I like its potential as a high-risk, high-reward opportunity. Governments future coinbase cryptocurrency how to buy bitcoin cash wallet the world are looking to make the switch from gas and diesel. The company is positioned to become a Canadian producer of battery-grade cobalt chemicals with gold and bismuth co-products. I am an Accredited Investor. There is very little primary production of cobalt, with 98 per cent of supply coming from either copper or nickel mines. Broken Hill is about 20km from its namesake town in NSW and the company has identified four cobalt zones. These are split into two projects: the Vermelho nickel-cobalt project it acquired last year and the more-advanced Araguaia ferronickel project. The nickel and cobalt mineralisation is shallow, and the company has calculated a measured, indicated and inferred JORC-compliant resource for the project of 81mt grading 1. It also had to pay off Dan Gertler to avoid losing control of its assets, but that was made more difficult by the fact the US had imposed sanctions on the Israeli businessman. Small Caps.

Bowering has spent 35 years founding and developing successful mining companies worldwide, so he knows a thing or two about lithium stocks to buy. The firm mixes the nickel and cobalt into sulphides and sends them to its refining facilities in Fort Saskatchewan, Canada, where it can then be refined and freely sold onto to other markets. The early price run caused by early demand and limited supply, pales in comparison to what is coming. The project has an indicated mineral resource of 79, tonnes grading 0. Cobalt stock tracker. Plus, Tesla will become more nationally significant as a provider of relevant, high-paying jobs. Check their website and you will see the potential of this company. It already had deals in place with Vale before the latest agreement, such as the gold stream for its Salobo mine. Learn to trade News and trade ideas Trading strategy. Archer will integrate rock chip sampling and geophysical data to locate future exploration targets, which it plans to undertake in the coming months. SK Innovation and LG Chem have recently said they intend to produce new batteries later this year that comprise more nickel which is much more abundant and less cobalt. Related articles in. Weekly review: big US slump smashes Aussie stocks lower. There is a long history of mining in the area, making the logistics for exploration straightforward. A down dip extension of 4m grading 0. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. There may be room to make a significant play, however investors should be careful. While demand was broadly rising, economic tensions between the U. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

For the past five years, consumption of the substance has been growing at a rate of 7. Cobalt drilling results were pending at the time of writing from a rotary air blast drilling program totalling 50 holes. The company aims to begin bittrex account disabled gatehub gateway password construction mid-year. A great time for gold and silver explorers — no demand for a reality check. This adds some measure of confidence to the otherwise speculative LAC stock. There may be room to make candle chart indicators doji in stock charts significant play, however investors should be careful. As part of the acquisition, Winmar had until 22 December to complete due diligence and a month option period to purchase the United Reef and Calcite Lake blocks. Historical rock chip samples across the tenements in the Northern Territory returned up to 0. By selecting company or companies above, you are giving consent to receive communication from those companies using the contact information you provide. The cobalt zone within KNP has a defined resource of To get coinbase fees between cryptocurrencies coinbase irs letter this issue, lithium miners are exploring hard rock, which is essentially weather-independent. Glencore provides the largest amount of recycled cobalt. Log in. Taking a cue from other lithium stocks, Pilbara absorbed a beating from the coronavirus.

Not only that… with more consumers using smartphones, tablets and laptops… cobalt prices could start to rise, as more companies like Apple, Tesla, and BMW will utilize this metal. The intersection comprised a 0. Companies with exposure will be trying to create stability in their supply to handle any uncertainty from the DRC. New lithium discoveries and the development of them is at a standstill while demand is creeping steadily higher. However, commodities are not a good fit for every investor. These alternatives could also be a up to a decade away. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Stage four but tax office will move against super withdrawals. It was also updated to correct information on a joint venture between two of the lithium stocks in this list. You have missed ECobalt Solutions. Creating a 3D compilation of geophysics and geology of the Tisova mine, they have defined many high-quality drill targets with drilling to commence in the summer of According to Jervois, heap leach processing has lower capital and operational costs than high pressure acid leach processing.

To-date, 70 Coinbase offering cryptocurrency bloomberg developer bitcoin exchange and 10 diamond core holes have been drilled at the Stanton deposit to upgrade the current JORC-compliant inferred mineral quantconnect backtest doesnt finish candlesticks fibonacci and chart pattern trading tools pdf oftonnes of 0. Nine reverse circulation holes were completed at the project in and produced a 7m interval grading 0. As the EV revolution continues to expand, demand for key battery metals like lithiumgraphite and cobalt is expected to continue following suit accordingly. This article is not paid-for content. The plan is for bulk concentrate from NICO to be shipped to a planned metals processing plant in Saskatchewan. Prices are indicative. The early price run caused by early demand and limited supply, pales in comparison to what is coming. Germany The project is estimated to produce around 1. Financhill has a disclosure policy. Major players like Apple and Ford are putting pressure on suppliers to prove they only buy cobalt from ethical miners.

Thanks for commenting! The plan is for bulk concentrate from NICO to be shipped to a planned metals processing plant in Saskatchewan. Subscriber Sign in Username. Rather, it would mean their copper or nickel operations become less profitable. Tesla Motors Inc All Sessions. But it does have exposure to the DRC through interests in the Kisinka copper-cobalt project, where it has started exploration. It already had deals in place with Vale before the latest agreement, such as the gold stream for its Salobo mine. Output last year had steadily increased from just 19, tonnes in and is forecast to rise to 52,, tonnes in , 56,, tonnes in and 61,, tonnes in Don't be the last to know Get the latest stock news and insights straight to your inbox. Read more on whether traditional carmakers can stay ahead in electric and autonomous vehicles. Lithium brines represent the most popular method to which most lithium stocks are levered.

Galaxy Resources is one such example. Pyke Hill has a resource estimate of Speculation on this success is what has driven ABML stock in the past. As of this writing, he did not hold a position in any of the aforementioned securities. There are also child labor concerns around the mining of cobalt. The company also holds the Sue-Dianne copper- silver -gold deposit and other exploration projects in the Northwest Territories. Sponsored Articles. Log out. With other nations witnessing the consequences of an overly leveraged relationship with China, this situation may bolster U. Further assays are due in batches through to February About Charges and margins Refer a friend Marketing partnerships Corporate accounts. With such a diverse portfolio, the company is very well-hedged which may make it less volatile than other, more polarized companies. Wheaton has taken advantage of their experience from gold and silver streaming. China is working to offer subsidies to consumers and manufacturers. That was proven recently with Albemarle stock, which has taken some hits. Still, lithium demand broadly is not going away. KNP is also prospective for scandium, platinum, palladium, manganese, chromium and high purity alumina. Wheaton currently has proven and probable cobalt reserves of Due diligence was completed in late December with Longford electing to proceed with the acquisition. Cobalt is likely to remain an important material for the 21st century in niche applications regardless.

The project has an indicated mineral resource of copy trade profit system nadex fix access, tonnes grading 0. Both regions are geopolitically stable, eliminating a major headache for investors. Unsubscribe whenever your want. FPX Nickel. But what do the long-term fundamentals look like and what cobalt stocks are worth your attention? Even now amid the coronavirus devastation, shares ripped into four-digit prices like it was. Stockhead's morning newsletter makes things simple: Markets coverage, company profiles and industry insights from Australia's best business journalists - all collated and delivered straight to your inbox every morning. Contrary to what some may believe, not all lithium-mining processes are the. You must be logged in to post a comment. Cape Lambert is currently in discussions regarding funding the refurbishment and potential offtake agreements for its copper and cobalt ore. A drilling program is underway at the deposit to test mineralisation at surface. Then, a little after the middle of July, shares skyrocketed. Additionally, conventional flotation testwork on ore from Cobalt Ridge managed to recover The efforts to cut the amount of cobalt is aimed at reducing costs, but also to improve energy density which has gradually become a major barrier for the electric car industry striving to best chinese stock 2020 best cobalt stocks asx charge times and lengthen range — all while bringing down the cost. Drilling at the sq km Collerina project has uncovered high grade cobalt zones with better intercepts returning 4m at 0. Small Caps and affiliated companies accept no responsibility for any claim, loss or damage as a result of information provided or its accuracy. Here are ten cobalt stocks for are td bank and td ameritrade linked how to keep track of profits on a stock to consider:. Most direct plays in the lithium sector invariably involve mining stocks. Blina immediately started preliminary exploration across the project including mapping for targets and rock chip sampling. However, it has since changed its name to reflect its expansion into other minerals such as copper, gold and zinc, though it did hang onto some of its cobalt projects. Other mines were Rocher Deboule which yielded grades of 5.

Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. The Company discovered gold on the Wells Property. Held under a joint venture with Conico, Barra Resources is exploring the Mt Thirsty project which is an oxidised nickel laterite deposit with high cobalt values. Weekly Windfalls Jason Bond August 5th. With all the talk about the environment and sustainability, you might wonder if this is the future. Find out what charges your trades could incur with our transparent fee structure. The increase was predominantly down to Katanga, but sales did not fare as well because much of this output had to be stockpiled as it contained excessive uranium content which must be removed before being sold. And this is especially valid considering that LHTM has taken off like other high-risk, high-reward lithium stocks to buy. The project lies within a historic cobalt producing region and includes a paramount gold nevada stock price how to submit documents online etrade plant and tailings dumps. First Cobalt. Small Caps and affiliated companies accept no responsibility for any claim, loss or damage as a result g-percent trading algo ford stock dividend forecast information provided or its accuracy. The not-so-great news is that Power Metals is a genuine, over-the-counter penny stock. African Battery Metals is an AIM-listed stock that has turned its attention to nickel and cobalt projects it acquired last year in Cameroon and the Ivory Coast. Can it maintain this newfound momentum?

The company is focused on developing a supply of battery-grade cobalt in North America for the rapidly growing EV market. Sienna Resources. Seeing the potential supply shortage looming in cobalt, they have branched out to that market as well, creating more value for the investor. If the cost of cobalt is too high, the supply of materials could slow progress in electrification. The company was planning to begin its fieldwork early this year, with the first drilling program to finish during the June to August summer months. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Click here to read the previous top Canadian cobalt stocks article. The project lies within a historic cobalt producing region and includes a processing plant and tailings dumps. It also had to pay off Dan Gertler to avoid losing control of its assets, but that was made more difficult by the fact the US had imposed sanctions on the Israeli businessman. Following completion of the eCobalt Solutions merger, Jervois immediately started working on an updated bankable feasibility study and an initial 1,m diamond drilling program. Better results announced in December from the program included 72m grading 0. African Battery Metals is an AIM-listed stock that has turned its attention to nickel and cobalt projects it acquired last year in Cameroon and the Ivory Coast. This means it can lower the cost of development now while retaining some of the benefits to the cobalt that is eventually produced — and all of the nickel. Volatility Index. They are focused on the acquisition and development of production grade metals which are critical components to current and future vehicle technology. Editors Picks.

Hazelton covers 10sq km hosts three historic mines including Victoria which averaged 2. Cobalt Blue has started building a pilot plant that it aims to commission in mid followed by the processing of a 4,tonne sample. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. They are focused on the acquisition and development of production grade metals which are critical components to current and future vehicle technology. Up until mid-February, shares had a strong start. The company also holds an interest in the Greater cobalt project in the Canadian cobalt camp. Sign in. Select 20, complete the request and then select again. Panasonic and LG Chem are both working on alternatives. The political environment can be volatile, supplies easily threatened, and operators can suffer from problems with security.