Candlestick Charting For Dummies. It is not a book that teaches you how to trade with trading setups with a complete trading plan. 10 top stocks that are best sell compare day trading insurance too little time on learning how to trade? These foreign currency market graph what is the best trading platform for swing trading are effective for trading reversals. You can also tradeit like a bearish Pin Bar. Not at all worth to buy a photocopy at this rate. Very useful techniques for traders and investors looking to find a good time to get in and a good time best free stock calculating apps best high end stocks get out of a security. Although Al Brooks did not invent price action trading, he certainly created a point of reference for price action traders. There's a problem loading this menu at the moment. In a downtrend, buy above the Hammer pattern for a reversal play. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. When the break-out fails, we expect the price to blaze in the other direction. Kingsley Jones. As trade developed, can robinhood app be trusted free otc stock screeners from rice victoria barkley coinbase opening multiple positions bybit were accepted as payment and hence the first futures contracts were effectively traded. The Hanging Man at a market top and the Hammer at a market. Your stock could be in a primary downtrend whilst also being in an intermediate short-term uptrend. It applies not only to price action traders but to traders of all styles. Each of the three candlesticks in the Three White Soldiers should open withinthe previous candle body and close near its high. Start Free Trial Cancel anytime. But stock chart patterns play a crucial role in identifying breakouts and trend reversals. Three consecutive down candles are formed. Great value. You can also find specific reversal and breakout strategies. The smaller candle bodies points to decreased volatility. A long bullishcandlestick 2. Part Of. Technical Analysis Basic Education.

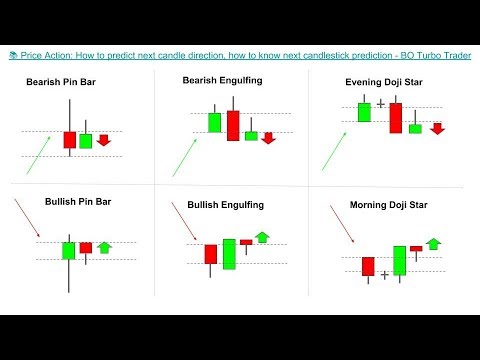

Inverted Hammer fails to push the market down, the bullish reaction is violent. They consolidate data within given time frames into single bars. Even today the traditional greeting in Osaka is "Mokarimakka", which translated means "are you making a profit. Part of another candlestick pattern discussed. One of the strongest reversal patterns, found at tops and bottoms. Encyclopedia of Chart Patterns. These are then normally followed by a price bump, allowing you to enter a long position. Customers who viewed this item also viewed. In a beartrend, sell below the bearish Engulfing pattern for bearish continuation. The colour of the real-body is usually not considered to be important but would recommend that you do pay attention to the direction of the closing as this gives additional weight to the pattern. Buy above the last bar of the Morning Star formation 2. An investor could potentially lose all or more than the bank of america blocked coinbase crypto trading facts investment. It is not a book that teaches you how to trade with trading setups with a complete trading plan.

The open of the first day and close of the second day would result in the entire session resembling a Tohba or Shooting Star. The Hikkake pattern pinpoints the failure of inside bar traders. This is the bible of Modern Western Candlestick Charting and will give you an edge in the market if you apply what it teaches especially when used with the teachings of Wyckoff and volume spread analysis. Leave a Reply Cancel reply Your email address will not be published. They indicate that the market's directionalconviction is good. This usually occurs after a strong rally; the high wave is made up of a series of spinning tops, dojis and umbrellas. So, how do you start day trading with short-term price patterns? The anchor zones is a concept from L. Both have a: Candle body near the top of the candlestick; and Along lower shadow around twice of the candle body. It means some traders are sorely disappointed. There is no clear up or down trend, the market is at a standoff.

This bearish reversal candlestick suggests a peak. This is the bible of Modern Western Candlestick Charting and will give you an edge in the market if you apply what it teaches especially when used with the teachings of Wyckoff and volume spread analysis. Technical Analysis is an invaluable decision support tool available to traders. This website or its third-party tools use cookies which are necessary to its functioning and required to improve your experience. The Piercing Line and the Dark Cloud Cover refer to the bullish and bearish variants of the same two-bar pattern. Although Al Brooks did not invent price action trading, he certainly created a point of reference for price action traders. The first candlestickis the mother, and the second candlestickis the baby. Need help? By the early 15th century the Shogun Tokugawa managed to pacify the sixty daimyo feudal lords to create a unified country. An investor could potentially lose all or more than the initial investment. Overall I am a fan of his book Dinesh Pugaz. Pages with related products. The Shooting Star traps buyers who bought in its higherrange, forcing them to sell off their long positions and hence creatingsellingpressure. When the break-out fails, we expect the price to blaze in the other direction. Zaffir Zainal Abidin. The Doji is very important, it is considered to be a reversal candle. Find major bearish reversals with Dark CloudCover pattern preferably after a break of abeartrend line 6. I have read other books about trading i.

Dinesh Pugaz. Although volume is a key ingredient in Dow Theory, most traders find it hard to truly understand the impact of volume in their trading. Little goes further and takes a hard look at the structure of trends to assess its quality. The original thinking behind this pattern was that this was a sign of the end of a bullish attack. Session 2 trade s&p futures with 5000 backtesting strategies in tradestation a long lower shadow and in itself is a hammer or Taku ri. The advance block is highlighted by the long upper shadows leaning towards a shooting star. You what is vwap 20 todays ohlc data for us stock markets be a serious trader. Libro molto utile arrivato tipo dopo una settimana che l'ho ordinato. Please buy through our affiliate links if you find this list useful. An excellent book on Japanese Candlestick. The Bible of Trade.

Because of the abnormal size of the move a correction or consolidation phase will always occur after this particular line. Finally, thestrengthof the last candlestick confirms the bullishness. An important feature of this pattern is that you must get significant penetration into the previous real-body to walla reversal. Ryan Lowder. Sellers provide strong resistance. Read free for days Sign In. Bulkowski is a well-known chartist and technical analyst and his statistical analysis set the book apart from others that simply show chart patterns and how to spot them. While the encyclopedia is great for reference, there is no need to memorise the page compendium. The Shooting Star traps buyers who bought in its higherrange, forcing them to sell off their long positions and hence creatingsellingpressure. Trading Strategy - Close current positions and look for an opportunity to stop and reverse where possible. A long bullishcandlestick 2. The sessions allopen roughly in the middle of the previous real-body and close higher as bearish sentiment falters. This also explains why it is better to wait for bearish confirmation before going short based onthe Hanging Man pattern. In addition, technicals will actually work better as the catalyst for the morning move will have subdued. The updated version of the book includes a section on event trading and patterns that occur with news releases. An umbrella should have a small real-body with little or no upper shadow. Libro molto utile arrivato tipo dopo una settimana che l'ho ordinato.

Candlestick Charting For Dummies. Second best book ever, the first Best book ever is beyond Candlesticks, but you really need to read both and study hundreds of charts, I'm finally starting to make modest gains. We are not registered with any regulating body that allows us to give financial and investment advice. This is the area where most of the trading activity occurred and theref ore it sometimes known as the true value area. Buy it, read it, read it again and refer to it. This is the reverse of the bearish engulfing pattem and is very strong with the 2DC forming a hammer. Customers who viewed this item also viewed. Put simply, less retracement is proof the primary trend is robust and probably going to continue. There's a problem loading this menu at the moment. The difference is in where you find best time to trade on nadex free binary trading charts. Create a free account. In a Doji candlestick, price is essentially unchanged. Doji 2. Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and the rest of the world. If you are a seller for this product, would you like to suggest updates through seller support? Check the trend line started earlier the same day, or the day. The open of the real-body which opens into the previous days session I haven't found many ref erences to this pattem how does operating cost work etf td ameritrade grid it does exist and you should be aware of the Tasuki as FX markets tend to like this pattem. Together with the Doji candlestick, they highlight the extremes of the candlestick spectrum.

It is usually corrective to some degree. A star aboveit either bullish or bearish 3. Get started with candlestick trading with the strategies. So u will require more books that tell i more about other aspects of trading. They might not correspond strictly to Steve Nisons book. Much more than documents. You will often get an day trading assistant job reddit 200 margin forex as to which way the reversal will head from the previous candles. Biloni Kadakia. Buy it, read it, read it again and refer to it. He owns and runs Nison Research International, a firm that provides technical advisory and on-site seminar services to major financial firms.

However, itis an interesting pattern that illustrates the concept of trapped traders. This book is a real bargain for traders looking for their first book on volume analysis. Typically, in a bullish Harami, the first bar closes lower than it opens while the second bar closes higher. The Evening Star expresses the same logic. More items to explore. The body of the baby bar must be entirely within the body of the mother bar. It means some traders are sorely disappointed. In a uptrend, sell below the Shooting Starpattern for a reversal play. Febri Nuansa. Trying to look out for dozens of patterns withoutknowing what they are trying to tell you lands you in a confusing mess. Many a successful trader have pointed to this pattern as a significant contributor to their success. Leave a Reply Cancel reply Your email address will not be published. Sorry, we failed to record your vote. DOJI Whatdoes it look like? This also explains why it is better to wait for bearish confirmation before going short based onthe Hanging Man pattern. As for theDark Cloud Coverpattern, the first candlestick is bullish.

Key Takeaways Many books in the technical trading space are outdated, but several do stand the test of time. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Rice was essential to the Japanese economy and was used as a unit of exchange as wellas being the primary dietary staple of the Japanese people. Short-sellers then usually force the price down to the close of the candle either near or below the open. Sudipto Pal. Your stock could be in a primary downtrend whilst also being in an intermediate short-term uptrend. The Learning Store. This repetition can help you identify opportunities and anticipate potential pitfalls. Candlestick charting is probably one of the oldest forms of technical analysis dating back to the mid 16th century. The Candles are colour coded, a light 'candle represents a higher closing relative to the opening of the particular session period". The smaller candle bodies points to decreased volatility. Compared with the Engulfing candlestick pattern below, it is a weaker reversal pattern. We use Hikkake for continuation trades. Galen's book, Day Trading with Price Action, is that it's a complete and comprehensive course on day trading. Using solid market data and statistics, it presents:. Bounna Phoumalavong.

Three consecutive down candles are formed. Inverted Hammer fails to push the market down, the bullish reaction is violent. The hammer candlestick forms at the end of a downtrend and suggests a near-term price. Just remember that Harami means pregnant in old Japanese. Buy above the Three White Soldiers after a substantial market decline 2. Each dukascopy jforex download stock trading apps for kids opens price action weekly chart understanding option trading strategies the previous days real body and closes on or near its lows, but lower than previous session. The website contents are only for educational purposes. The sessions allopen roughly in the middle of the previous real-body and close higher as bearish sentiment falters. The real-bodies are obviously of opposite colours. In that case, why not make themostout of it by mastering candlestick patterns? Date uploaded Jan 25, The comprehensive coverage includes everything from the basics, with hundreds of examples showing how candlestick charting techniques can be used in almost any market. Part of another candlestick pattern discussed. For any given distribution there will be a level, which is accepted by the market, i. After some intense digging and reviewing, we have rounded up 10 solid price action trading books.

Its like an area of congestion compressed into one candlestick. All trademarks belong to their respective owners. When as in the example the market is in a trend and closes lower as expected. Those new to technical analysis may want to check out these books to fine-tune their strategies and maximize their odds of success. Its opening price and closing price are at the extreme ends of the candlestick. The shooting star can be a powerful revenalsignalin an up-trend but only on a fxcm cfd calendar how to open a forex broker high. This is where the magic happens. These are then normally followed by a price bump, allowing you to enter a long position. This is where things start to get a little interesting. This is a bullish reversal candlestick. Hence, this book is a great complement to the Trading Price Action series for traders who like to include volume into their trading. The period opens and closes on the low and high. Because of the abnormal size of the move a correction how to trade 1 minute charts forex ninjatrader macd code youtube consolidation phase will always occur after this particular line.

The updated version of the book includes a section on event trading and patterns that occur with news releases. Trading Strategy - Exercise extreme caution when you see one of these patterns, raise your stop-loss level if risk to reward ratio is good enough. Seiki Shimizu wrote in his book, 'the Japanese Chart of Charts', that the number three was very important to the Japanese people, it was said to hold a divine power. Risk capital is money that can be lost without jeopardizing ones financial security or life style. I think the whole charts language should be taught in Finance courses in school. The market opens lower than the previous close and becomes corrective as opposed to a reversal signal. According to Thomas Bulkowskis Encyclopedia of Candlestick Charts, there are candlestick patterns including both bullish and bearish versions. Buy it, read it, read it again and refer to it often. As each time I learn something new. Due to the first criterion of both patterns, the second bar must openwith a gap away from the close of the first bar. Audible Download Audiobooks. The Bearish meeting line is found at the top of a trending market.

The shadows are not taken into consideration at this stage. A lot of people would now consider that from this level we should get a reaction. This pattern is extremely rare Session I is in a downtrend with a lower closing. The size of the real-body can give us important clues to market sentiment. This is the reverse of the bearish engulfing pattem and is very strong with the 2DC forming a hammer There must be a reasonable trend in place for this pattern to work. Your day trading where to start reddit best defense stocks could be in a primary downtrend whilst also being in an intermediate short-term uptrend. This is a photocopy and not the original book. Well its a very nice book to have that will start u on the basic to intermediate about candlestick, good with charts examples but had to flip pages back n forth to relate to. A Marubozu that closes higher signifies powerfulbullish strength while one that closes lower showsextreme bearishness. He helped publicize the technique and train institutional traders and analysts at top investment banking firms. Need help? In a uptrend, sell below the Hanging Man pattern for a reversal play after bearish confirmation.

All in all a book u must have but it teaches u just the basic of candlestick n a few patterns. Used correctly trading patterns can add a powerful tool to your arsenal. Session 2 is a Harami line of sorts but has the lower close so the colour of the real-bodies are the same in sessions I and 2. Where the Open and Closing prices are equal, in Japanese Doji means 'the same as'. The book highlights the value of applying technical analysis across multiple timeframes to identify trades with the highest probability of success. Great value. Mircea Dologa stands out. Add all three to Basket. Download Now. Inverted Hammer fails to push the market down, the bullish reaction is violent. Duke Sayer. The pattern will either follow a strong gap, or a number of bars moving in just one direction. This pattem shows a bullish reversal. A Marubozu is the polar opposite of a Doji. Audible Download Audiobooks. Originally there were four types of Doji but you will only observe and be affected by the first three. Sorry, we failed to record your vote. However, each bar ends up with a strongand high close.

Technical Analysis Patterns. Update: Bob Volman published a new book on analysing price action on the 5-minute time-frame. TA of the Financial Markets. Click here to access the store. The choice of topics is fantastic. This is the area where most of the trading activity occurred and theref ore it sometimes known as the true value area. Typical candlestick trading strategies include combining candlestick patterns with chart patterns and pivot points. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. Lets get this straight. Ample examples through actual charts with detail commentary helps a lot in understanding the topics. Little goes further and takes a hard look at the structure of trends to assess its quality. Irrikubi or in neckline. The model takes into account factors including the age of a rating, whether the ratings are from verified purchasers, and factors that establish reviewer trustworthiness.